Wendy's 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Wendy's annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

Table of contents

-

Page 1

-

Page 2

-

Page 3

-

Page 4

-

Page 5

-

Page 6

-

Page 7

...FOR THE FISCAL YEAR ENDED DECEMBER 28, 2008

â...ª

OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO . COMMISSION FILE NUMBER 1-2207

WENDY'S/ARBY'S GROUP, INC. (Exact Name of Registrant as Specified in its Charter)

(State or...

-

Page 8

(This Page Intentionally Left Blank)

-

Page 9

... merger with Wendy's International, Inc. ("Wendy's"), the corporate name of Triarc Companies, Inc. ("Triarc") changed to Wendy's/Arby's Group, Inc. ("Wendy's/Arby's" or, together with its subsidiaries, the "Company" or "we"). This Annual Report on Form 10-K and oral statements made from time to time...

-

Page 10

... the merger with Wendy's, our corporate name was changed from Triarc Companies, Inc. ("Triarc") to Wendy's/Arby's Group, Inc. Our principal executive offices are located at 1155 Perimeter Center West, Atlanta, Georgia 30338, and our telephone number is (678) 514-4100. We make our annual reports on...

-

Page 11

... may result in acquisition opportunities being made available to us from time to time. See Note 27 to the Consolidated Financial Statements for additional information on our agreements with the Management Company. Fiscal Year We use a 52/53 week fiscal year convention whereby our fiscal year ends...

-

Page 12

... items to franchisees (3) franchise royalties received from all Wendy's franchised restaurants; and (4) up-front franchise fees from restaurant operators for each new unit opened Wendy's Restaurants During 2008, Wendy's opened 15 new restaurants and closed 16 generally underperforming restaurants...

-

Page 13

..., price and value perception of food products offered. The number and location of units, quality and speed of service, attractiveness of facilities, effectiveness of marketing and new product development by Wendy's and its competitors are also important factors. The price charged for each menu item...

-

Page 14

... to use the Wendy's system in connection with the operation of the restaurant at that site. The Single Unit Sub-Franchise Agreement provides for a 20-year term and a 10-year renewal subject to certain conditions. The sub-franchisee pays to WROC a monthly royalty of 4% of gross sales, as defined in...

-

Page 15

... the operation of a Wendy's restaurant at a specified location. Upon execution of the International Agreements, the franchisee is required to pay a technical assistance fee. The current technical assistance fee is US$30,000 for each restaurant. Currently, the franchisee is required to pay a monthly...

-

Page 16

..., at least one assistant manager and as many as 30 full and part-time employees. Staffing levels, which vary during the day, tend to be heaviest during the lunch hours. During 2008, ARG opened 40 new Arby's restaurants and closed 15 generally underperforming Arby's restaurants. In addition, ARG...

-

Page 17

... the restaurant industry. A number of major grocery chains offer fresh deli sandwiches and fully prepared food and meals to go as part of their deli sections. Some of these chains also have in-store cafes with service counters and tables where consumers can order and consume a full menu of items...

-

Page 18

... financial statements and documents relating to the corporate or other business organization of the applicant. Franchisees that already operate one or more Arby's restaurants must satisfy certain criteria in order to be eligible to enter into additional franchise agreements, including capital...

-

Page 19

... sales for the first 36 months the unit is open. After 36 months, the monthly royalty rate reverts to the prevailing 4% rate for the remaining term of the agreement. The commitment fee is $5,000 per restaurant, which is credited against the franchise fee during the development process. In 2008...

-

Page 20

... months. General Governmental Regulations Various state laws and the Federal Trade Commission regulate Wendy's and Arby's franchising activities. The Federal Trade Commission requires that franchisors make extensive disclosure to prospective franchisees before the execution of a franchise agreement...

-

Page 21

... or results of operations. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" below. In 2001, a vacant property owned by Adams Packing Association, Inc. ("Adams"), an inactive subsidiary of the Company, was listed by the United States Environmental...

-

Page 22

..., financial condition, cash requirements and such other factors as the board of directors may deem relevant from time to time. Because we are a holding company, our ability to declare and pay dividends is dependent upon cash, cash equivalents and short-term investments on hand and cash flows from...

-

Page 23

...new operations and products. In addition, acquisitions may require significant management time and capital resources. We cannot assure you that we will have access to the capital required to finance potential acquisitions on satisfactory terms, that any acquisition would result in long-term benefits...

-

Page 24

...Related to the Wendy's and Arby's Businesses Growth of our restaurant businesses is significantly dependent on new restaurant openings, which may be affected by factors beyond our control. Our restaurant businesses derive earnings from sales at company-owned restaurants, franchise royalties received...

-

Page 25

... service, food safety and cleanliness would have a negative impact on our business. Our financial results are affected by the operating results of franchisees. As of December 28, 2008, approximately 79% of the Wendy's system and 69% of the Arby's system were franchise restaurants. We receive revenue...

-

Page 26

... food-away-from-home spending could hurt our revenues, results of operations, business and financial condition. In addition, if company-owned and franchised restaurants are unable to adapt to changes in consumer preferences and trends, company-owned and franchised restaurants may lose customers...

-

Page 27

... have introduced lower cost, value meal menu options. Our revenues and those of our franchisees may be hurt by this product and price competition. Moreover, new companies, including operators outside the quick service restaurant industry, may enter our market areas and target our customer base. For...

-

Page 28

...of operating our company-owned restaurants. Each brand devotes significant resources to recruiting and training its managers and hourly employees. Increased labor costs due to competition, increased minimum wage or employee benefits costs or other factors would adversely impact our cost of sales and...

-

Page 29

...future regulations that may become applicable to our businesses. Our operations are influenced by adverse weather conditions. Weather, which is unpredictable, can impact Wendy's and Arby's restaurant sales. Harsh weather conditions that keep customers from dining out result in lost opportunities for...

-

Page 30

... be time-consuming, result in costly litigation, cause delays in introducing new menu items or investment products or require us to enter into royalty or licensing agreements. As a result, any such claim could harm our business and cause a decline in our results of operations and financial condition...

-

Page 31

... breach of our computer systems or information technology may result in adverse publicity, loss of sales and profits, penalties or loss resulting from misappropriation of information. We may be required to recognize additional asset impairment and other asset-related charges. We have significant...

-

Page 32

... to pay the notes receivable and related interest are the current dislocation in the sub-prime mortgage sector and the current weakness in the broader credit market. These factors could result in increases in its borrowing costs and reductions in its liquidity and in the value of its investments...

-

Page 33

... leases are generally written for terms of 10 to 25 years with one or more five-year renewal options. In certain lease agreements Wendy's has the option to purchase the real estate. Certain leases require the payment of additional rent equal to a percentage, generally less than 6%, of annual sales...

-

Page 34

... location of company-owned and franchised restaurants as of December 28, 2008 is set forth below.

Wendy's Company Franchise Arby's Company Franchise

State

Alabama... ...Missouri ...Montana ...Nebraska ...Nevada ...New Hampshire ...New Jersey ...New Mexico...New York ...North Carolina ...North Dakota ...

-

Page 35

... alleged breach of fiduciary duties arising out of the Wendy's board of directors' search for a merger partner and out of its approval of the merger agreement on April 23, 2008, and failure to disclose material information related to the merger in Amendment No. 3 to the Form S-4 under the Securities...

-

Page 36

... Wendy's, its directors, and Triarc Companies, Inc. in the Supreme Court of the State of New York, New York County. An amended complaint was filed on June 20, 2008. The amended complaint alleges breach of fiduciary duties arising out of the Wendy's board of directors' search for a merger partner...

-

Page 37

... results of operations. Item 4. Submission of Matters to a Vote of Security Holders. On September 15, 2008, the Company held its Annual Meeting of Stockholders. The matters acted upon by the stockholders at that meeting were reported in our Quarterly Report on Form 10-Q for the fiscal quarter ended...

-

Page 38

... Stock would thereafter participate equally on a per share basis with our Class A Common Stock in any remaining assets of the Company. During our 2008 and 2007 fiscal years, we paid regular quarterly cash dividends of $0.08 and $0.09 per share on our Class A Common Stock and Class B Common Stock...

-

Page 39

... cash requirements, including debt service. See Note 10 of the Financial Statements and Supplementary Data included in Item 8 herein, and "Management's Discussion and Analysis-Results of Operations and Liquidity and Capital Resources" in Item 7 herein, for further information on the Credit Agreement...

-

Page 40

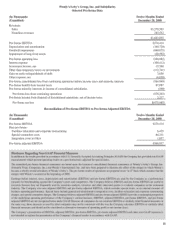

Item 6. Selected Financial Data.

December 28, 2008 Year Ended (1) December 30, December 31, January 1, 2007(2) 2006(2) 2006(2) (In millions, except per share amounts) January 2, 2005(2)

Sales ...Franchise revenues ...Asset management and related fees ...Revenues ...Operating (loss) profit ...(Loss)...

-

Page 41

... on the financial statements for all periods presented prior to the adoption date. (3) Income (loss) per share amounts for 2008 reflects the conversion of Triarc Companies, Inc. ("Triarc" and the former name of Wendy's/Arby's Group, Inc.) Class B Common Stock into Wendy's/Arby's Class A Common...

-

Page 42

... the Arby's Company-owned restaurant reporting unit; $484.0 charged to income from continuing operations and net income representing the aforementioned $460.1 charged to operating profit and other than temporary losses on investments of $112.7 partially offset by $88.8 of income tax benefit related...

-

Page 43

... from properties leased to franchisees, and (5) $3.4 million from franchise and related fees. Our revenues increased significantly in the 2008 fourth quarter due to the Wendy's Merger. The Wendy's royalty rate was 4.0% for the quarter ended December 28, 2008. While over 78% of our existing Arby...

-

Page 44

... the value of our Company by: • improving the quality and affordability of our core menu items; • increasing traffic in the restaurants and revitalizing the Wendy's and Arby's brands with new marketing programs, menu development and an improved customer experience; • improving company-owned...

-

Page 45

...that the Wendy's Merger will better position the Company to deliver long-term value to our stockholders through enhanced operational efficiencies, improved product offerings, and shared services. Wendy's operates, develops and franchises a system of distinctive quick service restaurants specializing...

-

Page 46

...continuing weakness in the broader financial market has adversely impacted, and may continue to adversely impact, DFR's cash flows. DFR reported operating losses for the first nine months of 2008. Updated financial information from DFR for the year ended December 31, 2008 will not be available until...

-

Page 47

..., of a limited number of publicly-traded companies. In addition, the Equities Account sells securities short and invests in market put options in order to lessen the impact of significant market downturns. Investment income (loss) from this account includes realized investment gains (losses) from...

-

Page 48

... of Financial Information Our fiscal reporting periods consist of 52 weeks ending on the Sunday closest to December 31 and are referred to herein as (1) "the year ended December 28, 2008" or "2008" which commenced on December 31, 2007 and ended on December 28, 2008 (and includes Wendy's for...

-

Page 49

... percentage changes between these years are considered not measurable or not meaningful ("n/m").

2008 2008 Change 2007 Amount Percent (In Millions)

Revenues: Sales ...Franchise revenues ...Asset management and related fees ...Costs and expenses: Cost of sales ...Cost of services ...General and...

-

Page 50

...:

Fourth Quarter 2008

Wendy's ...Arby's ...

11.7%

Full Year 2008 2007

16.1%

19.7%

Franchised Systemwide

Restaurant count: Wendy's restaurant count (a): Restaurant count at September 29, 2008 ...Opened since September 29, 2008 ...Closed since September 29, 2008 ...Net purchased from (sold by...

-

Page 51

... initiatives in the 2008 first and third quarters had a greater positive effect on franchised restaurants than Company-owned restaurants due to the increased exposure in many markets in which our franchisees operate. Asset Management and Related Fees As a result of the Deerfield Sale on December 21...

-

Page 52

...fourth quarter of 2008, we performed our annual goodwill impairment test. As a result of the acceleration of the general economic and market downturn as well as continued decreases in Arby's same store sales, we concluded that the carrying amount of the Arby's Company-owned restaurant reporting unit...

-

Page 53

... Arby's Term Loan outstanding principal balance as a result of the $143.2 million voluntary net prepayment in 2008 to assure compliance with certain covenants in the Arby's Credit Agreement. This decrease was partially offset by (1) a $3.7 million increase related to the change in our interest rate...

-

Page 54

...Corporate Restructuring, (2) interest income recognized in 2007 at our former asset management segment and (3) a decrease in interest rates. Other Than Temporary Losses on Investments

2008 2007 Change (In Millions)

DFR common stock...DFR Notes...Available-for-sale securities, including CDOs ...Cost...

-

Page 55

Benefit from Income Taxes Our effective tax rates for 2008 and 2007 were 17% and 89%, respectively. Our effective rates are impacted by recurring items, such as non-deductible expenses relative to pre-tax income (loss), state income taxes, adjustments related to prior year tax matters and the ...

-

Page 56

...In Millions)

Revenues: Sales...Franchise revenues ...Asset management and related fees ...Costs and expenses: Cost of sales ...Cost of services ...General and administrative ...Depreciation and amortization ...Impairment of other long-lived assets...Facilities relocation and corporate restructuring...

-

Page 57

... same-store sales. Same store sales of our Arby's Company-owned restaurants decreased principally due to lower sales volume from a decline in customer traffic as a result of (1) increased price discounting by other larger QSRs and (2) price discounting associated with the introduction of a new value...

-

Page 58

... declines in market value and increased carrying costs related to homes we purchased for resale from relocated employees. Depreciation and Amortization

2007 2006 Change (In Millions)

Arby's restaurants, primarily properties ...Asset management...General corporate, primarily properties ...

$56...

-

Page 59

... million of general corporate expense principally representing a fee related to our decision in 2006 to terminate the lease of an office facility in Rye Brook, New York rather than continue our efforts to sublease the facility. Gain on Sale of Consolidated Business The gain on sale of consolidated...

-

Page 60

...of fees related to the conversions and (2) a $1.0 million write-off of previously unamortized deferred financing costs in connection with principal repayments of the Arby's Term Loan from excess cash. Investment Income, Net

2007 2006 Change (In Millions)

Net gains (a): Available-for-sale securities...

-

Page 61

... 2006. This increase is a result of the after-tax and applicable minority interest effects of the variances discussed above, including the facilities relocation and corporate restructuring charge as offset by the gain on sale of consolidated business recorded in 2008. Liquidity and Capital Resources...

-

Page 62

...: • The Wendy's Merger, which increased our total capitalization by $2,991.8 million, consisting of additional stockholder's equity of $2,494.7 million and long-term debt of $497.1 million, including current portion; • Cash dividends paid of $30.5 million and the non-cash stock dividend of the...

-

Page 63

... an annual basis, from excess cash flow of the Arby's restaurant business as determined under the Arby's Credit Agreement (the "Excess Cash Flow Payment"). The Excess Cash Flow Payment for fiscal 2007 of $10.4 million was paid in the second quarter of 2008. There will be no Excess Cash Flow Payment...

-

Page 64

...with the Wendy's Merger based on an outstanding principal of $97.1 million and an effective interest rate of 8.6%. (6) During 2008 we entered into a new $20.0 million financing facility for one of our existing Company aircraft (the "Bank Term Loan"). The facility requires monthly payments, including...

-

Page 65

...Ratings The Company's corporate family and its senior debt are rated by Standard & Poor's ("S&P") and Moody's Investors Service ("Moody's). On March 2, 2009, S&P lowered its rating on the prior Arby's Credit Agreement to B and its corporate family rating on Arby's to B-. At the same time, S&P placed...

-

Page 66

... under our outstanding contractual obligations at December 28, 2008:

2009 2010-2011 Fiscal Years 2012-2013 After 2013 (in millions) Total

Long-term debt (a) ...Sale-leaseback obligations (b) ...Capitalized lease obligations (b) ...Operating leases (c) ...Purchase obligations (d) ...Severance...

-

Page 67

... of other purchase obligations. (e) Represents severance for Wendy's and Wendy's/Arby's personnel in connection with the Wendy's Merger and New York headquarters' employees. (f) Excludes Financial Accounting Standards Board ("FASB") Interpretation No. 48, "Accounting for Uncertainty in Income Taxes...

-

Page 68

... short taxable year in 2008 ending on the date of the Wendy's Merger. Also as a result of the Wendy's Merger, there was an ownership change at Wendy's/Arby's as defined in Section 382 of the Code which places a limit, as defined in the Code, on the amount of a Company's net operating losses that can...

-

Page 69

... impact on our consolidated financial position or results of operations. Universal Shelf Registration Statement In December 2008, the Company filed a universal shelf registration statement with the Securities and Exchange Commission in connection with the possible future offer and sale, from time...

-

Page 70

... Wendy's, its directors, and Triarc Companies, Inc. in the Supreme Court of the State of New York, New York County. An amended complaint was filed on June 20, 2008. The amended complaint alleges breach of fiduciary duties arising out of the Wendy's board of directors' search for a merger partner...

-

Page 71

... and third quarters of 2008, we performed interim goodwill impairment tests at our Arby's company-owned restaurant and franchise operations reporting units due to the general economic downturn, a decrease in market valuations, and decreases in Arby's same store sales. The results of these interim...

-

Page 72

...million tax benefit related to the portion of tax deductible goodwill) representing all of the goodwill recorded for the Arby's Company-owned restaurant reporting unit. We also concluded at that time that there was no impairment of goodwill for the Arby's franchise reporting unit or any of the Wendy...

-

Page 73

... receivable. We have received all four cash quarterly interest payments on the DFR Notes to date on a timely basis as well as dividends on the cumulative preferred stock which was previously held. Due to significant financial weakness in the credit markets, current publicly available information...

-

Page 74

...Federal and state income tax returns by the Internal Revenue Service or state taxing authorities, including remaining provisions included in "Current liabilities relating to discontinued operations" in our Consolidated Balance Sheets: Effective January 1, 2007, we adopted FIN 48. As a result, we now...

-

Page 75

... regarding each new lease agreement, lease renewal, and lease amendment, including, but not limited to property values, property lives, discount rates, and probable term, all of which can impact (i) the classification and accounting for a lease as capital or operating, (ii) the rent holiday and...

-

Page 76

...focus on value menu offerings and a reduction in the number of stores serving breakfast while refining this daypart strategy. We presently plan to open approximately 5 new Arby's Company-owned and 10 new Wendy's Company-owned restaurants during 2009 and close 11 Arby's Company-owned and 8 Wendy's 68

-

Page 77

...'s Merger. Franchise revenues will also be favorably impacted by net new restaurant openings by both Arby's and Wendy's franchisee locations. Despite an overall increase in franchise revenues, the same-store sales trends for franchised restaurants at Arby's and Wendy's will continue to be generally...

-

Page 78

... interest rates decrease. The fair market value of our investments in fixed-rate debt securities will decline if interest rates increase. See below for a discussion of how we manage this risk. Commodity Price Risk In our restaurants segments, we purchase certain food products, such as beef, poultry...

-

Page 79

...to adversely impact, DFR's cash flows. Due to the significant continuing weakness in the credit markets and at DFR based upon current publicly available information, and our ongoing assessment of the likelihood of full repayment of the principal amount of the DFR Notes, Company management determined...

-

Page 80

...began to pay management and incentive fees to the Management Company in an amount customary for other unaffiliated third party investors with similarly sized investments. The Equities Account is invested principally in debt and equity securities of a limited number of publicly-traded companies, cash...

-

Page 81

... following general types or categories (in millions):

Type At Cost At Fair Value (a)(b) Carrying Value Amount Percent

Cash equivalents ...Investment related receivables ...Current and non-current restricted cash equivalents ...Current and non-current investments accounted for as available-for-sale...

-

Page 82

...in the Equities Account by the Management Company, detailed above. (c) In addition to the Equities Account information included in footnote (b), non-current investments accounted for as available-for-sale securities includes $70.4 million of the carrying and fair value of DFR preferred stock, net of...

-

Page 83

...

Foreign Currency Risk

Year-End 2007 Carrying Value Interest Rate Risk Equity Price Risk

Cash equivalents...Investment related receivables...Restricted cash equivalents-non-current...Available-for-sale securities: Equities Account-restricted ...DFR preferred stock...Other ...Investment in Jurlique...

-

Page 84

...long-term debt, excluding capitalized lease and sale-leaseback obligations, primarily relates to the potential impact a decrease in interest rates of one percentage point has on the fair value of our $495.9 million of fixed-rate debt and not on our financial position or our results of operations. On...

-

Page 85

... TO CONSOLIDATED FINANCIAL STATEMENTS

Page

Glossary of Defined Terms ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of December 28, 2008 and December 30, 2007...Consolidated Statements of Operations for the years ended December 28, 2008, December 30...

-

Page 86

......Arby's...Arby's Credit Agreement...Arby's Restaurant ...Arby's Restaurant Discontinued Operations . . ARG...As Adjusted ...Asset Management ...Bakery ...Bank Term Loan ...Beverage Discontinued Operations ...Black-Scholes Model ...CAP ...Capitalized Lease Obligations...Carrying Value Difference...

-

Page 87

... Business Acquisitions and Dispositions Income (Loss) Per Share Long-Term Debt Facilities Relocation and Corporate Restructuring Retirement Benefit Plans Long-Term Debt Summary of Significant Accounting Policies Summary of Significant Accounting Policies Summary of Significant Accounting Policies...

-

Page 88

......Incentive Fee Shares ...Investments...Iron Curtain ...IRS ...Jurl ...K12 ...Lease Guarantees ...LIBOR ...LLC...Management Company...Management Company Employees ...Market Value Approach...National Propane...Net Exercise Features ...Notes Payable...Opportunities Fund ...Other Than Temporary Losses...

-

Page 89

... Rent ...Sublease ...Swap Agreements ...Sybra ...Syrup ...TDH ...THI ...TimWen ...Triarc ...We ...Wendy's...Wendy's/Arby's ...Wendy's Crew ...Wendy's Merger ...Wendy's Revolver ...

Summary of Significant Accounting Policies Summary of Significant Accounting Policies Summary of Significant Accounting...

-

Page 90

... balance sheets of Wendy's/Arby's Group, Inc. (formerly Triarc Companies, Inc.) and subsidiaries (the "Company") as of December 28, 2008 and December 30, 2007, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the three years in the period ended...

-

Page 91

... financial statements. (a) In connection with the September 29, 2008 merger with Wendy's International, Inc. (Wendy's), Wendy's/ Arby's Group, Inc. stockholders approved a charter amendment to convert each of the then outstanding shares of Triarc Companies, Inc. Class B common stock into one share...

-

Page 92

...Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands Except Per Share Amounts)

December 28, 2008

Year Ended December 30, 2007

December 31, 2006

Revenues: Sales ...Franchise revenues ...Asset management and related fees...Costs...

-

Page 93

...Wendy's International Inc. merger-related transactions: Conversion of Class B common stock to Class A common stock ...6,410 (6,410) - - - - Value of Wendy's stock options converted into Wendy's/Arby's Group, Inc. options ...- - 18,495 - - - Common stock issuance related to merger of Triarc Companies...

-

Page 94

...Retained Pension Translation Flow for-Sale (Deficit) Held in Common Common Paid-in Loss Hedges Adjustment Earnings Treasury Securities Capital Stock Stock

Total

Balance at December 31, 2006 ...$2,955 Cumulative effect of change in accounting for uncertainty in income taxes ...- Balance as adjusted...

-

Page 95

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY-CONTINUED

(In Thousands)

Unrealized Compensation/ Note Receivable Common from NonStock Executive Held in Officer Treasury Accumulated Other Comprehensive Income (Loss) ...

-

Page 96

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

December 28, 2008

Year Ended December 30, 2007

December 31, 2006

Cash flows from continuing operating activities: Net (loss) income ...Adjustments to reconcile net ...

-

Page 97

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

CONSOLIDATED STATEMENTS OF CASH FLOWS-CONTINUED

(In Thousands)

December 28, 2008

Year Ended December 30, 2007

December 31, 2006

Detail of cash flows related to investments (a): Operating investment adjustments, net: ...

-

Page 98

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

CONSOLIDATED STATEMENTS OF CASH FLOWS-CONTINUED

(In Thousands)

subsequent to September 29, 2006. Under accounting principles generally accepted in the United States of America, the net sales (purchases) of trading ...

-

Page 99

... for accrued interest. On December 14, 2006 the Company amended all outstanding stock options under its equity plans to permit optionees to pay both the exercise price and applicable minimum statutory withholding taxes by having the Company withhold shares that would have been issued to the optionee...

-

Page 100

...of Significant Accounting Policies Principles of Consolidation Effective September 29, 2008, in conjunction with the merger (the "Wendy's Merger") with Wendy's International, Inc. ("Wendy's") the corporate name of Triarc Companies, Inc. ("Triarc") changed to Wendy's/Arby's Group, Inc. ("Wendy's/Arby...

-

Page 101

... of restaurant food items, kids' meal toys and paper supplies. Investments Short-Term Investments Short-term investments consist of marketable equity securities with readily determinable fair values. The Company's marketable equity securities are classified and accounted for as "available-for-sale...

-

Page 102

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Investments The Company's investments (see Note 8) include (1) investments included in brokerage accounts ("Equities Account") ...

-

Page 103

... basis over their estimated lives of 5 to 27 years for CDO contracts and 15 years for contracts under which the Company managed investment funds Deferred financing costs, original issue debt discount, and adjustments to fair value of debt for purchase price adjustments related to the Wendy's Merger...

-

Page 104

... SFAS No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"). As a result, the Company now measures the cost of employee services received in exchange for an award of equity instruments, including grants of employee stock options and restricted stock, based on the fair value of the award at...

-

Page 105

... an ownership change, as defined in the Internal Revenue Code of 1986, as amended (the "Code") as it became part of the Wendy's consolidated group as it's new parent. As a result, Wendy's/Arby's had a short taxable year in 2008 ending on the date of the Wendy's Merger (see Note 14). The Company has...

-

Page 106

... to open new franchised restaurants. Rental income from locations owned by the Company and leased to franchisees is recognized on a straight-line basis over the respective operating lease terms. Asset management and related fees, which are no longer being received as a result of the Deerfield Sale...

-

Page 107

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Advertising Costs The Company incurs various advertising costs, including contributions to certain advertising cooperatives ...

-

Page 108

... regarding each new lease agreement, lease renewal, and lease amendment, including, but not limited to property values, property lives, discount rates, and probable term, all of which can impact (i) the classification and accounting for a lease as capital or operating, (ii) the rent holiday and...

-

Page 109

... business segments: Arby's restaurants and Wendy's restaurants subsequent to the Wendy's Merger on September 29, 2008. Prior to the Deerfield Sale on December 21, 2007, our business operations also included an asset management segment that offered a diverse range of fixed income and credit-related...

-

Page 110

... managed by the Company generated approximately 9% and 10% of asset management and related fees in 2007 and 2006, respectively. None of the above Deerfield revenue items in any of the periods presented represented more than 10% of consolidated revenues. As of December 28, 2008, Arby's restaurants...

-

Page 111

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

aggregate, service approximately 33% of Arby's Company-owned and franchised restaurants. As of December 28, 2008, the Wendy's ...

-

Page 112

... assumed ...Change in fair values of assets and liabilities allocated to: (Increase)/decrease in: Current assets Accounts and notes receivable ...Prepaid expenses and other current assets ...Investments ...Properties ...Other intangible assets Trademark ...Franchise agreements ...Favorable leases...

-

Page 113

... Wendy's Merger and the Conversion as if they had been consummated as of the beginning of each fiscal year:

2008 As Reported As Adjusted 2007 As Reported As Adjusted

Revenues: Sales...Franchise revenues ...Asset management and related fees ...Total revenues ...Operating (loss) profit ...Net (loss...

-

Page 114

... increase in deferred income taxes from a change in the estimate of tax basis of the net assets acquired. 2006 The Company completed the acquisitions of the operating assets, net of liabilities assumed, of 13 Arby's franchised restaurants in five separate transactions during the year ended December...

-

Page 115

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

There is no minority interest expense as a result of the Deerfield sale as a result of the terms of equity arrangement of the ...

-

Page 116

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

The fair value of the DFR Notes was based on the present value of the probability weighted average of expected cash flows from ...

-

Page 117

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

share for 2007 has been computed by dividing the allocated income for the Class A Common Stock and Class B Common Stock by the ...

-

Page 118

... FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(6) Short-Term Investments Short-Term Investments The Company's short-term investments, included in "Prepaid expenses and other current assets" in the accompanying Consolidated Balance Sheets, are carried at fair market value...

-

Page 119

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(7) Balance Sheet detail Cash and cash equivalents

Year End 2008 2007

Cash ...Cash equivalents...

$53,324 36,766 $90,090

$17,...

-

Page 120

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Non-Current

Year End 2008 2007

Notes receivable: DFR ...Franchisees ...Allowance for doubtful accounts...

$ 46,571 $46,219 9,...

-

Page 121

... Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Deferred costs and other assets

Year End 2008 2007

Deferred financing costs (a) ...Deferred costs of business acquisition (b) ...Non-current...

-

Page 122

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Accounts payable

Year End 2008 2007

Trade ...Other ...

$125,020 14,320 $139,340

$51,769 2,528 $54,297

Accrued expenses and ...

-

Page 123

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(8) Investments Non-Current Investments The following is a summary of the carrying value of investments classified as non-...

-

Page 124

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

any management fees. As a result of the withdrawal restriction, the amounts in the Equities Account are reported as non-current...

-

Page 125

...:

Year End 2007

Balance sheet information: Cash and cash equivalents ...Investments in securities...Other investments ...Other assets ...Accounts payable and accrued liabilities...Securities sold under agreements to repurchase...Long-term debt...Other liabilities...Convertible preferred stock...

-

Page 126

... related to our portion of TimWen included in our Consolidated Balance Sheet and Consolidated Statement of Operations as of and for the quarter ended December 28, 2008 (since the Wendy's Merger).

2008

Historical cost basis at September 29, 2008 ...Purchase price adjustments (Note 3) ...Equity...

-

Page 127

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Quarter ended December 28, 2008 (Canadian) (Unaudited)

Income statement information: Revenues...Income before income taxes and...

-

Page 128

...fourth quarter of 2008, we performed our annual goodwill impairment test. As a result of the acceleration of the general economic and market downturn as well as continued decreases in Arby's same store sales, we concluded that the carrying amount of the Arby's Company-owned restaurant reporting unit...

-

Page 129

... consolidated business" in the accompanying Consolidated Statement of Operations for the year ended December 30, 2007 (see Note 3). The following is a summary of the components of other intangible assets:

Cost

Non-amortizable Wendy's trademarks...Amortizable Franchise agreements ...Favorable leases...

-

Page 130

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(10) Long-Term Debt Long-term debt consisted of the following:

Year-End 2008 2007

Senior secured term loan, weighted average ...

-

Page 131

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(footnotes continued from previous page) The obligations under the Arby's Credit Agreement were secured by substantially all of...

-

Page 132

... Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(footnotes continued from previous page) (c) The sale-leaseback obligations (the "Sale-Leaseback Obligations"), which extend through 2028, relate to capitalized restaurant leased...

-

Page 133

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

was established to fund the advertising fund operations (see Note 29). There are no amounts outstanding under this facility as ...

-

Page 134

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

comprehensive income (loss)." If a hedge or portion thereof had been determined to be ineffective, any changes in fair value ...

-

Page 135

... The carrying amounts and estimated fair values of the Company's financial instruments for which the disclosure of fair values is required were as follows:

Year-End 2008 Carrying Amount Fair Value Carrying Amount 2007 Fair Value

Financial assets: Cash and cash equivalents (a) ...$ 90,102 $ 90,102...

-

Page 136

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(footnotes continued from previous page) (b) The fair values are based on quoted market prices. (c) The fair value of the DFR ...

-

Page 137

...our 2009 fiscal year, except for items recognized or disclosed on a recurring basis at least annually. FSP No. FAS 157-3, "Determining the Fair Value of a Financial Asset in a Market that is Not Active," ("FSP FAS 157-3") clarifies the application of SFAS 157 when the market for a financial asset is...

-

Page 138

... tax (liabilities) resulted from the following components:

Year-End 2008 2007

Deferred tax assets: Net operating/capital loss and tax credit carryforwards...Accrued compensation and related benefits ...Unfavorable leases ...Other ...Valuation allowances ...Total deferred tax assets ...Deferred tax...

-

Page 139

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

assigned values in the purchase price allocation (see note 3) and the tax basis of the net assets acquired partially offset by ...

-

Page 140

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

2008

2007

2006

Income tax benefit (provision) computed at U.S. Federal statutory rate ...State income taxes, net of U.S. ...

-

Page 141

...:

2008 2007

Beginning balance...Additions: Wendy's unrecognized tax benefits at the Wendy's Merger date...Tax positions related to the current year ...Tax positions of prior years...Reductions: Tax positions of prior years...Settlements ...Lapse of statute of limitations ...Ending balance ...

$12...

-

Page 142

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Wendy's shareholders. Subsequent to the merger, we only have Class A common stock; therefore, the summarized activity in the ...

-

Page 143

...to certain officers, other key employees, non-employee directors and consultants, although the Company has not granted any tandem stock appreciation rights or restricted share units. The Equity Plans also provide for the grant of shares of Wendy's/Arby's common stock to non-employee directors. As of...

-

Page 144

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

common shares of Wendy's. Pursuant to the merger agreement, each outstanding Wendy's option as of the merger date was converted...

-

Page 145

... affect the fair value estimates. As of December 28, 2008, there was $16,408 of total unrecognized compensation cost related to nonvested share-based compensation grants which would be recognized over a weighted-average period of 2.6 years. The Company's currently outstanding stock options have...

-

Page 146

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

The Company reduced the exercise prices of all outstanding stock options for each of three special cash dividends of $0.15 for ...

-

Page 147

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

employment agreement, the Company could have been obligated to grant stock options to the CEO having a fair value equal to the ...

-

Page 148

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

2007 Restricted Shares On May 23, 2007, the Company granted certain officers and key employees, other than our current Chief ...

-

Page 149

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

dates. The total fair value of 2007 Restricted Shares which vested during 2008 was $356 as of the May 23, 2008 vesting date. ...

-

Page 150

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts) 2008 2007 2006

Compensation expense related to stock options ...Compensation expense related to the effect of the Conversion on...

-

Page 151

... employer relocation costs, lease termination costs, office relocation expenses, and changes in the estimated carrying costs for real estate we purchased under terms of employee relocation agreements entered into as part of the RTM Acquisition. The project to combine the RTM and Arby's operations is...

-

Page 152

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

of them for his 2007 period of employment with the Company, both including applicable employer payroll taxes, (3) severance and...

-

Page 153

...compensation ...Employee relocation costs ...Office relocation costs...Lease termination costs...Total Arby's restaurants segment ...General Corporate: Cash obligations: Severance and retention incentive compensation ...Non-cash charges: Loss on properties and other assets ...Total general corporate...

-

Page 154

... of the Company's asset management fees to be received and, in 2007 a CDO which no longer had any projected cash flows. In addition to the impairment of asset management contracts, the 2007 charge is also related to (1) anticipated losses on the sale of an internally developed financial model (see...

-

Page 155

... Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

the Wendy's restaurants segment were estimated to be their expected realizable value, which reflect market declines in the areas where the properties are located. (19) Investment...

-

Page 156

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

(21) Other Operating Expense (Income), Net

2008 2007 2006

Rent expense of properties subleased to third parties, net ...Equity...

-

Page 157

... by the Company in determining amounts related to its defined benefit plans is its current fiscal year end based on the rollforward of an actuarial report. A reconciliation of the beginning and ending balances of the accumulated benefit obligations and the fair value of these two plans' assets and...

-

Page 158

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts) 2008 2007

Change in accumulated benefit obligations: Accumulated benefit obligations at beginning of year...Service cost (...

-

Page 159

...:

2008 2007 2006

Net periodic pension cost: Expected long-term rate of return on plan assets ...Discount rate ...Benefit obligations at end of year: Discount rate ...

6.5% 6.5% 7.5% 6.0% 5.5% 5.0% 6.3% 6.0% 5.5%

The expected long-term rate of return on plan assets of 6.5% reflects the Company...

-

Page 160

Wendy's/Arby's Group, Inc. and Subsidiaries (Formerly Triarc Companies, Inc.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

The expected benefits to be paid by the Company's remaining defined benefit plans over the next five fiscal years and in the ...

-

Page 161

...153 per month which includes an amount equal to the rent the Company pays plus a fixed amount reflecting a portion of the increase in the fair market value, at the time the sublease was executed, of the Company's leasehold interest as well as amounts for property taxes and the other costs related to...

-

Page 162

...28, 2008, associated with our sale of the propane business if National Propane required the repurchase. As of December 28, 2008, we have net operating loss tax carryforwards sufficient to substantially offset these deferred taxes. RTM, a subsidiary of Wendy's/Arby's, guarantees the lease obligations...

-

Page 163

..., management does not expect any material loss to result from these letters of credit because we do not believe performance will be required. Purchase and Capital Commitments Wendy's/Arby's Beverage Agreements Wendy's and Arby's have entered into beverage agreements, with the Coca-Cola Company and...

-

Page 164

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Advertising Commitments Wendy's and Arby's have purchase commitments of approximately $113,674 and $20,464 related to execution...

-

Page 165

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Distributions to Co-investment Shareholders As part of its overall retention efforts, the Company provided certain of its ...

-

Page 166

... pursuant to an initial public offering of DFR prior to 2006. Subsequently, certain of DFR Stock Purchasers, but not the Company, acquired additional shares at various prices in open-market transactions. The Company, through the date of the Deerfield Sale, was the investment manager of DFR and...

-

Page 167

...ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

related to the then anticipated loss on the sale of the model. This former executive also had certain rights which would have required...

-

Page 168

... the rent the Company pays plus a fixed amount reflecting a portion of the increase in the then fair market value of the Company's leasehold interest as well as amounts for property taxes and the other costs related to the use of the space. Either the Management Company or the Company may terminate...

-

Page 169

...charged any management fees. On September 12, 2008, 251 shares of Wendy's common stock, which were included in the Equities Account, were sold to the Management Company at the closing market value as of the day we decided to sell the shares. The sale resulted in a loss of $38. RTM Acquisition During...

-

Page 170

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

agreement and paid to Arby's fees and royalty payments that unaffiliated third-party franchisees pay. Under an arrangement that...

-

Page 171

... alleged breach of fiduciary duties arising out of the Wendy's board of directors' search for a merger partner and out of its approval of the merger agreement on April 23, 2008, and failure to disclose material information related to the merger in Amendment No. 3 to the Form S-4 under the Securities...

-

Page 172

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

On May 22, 2008, a putative class action complaint was filed by Ronald Donald Smith, on behalf of himself and others similarly ...

-

Page 173

... Sale (see Note 3), we managed and internally reported our operations as two business segments: (1) the operation and franchising of Arby's restaurants and (2) asset management ("Asset Management"). We evaluate segment performance and allocate resources based on each segment's operating profit (loss...

-

Page 174

... (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

The following is a summary of the Company's segment information:

2008 Revenues: Sales ...Franchise revenues...Wendy's Restaurants Arby's Restaurants Corporate Total

$530...

-

Page 175

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts) Arby's Restaurants Asset Management

2007 Revenues: Sales ...Franchise revenues...Asset management revenues ...

Corporate

Total...

-

Page 176

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts) Arby's Restaurants Asset Management

2006 Revenues: Sales ...Franchise revenues...Asset management revenues ...

Corporate

Total...

-

Page 177

... TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts) Wendy's Restaurants Arby's Restaurants

2008 Investments: Short term investments ...Long term investments...

Corporate

Eliminations

Total

Total investments ...2007 Investments...

-

Page 178

...(FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Revenues and long-lived asset information by geographic area are as follows:

U.S Canada Other International Total

2008 Revenues: Wendy's restaurants ...Arby's restaurants...

-

Page 179

...FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

March 30 (b)

2008 Quarter Ended September 28 June 29 (b) (b)

December 28 (b)

Revenues ...$302,854 Cost of sales (d) ...233,445 Operating (loss) profit ...8,057 Loss from...

-

Page 180

... prior year contingent tax benefit related to certain severance obligations to the Company's Former Executives. (d) We have reclassified Advertising into "Cost of sales" for all periods. Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Not applicable. Item...

-

Page 181

WENDY'S/ARBY'S GROUP, INC. AND SUBSIDIARIES (FORMERLY TRIARC COMPANIES, INC.)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED

(In Thousands Except Per Share Amounts)

Management's Report on Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining...

-

Page 182

.... We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's consolidated financial statements as of and for the year ended December 28, 2008 and our report dated March 13, 2009 expressed an unqualified opinion on those...

-

Page 183

... of directors pursuant to Regulation 14A that will contain such information. Notwithstanding the foregoing, information appearing in the section "Audit Committee Report" shall not be deemed to be incorporated by reference in this Form 10-K. PART IV Item 15. Exhibits and Financial Statement Schedules...

-

Page 184

... to Exhibit 4(i) of the Wendy's International, Inc. Form 10-K for the year ended December 30, 2001 (SEC file no. 001-08116). 10.1 -Triarc Companies, Inc. Amended and Restated 1997 Equity Participation Plan, incorporated herein by reference to Exhibit 10.2 to Triarc's Current Report on Form 8-K dated...

-

Page 185

...22, 2008 (SEC file no. 001-02207).** 10.7 -Form of Restricted Stock Agreement under the Wendy's/Arby's Group, Inc. Amended and Restated 2002 Equity Participation Plan, as amended.* ** 10.8 -1999 Executive Bonus Plan, incorporated herein by reference to Exhibit A to Triarc's 1999 Proxy Statement (SEC...

-

Page 186

... herein by reference to Exhibit 10(c) of the Wendy's International, Inc. Form 10-K for the year ended December 31, 2000 (SEC file no. 001-08116). 10.22-Form of Guaranty Agreement dated as of March 23, 1999 among National Propane Corporation, Triarc Companies, Inc. and Nelson Peltz and Peter W. May...

-

Page 187

... thereof.* ** 10.48-Form of Indemnification Agreement between Arby's Restaurant Group, Inc. and certain directors, officers and employees thereof, incorporated by reference to Exhibit 10.40 to Triarc's Annual Report on Form 10-K for the fiscal year ended December 30, 2007 (SEC file no. 001-02207...

-

Page 188

....1 -Consolidated Financial Statements of Deerfield Capital Corp. and subsidiaries (and related reports of independent registered public accounting firm), incorporated herein by reference to Item 8 of the Annual Report on Form 10-K of Deerfield Capital Corp. for the year ended December 31, 2008 (SEC...

-

Page 189

... the undersigned, thereunto duly authorized. Wendy's/Arby's Group, Inc. (Registrant)

By:

/s/ ROLAND C. SMITH

Roland C. Smith President and Chief Executive Officer

Dated: March 13, 2009 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below on March...

-

Page 190

(This Page Intentionally Left Blank)

-

Page 191

...ARBY'S GROUP, INC.

LIST OF SUBSIDIARIES AS OF

December 28, 2008

Subsidiary State or Jurisdiction Under Which Organized

Triarc Acquisition, LLC (formerly, Arby's Acquisition, LLC) Arby's Restaurant Holdings, LLC Triarc Restaurant Holdings, LLC Arby's Restaurant Group, Inc. RTM Acquisition Company...

-

Page 192

...

(1) 99.7% capital interest owned by Wendy's/Arby's Group, Inc. (the "Company"). Certain former members of management of the Company have been granted an equity interest in Jurl Holdings, LLC ("Jurl") representing in the aggregate a 0.30% capital interest in Jurl and up to a 15% profits interest in...

-

Page 193

... Accounting for Planned Major Maintenance Activities and FASB Interpretation No. 48, Accounting For Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109), appearing in this Annual Report on Form 10-K of Wendy's/Arby's Group, Inc. for the year ended December 28, 2008.

/s/ Deloitte...

-

Page 194

...Nos. 333-110719 and 333-155272 on Form S-3 of Wendy's/Arby's Group, Inc. (formerly Triarc Companies, Inc. and referred to herein as the "Company") of our report dated March 16, 2009, relating to the consolidated financial statements of Deerfield Capital Corp. appearing in this Amendment No. 1 to the...

-

Page 195

... financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant's other certifying officer...

-

Page 196

... financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant's other certifying officer...

-

Page 197

...undersigned officers of Wendy's/Arby's Group, Inc., a Delaware corporation (the "Company"), does hereby certify, to the best of such officer's knowledge, that: The Annual Report on Form 10-K for the year ended December 28, 2008 (the "Form 10-K") of the Company fully complies with the requirements of...

-

Page 198

(This Page Intentionally Left Blank)

-

Page 199

... Chief Financial Officer

Peter W. May 2,4,6

Vice Chairman, Wendy's/Arby's Group, Inc. President and Founding Partner, Trian Fund Management, L.P.

J. David Karam

President, Wendy's International, Inc.

Stockholder Information Transfer Agent and Registrar

If you require assistance with your account...

-

Page 200