Bank of Montreal 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 BMO Financial Group 197th Annual Report 2014 BMO Financial Group 197th Annual Report 2014 15

bill payments was higher through digital channels than

ABMs in Canada – something that has been true in the U.S.

for some time. But the vast majority of customers still

prefer to drop by a branch to open an account or arrange

a mortgage – and for now, this is independent of age

or geography.

In the end, keeping pace with human change means

a lot of things. Fundamentally, it’s a question of embracing

progress, but not without thinking about its implications.

As a bank, we will continue to make the required trade-

offs and let go of the parts that are less relevant to

stakeholders. And we will continue to insist on behaviours

that lead to high trust. Because it’s what we have

always done.

Measuring our performance

BMO’s performance in fiscal 2014 confirms the value of this

work and can be measured in financial terms. Results from

our four principal business groups reflect the momentum

flowing from investments we have been making over the

past several years as we execute the bank’s customer-

focused strategy:

Canadian Personal and Commercial Banking had a record

year, with over $2 billion in earnings and operating

leverage of 2%. Our largest business continued to deliver

good balance sheet growth and improved efficiency.

U.S. Personal and Commercial Banking finished fiscal 2014

with good momentum and growth, demonstrating

improved revenue and earnings trends in the second half.

Commercial lending continues to be strong, the small-

business segment is moving forward and retail banking is

coming to life.

Wealth Management has been the fastest-growing

operating group in the bank over the past five years,

growing from 17% of the bank’s operating group revenue to

22% in that period. BMO’s expanded global asset

management business continues to innovate and diversify

across its distinctive product offering.

Capital Markets generated over $1 billion in earnings, with a

strong ROE of 19%. We’ve made good progress in growing

Corporate & Investment Banking, improving the balance

with sales and trading, and enhancing our business across

an integrated North American platform with an increased

contribution from the U.S.

The results we’re seeing today reflect the consistent

performance of the 46,000 people who work here and the

overall soundness of our strategy. Four years ago, we made

a decision to strengthen BMO’s continental advantage as a

North American bank, with a footprint spanning strong

regional economies. We’re realizing the full value of our

investment through continued earnings growth. Progress in

the most recent fiscal year can be credited to decisions

made two and three years ago. We can’t ignore continuing

adjustment in markets across the world but remain

confident in the capacity of the system to adjust and

innovate – and in our ability to remain relevant and

profitable in all market conditions, good or bad.

The bank’s progress is sustainable, because our

commitment to generate a fair return for shareholders is in

balance with the need to provide high-quality products at

an optimal price, and to invest in a talented, well-trained

workforce. As digital sales continue to grow, we are

defining a path to improve relative efficiency and, at the

same time, a differentiated position in customer loyalty. In

all of our decision-making, we weigh what is necessary

against what is possible, determining where financial

performance intersects with social responsibility.

Chief Executive Officer’s Message

technology to manage the bank better, automate

processes and reduce costs to drive competitive advantage

– these are strategic competencies we work on every single

day. Likewise, we are managing a great deal more data

than before – and our first job is to protect our customers

and their ever-growing trail of digital information. Our

bank is strong in all of these areas and has the necessary

capabilities to lead the way.

And like our customers, we can’t help but be enthused by

new technologies.

In 2014, the next release of BMO’s top-rated mobile banking

app reinforced our position as an industry leader. The volume

of sales transactions that our customers conduct online is

now equivalent to more than 120 retail branches. We’re also

providing bite-sized financial management right on customers’

mobile devices, as we anticipate the questions that often

arise in the moment.

In the coming year, we’ll continue that momentum:

• Testing touchless ABMs in the U.S. that allow customers

to type in their transaction details on a smartphone

app and then scan a Quick Response code on the ABM

screen to conduct the transaction, replacing the need

for a card.

• Testing video ABMs that offer direct access to bankers

anytime for additional information and help.

• Launching Apple Pay for customers of BMO Harris

Bank, enabling them to pay for purchases using their

iPhones in a secure and contactless transaction that

doesn’t require sharing their debit and credit card

numbers with merchants.

•

Experimenting with MasterPass™ by MasterCard®,

which lets customers easily check out online purchases

– a shop-and-click experience that stores all of their

payment and shipping information in one convenient

and secure place.

All of these experiences have to be frictionless. We’re very

familiar with that, too.

The next wave of mobile capabilities is already having an

impact on consumers’ lives. Receiving travel alerts at the

airport; tracking personal health and fitness on the move;

being told that the item you viewed online is available

when you walk into a store – such innovations are now par

for the course. They are everywhere you look.

While companies launched in the digital era create products

and services that are remarkably convenient, many are still

largely unregulated. It is a fact that some customers are

ready and willing to pay with a smartphone instead of a

plastic card at the checkout counter and transfer money

through social media. These capabilities will inevitably

become part of nearly every bank’s product mix – ours

included. But they are not everything. The relevance of

human interaction has actually increased.

Our industry just reached a tipping point this year: retail

transaction volume for transactions such as transfers and

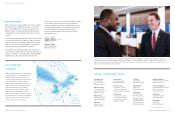

38%

Canadian P&C Banking

22%

BMO Capital Markets

22%

Wealth Management

18%

U.S. P&C Banking

2014 Revenue by

Operating Group1

(C$)

1 Excludes Corporate Services revenue

Over 75% of revenue

from retail businesses1

Diversified business mix

with retail focus

It’s a question of

embracing progress,

but not without thinking

about its implications.