Supervalu 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Supervalu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ÈANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended February 22, 2003

OR

‘TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 1-5418

SUPERVALU INC.

(Exact name of registrant as specified in its charter)

Delaware 41-0617000

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

11840 Valley View Road

Eden Prairie, Minnesota

(Address of principal executive offices)

55344

(Zip Code)

Registrant’s telephone number, including area code: (952) 828-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $1.00 per share New York Stock Exchange

Preferred Share Purchase Rights New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes ÈNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ‘

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes ÈNo ‘

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 7, 2002

was approximately $2,818,177,041 (based upon the closing price of Registrant’s Common Stock on the New

York Stock Exchange on September 7, 2002).

Number of shares of $1.00 par value Common Stock outstanding as of April 15, 2003: 133,783,038

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s definitive Proxy Statement filed for the Registrant’s 2003 Annual Meeting of

Stockholders are incorporated by reference into Part III, as specifically set forth in Part III.

Table of contents

-

Page 1

... SUPERVALU INC. (Exact name of registrant as specified in its charter) (State or other jurisdiction of incorporation or organization) Delaware (I.R.S. Employer Identification No.) 41-0617000 11840 Valley View Road Eden Prairie, Minnesota (Address of principal executive offices) 55344 (Zip Code... -

Page 2

...The company's principal executive offices are located at 11840 Valley View Road, Eden Prairie, Minnesota 55344 (Telephone: 952-828-4000). Unless the discussion in this Annual Report on Form 10-K indicates otherwise, all references to the "company," "SUPERVALU" or "Registrant" relate to SUPERVALU INC... -

Page 3

..., the company anticipates opening approximately 75 to 100 new extreme value stores and 8 to 12 regional banner stores and to continue its store remodeling program, including the conversion of the Baltimore-based Metro grocery store network to the Shoppers Food Warehouse banner. Extreme Value Stores... -

Page 4

... product under such private labels as SHOPPERS VALUE and BI-RITE. SUPERVALU supplies private label merchandise over a broad range of products in the majority of departments in the store. These products are produced to the company's specifications by many suppliers. Logistics Network. The company... -

Page 5

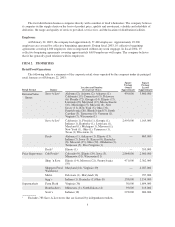

... and Number of Corporate Stores ExtremeValue Stores Save-A-Lot1 Save-A-Lot2 Deals Price Superstores Deals3 Cub Foods4 Shop 'n Save Supermarkets Shoppers Food Warehouse Metro Delaware (1), Maryland (16) bigg's Indiana (1), Kentucky (1),Ohio (9) Farm Fresh Virginia (36) Hornbacher's Minnesota... -

Page 6

... Region Location and Number of Distribution Centers Central Region Midwest Region Northern Region New England Region Northwest Region Southeast Region Eastern Region Additional Property Indiana (1), Ohio (1), Pennsylvania (2), West Virginia (1) Illinois (2), Missouri (1), Wisconsin (2) Minnesota... -

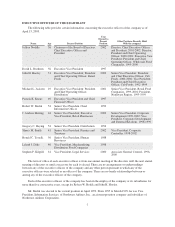

Page 7

... Vice President, Finance and Treasurer Senior Vice President, Human Resources Vice President, Merchandising, Distribution Food Companies Vice President, Legal Services 1994 2002 1988 1998 2000 Associate General Counsel, 19962000 The term of office of each executive officer is from one annual... -

Page 8

...Chief Executive Officer of Department 56, Inc. (a designer, importer and distributor of fine quality collectibles and other giftware products), 1997present Director of Wells Fargo & Company Chairman and Chief Executive Officer of GAGE Marketing Group, L.L.C. (an integrated marketing services company... -

Page 9

... "Executive Officers of the Registrant" above. Director of Donaldson Company, Inc. and General Cable Corporation Trustee of the Papermill Playhouse (the State Theatre of New Jersey) Clinical Professor of Finance and Management at J.L. Kellogg Graduate School of Management at Northwestern University... -

Page 10

... cost of sales against net sales relating to certain facilitative services it provided between its independent retailers and vendors related to products typically known as Direct Store Delivery (DSD) products. For additional information, please see the note on Summary of Significant Accounting... -

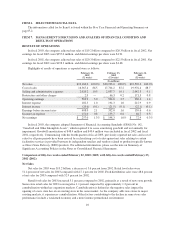

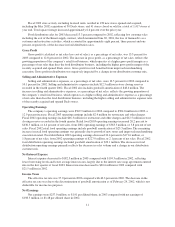

Page 11

... net sales than does the food distribution business, including the higher gross profit margin of the recently acquired and opened Deals stores. Gross profit in retail benefited from improved merchandising execution. Gross profit in distribution was negatively impacted by a change in our distribution... -

Page 12

... gross profit margin as a percentage of net sales than does the food distribution business and improved merchandising execution in retail. In 2001, gross profit includes $17.1 million in cost of sales for inventory markdowns related to restructure activities. Selling and Administrative Expenses... -

Page 13

... compared with 2001 weighted average diluted shares of 132.8 million, reflecting the net impact of stock option activity and shares repurchased under the treasury stock program. RESTRUCTURE AND OTHER CHARGES In the fourth quarter of fiscal 2003, the company recognized pre-tax restructure and other... -

Page 14

...real estate market, including $19.1 million for increased lease liabilities in exiting the non-core retail markets and the disposal of non-core assets, offset by a net decrease of $1.3 million in restructure reserves for the consolidation of distribution centers. In the fourth quarter of fiscal 2003... -

Page 15

... real estate and unpaid employee benefits. Details of the fiscal 2001 restructure activity for fiscal 2003 are as follows: Balance February 23, 2002 Fiscal Fiscal 2003 2003 Usage Adjustment (In thousands) Balance February 22, 2003 Lease related costs: Consolidation of distribution centers Exit... -

Page 16

... net future payments on exited real estate and employee related costs, net of after-tax proceeds from the sale of owned properties. Cash outflows will be funded by cash from operations. Fiscal 2003 net earnings include $.06 per diluted share of after-tax benefit as a result of the restructure plans... -

Page 17

... flows are less than the assets' carrying value. The company estimates net future cash flows based on its experience and knowledge of the market in which the closed property is located and, when necessary, utilizes local real estate brokers. It is management's intention to dispose of properties or... -

Page 18

... weighted average discount rates used in determining the benefit obligation were 7.0% and 7.25% for fiscal 2003 and 2002, respectively. Goodwill Management assesses the valuation of goodwill for each of the company's reporting units on an annual basis through the comparison of the fair value of the... -

Page 19

... borrowings secured by eligible accounts receivable. Outstanding borrowings under this program as of February 22, 2003 and February 23, 2002 were $80.0 million and $0, respectively, and are reflected in Notes Payable in the Consolidated Balance Sheets. In November 2001, the company sold zero-coupon... -

Page 20

...company's retail food business and includes approximately 8 to 12 regional banner stores and approximately 75 to 100 new extreme value stores, including extreme value general merchandise stores. The balance of the fiscal 2004 capital budget relates to distribution maintenance capital and information... -

Page 21

...At February 22, 2003, the estimated market value of the properties underlying these leases equaled or exceeded the purchase options. In July and August 2002, several class action lawsuits were filed against the company and certain of its officers and directors in the United States District Court for... -

Page 22

...450,561 $ 588,872 COMMON STOCK PRICE SUPERVALU's common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal 2003 year end, there were 6,960 shareholders of record compared with 7,155 at the end of fiscal 2002. Common Stock Price Range 2003 2002 High Low High Low Dividends... -

Page 23

... change to the fair value based method of accounting for stock-based employee compensation. SFAS No. 148 also amends the disclosure requirements of SFAS No. 123 to require additional disclosure in both annual and interim financial statements on the method of accounting for stock-based employee... -

Page 24

...the FASB issued SFAS No. 143, "Accounting for Asset Retirement Obligations", which addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. The company plans to adopt the provisions of SFAS No... -

Page 25

...customer. The market value of the fixed rate notes is subject to change due to fluctuations in market interest rates. At February 22, 2003, the estimated fair value of notes receivable approximates the net carrying value. The table below provides information about the company's financial instruments... -

Page 26

... The information called for by Item 8 is found in a separate section of this report on pages F-1 through F-37. See "Index of Selected Financial Data and Financial Statements and Schedules." ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE Not applicable... -

Page 27

... Option Values," "Long-Term Incentive Plans-Awards in Last Fiscal Year," "Pension Plans and Retirement Benefits," and "Change in Control and Other Agreements," and under the heading "Related Party Transactions, Compensation Committee Interlocks and Insider Participation." ITEM 12. SECURITY OWNERSHIP... -

Page 28

...the fair market value of the common stock on the date of the grant. Unless the Board otherwise specifies, restricted stock and restricted stock units will be forfeited and reacquired by the company if an employee is terminated. Performance awards granted under the plan may be payable in cash, shares... -

Page 29

... to the filing date of this report (the "Evaluation Date"), the company carried out an evaluation, under the supervision and with the participation of the company's management, including the company's chief executive officer and its chief financial officer, of the effectiveness of the design and... -

Page 30

... Depository Trust Company relating to certain outstanding debt securities of the Registrant, is incorporated by reference to Exhibit 4.5 to the Registrant's Report on Form 8-K dated November 13, 1992. Rights Agreement dated as of April 12, 2000, between SUPERVALU INC. and Wells Fargo Bank Minnesota... -

Page 31

... February 25, 1989.* SUPERVALU INC. Executive Incentive Bonus Plan is incorporated by reference to Exhibit (10)c. to the Registrant's Annual Report on Form 10-K for the year ended February 22, 1997.* SUPERVALU INC. Annual Cash Bonus Plan for Designated Corporate Officers, as amended, is incorporated... -

Page 32

... INC. Non-Qualified Supplement Executive Retirement Plan.* 10.24. SUPERVALU INC. Non-Employee Directors Deferred Stock Plan, as amended.* 10.25. Restricted Stock Unit Award Agreement for David L. Boehnen is incorporated by reference to Exhibit 10.26 to the Registrant's Annual Report on Form 10-K for... -

Page 33

...the undersigned, thereunto duly authorized. SUPERVALU INC. (Registrant) DATE: April 25, 2003 By: /s/ JEFFREY NODDLE Jeffrey Noddle Chief Executive Officer and President Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on... -

Page 34

...material, that involves management or other employees who have a significant role in the registrant's internal controls; and 6. The registrant's other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other factors... -

Page 35

...material, that involves management or other employees who have a significant role in the registrant's internal controls; and 6. The registrant's other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other factors... -

Page 36

... Statements and Schedules Page(s) Selected Financial Data: Five Year Financial and Operating Summary ...Financial Statements: Independent Auditors' Report of KPMG LLP ...Consolidated composition of net sales and operating earnings for each of the three years ended February 22, 2003, February 23... -

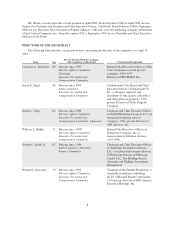

Page 37

... Data (a) (b) (g) Net sales Cost of sales Selling and administrative expenses Gain on sale of Hazelwood Farms Bakeries Restructure and other charges Operating earnings Interest, net Earnings before taxes Provision for income taxes Net earnings Net earnings per common share-diluted Balance Sheet Data... -

Page 38

...expenses primarily for store closing reserves and provisions for certain uncollectible receivables. (f) Fiscal 2000 net earnings include a net benefit of $10.9 million or $0.08 per diluted share from the gain on sale of Hazelwood Farms Bakeries and restructure charges. This reflects total pretax net... -

Page 39

INDEPENDENT AUDITORS' REPORT The Board of Directors and Stockholders SUPERVALU INC. Eden Prairie, Minnesota We have audited the accompanying consolidated balance sheets of SUPERVALU INC. and subsidiaries (the Company) as of February 22, 2003 and February 23, 2002, and the related consolidated ... -

Page 40

... results of sales to extreme value stores licensed by the company. Food distribution operations include results of sales to affiliated food stores, mass merchants and other customers, and other logistics arrangements. Management utilizes more than one measurement and multiple views of data to assess... -

Page 41

... per share data) February 22, 2003 (52 weeks) February 23, 2002 (52 weeks) February 24, 2001 (52 weeks) Net sales Costs and expenses Cost of sales Selling and administrative expenses Restructure and other charges Operating earnings Interest Interest expense Interest income Interest expense, net... -

Page 42

... Stockholders' equity Common stock, $1.00 par value: Authorized 200,000 shares Shares issued, 150,670 in 2003 and 2002 Capital in excess of par value Accumulated other comprehensive losses Retained earnings Treasury stock, at cost, 16,982 shares in 2003 and 17,781 shares in 2002 Total stockholders... -

Page 43

... Minimum pension liability, net of deferred taxes of $47.1 million Total comprehensive income Sales of common stock under option plans Cash dividends declared on common stock $0.5675 per share Compensation under employee incentive plans Purchase of shares for treasury BALANCES AT FEBRUARY 22, 2003... -

Page 44

... of notes payable Proceeds from issuance of long-term debt Repayment of long-term debt Reduction of obligations under capital leases Dividends paid Net proceeds from the sale of common stock under option plans Payment for purchase of treasury shares Net cash used in financing activities Net increase... -

Page 45

... by the company to its vendors were recorded as cost of sales. Commencing with the fourth quarter of fiscal 2003, the company has revised amounts previously reported by reclassifying cost of sales against net sales for all prior periods. The effect is to present the net gross margin associated with... -

Page 46

... on the general health of the economy and resultant demand for commercial property. While management believes the current estimates of reserves on closed properties are adequate, it is possible that continued weakness in the real estate market could cause changes in the company's assumptions and may... -

Page 47

... fair value of the respective reporting unit with its carrying value. Fair value was determined primarily based on valuation studies performed by the company, which considered the discounted cash flow method consistent with the company's valuation guidelines. The company performed the second annual... -

Page 48

..., "Accounting for Stock Based Compensation" to stock-based employee compensation: 2003 2002 2001 (In thousands, except per share data) Net earnings, as reported Deduct: total stock-based employee compensation expense determined under fair value based method for all awards, net of related tax effect... -

Page 49

... fair value of the respective reporting unit with its carrying value. Fair value was determined primarily based on valuation studies performed by the company, which considered the discounted cash flow method consistent with the company's valuation guidelines. The company performed the second annual... -

Page 50

... a Reseller of a Vendor's Products)", which codified EITF Issue No. 00-14, "Accounting for Certain Sales Incentives"; EITF Issue No. 00-22, "Accounting for 'Points' and Certain Other Time-Based or Volume-Based Sales and Incentive Offers, and Offers for Free Products or Services to be Delivered in... -

Page 51

...the FASB issued SFAS No. 143, "Accounting for Asset Retirement Obligations", which addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. The company plans to adopt the provisions of SFAS No... -

Page 52

...real estate market, including $19.1 million for increased lease liabilities in exiting the non-core retail markets and the disposal of non-core assets, offset by a net decrease of $1.3 million in restructure reserves for the consolidation of distribution centers. In the fourth quarter of fiscal 2003... -

Page 53

... real estate and unpaid employee benefits. Details of the fiscal 2001 restructure activity for fiscal 2003 are as follows: Balance February 23, 2002 Fiscal 2003 Usage Fiscal 2003 Adjustment Balanc February 22, 2003 (In thousands) Lease related costs: Consolidation of distribution centers Exit... -

Page 54

... 2003, the fiscal 2000 asset impairment charges for property, plant and equipment on food distribution properties were decreased by $4.5 million primarily due to changes in estimates on exited real estate in certain markets. The impairment charges reflect the difference between the carrying value... -

Page 55

...related to retail food. Impairment charges, a component of selling and administrative expenses in the Consolidated Statements of Earnings, reflect the difference between the carrying value of the assets and the estimated fair values, which were based on the estimated market values for similar assets... -

Page 56

...interest in WinCo Foods and Subsidiaries, the owner and operator of retail supermarkets located in Oregon, Washington, California and Nevada, a 26% interest in International Data, LLC, a strategic outsourcing services provider, specializing in, among other things, data services, check and remittance... -

Page 57

.... The estimated fair value was based on market quotes, where available, discounted cash flows and market yields for similar instruments. The estimated fair value of the company's interest rate swaps approximates the carrying value at February 22, 2003. The fair value of interest rate swaps are the... -

Page 58

... in Notes payable in the Consolidated Balance Sheets. As of February 22, 2003 there was $264.4 million of accounts receivable pledged as collateral. The average short-term interest rate on the outstanding borrowings was 1.76% for fiscal 2003. In April 2002, the company finalized a new three-year... -

Page 59

.... The debentures will generally be convertible if the closing price of the company's common stock on the New York Stock Exchange for twenty of the last thirty trading days of any fiscal quarter exceeds certain levels, at $35.07 per share for the quarter ended June 14, 2003, and rising to $113.29 per... -

Page 60

...,598 97,350 81,985 450,561 $1,007,170 The company is party to synthetic leasing programs for two of its major warehouses. The leases qualify for operating lease accounting treatment under SFAS No. 13, "Accounting for Leases". For additional information on synthetic leases, refer to the Commitments... -

Page 61

... capital leases in effect at February 22, 2003 are as follows: Direct Direct Financing Financing Lease Capital Lease Receivables Obligations (In thousands) Fiscal Year 2004 2005 2006 2007 2008 Later Total minimum lease payments Less unearned income Less interest Present value of net minimum lease... -

Page 62

... computed by applying the statutory federal income tax rate to earnings before taxes is attributable to the following: 2003 2002 (In thousands) 2001 Federal taxes based on statutory rate State income taxes, net of federal benefit Nondeductible goodwill Audit settlements Other Total provision $142... -

Page 63

... of their fair market value, determined based on the average of the opening and closing sale price of a share on the date of grant. The company's 1997 stock plan allows only the granting of non-qualified stock options to purchase common shares to salaried employees at fair market value determined on... -

Page 64

... pro forma net earnings and earnings per common share. The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following weighted-average assumptions and results: 2003 2002 2001 Dividend yield Risk free interest rate Expected life... -

Page 65

... exercise of employee stock options and for other compensation programs utilizing the company's stock. In fiscal 2002, the company purchased 1.3 million shares under the program at an average cost of $22.16 per share. In fiscal 2003, the company purchased 1.5 million shares under the program at an... -

Page 66

...At February 22, 2003, the estimated market value of the properties underlying these leases equaled or exceeded the purchase options. In July and August 2002, several class action lawsuits were filed against the company and certain of its officers and directors in the United States District Court for... -

Page 67

... company's non-union defined benefit pension plans and the post retirement benefit plans: Pension Benefits Post Retirement Benefits February 22, February 23, February 22, February 23, 2003 2002 2003 2002 (In thousands) CHANGES IN BENEFIT OBLIGATIONS Benefit obligations at beginning of year Service... -

Page 68

... prepaid pension asset or minimum pension liability based on the current market value of plan assets and the accumulated benefit obligation of the plan. Based on both performance of the pension plan assets and plan assumption changes, the company recorded a net after-tax adjustment in fiscal 2003 of... -

Page 69

...22, 2003 and February 23, 2002, respectively. Net periodic pension cost was $2.7 million, $2.8 million and $2.2 million for 2003, 2002 and 2001, respectively. SIGNIFICANT CUSTOMER During fiscal 2003 and 2002, no single customer accounted for ten percent or greater of net sales or accounts receivable... -

Page 70

... cost of sales against net sales relating to certain facilitative services it provided between its independent retailers and vendors related to products typically known as Direct Store Delivery (DSD) products. This reclassification had no impact on gross profit, earnings before income taxes, net... -

Page 71

... ended February 22, 2003, which are included in the annual report on Form 10-K for the 2003 fiscal year. In connection with our audits of the aforementioned consolidated financial statements, we also audited the related consolidated financial statement schedule as listed in the accompanying index... -

Page 72

SUPERVALU INC. and Subsidiaries SCHEDULE II-Valuation and Qualifying Accounts COLUMN A COLUMN B Balance at beginning of year COLUMN C COLUMN D COLUMN E Balance at end of year Description Additions Deductions Allowance for doubtful accounts: Year ended: February 22, 2003 February 23, 2002 ...