iHeartMedia 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

Commission File Number

1-9645

CLEAR CHANNEL COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

200 East Basse Road

San Antonio, Texas 78209

Telephone (210) 822-2828

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $.10 par value per share.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. YES NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). YES NO

On June 28, 2002, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the

Common Stock beneficially held by non-affiliates of the Company was approximately $16.9 billion. (For purposes hereof, directors, executive

officers and 10% or greater shareholders have been deemed affiliates).

On March 3, 2003, there were 613,847,376 outstanding shares of Common Stock, excluding 71,292 shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2003 Annual Meeting, expected to be filed within 120 days of our fiscal year end, are

incorporated by reference into Part III.

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal

y

ear ended December 31, 2002, or

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition

p

eriod from to

Texas

(State of Incorporation)

74-1787539

(I.R.S. Employer Identification No.)

Table of contents

-

Page 1

... period from Commission File Number 1-9645 CLEAR CHANNEL COMMUNICATIONS, INC. (Exact name of registrant as specified in its charter) Texas (State of Incorporation) 74-1787539 (I.R.S. Employer Identification No.) 200 East Basse Road San Antonio, Texas 78209 Telephone (210) 822-2828 (Address... -

Page 2

... about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management Certain... -

Page 3

... Communications, Inc. is a diversified media company with three reportable business segments: radio broadcasting, outdoor advertising and live entertainment. We were incorporated in Texas in 1974. As of December 31, 2002, we owned 1,184 domestic radio stations and a leading national radio network... -

Page 4

... strategy using outdoor advertising. While price and availability are important competitive factors, service and customer relationships are also critical components of local sales. Advertising rates are based on a particular display's exposure, or number of "impressions" delivered, in relation... -

Page 5

... broadcast rights. We also provide local news programming for the ABC, CBS, NBC and FOX affiliate stations in Jacksonville, Florida; Harrisburg, Pennsylvania; Memphis, Tennessee; Mobile, Alabama; Cincinnati, Ohio; Albany, New York; San Antonio, Texas; and Salt Lake City, Utah. Local news programming... -

Page 6

...achieved by mobilizing the radio and television broadcasting, outdoor advertising and live entertainment segments for the advertiser's benefit. Additionally, we seek to create situations in which we own more than one type of media in the same market. We have found the access to multiple media assets... -

Page 7

... market management. Radio Broadcasting Our radio strategy centers around providing programming that is relevant to our communities. We operate in a competitive marketplace and compete with all advertising media including television, newspaper, direct mail, cable, yellow pages, Internet, satellite... -

Page 8

... Channel consists of three reportable operating segments: radio broadcasting, outdoor advertising and live entertainment. The radio broadcasting segment includes radio stations for which we are the licensee and for which we program and/or sell air time under local marketing agreements or joint sales... -

Page 9

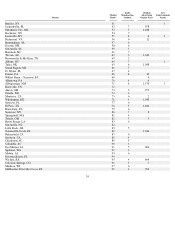

Market Market Rank* Radio Broadcasting Stations Outdoor Advertising Display Faces Live Entertainment Venues New York, NY Los Angeles, CA Chicago, IL San Francisco, CA Dallas, TX Philadelphia, PA Houston, TX Washington, DC Boston, MA Detroit, MI Atlanta, GA Miami, FL Seattle, WA Phoenix, AZ ... -

Page 10

Market Market Rank* Radio Broadcasting Stations Outdoor Advertising Display Faces Live Entertainment Venues Buffalo, NY Jacksonville, FL Oklahoma City..., MA Toledo, OH Baton Rouge, LA Greenville, NC Little Rock, AR Gainesville-Ocala,...Des Moines, IA Spokane, WA Mobile, AL Daytona Beach, FL Wichita... -

Page 11

Market Market Rank* Radio Broadcasting Stations Outdoor Advertising Display Faces Live Entertainment Venues Various U.S. Cities Various U.S. Cities Various U.S. Cities Various U.S. Cities Various U.S. Cities International: Africa (b) Australia - New Zealand (a), (b) Baltics and Russia Belgium ... -

Page 12

... television stations. Our television stations are affiliated with various television networks, including ABC, CBS, NBC, FOX, UPN, PAX and WB. Media Representation We own the Katz Media Group, a full-service media representation firm that sells national spot advertising time for clients in the radio... -

Page 13

... radio and television stations for terms of up to eight years. The 1996 Act requires the FCC to renew a broadcast license if it finds that the station has served the public interest, convenience and necessity; there have been no serious violations of either the Communications Act or the FCC's rules... -

Page 14

... to radio station acquisitions based on estimated advertising revenue shares or other criteria. This policy, which the FCC formally adopted as an "interim policy" in November 2001, has delayed approval of a number of our radio acquisitions. With respect to television, the 1996 Act directed the... -

Page 15

... price. There are 22 markets where we own both radio and television stations. In the majority of these markets, the number of radio stations we own complies with the limit imposed by the revised rule. Our acquisition of television stations in five markets in our 2002 merger with The Ackerley Group... -

Page 16

...'s station's total weekly broadcast programming hours) or a same-market media owner (including broadcasters, cable operators, and newspapers). To the best of our knowledge at present, none of our officers, directors or five percent stockholders holds an interest in another television station, radio... -

Page 17

...advertising practices, application procedures and other areas affecting the business or operations of broadcast stations. Public Interest Programming . Broadcasters are required to air programming addressing the needs and interests of their communities of license, and to place "issues/programs lists... -

Page 18

... in the mass communications industry, such as direct broadcast satellite service, the continued establishment of wireless cable systems and low power television stations, "streaming" of audio and video programming via the Internet, digital television and radio technologies, the establishment of... -

Page 19

... or a decline in general economic conditions. At December 31, 2002, we had debt outstanding of $8.8 billion and shareholders' equity of $14.2 billion. We may continue to borrow funds to finance acquisitions of radio broadcasting, outdoor advertising and live entertainment properties, as well as... -

Page 20

... us to complete potential acquisitions or require us to divest stations we have already acquired. For instance, the FCC has adopted modified rules that in some cases permit a company to own fewer radio stations than allowed by the Telecommunications Act of 1996 in markets or geographical areas where... -

Page 21

... acquiring additional radio or television stations or outdoor advertising or entertainment properties in any market where we already have a significant position. Following passage of the Telecommunications Act of 1996, the DOJ has become more aggressive in reviewing proposed acquisitions of radio... -

Page 22

... businesses. These acquisitions or dispositions could be material. Capital Requirements Necessary to Implement Acquisitions Could Pose Risks We face stiff competition from other broadcasting, outdoor advertising and live entertainment companies for acquisition opportunities. If the prices sought... -

Page 23

..., both general and relative to the radio broadcasting, outdoor advertising, live entertainment and all related media industries, which may cause companies to reduce their expenditures on advertising or corporate sponsorship or reduce the number of persons willing to attend live entertainment events... -

Page 24

..., any lack of availability of popular musical artists, touring Broadway shows, specialized motor sports talent and other performers could limit our ability to generate revenues. In addition, we require access to venues to generate revenues from live entertainment events. We operate a number of our... -

Page 25

... square foot data and administrative service center in San Antonio. Operations Radio Broadcasting In the latter part of 2002, we moved our radio operations to our corporate headquarters in San Antonio, Texas. Previously, our radio operations were headquartered in 21,201 square feet of leased office... -

Page 26

... international outdoor advertising operations is in 8,688 square feet of leased office space in London, England. The lease on this premises expires in June 2014. The types of properties required to support each of our outdoor advertising branches include offices, production facilities and structure... -

Page 27

... leased office space in New York City, New York. The lease on this premises expires in September 2020. Several members of the live entertainment senior management team as well as other live entertainment operations are located in 95,165 square feet of leased office space in Houston, Texas. The lease... -

Page 28

... quarters indicated, the reported high and low sales prices of the common stock as reported on the NYSE. Clear Channel Common Stock Market Price High Low 2001 First Quarter Second Quarter Third Quarter Fourth Quarter 2002 First Quarter Second Quarter Third Quarter Fourth Quarter Dividend Policy... -

Page 29

... ended December 31, (1) 2002 2001 2000 1999 1998 Results of Operations Information: Revenue Operating Expenses: Divisional operating expenses Non-cash compensation expense Depreciation and amortization Corporate expenses Operating income (loss) Interest expense Gain (loss) on sale of assets related... -

Page 30

28 -

Page 31

... 2,323,643 4,483,429 (1) Acquisitions and dispositions significantly impact the comparability of the historical consolidated financial data reflected in this schedule of Selected Financial Data. The Selected Financial Data should be read in conjunction with Management's Discussion and Analysis. 29 -

Page 32

... basis. Our reportable operating segments are: Radio Broadcasting which includes all domestic and international radio assets and radio networks; Outdoor Advertising which includes domestic and international billboards, transit displays, street furniture and other outdoor advertising media; and Live... -

Page 33

... Ended December 31, 2002 2001 % Change 2002 v. 2001 Reported Basis: Revenue Divisional Operating Expenses Corporate Expenses EBITDA as Adjusted * Reconciliation to net income (loss): Non-cash compensation expense Depreciation and amortization Interest expense Gain (loss) on sale of assets related... -

Page 34

... for the year ended December 31, 2002 from the same period of 2001. The increase in reported basis revenue is largely attributable to revenue improvements in our radio segment of $261.7 million, driven by improvement in advertising demand for our radio inventory. Both national and local sales of our... -

Page 35

...and weak advertising demand for our outdoor advertising inventory. Our entertainment segment is lagging behind our radio and television businesses in terms of revenue growth primarily from the effects of the 2002 recession, September 11th, as well as a change in the mix of types of events in 2002 as... -

Page 36

... shares of Lamar Advertising Company that we acquired in the AMFM merger Net loss related to write-downs of investments acquired in mergers Gain realized on the sale of five stations in connection with governmental directives regarding the AMFM merger Net loss on sale of assets related to mergers... -

Page 37

Gain (loss) on Marketable Securities The gain (loss) on marketable securities for the year ended December 31, 2002 was a loss of $3.1 million as compared to a gain of $25.8 million for the year ended December 31, 2001. 33 -

Page 38

..., respectively. The income recognized in 2002 related primarily to: (1) a $44.5 million aggregate gain recognized on the sale of a television license, the sale of assets in our live entertainment segment and the sale of our interest in a British radio license; (2) a $12.0 million gain recognized on... -

Page 39

... million for the year ended December 31, 2002 as compared to 2001. We experienced broad based revenue increases during 2002 on both a reported and pro forma basis. Growth occurred across our large and small market clusters, in national and local sales, in our syndicated radio programs and across our... -

Page 40

... operating expenses increased $21.4 million in 2002 as compared to 2001. The increase is attributable to acquisitions as well as the addition of new programs and an increase in talent fees in our national syndication business. Also, commission expense and the accrual for our incentive bonus plan... -

Page 41

... us national coverage in billboards in the United Kingdom, which has helped us gain sales we would not have received prior to the acquisition. We also renewed our Madrid and Valencia bus contracts. Divisional operating expenses increased on a reported basis $133.4 million for the year ended December... -

Page 42

Segment Reconciliations (In thousands) As Reported Years Ended December 31, 2002 2001 EBITDA as Adjusted * Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Consolidated EBITDA as Adjusted * $1,591,104 505,551 157,648 113,991 (176,370) $2,191,924 $1,350,834 527,350 150,531... -

Page 43

... our fiscal year 2001 reported basis amounts are the revenues and divisional operating expenses for a twelve-month period from our 2000 acquisitions, the most significant being SFX Entertainment, Inc., acquired August 1, 2000, AMFM Inc. acquired on August 30, 2000, and Donrey Media Group acquired on... -

Page 44

approximately $1.2 billion of the total $2.6 billion increase in reported revenue for fiscal year 2001 as compared to fiscal year 2000. The increase in reported 39 -

Page 45

... the mix of live music events within the entertainment division as compared to fiscal year 2000. In addition, pro forma divisional operating expenses increased in our other segments relating to the reorganization of these business units as well as other expenses during the quarter ended December 31... -

Page 46

... shares of Lamar Advertising Company that we acquired in the AMFM merger; and a net loss of $15.7 million related to write-downs of investments acquired in mergers. The gain on marketable securities is primarily related to the reclassification of 2.0 million shares of American Tower Corporation... -

Page 47

...revenue, these decreases were offset by increases in expenses associated with the reorganization of our radio workforce. During 2001, we hired a significant number of new sales and marketing people in an effort to create more demand on our advertising inventory and paid severance to other terminated... -

Page 48

Outdoor Advertising (In thousands) Years Ended December 31, 2001 2000 % Change 2001 v. 2000 As Reported Basis: Revenue Divisional Operating Expenses EBITDA as Adjusted * * See page 30 for cautionary disclosure Pro Forma Basis: Revenue Divisional Operating Expenses Reconciliation of Reported Basis ... -

Page 49

... the number of live events decreased over the prior period, during 2001, we changed the mix of live music events to include approximately 48% more stadium and arena events as compared to the prior year. Stadium and arenas are generally larger venues that allow for more ticket sales related to... -

Page 50

Segment Reconciliations (In thousands) As Reported Years Ended December 31, 2001 2000 EBITDA as Adjusted * Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Consolidated EBITDA as Adjusted * $1,350,834 527,350 150,531 74,582 (187,434) $1,915,863 $1,045,696 650,898 73,472 ... -

Page 51

..., respectively, relating to acquisitions of radio, outdoor and entertainment assets. This was also offset by $598.4 million of capital expenditures related to purchases of property, plant and equipment. Financing Activities: Financing activities for the year ended December 31, 2002 principally... -

Page 52

quarterly reductions in the amounts available for 46 -

Page 53

..., which we purchased for an aggregate price of $4.8 million. Long-Term Bonds On January 15, 2002, we redeemed all of the outstanding 12.625% exchange debentures due 2006, originally issued by SFX Broadcasting for $150.8 million plus accrued interest. During the year ended December 31, 2002, we also... -

Page 54

... date of February 27, 2002, as a part of our merger with Jacor. Each warrant represented the right to purchase .130441 shares of our common stock at an exercise price of $34.56 per full share. During the first quarter of 2002, we received $11.8 million in proceeds and issued .3 million shares... -

Page 55

... the year ended December 31, 2002. Future acquisitions of radio broadcasting stations, outdoor advertising facilities, live entertainment assets and other media-related properties affected in connection with the implementation of our acquisition strategy are expected to be financed from increased... -

Page 56

... construction of new revenue producing advertising displays. Our live entertainment capital expenditures decreased $4.1 million during the year ended December 31, 2002 as compared to 2001 primarily due to a higher spending in 2001 relating to a consolidated sales and operations facility. This... -

Page 57

... On June 12, 2002, Univision Communications, Inc., a Spanish language television group, announced that it would acquire Hispanic Broadcasting in a stock for stock merger. Pursuant to the terms of the merger agreement, each share of Hispanic will be exchanged for .85 shares of Univision. As... -

Page 58

... the world. Foreign operations are measured in their local currencies except in hyper-inflationary countries in which we operate. As a result, our financial results could be affected by factors such as changes in foreign currency exchange rates or weak economic conditions in the foreign markets in... -

Page 59

... initial measurement provisions are applicable on a prospective basis to guarantees issued or modified after December 31, 2002, irrespective of the guarantor's fiscal year-end. We adopted the disclosure requirements of this Interpretation for our 2002 annual report. Management does not believe that... -

Page 60

...changes in current economic conditions. Revenue Recognition Radio broadcasting revenue is recognized as advertisements or programs are broadcast and is generally billed monthly. Outdoor advertising provides services under the terms of contracts covering periods up to three years, which are generally... -

Page 61

... impairment charges in future periods under Statement 142 to the extent we do not achieve our expected cash flow growth rates, and to the extent that market values and long-term interest rates in general decrease and increase, respectively. Accounting for Investments At December 31, 2002, we had $89... -

Page 62

..., we believe we have offset these higher costs by increasing the effective advertising rates of most of our broadcasting stations and outdoor display faces. Ratio of Earnings to Fixed Charges The ratio of earnings to fixed charges is as follows: Year Ended December 31, 2002 2001 2000 1999 1998 2.62... -

Page 63

... independent auditors have unrestricted access to the Board, without management present, to discuss the results of their audit and the quality of financial reporting and internal accounting controls. /s/ Lowry Mays Chairman/Chief Executive Officer /s/ Randall T. Mays Executive Vice President/Chief... -

Page 64

...SHAREHOLDERS AND BOARD OF DIRECTORS CLEAR CHANNEL COMMUNICATIONS, INC. We have audited the accompanying consolidated balance sheets of Clear Channel Communications, Inc. and subsidiaries (the Company) as of December 31, 2002 and 2001, and the related consolidated statements of operations, changes in... -

Page 65

... and improvements Structures and site leases Towers, transmitters and studio equipment Furniture and other equipment Construction in progress Less accumulated depreciation INTANGIBLE ASSETS Definite-lived intangibles, net Indefinite-lived intangibles - licenses Indefinite-lived intangibles - other... -

Page 66

... Stock, - Class B, par value $1.00 per share, authorized 8,000,000 shares, no shares issued and outstanding Common Stock, par value $.10 per share, authorized 1,500,000,000 shares, issued 613,402,780 and 598,270,433 shares in 2002 and 2001, respectively Additional paid-in capital Common stock... -

Page 67

... Depreciation and amortization Corporate expenses (excludes non-cash compensation expense of $1,036, $3,966 and $11,673 in 2002, 2001 and 2000, respectively) Operating income (loss) Interest expense Gain (loss) on sale of assets related to mergers Gain (loss) on marketable securities Equity in... -

Page 68

... STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (In thousands, except share data) Common Shares Issued Balances at December 31, 1999 Net income Common Stock, stock options and common stock warrants issued for business acquisitions Deferred compensation acquired Purchase of treasury shares Conversion... -

Page 69

...on sale of assets related to mergers (Gain) loss on forward exchange contract (Gain) loss on trading securities Equity in earnings of nonconsolidated affiliates Increase (decrease) other, net Changes in operating assets and liabilities, net of effects of acquisitions: Decrease (increase) in accounts... -

Page 70

... on credit facilities Proceeds from long-term debt Payments on long-term debt Proceeds from forward exchange contract Proceeds from exercise of stock options, stock purchase plan and common stock warrants Payments for purchase of treasury shares Net cash (used in) provided by financing activities... -

Page 71

... POLICIES Nature of Business Clear Channel Communications, Inc., incorporated in Texas in 1974, is a diversified media company with three principal business segments: radio broadcasting, outdoor advertising and live entertainment. The Company's radio broadcasting segment owns, programs and sells... -

Page 72

... typically four to fifteen years. The Company periodically reviews the appropriateness of the amortization periods related to its definite-lived assets. These assets are stated at cost. Indefinite-lived intangibles include broadcast FCC licenses and billboard permits. The excess cost over fair value... -

Page 73

... on foreign operations. Revenue Recognition Radio broadcasting revenue is recognized as advertisements or programs are broadcast and is generally billed monthly. Outdoor advertising provides services under the terms of contracts covering periods up to three years, which are generally billed monthly... -

Page 74

... in highly inflationary countries, are included in operations. Stock Based Compensation The Company accounts for its stock-based award plans in accordance with Accounting Principles Board ("APB") Opinion No. 25, Accounting for Stock Issued to Employees, and related interpretations, under which... -

Page 75

... measurement provisions are applicable on a prospective basis to guarantees issued or modified after December 31, 2002, irrespective of the guarantor's fiscal year-end. The Company adopted the disclosure requirements of this Interpretation for its 2002 annual report. Management does not believe... -

Page 76

... of an entity's accounting policy with respect to stock-based employee compensation on reported net income and earnings per share in annual and interim financial statements. Statement 148 does not amend Statement 123 to require companies to account for employee stock options using the fair value... -

Page 77

...'s billboard permits. However, the Company recognized impairment on its FCC licenses of approximately $6.0 billion, net of deferred tax of $3.7 billion, which was recorded as a component of the cumulative effect of a change in accounting principle during the first quarter of 2002. The Company used... -

Page 78

71 -

Page 79

... NOTE C - BUSINESS ACQUISITIONS 2002 Acquisitions: Ackerley Merger On June 14, 2002, the Company consummated its merger with The Ackerley Group, Inc. ("Ackerley"). Pursuant to the terms of the merger agreement, each share of Ackerley ordinary and Class B common stock was exchanged for 0.35 shares of... -

Page 80

... opportunities, as the Company has radio broadcasting operations, outdoor advertising operations or live entertainment venue presence in 15 of Ackerley's 18 television markets. The following table summarizes the estimated fair value of Ackerley's assets acquired and liabilities assumed at the date... -

Page 81

...operations. Other In addition to the acquisition discussed above, during 2002 the Company acquired substantially all of the assets of 27 radio stations, 9,275 outdoor display faces and certain music, racing events promotional and exhibition related assets. The aggregate cash and restricted cash paid... -

Page 82

... Company's common stock and each share of SFX Class B common stock was exchanged for one share of the Company's common stock. Approximately, 39.2 million shares of the Company's common stock were issued in the SFX merger. Based on the average market price of the Company's common stock at the signing... -

Page 83

... closed in July 2002. Also, in connection with the Company's mergers in 2000 with SFX and AMFM, the Company restructured the SFX and AMFM operations. The AMFM corporate offices in Dallas and Austin, Texas were closed on March 31, 2001 and a portion of the SFX corporate office in New York was closed... -

Page 84

... stations, a narrowcast radio broadcast service and a radio representation company in Australia. Hispanic Broadcasting Corporation The Company owns 26% of the total common stock of Hispanic Broadcasting Corporation ("HBC"), a leading domestic Spanish-language radio broadcaster. At December 31, 2002... -

Page 85

...nonconsolidated affiliates: (In thousands) ARN HBC ACIR Clear Media All Others Total At December 31, 2001 Acquisition of new investments Transfers from cost investments and other reclasses Additional investment, net Equity in net earnings (loss) Cumulative effect of a change in accounting principle... -

Page 86

... AMFM merger, Clear Channel and AMFM entered into a Consent Decree with the Department of Justice regarding AMFM's investment in Lamar Advertising Company, ("Lamar"). The Consent Decree, among other things, required the Company to sell all of its 26.2 million shares of Lamar by December 31, 2002 and... -

Page 87

... are supported by a limited subsidiary guaranty and a pledged intercompany note from AMFM Operating Inc., a wholly-owned subsidiary of the Company. The limited subsidiary guaranty guarantees and the pledged intercompany note secures a portion of the credit facility obligations. At December 31, 2002... -

Page 88

... of AMFM Operating Inc. long-term bonds was $1.3 billion at December 31, 2002, which includes a purchase accounting premium of $44.6 million. On January 15, 2002, the Company redeemed all of the outstanding 12.625% exchange debentures due 2006, originally issued by SFX Broadcasting. The debentures... -

Page 89

...any time at the option of the Company in whole or in part, at redemption prices equal to the issue price plus accrued original issue discount to the date of redemption. The LYONs can be purchased by the Company, at the option of the holder, on February 9, 2003; February 9, 2008; and February 9, 2013... -

Page 90

... on June 25, 2001, Clear Channel Investments, Inc., a wholly-owned subsidiary of the Company, entered into two ten-year secured forward exchange contracts that monetized 2.6 million shares and .3 million shares of the Company's investment in American Tower Corporation, ("AMT"), respectively. The... -

Page 91

... AND CONTINGENCIES The Company leases office space, certain broadcasting facilities, equipment and the majority of the land occupied by its outdoor advertising structures under long-term operating leases. Some of the lease agreements contain renewal options and annual rental escalation clauses... -

Page 92

... opinion of the Company's management, liabilities, if any, arising from these actions are either covered by insurance or accrued reserves, or would not have a material adverse effect on the financial condition of the Company. In various areas in which the Company operates, outdoor advertising is the... -

Page 93

... 31, 2002, these outstanding balances are recorded in "Long-term debt" on the Company's financial statements. Within the Company's bank credit facilities agreements is a provision that requires the Company to reimburse lenders for any increased costs that they may incur in an event of a change in... -

Page 94

... licenses or sells its FCC licenses. As the Company continues to amortize its tax basis in its FCC licenses, the deferred tax liability will increase over time. The reconciliation of income tax computed at the U.S. federal statutory tax rates to income tax expense (benefit) is: (In thousands) 2002... -

Page 95

87 -

Page 96

... to purchase its common stock to employees and directors of the Company and its affiliates under various stock option plans at no less than the fair market value of the underlying stock on the date of grant. These options are granted for a term not exceeding ten years and are forfeited in the event... -

Page 97

.... There were 47.5 million shares available for future grants under the various option plans at December 31, 2002. Vesting dates range from February 2003 to October 2007, and expiration dates range from February 2003 to October 2012 at exercise prices and average contractual lives as follows: 89 (2) -

Page 98

... under these plans without an increase in the market price of Clear Channel stock. Such an increase in stock price would benefit all stockholders commensurately. Other As a result of mergers during 2000, the Company assumed 2.7 million employee stock options with vesting dates that vary through... -

Page 99

... as a component of "non-cash compensation expense". Common Stock Reserved for Future Issuance Common stock is reserved for future issuances of, approximately 90.5 million shares for issuance upon the various stock option plans to purchase the Company's common stock (including 42.9 million options... -

Page 100

.... Under the plan, shares of the Company's common stock may be purchased at 85% of the market value on the day of purchase. Employees may purchase shares having a value not exceeding ten percent (10%) of their annual gross compensation or $25,000, whichever is lower. During 2002, 2001 and 2000... -

Page 101

...year ended December 31, 2002 2001 2000 The following details the components of "Other income (expense) - net": Reimbursement of capital cost Gain (loss) on disposal of fixed assets Gain on sale of operating assets Gain on sale...shares held prior to merger... expenses": Acquisition accruals Accrued... -

Page 102

... 26 venues are in 3 international markets. "Other" includes television broadcasting, sports representation and media representation. (In thousands) Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Eliminations Consolidated 2002 Revenue Divisional operating expenses Non-cash... -

Page 103

(In thousands) Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Eliminations Consolidated 2000 Revenue Divisional operating expenses Non-cash compensation Depreciation Amortization Corporate expenses Operating income (loss) Identifiable assets Capital expenditures $ 2,431,... -

Page 104

... 30, 2002 2001 2002 December 31, 2001 Revenue Operating expenses: Divisional operating expenses Non-cash compensation Depreciation and amortization Corporate expenses Operating income (loss) Interest expense Gain (loss) on sale of assets related to mergers Gain on marketable securities Equity... -

Page 105

...) Diluted: Income (loss) before cumulative effect of a change in accounting principle Cumulative effect of a change in accounting principle Net income (loss) Stock price: High Low $ (27.85) $ (.53) $....99 The Company's Common Stock is traded on the New York Stock Exchange under the symbol CCU. 96 -

Page 106

...January 15, 2013. Interest is payable on January 15 and July 15 on both series of notes. The aggregate net proceeds of approximately $791.2 million were used to repay borrowings outstanding under the Company's bank credit facilities and to finance the redemption of AMFM Operating, Inc.'s outstanding... -

Page 107

... Vice President/Finance Chairman/Chief Executive Officer - Clear Channel Entertainment President - Clear Channel Television Chief Executive Officer - Clear Channel Radio 1972 1989 1993 1989 1993 1997 1998 1999 2000 2001 2002 The officers named above serve until the next Board of Directors meeting... -

Page 108

... Vice President and General Counsel of Eller Media from March 1996 to March 1999. Mr. Parry was appointed Chief Executive Officer - Clear Channel International in June 1998. Prior thereto, he was the Chief Executive of More Group plc. for the remainder of the relevant five-year period. Ms. Hill was... -

Page 109

...and reported within the time periods specified in the SEC's rules and forms, and include controls and procedures designed to ensure that information we are required to disclose in such reports is accumulated and communicated to management, including our principal executive and financial officers, as... -

Page 110

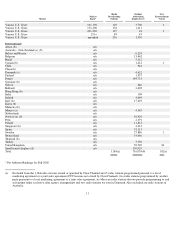

SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS Allowance for Doubtful Accounts (In thousands) Balance at Beginning of period Charges to Costs, Expenses and other Write-off of Accounts Receivable Balance at end of Period Description Other (1) Year ended December 31, 2000 Year ended December 31, ... -

Page 111

SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS Deferred Tax Asset Valuation Allowance (In thousands) Balance at Beginning of period Charges to Costs, Expenses and other Balance at end of Period Description Deletions (2) Other (1) Year ended December 31, 2000 Year ended December 31, 2001 Year ... -

Page 112

... to Clear Channel's Schedule 13-D/A, dated October 10, 2002). Waiver and Third Agreement Concerning Buy-Sell Agreement by and between Clear Channel Communications, Inc., L. Lowry Mays and B.J. McCombs, dated July 26, 2002 (incorporated by reference to the exhibits to Clear Channel's Schedule 13... -

Page 113

... to the exhibits of the Company's Annual Report on Form 10-K for the year ended December 31, 1999). Fifth Supplemental Indenture dated June 21, 2000, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York, as Trustee (incorporated by... -

Page 114

... Clear Channel Communications, Inc.2000 Employee Stock Purchase Plan. Voting Agreement dated as of October 8, 1998, by and among Jacor Communications, Inc. and L. Lowry Mays, Mark P. Mays and Randall T. Mays and certain related family trusts (incorporated by reference to the exhibits to the Company... -

Page 115

...dated August 30, 2000 (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2000). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst & Young LLP. Power... -

Page 116

... joinder of the others, to execute in the name of each such person who is then an officer or director of the Registrant and to file any amendments to this annual report on Form 10-K necessary or advisable to enable the Registrant to comply with the Securities Exchange Act of 1934, as amended, and... -

Page 117

Name Title Date /s/ Perry J. Lewis Perry J. Lewis /s/ B. J. McCombs B. J. McCombs /s/ Phyllis Riggins Phyllis Riggins /s/ Theodore H. Strauss Theodore H. Strauss /s/ J.C. Watts J. C. Watts /s/ John H. Williams John H. Williams Director Director Director Director Director Director March 10, 2003... -

Page 118

... certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions): a) all significant deficiencies in the design or operation of internal controls... -

Page 119

... certifying officers and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions): a) all significant deficiencies in the design or operation of internal controls... -

Page 120

...(Reg. No. 33-289161) dated April 19, 1984). Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 1997... -

Page 121

... to the exhibits of the Company's Annual Report on Form 10-K for the year ended December 31, 1999). Fifth Supplemental Indenture dated June 21, 2000, to Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York, as Trustee (incorporated by... -

Page 122

... Clear Channel Communications, Inc.2000 Employee Stock Purchase Plan. Voting Agreement dated as of October 8, 1998, by and among Jacor Communications, Inc. and L. Lowry Mays, Mark P. Mays and Randall T. Mays and certain related family trusts (incorporated by reference to the exhibits to the Company... -

Page 123

...dated August 30, 2000 (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2000). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst & Young LLP. Power... -

Page 124

EXHIBIT 4.17 CLEAR CHANNEL COMMUNICATIONS, INC. AND THE BANK OF NEW YORK, as Trustee ---------ELEVENTH SUPPLEMENTAL INDENTURE Dated as of January 9, 2003 TO SENIOR INDENTURE Dated as of October 1, 1997 ---------4 5/8% Senior Notes due January 15, 2008 5 3/4% Senior Notes due January 15, 2013 -

Page 125

..., dated as of the 9th day of January 2003 (this "Eleventh Supplemental Indenture"), between Clear Channel Communications, Inc., a corporation duly organized and existing under the laws of the State of Texas (hereinafter sometimes referred to as the "Company") and The Bank of New York, a New York... -

Page 126

... payable, the transfer of such 2008 Notes and 2013 Notes will be registrable and such 2008 Notes and 2013 Notes will be exchangeable for 2008 Notes and 2013 Notes bearing identical terms and provisions at the office or agency of the Company in the Borough of Manhattan, The City and State of New York... -

Page 127

...: "Principal Property" means any radio broadcasting, television broadcasting, outdoor advertising or live entertainment property located in the United States owned or leased by the Company or any Subsidiary, unless, in the opinion of the Board of Directors of the Company, such properties are not in... -

Page 128

..."Reference Treasury Dealer" means each of Credit Suisse First Boston, J.P. Morgan Securities Inc. and two other primary U.S. Government securities dealers in New York City (each, a "Primary Treasury Dealer") appointed by the Trustee in consultation with the Company; provided, however, that if any of... -

Page 129

...COMPANY; A NEW YORK CORPORATION ("DTC"), TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME... USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL SINCE THE REGISTERED OWNER ... -

Page 130

...and delivered by the Company and The Bank of New York, as Trustee (herein called the "Trustee"), be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on the next preceding January 15 or July 15, as the case may be (herein called... -

Page 131

...shall be paid to the same Person to whom the principal hereof is payable. Interest on the Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months. The Bank of New York will be the Paying Agent and the Security Registrar with respect to the Notes. The Company reserves... -

Page 132

... obtained. "Reference Treasury Dealer" means each of Credit Suisse First Boston, J.P. Morgan Securities Inc. and two other primary U.S. Government securities dealers in New York City (each, a "Primary Treasury Dealer") appointed by the Company in consultation with the Trustee; provided, however... -

Page 133

... and subject to the limitations provided in the Indenture. Upon due presentment for registration of transfer of this Note at the office or agency of the Company in the Borough of Manhattan, The City of New York designated for such purpose or at any of the Company's other offices or agencies as the... -

Page 134

..., all terms used in this Note which are defined in the Indenture shall have the meanings assigned to them in the Indenture. This Note shall be construed in accordance with and governed by the laws of the State of New York. Unless the certificate of authentication hereon has been manually executed by... -

Page 135

... to be duly executed. CLEAR CHANNEL COMMUNICATIONS, INC. by Name: Title: [Company Seal] by Name: Title: TRUSTEE'S CERTIFICATE OF AUTHENTICATION This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture. THE BANK OF NEW YORK, as Trustee, Dated by... -

Page 136

... Act State) Additional abbreviations may also be used though not in the above list FOR VALUE RECEIVED, the undersigned hereby sell(s), assign(s), and transfer(s) unto PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE: : PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS INCLUDING... -

Page 137

..., which requirements include membership or participation in the Security Transfer Agent Medallion Program ("STAMP") or such other "signature guarantee program" as may be determined by the Registrar in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of... -

Page 138

... BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY; A NEW YORK CORPORATION ("DTC"), TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED... -

Page 139

...and delivered by the Company and The Bank of New York, as Trustee (herein called the "Trustee"), be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on the next preceding January 15 or July 15, as the case may be (herein called... -

Page 140

... will at all times be a Paying Agent in The City of New York and there will be no more than one Security Registrar for the Notes. This Note is one of the duly authorized issue of debentures, notes, bonds or other evidences of indebtedness (hereinafter called the "Securities") of the Company, of the... -

Page 141

... obtained. "Reference Treasury Dealer" means each of Credit Suisse First Boston, J.P. Morgan Securities Inc. and two other primary U.S. Government securities dealers in New York City (each, a "Primary Treasury Dealer") appointed by the Company in consultation with the Trustee; provided, however... -

Page 142

... and subject to the limitations provided in the Indenture. Upon due presentment for registration of transfer of this Note at the office or agency of the Company in the Borough of Manhattan, The City of New York designated for such purpose or at any of the Company's other offices or agencies as the... -

Page 143

... shall be construed in accordance with and governed by the laws of the State of New York. Unless the certificate of authentication hereon has been manually executed by or on behalf of the Trustee under the Indenture, this Note shall not be entitled to any benefits under the Indenture, or be valid or... -

Page 144

... to be duly executed. CLEAR CHANNEL COMMUNICATIONS, INC. by Name: Title: [Company Seal] by Name: Title: TRUSTEE'S CERTIFICATE OF AUTHENTICATION This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture. THE BANK OF NEW YORK, as Trustee, Dated by... -

Page 145

... Minors Act State) Additional abbreviations may also be used though not in the above list FOR VALUE RECEIVED, the undersigned hereby sell(s), assign(s), and transfer(s) unto PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE: PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS INCLUDING... -

Page 146

..., which requirements include membership or participation in the Security Transfer Agent Medallion Program ("STAMP") or such other "signature guarantee program" as may be determined by the Registrar in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of... -

Page 147

... to or upon a Company Order. ARTICLE V Miscellaneous Provisions SECTION 5.01. Except as otherwise expressly provided in this Eleventh Supplemental Indenture or in the form of 2008 Notes and 2013 Notes or otherwise clearly required by the context hereof or thereof, all terms used herein or in said... -

Page 148

IN WITNESS WHEREOF, the parties hereto have caused this Eleventh Supplemental Indenture to be duly executed as of the day and year first above written. CLEAR CHANNEL COMMUNICATIONS, INC., by Name: Title: THE BANK OF NEW YORK, as Trustee by Name: Title: -

Page 149

.... 2000 Employee Stock Purchase Plan (the "Plan") is to provide employees of Clear Channel Communications, Inc. (the "Company") and its Designated Subsidiaries with an opportunity to acquire an interest in the Company through the purchase of Common Stock of the Company, $.10 par value per share (the... -

Page 150

... the New York Stock Exchange or such other exchange or national quotation system that the Common Stock is then trading. j. "Offering Date" shall mean the first day of each month during each Plan Year; provided, that, the Committee shall have the power to change the Offering Date. k. "Offering Period... -

Page 151

...) effective as of the start of the next Offering Period, provided the Employee submits or electronically files the Authorization Form through the VRS or other means maintained by the Designated Broker requesting such change by the date required by the Company or otherwise properly contacts the... -

Page 152

... to purchase Common Stock on the Exercise Date to which such amounts relate and no future contributions will be made to the Plan. A Participant's status as an Employee shall not be considered terminated in the case of a leave of absence agreed to in writing by the Company (including, but not limited... -

Page 153

... under the Plan may be used by the Company for any corporate purpose, and the Company shall not be obligated to segregate such payroll deductions. 15. Effect of Certain Changes. In the event of any increase, reduction, or change or exchange of shares of Common Stock for a different number or kind... -

Page 154

... Offering Periods, limit the frequency and/or number of changes in the amount withheld during an Offering Period, establish the exchange ratio applicable to amounts withheld in a currency other than U.S. dollars, permit payroll withholding in excess of the amount designated by a Participant in order... -

Page 155

... "Entertainment Businesses"). The Executive's office will be based in Houston, Texas. The Executive will perform job duties that are usual and customary for this position, and will perform additional services and duties that the Board of Directors of the Company (the "Board") or the Chief Operating... -

Page 156

..., but in no event later than 60 days following the end of such period. (d) STOCK OPTIONS. The Executive has been granted and/or will be granted certain non-qualified options to purchase shares of common stock on the terms and conditions set forth in the applicable stock option plan under which they... -

Page 157

...New York City which is reasonably equivalent to the apartment now provided by the Company. (k) CHANGE IN CONTROL. Within ninety (90) days of a Change in Control, the Company shall pay to the Executive a bonus in a lump sum equal to two times the Executive's then current annual base salary. A "Change... -

Page 158

... or proprietary nature, including but not limited to the Company's customer lists, formatting and programming concepts and plans, pricing information, production and cost data, compensation and fee information, strategic business plans, budgets, financial statements, and other information... -

Page 159

... promoting, producing, and presenting live diversified entertainment events of a character presented by the Entertainment Businesses during the Executive's employment by the Company in any location in which the Company, or any subsidiary or affiliate of the Company, operates or has specific plans... -

Page 160

... the Company, or any subsidiary or affiliate of the Company; or (iii) solicit or encourage any such employee to accept employment with any business, operation, corporation, partnership, association, agency, or other person or entity with which the Executive may be associated. If, during the term of... -

Page 161

...or disability) where such non-performance has continued for more than 30 days following written notice of such non-performance from the Board; (iii) the Executive's refusal or failure to follow lawful directives of the Chief Operating Officer of the Company or the Board where such refusal or failure... -

Page 162

... with the Company for Good Reason, the Company will, within 30 days, pay in a lump sum amount to the Executive (i) his accrued and unpaid base salary, any payments to which he may be entitled under any applicable employee benefit plan (according to the terms of such plans and policies) and (ii... -

Page 163

...at such determinations, shall be made by a nationally recognized public accounting firm that is selected by the Executive (the "Accounting Firm") which shall provide detailed supporting calculations both to the Company and the Executive within fifteen (15) business days of the receipt of notice from... -

Page 164

...Board or the Company, the notice will be sent to Mark P. Mays, Chief Operating Officer of Clear Channel Communications, Inc., 200 E. Basse Road, San Antonio, Texas 78209, and a copy of the notice will be sent to Ken Wyker, General Counsel of Clear Channel Communications, Inc., 200 E. Basse Road, San... -

Page 165

... jurisdiction of the state and federal courts located in Bexar County, San Antonio, Texas for any lawsuit arising from or relating to this Agreement. 12. LEGAL FEES AND EXPENSES. In event of a dispute between the Company and the Executive under this Agreement, the prevailing party in any legal... -

Page 166

..., than the benefits provided to the other senior executives of the Company by the Directors and Officers Insurance maintained by the Company on the date hereof; provided, however, that the Board may elect to terminate Directors and Officers Insurance for all officers and directors, including the... -

Page 167

... to it. IN WITNESS WHEREOF, the parties have duly executed and delivered this Agreement as of the date first written above. CLEAR CHANNEL COMMUNICATIONS, INC. By: /s/ MARK P. MAYS Mark P. Mays, Chief Operating Officer of Clear Channel Communications, Inc. /s/ BRIAN E. BECKER Brian E. Becker 13 -

Page 168

EXHIBIT A SUMMARY OF PROPOSED ANNUAL BONUS TERMS Percentage EBITDA Increase: Less than 15.0 ....00 $530,000.00 $610,000.00 $700,000.00 $800,000.00 plus ($100,000.00 multiplied times the total of each full 1.0% EBITDA increase over 30.0%). Example: If the percentage EBITDA increase... -

Page 169

... Options to purchase 202,500 shares of the Company's common stock with an exercise price of $27.20 per share were granted to the Executive; such options will continue to be governed under the terms of the applicable stock option plan under which they were issued, except if the Executive's employment... -

Page 170

... upon performance of the Executive, which will be assessed in the sole discretion of the Chief Operating Officer of the Company and/or the Compensation Committee of the Board of Directors. Notwithstanding the foregoing, all such stock options will immediately vest upon the occurrence of a Change in... -

Page 171

... in 1999 LYONS - 1996 issue LYONS - 1998 issue Less: Anti-dilutive items Numerator for net income (loss) before cumulative effect of a change in accounting principle per common share diluted Numerator for cumulative effect of a change in accounting principle per common share - diluted Numerator for... -

Page 172

...(In thousands, except ratio) Year Ended 2002 2001 2000 1999 1998 C> Income (loss) before income taxes, equity in earnings of non-consolidated affiliates, extraordinary item and cumulative effect of a change in accounting principle Dividends and other received... -

Page 173

...> Name Clear Channel Communications, Inc. Clear Channel Broadcasting, Inc. Clear Channel Broadcasting Licenses, Inc. Clear Channel Holdings, Inc. Eller Media Corporation Clear Channel Outdoor, Inc.(1) Universal Outdoor Holdings, Inc. Clear Channel International, Ltd. Jacor Communications Company... -

Page 174

... Inc. and related prospectus of our reports dated February 10, 2003 with respect to the consolidated financial statements and schedule of Clear Channel Communications, Inc. included in this Annual Report (Form 10-K) for the year ended December 31, 2002. /s/ Ernst & Young LLP San Antonio, Texas March... -

Page 175

... statements of Clear Channel Communications, Inc. and subsidiaries, as of December 31, 2002 and 2001, and for each of the three years in the period ended December 31, 2002, and have issued our report thereon dated February 10, 2003. Our audits also included the financial statement schedule listed in... -

Page 176

...the annual report on Form 10-K (the "Form 10-K") for the fiscal year ended December 31, 2002 of Clear Channel Communications, Inc. (the "Issuer"). The undersigned hereby certifies that the Form 10-K fully complies with the requirements of section 13(a) or section 15(d) of the Securities Exchange Act... -

Page 177

...the annual report on Form 10-K (the "Form 10-K") for the fiscal year ended December 31, 2002 of Clear Channel Communications, Inc. (the "Issuer"). The undersigned hereby certifies that the Form 10-K fully complies with the requirements of section 13(a) or section 15(d) of the Securities Exchange Act...