Arrow Electronics 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Arrow Electronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Arrow Electronics, Inc.

Annual Report

Table of contents

-

Page 1

Arrow Electronics, Inc. Annual Report -

Page 2

...Greece, Hong Kong, Hungary, India, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Morocco, Netherlands, New Zealand, Norway, Philippines, Poland, Portugal, Romania, Russian Federation, Scotland, Serbia, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland... -

Page 3

... file number 1-4482 ARROW ELECTRONICS, INC. (Exact name of registrant as specified in its charter) New York (State or other jurisdiction of incorporation or organization) 50 Marcus Drive, Melville, New York (Address of principal executive offices) (631) 847-2000 (Registrant's telephone number... -

Page 4

... Accountants on Accounting and Financial Disclosure...89 Item 9A. Controls and Procedures...89 Item 9B. Other Information...91 PART III Item 10. Directors, Executive Officers, and Corporate Governance...92 Item 11. Executive Compensation...92 Item 12. Security Ownership of Certain Beneficial Owners... -

Page 5

... Poland, Portugal, Romania, the Russian Federation, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, and the United Kingdom. In the Asia Pacific region, Arrow operates in Australia, China, Hong Kong, India, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan, Thailand... -

Page 6

... needs of customers. This acquisition strengthened the company's e-commerce capabilities. In June 2010, it acquired PCG Parent Corp., doing business as Converge ("Converge"), a provider of reverse logistics services in the Americas, Europe, and the Asia Pacific region. This acquisition builds on the... -

Page 7

... 3, 2011, the company acquired Nu Horizons Electronics Corp. ("Nu Horizons"), a global distributor of advanced technology semiconductor, display, illumination, and power solutions to a wide variety of commercial OEMs and electronic manufacturing services providers. This acquisition builds on the... -

Page 8

...its portfolio of products and services. In December 2010, it acquired Diasa Informática, S.A. ("Diasa"), a leading European value-added distributor of servers, storage, software, and networking products in Spain and Portugal. This acquisition complements the company's existing portfolio of hardware... -

Page 9

...call on customers by telephone or email from centralized selling locations, and inbound sales agents serve customers that call into the company. Each of the company's North American selling locations and primary distribution centers in the global components business segment are electronically linked... -

Page 10

...request directed to the company at the following address and telephone number: Arrow Electronics, Inc. 50 Marcus Drive Melville, New York 11747-4210 (631) 847-2000 Attention: Corporate Secretary The company also makes these filings available, free of charge, through its website (http://www.arrow.com... -

Page 11

..., Human Resources Executive Vice President, Finance and Operations, and Chief Financial Officer Set forth below is a brief account of the business experience during the past five years of each executive officer of the company. Michael J. Long was appointed Chairman of the Board of Directors in... -

Page 12

...gross profit margins and, thus, overall profitability. The sizes of the company's competitors vary across market sectors, as do the resources the company has allocated to the sectors in which it does business. Therefore, some of the competitors may have a more extensive customer and/or supplier base... -

Page 13

... may be occasions, including through acquisitions, where environmental liability arises. For example, the company has recently expanded into the information technology asset disposition business, or ITAD, pursuant to which, the company is responsible to its customers to dispose of certain assets in... -

Page 14

... have a material adverse effect on the company's business. The company may not have adequate or cost-effective liquidity or capital resources. The company requires cash or committed liquidity facilities for general corporate purposes, such as funding its ongoing working capital, acquisition, and... -

Page 15

... make investments. The company's failure to have long-term sales contracts may have a material adverse effect on its business. Most of the company's sales are made on an order-by-order basis, rather than through long-term sales contracts. The company generally works with its customers to develop non... -

Page 16

... of the company's international sales and locations, its operations are subject to a variety of risks that are specific to international operations, including the following import and export regulations that could erode profit margins or restrict exports; the burden and cost of compliance with... -

Page 17

... existing customer and supplier relationships; and potential loss of key employees, especially those of the acquired companies. Further, the company has made, and may continue to make acquisitions of, or investments in new services, businesses or technologies to expand our current service offerings... -

Page 18

... fails to maintain an effective system of internal controls, or if management or the company's independent registered public accounting firm discovers material weaknesses in the company's internal controls, it may be unable to produce reliable financial reports or prevent fraud, which could have... -

Page 19

... sales offices, distribution centers, and administrative facilities worldwide. Its executive office is located in Melville, New York and occupies a 163,000 square foot facility under a long-term lease expiring in 2013. The company owns 12 locations throughout the Americas, EMEA, and the Asia Pacific... -

Page 20

... a defendant in a lawsuit filed in September 2006 in the United States District Court for the Central District of California (Apollo Associates, L.P., et anno. v. Arrow Electronics, Inc. et al.) in connection with alleged contamination at a third site, an industrial building formerly leased by Wyle... -

Page 21

...defense of the company, and the company has recovered approximately $13 million from them to date. The company has sued certain of the umbrella liability policy carriers, however, because they have yet to make payment on the tendered losses. The company...will materially impact the company's consolidated ... -

Page 22

.... Dividend History The company did not pay cash dividends on its common stock during 2010 or 2009. While from time to time the Board of Directors considers the payment of dividends on the common stock, the declaration of future dividends is dependent upon the company's earnings, financial condition... -

Page 23

... at the time of each reported data point. As a result of Bell Microproducts, Inc., Jaco Electronics, Inc., and Nu Horizons Electronics Corp. having filed notice to terminate their registrations with the SEC, the company revised its Peer Group to include Anixter International Inc., Celestica... -

Page 24

...The companies included in the below graph for the old Peer Group are Avnet, Inc., Ingram Micro Inc., Nu Horizons Electronics Corp., and Tech Data Corporation. 160 140 120 100 80 60 40 2005 2006 Arrow Electronics 2007 2008 Peer Group 2009 S&P 500 Stock Index 2010 Arrow Electronics Peer Group S&P 500... -

Page 25

... the "total number of shares purchased" and the "total number of shares purchased as part of publicly announced program" for the quarter ended December 31, 2010 is 3,867 shares, which relate to shares withheld from employees for stock-based awards, as permitted by the plan, in order to satisfy the... -

Page 26

... and must be read in conjunction with the company's consolidated financial statements and related notes appearing elsewhere in this Annual Report on Form 10-K (dollars in thousands except per share data): For the years ended December 31: Sales Operating income (loss) 2010 (a) 2009 (b) 2008 (c) 2007... -

Page 27

...of related taxes or $.10 per share on both a basic and diluted ...million net of related taxes or $.01 per share on both a basic and diluted basis), as well ...share on both a basic and diluted basis) and a reduction of interest expense of $6.9 million ($4.2 million net of related taxes or $.03 per share... -

Page 28

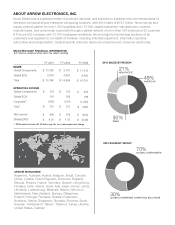

... users of electronic components and enterprise computing solutions. The company provides one of the broadest product offerings in the electronic components and enterprise computing solutions distribution industries and a wide range of value-added services to help customers reduce time to market... -

Page 29

... nature of the company's business does not provide for the visibility of material forward-looking information from its customers and suppliers beyond a few months. Sales Following is an analysis of net sales (in millions) by reportable segment for the years ended December 31: 2010 Global components... -

Page 30

... company's international financial statements. The decrease in sales for 2009 was offset, in part, by the LOGIX acquisition. Excluding the impact of foreign currency and pro forma for acquisitions, the company's global ECS business segment sales decreased by 12.1% in 2009. Gross Profit The company... -

Page 31

... multiple locations. The facilities costs are related to the exit activities of 9 vacated facilities in the Americas and EMEA. During the fourth quarter of 2008, the company recorded an impairment charge of $25.4 million in connection with an approved plan to actively market and sell a building and... -

Page 32

... administrative expenses as a result of acquisitions. These increases were offset, in part, by the impact of a stronger U.S. dollar on the translation of the company's international financial statements for 2010 compared with the year-earlier period. Selling, general and administrative expenses, as... -

Page 33

...exchange rates. This decrease was offset, in part, by expenses incurred by LOGIX, which was acquired in June 2008. Selling, general and administrative expenses, as a percentage of sales, was 8.9% and 9.6% for 2009 and 2008, respectively. Loss on Prepayment of Debt During 2010, the company recognized... -

Page 34

...business segment, increased gross profit margins, reduced selling, general and administrative expenses as a percentage of sales due to the company's continuing efforts to streamline and simplify processes, and a lower effective income tax rate. This was offset, in part, by increased depreciation and... -

Page 35

... services provider; ETG, a leading solid-state lighting distributor and value-added service provider; Diasa, a leading European value-added distributor of servers, storage, software, and networking products in Spain and Portugal; and Intechra, which provides fully customized information technology... -

Page 36

... ERP initiative. During 2008, the company acquired Hynetic, a components distribution business in India; ACI, a distributor of electronic components used in defense and aerospace applications; LOGIX, a leading valueadded distributor of midrange servers, storage, and software; Achieva, a value-added... -

Page 37

...its revolving credit facility or asset securitization program at December 31, 2010 and 2009. Both programs include terms and conditions that limit the incurrence of additional borrowings, limit the company's ability to pay cash dividends or repurchase stock, and require that certain financial ratios... -

Page 38

... payment terms with the customer, product returns, and has risk of loss if the customer does not make payment. As the principal with the customer, the company recognizes the sale and cost of sale of the product upon receiving notification from the supplier that the product was shipped. The company... -

Page 39

... company accounts for available-for-sale investments at fair value, using quoted market prices, and the related holding gains and losses are included in "Other" in the shareholders' equity section in the company's consolidated balance sheets. The company assesses its long-term investments accounted... -

Page 40

... estimated. Stock-Based Compensation The company records share-based payment awards exchanged for employee services at fair value on the date of grant and expenses the awards in the consolidated statements of operations over the requisite employee service period. Stock-based compensation expense... -

Page 41

... its discounted cash flow analysis to its current market capitalization allowing for a reasonable control premium. As of the first day of the fourth quarters of 2010, 2009, and 2008, the company's annual impairment testing did not indicate impairment at any of the company's reporting units. During... -

Page 42

...business segment and the fair value of the North America and EMEA reporting units within the global ECS business segment exceeded their carrying values by approximately 70%, 159%, and 129%, respectively. Impairment of Long-Lived Assets The company reviews long-lived assets, including property, plant... -

Page 43

... company reports shipping and handling costs, primarily related to outbound freight, in the consolidated statements of operations as a component of selling, general and administrative expenses. If the company included such costs in cost of sales, gross profit margin as a percentage of sales for 2010... -

Page 44

... exposure relates to transactions in which the currency collected from customers is different from the currency utilized to purchase the product sold in Europe, the Asia Pacific region, Canada, and Latin America. The company's policy is to hedge substantially all such currency exposures for which... -

Page 45

..., respectively), through its maturity. The swaps are classified as fair value hedges and had a fair value of $14.8 million and $9.6 million at December 31, 2010 and 2009, respectively. In December 2010, the company entered into interest rate swaps, with an aggregate notional amount of $250.0 million... -

Page 46

... fairly in all material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Arrow Electronics, Inc.'s internal control over financial reporting as of December 31, 2010, based on criteria... -

Page 47

ARROW ELECTRONICS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands except per share data) Years Ended December 31, 2010 2009 2008 Sales Costs and expenses: Cost of sales Selling, general and administrative expenses Depreciation and amortization Restructuring, integration, and other charges... -

Page 48

... EQUITY Current liabilities: Accounts payable Accrued expenses Short-term borrowings, including current portion of long-term debt Total current liabilities Long-term debt Other liabilities Equity: Shareholders' equity: Common stock, par value $1: Authorized - 160,000 shares in 2010 and 2009 Issued... -

Page 49

... from financing activities: Change in short-term and other borrowings Repayments of long-term bank borrowings, net Repurchase/repayment of senior notes Net proceeds from note offerings Proceeds from exercise of stock options Excess tax benefits from stock-based compensation arrangements Repurchases... -

Page 50

...Unrealized loss on interest rate swaps designated as cash flow hedges, net Other employee benefit plan items, net Comprehensive loss Amortization of stock-based compensation Shares issued for stock-based compensation awards Tax benefits related to stock-based compensation awards Repurchase of common... -

Page 51

...STATEMENTS OF EQUITY (continued) (In thousands) Common Stock at Par Value Balance at December 31, 2009 Consolidated net income (loss) Translation adjustments Unrealized gain on securities, net Other employee benefit plan items, net Comprehensive income Amortization of stock-based compensation Shares... -

Page 52

.... Software Development Costs The company capitalizes certain internal and external costs incurred to acquire or create internal-use software. Capitalized software costs are amortized on a straight-line basis over the estimated useful life of the software, which is generally three to seven years... -

Page 53

... company accounts for available-for-sale investments at fair value, using quoted market prices, and the related holding gains and losses are included in "Other" in the shareholders' equity section in the company's consolidated balance sheets. The company assesses its long-term investments accounted... -

Page 54

... liability, the company's effective tax rate in a given financial statement period may be affected. Net Income (Loss) Per Share Basic net income (loss) per share is computed by dividing net income (loss) attributable to shareholders by the weighted average number of common shares outstanding for the... -

Page 55

...tax effected as investments in international affiliates are deemed to be permanent. Stock-Based Compensation The company records share-based payment awards exchanged for employee services at fair value on the date of grant and expenses the awards in the consolidated statements of operations over the... -

Page 56

..., lease return, logistics management, and environmentally responsible recycling of all types of information technology. Intechra is headquartered in Jackson, Mississippi, and has approximately 300 employees. Total Intechra sales for 2010 were $77,757, of which $2,556 were included in the company... -

Page 57

...546. Converge is a leading provider of reverse logistics services, headquartered in Peabody, Massachusetts. Converge, with approximately 350 employees, also has offices in Singapore and Amsterdam, with support centers throughout Europe, Asia, and the Americas. Total Converge sales for 2010 were $306... -

Page 58

...; Eshel Technology Group, Inc., a leading solid-state lighting distributor and value-added service provider; and Diasa Informática, S.A., a leading European value-added distributor of servers, storage, software, and networking products in Spain and Portugal. The impact of these acquisitions was not... -

Page 59

...,508 of debt paid at closing, cash acquired of $3,647, and acquisition costs. In addition, $46,663 in debt was assumed. LOGIX is a leading value-added distributor of midrange servers, storage, and software to over 6,500 partners in 11 European countries. Total LOGIX sales for 2008 were $583,866, of... -

Page 60

...in India; ACI Electronics LLC, a distributor of electronic components used in defense and aerospace applications; Achieva Ltd., a value-added distributor of semiconductors and electromechanical devices; Excel Tech, Inc., the sole Broadcom distributor in Korea; and Eteq Components Pte Ltd, a Broadcom... -

Page 61

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Goodwill represents the excess of the cost of an acquisition over the fair value of the assets acquired. The company tests goodwill for impairment annually as of the first day of the ... -

Page 62

... 2010 Interest rate swaps designated as fair value hedges Short-term borrowings in various countries $ 61,210 61,210 $ 2009 69,544 41,943 2,036 9,572 123,095 $ $ Short-term borrowings in various countries are primarily utilized to support the working capital requirements of certain international... -

Page 63

... ratings (.60% at December 31, 2010). The company has a $600,000 asset securitization program collateralized by accounts receivables of certain of its United States subsidiaries which expires in April 2012. The asset securitization program is conducted through Arrow Electronics Funding Corporation... -

Page 64

...its revolving credit facility or asset securitization program at December 31, 2010 and 2009. Both programs include terms and conditions that limit the incurrence of additional borrowings, limit the company's ability to pay cash dividends or repurchase stock, and require that certain financial ratios... -

Page 65

... equity ownership interest in Marubun Corporation ("Marubun"), which are accounted for as available-forsale securities. The fair value of the company's available-for-sale securities is as follows at December 31: 2010 Marubun WPG Cost basis Unrealized holding gain Fair value $ 10,016 3,726 $ 13,742... -

Page 66

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Derivative Instruments The company uses various financial instruments, including derivative financial instruments, for purposes other than trading. Derivatives used as part of the company... -

Page 67

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) The effect of derivative instruments on the consolidated statement of operations is as follows for the years ended December 31: Gain/(Loss) Recognized in Income 2010 2009 Fair value hedges... -

Page 68

... converting the interest expense on $300,000 of long-term debt from U.S. dollars to euros. During the second quarter of 2010, the company paid $2,282, plus accrued interest, to terminate these crosscurrency swaps. The cross-currency swaps had a negative fair value at December 31, 2009 of $54,440... -

Page 69

... of 35% and effective income tax rates for the years ended December 31 are as follows: 2010 United States International Income before income taxes Provision at statutory tax rate State taxes, net of federal benefit International effective tax rate differential Non-deductible impairment charge Other... -

Page 70

... to examination by tax authorities. The following describes the open tax years, by major tax jurisdiction, as of December 31, 2010: United States - Federal United States - State Germany (a) Hong Kong Italy (a) Sweden United Kingdom (a) 2008 - present 2001 - present 2007 - present 2004 - present 2006... -

Page 71

... included in the international effective tax rate differential. The company also has Federal net operating loss carryforwards of approximately $81,523 at December 31, 2010 which relate to recently acquired subsidiaries. These Federal net operating losses expire in various years beginning after 2020... -

Page 72

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 9. Restructuring, Integration, and Other Charges In 2010, 2009, and 2008, the company recorded restructuring, integration, and other charges of $33,494 ($24,605 net of related taxes or $.... -

Page 73

... related to exit activities for 28 vacated facilities worldwide due to the company's continued efforts to streamline its operations and reduce real estate costs. These initiatives are due to the company's continued efforts to lower cost and drive operational efficiency. 2008 Restructuring Charge The... -

Page 74

...activities of 9 vacated facilities in the Americas and EMEA. During the fourth quarter of 2008, the company recorded an impairment charge of $25,423 in connection with an approved plan to actively market and sell a building and related land in the United States within the company's global components... -

Page 75

... a prior year which was conditional upon the financial performance of the acquired company and the continued employment of the selling shareholders and other acquisition-related expenses of $1,035, primarily consisting of professional fees directly related to recent acquisition activity. Preference... -

Page 76

..., and 4,368 shares for the years ended December 31, 2010, 2009, and 2008, respectively, were excluded from the computation of net income (loss) per share on a diluted basis as their effect is anti-dilutive. 12. Employee Stock Plans Omnibus Plan The company maintains the Arrow Electronics, Inc. 2004... -

Page 77

... grant to directors, which become exercisable in equal installments over a two-year period. Options currently outstanding have terms of ten years. The following information relates to the stock option activity for the year ended December 31, 2010: Weighted Average Remaining Contractual Life Shares... -

Page 78

... in the case of restricted stock units until the date of delivery or other payment). Compensation expense is recognized on a straight-line basis as shares become free of forfeiture restrictions (i.e., vest) generally over a four-year period. Non-Employee Director Awards The company's Board shall set... -

Page 79

...Benefit Plans Supplemental Executive Retirement Plans ("SERP") The company maintains an unfunded Arrow SERP under which the company will pay supplemental pension benefits to certain employees upon retirement. There are 11 current and 14 former corporate officers participating in this plan. The Board... -

Page 80

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) The company uses a December 31 measurement date for the Arrow SERP and the Wyle SERP. Pension information for the years ended December 31 is as follows: 2010 Accumulated benefit obligation... -

Page 81

... in the company's employee stock ownership and 401(k) plans. The company uses a December 31 measurement date for this plan. Pension information for the years ended December 31 is as follows: 2010 Accumulated benefit obligation Changes in projected benefit obligation: Projected benefit obligation at... -

Page 82

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 2010 Weighted average assumptions used to determine net periodic pension cost: Discount rate Expected return on plan assets 2009 5.50 % 8.25 % 6.00% 8.00% The amounts reported for net... -

Page 83

... in net periodic pension cost for the year ended December 31, 2011 are $112 and $3,923, respectively. Defined Contribution Plan The company has a defined contribution plan for eligible employees, which qualifies under Section 401(k) of the Internal Revenue Code. The company's contribution to the... -

Page 84

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 14. Lease Commitments The company leases certain office, distribution, and other property under non-cancelable operating leases expiring at various dates through 2022. Rental expense ... -

Page 85

... a defendant in a lawsuit filed in September 2006 in the United States District Court for the Central District of California (Apollo Associates, L.P., et anno. v. Arrow Electronics, Inc. et al.) in connection with alleged contamination at a third site, an industrial building formerly leased by Wyle... -

Page 86

.... Impact on Financial Statements The company believes that any cost which it may incur in connection with environmental conditions at the Norco, Huntsville, and El Segundo sites and the related litigation is covered by the contractual indemnifications (except, under the terms of the environmental... -

Page 87

... computing solutions to value-added resellers through its global ECS business segment. As a result of the company's philosophy of maximizing operating efficiencies through the centralization of certain functions, selected fixed assets and related depreciation, as well as borrowings, are not directly... -

Page 88

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) Sales, by geographic area, for the years ended December 31 are as follows: 2010 Americas (b) EMEA Asia/Pacific Consolidated (b) $ 9,111,557 5,633,508 3,999,611 $ 2009 7,056,745 4,248,049 ... -

Page 89

ARROW ELECTRONICS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Dollars in thousands except per share data) 17. Quarterly Financial Data (Unaudited) The company operates on a quarterly interim reporting calendar that closes on the Saturday following the end of the calendar quarter. A summary of... -

Page 90

...sales facilities in more than 50 locations across North America, Asia, and Europe, as well as regional logistics centers throughout the world, serving a wide variety of end markets including industrial, military, networking, and data communications. Nu Horizons is headquartered in Melville, New York... -

Page 91

...'s Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the company's internal control over financial reporting as of December 31, 2010, and concluded that it is effective. The company acquired eight separate entities over the course of the year ended December 31, 2010... -

Page 92

... our opinion, Arrow Electronics, Inc. maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 93

... change in the company's internal control over financial reporting that occurred during the company's most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the company's internal control over financial reporting. Item 9B. Other Information. None. 91 -

Page 94

...Executive Officers, and Corporate Governance. See "Executive Officers" in Part I of this Annual Report on Form 10-K. In addition, the information set forth under the headings "Election of Directors" and "Section 16(A) Beneficial Ownership Reporting Compliance" in the company's Proxy Statement, filed... -

Page 95

PART IV ARROW ELECTRONICS, INC. SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (In thousands) For the three years ended December 31, Allowance for doubtful accounts 2010 2009 2008 (a) $ $ $ 39,674 52,786 71,232 $ $ 5,001 7,515 $ $ $ 5,849 1,001 7,787 $ 12,526 $ 21,628 $ 41,099 $ 37,998 $ 39,674 $ ... -

Page 96

.../s/ Michael J. Long Michael J. Long, Chairman, President, and Chief Executive Officer By: /s/ Paul J. Reilly Paul J. Reilly, Executive Vice President, Finance and Operations, and Chief Financial Officer By: /s/ Derrick Barker Derrick Barker, Vice President, Corporate Controller, and Chief Accounting... -

Page 97

... Counsel and Secretary Andrew S. Bryant President, Arrow Enterprise Computing Solutions (ECS) Peter T. Kong President, Arrow Global Components John P. McMahon Senior Vice President, Human Resources Corporate Headquarters 50 Marcus Drive Melville, New York 11747-4210 www.arrow.com Annual Meeting... -

Page 98

www.arrow.com