American Eagle Outfitters 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 American Eagle Outfitters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

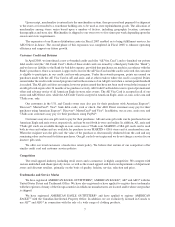

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA.

The following Selected Consolidated Financial Data should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” included under Item 7 below and the

Consolidated Financial Statements and Notes thereto, included in Item 8 below. Most of the selected data presented

below is derived from our Consolidated Financial Statements, which are filed in response to Item 8 below. The

selected Consolidated Statement of Operations data for the years ended January 28, 2006 and January 29, 2005 and

the selected Consolidated Balance Sheet data as of February 3, 2007, January 28, 2006 and January 29, 2005 are

derived from audited Consolidated Financial Statements not included herein.

January 31,

2009

February 2,

2008

February 3,

2007

January 28,

2006

January 29,

2005

For the Years Ended(1)

(In thousands, except per share amounts, ratios and other financial information)

Summary of Operations(2)

Net sales(3). . . . ................... $2,988,866 $3,055,419 $2,794,409 $2,321,962 $1,889,647

Comparable store sales (decrease)

increase(4). . . ................... (10)% 1% 12% 16% 21%

Gross profit. . . . ................... $1,174,101 $1,423,138 $1,340,429 $1,077,749 $ 881,188

Gross profit as a percentage of net sales . . 39.3% 46.6% 48.0% 46.4% 46.6%

Operating income(5) . . . . . . . ......... $ 302,140 $ 598,755 $ 586,790 $ 458,689 $ 360,968

Operating income as a percentage of net

sales . . . . . . . ................... 10.1% 19.6% 21.0% 19.8% 19.1%

Income from continuing operations(2) . . . $ 179,061 $ 400,019 $ 387,359 $ 293,711 $ 224,232

Income from continuing operations as a

percentage of net sales(2) . . ......... 6.0% 13.1% 13.9% 12.7% 11.9%

Per Share Results(6)

Income from continuing operations per

common share-basic(2) . . . ......... $ 0.87 $ 1.85 $ 1.74 $ 1.29 $ 1.03

Income from continuing operations per

common share-diluted(2) . . ......... $ 0.86 $ 1.82 $ 1.70 $ 1.26 $ 1.00

Weighted average common shares

outstanding — basic . . . . . . ......... 205,169 216,119 222,662 227,406 217,725

Weighted average common shares

outstanding — diluted . . . . ......... 207,582 220,280 228,384 233,031 225,366

Cash dividends per common share(7) . . . . $ 0.40 $ 0.38 $ 0.28 $ 0.18 $ 0.04

Balance Sheet Information

Total cash and short-term investments. . . . $ 483,853 $ 619,939 $ 813,813 $ 751,518 $ 589,607

Long-term investments. . . . . . ......... $ 251,007 $ 165,810 $ 264,944 $ 145,744 $ 84,416

Total assets(8) . . ................... $1,963,676 $1,867,680 $1,979,558 $1,605,649 $1,328,926

Short-term debt . ................... $ 75,000 $ — $ — $ — $ —

Long-term debt . ................... $ — $ — $ — $ — $ —

Stockholders’ equity . . . . . . . ......... $1,409,031 $1,340,464 $1,417,312 $1,155,552 $ 963,486

Working capital(8) . . . . . . . . . ......... $ 523,596 $ 644,656 $ 724,490 $ 725,294 $ 582,739

Current ratio(8) . ................... 2.30 2.71 2.56 3.06 3.06

Average return on stockholders’ equity . . . 13.0% 29.0% 30.1% 27.8% 26.7%

17