Avnet 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

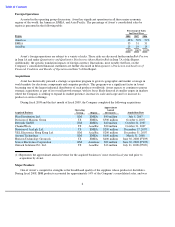

Issuer Purchases of Equity Securities

The following table includes the Company’s monthly purchases of common stock during the fourth quarter

ended June 28, 2008:

The purchases of Avnet common stock noted above were made on the open market to obtain shares for purchase

under the Company’s Employee Stock Purchase Plan. None of these purchases were made pursuant to a publicly

announced repurchase plan and the Company does not currently have a stock repurchase plan in place.

16

Maximum Number (or

Total Number of

Approximate Dollar

Total

Shares Purchased as

Value) of Shares That

Number of

Part of Publicly

may yet be Purchased

Shares

Average Price

Announced Plans or

Under the Plans or

Period

Purchased

Paid per Share

Programs

Programs

April

4,500

$

33.49

—

—

May

12,000

$

27.09

—

—

June

5,500

$

31.17

—

—

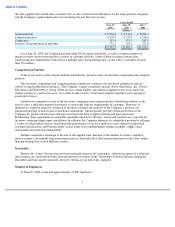

Item 6.

Selected Financial Data

Years Ended

June 28,

June 30,

July 1,

July 2,

July 3,

2008

2007

2006

2005

2004

(Millions, except for per share and ratio data)

Income:

Sales

$

17,952.7

$

15,681.1

$

14,253.6

$

11,066.8

$

10,244.7

Gross profit

2,313.7

2,048.6

1,839.0

(c)

1,459.0

1,364.9

Operating income

710.4

(a)

678.3

(b)

433.1

(c)

321.3

202.2

(d)

Income tax provision

209.9

(a)

193.5

(b)

111.6

(c)

71.5

25.5

(d)

Net income

499.1

(a)

393.1

(b)

204.5

(c)

168.2

72.9

(d)

Financial Position:

Working capital

3,191.5

2,711.8

2,029.1

2,065.4

1,839.0

Total assets

8,200.1

7,355.1

6,215.7

5,098.2

4,863.7

Long

-

term debt

1,181.5

1,156.0

918.8

1,183.2

1,196.2

Shareholders

’

equity

4,134.7

3,400.6

2,831.2

2,097.0

1,953.4

Per Share:

Basic earnings

3.32

(a)

2.65

(b)

1.40

(c)

1.39

0.61

(d)

Diluted earnings

3.27

(a)

2.63

(b)

1.39

(c)

1.39

0.60

(d)

Book value

27.49

22.70

19.30

17.36

16.21

Ratios:

Operating income margin on sales

4.0

%(a)

4.3

%(b)

3.0

%(c)

2.9

%

2.0

%(d)

Net income margin on sales

2.8

%(a)

2.5

%(b)

1.4

%(c)

1.5

%

0.7

%(d)

Return on equity

13.3

%(a)

12.7

%(b)

7.8

%(c)

8.1

%

3.9

%(d)

Return on capital

10.9

%(a)

11.2

%(b)

7.6

%(c)

7.5

%

5.1

%(d)

Quick

1.4:1

1.3:1

1.1:1

1.5:1

1.3:1

Working capital

2.1:1

2.0:1

1.8:1

2.2:1

2.1:1

Total debt to capital

22.9

%

26.2

%

30.4

%

37.2

%

41.0

%

(a)

Includes the impact of restructuring, integration and other items, gains on sale of assets and other items which

totaled to a gain of $11.0 million pre

-

tax, $14.7 million after tax and $0.09 per share on a diluted basis (see