Toro 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Toro Company

2012 Annual Report

at its roots

innovation

Table of contents

-

Page 1

The Toro Company 2012 Annual Report innovation at its roots -

Page 2

...been key to our success. This constant focus has fueled creative solutions to help our customers enrich the beauty, productivity and sustainability of the land. Leveraging Toro's sensing technology used on golf courses, the award-winning Precisionâ„¢ Soil Sensor helps homeowners maximize irrigation... -

Page 3

... of snow and summer drought hurt contractors' revenues in certain markets, overall our landscape contractor customers were healthy. Our powerful lineup of new Toro® and Exmark® products helped generate strong sales, and incremental sales from acquisitions also contributed to growth for the year... -

Page 4

... saw its sales of walk power mowers and riding products increase against the industry trend. Toro remains committed to delivering innovative products for our residential customers in partnership with dealers and The Home Depot® to grow this segment. Our micro-irrigation business expanded as growers... -

Page 5

... of assets related to Stone Construction Equipment provided Toro with an expanded offering of rental products for use in light construction and hardscapes. Over the past several years, Toro has developed a number of products internally and acquired others as part of our focused rental strategy. The... -

Page 6

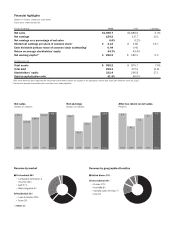

...less trade payables. Net sales Dollars in millions 1,958.7 Net earnings Dollars in millions 129.5 119.7 117.7 After-tax return on net sales Percent 6.6 6.2 5.5 93.2 4.1 1,878.2 1,690.4 1,523.4 1,884.0 6.4 62.8 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011... -

Page 7

..., D.C. 20549 FORM 10-K Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Fiscal Year Ended October 31, 2012 THE TORO COMPANY (Exact name of registrant as specified in its charter) Delaware (State of incorporation) 1-8649 (Commission File Number) 41-0580470... -

Page 8

...Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ... PART III ITEM 10. ITEM 11. ITEM 12. ITEM 13. ITEM 14. Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 9

... services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and construction equipment, and residential yard and snow removal products. We produced our first mower for golf course use in 1921 when we mounted five reel mowers on a Toro tractor... -

Page 10

... underground irrigation systems for the golf course market, including sprinkler heads, controllers, turf sensors, and electric, battery-operated, and hydraulic valves. These irrigation systems are designed to use computerized management systems and a variety of other technologies to help customers... -

Page 11

...solutions products as a means of expanding our brand presence. Walk Power Mower Products. We manufacture and market numerous walk power mower models under our Toro and Lawn-Boy brand names, as well as the Pope brand in Australia and the Hayter brand in the United Kingdom. Models differ as to cutting... -

Page 12

... for our products, taking into account production capacity, timing of shipments, and field inventory levels. In fiscal 2012, our production system utilized Kanban, supplier pull, and build-to-order methodologies in our manufacturing facilities as appropriate for the business units they support in... -

Page 13

... and component costs are generally for steel, engines, hydraulic components, transmissions, plastic resin, and electric motors, all of which we purchase from several suppliers around the world. Service and Warranty Our products are warranted to ensure customer confidence in design, workmanship, and... -

Page 14

... they utilize to deliver high levels of customer satisfaction. Our current marketing strategy is to maintain distinct brands and brand identification for Toroா, Exmarkா, Irritrolா, Hayterா, Popeா, Unique Lighting Systemsா, Lawn-Boyா, and Lawn Genieா products. We advertise our... -

Page 15

...The principal competitive factors in our markets are product innovation, quality and reliability, pricing, product support and customer service, warranty, brand awareness, reputation, distribution, shelf space, and financing options. We believe we offer total solutions and full service packages with... -

Page 16

... of open account terms directly to home centers and mass retailers; general line irrigation dealers; international distributors and dealers, other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; government customers; and rental companies. Some independent... -

Page 17

... adverse effect on sales of our irrigation products, and lower snow fall accumulations in key markets have had an adverse effect on sales of our snow thrower products. Similarly, adverse weather conditions in one season may adversely affect customer purchasing patterns and our net sales for some of... -

Page 18

... segment customers on acceptable terms to finance new product purchases; and the amount of government revenues, budget, and spending levels for grounds maintenance equipment. Our professional segment products are sold by distributors or dealers, or directly to government customers, rental companies... -

Page 19

... segment products purchased at retailers, such as The Home Depot, which accounted for approximately 11 to 13 percent of our total consolidated net sales in each of fiscal 2012, 2011, and 2010. We believe that our diverse distribution channels and customer base should reduce the long-term impact... -

Page 20

... denominated in foreign currencies. Our reported net sales and net earnings are subject to fluctuations in foreign currency exchange rates. Because our products are manufactured or sourced primarily from the United States and Mexico, a stronger U.S. dollar and Mexican peso generally have a negative... -

Page 21

...change customer preferences and buying patterns in ways that we do not currently anticipate, we may experience lower market demand for our products that may, ultimately, adversely affect our net sales, profit margins, and overall financial results. As required under the Dodd-Frank Wall Street Reform... -

Page 22

... currently manufacture most of our products at seven locations in the United States, two locations in Mexico, and one location in each of Australia, Italy, the United Kingdom, and Romania. We also have several locations that serve as distribution centers, warehouses, test labs, and corporate offices... -

Page 23

... our internal controls; to manage our manufacturing and supply chain processes; and to maintain our research and development data. The failure of our management information systems to perform properly could disrupt our business and product development, which may result in decreased sales, increased... -

Page 24

... development, promotion, and sale of their products than we can. In addition, competition could increase if new companies enter the market or if existing competitors expand their product lines or intensify efforts within existing product lines. Our current products, products under development, and... -

Page 25

... that inordinately impacts the lawn and garden, outdoor power equipment, or irrigation industries generally by promoting the purchase, such as through customer rebate or other incentive programs, of certain types of mowing or irrigation equipment or other products that we sell, could impact us... -

Page 26

... with our distribution channel partners, our success in partnering with new dealers, and our customers' ability to pay amounts owed to us; • a decline in retail sales or financial difficulties of our distributors or dealers, which could cause us to repurchase financed product; and • continued... -

Page 27

... Products Manufactured / Use Corporate headquarters, warehouse, and test lab Components for professional and residential products and distribution center Residential and professional distribution center Professional and residential parts distribution center Professional and residential products... -

Page 28

...Exmark and Sitework Systems Businesses and our Information Services function. In September 2010, he also assumed responsibility for our Micro-Irrigation Business and Corporate Accounts. From November 2007 to February 2009, he served as Chief Information Officer and Vice President, Corporate Services... -

Page 29

PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is listed for trading on the New York Stock Exchange and trades under the symbol ''TTC.'' The high, low, and last sales prices for our common stock and cash ... -

Page 30

... $40 $20 $0 2007 2008 2009 2010 2011 2012 The Toro Company S&P 500 Peer Group 17DEC201218291643 *$100 invested on 10/31/07 in stock or index, including reinvestment of dividends. Fiscal year ending October 31. Fiscal year ending October 31 The Toro Company S&P 500 Peer Group 2007 $100.00 100.00... -

Page 31

... define new products as those introduced in the current and previous two fiscal years. OVERVIEW We design, manufacture, and market professional turf maintenance equipment and services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and 25 -

Page 32

... of snow thrower products and service parts due to reduced demand resulting from the lack of snowfall during the 2011-2012 winter season. However, sales of walk power mowers, zero-turn radius riding mowers, and trimmers were up due to positive customer response to newly introduced products and... -

Page 33

... migrate to zero-turn radius mowers from lawn and garden tractors. We also anticipate new products, such as our new twostage snow thrower products and extension of our lithium-ion battery-powered home solutions products, to be well received by customers in fiscal 2013. • International markets will... -

Page 34

...of new and enhanced products that were well received by customers and resulted in increased sales, strong demand for domestic golf and landscape contractor equipment as customers replaced their aged inventory, continued acceptance and demand for our drip irrigation solutions for agricultural markets... -

Page 35

... addition, riding product sales increased primarily from positive customer acceptance for our new line of zero-turn radius riding mowers. However, sales of walk power mowers and electric blowers were down due mainly to unfavorable weather conditions. • An increase in international net sales in for... -

Page 36

... for golf courses and related investments in equipment, which contributed to higher sales of our golf equipment products. • Increased net sales of micro-irrigation products due to continued acceptance and demand for our drip irrigation solutions for agricultural markets, additional manufacturing... -

Page 37

... of walk power mowers, zero-turn radius riding mowers, and trimmers due to positive customer response to newly introduced products and favorable weather conditions that drove strong demand. • Increased sales of Pope products in Australia due to more favorable weather conditions in fiscal 2012... -

Page 38

... improved to 35 days in fiscal 2012 compared to 37 days in fiscal 2011 primarily as a result of lower international sales in fiscal 2012 compared to fiscal 2011 that generally have longer payment terms. Average net inventories increased by 7.5 percent in fiscal 2012 compared to fiscal 2011 as we... -

Page 39

... net earnings and lower repurchases of shares of our common stock in fiscal 2012 as compared to fiscal 2011. Liquidity and Capital Resources Our businesses are seasonally working capital intensive and require funding for purchases of raw materials used in production, replacement parts inventory... -

Page 40

...for expanding markets and in new markets, help us to meet product demand, and increase our manufacturing efficiencies and capacity. Cash used in investing activities was down 31.7 percent in fiscal 2012 compared to fiscal 2011 due mainly to lower levels of purchases of property, plant, and equipment... -

Page 41

...form of open account terms to home centers and mass retailers; general line irrigation dealers; international distributors and dealers other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; government customers; and rental companies. End-User Financing. We... -

Page 42

... horizontal directional drills for the construction market. On December 9, 2011, during the first quarter of fiscal 2012, we completed the acquisition of certain assets and assumed certain liabilities for a greens roller product line for the golf course market. The aggregate purchase price of these... -

Page 43

... accounts. Each fiscal quarter, we prepare an analysis of our ability to collect outstanding receivables that provides a basis for an allowance estimate for doubtful accounts. In doing so, we evaluate the age of our receivables, past collection history, current financial conditions of key customers... -

Page 44

... from transactions in the normal course of business, such as sales to third party customers, sales and loans to wholly owned foreign subsidiaries, foreign plant operations, and purchases from suppliers. Because our products are manufactured or sourced primarily from the United States and Mexico... -

Page 45

... not able to increase selling prices of our products or obtain manufacturing efficiencies to offset increases in commodity costs. Further information regarding rising prices for commodities is presented in Part II, Item 7, ''Management's Discussion and Analysis of Financial Condition and Results of... -

Page 46

...'s Chairman of the Board, President, and Chief Executive Officer and Vice President, Finance and Chief Financial Officer, evaluated the effectiveness of the company's internal control over financial reporting as of October 31, 2012. In making this evaluation, management used the criteria set forth... -

Page 47

...Independent Registered Public Accounting Firm The Stockholders and Board of Directors The Toro Company: We have audited the accompanying consolidated balance sheets of The Toro Company and subsidiaries as of October 31, 2012 and 2011 and the related consolidated statements of earnings, comprehensive... -

Page 48

... for income taxes Net earnings Basic net earnings per share of common stock Diluted net earnings per share of common stock Weighted-average number of shares of common stock outstanding - Basic Weighted-average number of shares of common stock outstanding - Diluted The financial statements should be... -

Page 49

... (Dollars in thousands) Fiscal years ended October 31 2012 $129,541 (2,532) (528) (88) (3,148) $126,393 2011 $117,658 104 (539) 2,671 2,236 $119,894 2010 $93,237 (640) 681 300 341 $93,578 Net earnings Other comprehensive (loss) income, net of tax: Foreign currency translation adjustments Pension... -

Page 50

... taxes Total current assets Property, plant, and equipment, net Other assets Goodwill Other intangible assets, net Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current portion of long-term debt Short-term debt Accounts payable Accrued liabilities: Warranty Advertising and marketing programs... -

Page 51

...: Purchases of property, plant, and equipment, net Proceeds from asset disposals Distributions from (investments in) finance affiliate, net Other Acquisitions, net of cash acquired Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: (Decrease) increase in short-term debt, net... -

Page 52

... comprehensive income Net earnings Balance as of October 31, 2011 Cash dividends paid on common stock - $0.44 per share Issuance of 1,664,835 shares under stock-based compensation plans Contribution of stock to a deferred compensation trust Purchase of 2,604,525 shares of common stock Excess tax... -

Page 53

...for-one stock split is also reflected in the share amounts in all periods presented in this report. Receivables The company's financial exposure to collection of accounts receivable is reduced due to its Red Iron Acceptance, LLC (''Red Iron'') joint venture with TCF Inventory Finance, Inc. (''TCFIF... -

Page 54

... assets. Buildings, including leasehold improvements, are generally depreciated over 10 to 45 years, and equipment over two to seven years. Tooling costs are generally depreciated over three to five years using the straight-line method. Software and web site development costs are generally amortized... -

Page 55

... of the company's foreign operations is the applicable local currency. The functional currency is translated into U.S. dollars for balance sheet accounts using current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using a weighted-average exchange rate... -

Page 56

... not offer a right of return for products shipped to the key retailer's stores from the seasonal distribution centers. From time to time, the company also stores inventory on a consignment basis at other customers' locations. The amount of consignment inventory as of October 31, 2012 and 2011 was... -

Page 57

... are used by the company as a marketing tool to assist customers to buy inventory. The financing costs for distributor and dealer inventories were $19,492, $16,394, and $14,490 for the fiscal years ended October 31, 2012, 2011, and 2010, respectively. that the weighted-average number of shares of... -

Page 58

... directional drills for the underground utilities market. On December 9, 2011, during the first quarter of fiscal 2012, the company completed the acquisition of certain assets and assumed certain liabilities for a greens roller product line for the golf course market. The aggregate purchase price... -

Page 59

... for the advances paid by Red Iron to the company. The net amount of new receivables financed for dealers and distributors under this arrangement during fiscal 2012 and 2011 was $1,191,343 and $1,111,778, respectively. Summarized financial information for Red Iron is presented as follows: For... -

Page 60

...86,400 5,765 (145) $92,020 (20) $92,000 Patents Non-compete agreements Customer related Developed technology Trade name Other Total amortizable Non-amortizable - trade names Total other intangible assets, net Estimated Life (Years) 5-13 2-10 5-13 2-10 5 Gross Carrying Amount $ 9,403 6,250 8,189 25... -

Page 61

... required to make an offer to purchase the senior notes at a price equal to 101% of the principal amount of the senior notes plus accrued and unpaid interest to the date of repurchase. In connection with the issuance in June 1997 of $175,000 in long-term debt securities, the company paid $23,688 to... -

Page 62

... original amount of 3 million shares in connection with the company's two-for-one stock split discussed above) in open-market or in privately negotiated transactions. This program has no expiration date but may be terminated by the Board at any time. During fiscal 2012, 2011, and 2010, the company... -

Page 63

... closing price of the company's common stock on the date of grant, as reported by the New York Stock Exchange. Options are generally granted to officers, other employees, and non-employee members of the company's Board of Directors on an annual basis in the first quarter of the company's fiscal year... -

Page 64

... achievement of performance goals of the company, which are generally measured over a three-year period. The number of shares of common stock a participant receives will be increased (up to 200 percent of target levels) or reduced (down to zero) based on the level of achievement of performance goals... -

Page 65

...168) $(117) Defined Benefit Pension Plans Net actuarial loss Net prior service cost (credit) Total $523 54 $577 Total $574 (114) $460 The company's businesses are organized, managed, and internally grouped into segments based on differences in products and services. Segment selection was based on... -

Page 66

...properties, agricultural fields, and residential and commercial landscapes, as well as directly to government customers, rental companies, and large retailers. The Residential business segment consists of walk power mowers, riding mowers, snow throwers, replacement parts, and home solutions products... -

Page 67

.... See Note 3 for additional information related to Red Iron. Some products sold to independent dealers in Australia finance their products with a third party finance company. This third party financing company purchased $23,727 of receivables from the company during fiscal 2012. As of October 31... -

Page 68

... its exposure to the variability in future cash flows for forecasted trade sales and purchases is two years. Results of hedges of intercompany loans are recorded in other income, net as an offset to the remeasurement of the foreign loan balance. The company formally assesses, at a hedge's inception... -

Page 69

... which hedge accounting is discontinued and the derivative remains outstanding, the company carries the derivative at its fair value on the consolidated balance sheet, recognizing future changes in the fair value in other income, net. For the fiscal years ended October 31, 2012 and 2011, there were... -

Page 70

... (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). The framework utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to... -

Page 71

...flows using the rate at which similar amounts of debt could currently be borrowed. 16 QUARTERLY FINANCIAL DATA (unaudited) Summarized quarterly financial data for fiscal 2012 and 2011 are as follows: Fiscal year ended October 31, 2012 Quarter Net sales Gross profit Net earnings Basic net earnings... -

Page 72

... fourth fiscal quarter ended October 31, 2012 that has materially affected, or is reasonably likely to materially affect, the company's internal control over financial reporting. ITEM 9B.OTHER INFORMATION None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE Information on... -

Page 73

... the caption ''Corporate Governance - Director Independence'' and ''Corporate Governance - Policies and Procedures Regarding Related Person Transactions'' in the company's proxy statement for its 2013 Annual Meeting of Shareholders to be filed with the SEC. ITEM 12. SECURITY OWNERSHIP OF CERTAIN... -

Page 74

...quarter ended May 4, 2012, Commission File No. 1-8649).** 2.6 Receivable Purchase Agreement by and among Toro Credit Company, as Seller, The Toro Company, and Red Iron Acceptance, LLC, as Buyer (incorporated by reference to Exhibit 2.1 to Registrant's Current Report on Form 8-K dated October 1, 2009... -

Page 75

... the quarter ended May 1, 2009, Commission File No. 1-8649).* 10.11 Form of Nonqualified Stock Option Agreement between The Toro Company and its Non-Employee Directors under The Toro Company 2000 Directors Stock Plan (incorporated by reference to Exhibit 10.20 to Registrant's Annual Report on Form... -

Page 76

... to Exhibit 10.1 to Registrant's Current Report on Form 8-K dated August 12, 2009, Commission File No. 1-8649). 10.26 (1) First Amendment to Credit and Security Agreement, dated June 6, 2012, by and between Red Iron Acceptance, LLC and TCF Inventory Finance, Inc. (incorporated by reference to... -

Page 77

...,002 2 Provision consists of rebates, cooperative advertising, floor planning costs, commissions, and other promotional program expenses. The expense of each program is classified either as a reduction of net sales or as a component of selling, general, and administrative expense. Claims paid. 71 -

Page 78

...Officer and Director (principal executive officer) Vice President, Finance and Chief Financial Officer (principal financial officer) Vice President, Corporate Controller (principal accounting officer) Director Director Director Director Director Director Director Director Director December 21, 2012... -

Page 79

...and between Red Iron Holding Corporation, a Delaware corporation ("Toro Sub"), and TCFIF Joint Venture I, LLC, a Minnesota limited liability company ("TCFIF Sub"). Toro Sub and TCFIF Sub are individually referred to herein as a "Member" and, collectively, as the "Members." Defined terms used but not... -

Page 80

3. The Schedule of Definitions to the Agreement shall be amended with the addition of the following: Term Policies Section No. 6.02(h) 2 -

Page 81

IN WITNESS WHEREOF, the Members have duly executed this Amendment as of the day and year first above written. RED IRON HOLDING CORPORATION /s/ Stephen R. Wolfe Name: Stephen R. Wolfe Title: CFO TCFIF JOINT VENTURE I, LLC /s/ Rosario A. Perrelli Name: Rosario A. Perrelli Title: President and CEO 3 -

Page 82

... Date"), between The Toro Company, a Delaware corporation ("Toro"), and [_participant_] ("you") sets forth the terms and conditions of the grant to you of a restricted stock unit ("RSU") award (this "RSU Award") relating to [# of shares] shares of common stock, par value $1.00 per share, of Toro... -

Page 83

...[the/each] date as of which Award Shares subject to this RSU Award become vested pursuant to Section 1 of this Agreement, Toro shall direct its transfer agent to issue such number of Award Shares in your name or a nominee in book entry or to issue one or more physical stock certificates representing... -

Page 84

... an on-line or electronic system established and maintained by Toro or a third party designated by Toro. 11. Governing Law. This Agreement and the RSU Award Acceptance Agreement shall be construed, administered and governed in all respects under and by the applicable laws of the State of Delaware... -

Page 85

.... 15. Non-Negotiable Terms. The terms of this Agreement and the RSU Award Acceptance Agreement are not negotiable, but you may refuse to accept this RSU Award by notifying Toro's Vice President, Secretary and General Counsel, or Director, Total Rewards and HR Services, as applicable, in writing... -

Page 86

IN WITNESS WHEREOF, this Agreement has been executed and delivered by Toro and has been executed by you by execution of the attached RSU Award Acceptance Agreement. [grant date] By: Chairman and CEO 5 -

Page 87

... AGREEMENT I hereby agree to the terms and conditions governing this RSU Award as set forth in the Restricted Stock Unit Award Agreement, this RSU Award Acceptance Agreement and as supplemented by the terms and conditions set forth in the Plan. In accepting this RSU Award, I hereby acknowledge... -

Page 88

... future Prospectuses relating the Plan and copies of all reports, proxy statements and other communications distributed to Toro's security holders generally by email directed to my Toro email address. Note: If you do not wish to accept this RSU Award on the terms stated in the Restricted Stock Unit... -

Page 89

...TORO COMPANY AND SUBSIDIARIES Computation of Ratio of Earnings to Fixed Charges (Not Covered by Independent Auditors' Report) 10/31/2012 10/31/2011 10/31/2010 10/31/2009 10/31/2008 Earnings before income taxes Plus...,430,532 7.93 Interest expense Rentals (interest expense) Total fixed charges... -

Page 90

...Inc. Irritrol Systems Europe S.r.l. Irritrol Systems Europe Productions S.r.l. MTI Distributing, Inc. Rain Master Irrigation Systems, Inc. Red Iron Acceptance, LLC Red Iron Holding Corporation Red Iron Insurance, Limited The ShopToro Company Toro Australia Pty. Limited Toro Australia Group Sales Pty... -

Page 91

...' equity and related financial statement schedule for each of the years in the three year period ended October 31, 2012, and the effectiveness of internal control over financial reporting as of October 31, 2012, which report is included in the Annual Report on Form 10-K of The Toro Company. /s/ KPMG... -

Page 92

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: December 21, 2012 /s/ Michael J. Hoffman Michael J. Hoffman Chairman of the Board, President and Chief Executive Officer (Principal Executive... -

Page 93

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: December 21, 2012 /s/ Renee J. Peterson Renee J. Peterson Vice President, Finance and Chief Financial Officer (Principal Financial Officer) -

Page 94

... 31, 2012 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), we, Michael J. Hoffman, Chairman of the Board, President and Chief Executive Officer of the Company, and Renee J. Peterson, Vice President, Finance and Chief Financial Officer of the Company, certify... -

Page 95

... H. Nassau Retired Regional Director of Corporate Accounts F2 Intelligence Group William E. Brown, Jr. Group Vice President, International and Commercial Businesses Richard M. Olson Vice President, Exmark James C. O'Rourke Gary L. Ellis Senior Vice President and Chief Financial Ofï¬cer Medtronic... -

Page 96

... strategies to increase share in the rapidly expanding micro irrigation agricultural business. We also continue to execute acquisitions that expand our offerings to existing customers and explore new markets. Installed by many of the same contractors that purchase our irrigation products, and sold... -

Page 97

The Toro Company 8111 Lyndale Avenue South Bloomington, MN 55420-1196 952-888-8801 www.thetorocompany.com