Apple 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Apple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company had net deferred losses of $175 million and $240 million associated with cash flow hedges, net of

taxes, recorded in AOCI as of September 28, 2013 and September 29, 2012, respectively. Deferred gains and

losses associated with cash flow hedges of foreign currency revenue are recognized as a component of net sales

in the same period as the related revenue is recognized, and deferred gains and losses related to cash flow hedges

of inventory purchases are recognized as a component of cost of sales in the same period as the related costs are

recognized. Deferred gains and losses associated with cash flow hedges of interest income or expense are

recognized as a component of other income/(expense), net in the same period as the related income or expense is

recognized. The Company’s hedged foreign currency transactions and hedged interest rate transactions as of

September 28, 2013 are expected to occur within 12 months and five years, respectively.

Derivative instruments designated as cash flow hedges must be de-designated as hedges when it is probable the

forecasted hedged transaction will not occur in the initially identified time period or within a subsequent two-

month time period. Deferred gains and losses in AOCI associated with such derivative instruments are

reclassified immediately into other income and expense. Any subsequent changes in fair value of such derivative

instruments are reflected in other income and expense unless they are re-designated as hedges of other

transactions. The Company did not recognize any significant net gains or losses related to the loss of hedge

designation on discontinued cash flow hedges during 2013, 2012 and 2011.

The Company’s unrealized net gains and losses on net investment hedges, included in the cumulative translation

adjustment account of AOCI, were not significant as of September 28, 2013 and September 29, 2012. The

ineffective portions of and amounts excluded from the effectiveness test of net investment hedges are recorded in

other income and expense.

The gain/loss recognized in other income and expense for foreign currency forward and option contracts not

designated as hedging instruments was not significant during 2013, 2012 and 2011, respectively. These amounts

represent the net gain or loss on the derivative contracts and do not include changes in the related exposures,

which generally offset a portion of the gain or loss on the derivative contracts.

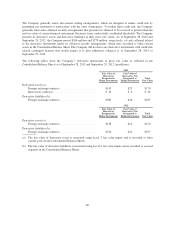

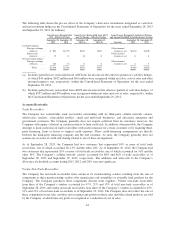

The following table shows the notional principal amounts of the Company’s outstanding derivative instruments

and credit risk amounts associated with outstanding or unsettled derivative instruments as of September 28, 2013

and September 29, 2012 (in millions):

2013 2012

Notional

Principal

Credit

Risk

Amounts

Notional

Principal

Credit

Risk

Amounts

Instruments designated as accounting hedges:

Foreign exchange contracts ............................... $35,013 $ 159 $41,970 $ 140

Interest rate contracts .................................... $ 3,000 $ 44 $ 0 $ 0

Instruments not designated as accounting hedges:

Foreign exchange contracts ............................... $16,131 $ 25 $13,403 $ 12

The notional principal amounts for outstanding derivative instruments provide one measure of the transaction

volume outstanding and do not represent the amount of the Company’s exposure to credit or market loss. The credit

risk amounts represent the Company’s gross exposure to potential accounting loss on derivative instruments that are

outstanding or unsettled if all counterparties failed to perform according to the terms of the contract, based on

then-current currency or interest rates at each respective date. The Company’s gross exposure on these transactions

may be further mitigated by collateral received from certain counterparties. The Company’s exposure to credit loss

and market risk will vary over time as a function of currency and interest rates. Although the table above reflects the

notional principal and credit risk amounts of the Company’s derivative instruments, it does not reflect the gains or

losses associated with the exposures and transactions that the instruments are intended to hedge. The amounts

ultimately realized upon settlement of these financial instruments, together with the gains and losses on the

underlying exposures, will depend on actual market conditions during the remaining life of the instruments.

59