American Express 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AMERICAN EXPRESS COMPANY

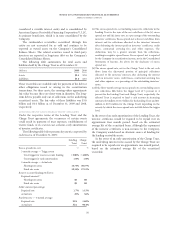

OTHER INTANGIBLE ASSETS

Intangible assets are amortized over their estimated useful

lives of 1 to 22 years. The Company reviews intangible assets

for impairment quarterly and whenever events and

circumstances indicate that their carrying amounts may not

be recoverable. In addition, on an annual basis, the Company

performs an impairment evaluation of all intangible assets by

assessing the recoverability of the asset values based on the

cash flows generated by the relevant assets or asset groups. An

impairment is recognized if the carrying amount is not

recoverable and exceeds the asset’s fair value.

The components of other intangible assets were as follows:

(Millions) 2009 2008

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Customer relationships(a) $ 873 $(240) $633 $744 $(135) $609

Other 145 (61) 84 160 (52) 108

Total $1,018 $(301) $717 $904 $(187) $717

(a) Includes approximately $265 million related to a customer intangible payment made in connection with the renegotiated contract with Delta

Air Lines.

Amortization expense for the years ended December 31, 2009, 2008 and 2007 was $140 million, $83 million and $47 million,

respectively. Intangible assets acquired in 2009 and 2008 are being amortized, on average, over 5 years and 8 years, respectively.

Estimated amortization expense for other intangible assets over the next five years is as follows:

(Millions) 2010 2011 2012 2013 2014

Estimated amortization expense $141 $125 $115 $105 $81

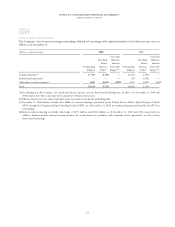

OTHER

The Company has $168 million and $141 million in

affordable housing partnership interests as of December 31,

2009 and 2008, respectively, included in other assets in the

table above. The Company is a limited partner and typically

has a less than 50 percent interest in the affordable housing

partnerships. These partnership interests are accounted for in

accordance with GAAP governing equity method investments

and joint ventures.

92