Toro 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A CENTURY OF INNOVATION

The Toro Company

2013 Annual Report

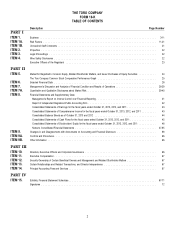

Table of contents

-

Page 1

The Toro Company 2013 Annual Report A CENTURY OF INNOVATION -

Page 2

... rain/moisture sensors and landscape lighting. Signiï¬cantly lighter than comparably equipped competitive mowers, Toro's new Reelmaster® 3550-D is the lightest fairway mower on the market- making it gentle on turf, and delivering a high level of productivity and outstanding quality of cut. -

Page 3

... grounds equipment offerings. Sales ultimately evened out for the full ï¬scal year, as we expected. Adverse spring weather conditions kept golf rounds down early and for the year, but improved summer weather and increased play somewhat helped golf course revenue recover. Turning to golf irrigation... -

Page 4

... golf course development in key international markets. The landscape contractor and grounds markets delivered solid results in ï¬scal 2013. Our landscape contractor customers drove strong retail activity throughout the year, especially in the professional zero-turn product category. Tax-supported... -

Page 5

... Board of Directors and employees, I want to thank all of you, our shareholders, for your continued trust in The Toro Company. Sincerely, Outlook We will remain focused on the very things that have made us successful for our ï¬rst 100 years: developing innovative products and serving our customers... -

Page 6

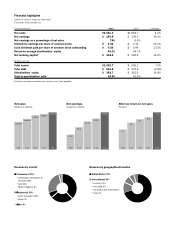

...plus inventory, less trade payables. $1,002.7 $ 223.5 $ 358.7 38.4% $ 935.2 $ 225.3 $ 312.4 41.9% 7.2% (0.8)% 14.8% Net sales...70% Landscape Contractor & Grounds 38% Golf 26% Micro Irrigation 6% Residential 29% Lawn & Garden 26% Snow 3% Other 1% Europe 12% Australia 8% Canada/Latin America 6% ... -

Page 7

... the closing price of the common stock on May 3, 2013, the last business day of the registrant's most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $2.6 billion. The number of shares of common stock outstanding as of December 12, 2013 was 56... -

Page 8

...Internal Control over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Earnings for the fiscal years ended October 31, 2013, 2012, and 2011 ...Consolidated Statements of Comprehensive Income for the fiscal years ended October 31, 2013, 2012... -

Page 9

... services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and construction equipment, and residential yard and snow removal products. We produced our first mower for golf course use in 1921 when we mounted five reel mowers on a Toro tractor... -

Page 10

... underground irrigation systems for the golf course market, including sprinkler heads, controllers, turf sensors, and electric, battery-operated, and hydraulic valves. These irrigation systems are designed to use computerized management systems and a variety of other technologies to help customers... -

Page 11

... hedge trimmers, electric and gas blower-vacuums, and electric snow throwers. In Australia, we also design and market underground and hose-end retail irrigation products under the Pope brand name. In fiscal 2013, we enhanced and broadened our product offering of lithium-ion battery powered trimmers... -

Page 12

Financial Information about International Operations and Business Segments We currently manufacture our products in the United States (''U.S.''), Mexico, Australia, the United Kingdom, Italy, and Romania for sale throughout the world. In late fiscal 2013, we began manufacturing micro-irrigation ... -

Page 13

... and replacement production equipment, as well as expansion and construction of facilities, including the construction of a new corporate facility and expansion of our product development and test capacities. estimated number of products under warranty, historical average costs incurred to service... -

Page 14

... directly to dealers and rental companies. Toro and Exmark landscape contractor products are also sold directly to dealers in certain regions of North America. Residential products, such as walk power mowers, riding products, and snow throwers, are generally sold directly to home centers, dealers... -

Page 15

... they utilize to deliver high levels of customer satisfaction. Our current marketing strategy is to maintain distinct brands and brand identification for Toroா, Exmarkா, Irritrolா, Hayterா, Popeா, Unique Lighting Systemsா, Lawn-Boyா, and Lawn Genieா products. We advertise our... -

Page 16

..., offered primarily to Toro and Exmark dealers, provide end-user customers revolving and installment lines of credit for Toro and Exmark products, parts, and services. Distributor Financing. Occasionally, we enter into long-term loan agreements with some distributors. These transactions are used for... -

Page 17

... the SEC's home page on the Internet at http://www.sec.gov. We make available, free of charge on our web site www.thetorocompany.com (select the ''Investor Information'' link and then the ''Financials'' link), our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form... -

Page 18

... segment customers on acceptable terms to finance new product purchases; and the amount of government revenues, budget, and spending levels for grounds maintenance equipment. Our professional segment products are sold by distributors or dealers, or directly to government customers, rental companies... -

Page 19

...on our business and operating results. Changing buying patterns of customers could also result in reduced sales of one or more of our residential segment products, resulting in increased inventory levels. Our residential lawn and garden products are generally manufactured throughout the year and our... -

Page 20

... financial resources, expose us to difficulties presented by international economic, political, legal, accounting, and business factors, and may not be successful or produce desired levels of net sales. We currently manufacture our products in the U.S., Mexico, Australia, the United Kingdom, Italy... -

Page 21

...expand existing, open and manage new, and/or move production between manufacturing facilities could adversely affect our business and operating results. We currently manufacture most of our products at seven locations in the U.S., two locations in Mexico, and one location in each of Australia, Italy... -

Page 22

..., as well as sales to third party customers, purchases from suppliers, and bank lines of credit with creditors denominated in foreign currencies. Our reported net sales and net earnings are subject to fluctuations in foreign currency exchange rates. Because our products are manufactured or sourced... -

Page 23

...able to implement price increases to cover or partially offset costs related to research, development, engineering, and other expenses to design Tier 4 diesel engine compliant products in the form of price increases to our customers, and/or our competitors implement different strategies with respect... -

Page 24

... that inordinately impacts the lawn and garden, outdoor power equipment, or irrigation industries generally by promoting the purchase, such as through customer rebate or other incentive programs, of certain types of mowing or irrigation equipment or other products that we sell, could impact us... -

Page 25

...information, and to manage or support a variety of business processes and activities, including, among other things, our accounting and financial functions, including maintaining our internal controls; our manufacturing and supply chain processes; and the data related to our research and development... -

Page 26

... upon the joint venture to provide competitive inventory financing programs, including floor plan and open account receivable financing, to certain distributors and dealers of our products. Any material change in the availability or terms of credit offered to our customers by the joint venture, any... -

Page 27

... with our distribution channel partners, our success in partnering with new dealers, and our customers' ability to pay amounts owed to us; • a decline in retail sales or financial difficulties of our distributors or dealers, which could cause us to repurchase financed product; and • the... -

Page 28

... California used as a testing site. Plant utilization varies during the year depending on the production cycle. We consider each of our current facilities to be in good operating condition. Management believes we have sufficient manufacturing capacity for fiscal 2014, although strategies for future... -

Page 29

... General Manager, International Business. Vice President, Information Services since June 2013. From September 2011 to June 2013, he served as Managing Director, Corporate Communications and Investor Relations. From August 2010 to September 2011, he served as Director, Investor and Public Relations... -

Page 30

..., AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is listed for trading on the New York Stock Exchange and trades under the symbol ''TTC.'' The high, low, and last sales prices for our common stock and cash dividends paid for each of the quarterly periods for fiscal 2013 and 2012 were as... -

Page 31

... 2008 2009 2010 2011 2012 2013 The Toro Company S&P 500 Peer Group 13DEC201312503542 *$100 invested on 10/31/08 in stock or index, including reinvestment of dividends. Fiscal year ending October 31. Fiscal year ending October 31 The Toro Company S&P 500 Peer Group 2008 $100.00 100.00 100.00 2009... -

Page 32

... define new products as those introduced in the current and previous two fiscal years. OVERVIEW We design, manufacture, and market professional turf maintenance equipment and services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and 26 -

Page 33

... seasons in key markets. Additionally, adverse spring weather conditions negatively impacted our net sales and demand for walk power mowers during the key selling period. However, sales of Pope irrigation products in Australia, zero-turn radius riding mowers, and handheld trimmer and blower products... -

Page 34

... and infrastructure that expanded our market presence to contribute to sales growth of our micro-irrigation products in fiscal 2014. In late fiscal 2013, we launched our Toro branded underground utility products, and we anticipate continued growth and demand in the rental and construction market to... -

Page 35

... in fiscal 2013. • Increased sales of Pope irrigation products in Australia, zero-turn radius riding mowers, and handheld trimmer and blower products in our residential segment due to positive customer response to newly introduced and enhanced products, as well as favorable weather conditions... -

Page 36

... the successful introduction of new and enhanced products that were well received by customers and resulted in increased sales, strong demand for domestic golf and landscape contractor equipment as customers replaced their aged inventory, market growth and demand for our drip irrigation solutions in... -

Page 37

... rental and construction market from broadening our customer base as part of our acquisitions in fiscal 2012, improved market conditions, and new product introductions. • Incremental sales of $6.4 million from acquisitions. • Increased sales of golf and grounds equipment and irrigation systems... -

Page 38

... snow thrower products and service parts due to the lack of snowfall during the 2011-2012 winter season. Somewhat offsetting the decrease in residential segment net sales included higher shipments and demand of walk power mowers, zero-turn radius riding mowers, and trimmers due to positive customer... -

Page 39

... volume of purchases and our supply chain initiatives. As a result of higher average inventory levels and receivables, our average net working capital (accounts receivable plus inventory less trade payables) as a percentage of net sales increased to 16.6 percent as of the end of fiscal 2013 compared... -

Page 40

...and Other Long-Term Assets Fiscal 2013 capital expenditures of $49.4 million were higher by 14.3 percent compared to fiscal 2012. This increase was primarily attributable to capital expenditures for new product tooling, replacement production equipment, implementation of new information systems, and... -

Page 41

... enable sales growth for expanding markets and in new markets, help us to meet product demand, and increase our manufacturing efficiencies and capacity. Cash used in investing activities in fiscal 2013 decreased $2.6 million, or 5.4 percent, from fiscal 2012 due to lower amounts of cash utilized for... -

Page 42

... terms to home centers and mass retailers; general line irrigation dealers; international distributors and dealers other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; micro-irrigation dealers and distributors; government customers; and rental companies... -

Page 43

... for a company in China that manufactures waterefficient drip irrigation products, sprinklers, emitters, and filters for agriculture, landscaping, and green house production. The purchase price of this acquisition was $3.5 million. On April 25, 2012, during the second quarter of fiscal 2012, we... -

Page 44

... products sold to distributors, volume discounts, retail financing support, floor planning, cooperative advertising, commissions, and other sales discounts and promotional programs. The estimates for sales promotion and incentive costs are based on the terms of the arrangements with customers... -

Page 45

... exposed to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales to third party customers, sales and loans to wholly owned foreign subsidiaries, foreign plant operations, and purchases from suppliers. Because our products are manufactured or... -

Page 46

... not able to increase selling prices of our products or obtain manufacturing efficiencies to offset increases in commodity costs. Further information regarding rising prices for commodities is presented in Part II, Item 7, ''Management's Discussion and Analysis of Financial Condition and Results of... -

Page 47

... system is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. The company's internal control over financial reporting includes... -

Page 48

Report of Independent Registered Public Accounting Firm The Stockholders and Board of Directors The Toro Company: We have audited the accompanying consolidated balance sheets of The Toro Company and subsidiaries as of October 31, 2013 and 2012 and the related consolidated statements of earnings, ... -

Page 49

...-average number of shares of common stock outstanding - Basic Weighted-average number of shares of common stock outstanding - Diluted CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Dollars in thousands) Fiscal years ended October 31 2013 $154,845 (2,342) 645 (899) (2,596) $152,249 2012 $129... -

Page 50

... taxes Total current assets Property, plant, and equipment, net Other assets Goodwill Other intangible assets, net Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current portion of long-term debt Accounts payable Accrued liabilities: Warranty Advertising and marketing programs Compensation and... -

Page 51

...from exercise of stock options Purchases of Toro common stock Dividends paid on Toro common stock Net cash used in financing activities Effect of exchange rates on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents as of the beginning of the fiscal year Cash and cash... -

Page 52

... of 669,426 shares under stock-based compensation plans Contribution of stock to a deferred compensation trust Purchase of 2,147,185 shares of common stock Excess tax benefits from stock-based awards Other comprehensive loss Net earnings Balance as of October 31, 2013 The financial statements should... -

Page 53

... is reduced due to its Red Iron Acceptance, LLC (''Red Iron'') joint venture with TCF Inventory Finance, Inc. (''TCFIF''), as further discussed in Note 3. For receivables not serviced through Red Iron, the company grants credit to customers in the normal course of business and performs on-going... -

Page 54

... for impairment annually during each fourth fiscal quarter or more frequently if changes in circumstances or occurrence of events suggest the remaining value may not be recoverable. The company reviewed the fair value of its reporting units that have goodwill on their respective balance sheets with... -

Page 55

...years ended October 31 Beginning balance Warranty provisions Warranty claims Changes in estimates Additions from acquisitions Ending balance 2013 $ 69,848 41,067 (35,529) (3,209) - $ 72,177 2012 $ 62,730 38,439 (35,431) 3,910 200 $ 69,848 Accounts Payable The company has a customer-managed services... -

Page 56

... operating costs of distribution and corporate facilities, warranty expense, depreciation and amortization expense on non-manufacturing assets, advertising and marketing expenses, selling expenses, engineering and research costs, information systems costs, incentive and profit sharing expense, and... -

Page 57

...-average number of shares of common stock, assumed issuance of contingent and restricted shares, and effect of dilutive securities 2013 2012 2011 2013 57,898 24 2012 59,440 6 2011 62,530 4 Advertising General advertising expenditures are expensed the first time advertising takes place. Production... -

Page 58

... for a company in China that manufactures water-efficient drip irrigation products, sprinklers, emitters, and filters for agriculture, landscaping, and green house production. The net purchase price of this acquisition was $3,496, of which $2,101 was paid in cash and the remaining balance of $1,395... -

Page 59

... advances paid by Red Iron to the company. The net amount of new receivables financed for dealers and distributors under this arrangement during fiscal 2013, 2012, and 2011 was $1,211,470, $1,191,343, and $1,111,778, respectively. Summarized financial information for Red Iron is presented as follows... -

Page 60

...date on a semi-annual basis at the treasury rate plus 30 basis points, plus, in both cases, accrued and unpaid interest. In the event of the occurrence of both (i) a change of control of the company, and (ii) a downgrade of the notes below an investment grade rating by both Moody's Investors Service... -

Page 61

... authorized shares from 100 million to 175 million. Stock Repurchase Program. On December 11, 2012, the company's Board of Directors authorized the repurchase of 5 million shares of the company's common stock in open-market or in privately negotiated transactions. This program has no expiration date... -

Page 62

... Toro Company 2010 Equity and Incentive Plan, as amended, for officers, other employees, and non-employee members of the company's Board of Directors. The company's incentive plan allows it to grant equity-based compensation awards, including stock options, restricted stock and restricted stock unit... -

Page 63

... closing price of the company's common stock on the date of grant, as reported by the New York Stock Exchange. Options are generally granted to officers, other employees, and non-employee members of the company's Board of Directors on an annual basis in the first quarter of the company's fiscal year... -

Page 64

...years ended October 31 Weighted-average fair value at date of grant Fair value of restricted stock and restricted stock unit awards vested 2013 $46.10 1,207 2012 $33.61 967 2011 $27.17 37 Performance Share Awards. The company grants performance share awards to executive officers and other employees... -

Page 65

... healthcare plan as the company deems these plans to be immaterial to its consolidated financial position and results of operations. 12 SEGMENT DATA The company's businesses are organized, managed, and internally grouped into segments based on differences in products and services. Segment... -

Page 66

... Residential business segment consists of walk power mowers, riding mowers, snow throwers, replacement parts, and home solutions products, including trimmers, blowers, blower-vacuums, and underground and hose-end retail irrigation products sold in Australia. Residential business segment products are... -

Page 67

... Customer Financing Wholesale Financing. In fiscal 2009, Toro Credit Company sold its receivable portfolio to Red Iron, the company's joint venture with TCFIF. See Note 3 for additional information related to Red Iron. Some products sold to independent dealers in Australia finance their products... -

Page 68

... October 2013. the residential segment that has significant sales to The Home Depot. Derivative Instruments and Hedging Activities The company is exposed to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales to third party customers, sales... -

Page 69

... which hedge accounting is discontinued and the derivative remains outstanding, the company carries the derivative at its fair value on the consolidated balance sheet, recognizing future changes in the fair value in other income, net. For the fiscal years ended October 31, 2013 and 2012, there were... -

Page 70

..., net Other income, net October 31, October 31, 2013 2012 $(1,402) (483) $(1,885) $4,165 379 $4,544 During the second quarter of fiscal 2007, the company entered into three treasury lock agreements based on a 30-year U.S. Treasury security with a principal balance of $30,000 each for two of the... -

Page 71

... or disclosure in the notes to the financial statements. $1,266 $1,931 443 2,777 $5,151 QUARTERLY FINANCIAL DATA (unaudited) Summarized quarterly financial data for fiscal 2013 and 2012 are as follows: Fiscal year ended October 31, 2013 Quarter Net sales Gross profit Net earnings Basic net... -

Page 72

...this report in Part II, Item 8, ''Financial Statements and Supplementary Data'' under the caption ''Report of Independent Registered Public Accounting Firm.'' There was no change in the company's internal control over financial reporting that occurred during the company's fourth fiscal quarter ended... -

Page 73

... in Part II, Item 8, ''Financial Statements and Supplementary Data'' of this report: • Management's Report on Internal Control over Financial Reporting. • Report of Independent Registered Public Accounting Firm. • Consolidated Statements of Earnings for the fiscal years ended October 31, 2013... -

Page 74

...quarter ended May 4, 2012, Commission File No. 1-8649).** 2.6 Receivable Purchase Agreement by and among Toro Credit Company, as Seller, The Toro Company, and Red Iron Acceptance, LLC, as Buyer (incorporated by reference to Exhibit 2.1 to Registrant's Current Report on Form 8-K dated October 1, 2009... -

Page 75

...'s Annual Report on Form 10-K for the fiscal year ended October 31, 2012, Commission File No. 1-8649).* 10.21 Form of Nonqualified Stock Option Agreement for Grants Outside the United States of America between The Toro Company and other employees under The Toro Company 2010 Equity and Incentive Plan... -

Page 76

... Current Report on Form 8-K dated August 12, 2009, Commission File No. 1-8649). 10.27 (1) First Amendment to Credit and Security Agreement, dated June 6, 2012, by and between Red Iron Acceptance, LLC and TCF Inventory Finance, Inc. (incorporated by reference to Exhibit 10.1 to Registrant's Quarterly... -

Page 77

...,955 2 Provision consists of rebates, cooperative advertising, floor planning costs, commissions, and other promotional program expenses. The expense of each program is classified either as a reduction of net sales or as a component of selling, general, and administrative expense. Claims paid. 71 -

Page 78

... by the undersigned, thereunto duly authorized. THE TORO COMPANY (Registrant) By: /s/ Renee J. Peterson Renee J. Peterson Vice President, Treasurer and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the... -

Page 79

Intentionally left blank -

Page 80

... and Chief Operating Ofï¬cer The Mosaic Company William E. Brown, Jr. Group Vice President, Commercial and Irrigation Businesses Richard M. Olson Vice President, International Business Gary L. Ellis Senior Vice President and Chief Financial Ofï¬cer Medtronic, Inc. Gregg W. Steinhafel Chairman... -

Page 81

...marking Toro's entry into the underground utility construction market, Toro's powerful RT600 is the only riding trencher in its class with several exclusive features to help minimize stalls, absorb shock loads and multiply torque for unsurpassed trenching power. Toro's TimeCutter® zero turn mowers... -

Page 82

The Toro Company 8111 Lyndale Avenue South Bloomington, MN 55420-1196 952-888-8801 www.thetorocompany.com