Air France 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Air France annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated income statement

In € million December31, 2015 December31, 2014(1)

Sales 26,059 24,912

Other revenues 3 18

External expenses (15,682) (15,171)

Aircraft fuel (6,183) (6,629)

Chartering costs (430) (438)

Landing fees and en route charges (1,947) (1,840)

Catering (655) (591)

Handling charges and other operating costs (1,536) (1,476)

Aircraft maintenance costs (2,372) (1,729)

Commercial and distribution costs (896) (870)

Other external expenses (1,663) (1,598)

Salaries and related costs (7,852) (7,636)

Taxes other than income taxes (167) (169)

Other income and expenses 1,113 508

EBITDAR 3,474 2,462

Aircraft operating lease costs (1,027) (873)

EBITDA 2,447 1,589

Amortization, depreciation and provisions (1,631) (1,718)

Income/(loss) from current operations 816 (129)

Sales of aircraft equipment (6) 0

Sales of subsidiaries 224 185

Other non-current income and expenses 81 695

Income/(loss) from operating activities 1,115 751

Income from cash and cash equivalents 63 76

Cost of inancial debt (373) (446)

Net cost of inancial debt (310) (370)

Foreign exchange gains/(losses), net (360) (199)

Change in fair value of inancial assets and liabilities (178) (92)

Other inancial income and expenses (67) (68)

Income/(loss) before tax 200 22

Income taxes (43) (195)

Net income/(loss) of consolidated companies 157 (173)

Share of proits/(losses) of associates (30) (39)

Income/(loss) from continuing operations 127 (212)

Net income/(loss) from discontinued operations 0 (4)

Net income/(loss) for the period 127 (216)

Minority interest (9) (9)

Net income/(loss) for the period, Group 118 (225)

(1) Restated for the reclassification of items relating to capitalized production, foreign currency effects linked to the revaluation of pro-

visions in foreign currencies and temporary staff expenses.

Consolidated statement of cash flows

In € million December31, 2015 December31, 2014(1)

Net income from continuing operations 127 (212)

Net income from discontinued operations – (4)

Amortization, depreciation and operating provisions 1,631 1,725

Financial provisions 59 68

Result on disposals of tangible and intangible assets (224) (19)

Result on disposals of subsidiaries and associates (224) (184)

Derivatives – non-monetary result 91 73

Unrealized foreign exchange gains and losses, net 294 163

Share of (proits) losses of associates 30 39

Deferred taxes 4 158

Impairment 5 114

Other non-monetary items 32 (1,042)

Sub-total 1,825 879

Of which discontinued operations – (6)

(Increase)/decrease in inventories 36 (24)

(Increase)/decrease in trade receivables (55) 98

Increase/ (decrease) in trade payables (62) 29

Change in other receivables and payables 156 10

Change in working capital from discontinued operations – 20

Net cash ow from operating activities 1,900 1,012

Acquisition of subsidiaries, of shares in non-controlled entities (7) (43)

Purchase of property, plant and equipment and intangible assets (1,647) (1,431)

Proceeds on disposal of subsidiaries, of shares in non-controlled entities 342 354

Proceeds on disposal of property, plant and equipment and intangible assets 353 269

Dividends received 5 20

Decrease/(increase) in net investments, more than 3 months (208) 285

Net cash ow used in investing activities of discontinued operations – (20)

Net cash flow used in investing activities (1,162) (566)

Capital increase 1 –

Perpetual 600 –

Sale of minority interest without change of control 4 –

Issuance of debt 1,077 1,583

Repayment on debt (1,549) (2,024)

Payment of debt resulting from inance lease liabilities (664) (565)

New loans (89) (10)

Repayment on loans 140 36

Dividends paid (24) (3)

Net cash ow from nancing activities (504) (983)

Effect of exchange rate on cash and cash equivalents and bank overdrafts (43) (77)

Change in cash and cash equivalents and bank overdrafts 191 (614)

Cash and cash equivalents and bank overdrafts at beginning of period 2,910 3,518

Cash and cash equivalents and bank overdrafts at end of period 3,101 2,910

(1) Restated for the reclassification of items relating to capitalized production, foreign currency effects linked to the revaluation of pro-

visions in foreign currencies and temporary staff expenses.

AIR FRANCE-KLM

26

AIR FRANCE-KLM

27

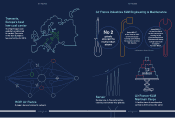

KEY FIGURES KEY FIGURES