Supervalu 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Supervalu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

FISCAL 2011

Table of contents

-

Page 1

ANNUAL REPORT FISCAL 2011 -

Page 2

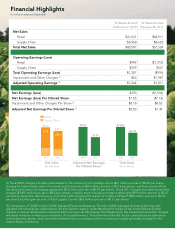

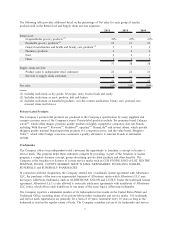

Financial Highlights (In millions except per share data) 52 Weeks Ended February 27, 2010 52 Weeks Ended February 26, 2011 Net Sales Retail Supply Chain TPtal Net Sales Operating Earnings (LPss) Retail Supply Chain TPtal Operating Earnings (LPss) Impairment and Other Charges (1) $31,637 $8,960 $... -

Page 3

...Lot. We opened 142 new hard-discount Save-A-Lot stores, including ten co-branded locations operated by Rite-Aid and six Hispanic-oriented stores in Texas. Fiscal 2011 marks the first year since 2005 that Save-A-Lot has meaningfully grown its retail store count. The company remains on track to double... -

Page 4

... operations and retail shrink. Funding from our transformative programs has already been identified and I am encouraged with the progress we have made to date. Looking forward to fiscal 2012, we are acting with a sense of urgency to improve sales and drive returns for our shareholders as we execute... -

Page 5

... FLYING CLOUD DRIVE EDEN PRAIRIE, MINNESOTA (Address of principal executive offices) 41-0617000 (I.R.S. Employer Identification No.) 55344 (Zip Code) Registrant's telephone number, including area code: (952) 828-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class... -

Page 6

... ...Legal Proceedings ...Removed and Reserved...PART II 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...6. Selected Financial Data ...7. Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 7

... resources to fund new store growth and remodeling activities that achieve appropriate returns on capital investment Competitive Practices k The Company's ability to attract and retain customers k The Company's ability to hire, train or retain employees k Competition from other food or drug retail... -

Page 8

...that affect the Company and the Company's customers or suppliers k Unseasonably adverse climate conditions that impact the availability or cost of certain products in the grocery supply chain Accounting Matters k Changes in accounting standards that impact the Company's financial statements Goodwill... -

Page 9

... formerly owned by Albertson's, Inc. ("Albertsons") operating approximately 1,125 stores under the banners of Acme, Albertsons, Jewel-Osco, Shaw's, Star Market, the related in-store pharmacies under the Osco and Sav-on banners, 10 distribution centers and certain regional and corporate offices (the... -

Page 10

... distribution to both the Company's own stores and stores of independent retail customers. The Company operates 1,114 traditional retail food stores under the Acme, Albertsons, Cub Foods, Farm Fresh, Hornbacher's, Jewel-Osco, Lucky, Shaw's, Shop 'n Save, Shoppers Food & Pharmacy and Star Market... -

Page 11

... business concept, group advertising, private-label products and other benefits. The Company is the franchisor or licensor of certain service marks such as CUB FOODS, SAVE-A-LOT, SENTRY, FESTIVAL FOODS, COUNTY MARKET, SHOP 'N SAVE, NEWMARKET, FOODLAND, JUBILEE, SUPERVALU and SUPERVALU PHARMACIES. In... -

Page 12

..., brand recognition, store location, in-store marketing and merchandising, promotional strategies and other competitive activities. The traditional wholesale distribution component of the Company's Supply chain services business competes directly with a number of traditional grocery wholesalers. The... -

Page 13

... and Legal 2010 2006 Executive Vice President; President and Chief Operating Officer, Supply Chain Services, 2006-2011 Executive Vice President Market and Real Estate Development, 2010; Senior Vice President Real Estate and Store Development, 2006-2010 Vice President, Chief Financial Officer Supply... -

Page 14

... as President and CEO of the Americas for Wal-Mart Stores, Inc., from 2004 to 2009. (2) Julie Dexter Berg was appointed Executive Vice President, Chief Marketing Officer in March 2010. Prior to joining the Company, Ms. Dexter Berg was the Managing Partner at Brandmaking LLC, a marketing strategy... -

Page 15

...independent retail customers, (ii) decreases in sales volume due to increased difficulty in selling the Company's products and (iii) difficulty in attracting and retaining customers. Any of these outcomes may adversely affect the Company's financial condition and results of operations. Food and drug... -

Page 16

...comply with numerous provisions regulating health and sanitation standards, equal employment opportunity, minimum wages and licensing for the sale of food, drugs and alcoholic beverages. The Company's inability to timely obtain permits, comply with government regulations or make capital expenditures... -

Page 17

... may cause physical damage to the Company's properties, closure of one or more of the Company's stores or distribution facilities, lack of an adequate work force in a market, temporary disruption in the supply of products, disruption in the transport of goods, delays in the delivery of goods to the... -

Page 18

... on the Company's financial condition, results of operations or cash flows. In September 2008, a class action complaint was filed against the Company, as well as International Outsourcing Services, LLC ("IOS"), Inmar, Inc., Carolina Manufacturer's Services, Inc., Carolina Coupon Clearing, Inc. and... -

Page 19

... on the information presently available to the Company, management does not expect that the ultimate resolution of this lawsuit will have a material adverse effect on the Company's financial condition, results of operations or cash flows. In December 2008, a class action complaint was filed in the... -

Page 20

... II ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The Company's common stock is listed on the New York Stock Exchange under the symbol SVU. As of April 15, 2011, there were 14,962 stockholders of record. Common Stock Price... -

Page 21

... compares the yearly change in the Company's cumulative shareholder return on its common stock for the period from the end of fiscal 2006 to the end of fiscal 2011 to that of the Standard & Poor's ("S&P") 500 and a group of peer companies in the retail grocery industry. The stock price performance... -

Page 22

... hard-discount food stores and is adjusted for planned sales and closures as of the end of each fiscal year. Historical data is not necessarily indicative of the Company's future results of operations or financial condition. See discussion of "Risk Factors" in Part I, Item 1A of this Annual Report... -

Page 23

... to fund retail store remodeling activity and new hard-discount stores. The following discussion summarizes operating results in fiscal 2011 compared to fiscal 2010 and for fiscal 2010 compared to fiscal 2009. Comparability is affected by income and expense items that fluctuated significantly... -

Page 24

... value-focused competitive activity and the impact of the challenging economic environment on consumers. During fiscal 2011 the Company added 132 new stores through new store development, comprised of 3 traditional retail food stores and 129 hard-discount food stores, and sold or closed 87 stores... -

Page 25

... 52-week period for both years. Identical store retail sales performance was primarily the result of a challenging economic environment, heightened competitive activity and investments in price and promotions. During fiscal 2010, the Company added 40 new stores through new store development and sold... -

Page 26

... the Retail food segment due to the significant decline in the market price of the Company's common stock as of the end of the third quarter of fiscal 2009 as well as the impact of the unprecedented decline in the economy on the Company's plan. Operating Earnings (Loss) Operating earnings for fiscal... -

Page 27

... locations in the Company's stores; supporting the introduction of new products into the Company's retail stores and distribution system; exclusivity rights in certain categories; and to compensate for temporary price reductions offered to customers on products held for sale at retail stores... -

Page 28

total vendor funds earned, including advertising allowances, with no offsetting changes to the base price on the products purchased, would impact gross profit by less than 10 basis points. Inventories Inventories are valued at the lower of cost or market. Substantially all of the Company's inventory... -

Page 29

.... The Company's reporting units are the operating segments of the business which consist of traditional retail stores, hard-discount stores, and supply chain services. Fair values are determined by using both the market approach, applying a multiple of earnings based on guideline for publicly traded... -

Page 30

...As of February 26, 2011, each 25 basis point change in the discount rate would impact the self-insurance liabilities by approximately $1. Benefit Plans The Company sponsors pension and other postretirement plans in various forms covering substantially all employees who meet eligibility requirements... -

Page 31

... on plan assets would increase pension expense by approximately $4. Similarly, for postretirement benefits, a 100 basis point change in the healthcare cost trend rate would impact the accumulated postretirement benefit obligation as of the end of fiscal 2011 by approximately $12 and the service and... -

Page 32

...Net earnings, adjusted for the impact of noncash impairment charges, depreciation and amortization and LIFO expense, substantially offset by the changes in deferred income taxes and operating assets and liabilities. Net cash used in investing activities was $227, $459 and $1,014 in fiscal 2011, 2010... -

Page 33

...The Company's dividend policy will continue to emphasize a high level of earnings retention for growth. Capital spending for fiscal 2011 was $604, including $7 of capital leases. Capital spending primarily included store remodeling activity, new retail stores and technology expenditures. The Company... -

Page 34

.... These contracts primarily relate to the Company's commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services to the Company and agreements to indemnify officers, directors and employees in the performance of their work. While... -

Page 35

... related to sponsored defined benefit pension and postretirement benefit plans and deferred compensation plans. The defined benefit pension plan has plan assets of approximately $1,896 as of the end of February 26, 2011. The Company's purchase obligations include various obligations that have annual... -

Page 36

... years ended February 26, 2011, February 27, 2010 and February 28, 2009 Notes to Consolidated Financial Statements Unaudited Quarterly Financial Information Financial Statement Schedule: Schedule II - Valuation and Qualifying Accounts All other schedules are omitted because they are not applicable... -

Page 37

... related consolidated statements of earnings, stockholders' equity, and cash flows for each of the fiscal years in the three-year period ended February 26, 2011. In connection with our audits of the consolidated financial statements, we have also audited the accompanying financial statement schedule... -

Page 38

... FINANCIAL INFORMATION (In millions) February 26, 2011 (52 weeks) Net sales Retail food % of total Supply chain services % of total Total net sales Operating earnings (loss) Retail food % of sales Supply chain services % of sales Corporate Total operating earnings (loss) % of sales Interest expense... -

Page 39

SUPERVALU INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (In millions, except per share data) February 26, 2011 (52 weeks) Net sales Cost of sales Gross profit Selling and administrative expenses Goodwill and intangible asset impairment charges Operating earnings (loss) Interest Interest ... -

Page 40

... 7,026 3,698 1,493 508 16,436 February 27, 2010 $ $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ Accrued vacation, compensation and benefits Current maturities of long-term debt and capital lease obligations Other current liabilities Total current liabilities Long... -

Page 41

...activity (net of tax of $261) Sales of common stock under option plans Cash dividends declared on common stock $0.6875 per share Compensation under employee incentive plans Purchase of shares for treasury Balances as of February 28, 2009 Net earnings Pension and other postretirement activity (net of... -

Page 42

... from the sale of common stock under option plans and related tax benefits Payment for purchase of treasury shares Other Net cash used in financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year $ (1,510... -

Page 43

... the United States grocery channel. SUPERVALU conducts its retail operations under the Acme, Albertsons, Cub Foods, Farm Fresh, Hornbacher's, Jewel-Osco, Lucky, Save-A-Lot, Shaw's, Shop 'n Save, Shoppers Food & Pharmacy and Star Market banners as well as in-store pharmacies under the Osco and Sav-on... -

Page 44

... life of the contracts. Selling and Administrative Expenses Selling and administrative expenses consist primarily of store and corporate employee-related costs, such as salaries and wages, health and welfare, worker's compensation and pension benefits, as well as rent, occupancy and operating costs... -

Page 45

... Company's reporting units are the operating segments of the business which consist of traditional retail stores, hard-discount stores and supply chain services. Fair values are determined by using both the market approach, applying a multiple of earnings based on guideline publicly traded companies... -

Page 46

... the end of the fiscal year are net of discounts of $178 and $191 as of February 26, 2011 and February 27, 2010, respectively. Benefit Plans The Company recognizes the funded status of its sponsored defined benefit plans in its Consolidated Balance Sheets and gains or losses and prior service costs... -

Page 47

...The Company uses the straight-line method to recognize compensation expense based on the fair value on the date of grant, net of the estimated forfeiture rate, over the requisite service period related to each award. The fair value of stock options is estimated using the Black-Scholes option pricing... -

Page 48

... quarter of fiscal 2011 the Company's stock price had a significant and sustained decline and book value per share substantially exceeded the stock price. As a result, the Company completed an impairment review and recorded non-cash impairment charges of $1,840 related to the Retail food segment... -

Page 49

...to the reserves for closed properties and property, plant and equipment-related impairment charges for fiscal 2011, 2010 and 2009 were primarily related to the Retail food segment, and were recorded as a component of Selling and administrative expenses in the Consolidated Statements of Earnings. 45 -

Page 50

...-Related Impairment Charges were measured at fair value using Level 3 inputs. Financial Instruments For certain of the Company's financial instruments, including cash and cash equivalents, receivables and accounts payable, the fair values approximate book values due to their short maturities... -

Page 51

...the debt and capital lease obligations, as of February 26, 2011 consist of the following: Fiscal Year 2012 2013 2014 2015 2016 Thereafter $ 338 806 340 514 568 3,281 Certain of the Company's credit facilities and long-term debt agreements have restrictive covenants and crossdefault provisions which... -

Page 52

... was $1,678. The Company also had $4 of outstanding letters of credit issued under separate agreements with financial institutions. These letters of credit primarily support workers' compensation, merchandise import programs and payment obligations. Facility fees under the non-extended and extended... -

Page 53

NOTE 7-LEASES The Company leases certain retail stores, distribution centers, office facilities and equipment from third parties. Many of these leases include renewal options and, to a limited extent, include options to purchase. Future minimum lease payments to be made by the Company for ... -

Page 54

...15 Fiscal Year 2012 2013 2014 2015 2016 Thereafter Total minimum lease receipts Less unearned income Net investment in direct financing leases Less current portion Long-term portion $ The carrying value of owned property leased to third parties under operating leases was as follows: 2011 Property... -

Page 55

... on tax positions related to prior years Decrease due to lapse of statute of limitations Ending balance $ 133 18 (1) 41 (9) - 182 $ 2010 114 7 (4) 34 (14) (4) 133 $ 2009 146 5 - 22 (37) (22) 114 $ $ $ Included in the balance of unrecognized tax benefits as of February 26, 2011, February 27, 2010... -

Page 56

... awards granted will not be for a term of more than seven years. Stock options are granted to key salaried employees and to the Company's non-employee directors to purchase common stock at an exercise price not less than 100 percent of the fair market value of the Company's common stock on the date... -

Page 57

....94 29.40 3.24 $ 7 Weighted Average Remaining Contractual Term (In years) Aggregate Intrinsic Value (In thousands) $ 21,657 16,645 $ $ 29.64 32.54 3.20 2.54 $ $ 6 - The weighted average grant date fair value of all stock options granted during fiscal 2011, 2010 and 2009 was $3.99, $4.92 and... -

Page 58

...26, 2011, there was $21 of unrecognized compensation expense related to unvested stockbased awards granted under the Company's stock plans. The expense is expected to be recognized over a weighted average remaining vesting period of approximately two years. NOTE 10-TREASURY STOCK PURCHASE PROGRAM On... -

Page 59

... 2011 2010 Change in Benefit Obligation Benefit obligation at beginning of year Service cost Interest cost Transfers Actuarial loss (gain) Benefits paid Benefit obligation at end of year Changes in Plan Assets Fair value of plan assets at beginning of year Actual return on plan assets Employer... -

Page 60

...) Amounts recognized in accumulated other comprehensive losses for the defined benefit pension plans and other postretirement benefit plans consists of the following: Pension Benefits 2011 2010 Prior service benefit Net actuarial loss Total recognized in accumulated other comprehensive losses Total... -

Page 61

... obligations and net periodic benefit cost consisted of the following: 2011 Benefit obligation assumptions: Discount rate(2) Rate of compensation increase Net periodic benefit cost assumptions:(1) Discount rate(2) Rate of compensation increase Expected return on plan assets(3) (1) 5.60% 2.00% 6.00... -

Page 62

... end of fiscal 2011 by approximately $12 and the service and interest cost by approximately $1 for fiscal 2012. Pension Plan Assets Plan assets are held in trust and invested in separately managed accounts and other commingled investment vehicles holding domestic and international equity securities... -

Page 63

... allocation guidelines and the actual allocation of pension plan assets are as follows: Asset Category Domestic equity International equity Private equity Fixed income Real estate Cash and other Total Target 31.8% 15.7% 7.5% 35.0% 10.0% 100.0% 2011 35.5% 18.0% 3.5% 35.6% 7.3% 0.1% 100.0% 2010 42... -

Page 64

...'s benefit plans held in a master trust as of February 26, 2011, by asset category, consisted of the following: Level 1 Common stock Common collective trusts - fixed income Common collective trusts - equity Government securities Mutual funds Corporate bonds Real estate partnerships Private equity... -

Page 65

... Company's common stock as of February 26, 2011 and February 27, 2010. Post-Employment Benefits The Company recognizes an obligation for benefits provided to former or inactive employees. The Company is self-insured for certain of its employees' short-term and long-term disability plans, the primary... -

Page 66

.... These contracts primarily relate to the Company's commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services to the Company and agreements to indemnify officers, directors and employees in the performance of their work. While... -

Page 67

... Financial Information for financial information concerning the Company's operations by reportable segment. The Company's operating segments reflect the manner in which the business is managed and how the Company allocates resources and assesses performance internally. The Company's chief operating... -

Page 68

...long-term financial performance, based on operating earnings as a percent of sales. The Retail food reportable segment derives revenues from the sale of groceries at retail locations operated by the Company (both the Company's own stores and stores licensed by the Company). The Supply chain services... -

Page 69

... quarters of fiscal 2011 and fiscal year 2011 year-to-date, all potentially dilutive shares were antidilutive and therefore excluded from the calculation of Net earnings (loss) per share-diluted. During fiscal 2010 the Company recorded charges of $39, after tax, related to the planned retail market... -

Page 70

SUPERVALU INC. and Subsidiaries SCHEDULE II-Valuation and Qualifying Accounts (In millions) Balance at Beginning of Fiscal Year $ 12 15 20 Balance at End of Fiscal Year $ 8 12 15 Description Allowance for losses on receivables: 2011 2010 2009 Additions 12 6 15 Deductions (16) (9) (20) 66 -

Page 71

...Executive Officer and Chief Financial Officer, in a manner that allows timely decisions regarding required disclosure. Management's Annual Report on Internal Control Over Financial Reporting The financial statements, financial analyses and all other information included in this Annual Report on Form... -

Page 72

... reference into this Annual Report on Form 10-K. ITEM 11. EXECUTIVE COMPENSATION The information called for by Item 11 is incorporated by reference to the Company's definitive Proxy Statement to be filed with the SEC pursuant to Regulation 14A in connection with the Company's 2011 Annual Meeting of... -

Page 73

... of Certain Beneficial Owners" and "Security Ownership of Management." The following table sets forth information as of February 26, 2011 about the Company's common stock that may be issued under all of its equity compensation plans: Equity Compensation Plan Information Number of securities to... -

Page 74

... Statement to be filed with the SEC pursuant to Regulation 14A in connection with the Company's 2011 Annual Meeting of Stockholders under the heading "Board Practices- Policy and Procedures Regarding Transactions with Related Persons." ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES The information... -

Page 75

... registered public accountants, are filed as part of this Annual Report on Form 10-K. (2) Financial Statement Schedules: The consolidated financial statement schedule to the Company listed in the accompanying "Index of Financial Statements and Schedules." (3) Exhibits: (2) Plan of Acquisition... -

Page 76

...(Zero Coupon-Senior), is incorporated herein by reference to Exhibit 4.1 to the Company's Registration Statement on Form S-3 (Registration No. 333-81252) filed with the SEC on January 23, 2002. Indenture dated as of May 1, 1992, between Albertson's, Inc. and Morgan Guaranty Trust Company of New York... -

Page 77

... Form 10-Q for the quarterly period (12 weeks) ended September 11, 2004.* Form of SUPERVALU INC. 2002 Stock Plan Restricted Stock Award Certificate and Restricted Stock Award Terms and Conditions, as amended, is incorporated herein by reference to Exhibit 10.37 to the Company's Annual Report on Form... -

Page 78

... Plan Stock Option Agreement and Stock Option Terms and Conditions for Employees, is incorporated herein by reference to Exhibit 10.29 to the Company's Annual Report on Form 10-K for the year ended February 24, 2007.* Form of Albertson's, Inc. 2004 Equity and Performance Incentive Plan Award... -

Page 79

... ended August 4, 2005.* Form of Albertson's, Inc. 2004 Equity and Performance Incentive Plan Award of Deferrable Restricted Stock Units is incorporated herein by reference to Exhibit 10.62 to the Current Report on Form 8-K of Albertson's, Inc. (Commission File Number 1-6187) filed with the SEC... -

Page 80

Albertson's, Inc. (Commission File Number 1-6187) filed with the SEC on December 20, 2004.* 10.35 SUPERVALU INC. Deferred Compensation Plan for Non-Employee Directors, as amended, is incorporated herein by reference to Exhibit 10.11 to the Company's Annual Report on Form 10-K for the year ended ... -

Page 81

... Report on Form 8-K filed with the SEC on September 27, 2006.* Albertson's, Inc. 2000 Deferred Compensation Plan, dated as of January 1, 2000, is incorporated herein by reference to Exhibit 10.10 to the Annual Report on Form 10-K of Albertson's, Inc. (Commission File Number 16187) for the year ended... -

Page 82

... herein by reference to Exhibit 10.13 to the Annual Report on Form 10-K of Albertson's, Inc. (Commission File Number 1-6187) for the year ended February 2, 1989.* First Amendment to the Albertson's, Inc. Executive Pension Makeup Plan, dated as of June 8, 1989, is incorporated herein by reference... -

Page 83

... Inc. Executive Pension Makeup Trust, dated as of March 31, 2000, is incorporated herein by reference to Exhibit 10.18.4 to the Annual Report on Form 10-K of Albertson's, Inc. (Commission File Number 1-6187) for the year ended February 1, 2001.* Albertson's, Inc. 1990 Deferred Compensation Plan is... -

Page 84

... by reference to Exhibit 10.21.3 to the Annual Report on Form 10-K of Albertson's, Inc. (Commission File Number 1-6187) for the year ended January 30, 2003.* Amendment to the Albertson's, Inc. Non-Employee Directors' Deferred Compensation Plan, dated as of December 22, 2003, is incorporated herein... -

Page 85

... Compensation Trust, dated as of March 31, 2000, is incorporated herein by reference to Exhibit 10.23.1 to the Annual Report on Form 10-K of Albertson's, Inc. (Commission File Number 1-6187) for the year ended February 1, 2001.* 10.103 American Stores Company Supplemental Executive Retirement Plan... -

Page 86

...1, 2004, by and between Albertson's, Inc. and Atlantic Trust Company, N.A. is incorporated herein by reference to Exhibit 10.62 to the Quarterly Report on Form 10-Q of Albertson's, Inc. (Commission File Number 1-6187) for the quarter ended November 3, 2005.* 10.107 SUPERVALU INC. 2007 Stock Plan, as... -

Page 87

10.117 SUPERVALU INC. 2007 Stock Plan Form of Restricted Stock Award Terms and Conditions is incorporated herein by reference to Exhibit 10.7 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 14, 2008.* 10.118 Excess Plan Agreement for Michael L. Jackson dated May 27, 2008 by... -

Page 88

... herein by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q filed with the SEC on October 20, 2010.* 10.133 Severance Agreement and General Release, dated November 18, 2010, by and among SUPERVALU INC and David L. Boehnen, is incorporated herein by reference to Exhibit 10... -

Page 89

... Data File. 101. The following materials from the SUPERVALU INC. Annual Report on Form 10-K for the fiscal year ended February 26, 2011 formatted in Extensible Business Reporting Language (XBRL): (i) the Consolidated Segment Financial Information (ii) the Consolidated Statements of Earnings, (iii... -

Page 90

... Exchange Act of 1934, SUPERVALU has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. SUPERVALU INC. (Registrant) DATE: April 21, 2011 By: /s/ CRAIG R. HERKERT Craig R. Herkert Chief Executive Officer Pursuant to the requirements... -

Page 91

...C. SALES, Non-Executive Chairman Businessperson, Retired Vice Chairman, Canadian Tire Corporation, Ltd. A retail, financial service and petroleum company DAVID E. PYLIPOW Executive Vice President, Human Resources & Communications WAYNE R. SHURTS Executive Vice President & Chief Information Officer... -

Page 92

P.O. Box 990 Minneapolis, MN 55440 952-828-4000 www.supervalu.com