Black & Decker 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stanley Black & Decker 2014 Annual Report

JAMES M. LOREE

President &

Chief Operating Ocer

JOHN F. LUNDGREN

Chairman &

Chief Executive Ocer

VISION

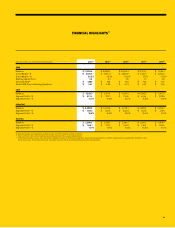

%

Organic Growth

>%

Operating Margin

%

Cash Flow Return on Investment

Working Capital Turns

>%

Revenue from Emerging Markets

LONGTERM FINANCIAL

OBJECTIVES/CAPITAL ALLOCATION

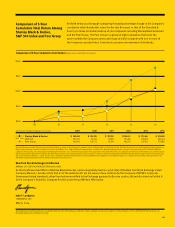

Our long-term objective is to supplement

this 4–6% organic performance with

acquisitions yielding approximately 10%

total revenue growth while producing a

double-digit earnings per share CAGR

and a CFROI between 12%–15%. This

formula, coupled with a capital allocation

approach focused on sizable returns

of capital to investors, has resulted

in favorable relative and absolute

long-term shareholder returns and, we

believe, will continue to do so in the future.

Specifically, our capital allocation

approach is to maintain a strong

investment grade credit rating, while

allocating excess capital in approximately

equal proportions to returning it to

shareholders (dividends and repurchases)

and M&A. Our near-term capital

allocation priority is to complete our

previously communicated $1 billion

share repurchase program.

Our expectation is to resume M&A

activity in the latter part of 2015 or in

2016, depending on the availability of

attractive targets at reasonable prices.

During the recent acquisition pause,

we have kept our business development

organizations intact and we are beginning

to warm up the pipeline again. Any

M&A opportunities will be evaluated in

relation to potential share repurchases

and the impact on CFROI. Currently, top

M&A priorities include: 1) tool industry

consolidation, 2) Engineered Fastening

bolt-ons and 3) expanding our industrial

platform. M&A activity in Security is

expected to be minimal until the core

business turnaround is in the late stages.

James M. Loree

President & Chief Operating Ocer

John F. Lundgren

Chairman & Chief Executive Ocer

SUMMARY

2014 was a year of forward progress

for the Company and we find ourselves

operating in an external environment

that is more dynamic than ever. Forces

of rapid and often sudden change

are emanating from many directions,

including geopolitics, digital and other

technologies, emerging and potentially

disruptive competitors, currency

revaluations and economics in general.

These times call for agile leadership

and organizations but they also require

stability and strength. With a solid,

high performing enterprise we are

operating from a position of strength

and competitive advantage. We believe

that we have created a culture and

defined the strategic programs that can

achieve this delicate balance between

agility and stability — the right posture

to keep this over 170-year-old enterprise

strong and vital as we move forward.