Audiovox 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

AUDIOVOX

Management’s Discussion and

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

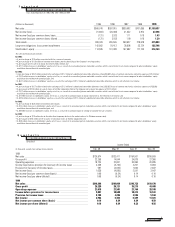

(Dollars in thousands, except share and per share data)

Audiovox Corporation and Subsidiaries

Forward-looking Statements

This Annual Report contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Words such as “may,” “believe,”

“estimate,” “expect,” “plan,” “intend,” “project,” “anticipate,” “contin-

ues,” “could,” “potential,” “predict” and similar expressions may identify

forward-looking statements. The Company has based these forward-look-

ing statements on its current expectations and projections about future

events, activities or developments. The Company’s actual results could

differ materially from those discussed in or implied by these forward-look-

ing statements. Forward-looking statements include statements relating

to, among other things:

• growth trends in the wireless, automotive and consumer electronic

businesses

• technological and market developments in the wireless, automotive

and consumer electronics businesses

• liquidity

• availability of key employees

• expansion into international markets

• the availability of new consumer electronic products

These forward-looking statements are subject to numerous risks, uncer-

tainties and assumptions about the Company including, among other things:

• the ability to keep pace with technological advances

• significant competition in the wireless, automotive and consumer elec-

tronics businesses

• quality and consumer acceptance of newly introduced products

• the relationships with key suppliers

• the relationships with key customers

• possible increases in warranty expense

• the loss of key employees

• foreign currency risks

• political instability

• changes in U.S. federal, state and local and foreign laws

• changes in regulations and tariffs

• seasonality and cyclicality

• inventory obsolescence and availability

The Company markets its products under the Audiovox brand as well

as private labels to a large and diverse distribution network both domes-

tically and internationally. The Company operates through two marketing

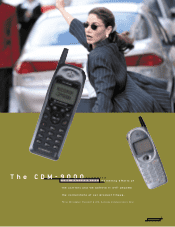

groups: Wireless and Electronics. The Wireless Group consists of

Audiovox Communications Corp. (ACC), a 95%-owned subsidiary of

Audiovox, and Quintex, which is a wholly-owned subsidiary of ACC. ACC

markets wireless handsets and accessories primarily on a wholesale

basis to wireless carriers in the United States and, to a lesser extent, car-

riers overseas. Quintex is a small operation for the direct sale of hand-

sets, accessories and wireless telephone service. For fiscal 1999, sales

through Quintex were $53.2 million or 5.7% of the Wireless Group sales.

Quintex receives activation commissions and residual fees from retail

sales. Quintex also receives a monthly residual payment which is based

upon a percentage of the customer’s usage.

The Electronics Group consists of Audiovox Electronics (AE), a division

of Audiovox, and Audiovox Communications (Malaysia) Sdn. Bhd.,

Audiovox Holdings (M) Sdn. Bhd. and Audiovox Venezuela, C.A., which are

wholly-owned subsidiaries. The Electronics Group markets automotive

sound and security systems, electronic car accessories, home and

portable sound products, FRS radios and in-vehicle video systems. Sales

are made through an extensive distribution network of mass merchandis-

ers, power retailers and others. In addition, the Company sells some of its

products directly to automobile manufacturers on an OEM basis.

The Company allocates interest and certain shared expenses to the

marketing groups based upon estimated usage. General expenses and

other income items that are not readily allocable are not included in the

results of the two marketing groups.

From fiscal 1996 through 1999, several major events and trends have

affected the Company’s results and financial conditions.

The Wireless Group increased its handset sales from 2.1 million units

in fiscal 1996 to 3.3 million units in fiscal 1998 to 6.1 million units in fis-

cal 1999. This increase in sales was primarily due to:

• the introduction of digital technology, which has allowed carriers to sig-

nificantly increase subscriber capacity

• increased number of carriers competing in each market

• reduced cost of service and expanded feature options