Archer Daniels Midland 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Archer Daniels Midland annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Item 1.

BUSINESS (Continued)

Corporate

Compagnie Industrielle et Financiere des Produits Amylaces SA (Luxembourg) and affiliates, of which the

Company has a 41.5% interest, is a joint venture which targets investments in food, feed ingredients and bioenergy

businesses.

In July 2010, the Company made a $100 million cornerstone investment in Agricultural Bank of China, to help

advance its strategic growth plans in China.

Methods of Distribution

Since the Company‘s customers are principally other manufacturers and processors, the Company‘s products are

distributed mainly in bulk from processing plants or storage facilities directly to customers‘ facilities. The

Company has developed a comprehensive transportation system to efficiently move both commodities and

processed products virtually anywhere in the world. The Company owns or leases large numbers of the trucks,

trailers, railroad tank and hopper cars, river barges, towboats, and ocean-going vessels used in this transportation

system.

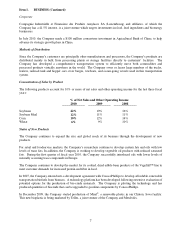

Concentration of Sales by Product

The following products account for 10% or more of net sales and other operating income for the last three fiscal

years:

% of Net Sales and Other Operating Income

2010

2009

2008

Soybeans

22%

19%

16%

Soybean Meal

12%

11%

11%

Corn

10%

12%

14%

Wheat

6%

9%

10%

Status of New Products

The Company continues to expand the size and global reach of its business through the development of new

products.

For retail and foodservice markets, the Company‘s researchers continue to develop custom fats and oils with low

levels of trans fats. In addition, the Company is working to develop vegetable oil products with reduced saturated

fats. During the first quarter of fiscal year 2010, the Company successfully introduced oils with lower levels of

naturally occurring trace compounds in Europe.

The Company continues to develop the market for its cooked, dried edible bean products of the Vegefull™ line to

meet customer demands for increased protein and fiber in food.

In 2007, the Company entered into a development agreement with ConocoPhillips to develop affordable, renewable

transportation biofuels from biomass. A technology platform has been developed following extensive evaluation of

potential options for the production of bio-crude materials. The Company is piloting the technology and has

produced quantities of biocrude that can be upgraded to gasoline components by ConocoPhillips.

In December 2009, the Company started production of Mirel®, a renewable plastic in our Clinton, Iowa facility.

This new bioplastic is being marketed by Telles, a joint venture of the Company and Metabolix.