Black & Decker 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

successfully focus on the crucial rhythms and rigors of an

integration is of utmost importance to us, and we have

walked away and will continue to walk away from acquisi-

tive growth opportunities if we feel the timing conflicts

with the successful navigation and development of our

core business franchise.

Organic Growth: Innovative New Products and

Emerging Markets

Inherent in our legacy and crucial to our future is our ability

to bring innovative, world-class products and services to

our customers. Our success in this was key to the organic

growth we drove throughout the year, particularly in certain

markets that were flat or retracting. For example, our pro-

fessional power tool and accessories business grew %,

due to the successful launch of the DWALT - and -volt

MAX* cordless lithium ion product line and the late-

launch of the -volt cordless lithium ion products. Within

our industrial segment, our $ million engineered fas-

tening business, which largely operates under the Emhart

brand, grew %, compared to the % growth of global light

vehicle automotive production, due to new products and

increased customer platform penetration, which resulted in

strong market share gains.

As we wrote last year, significant emphasis has been,

and will continue to be placed on growth in the emerging

markets, both organically and through acquisition. In

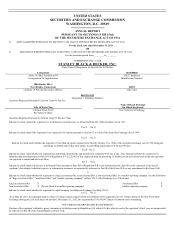

MILLIONS OF DOLLARS, EXCEPT PERSHARE AMOUNTS

SWK

Revenue $ ,. $ ,. $ ,. $ ,. $ ,.

Gross Margin $ ,. $ ,. $ ,. $ ,. $ ,.

Gross Margin % .% .% .% .% .%

Working Capital Turns . . . . .

Free Cash Flow* $ , $ $ $ $

Diluted EPS from Continuing Operations $ . $ . $ . $ . $ .

CDIY

Revenue $ ,. $ ,. $ ,. $ ,. $ ,.

Segment Profit $ . $ . $ . $ . $ .

Segment Profit % .% .% .% .% .%

Working Capital Turns . . . . .

Security

Revenue $ ,. $ ,. $ ,. $ ,. $ ,.

Segment Profit $ . $ . $ . $ . $ .

Segment Profit % .% .% .% .% .%

Working Capital Turns . . . . .

Industrial

Revenue $ ,. $ ,. $ . $ ,. $ ,.

Segment Profit $ . $ . $ . $ . $ .

Segment Profit % .% .% .% .% .%

Working Capital Turns . . . . .

Excludes merger and acquisition-related charges/payments.

* Refer to the inside back cover.

** The results from – were recast for certain discontinued operations for comparability.

Financial Highlights**

C

o

m

m

o

n

P

l

a

t

f

o

r

m

s

C

o

m

m

o

n

P

l

a

t

f

o

r

m

s

Operational

Lean

Complexity

Reduction

Order-to-Cash

Excellence

Sales &

Operations

Planning

Global

Supply

Management

C

o

n

t

r

o

l

I

m

p

r

o

v

e

E

x

p

a

n

d

Breakthrough

Customer Value

THE STANLEY FULFILLMENT SYSTEM