Arrow Electronics 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Arrow Electronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

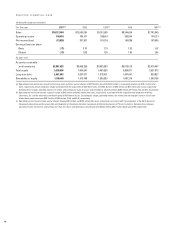

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1 Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of

the company and its majority-owned subsidiaries. All significant

intercompany transactions are eliminated.

Use of Estimates

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make

estimates and assumptions that affect the amounts reported in

the consolidated financial statements and accompanying notes.

Actual results could differ from those estimates.

Cash and Short-term Investments

Short-term investments which have a maturity of ninety days or

less at time of purchase are considered cash equivalents in the

consolidated statement of cash flows. The carrying amount reported

in the consolidated balance sheet for short-term investments

approximates fair value.

Financial Instruments

The company uses various financial instruments, including derivative

financial instruments, for purposes other than trading. The company

does not use derivative financial instruments for speculative purposes.

Derivatives used as part of the company’s risk management

strategy are designated at inception as hedges and measured

for effectiveness both at inception and on an ongoing basis.

Inventories

Inventories are stated at the lower of cost or market. Cost is

determined on the first-in, first-out (FIFO) method.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Depreciation

is computed on the straight-line method for financial reporting

purposes and on accelerated methods for tax reporting purposes.

Leasehold improvements are amortized over the shorter of the

term of the related lease or the life of the improvement. Long-lived

assets are reviewed for impairment whenever changes in circum-

stances or events may indicate that the carrying amounts may not

be recoverable. If the fair value is less than the carrying amount

of the asset, a loss is recognized for the difference.

Cost in Excess of Net Assets of Companies Acquired

The cost in excess of net assets of companies acquired is being

amortized on a straight-line basis over periods of 20 to 40 years.

Management reassesses the carrying value and remaining life

of the excess cost over fair value of net assets of companies

acquired on an ongoing basis. Whenever events indicate that the

carrying values are impaired, the excess cost over fair value of

those assets is adjusted appropriately.

Foreign Currency Translation

The assets and liabilities of foreign operations are translated at

the exchange rates in effect at the balance sheet date, with the

related translation gains or losses reported as a separate compo-

nent of shareholders’ equity. The results of foreign operations are

translated at the monthly average exchange rates.

Income Taxes

Income taxes are accounted for under the liability method.

Deferred taxes reflect the tax consequences on future years of

differences between the tax bases of assets and liabilities and

their financial reporting amounts.

Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing income

(loss) available to common shareholders by the weighted average

number of common shares outstanding for the period. Diluted

earnings per share reflects the potential dilution that would occur if

securities or other contracts to issue common stock were exercised

or converted into common stock.

Comprehensive Income (Loss)

Comprehensive income (loss) is defined as the aggregate change

in shareholders’ equity excluding changes in ownership interests.

The foreign currency translation adjustments included in compre-

hensive income (loss) have not been tax effected as investments

in foreign affiliates are deemed to be permanent.

Segment Reporting

Operating segments are defined as components of an enterprise

for which separate financial information is available that is

evaluated regularly by the chief operating decision makers in

deciding how to allocate resources and in assessing performance.

The company’s operations are classified into two reportable

business segments, the distribution of electronic components

and the distribution of computer products.

Revenue Recognition

The company recognizes revenue in accordance with SEC Staff

Accounting Bulletin No. 101, “Revenue Recognition in Financial

Statements” (“SAB 101”). Under SAB 101 revenue is recognized

when the title and risk of loss have passed to the customer, there

is persuasive evidence of an arrangement, delivery has occurred

or services have been rendered, the sales price is determinable,

and collectibility is reasonably assured. Revenue typically is

recognized at time of shipment. Sales are recorded net of discounts,

rebates, and returns.

Software Development Costs

The company capitalizes certain costs incurred in connection

with developing or obtaining software for internal use. Capitalized

software costs are amortized on a straight-line basis over the esti-

mated useful life of the software, which is generally three years.