ADP 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

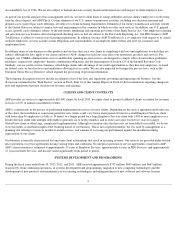

Item 6. Selected Financial Data

The following selected financial data is derived from our consolidated financial statements and should be read in conjunction with the

consolidated financial statements and related notes, Management's Discussion and Analysis of Financial Condition and Results of Operations,

and Quantitative and Qualitative Disclosures About Market Risk included in this Annual Report on Form 10-K.

Note 1. Non-GAAP Financial Measures

The following table reconciles results within our Selected Financial Data to adjusted results that exclude a goodwill impairment charge

related to our ADP AdvancedMD business for the fiscal year ended June 30, 2013 ("fiscal 2013"), a gain on the sale of assets related to rights

and obligations to resell a third-

party expense management platform for the fiscal year ended June 30, 2012 ("fiscal 2012"), and certain favorable

tax items for the fiscal years ended June 30, 2010 and 2009. We use certain adjusted results, among other measures, to evaluate our operating

performance in the absence of certain items and for planning and forecasting of future periods. We believe that the adjusted results provide

relevant and useful information for investors because it allows investors to view performance in a manner similar to the method used by us and

improves our ability to understand our operating performance. Since adjusted earnings from continuing operations before income taxes, adjusted

net earnings from continuing operations, and adjusted diluted earnings per share (“EPS”) from continuing operations are not measures of

performance calculated in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), they

should not be considered in isolation from, or as a substitute for, earnings from continuing operations before income taxes, net earnings from

continuing operations, and diluted EPS from continuing operations, and they may not be comparable to similarly titled measures employed by

other companies.

15

(Dollars and shares in millions, except per share amounts)

Years ended June 30,

2013

2012

2011

2010

2009

Total revenues

$

11,310.1

$

10,616.0

$

9,833.0

$

8,881.6

$

8,797.8

Total costs of revenues

$

6,649.6

$

6,214.3

$

5,708.4

$

4,999.9

$

4,794.8

Gross profit

$

4,660.5

$

4,401.7

$

4,124.6

$

3,881.7

$

4,003.0

Earnings from continuing operations before income taxes

$

2,084.3

$

2,107.9

$

1,918.0

$

1,855.6

$

1,895.9

Adjusted earnings from continuing operations before income taxes (Note 1)

$

2,127.0

$

2,041.9

$

1,918.0

$

1,855.6

$

1,895.9

Net earnings from continuing operations

$

1,364.1

$

1,379.7

$

1,245.0

$

1,202.6

$

1,322.5

Adjusted net earnings from continuing operations (Note 1)

$

1,406.8

$

1,338.5

$

1,245.0

$

1,190.4

$

1,202.5

Basic earnings per share from continuing operations

$

2.83

$

2.83

$

2.52

$

2.40

$

2.63

Diluted earnings per share from continuing operations

$

2.80

$

2.80

$

2.50

$

2.39

$

2.61

Adjusted diluted earnings per share from continuing operations (Note 1)

$

2.89

$

2.72

$

2.50

$

2.36

$

2.38

Basic weighted average shares outstanding

482.7

487.3

493.5

500.5

503.2

Diluted weighted average shares outstanding

487.1

492.2

498.3

503.7

505.8

Cash dividends declared per share

$

1.70

$

1.55

$

1.42

$

1.35

$

1.28

Return on equity ("ROE") from continuing operations (Note 2)

22.2

%

22.8

%

21.7

%

22.3

%

25.4

%

At year end:

Cash, cash equivalents and marketable securities

$

2,041.1

$

1,665.4

$

1,523.7

$

1,775.5

$

2,388.5

Total assets

$

32,268.1

$

30,817.4

$

34,238.3

$

26,862.2

$

25,351.7

Obligations under reverse repurchase agreements and commercial paper borrowing

$

245.9

$

—

$

—

$

—

$

730.0

Long-term debt

$

14.7

$

16.8

$

34.2

$

39.8

$

42.7

Stockholders’ equity

$

6,189.9

$

6,114.0

$

6,010.4

$

5,478.9

$

5,322.6