Amtrak 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Amtrak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Railroad Passenger Corporation and Subsidiaries (Amtrak)

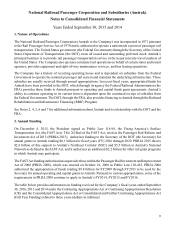

Notes to Consolidated Financial Statements (continued)

3. Basis of Presentation and Summary of Significant Accounting Policies (continued)

14

necessary to prepare such assets for their intended use are completed, at which time depreciation commences.

Capitalized interest is recorded as part of the asset to which it relates and is depreciated over the asset’s useful

life. Interest costs capitalized on construction projects were $6.5 million and $11.7 million for FY2015 and

FY2014, respectively.

The useful lives of locomotives, passenger cars, and other rolling stock assets for depreciation purposes range

up to 42 years. Right-of-way and other properties (excluding land) are depreciated using useful lives ranging

up to 105 years. Other equipment including computers, office equipment, and maintenance equipment is

depreciated using useful lives ranging from five to 24 years. Expenditures that significantly increase asset

values or extend useful lives are capitalized, including major overhauls. Repair and maintenance expenditures,

including preventive maintenance, are charged to operating expense when the work is performed. The cost

of internally developed software is capitalized and amortized over its estimated useful life, which is generally

five to ten years.

The Company accounts for asset retirement obligations (AROs) in accordance with Financial Accounting

Standards Board (FASB) Accounting Standards Codification (ASC) Topic 410, Asset Retirement and

Environmental Obligations. The standard applies to legal obligations associated with the retirement of long-

lived assets that result from the acquisition, construction, development and/or normal use of the asset. In

accordance with FASB ASC Topic 410, the Company recognizes the fair value of any liability for conditional

AROs, including environmental remediation liabilities, in the period in which it is incurred, which is generally

upon acquisition, construction, or development and/or through the normal operation of the asset, if sufficient

information exists with which Amtrak can reasonably estimate the fair value of the obligation. Amtrak

capitalizes the cost by increasing the carrying amount of the related long-lived asset. The capitalized cost is

depreciated over the useful life of the related asset and upon settlement of the liability Amtrak either settles

the obligation for its recorded amount or incurs a gain or loss upon settlement. The asset retirement costs

capitalized were $9.3 million and $9.7 million as of September 30, 2015 and 2014, respectively, and were

included in “Right of way and other properties” in the Consolidated Balance Sheets.

Indirect Cost Capitalized to Property and Equipment

Overhead expense allocations represent the indirect support expenses related to specific geographic regions

and departments that are involved in particular operating and capital projects. These indirect costs, which

include fringe benefits allocable to direct labor, are capitalized along with the direct costs of labor, material,

and other direct costs. Amtrak’s overhead rates are updated at the end of each fiscal year based upon the

actual activity and costs incurred during the fiscal year.

Impairment of Long-Lived Assets

Properties and other long-lived assets are reviewed for impairment whenever events or business conditions

indicate that their carrying amounts may not be recoverable. Initial assessments of recoverability are based

on estimates of undiscounted future net cash flows. If impairment indicators are present, the assets are

evaluated for sale or other disposition, and their carrying amounts are reduced to fair value based on discounted

cash flows or other estimates of fair value.

In performing its impairment analysis, the Company assumes future Federal Government subsidies at levels

consistent with the historical funding levels discussed in Note 2. The Company believes funding at historical