Audiovox 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

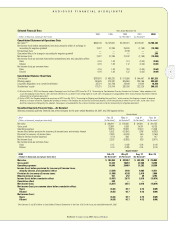

Selected Financial Data Years Ended November 30,

1998 1999 2000 2001 2002

(Dollars in thousands, except per share data) (As Restated*) (As Restated*)

Consolidated Statement of Operations Data

Net sales(1)(2) $606,108 $1,149,537 $1,670,291 $1,276,591 $1,100,382

Net income (loss) before extraordinary item and cumulative effect of a change in

accounting for negative goodwill 2,972 27,246 25,303 (7,198) (14,280)

Extraordinary item — — 2,189 — —

Cumulative effect of a change in accounting for negative goodwill — — — — 240

Net income (loss) 2,972 27,246 27,492 (7,198) (14,040)

Net income (loss) per common share before extraordinary item and cumulative effect:

Basic 0.16 1.43 1.19 (0.33) (0.65)

Diluted 0.16 1.39 1.12 (0.33) (0.65)

Net income (loss) per common share:

Basic 0.16 1.43 1.29 (0.33) (0.64)

Diluted 0.16 1.39 1.22 (0.33) (0.64)

Consolidated Balance Sheet Data

Total assets $287,816 $ 486,220 $ 517,586 $ 544,497 $ 551,235

Working capital 160,609 272,081 305,369 284,166 292,687

Long-term obligations, less current installments 33,724 122,798 23,468 10,040 18,250

Stockholders’ equity 177,720 216,744 330,766 323,220 309,513

(1) Effective March 1, 2002, the Company adopted Emerging Issues Task Force (EITF) Issue No. 01-9, “Accounting for Consideration Given by a Vendor to a Customer.” Upon adoption of this

Issue, the Company reclassified its sales incentives offered to its customers from selling expenses to net sales. For purposes of comparability, these reclassifications have been reflected

retroactively for all periods presented.

(2) In fiscal 2001, the Company adopted the provisions of EITF Issue No. 00-10, “Accounting for Shipping and Handling Fees and Costs,” which requires the Company to report all amounts

billed to a customer related to shipping and handling as revenue. The Company has reclassified such billed amounts, which were previously netted in cost of sales, to net sales. Gross

profit has remained unchanged by this adoption. For purposes of comparability, these reclassifications have been reflected retroactively for all periods presented.

Unaudited Quarterly Financial Data—As Restated

Selected unaudited, quarterly financial data of the Company for the years ended November 30, 2001 and 2002 appears below:

Quarter Ended

2001 Feb. 28 May 31 Aug. 31 Nov. 30

(Dollars in thousands, except per share data) (As Restated*) (As Restated*) (As Restated*) (As Restated*)

Net sales $ 348,047 $ 276,581 $ 310,811 $ 341,152

Gross profit 23,861 5,393 24,001 18,135

Operating expenses 18,913 18,997 21,470 21,246

Income (loss) before provision for (recovery of) income taxes and minority interest 5,552 (13,891) 1,248 (4,393)

Provision for (recovery of) income taxes 2,029 (5,024) 540 (1,169)

Minority interest income (expense) (170) 562 121 147

Net income (loss) 3,353 (8,305) 829 (3,077)

Net income (loss) per common share:

Basic 0.15 (0.38) 0.04 (0.14)

Diluted 0.15 (0.38) 0.04 (0.14)

Quarter Ended

2002 Feb. 28 May 31 Aug. 31 Nov. 30

(Dollars in thousands, except per share data) (As Restated*) (As Restated*) (As Restated*)

Net sales $ 184,269 $ 297,267 $ 301,992 $ 316,853

Gross profit 13,723 18,653 27,468 14,755

Operating expenses 18,946 24,089 21,283 24,356

Income (loss) before provision for (recovery of) income taxes,

minority interest, and cumulative effect (7,554) 7,993 4,985 11,571

Provision for (recovery of) income taxes (1,500) 4,320 2,416 7,696

Minority interest income 557 257 49 4,193

Income (loss) before cumulative effect (5,497) 3,673 2,618 (15,074)

Cumulative effect 240 — — —

Net income (loss) (5,257) 3,673 2,618 (15,074)

Net income (loss) per common share before cumulative effect:

Basic (0.25) 0.17 0.12 (0.69)

Diluted (0.25) 0.17 0.12 (0.69)

Net income (loss):

Basic (0.24) 0.17 0.12 (0.69)

Diluted (0.24) 0.17 0.12 (0.69)

*See footnotes 2 and 26 of Notes to Consolidated Financial Statements in the Form 10-K for the fiscal year ended November 30, 2002.

AUDIOVOX FINANCIAL HIGHLIGHTS

Audiovox Corporation 2002 Annual Report

1