Aetna 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report- Page 11

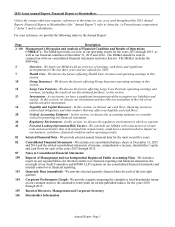

Operating Summary

(Millions) 2015 2014 2013

Premiums:

Life $ 1,215.6 $ 1,240.7 $ 1,150.6

Disability 879.0 824.9 742.4

Long-term care 43.9 44.3 44.9

Total premiums 2,138.5 2,109.9 1,937.9

Fees and other revenue 101.9 104.3 115.4

Net investment income 237.9 261.2 286.6

Net realized capital (losses) gains (.4) 14.4 1.3

Total revenue 2,477.9 2,489.8 2,341.2

Current and future benefits 1,836.4 1,798.3 1,811.2

Operating expenses:

Selling expenses 121.4 116.1 105.8

General and administrative expenses 346.1 337.2 301.7

Reversal of allowance on reinsurance recoverable —— (42.2)

Total operating expenses 467.5 453.3 365.3

Amortization of other acquired intangible assets .2 1.2 4.4

Total benefits and expenses 2,304.1 2,252.8 2,180.9

Income before income taxes 173.8 237.0 160.3

Income taxes 38.3 57.4 32.3

Net income including non-controlling interests 135.5 179.6 128.0

Less: Net income attributable to non-controlling interests —— 2.8

Net income attributable to Aetna for Group Insurance $ 135.5 $ 179.6 $ 125.2

The table presented below reconciles net income attributable to Aetna to operating earnings (1) for our Group

Insurance segment:

(Millions) 2015 2014 2013

Net income attributable to Aetna for Group Insurance $ 135.5 $ 179.6 $ 125.2

Net realized capital losses (gains), net of tax .3 (9.4) (.8)

Amortization of other acquired intangible assets, net of tax .2 .8 2.9

Charge for changes in life insurance claim payment practices, net of tax —— 35.7

Reversal of allowance and gain on sale of reinsurance recoverable, net of tax —— (32.1)

Operating earnings for Group Insurance $ 136.0 $ 171.0 $ 130.9

(1) Operating earnings excludes net realized capital gains and losses, amortization of other acquired intangible assets and the other items

described in the reconciliation in Note 20 of Notes to Consolidated Financial Statements beginning on page 145.

Operating earnings for 2015 declined by $35 million compared to 2014, primarily due to lower underwriting

margins in our long-term care and life products as well as lower net investment income, partially offset by higher

underwriting margins in our disability products. Operating earnings for 2014 increased by $40 million compared to

2013, primarily due to higher underwriting margins, reflecting improved experience in both our life and disability

products, partially offset by lower net investment income.

We calculate our group benefit ratio by dividing current and future benefits by total premiums. Our group benefit

ratios for the last three years were:

2015 2014 2013

Group benefit ratio 85.9% 85.2% 93.5%