iHeartMedia 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

[x] Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2006, or

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to _________.

Commission File Number

1-9645

CLEAR CHANNEL COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

Texas

(State of Incorporation) 74-1787539

(I.R.S. Employer Identification No.)

200 East Basse Road

San Antonio, Texas 78209

Telephone (210) 822-2828

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.10 par value per share New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [X]

NO [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by checkmark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). YES [ ] NO [X]

As of June 30, 2006, the aggregate market value of the Common Stock beneficially held by non-affiliates of the registrant was

approximately $10.0 billion based on the closing sale price as reported on the New York Stock Exchange. (For purposes hereof,

directors, executive officers and 10% or greater shareholders have been deemed affiliates).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition

of “accelerate filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer [X] Accelerated filer [ ]

Non-accelerated filer [ ]

On February 22, 2007, there were 496,173,900 outstanding shares of Common Stock, excluding 130,304 shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2007 Annual Meeting, expected to be filed within 120 days of our fiscal year end,

are incorporated by reference into Part III.

Table of contents

-

Page 1

... File Number 1-9645 CLEAR CHANNEL COMMUNICATIONS, INC. (Exact name of registrant as specified in its charter) Texas (State of Incorporation) 74-1787539 (I.R.S. Employer Identification No.) 200 East Basse Road San Antonio, Texas 78209 Telephone (210) 822-2828 (Address, including zip code, and... -

Page 2

..., Executive Officers and Corporate Governance ...97 Executive Compensation ...98 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...98 Certain Relationships and Related Transactions and Director Independence ...98 Principal Accountant Fees and Services... -

Page 3

...also operated a live entertainment and sports representation business, which are reported as discontinued operations. On November 16, 2006, we announced plans to sell 448 of our radio stations, all located outside the top 100 U.S. media markets, as well as all of our television stations. The sale of... -

Page 4

... market ownership rules. Our principal executive offices are located at 200 East Basse Road, San Antonio, Texas 78209 (telephone: 210822-2828). Operating Segments Our business consists of three reportable operating segments: radio broadcasting, Americas outdoor advertising and international outdoor... -

Page 5

... revenues and programming with other radio stations owned by companies such as CBS, Cox Radio, Entercom and Radio One. We also compete with other advertising media, including satellite radio, television, newspapers, outdoor advertising, direct mail, cable television, yellow pages, the Internet... -

Page 6

... Rank* Stations New York, NY 1 5 Oklahoma City, OK Los Angeles, CA 2 8 Rochester, NY Chicago, IL 3 6 Louisville, KY San Francisco, CA 4 7 Richmond, VA Dallas-Ft. Worth, TX 5 6 Birmingham, AL Philadelphia, PA 6 6 Dayton, OH Houston-Galveston, TX 7 8 McAllen-Brownsville-Harlingen, TX Washington, DC... -

Page 7

... online access to information about our inventory, including pictures, locations and other pertinent display data that is helpful in their buying decisions. Additionally, in the United States we recently introduced a service guaranty in which we have committed to specific monitoring and reporting... -

Page 8

... smaller and local companies operating a limited number of display faces in a single or a few local markets. We also compete with other media in our respective markets including broadcast and cable television, radio, print media, the Internet and direct mail. Outdoor Advertising - Americas (19%, 18... -

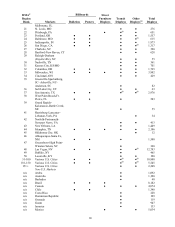

Page 9

... 19 20 Billboards Markets United States New York, NY Los Angeles, CA Chicago, IL Philadelphia, PA Boston, MA (Manchester, NH) San Francisco-OaklandSan Jose, CA Dallas-Ft. Worth, TX Washington, DC (Hagerstown, MD) Atlanta, GA Houston, TX Detroit, MI Tampa-St. Petersburg (Sarasota), FL Seattle-Tacoma... -

Page 10

... Salem, NC Las Vegas, NV Buffalo, NY Louisville, KY Various U.S. Cities Various U.S. Cities Various U.S. Cities Non-U.S. Markets Aruba Australia Barbados Brazil Canada Chile Costa Rica Dominican Republic Grenada Guam Jamaica Mexico Bulletins Posters Street Furniture Displays â- Transit... -

Page 11

... in 2006, 2005 and 2004, respectively) Sources of Revenue Outdoor advertising revenue is derived from the sale of advertising copy placed on our display inventory. Our international display inventory consists primarily of billboards, street furniture displays, transit displays and other outof-home... -

Page 12

... markets sell equipment or provide cleaning and maintenance services as part of a billboard or street furniture contract with a municipality. Production revenue relates to the production of advertising posters usually to small customers. Advertising inventory and markets At December 31, 2006... -

Page 13

... the Katz Media Group, a full-service media representation firm that sells national spot advertising time for clients in the radio and television industries throughout the United States. As of December 31, 2006, Katz Media represented over 3,300 radio stations and 400 television stations. Katz Media... -

Page 14

... overhaul of the country's telecommunications laws. The 1996 Act changed both the process for renewal of broadcast station licenses and the broadcast ownership rules. The 1996 Act established a "two-step" renewal process that limited the FCC's discretion to consider applications filed in competition... -

Page 15

...licensee's station in the same market and sells all of the advertising within that programming. Under these rules, an entity that owns one or more radio or television stations in a market and programs more than 15% of the broadcast time on another station in the same service (radio or television) in... -

Page 16

... weekly broadcast programming hours) or a samemarket media owner (including broadcasters, cable operators, and newspapers). To the best of our knowledge at present, none of our officers, directors or five percent or greater stockholders holds an interest in another television station, radio station... -

Page 17

... rules prohibiting ownership of a daily newspaper and a broadcast station, and limiting ownership of television and radio stations, in the same market. In place of those rules, the FCC adopted new "cross-media limits" that would apply to certain markets depending on the number of television stations... -

Page 18

... future reviews or any other agency or legislative initiatives upon the FCC's broadcast rules. Further, the 1996 Act's relaxation of the FCC's ownership rules has increased the level of competition in many markets in which our stations are located. Alien Ownership Restrictions The Communications Act... -

Page 19

... rights to air syndicated programming, cable and satellite systems' carriage of syndicated and network programming on distant stations, political advertising practices, obscenity and indecency in broadcast programming, application procedures and other areas affecting the business or operations... -

Page 20

... in the mass communications industry, such as direct broadcast satellite service, the continued establishment of wireless cable systems and low power television stations, "streaming" of audio and video programming via the Internet, digital television and radio technologies, the establishment of... -

Page 21

...audience loyalty of our key on-air talent and program hosts is highly sensitive to rapidly changing public tastes. A loss of such popularity or audience loyalty is beyond our control and could limit our ability to generate revenues. Doing Business in Foreign Countries Creates Certain Risks Not Found... -

Page 22

... additional radio or television stations or outdoor advertising properties in any market where we already have a significant position. Following passage of the Telecommunications Act of 1996, the DOJ has become more aggressive in reviewing proposed acquisitions of radio stations, particularly... -

Page 23

...regulates the locations of billboards, mandates a state compliance program, requires the development of state standards, promotes the expeditious removal of illegal signs, and requires just compensation for takings. Size, location, lighting and the use of new technologies for changing displays, such... -

Page 24

... advertising revenues with other radio stations and outdoor advertising companies, as well as with other media, such as newspapers, magazines, television, direct mail, satellite radio and Internet based media, within their respective markets. Audience ratings and market shares are subject to change... -

Page 25

... and personal digital video recorders. These new technologies and alternative media platforms compete with our radio and television stations for audience share and advertising revenue, and in the case of some products, allow listeners and viewers to avoid traditional commercial advertisements. The... -

Page 26

...000 square foot data and administrative service center. Operations Radio Broadcasting Our radio executive operations are located in our corporate headquarters in San Antonio, Texas. The types of properties required to support each of our radio stations include offices, studios, transmitter sites and... -

Page 27

... regarding commercial advertising run by us on behalf of offshore and/or online (Internet) gambling businesses, including sports bookmaking and casino-style gambling. On October 5, 2006, the Company received a subpoena from the Assistant United States Attorney for the Southern District of New York... -

Page 28

Additionally, two lawsuits have been filed against Clear Channel and its officers and directors in the United States District Court for the Western District of Texas: Alaska Laborers Employees Retirement Fund v. Clear Channel Communications, Inc., et al., No. SA07CA0042RF (filed January 11, 2007); ... -

Page 29

...sales prices of the common stock as reported on the NYSE. Common Stock Market Price Low High 2005 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...2006 First Quarter...Second Quarter ...Third Quarter ...Fourth Quarter ...Dividend Policy Our Board of Directors declared a quarterly... -

Page 30

... sale of assets related to mergers ⎯ Gain (loss) on marketable securities 2,306 Equity in earnings of nonconsolidated affiliates 37,478 Other income (expense) - net (8,421) Income (loss) before income taxes, minority interest, discontinued operations and cumulative effect of a change in accounting... -

Page 31

... of the historical consolidated financial data reflected in this schedule of Selected Financial Data. (2) We recorded a non-cash charge of $4.9 billion, net of deferred taxes of $3.0 billion, as a cumulative effect of a change in accounting principle during the fourth quarter of 2004 as a result of... -

Page 32

... 16, 2006 we announced plans to sell 448 radio stations located outside the top 100 U.S. media markets and all of our television stations. The sale of these assets is not contingent on the closing of the merger with the private equity funds sponsored by Bain Capital Partners, LLC and Thomas H. Lee... -

Page 33

... incur to maintain and/or increase our audience share. Outdoor Advertising Our revenues are derived from selling advertising space on the displays that we own or operate in key markets worldwide, consisting primarily of billboards, street furniture displays and transit displays. We own the majority... -

Page 34

... life of the option. The following table details compensation costs related to share-based payments for the year ended December 31, 2006: (In millions) Radio Broadcasting Direct Operating Expenses SG&A Americas Outdoor Advertising Direct Operating Expenses SG&A International Outdoor Advertising... -

Page 35

... first six months of 2006 related to Clear Media Limited, or Clear Media, a Chinese outdoor advertising company. We began consolidating Clear Media in the third quarter of 2005. Increased street furniture revenues also contributed to our international revenue growth. Our 2006 revenue increased $17... -

Page 36

... of the initial public offering of 10% of our subsidiary Clear Channel Outdoor Holdings, Inc., which we completed on November 11, 2005. Discontinued Operations We completed the spin-off of our live entertainment and sports representation businesses on December 21, 2005. Therefore, we reported the... -

Page 37

... Clear Media which we began consolidating in the third quarter of 2005. Also contributing to the increase was approximately $25.9 million from growth in street furniture revenues and $11.9 million related to movements in foreign exchange, partially offset by a decline in billboard revenues for 2006... -

Page 38

...of Segment Operating Income (Loss) (In thousands) Radio Broadcasting Americas Outdoor Advertising International Outdoor Advertising Other Gain on disposition of assets - net Merger expenses Corporate Consolidated operating income Years Ended December 31, 2005 2006 $ 1,280,215 $ 1,197,361 420,695 359... -

Page 39

...programming and content expenses and new initiatives. Our Americas outdoor direct operating expenses increased $21.3 million primarily from increases in direct production and site lease expenses related to revenue sharing agreements associated with the increase in revenues. Our international outdoor... -

Page 40

... purchase agreements signed for the sale of 39 of our radio stations as of December 31, 2006. The results of operations for these stations, along with 5 stations which were sold in the fourth quarter of 2006, are reclassified as discontinued operations. Cumulative Effect of a Change in Accounting... -

Page 41

...revenues. We also experienced improved yield on our street furniture inventory during 2005 compared to 2004. We acquired a controlling majority interest in Clear Media Limited, a Chinese outdoor advertising company, during the third quarter of 2005, which we had previously accounted for as an equity... -

Page 42

... owned by a consortium of equity funds sponsored by Bain Capital Partners, LLC and Thomas H. Lee Partners, L.P. It is anticipated that the funds necessary to consummate the merger and related transactions will be funded by new credit facilities, private and/or public offerings of debt securities and... -

Page 43

... portion of our properties or assets with a sale price in excess of $50.0 million except for the announced plan to sell 448 of our radio stations and all of our television stations; Make any capital expenditure in excess of $50.0 million individually, or $100.0 million in the aggregate, except for... -

Page 44

... employee stock options of $31.5 million. Discontinued Operations We had definitive asset purchase agreements signed for the sale of 39 of our radio stations as of December 31, 2006. The cash flows from these stations, along with 5 stations which were sold in the fourth quarter of 2006, are reported... -

Page 45

... of $1.75 billion, which can be used for general working capital purposes including commercial paper support as well as to fund capital expenditures, share repurchases, acquisitions and the refinancing of public debt securities. At December 31, 2006, the outstanding balance on this facility was... -

Page 46

..., or effect certain asset sales. At December 31, 2006, we were in compliance with all debt covenants. Uses of Capital Dividends Our Board of Directors declared quarterly cash dividends as follows: (In millions, except per share data) Amount per Common Declaration Share Date October 26, 2005... -

Page 47

... cash and our television business acquired a station for $21.0 million in cash. Capital Expenditures (In millions) Radio Non-revenue producing Revenue producing $ $ 99.7 ⎯ 99.7 Year Ended December 31, 2006 Capital Expenditures Americas International Corporate and Outdoor Outdoor Other $ $ 33.7 56... -

Page 48

... of the relevant advertising revenue or a specified guaranteed minimum annual payment. Also, we have non-cancelable contracts in our radio broadcasting operations related to program rights and music license fees. In the normal course of business, our broadcasting operations have minimum future... -

Page 49

...December 31, 2006 was a liability of $29.8 million. On February 1, 2007, our 3.125% Senior Notes and the related interest rate swap agreement matured. Equity Price Risk The carrying value of our available-for-sale and trading equity securities is affected by changes in their quoted market prices. It... -

Page 50

... 2006, we accounted for our share-based payments under the recognition and measurement provisions of APB Opinion No. 25, Accounting for Stock Issued to Employees and related Interpretations, as permitted by Statement of Financial Accounting Standards No. 123, Accounting for Stock Based Compensation... -

Page 51

.... Our key assumptions using the direct method are market revenue growth rates, market share, profit margin, duration and profile of the build-up period, estimated start-up capital costs and losses incurred during the build-up period, the risk-adjusted discount rate and terminal values. This data is... -

Page 52

... offset these higher costs by increasing the effective advertising rates of most of our broadcasting stations and outdoor display faces. Ratio of Earnings to Fixed Charges The ratio of earnings to fixed charges is as follows: 2006 2.35 2005 2.31 Year Ended December 31, 2004 2003 2.86 3.64 2002 2.58... -

Page 53

estimated interest portion of rental charges. We had no preferred stock outstanding for any period presented. ITEM 7A. Quantitative and Qualitative Disclosures about Market Risk Required information is within Item 7 53 -

Page 54

... the Public Company Accounting Oversight Board (United States) and, accordingly, they have expressed their professional opinion on the financial statements in their report included herein. The Board of Directors meets with the independent registered public accounting firm and management periodically... -

Page 55

... and schedule based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of... -

Page 56

... equivalents Accounts receivable, net of allowance of $57,799 in 2006 and $47,061 in 2005 Prepaid expenses Other current assets Income taxes receivable Total Current Assets PROPERTY, PLANT AND EQUIPMENT Land, buildings and improvements Structures Towers, transmitters and studio equipment Furniture... -

Page 57

LIABILITIES AND SHAREHOLDERS' EQUITY (In thousands, except share data) December 31, 2006 CURRENT LIABILITIES Accounts payable Accrued expenses Accrued interest Current portion of long-term debt Deferred income Other current liabilities Total Current Liabilities Long-term debt Other long-term ... -

Page 58

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) Revenue $ Operating expenses: Direct operating expenses (includes share-based payments of $17,327, $212 and $930 in 2006, 2005 and 2004, respectively and excludes depreciation and amortization) 2,650,093 Selling, general and... -

Page 59

...31, 2004 Net income Dividends declared Spin-off of Live Nation Gain on sale of subsidiary common stock Purchase of common shares Treasury shares retired and cancelled Exercise of stock options and other Amortization and adjustment of deferred compensation Currency translation adjustment 567,572,736... -

Page 60

... premiums and accretion of note discounts, net Share-based compensation (Gain) loss on sale of operating and fixed assets (Gain) loss on sale of available-for-sale securities (Gain) loss on forward exchange contract (Gain) loss on trading securities Equity in earnings of nonconsolidated affiliates... -

Page 61

... on long-term debt Payment to terminate forward exchange contract Proceeds from exercise of stock options, stock purchase plan and common stock warrants Dividends paid Proceeds from initial public offering Payments for purchase of common shares Net cash used in financing activities CASH FLOWS... -

Page 62

...ACCOUNTING POLICIES Nature of Business Clear Channel Communications, Inc., (the "Company") incorporated in Texas in 1974, is a diversified media company with three principal business segments: radio broadcasting, Americas outdoor advertising and international outdoor advertising. The Company's radio... -

Page 63

..., 2006, the Company announced plans to sell 448 of its radio stations, all located outside the top 100 U.S. media markets, as well as all of its television stations. The sale of these assets is not contingent on the closing of the Merger. Definitive asset purchase agreements were signed for the sale... -

Page 64

...agreements, typically four to fifteen years. The Company periodically reviews the appropriateness of the amortization periods related to its definite-lived assets. These assets are stated at cost. Indefinite-lived intangibles include broadcast FCC licenses and billboard permits. The excess cost over... -

Page 65

...component of shareholders' equity. The net unrealized gains or losses on the trading securities are reported in the statement of operations. In addition, the Company holds investments that do not have quoted market prices. The Company periodically reviews the value of available-for-sale, trading and... -

Page 66

... expenses. Share-Based Payments The Company adopted Financial Accounting Standard No. 123 (R), Share-Based Payment ("Statement 123(R)"), on January 1, 2006 using the modified-prospective-transition method. Under the fair value recognition provisions of this statement, stock based compensation cost... -

Page 67

... of operations. NOTE B - STRATEGIC REALIGNMENT Initial Public Offering ("IPO") of Clear Channel Outdoor Holdings, Inc. ("CCO") The Company completed the IPO on November 11, 2005, which consisted of the sale of 35.0 million shares, for $18.00 per share, of Class A common stock of CCO, its indirect... -

Page 68

... Held for Sale On November 16, 2006, the Company announced plans to sell certain radio markets, comprising 448 of its radio stations. These markets are located outside the top 100 U.S. media markets. As of December 31, 2006, the Company had sold 5 radio stations and signed definitive asset purchase... -

Page 69

...987 104,054 821,612 Transit, street furniture, and other outdoor contractual rights Talent contracts Representation contracts Other Total $ $ Total amortization expense from continuing operations related to definite-lived intangible assets for the years ended December 31, 2006, 2005 and 2004 was... -

Page 70

...by EITF 02-07, Unit of Accounting for Testing Impairment of Indefinite-Lived Intangible Assets. The Company's key assumptions using the direct method are market revenue growth rates, market share, profit margin, duration and profile of the build-up period, estimated start-up capital costs and losses... -

Page 71

... Media Limited for $8.9 million. Clear Media is a Chinese outdoor advertising company and as a result of consolidating its operations during the third quarter of 2005, the acquisition resulted in an increase in the Company's cash of $39.7 million. Also, the Company's national representation business... -

Page 72

... the Company acquired two television stations for $10.0 million in cash and $8.7 million in restricted cash and our national representation business acquired new contracts for a total of $32.4 million in cash during the year ended December 31, 2004. Finally, the Company exchanged outdoor advertising... -

Page 73

...broadcasting company. ACIR owns and operates radio stations throughout Mexico. Summarized Financial Information The following table summarizes the Company's investments in these nonconsolidated affiliates: (In thousands) At December 31, 2005 Acquisition (disposition) of investments Other, net Equity... -

Page 74

... its outdoor advertising displays from leased land and to reclaim the site to its original condition upon the termination or nonrenewal of a lease. The liability is capitalized as part of the related long-lived assets' carrying value. Due to the high rate of lease renewals over a long period of time... -

Page 75

..., or Federal Funds rate selected at the Company's discretion, plus a margin. The multi-currency revolving credit facility can be used for general working capital purposes including commercial paper support as well as to fund capital expenditures, share repurchases, acquisitions and the refinancing... -

Page 76

... a change in long-term debt ratings that would have a material impact to its financial statements. Additionally, the Company's 8% senior notes due 2008, which were originally issued by AMFM Operating Inc., a wholly-owned subsidiary of the Company, contain certain restrictive covenants that limit the... -

Page 77

... Contracts On June 5, 2003, Clear Channel Investments, Inc. ("CCI, Inc."), a wholly owned subsidiary of the Company, entered into a five-year secured forward exchange contract (the "contract") with respect to 8.3 million shares of its investment in XM Satellite Radio Holdings, Inc. ("XMSR"). Under... -

Page 78

... advertising revenue or a specified guaranteed minimum annual payment. The Company has various contracts in its radio broadcasting operations related to program rights and music license fees. In addition, the Company has commitments relating to required purchases of property, plant, and equipment... -

Page 79

...various foreign currencies, which are used to hedge net assets in those currencies and provides funds to the Company's international operations for certain working capital needs. Subsidiary borrowings under this sub-limit are guaranteed by the Company. At December 31, 2006, this portion of the $1.75... -

Page 80

... protection to its international subsidiary's banking institutions related to overdraft lines up to approximately $39.9 million. As of December 31, 2006, no amounts were outstanding under these agreements. As of December 31, 2006, the Company has outstanding commercial standby letters of credit... -

Page 81

... capital loss carryforward due to the uncertainty of the ability to utilize the carryforward prior to its expiration. During the first quarter of 2006, the Company received a federal tax refund of $133.4 million related to the restructuring its international businesses consistent with its strategic... -

Page 82

...year ended December 31, 2006. In addition, current tax expense was reduced by approximately $22.1 million related to the disposition of certain operating assets and the filing of an amended tax return during 2006. As discussed above, the Company recorded a capital loss on the spin-off of Live Nation... -

Page 83

... to expense over five years. Prior to January 1, 2006, the Company accounted for its share-based payments under the recognition and measurement provisions of APB Opinion No. 25, Accounting for Stock Issued to Employees ("APB 25") and related Interpretations, as permitted by Statement of Financial... -

Page 84

... stock awards, is estimated using a Black-Scholes optionpricing model and amortized to expense over the options' vesting periods. (In thousands, except per share data) Income before discontinued operations and cumulative effect of a change in accounting principle: Reported Share-based payments... -

Page 85

... years Risk-free interest rate Dividend yield The following table presents a summary of the Company's stock options outstanding at and stock option activity during the year ended December 31, 2006 ("Price" reflects the weighted average exercise price per share): (In thousands, except per share data... -

Page 86

... number of shares of CCO's common stock represented by each option for any change in capitalization. Prior to CCO's IPO, CCO did not have any compensation plans under which it granted stock awards to employees. However, the Company had granted certain of CCO's officers and other key employees stock... -

Page 87

...the time of grant for periods equal to the expected life of the option. The following assumptions were used to calculate the fair value of CCO's options on the date of grant during the years ended December 31, 2006 and 2005: Expected volatility Expected life in years Risk-free interest rate Dividend... -

Page 88

... 31, 2006, there was $82.7 million of unrecognized compensation cost related to nonvested sharebased compensation arrangements. The cost is expected to be recognized over a weighted average period of approximately 3.0 years. Share Repurchase Programs The Company's Board of Directors approved two... -

Page 89

...31, 2006 and 2005, respectively, relating to the Company's non-qualified deferred compensation plan. During the year ended December 31, 2006, 46.7 million shares were retired from the Company's shares held in treasury account. Reconciliation of Earnings per Share (In thousands, except per share data... -

Page 90

...common stock may be purchased at 95% of the market value on the day of purchase. The Company changed its discount from market value offered to participants under the plan from 15% to 5% in July 2005. Employees may purchase shares having a value not exceeding 10% of their annual gross compensation or... -

Page 91

... initiatives which are ancillary to our other businesses. Share-based payments are recorded by each segment in direct operating and selling, general and administrative expenses. (In thousands) Radio Broadcasting Americas Outdoor Advertising International Outdoor Advertising Other Corporate, merger... -

Page 92

(In thousands) Radio Broadcasting Americas Outdoor Advertising International Outdoor Advertising Other Corporate and gain on disposition of assets - net Eliminations Consolidated 2005 Revenue $ 3,502,508 $ 1,216,382 $ 1,449,696 $ 532,339 $ ⎯ $ (122,120) $ Direct operating expenses 958,071 489,... -

Page 93

NOTE P - QUARTERLY RESULTS OF OPERATIONS (Unaudited) (In thousands, except per share data) Revenue Operating expenses: Direct operating expenses Selling, general and administrative expenses Depreciation and amortization Corporate expenses Merger expenses Gain (loss) on disposition of assets - net ... -

Page 94

... - SUBSEQUENT EVENTS The Company filed a Definitive Proxy Statement with the SEC on January 29, 2007 related to its proposed merger with a group of private equity funds sponsored by Bain Capital Partners, LLC and Thomas H. Lee Partners, L.P. The special meeting to vote on the merger will be March 21... -

Page 95

... to ensure that material information relating to Clear Channel Communications, Inc. (the "Company") including its consolidated subsidiaries, is made known to the officers who certify the Company's financial reports and to other members of senior management and the Board of Directors. Based on their... -

Page 96

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Clear Channel Communications, Inc. and subsidiaries as of December 31, 2006 and 2005 and the related consolidated statements of operations, changes in shareholders' equity, and cash flows... -

Page 97

... the captions "Code of Business Conduct and Ethics", "Election of Directors" or "Compliance With Section 16(A) of the Exchange Act," in our Definitive Proxy Statement, which will be filed with the Securities and Exchange Commission within 120 days of our fiscal year end. The following information... -

Page 98

... Related Transactions and Director Independence The information required by this item is incorporated by reference to our Definitive Proxy Statement under the heading "Certain Transactions", expected to be filed within 120 days of our fiscal year end. ITEM 14. Principal Accountant Fees and Services... -

Page 99

...following financial statement schedule for the years ended December 31, 2006, 2005 and 2004 and related report of independent auditors is filed as part of this report and should be read in conjunction with the consolidated financial statements. Schedule II Valuation and Qualifying Accounts All other... -

Page 100

... at Beginning of period Charges to Costs, Expenses and other Write-off of Accounts Receivable Balance at end of Period Description Year ended December 31, 2004 Year ended December 31, 2005 Year ended December 31, 2006 Other $ 44,991 $ 38,146 $ 36,892 $ 1,155 (1) $ 47,400 $ 47,400 $ 35... -

Page 101

... Year ended December 31, 2006 $ 60,672 $ - $ 60,672 $ - $ - $ - $ - $ - $ 571,154 $ 571,154 $ 571,154 $ - $ - $ (17,756) $ 553,398 (1) Related to a valuation allowance for the capital loss carryforward recognized during 2005 as a result of the spinoff of Live Nation. During... -

Page 102

...). Third Amendment to Clear Channel's Articles of Incorporation (incorporated by reference to the exhibits to Clear Channel's Quarterly Report on Form 10-Q for the quarter ended May 31, 2000). Agreement Concerning Buy-Sell Agreement by and between Clear Channel Communications, Inc., L. Lowry Mays... -

Page 103

... the quarter ended September 30, 2001). Eleventh Supplemental Indenture dated January 9, 2003, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report... -

Page 104

... Company's Definitive 14A Proxy Statement dated March 24, 1998). The Clear Channel Communications, Inc. 2000 Employee Stock Purchase Plan (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002). The Clear Channel Communications... -

Page 105

... T. Mays and Clear Channel Communications, Inc. (incorporated by reference to the exhibits to Clear Channel's Current Report on Form 8-K dated November 16, 2006). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst... -

Page 106

Exhibit Number 24 31.1 Description Power of Attorney (included on signature page). Certification of Chief Executive Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Certification of ... -

Page 107

...Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on February 28, 2007. CLEAR CHANNEL COMMUNICATIONS, INC. By: /S/ Mark P. Mays Mark P. Mays Chief Executive Officer Power of Attorney Each person whose... -

Page 108

Name /S/ Phyllis Riggins Phyllis Riggins /S/ Theodore H. Strauss Theodore H. Strauss /S/ J.C. Watts J. C. Watts /S/ John H. Williams John H. Williams /S/ John B. Zachry John B. Zachry Title Date Director February 28, 2007 Director February 28, 2007 Director February 28, 2007 Director ... -

Page 109

...). Third Amendment to Clear Channel's Articles of Incorporation (incorporated by reference to the exhibits to Clear Channel's Quarterly Report on Form 10-Q for the quarter ended May 31, 2000). Agreement Concerning Buy-Sell Agreement by and between Clear Channel Communications, Inc., L. Lowry Mays... -

Page 110

... the quarter ended September 30, 2001). Eleventh Supplemental Indenture dated January 9, 2003, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report... -

Page 111

... Company's Definitive 14A Proxy Statement dated March 24, 1998). The Clear Channel Communications, Inc. 2000 Employee Stock Purchase Plan (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002). The Clear Channel Communications... -

Page 112

... T. Mays and Clear Channel Communications, Inc. (incorporated by reference to the exhibits to Clear Channel's Current Report on Form 8-K dated November 16, 2006). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst... -

Page 113

Exhibit Number 24 31.1 Description Power of Attorney (included on signature page). Certification of Chief Executive Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Certification of ... -

Page 114

... 11 - Computation of Per Share Earnings (In thousands, except per share data) NUMERATOR: Income before discontinued operations and cumulative effect of a change in accounting principle Income from discontinued operations, net Cumulative effect of a change in accounting principle Net income (loss... -

Page 115

... EARNINGS TO FIXED CHARGES (In thousands, except ratio) 2006 Income (loss) before income taxes, equity in earnings of non-consolidated affiliates, extraordinary item and cumulative effect of a change in accounting principle $ 1,152,100 Dividends and other received from nonconsolidated affiliates 15... -

Page 116

... Operating Company Capstar TX, LP CC Broadcast Holdings, Inc. CC Holdings-Nevada, Inc. CC Identity GP, LLC CC Identity Holdings, Inc. CC Licenses, LLC CCB Texas Licenses, LP CCBL FCC Holdings, Inc. CCBL GP, LLC Central NY News, Inc. Christal Radio Sales, Inc. Cine Guarantors II, Inc. Citi GP, LLC... -

Page 117

... Katz Communications, Inc. Katz Media Group, Inc. Katz Millennium Sales & Marketing, Inc. *Keller Booth Sumners JV *Kelnic II JV KTZMedia Corporation KVOS TV, Ltd. Lubbock Tower Company M Street Corp M Street, LLC Oklahoma City Tower Company *Outdoor Management Services, Inc. Premiere Radio Networks... -

Page 118

Terrestrial RF Licensing, Inc. The New Research Group, Inc. *Transportation Media of Texas JV Radio Computing Services, Inc. *Clear Channel Airports of Georgia, Inc. *Get Outdoors Florida, LLC Media Monitors, LLC Musicpoint International, LLC *Interspace Services, Inc. *Sunset Billboards, LLC AMFM.... -

Page 119

...Clear Channel KNR Neth Antilles NV* Clear Channel Latvia * Clear Channel Lietuva* Clear Channel More France SA * Clear Channel NI Ltd.* Clear Channel Norway AS * Clear Channel Outdoor Company Canada* Clear Channel Outdoor Limited * Clear Channel Outdoor Mexico SA de CV * Clear Channel Outdoor Mexico... -

Page 120

... Invest. Pty Ltd.* Clear Channel South America S.A.C.* Clear Channel Sverige AB * Clear Channel Tanitim Ve Lierisin AS * Clear Channel UK Ltd * Clear Media Limited* Comurben SA* Dauphin Adshel SA * Defi Belgique * Defi Deutschland GmbH* Defi France SAS * Defi Group Asia* Defi Group SAS * Defi Italia... -

Page 121

... Ltd.* MOF Adshel Ltd.* More Communications Ltd.* More Media Ltd.* More O'Ferrall Ltd.* More O'Ferrall Ireland Ltd. * Morebus Ltd.* Multimark Ltd.* Nitelites (Ireland) Ltd.* Mobiliario Urbano de Nueva Leon SA de CV* Outdoor Advertising BV* Outdoor International Holdings BV* Outstanding Media I Norge... -

Page 122

...Signways Ltd.* Simon Outdoor Ltd.* Sirocco International S.A.* Sites International Ltd.* Sviluppo & Pubblicita Srl* Taxi Media Holdings Ltd.* Taxi Media Ltd.* Team Relay Ltd.* The Canton Property Co. Ltd.* The Kildoon Property Co. Ltd.* Torpix Ltd.* Town & City Posters Advertising. Ltd.* Tracemotion... -

Page 123

... effectiveness of internal control over financial reporting, and the effectiveness of internal control over financial reporting of Clear Channel Communications, Inc. included in this Annual Report (Form 10-K) for the year ended December 31, 2006. /s/ERNST & YOUNG LLP San Antonio, Texas February 26... -

Page 124

... SARBANES-OXLEY ACT OF 2002 I, Mark P. Mays, Chief Executive Officer of Clear Channel Communications, Inc. certify that: 1. I have reviewed this Annual Report on Form 10-K of Clear Channel Communications, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material... -

Page 125

...-OXLEY ACT OF 2002 I, Randall T. Mays, President and Chief Financial Officer of Clear Channel Communications, Inc. certify that: 1. I have reviewed this Annual Report on Form 10-K of Clear Channel Communications, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of... -

Page 126

... Act of 2002 and accompanies the Annual Report on Form 10-K (the "Form 10-K") for the year ended December 31, 2006 of Clear Channel Communications,... 2007 By:/s/ Mark P. MAYS Name: Mark P. Mays Title: Chief Executive Officer A signed original of this written statement required by Section 906 has been... -

Page 127

...Act of 2002 and accompanies the Annual Report on Form 10-K (the "Form 10-K") for the year ended December 31, 2006 of Clear Channel Communications...:/s/ RANDALL T. MAYS Name: Randall T. Mays Title: President and Chief Financial Officer A signed original of this written statement required by Section 906...