Alcoa 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have made solid progress on this program, as we have

sold the Latin America PET bottle business, our equity interest in

Latasa, a can producer based primarily in Brazil, and the packag-

ing equipment business. We have announced the sale of the

specialty chemicals business and expect to complete it in the first

quarter, with the remainder of this divestiture program completed

by the end of the first half of 2004. In total, the program should

generate proceeds in excess of $750 million,

which will be used to pay down debt.

We added to our portfolio this year

with the acquisition of the Camargo

Correa Group’s 40.9% interest in Alcoa’s

South American operations, a position

these partners held since 1984. The largest

subsidiary in these operations is Alcoa

Aluminio, headquartered in São Paulo.

Aluminio owns and operates mining,

refining, power generation, smelting, and

aluminum fabrication facilities at various

locations in Brazil. Additional businesses

include closures and flexible packaging.

We also expanded our aluminum

alliance with Kobe Steel Ltd. in Japan on

the joint development of aluminum prod-

ucts for the automotive market. As part of this arrangement,

we assumed complete control of aluminum rolling operations in

Australia, used in making beverage containers, foil, and sheet.

Strengthening and Growing

In 2003, we made significant strides in strengthening our asset

base in both our primary metals and alumina businesses,

accelerating movement down the global cost curve, and laying

the foundation for our continued leadership position in the

industry.

The year began with the finalization

of agreements to build a new, state-of-the-

art, greenfield smelter in Iceland. We plan to

break ground on this 322,000-metric-tons-

per-year (mtpy) smelter – to be among

the most efficient in the world in terms of

production and sustainability – in 2005

and expect production to begin in 2007.

Our joint venture with the Aluminum

Corporation of China, Ltd. (Chalco), at

Pingguo, has been delayed pending final

government approvals. We expect agree-

ments in this regard to be formalized in

2004. This joint venture will enhance our

position in the fastest-growing market in the

aluminum industry within one of the most efficient – and grow-

ing – alumina and aluminum production facilities in China.

Elsewhere in China, we are working toward completing a

joint venture with China International Trust & Investment, our

equity partner in Bohai Aluminum, with the objective of

expanding soft-alloy extrusions and foil opportunities in this

2

fast-growing region. We are also installing a new foil production

line at Alcoa Shanghai Aluminum.

In Canada, we are working with the government of Québec

to upgrade and expand our hydropowered smelting operations in

Baie-Comeau and Deschambault.

In Brazil, in addition to restructuring our long-term partner-

ship with the Camargo Correa Group, we are engaged in several

hydropower projects that will increase our

energy self-sufficiency and cost-competi-

tiveness while meeting Alcoa and Brazilian

standards for socially and environmentally

sound development. For example, in the

case of the Barra Grande hydropower facil-

ity, construction has begun and is expected

to be completed in 2006, with total

installed capacity of 690 MW. Upon the

completion of this project, coupled with

other hydropower investments we have

made, we will provide more than 40% of

the energy required for our two smelters in

that country. And we have an additional

355 MW under concession.

During 2003, we signed a Memoran-

dum of Understanding (MOU) with the

government of the Kingdom of Bahrain that paves the way for

Alcoa to acquire up to a 26% equity stake in Alba, a Bahrain com-

pany that owns and operates a 512,000-mtpy aluminum smelter.

The MOU also covers a long-term alumina supply arrangement

for Alba. Alba is currently adding a fifth potline which, when

completed in 2005, will bring its overall capacity to 819,000 mtpy

and make it the largest prebake aluminum smelter in the world.

The MOU is designed to accelerate plans for an additional expan-

sion, a sixth line with 307,000 mtpy of additional capacity.

In addition, we have announced plans

to conduct a feasibility study over the next

two years to explore building a smelter in

Brunei Darussalam.

Alcoa World Alumina and Chemicals

(AWAC) – a global alliance between

Alcoa and Alumina Ltd, with Alcoa

holding 60% – completed the 250,000-

mtpy construction expansion of its

Jamalco alumina refinery in Clarendon,

Jamaica ahead of schedule. AWAC also

broke ground on a 250,000-mtpy alumina

expansion at its Paranam alumina refinery

in Suriname. And we have begun an effi-

ciency upgrade at AWAC’s Pinjarra alumi-

na refinery in Western Australia that will

increase capacity there by 600,000 mtpy.

As part of our strategy, we continue to explore promising

opportunities across the world, including some in Russia. These

efforts are designed to lower Alcoa’s costs in primary metals – in

many cases replacing older, less competitive capacity with newer,

more efficient operations, while in other cases we are adding

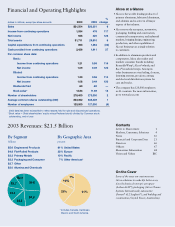

Top Quintile S&P Industrials

Alcoa ROC

Alcoa Quarter Annualized

All indicators are based on the Bloomberg ROC Methodology.

1Q 03 Quarter Annualized ROC excludes $47 million after-tax

cumulative effect of accounting change due to adoption of FAS 143.

4Q 02 1Q 03 2Q 03 3Q 03 4Q 03

0

5

10

15

20

Return on Capital Continues

to Show Improvement

Percent

Continue to

reduce costs –

eliminate $1.2B

in costs on a

run-rate basis

by the end

of 2006

98-00 01-02 03

Goal 2001-2003 Goal

278 278 278

253

150

Surpassed Second $1 Billion

Cost-Savings Goal

Quarterly Run Rate in Millions of Dollars