ADP 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EXECUTIVE OVERVIEW

During the fiscal year ended June 30, 2009 (“fiscal 2009”), we maintained focus on the execution of our five-point strategic growth

program, which consists of:

zStrengthening the core business;

zGrowing our differentiated HR Business Process Outsourcing (“BPO”) offerings;

zFocusing on international expansion;

zEntering adjacent markets that leverage the core; and

zExpanding pretax margins.

ADP’ s fiscal 2009 results were clearly impacted by the severe economic conditions, including rising unemployment, declining automobile

sales, low interest rates, and volatile financial markets. However, we are meeting the challenge of this recessionary environment by continuing

to focus on our five-point strategy and taking the actions necessary for the Company to be stronger and even better positioned for when the

economy improves.

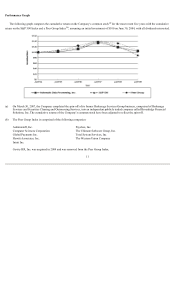

The headwinds from the global recession impacted our growth during fiscal 2009. Consolidated revenues from continuing operations in

fiscal 2009 grew 1%, to $8,867.1 million, as compared to $8,776.5 million in the fiscal year ended June 30, 2008 (“fiscal 2008”) due to

increases in revenues in Employer Services of 4%, or $225.3 million, to $6,587.7 million, and PEO Services of 12%, or $125.3 million, to

$1,185.8 million. Such increases were partially offset by fluctuations in foreign currency rates, which reduced our revenue by $188.0 million,

or 2%, a decrease in the consolidated interest on funds held for clients of $74.7 million and a decrease in Dealer Services revenue of 3%, or

$42.8 million. Earnings from continuing operations before income taxes and net earnings from continuing operations increased 5% and 14%,

respectively. Diluted earnings per share from continuing operations increased 20%, to $2.63 in fiscal 2009, from $2.20 per share in fiscal 2008,

on fewer weighted average diluted shares outstanding.

Employer Services’ revenues increased 4% and PEO Services revenues increased 12% in fiscal 2009. Employer Services’ and PEO

Services’ new business sales, which represent annualized recurring revenues anticipated from sales orders to new and existing clients, declined

15% worldwide, to approximately $982.3 million in fiscal 2009. In fiscal 2009, average client funds balances declined 3% due to lower

bonuses, lower wage growth, and a decline in pays per control. Our key business metrics for Employer Services showed year-over-year

declines in fiscal 2009. “Pays per control,” which represents the number of employees on our clients’ payrolls as measured on a same-store-

sales basis utilizing a subset of approximately 137,000 payrolls of small to large businesses that are reflective of a broad range of U.S.

geographic regions, decreased 2.5% in fiscal 2009. Client retention decreased 1.2 percentage points worldwide over last year’ s record level.

PEO Services’ revenues grew 12% in fiscal 2009 due to a 10% increase in the average number of worksite employees. Dealer Services’

revenues, which were negatively impacted by the difficulties facing the automotive industry, decreased 3% in fiscal 2009 due to dealership

consolidations and closings, lower transactional revenue and dealerships reducing services in order to cut their discretionary expenses.

We have a strong focus on strengthening our business model, which has approximately 90% recurring revenues, excellent margins from the

ability to generate consistent, strong cash flows, strong client retention and low capital expenditure requirements. We believe we have right-

sized the organization for the expected near-term lower revenue growth. Additionally, ADP has continued to return excess cash to our

shareholders. We have bought back approximately 20% of the Company’ s common stock that was outstanding at the beginning of the fiscal

year ended June 30, 2006. We have also raised the dividend payout for 34 consecutive years while still maintaining our AAA credit rating.

We are especially pleased with the performance of our investment portfolio and the investment choices we made throughout the year. Our

investment portfolio does not contain any asset-backed securities with underlying collateral of sub-prime mortgages, alternative-A mortgages,

sub-prime auto loans or home equity loans, collateralized debt obligations, collateralized loan obligations, credit default swaps, asset-backed

commercial paper, derivatives, auction rate securities, structured investment vehicles or non-investment-grade fixed-income securities. We own

senior tranches of fixed rate credit card, rate reduction, auto loan and other asset-backed securities, secured predominately by prime collateral.

All collateral on asset-backed securities is performing as expected. In addition, we own senior debt directly issued by Federal Home Loan

Banks, Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”). We do not

own subordinated debt, preferred stock or common stock of any of these agencies. We do own AAA rated mortgage-backed securities, which

represent an undivided beneficial ownership interest in a group or pool of one or more residential mortgages. These securities are collateralized

by the cash flows of 15-year and 30-year residential mortgages and are guaranteed by Fannie Mae and Freddie Mac as to the timely payment of

principal and interest. Our client funds investment strategy is structured to allow us to average our way through an interest rate cycle by

laddering investments out to five years (in the case of the extended portfolio) and out to ten years (in the case of the long portfolio). This

investment strategy is supported by our short-term financing arrangements necessary to satisfy short-term funding requirements relating to

client funds obligations. In addition, our AAA credit rating has helped us maintain uninterrupted access to the commercial paper market.

14