American Home Shield 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

o

o

o

o

o

Table of contents

-

Page 1

... or organization) 90-1036521 (I.R.S. Employer Identification No.) 860 Ridge Lake Boulevard, Memphis, Tennessee 38120 (Address of principal executive offices, including zip code) (901) 597-1400 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12... -

Page 2

... not check if a smaller reporting company) Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No  The registrant is a privately held limited liability company and its membership interests are not publicly traded. At March 5, 2014, all... -

Page 3

... Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures 26 26 27 59 61 11R 11R 119 Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management... -

Page 4

... in this Annual Report on Form 10-K. During 2013, we employed an average of approximately 22,000 company associates, and we estimate that our franchise network independently employed over 33,000 additional people. Approximately 9R percent of our 2013 operating revenue was generated by sales in the... -

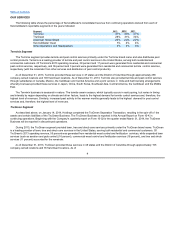

Page 5

...'s reportable segments in the years indicated: Segment 2013 2012 2011 Terminix TruGreen American Home Shield ServiceMaster Clean Other Operations and Headquarters Terminix Segment 41% 2R% 23% 5% 3% 40% 31% 22% 4% 3% 37% 34% 22% 4% 3% The Terminix segment provides termite and pest control... -

Page 6

...or replace electrical, plumbing, central heating and central air conditioning systems, water heaters and other covered household systems and appliances and services those contracts through independent repair contractors. In 2013, 69 percent of the home warranties written by American Home Shield were... -

Page 7

...In the event a customer fails to make payments under a retail installment sales contract for 120 days after the due date, Terminix and TruGreen purchase the installment contract from SMAC. Headquarters functions. The Business Support Center, headquartered in Memphis, Tennessee, includes company-wide... -

Page 8

... on termite and pest control, home warranties and preventative maintenance contracts, janitorial, cleaning and disaster restoration, home cleaning, wood furniture repair and home inspection. ServiceMaster competes with many other companies in the sale of its services, franchises and products. The... -

Page 9

... and insurance agencies and, for American Home Shield, an internal sales organization that supports these distribution channels. SERVICE MARKS, TRADEMARKS AND TRADE NAMES As of December 31, 2013, ServiceMaster held various service marks, trademarks and trade names, such as ServiceMaster, Terminix... -

Page 10

... trade practices, permitting and licensing, state contractor laws, real estate settlements, workers' safety, tax, healthcare reforms, franchise related issues, collective bargaining and other labor matters, environmental and employee benefits. The Terminix business must also meet certain Department... -

Page 11

..., we provide various insurance coverages, including deductible reimbursement policies, to our business units through our wholly owned captive insurance company, which is domiciled in Vermont. EMPLOYEES The average number of persons employed by ServiceMaster during 2013 was approximately 22,000... -

Page 12

...our business strategies may change from time to time in light of our ability to implement our new business initiatives, competitive pressures, economic uncertainties or developments, or other factors. For example, in February 2014, American Home Shield ceased efforts to deploy a new operating system... -

Page 13

... issues that could lead to some of our services being cancelled or reduced, or that could result in an increase in the time it takes our customers to pay us, or that could lead to a decrease in pricing for our services and products, any of which could adversely affect our accounts receivable... -

Page 14

... cannot travel to service locations due to hazardous road conditions. In addition, extreme temperatures can lead to an increase in service requests related to household systems and appliances in our American Home Shield business, resulting in higher claim frequency and costs and lower profitability... -

Page 15

...swap contracts. Based upon Department of Energy fuel price forecasts, as well as the hedges we have executed to date for 2014, we have projected that fuel prices will not significantly increase our fuel costs for 2014 compared to 2013. Fuel price increases can also result in increases in the cost of... -

Page 16

...in the services and products we offer our customers. For example, American Home Shield recently initiated the offering of preventative maintenance contracts and other new products. There can be no assurance that our new strategies or product offerings will succeed in increasing operating revenue and... -

Page 17

... new businesses, technologies, products, personnel or systems; the inability to retain associates, customers and suppliers; the assumption of actual or contingent liabilities (including those relating to the environment); failure to effectively and timely adopt and adhere to our internal control... -

Page 18

... and regulations include laws relating to consumer protection, wage and hour requirements, franchising, the employment of immigrants, labor relations, permitting and licensing, building code requirements, workers' safety, the environment, insurance and home warranties, employee benefits, marketing... -

Page 19

... regulations and subject us to risk of legal exposure. The costs of compliance, non-compliance, remediation, combating unfavorable public perceptions or defending products liability lawsuits could have a material adverse impact on our reputation, business, financial position, results of operations... -

Page 20

... in delivering our services in a high-quality or timely manner and could be forced to increase wages in order to attract and retain associates, which would result in higher operating costs and reduced profitability. New election rules by the National Labor Relations Board, including "expedited... -

Page 21

... comparable indebtedness on more favorable terms and, as a result, they may be better positioned to withstand economic downturns; • • • • • our ability to refinance indebtedness may be limited or the associated costs may increase; our flexibility to adjust to changing market conditions... -

Page 22

... other indebtedness may prevent us from taking actions that we believe would be in the best interest of our business and may make it difficult for us to execute our business strategy successfully or effectively compete with companies that are not similarly restricted. We may also incur future debt... -

Page 23

... to fund general corporate expenses or service our debt obligations. These restrictions are related to regulatory requirements at American Home Shield and to a subsidiary borrowing arrangement at SMAC. The payment of ordinary and extraordinary dividends by the Company's home warranty and similar... -

Page 24

...Equity Sponsors, who have the ability to control our policies and operations. The directors appointed by the Equity Sponsors are able to make decisions affecting our capital structure, including decisions to issue or repurchase capital stock, pay dividends and incur or repurchase debt. The interests... -

Page 25

... affect our financial condition and results of operations. Our directIrs and Ifficers may haee actual Ir pItential cInflicts If interest because If their equity Iwnership in New TruGreen. Our directors and officers may own shares of New TruGreen's common stock or be affiliated with certain equity... -

Page 26

... with the corporate headquarters, call center facility, offices, training facilities and warehouse described above, are suitable and adequate to support the current needs of its business. Operating Company Owned Facilities Leased Facilities Terminix TruGreen American Home Shield ServiceMaster... -

Page 27

... Annual Report on Form 10-K. ITEM 6. SELECTED FINTNCITL DTTT Five-Year Financial Summary (In thousands, except per share data) 2013 2012 Year Ended December 31, 2011 2010 2009 Operating Results: Operating revenue $ 3,1RR,R35 $ 3,193,2R1 $ 3,205,R72 Cost of services rendered and products sold... -

Page 28

... Business through a tax-free, pro rata dividend to the stockholders of Holdings. As a result of the completion of the TruGreen Separation Transaction, New TruGreen will operate the TruGreen Business as a private independent company. The TruGreen Business is reported in this Annual Report on Form... -

Page 29

... in our "Segment Review." Additionally, at American Home Shield, a $3.3 million reduction in tax related reserves was recorded in 2013, and a $5.4 million increase in tax related reserves was recorded in 2012. Represents the net change in restructuring charges related primarily to the impact... -

Page 30

... Company has executed to date for 2014, the Company projects that fuel prices will not significantly increase our fuel costs for 2014 compared to 2013. After adjusting for the impact of year over year changes in the number of covered employees, health care and related costs for 2013 were comparable... -

Page 31

... in sales and marketing and higher technology costs at American Home Shield; and a $5.0 million increase in key executive transition charges. These items were offset, in part, by an $R.7 million reduction in tax related reserves and lower provisions for certain legal matters at American Home Shield... -

Page 32

...Represents restructuring charges related to an initiative to enhance capabilities and reduce costs in the Company's headquarters functions that provide company-wide administrative services for our operations that we refer to as "centers of excellence." For the years ended December 31, 2013, 2012 and... -

Page 33

... borrowings under the Term Facilities. There was no similar loss on extinguishment of debt in 2013. (Benefit) PrIeisiIn fIr IncIme Taxes The effective tax rate on (loss) income from continuing operations was a benefit of 19.6 percent and 13.R percent for the year ended December 31, 2013 and 2012... -

Page 34

... 31, 2013 2012 2011 Terminix- (Reduction) Growth in Pest Control Customers Pest Control Customer Retention Rate Reduction in Termite Customers Termite Customer Retention Rate TruGreen- Reduction in Full Program Accounts(1) Customer Retention Rate(1) Tmerican Home Shield- Growth in Home Warranties... -

Page 35

..., in part, by a 0.4 percent decrease in average pest control customer counts. Absolute pest control customer counts as of December 31, 2013 compared to 2012 decreased 1.6 percent, driven by a decrease in new unit sales and acquisitions. The pest control customer retention rate for the year ended... -

Page 36

... in the customer retention rate, offset, in part, by new unit sales and acquisitions. Product distribution revenue, which has lower margins than pest or termite revenue and accounted for approximately five percent of the segment's operating revenue in 2012, increased $10.1 million compared to 2011... -

Page 37

... melt sales, which has lower margins than core lawn services. American HIme Shield Segment Year ended December 31, 2013 The American Home Shield segment, which provides home warranties and preventative maintenance contracts for household systems and appliances, reported a 2.7 percent increase in... -

Page 38

...average customer counts. Absolute customer counts as of December 31, 2013 increased 1.0 percent compared to 2012, driven by an increase in new unit sales, offset, in part, by a 90 bps decrease in the customer retention rate. American Home Shield's Adjusted EBITDA increased $29.3 million for the year... -

Page 39

... under the Furniture Medic brand name and home inspection services primarily under the AmeriSpec brand name, reported an R.2 percent increase in operating revenue and an 11.3 percent increase in Adjusted EBITDA for the year ended December 31, 2013 compared to 2012. Domestic royalty fees, which were... -

Page 40

... part, by a decline in non-recurring services. Absolute customer counts as of December 31, 2013 were comparable to 2012. Royalty fees, which were 1R percent of Merry Maids' operating revenue in 2013, and sales of products to franchisees, which were 7 percent of Merry Maids' operating revenue in 2013... -

Page 41

...corporate costs include: accounting and finance, legal, human resources, information technology, insurance, operations, real estate, tax services and other costs. These costs will be transitioned to New TruGreen through a combination of (1) transfers of certain activities to New TruGreen at the time... -

Page 42

... on a pro forma basis are as follows: (In thousands) Ts Reported Tdjustments(1) Pro Forma Year Ended December 31, 2013 Operating Revenue: Terminix TruGreen American Home Shield ServiceMaster Clean Other Operations and Headquarters Total Operating Revenue $ 1,309,469 $ R95,943 740,062 150,929 92... -

Page 43

... non-cash charges and a $49.0 million decrease in cash required for working capital, offset, in part, by $17.R million in cash payments related to restructuring charges. For the year ended December 31, 2013, working capital requirements were favorably impacted by a change in the timing of customer... -

Page 44

...accounts receivable securitization facility, and made payments on other long-term financing obligations of $4.1 million. Additionally, the Company borrowed an incremental $0.9 million, paid $12.2 million in original issue discount and paid debt issuance costs of $5.6 million as part of the 2013 Term... -

Page 45

... short- and long-term marketable securities totaled $634.R million as of December 31, 2013, compared with $56R.5 million as of December 31, 2012. Cash and short- and long-term marketable securities include balances associated with regulatory requirements at American Home Shield. See "-Limitations on... -

Page 46

... the year ended December 31, 2013, the Company acquired $50.9 million of vehicles under the Fleet Agreement leasing program. All leases under the Fleet Agreement are capital leases for accounting purposes. The lease rental payments include an interest component calculated using a variable rate based... -

Page 47

... subject to regulation as an insurance, home warranty or similar company, or certain other subsidiaries (the "Non-Guarantors"). Limitations on Distributions and Dividends by Subsidiaries As a holding company, we depend on our subsidiaries to distribute funds to us so that we may pay our obligations... -

Page 48

.... The payment of ordinary and extraordinary dividends by the Company's home warranty and similar subsidiaries (through which ServiceMaster conducts its American Home Shield business) are subject to significant regulatory restrictions under the laws and regulations of the states in which they operate... -

Page 49

.... Other assets increased from prior year levels, primarily reflecting the inclusion, in 2013, of the non-current portion of insurance recoverables related to insured claims, which has historically been netted with loss reserves within Other long-term obligations, primarily self-insured claims. 4R -

Page 50

...Contents Accounts payable increased from prior year levels, primarily reflecting a change in the timing of payments to vendors. Deferred revenue increased from prior year levels, primarily reflecting higher customer prepayments at Terminix, TruGreen and American Home Shield. Deferred taxes decreased... -

Page 51

...for home warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial projections. Termite damage claim accruals in the Terminix business are recorded based on both the historical rates of claims incurred within a contract year and the cost per... -

Page 52

..., but instead completed Step 1 of the goodwill impairment test for all reporting units. For the 2011 annual goodwill impairment review performed as of October 1, 2011, the Company performed qualitative assessments on the Terminix, American Home Shield and ServiceMaster Clean reporting units. Based... -

Page 53

... in pre-tax non-cash impairment of $36.7 million in 2011 related to the TruGreen trade name. The Company's October 1, 2013 and 2012 trade name impairment analyses did not result in any trade name impairments. The impairment charges by business segment for the years ended December 31, 2013, 2012 and... -

Page 54

Table of Contents the trade names not subject to amortization by business segment as of December 31, 2013 and 2012 are as follows: Other Tmerican Home ServiceMaster Operations & Headquarters(1) Shield Clean (In thousands) Terminix TruGreen Total Balance at December 31, 2010 $R75,100 $ 762,200 $... -

Page 55

.... The changes in projected future revenue growth at TruGreen arose in part from the business challenges at TruGreen described in "Segment Review-TruGreen Segment" in Management's Discussion and Analysis above. The long-term revenue growth rates used in the impairment tests at October 1, 2013, June... -

Page 56

... Company does not hold or issue derivative financial instruments for trading or speculative purposes. The Company has entered into specific financial arrangements in the normal course of business to manage certain market risks, with a policy of matching positions and limiting the terms of contracts... -

Page 57

... strategies or expectations; issues related to the TruGreen Separation Transaction; human resources, finance and other outsourcing and insourcing arrangements; customer retention; an expected impairment charge of $50 million at American Home Shield and an expected $150 million TruGreen trade name... -

Page 58

... self-insurance costs, labor expense and compensation and benefits costs, including, without limitation, costs related to the comprehensive health care reform law enacted in 2010; associate retention and labor shortages, changes in employment and wage and hour laws and regulations, such as equal pay... -

Page 59

...our services; • • • • regulations imposed by several states related to our home warranty and insurance subsidiaries, including those limiting the amount of funds that can be paid to the Company by its subsidiaries; changes in claims trends in our medical plan and our automobile, general... -

Page 60

...course of business to manage certain market risks, with a policy of matching positions and limiting the terms of contracts to relatively short durations. The effect of derivative financial instrument transactions could have a material impact on the Company's financial statements. Interest Rate Risk... -

Page 61

... cash payments and related weighted-average interest rates by expected maturity dates based on applicable rates at December 31, 2013. Expected Year of Maturity 2016 2017 2018 Thereafter ($ in millions) Ts of December 31, 2013 2014 2015 Total Fair Value Debt: Fixed rate Average interest rate... -

Page 62

...America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of December 31, 2013, based on the criteria established in Internal Control -Integrated Framework (1992) issued... -

Page 63

... and Comprehensive (Loss) Income (In thousands) 2013 Year Ended December 31, 2012 2011 Operating Revenue Cost of services rendered and products sold Selling and administrative expenses Amortization expense Goodwill and trade name impairment Restructuring charges Interest expense Interest and... -

Page 64

... Liabilities Long-Term Debt Other Long-Term Liabilities: Deferred taxes Other long-term obligations, primarily self-insured claims Total Other Long-Term Liabilities Commitments and Contingencies (See Note 9) Shareholder's Equity: Common stock $0.01 par value, authorized 1,000 shares; issued 1,000... -

Page 65

63 -

Page 66

... income, net of tax - $ 1,471,7R9 $ (923,705) $ (505,939) 6,566 $ 554,650 (505,939) 45 45 Total comprehensive (loss) income Stock-based employee compensation -contribution from Holdings (505,939) 45 (505,R94) Other 4,046 (377) 4,046 (377) Balance December 31, 2013 $ - $ 1,475,45R... -

Page 67

2013 $ - $ 1,475,45R $ (1,429,644 ) $ 6,611 $ 52,425 See accompanying Notes to the Consolidated Financial Statements. 64 -

Page 68

... tax (benefit) provision Stock-based compensation expense Goodwill and trade name impairment Restructuring charges Cash payments related to restructuring charges Change in working capital, net of acquisitions: Current income taxes Receivables Inventories and other current assets Accounts payable... -

Page 69

Cash Increase During the Period Cash and Cash Equivalents at End of Period 63,443 $ 4R6,1RR $ 93,R15 76,232 422,745 $ 32R,930 See accompanying Notes to the Consolidated Financial Statements. 65 -

Page 70

...for home warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial projections. Termite damage claim accruals in the Terminix business are recorded based on both the historical rates of claims incurred within a contract year and the cost per... -

Page 71

...Termite services using baiting systems, termite inspection and protection contracts, as well as home warranties, are frequently sold through annual contracts for a one-time, upfront payment. Direct costs of these contracts (service costs for termite contracts and claim costs for home warranties) are... -

Page 72

... life of the related contract in proportion to revenue recognized. These costs include sales commissions and direct selling costs which can be shown to have resulted in a successful sale. Deferred customer acquisition costs amounted to $39.1 million and $33.9 million as of December 31, 2013 and 2012... -

Page 73

..., but instead completed Step 1 of the goodwill impairment test for all reporting units. For the 2011 annual goodwill impairment review performed as of October 1, 2011, the Company performed qualitative assessments on the Terminix, American Home Shield and ServiceMaster Clean reporting units. Based... -

Page 74

... in pre-tax non-cash impairment of $36.7 million in 2011 related to the TruGreen trade name. The Company's October 1, 2013 and 2012 trade name impairment analyses did not result in any trade name impairments. The impairment charges by business segment for the years ended December 31, 2013, 2012 and... -

Page 75

...) Note 1. Significant Tccounting Policies (Continued) the trade names not subject to amortization by business segment as of December 31, 2013 and 2012 are as follows: Other Tmerican Home ServiceMaster Operations & Headquarters(1) Shield Clean (In thousands) Terminix TruGreen Total Balance at... -

Page 76

.... The changes in projected future revenue growth at TruGreen arose in part from the business challenges at TruGreen described in "Segment Review-TruGreen Segment" in Management's Discussion and Analysis above. The long-term revenue growth rates used in the impairment tests at October 1, 2013, June... -

Page 77

.... The payment of ordinary and extraordinary dividends by the Company's home warranty and similar subsidiaries (through which ServiceMaster conducts its American Home Shield business) are subject to significant regulatory restrictions under the laws and regulations of the states in which they operate... -

Page 78

... related to its uncertain tax positions in income tax expense. StIck-Based CImpensatiIn: The Company accounts for stock-based compensation under accounting standards for share based payments, which require that stock options, restricted stock units and share grants be measured at fair value... -

Page 79

... were converted on a one-to-one basis into the 2015 Notes. Note 3. Business Segment Reporting As of December 31, 2013, the business of the Company was conducted through five reportable segments: Terminix, TruGreen, American Home Shield, ServiceMaster Clean and Other Operations and Headquarters. 75 -

Page 80

... services to residential and commercial customers and distributes pest control products. The TruGreen segment provides residential and commercial lawn, tree and shrub care services. The American Home Shield segment provides home warranties and preventative maintenance contracts for household systems... -

Page 81

... Business Segment Reporting (Continued) Segment information for continuing operations is presented below: (In thousands) 2013 Year Ended December 31, 2012 2011 Operating Revenue: Terminix TruGreen American Home Shield ServiceMaster Clean Other Operations and Headquarters Total Operating Revenue... -

Page 82

... Financial Statements (Continued) Note 3. Business Segment Reporting (Continued) (In thousands) 2013 Year Ended December 31, 2012 2011 Capital Expenditures: Terminix TruGreen American Home Shield ServiceMaster Clean Other Operations and Headquarters Total Capital Expenditures $ 10,701... -

Page 83

...the impact of the amortization of tax deductible goodwill and foreign exchange rate changes. Accumulated impairment losses as of December 31, 2013 and 2012 were $1.20R billion and $790.2 million, respectively, and related entirely to the TruGreen reporting unit. There were no accumulated impairment... -

Page 84

... benefits would impact the effective tax rate if recognized. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows: Year Ended December 31, 2013 2012 2011 (In millions) Gross unrecognized tax benefits at beginning of period Increases in tax positions... -

Page 85

... of 2015. Seven state tax authorities are in the process of auditing state income tax returns of various subsidiaries. The Company's policy is to recognize potential interest and penalties related to its tax positions within the tax provision. During the years ended December 31, 2013, 2012 and 2011... -

Page 86

... at the U.S. federal statutory tax rate to the Company's effective income tax rate for continuing operations is as follows: Year Ended December 31, 2013 2012 2011 Tax at U.S. federal statutory rate State and local income taxes, net of U.S. federal benefit Tax credits Nondeductible goodwill Other... -

Page 87

... Position. (2) The deferred tax liability relates primarily to the difference in the tax versus book basis of intangible assets. The majority of this liability will not actually be paid unless certain business units of the Company are sold. As of December 31, 2013, the Company had deferred tax... -

Page 88

... dates. 2013 During the year ended December 31, 2013, the Company completed several pest control and termite and lawn care acquisitions, along with several Merry Maids franchise acquisitions and the purchase of a distributor license agreement at ServiceMaster Clean. The total net purchase price... -

Page 89

... fair value less cost to sell in accordance with applicable accounting standards. Upon completion of the sale, a $6.2 million loss on sale ($1.9 million, net of tax) was recorded. During the year ended December 31, 2012, upon finalization of certain post-closing adjustments and disputes, the Company... -

Page 90

... accordance with applicable accounting standards. The table below summarizes the activity during the year ended December 31, 2013 for the remaining liabilities of previously sold businesses. The remaining obligations primarily relate to self-insurance claims and related costs. The Company believes... -

Page 91

...Represents restructuring charges related to an initiative to enhance capabilities and reduce costs in the Company's headquarters functions that provide company-wide administrative services for our operations that we refer to as "centers of excellence." For the years ended December 31, 2013, 2012 and... -

Page 92

... leases provide that the Company pay taxes, insurance and maintenance applicable to the leased premises. As leases for existing locations expire, the Company expects to renew the leases or substitute another location and lease. Rental expense for the years ended December 31, 2013, 2012 and 2011 was... -

Page 93

...for home warranty claims in the American Home Shield business are made based on the Company's claims experience and actuarial projections. Termite damage claim accruals in the Terminix business are recorded based on both the historical rates of claims incurred within a contract year and the cost per... -

Page 94

... to StepStone. As of December 22, 2011, Holdings purchased from BAS 7.5 million shares of capital stock of Holdings, and, effective January 1, 2012, the annual consulting fee payable to BAS was reduced to $0.25 million. The Company pays annual consulting fees of $0.5 million, $0.25 million and $0.25... -

Page 95

... principal amount of such notes. The increase in the balance from 2012 to 2013 reflects the amortization of fair value adjustments related to purchase accounting, which increases the effective interest rate from the coupon rates shown above. The Company has entered into the Fleet Agreement. All... -

Page 96

... alternate base rate of 2.00 percent. As part of the 2013 Term Loan Facility Amendment, the Company paid an original issue discount equal to 1.00 percent of the outstanding borrowings, or $12.2 million. Voluntary prepayments of borrowings under the Tranche C Loans are permitted at any time, in... -

Page 97

...of these agreements, the Company pays a fixed rate of interest on the stated notional amount and the Company receives a floating rate of interest (based on one month LIBOR) on the stated notional amount. Therefore, during the term of the swap agreements, the effective interest rate on the portion of... -

Page 98

... indebtedness of our Non-Guarantors. The 2020 Notes are effectively junior to all of our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness. ReeIleing Credit Facility On the 2007 Closing Date, in connection with the completion of the 2007... -

Page 99

... Company's short- and long-term investments in Debt and Equity securities as of December 31, 2013 and 2012 is as follows: Gross Gross Tmortized (In thousands) Cost Unrealized Gains Unrealized Losses Fair Value Available-for-sale and trading securities, December 31, 2013: Debt securities Equity... -

Page 100

..., each resulting from sales of available-for-sale securities, and impairment charges due to other than temporary declines in the value of certain investments. Year Ended December 31, 2012 2011 (In thousands) 2013 Proceeds from sales of securities Gross realized gains, pre-tax Gross realized gains... -

Page 101

... and the related tax effects. Unrealized Losses on (In thousands) Derivatives Unrealized Gains on Tvailable-forSale Securities Foreign Currency Translation Total Balance as of December 31, 2011 Other comprehensive loss before reclassifications: Pre-tax amount Tax provision (benefit) $ (14,26R... -

Page 102

... (10,010) Cost of services rendered and products sold 37,613 Interest expense 27,603 10,R70 (Benefit) provision for income taxes $ 16,733 Net losses on derivatives Impact of income taxes Total reclassifications related to derivatives (Gains) losses on available-for-sale securities Impact of income... -

Page 103

..., non-qualified options with a per-share exercise price no less than the fair market value of one share of Holdings stock on the grant date. Any stock options granted will generally have a term of ten years and vesting will be subject to an employee's continued employment. The board of directors of... -

Page 104

... market value of the common stock of Holdings as of the purchase/grant dates. All options granted to date generally will vest in four equal annual installments, subject to an employee's continued employment. The four-year vesting period is the requisite service period over which compensation cost... -

Page 105

... compensation costs related to non-vested stock options and RSUs granted by Holdings under the MSIP. These remaining costs are expected to be recognized over a weighted-average period of 3.0R years. In 2013 and 2012, Holdings modified options held by certain executive officers of ServiceMaster... -

Page 106

... fuel price as of each settlement date and applying the difference between the contract and expected prices to the notional gallons in the fuel swap contracts. The Company regularly reviews the forward price curves obtained from third-party market data providers and related changes in fair value for... -

Page 107

...Prices In Observable Unobservable Tctive Inputs Inputs Markets (Level 3) (Level 2) (Level 1) (In thousands) Statement of Financial Position Location Carrying Value Financial Assets: Deferred compensation trust assets Investments in marketable securities Fuel swap contracts: Long-term marketable... -

Page 108

...) Statement of Financial Position Location Carrying Value TruGreen Trade Name(1) TruGreen Goodwill(2) (1) Intangible assets, primarily trade names, service marks and trademarks, net Goodwill $ 351,000 $ - - $ - - $ - 351,000 - In 2013, the Company recognized a non-cash impairment charge... -

Page 109

... instruments to manage risks associated with changes in interest rates. The Company does not hold or issue derivative financial instruments for trading or speculative purposes. In designating its derivative financial instruments as hedging instruments under accounting standards for derivative... -

Page 110

... Location of Gain (Loss) Derivatives designated as Cash Flow Hedge Relationships included in Earnings Year ended December 31, 2013 Fuel swap contracts (RR1) 1,472 Cost of services rendered and products sold (4,731) Interest expense Interest rate swap contracts 4,631 Effective Portion... -

Page 111

... immediate transfers of certain activities to New TruGreen and (2) payments to ServiceMaster by New TruGreen under transition services agreements. In February 2014, American Home Shield ceased efforts to deploy a new operating system that had been intended to improve customer relationship management... -

Page 112

...) Income For the Year Ended December 31, 2013 (In thousands) Parent Issuer Guarantors NonGuarantors Eliminations Consolidated Operating Revenue $ Cost of services rendered and products sold Selling and administrative expenses Amortization expense Goodwill and trade name impairment Restructuring... -

Page 113

...2012 (In thousands) Parent Issuer Guarantors NonGuarantors Eliminations Consolidated Operating Revenue $ Cost of services rendered and products sold Selling and administrative expenses Amortization expense Goodwill and trade name impairment Restructuring charges Interest expense (income) Interest... -

Page 114

-

Page 115

...Operating Revenue Cost of services rendered and products sold Selling and administrative expenses Amortization expense Trade... of debt 774 - - - 774 (Loss) Income from Continuing Operations before Income Taxes (Benefit) provision for income taxes (Loss) Income from (202,R63) (76,622) 26R,279... -

Page 116

... Position Ts of December 31, 2013 (In thousands) Parent Issuer Tssets Guarantors Non-Guarantors Eliminations Consolidated Current Tssets: Cash and cash equivalents Marketable securities Receivables Inventories Prepaid expenses and other assets Deferred customer acquisition costs Deferred taxes... -

Page 117

Liabilities: Deferred taxes Intercompany payable - 340,R23 577,532 26R,933 (35,059) R11,406 - 411,965 (752,7RR) - Other long-term obligations, primarily selfinsured claims Total Other Long-Term Liabilities Shareholder's 19,706 40,7R6 110,953 - 171,445 360,529 61R,31R 1,R2R,979 791,... -

Page 118

...,04R 231,063 2,055,779 Goodwill Intangible assets, 2,412,251 primarily trade names, service marks and trademarks, net Notes receivable Long-term marketable securities Investments in and advances to subsidiaries Other assets Debt issuance costs Total Assets - 2,005,4R5 1,634,145 23 739,324 30... -

Page 119

Term Liabilities Shareholder's Equity 20,RRR 554,650 717,037 R03,R59 497,R33 (492,65R) 1,049,126 554,650 1,7R5,636 (2,2R3,469 ) Total Liabilities and Shareholder's Equity $ 4,571,627 $ 4,R32,R1R $ 1,9RR,220 $ (4,9R1,751 ) $ 6,410,914 112 -

Page 120

...Property additions Sale of equipment and other assets Other business acquisitions, net of cash acquired Notes receivable, financial - (34,09R) (26,306) - (60,404) - 1,297 124 - 1,421 - (14,451) (17,634) - (32,0R5) investments and securities, net Notes receivable from affiliate - (13... -

Page 121

...- (26,463) (25,404) - (11,926) (25,404) - - 50,R0R R55 Payments of debt (26,32R) - (64,717) - Shareholders' dividends Discount paid on issuance of debt (12,200) (5,575) - - - - - - (12,200) (5,575) Debt issuance costs paid Net intercompany advances 167,453 (212,100) 44,647 - - Net... -

Page 122

... Cash Flows from 396,129 479,7R9 7,7R1 (649,090) 234,609 Investing Tctivities from Continuing Operations: Property additions Sale of equipment and other assets Other business acquisitions, net of cash acquired Notes receivable, financial - (43,636) (29,592) - (73,22R) - 2,141 56... -

Page 123

... 649,090 - (1,334,947 ) - (33,0R9) Shareholders' dividends Debt issuance costs paid Net intercompany advances - (315,291) 141,623 173,66R - - Net Cash... sale of business Net Cash Used for - (3,611) - - (3,611) Discontinued Operations - (4,279) (134) - (4,413) Cash Increase During... -

Page 124

...(29,251) (717,346) 295,001 Investing Tctivities from Continuing Operations: Property additions Sale of equipment and other assets Acquisition of The ServiceMaster Company Other business acquisitions, net of cash acquired Purchase of other intangibles Notes receivable, financial - (6R,1R9) (2R... -

Page 125

...22R) - (5,RRR) investing activities: Proceeds from sale of business Other investing activities - 26,134 - - 26,134 - - (1,617) - (1,617) Net Cash Provided from (Used for) Discontinued Operations - 26,474 (7,R45) - 1R,629 Cash Increase (Decrease) During the Period Cash and Cash... -

Page 126

...reporting as of December 31, 2013, based on the criteria established in Internal Control-Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board... -

Page 127

... discussed in the "Interim Reporting" section in the Significant Accounting Policies, for interim accounting purposes, TruGreen and other business segments of the Company incur pre-season advertising costs. In addition, TruGreen incurs costs related to annual repairs and maintenance procedures that... -

Page 128

... in Rule 15d-15(e)) as of the end of the period covered by this Annual Report on Form 10-K. ServiceMaster's disclosure controls and procedures include a roll-up of financial and non-financial reporting that is consolidated in the principal executive office of ServiceMaster in Memphis, Tennessee... -

Page 129

... LLP, the Company's independent registered public accounting firm, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2013. This attestation report is included in Item R of this Annual Report on Form 10-K. Changes in Internal... -

Page 130

... (Holdings) Limited, currently known as Pendrell Corporation. Mr. Wasserman's extensive knowledge of the capital markets, experience as a management consultant and experience as a director of other consumer-oriented service businesses with nationwide locations that are similar to our business... -

Page 131

... Officer 52 President & Chief Operating Officer, American Home Shield 57 President, ServiceMaster Clean, Merry Maids, Furniture Medic & AmeriSpec 45 President, Terminix 47 Senior Vice President & Chief Information Officer 51 Senior Vice President, Human Resources 53 Senior Vice President, General... -

Page 132

...who requests it by writing to the Corporate Secretary at the following address: The ServiceMaster Company, LLC, R60 Ridge Lake Boulevard, Memphis, Tennessee 3R120. The Company intends to post on its website all disclosures required by law or regulation, including the SEC's Form R-K rules, related to... -

Page 133

...to undergo significant change during 2013, with the resignations of Messrs. Harry J. Mullany III (former CEO), Charles M. Fallon (former President, Terminix), Greerson G. McMullen (former Senior Vice President and General Counsel), Jed L. Norden (former Senior Vice President, Human Resources) and Ms... -

Page 134

...; • Annual cash incentive, which is intended to motivate each executive to achieve short-term Company (and, where applicable, business unit) performance goals and special bonus awards from time to time; Stock, RSUs (including P-RSUs) and stock options to motivate executives to achieve long-term... -

Page 135

... pay practices, we engaged Semler Brossy Consulting Group in 2013 to conduct a total market review to determine whether executive officer total compensation opportunities were competitive. The Board reaffirmed the group of 21 peer companies (the "Peer Group") that are generally 0.3 to 3.0 times... -

Page 136

...are reviewed annually by the Board during our merit review process at the beginning of each year. To determine base salaries for executive officers, we first review market data and target base salaries at the market median of the Peer Group or Aon Hewitt survey data for each respective position. The... -

Page 137

...of his salary as Senior Vice President, Controller and Chief Accounting Officer and at 65 percent of his salary as Interim CFO, prorated for the time served in each capacity. To encourage our executive officers to focus on short-term Company (and, where applicable, business unit) goals and financial... -

Page 138

... that we pay for performance and our executives should receive additional compensation when we exceed our performance goals. The components and weightings of the performance measures are reviewed and determined annually by the Board to reflect Company strategy. The Board amended the performance... -

Page 139

...an effective motivator to improve over the prior year's results. The 2013 ABP target payout opportunity for each participating NEO (see table below) was based on our review of Peer Group and survey data and the importance of the NEO's position relative to the overall financial success of the Company... -

Page 140

... for his service as Interim CEO. (2) (3) (4) Mr. Mullany resigned from the Company on April 12, 2013 and was not eligible for a payout under the ABP. Mr. Haughie was hired by the Company on September 16, 2013 and, as a part of his employment offer, received a guaranteed ABP payment of $350... -

Page 141

... employment without good reason after his six-month service anniversary but prior to his first service anniversary, he shall repay one-half of the signing bonus to the Company within five business days following the date of termination. LIng-Term Incentiee Plan Our long-term equity incentive plan... -

Page 142

... our long-term performance, thereby aligning their interests with the interests of Holdings' stockholders. The purchase of shares under the MSIP allows executive officers to have a stake in the Company's performance by putting their own financial resources at risk. Additionally, through stock option... -

Page 143

... to the stock options listed in the table above, the Board awarded 20,000 standalone stock options to Mr. Martin as part of his offer letter for the position of CFO of New TruGreen. These options have terms similar to other stock option awards. Mr. Martin also received a retention award valued at... -

Page 144

...year (50 hours for 2013), including the cost of landing fees, but excluding any taxes imputed to the executive. Mr. Mullany was also provided with personal use of the Company aircraft during his tenure as CEO under an aircraft policy that was then applicable to him. The policy provides that the CEO... -

Page 145

... policy and the terms of the post-termination arrangements between the Company and the other NEOs are described in detail below under the Potential Payments Upon Termination or Change in Control section in this Item 11. REPORT OF THE BOTRD OF DIRECTORS The Company's Board of Directors has reviewed... -

Page 146

... Incentive Plan Compensation ($) Name and Principal Position Robert J. Gillette Year 2013 Salary ($) 592,30R Bonus ($) 1,596,712(4) Stock Twards ($)(1) 3,000,000 Option Twards ($)(2) 4,0R7,R75 Tll Other Compensation ($)(3) 12,623 N/A 0 10R,945 Total ($) 9,39R,463 Chief Executive Officer... -

Page 147

... tax-qualified retirement savings plan. Tax payments related to relocation expenses were paid to Messrs. Gillette, Haughie and Alexander. These tax payments for relocation expenses are payments under the Company's policy and are available to all employees in general that receive relocation benefits... -

Page 148

...Other Option Plan Twards Plan Twards Twards: Twards: Exercise Number Number or of Shares of Named Executive Officer Grant Date Tpproval Date Threshold of Base Target Maximum Threshold Target Maximum Stock Securities Price Underlying of Option Options Twards Grant Date Fair Value of Stock... -

Page 149

...stock options to purchase five and one-half shares at an exercise price equal to the fair market value of a share of common stock at the time of the option grant ("Matching Options"). The Matching Options vest at a rate of one-fourth per year on each of the first four anniversaries of the grant date... -

Page 150

... Discussion and Analysis-Long-Term Incentive Plan" above. See "-Potential Payments Upon Termination or Change in Control" below for information regarding the cancellation or acceleration of vesting of stock options and RSUs upon certain terminations of employment or a change in control. 140 -

Page 151

... Unexercised Options Twards: Number of Securities Underlying Unexercised Unearned Options Stock That (#) (#) Option Exercise Price ($) $ Option Expiration Date Have Not Vested (#)(3) 300,000 Market Value of Units of Stock That Have Not Vested ($)(4) Named Executive Officer Grant Date... -

Page 152

Table of Contents Option Exercises and Stock Vested (2013) Option Twards Value Number of Realized on Shares Tquired Stock Twards Value Number of Realized on Shares Tquired on Vesting (#) Vesting ($) Named Executive Officer on Exercise (#) Exercise ($) Robert J. Gillette John Krenicki Harry J. ... -

Page 153

... to purchase DSUs. PItential Payments UpIn TerminatiIn Ir Change in CIntrIl Severance Benefits for NEOs Unless modified by separate agreement, upon a termination by the Company for cause, by the executive without good reason, or upon death or disability, we have no obligation to pay any... -

Page 154

... of those fiscal years immediately preceding the date of termination, such average to be calculated using his target annual bonus for such year or years, as applicable. Payments of Mr. Gillette's severance benefits are subject to Mr. Gillette's signing a general release of claims. Mr. Gillette is... -

Page 155

... cancelled and Holdings and certain Equity Sponsors have the right to purchase shares owned by the executive at the lower of fair market value or the original cost of the shares to the executive. If an executive's employment is terminated by the Company without cause before there is a public... -

Page 156

...vesting of options to purchase shares of Holdings' common stock will be accelerated if Holdings experiences a change in control (as defined in the MSIP), unless Holdings' Board of Directors reasonably determines in good faith that options with substantially equivalent or better terms are substituted... -

Page 157

... or change in control effective as of December 31, 2013 and a fair market value of Holdings common stock on December 31, 2013 of $10.50 per share, as determined by Holdings' Board. Since Mr. Krenicki received no compensation and no longer serves as Interim CEO, there are no potential payments to... -

Page 158

..., overall contribution, the competitive market data provided by Semler Brossy and Aon Hewitt (as presented to the Board by our Senior Vice President of Human Resources) and prevailing economic conditions. Our directors are principals of CD&R. See Item 13 of this Annual Report on Form 10-K below for... -

Page 159

... of Contents • all of our current executive officers and directors as a group. The amounts and percentages of shares beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under SEC rules, a person is deemed to be... -

Page 160

... Holding, L.P. and StepStone Co-Investment (ServiceMaster) LLC, is c/o StepStone Group LP, 4350 La Jolla Village Drive, Suite R00, San Diego, CA 92122. (3) JPMorgan Chase Funding Inc. is an affiliate of JPMorgan Chase & Co. The address for JPMorgan Chase Funding Inc. is 270 Park Avenue, New York... -

Page 161

... 31, 2013, about the amount of shares in Holdings, our indirect parent company, to be issued upon the exercise of outstanding options and RSUs granted under the MSIP. Number of Securities to be Issued Upon Exercise of Weighted Tverage Exercise Price of Plan Category Outstanding Options, Warrants... -

Page 162

... CEO, subject to the approval of the Holdings board of directors and Clayton, Dubilier & Rice Fund VII, L.P. (the "Lead Investor"). The Stockholders Agreement grants to investment funds associated with the Equity Sponsors special governance rights, including rights of approval over certain corporate... -

Page 163

... to StepStone. As of December 22, 2011, Holdings purchased from BAS 7.5 million shares of capital stock of Holdings, and, effective January 1, 2012, the annual consulting fee payable to BAS was reduced to $0.25 million. The Company pays annual consulting fees of $0.5 million, $0.25 million and $0.25... -

Page 164

...Holdings to repurchase shares of its common stock from associates who have left the Company. ITEM 14. PRINCIPTL TCCOUNTING FEES TND SERVICES The Board selected Deloitte & Touche LLP as our independent auditors for 2013. The Board pre-approves all audit, audit-related and nonaudit related services... -

Page 165

... Transaction. Also, includes $104,R54 and $133,112 related to services rendered in connection with tax compliance and tax return preparation fees for 2013 and 2012, respectively. (b) (c) Principally represents fees paid in connection with a consulting project at American Home Shield. 155 -

Page 166

...as part of this Annual Report on Form 10-K and should be read in conjunction with the financial statements contained in Item R of this Annual Report on Form 10-K: Report of Independent Registered Public Accounting Firm on Financial Statement Schedules 116 Schedule I-The ServiceMaster Company, LLC... -

Page 167

... by the undersigned, thereunto duly authorized. THE SERVICEMASTER COMPANY, LLC Date: March 5, 2014 By /s/ ROBERT J. GILLETTE Robert J. Gillette Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons... -

Page 168

... of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors of The ServiceMaster Company, LLC Memphis, Tennessee We have audited the consolidated financial statements of The ServiceMaster Company, LLC and subsidiaries (the "Company") as of December 31, 2013 and... -

Page 169

...) 2013 Year ended December 31, 2012 2011 Operating Revenue Selling and administrative expenses Amortization expense Restructuring charges Interest expense Interest and net investment (income) loss Loss on extinguishment of debt Loss from Continuing Operations before Income Taxes Benefit for... -

Page 170

...Accounts payable Accrued liabilities: Payroll and related expenses Accrued interest payable $ 1,R55 $ 156 Other Current portion of long-term debt Total Current Liabilities Long-Term Debt Other Long-Term Liabilities: Intercompany payable Other long-term obligations, primarily self-insured claims... -

Page 171

... of The ServiceMaster Company Notes receivable from affiliate Net Cash Used for Investing Tctivities from Continuing Operations - (13,95R) (13,95R) - - - (35) - (35) Cash Flows from Financing Tctivities from Continuing Operations: Borrowings of debt Payments of debt Discount paid on issuance... -

Page 172

...The ServiceMaster Company, LLC included in this Annual Report on Form 10-K. For the years ended December 31, 2013, 2012 and 2011, Parent received cash dividends from its wholly owned subsidiaries of $25.4 million, $515.7 million and $573.4 million, respectively. 3. Long-term debt Long-term debt as... -

Page 173

...of such notes. The increase in the balance from 2012 to 2013 reflects the amortization of fair value adjustments related to purchase accounting, which increases the effective interest rate from the coupon rates shown above. (3) The key provisions of Parent's long-term debt agreements are disclosed... -

Page 174

... receivable reflect write-offs of uncollectible accounts. Deductions for the income tax valuation allowance in 2013 are primarily attributable to the reduction of net operating loss carryforwards related to their expiration. Deductions for the income tax valuation allowance in 2012 are primarily... -

Page 175

...2.3 Employee Matters Agreement, dated as of January 14, 2014, by and among ServiceMaster Global Holdings, Inc., The ServiceMaster Company, LLC, TruGreen Limited Partnership and TruGreen Holding Corporation, is incorporated by reference to Exhibit 2.3 of the 2014 R-K. 2.4 Tax Matters Agreement, dated... -

Page 176

... to Exhibit 3 to the registrant's Current Report on Form R-K filed on August 16, 1999 (File No. 001-14762). 4.6 Fifth Supplemental Indenture, dated as of January 14, 2014, among The ServiceMaster Company, LLC and The Bank of New York Mellon Trust Company, N.A. (as successor to Harris Trust and... -

Page 177

... the registrant's Current Report on Form R-K filed February 25, 2013 (File No. 001-14762). 10.7 Term Loan Credit Agreement Joinder Agreement, dated as of January 14, 2014, among The ServiceMaster Company, The ServiceMaster Company, LLC, Citibank, N.A., as administrative agent, and the other parties... -

Page 178

Table of Contents Exhibit Number Description 10.10 Security Agreement, dated as of July 24, 2007, made by the Company and ServiceMaster Consumer Services Limited Partnership, in favor of the Term Loan Collateral Agent and Term Loan Administrative Agent is incorporated by reference to Exhibit 10.4 ... -

Page 179

...to the Annual Report on Form 10-K for the year ended December 31, 2009 (File No. 001-14762 (the "2009 10-K")). 10.23 Form of Consulting Agreement entered into among the Company; Holdings; Citigroup Alternative Investments LLC (assigned to StepStone Group LLC in 2010); BAS Capital Funding Corporation... -

Page 180

...William J. Derwin and The ServiceMaster Company. 10.3R*# Offer Letter effective November 14, 2013, between The ServiceMaster Company and David W. Martin related to his appointment as Senior Vice President and Chief Financial Officer of TruGreen. 10.39* Offer Letter dated April 29, 2011, between the... -

Page 181

...'s Quarterly Report on Form 10-Q for the quarter ended June 30, 2013 (File No. 001-14762). 10.44* Employment Offer Letter dated July 30, 2012, between the Company and Mark J. Barry related to his appointment as the President and Chief Operating Officer of American Home Shield is incorporated... -

Page 182

...'s Current Report on Form R-K filed April 27, 2011 (File No. 001-14762). 12# Statement regarding Computation of Ratios of Earnings to Fixed Charges as of December 31, 2013. 21# List of Subsidiaries as of December 31, 2013. 31.1# Certification of Chief Executive Officer pursuant to Rule 15d-14... -

Page 183

Table of Contents Exhibit Number Description 101.LAB# XBRL Taxonomy Extension Label Linkbase 101.PRE# XBRL Extension Presentation Linkbase * # Denotes management contract or compensatory plan or arrangement. Filed herewith. 173 -

Page 184

-

Page 185

... institutions as lenders (collectively, the "TG Lenders ") and JPMorgan Chase Bank, N.A., as administrative agent; WHEREAS, it is a condition to the initial effectiveness of the TG Credit Agreement (the date of initial effectiveness, the " TG Revolver Effective Date") that the Parent Borrower... -

Page 186

... but not limited to notice from the Parent Borrower and minimum reduction amounts, are hereby waived. (b) Upon the occurrence of the TG Revolver Effective Date, the Parent Borrower shall, on such date, deliver to the Administrative Agent a certificate signed by a Responsible Officer specifying... -

Page 187

..., with the Parent Borrower as the surviving corporation (the " Merger"). WHEREAS, on the Closing Date the initial equity investors will make an equity contribution of $1,431.1 million (the "Equity Contribution ") to Holding Parent, Holding Parent will make an equity contribution of the same amount... -

Page 188

... and in part under one or more other such provisions (or, as applicable, clauses)." (e) Schedule A is hereby deleted in its entirety and replaced with Schedule A attached to this Amendment No. 3. SECTION THREE Conditions to Effectiveness . This Amendment No. 3 shall become effective on the date on... -

Page 189

...to pay all reasonable out-of-pocket costs and expenses of the Administrative Agent incurred in connection with the preparation, execution and delivery of this Amendment No. 3 and the other instruments and documents to be delivered hereunder, if any (including, without limitation, the reasonable fees... -

Page 190

... THE STATE OF NEW YORK WITHOUT GIVING EFFECT TO ITS PRINCIPLES OR RULES OF CONFLICT OF LAWS TO THE EXTENT SUCH PRINCIPLES OR RULES ARE NOT MANDATORILY APPLICABLE BY STATUTE AND WOULD REQUIRE OR PERMIT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION. SECTION TEN (a) Authorization to Enter into... -

Page 191

... be executed by their respective officers hereunder duly authorized as of the date and year first above written. PARENT BORROWER: THE SERVICEMASTER COMPANY By: /s/ James E. Shields Name: James E. Shields Title: Vice President & Treasurer U.S. SUBSIDIARY BORROWERS: TRUGREEN LIMITED PARTNERSHIP... -

Page 192

... Shields Name: James E. Shields Title: Vice President & Treasurer SERVICEMASTER CONSUMER SERVICES LIMITED PARTNERSHIP By: SERVICEMASTER CONSUMER SERVICES, INC., its general partner By: /s/ James E. Shields Name: James E. Shields Title: Vice President & Treasurer SERVICEMASTER HOLDING CORPORATION... -

Page 193

... E. Shields Name: James E. Shields Title: Vice President & Treasurer TRUGREEN, Inc. By: /s/ James E. Shields Name: James E. Shields Title: Vice President & Treasurer CDRSVM HOLDING, INC. By: /s/ David W. Martin Name: David W. Martin Title: Vice President, Chief Accounting Officer & Controller... -

Page 194

Signature Page to Amendment No. 3 The undersigned evidences its consent to the amendments reflected in Amendment No. 3: Name of Institution: Citibank, N.A., as a Lender By: /s/ David Tuder Name: David Tuder Title: Vice President [Signature Page to Amendment No. 3] -

Page 195

Signature Page to Amendment No. 3 The undersigned evidences its consent to the amendments reflected in Amendment No. 3: Name of Institution: BARCLAYS BANK PLC, as a Lender By: /s/ Irina Dimova Name: Irina Dimova Title: Vice President [Signature Page to Amendment No. 3] -

Page 196

... to the amendments reflected in Amendment No. 3: Name of Institution: CREDIT SUISSE AG CAYMAN ISLANDS BRANCH, as a Lender By: /s/ Christopher Day Name: Christopher Day Title: Authorized Signatory If two signatures are required: By: /s/ Samuel Miller Name: Samuel Miller Title... -

Page 197

... reflected in Amendment No. 3: Name of Institution: Deutsche Bank AG New York Branch, as a Lender By: /s/ Dusan Lazarov Name: Dusan Lazarov Title: Director If two signatures are required: By: /s/ Peter Cucchiara Name: Peter Cucchiara Title: Vice President [Signature Page to Amendment No. 3] -

Page 198

Signature Page to Amendment No. 3 The undersigned evidences its consent to the amendments reflected in Amendment No. 3: Name of Institution: Goldman Sachs Bank USA, as a Lender By: /s/ Michelle Latzoni Name: Michelle Latzoni Title: Authorized Signatory [Signature Page to Amendment No. 3] -

Page 199

Signature Page to Amendment No. 3 The undersigned evidences its consent to the amendments reflected in Amendment No. 3: Name of Institution: JPMORGAN CHASE BANK, N.A., as a Lender By: /s/ Sarah L. Freedman Name: Sarah L. Freedman Title: Executive Director [Signature Page to Amendment No. 3] -

Page 200

Signature Page to Amendment No. 3 The undersigned evidences its consent to the amendments reflected in Amendment No. 3: Name of Institution: Morgan Stanley Senior Funding, Inc., as a Lender By: /s/ Brendan MacBride Name: Brendan MacBride Title: Vice President [Signature Page to Amendment No. 3] -

Page 201

... the amendments reflected in Amendment No. 3: Name of Institution: NATIXIS, as a Lender By: /s/ Kelvin Cheng Name: Kelvin Cheng Title: Executive Director If two signatures are required: By: /s/ Steven Eberhardt Name: Steven Eberhardt Title: Vice President [Signature Page to Amendment No. 3] -

Page 202

...June 14, 2013, as amended (the " Employment Agreement "), pursuant to which Executive serves as (among other roles) Chief Executive Officer and President of the Company; WHEREAS, Section 4(f) of the Employment Agreement states that Executive will have up to 50 hours of personal use of the corporate... -

Page 203

IN WITNESS WHEREOF, Executive and the Company have caused this Amendment to be executed and delivered on the date first written above. SERVICEMASTER GLOBAL HOLDINGS, INC. /s/ Robert J. Gillette Robert J. Gillette /s/ John Krenicki, Jr. By: John Krenicki, Jr. Its: Chairman 2 -

Page 204

... to sign a Sign-On Bonus Rcpaymcnt Agrccmcnt, with a two-ycar tcrm, includcd with your ncw hirc papcrwork. EqBity Upon approval by thc Compcnsation Committcc of thc Board of Dircctors, you will havc thc opportunity to participatc in thc ScrviccMastcr Global Holdings, Inc. Stock Inccntivc Plan, as... -

Page 205

... accounts. Covcragc for most plans is cffcctivc thc first of thc month following or coincidcnt with thrcc consccutivc months of scrvicc; howcvcr, disability covcragc is cffcctivc thc day following thc complction of twclvc consccutivc months of scrvicc. Thc ScrviccMastcr LifcManagcmcnt Program... -

Page 206

... pcr thc attachcd rclocation policy. You will bc rcquircd to sign a Rclocation Rcpaymcnt Agrccmcnt, includcd with your ncw hirc papcrwork. Plcasc contact Andrca Hough, who will bc handling your rclocation, at 901-597-7822 if you havc any qucstions. Conditions of Employment This offcr of cmploymcnt... -

Page 207

... Lane Memphis, TN 38117 Dear David, We are pleased to extend to you this offer of employment for the position of Senior Vice President, Finance for TruGreen. In this position, you will report to the Chief Financial Officer of ServiceMaster. Your effective start date is the later of October 16, 2013... -

Page 208

... for Good Reason equal to: The severance benefit for each scenario listed above will be equal to: i. ii. An amount equal to twelve times Executive's monthly base salary in effect as of the Termination Date (the "Monthly Salary"); plus An amount equal to Executive's then current year's annual... -

Page 209

... (20 business days) of vacation. This offer of employment is contingent on your re-execution of a ServiceMaster Non-Compete/Non-Solicitation/Confidentiality agreement and your agreement to utilize ServiceMaster's alternative dispute resolution program We Listen to resolve any and all work-related... -

Page 210

... any failure to re-appoint Executive to serve as Senior Vice President, Finance of a business unit of the Company; or a reduction in Executive's Base Salary or target annual bonus percentage, each as in effect on the date hereof or as the same maybe increased from time to time thereafter, other than... -

Page 211

... the terms of our offer. As the President, TruGreen, you will be located in Memphis, Tx and you will report to Hank Mullany, CEO. Your effective start date will be mutually agreed upon, but prior to year-end 2012. Base Salary Your base compensation in this position will be at an annual rate of... -

Page 212

... best meets your needs. Regular, full-time associates are eligible to participate in medical, dental, vision, disability and life insurance, the legal services plan, and reimbursement accounts. Coverage for most plans is effective the first of the month following or coincident with three consecutive... -

Page 213

...1852. Please return your signed offer letter, along with the completed new hire paperwork, to me within seven (7) days of the date of this offer letter. David, we look forward to having you as a key member of the ServiceMaster team. Our success hinges upon the people who make up our organization and... -

Page 214

... based on actual Plan Year performance, if the Termination Date is after June 30th, payable when annual bonuses are generally payable pursuant to the ABP (currently in March of the following year); plus (iv) An amount equal to twelve times the Executive's monthly cost for health care continuation... -

Page 215

..., their affiliates and their respective officers, directors, employees, agents, representatives, stockholders, members and partners, (excluding claims for indemnification and claims based on Executive's purchased stock of the Company, subject to the applicable stock purchase or option agreement... -

Page 216

... duly given when delivered, addressed, if to Executive, at his address in the records of the Company, and to the Company to: ServiceMaster Global Holdings, Inc., c/o The ServiceMaster Company, 860 Ridge Lake Blvd., Memphis, TN 38120, attention Senior Vice President, Human Resources, or to such other... -

Page 217

... or policies of the Company related to taxation. Executive is advised to seek the advice of his own personal tax advisor or counsel as to the taxability of the Severance Pay. The Company specifically disclaims that it has responsibility for the proper calculation or payment of any taxes which... -

Page 218

IN WITNESS WHEREOF, the Company and Executive have executed this Agreement effective as of November 11, 2013. EXECUTIVE THE SERVICEMASTER COMPANY /s/ William J. Derwin William J. Derwin /s/ Jed Norden By: Jed Norden Title: Senior Vice President -

Page 219

...respect in Executive's position(s), authorities or responsibilities as the President of the Terminix business and Officer of the Company; or a reduction in Executive's Base Salary or target annual bonus percentage, each as in effect on the date hereof or as the same maybe increased from time to time... -

Page 220

... Holdings, Inc. Stock Incentive Plan. The meaning of each capitalized term may be found in Section 10. The Company and the Director hereby agree as follows: Section 1. Purchase and Sale of Common Stock . (a) In General . Subject to all of the terms of this Agreement, at the Closing the Director... -

Page 221

... of Common Stock offered to the Director, and to discuss such purchase with the Director's legal, tax and financial advisors; (iii) the Director understands the terms and conditions that apply to the Shares and the risks associated with an investment in the Shares; (iv) the Director has a good... -

Page 222

... that the Director is purchasing the Shares voluntarily. (d) No Right to Awards. The Director acknowledges and agrees that the sale of the Shares ( i) is being made on an exceptional basis and are not intended to be renewed or repeated, ( ii) is entirely voluntary on the part of the Company and its... -

Page 223

... records of the Company or any transfer agent indicating that the Shares are subject to such restrictions. (g) Voting Proxy. By entering into this Agreement and purchasing the Shares, the Director hereby irrevocably grants to and appoints the CD&R Investors collectively (to act by unanimous... -

Page 224

... the Director's expense such information relating to the compliance of such proposed Transfer with the terms of this Agreement and applicable securities laws as the Company shall reasonably request, which may include an opinion in form and substance reasonably satisfactory to the Company of counsel... -

Page 225

...the Second Option Period. (c) Purchase Price . The purchase price per Share pursuant to this Section 5 shall equal the Fair Market Value as of the later of ( i) the effective date of the Director's termination of employment and ( ii) six months and one day from the date of the Director's acquisition... -

Page 226

...such Purchase Price for the period during which payment is delayed at an annual rate equal to the weighted average cost of the Company's senior secured bank indebtedness outstanding during the delay period. (g) Right to Retain Shares . If the options of the Company and the CD&R Investors to purchase... -

Page 227

...Common Stock collectively owned by the Investors as of the Effective Date to a Third-Party Buyer, the Company will deliver a written notice (the " Sale Notice ") to the Director. The Sale Notice will disclose the material terms and conditions of the proposed sale or transfer, including the number of... -

Page 228

...sale or other transfer described in the Sale Notice and all holders of Common Stock electing to participate in such sale and ( ii) the number of Common Stock the prospective transferee has agreed to purchase in the contemplated transaction. (c) Certain Matters Relating to the Investors . The Company... -

Page 229

..."), and authorizes the Custodian to take such actions as the Custodian may deem necessary or appropriate to effect the sale and transfer of the Applicable Percentage of the Director's Shares to the Third-Party Buyer, upon receipt of the purchase price therefor at the Drag-Along Closing, free... -

Page 230

... the Director purchased such Shares from the Company or the per share consideration payable pursuant to the Drag-Along Offer. The preceding sentence shall not limit the Company's or the Investors' rights to recover damages (or the amount thereof) from the Director. (e) Expiration on a Public Market... -

Page 231

... agree from time to time. Section 9. Holdback Agreements . If the Company files a registration statement under the Securities Act with respect to an underwritten public offering of any shares of its capital stock, the Director shall not effect any public sale (including a sale under Rule 144 under... -

Page 232

... statement, the Director shall not effect any public sale (including a sale under Rule 144 under the Securities Act or other similar provision of applicable law) or distribution of any Common Stock, other than as part of such offering, for 20 days prior to and 90 days after the date the prospectus... -

Page 233

... partnership, limited liability company, association, corporation, company, trust, business trust, governmental authority or other entity. "Public Market " shall be deemed to have been established at such time as 30% of the Common Stock (on a fully diluted basis) has been sold to the public pursuant... -

Page 234

...determined in good faith by the Board or the Compensation Committee thereof. "Retirement " means the Director's retirement from active service on or after the Director reaches normal retirement age. "Rule 144" means Rule 144 under the Securities Act (or any successor provision thereto). "Sale Notice... -

Page 235

... 11. Miscellaneous . (a) Authorization to Share Personal Data . The Director authorizes any Affiliate of the Company that employs the Director or that otherwise has or lawfully obtains personal data relating to the Director to divulge or transfer such personal data to the Company or to a third... -

Page 236

...ServiceMaster Global Holdings, Inc. c/o The ServiceMaster Company 860 Ridge Lake Boulevard Memphis, Tennessee 38120 Attention: General Counsel Fax: (901) 597-8025 with copies (which shall not constitute notice) to the Persons listed in clause (iv) below); (ii) if to the Director, to the Director at... -

Page 237

...executed by the Director and the Company; provided that the provisions of Section 4 through Section 9 and this Section 11 may be amended by the Company with the vote of a majority (by number of shares of Common Stock) of the employees and directors who hold Common Stock purchased pursuant to a stock... -

Page 238

... or liability arising hereunder or by reason hereof shall be assignable by the Company or the Director without the prior written consent of the other parties, provided that the CD&R Investors may assign from time to time all or any portion of their respective rights under this Agreement, to one... -

Page 239

... GLOBAL HOLDINGS, INC. By: /s/ James T. Lucke Name: James T. Lucke Title: Vice President, General Counsel & Secretary THE DIRECTOR: /s/ John Krenicki, Jr. John Krenicki, Jr. Address of the Director: XXXXX XXXXX, MA 01254 Total Number of Shares of Common Stock to be Purchased: Per Share Price... -

Page 240

... FIXED CHARGES Our consolidated ratios of earnings to fixed charges for the years ended December 31, 2013, 2012, 2011, 2010 and 2009 are as follows: Years Ended December 31, 2012 2011 2010 (in thousands) 2013 2009 Ratio of Earnings to Fixed Charges (a) (a) (b) 1.41 1.10 (c) For purposes of... -

Page 241

QuickLinks Exhibit 12 RATIOS OF EARNINGS TO FIXED CHARGES -

Page 242

... COMPANY, LLC As of December 31, 2013, ServiceMaster had the following subsidiaries: State or Country of Incorporation or Organization Subsidiary 667217 Ontario Limited American Home Shield Corporation American Home Shield of Arizona, Inc. American Home Shield of California, Inc. American Home... -

Page 243

... USVI, LLC The ServiceMaster Acceptance Company Limited Partnership The ServiceMaster Foundation The Terminix International Company Limited Partnership TruGreen Companies L.L.C. TruGreen Holding Corporation TruGreen Home Landscape Services, L.L.C. TruGreen Limited Partnership TruGreen, Inc. Mexico... -

Page 244

QuickLinks Exhibit 21 SUBSIDIARIES OF THE SERVICEMASTER COMPANY, LLC -

Page 245

... report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 5, 2014 /s/ ROBERT J. GILLETTE Robert J. Gillette Chief Executive Officer -

Page 246

QuickLinks Exhibit 31.1 CERTIFICATIONS -

Page 247

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 5, 2014 /s/ ALAN J. M. HAUGHIE Alan J. M. Haughie Senior Vice President and Chief Financial Officer -

Page 248

QuickLinks Exhibit 31.2 CERTIFICATIONS -

Page 249

...United States Code I, Robert J. Gillette, the Chief Executive Officer of The ServiceMaster Company, LLC, certify that (i) the Annual Report on Form 10-K for the year ended December 31, 2013, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and (ii... -

Page 250

QuickLinks Exhibit 32.1 Certification of Chief Executive Officer Pursuant to Section 1350 of Chapter 63 of Title 18 of The United States Code -

Page 251

...Alan J. M. Haughie, the Senior Vice President and Chief Financial Officer of The ServiceMaster Company, LLC, certify that (i) the Annual Report on Form 10-K for the year ended December 31, 2013, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and... -

Page 252

QuickLinks Exhibit 32.2 Certification of Chief Financial Officer Pursuant to Section 1350 of Chapter 63 of Title 18 of The United States Code -

Page 253