Sprouts Farmers Market 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Sprouts Farmers Market annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ÈANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended December 28, 2014

Commission File Number: 001-36029

Sprouts Farmers Market, Inc.

(Exact name of registrant as specified in its charter)

Delaware 32-0331600

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

11811 N. Tatum Boulevard, Suite 2400

Phoenix, Arizona 85028

(Address of principal executive offices and zip code)

(480) 814-8016

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which Registered

Common Stock, $0.001 par value NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ÈNo ‘

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘No È

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes ÈNo ‘

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes ÈNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. È

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ÈAccelerated filer ‘

Non-accelerated filer ‘(Do not check if a smaller reporting company) Smaller reporting company ‘

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ‘No È

As of June 27, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the

registrant’s voting common stock held by non-affiliates of the registrant was $3,365,500,197, based on the last reported sale price of such stock as

reported on The NASDAQ Global Select Market on such date.

As of February 24, 2015, there were outstanding 152,064,393 shares of the registrant’s common stock, $0.001 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2015 Annual Meeting of Stockholders are incorporated by reference in Part III of this

Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of

the registrant’s fiscal year ended December 28, 2014.

Table of contents

-

Page 1

... FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 28, 2014 Commission File Number: 001-36029 Sprouts Farmers Market, Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction... -

Page 2

...and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...PART III Item 10. Directors, Executive Officers and Corporate Governance ...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 3

... company, converted into Sprouts Farmers Market, Inc., a Delaware corporation, as described under "Management's Discussion and Analysis of Financial Condition and Results of Operations-Factors Affecting Comparability of Results of Operations-Corporate Conversion." As used in this Annual Report... -

Page 4

... Are Sprouts Farmers Market operates as a healthy grocery store that offers fresh, natural and organic food that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing... -

Page 5

... and the rising costs of health care. We believe customers are attracted to retailers with comprehensive health and wellness product offerings. As a result, food retailers are offering an increased assortment of fresh, natural and organic foods as well as vitamins and supplements to meet this demand... -

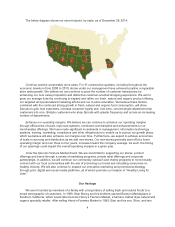

Page 6

... 191 stores as of December 28, 2014. We expect to continue to expand our store base with 27 store openings planned in fiscal 2015, of which seven have opened as of the date of this Annual Report on Form 10-K, and we intend to achieve 14% annual new store growth over at least the next five years. 3 -

Page 7

...organic product offering, our targeted and personalized marketing efforts and our in-store education. We believe these factors, combined with the continued strong growth in fresh, natural and organic food consumption, will allow Sprouts to gain new customers, increase customer loyalty and, over time... -

Page 8

... the goal of making affordable healthy foods, vitamins and other products available to everyone. In 2002, we opened the first Sprouts Farmers Market store in Chandler, Arizona. In 2010, we had 54 stores and reached over $620 million in net sales and approximately 3,700 team members. In April 2011... -

Page 9

... Sprouts, we believe in "Healthy Living for Less" and strive to provide more consumers with the opportunity to offer their families great tasting, healthy, natural and organic products for less. Our stores are typically staffed with 80 to 90 full and part-time team members including a store manager... -

Page 10

...and fiscal 2014, respectively. We have 27 store openings planned in fiscal 2015, of which seven have opened as of the date of this Annual Report on Form 10-K, and we intend to achieve 14% annual new store growth over at least the next five years. Our Product Offering We are a complete food retailer... -

Page 11

... sell as perishable and non-perishable. Perishable product categories include produce, meat, seafood, deli and bakery. Non-perishable product categories include grocery, vitamins and supplements, bulk items, dairy and dairy alternatives, frozen foods, beer and wine, and natural health and body care... -

Page 12

... and international wines, many of which we price at $10 or less. We also stock Kosher, organic, sustainable and biodynamic, local, exclusive-to-Sprouts and even non-alcoholic wines. Natural Health and Body Care. Sprouts offers approximately 2,500 natural, cruelty-free health and beauty products, old... -

Page 13

..., such as produce. Through department-specific promotions, in-store signage, and customer education, these trial customers become "transition" customers that shop new departments and try new products. Over time, through customer service and engagement, targeted marketing, and increased knowledge of... -

Page 14

... items on sale Every vitamin, supplement and body care product is 25% off regular retail pricing 20% off any frozen item a customer can fit into a Sprouts grocery bag. These products include natural and organic entrees, side dishes, and frozen vegetables and desserts 25% off thousands of gluten-free... -

Page 15

... 1,200 Sprouts Farmers Market stores operating under our current format. We believe we have significant growth opportunity in existing markets, as approximately 400 of these 1,200 potential stores are located in our current markets (nine states). We intend to achieve 14% annual new store growth over... -

Page 16

... Grocers by Vitamin Cottage and Trader Joe's. Insurance and Risk Management We use a combination of insurance and self-insurance to provide for potential liability for workers' compensation, general liability, product liability, director and officers' liability, team member healthcare benefits, and... -

Page 17

...foods and dietary supplements, including powers to issue a public warning letter to a company, publicize information about illegal products, institute an administrative detention of food, request or order a recall of illegal products from the market, and request the Department of Justice to initiate... -

Page 18

... applicable statutes and regulations. Additionally, the USDA's Agricultural Marketing Service (referred to as "AMS") oversees the National Organics Program for all foods making such "organic" claims. Under the Program, products labeled "organic" must be certified by an accredited agent as compliant... -

Page 19

...-8016. Effective March 9, 2015, our principal executive offices will be located at 5455 E. High Street, Suite 111, Phoenix, Arizona 85054. Our website address is www.sprouts.com. The information on or accessible through our website is not incorporated by reference into this Annual Report on Form 10... -

Page 20

...approximately 1,200 Sprouts Farmers Market stores operating under our current format, we anticipate that it will take years to grow our store count to that number. We cannot assure you that we will grow our store count to approximately 1,200 stores. We opened 24 and 19 stores in fiscal 2014 and 2013... -

Page 21

... grocery and frozen food products, accounting for approximately 23% of our total purchases in each of fiscal 2014 and 2013. We also have commitments in place with NB to order certain amounts of our distribution-sourced organic and natural produce, and to maintain certain minimum average annual store... -

Page 22

.... We have actively pursued new store growth and plan to continue doing so in the future. We cannot assure you that our new store openings will be successful or reach the sales and profitability levels of our existing stores. New store openings may negatively impact our financial results in the short... -

Page 23

... and the cost of these products. Our store offerings currently include natural and organic products and dietary supplements. A change in consumer preferences away from our offerings would have a material adverse effect on our business. Additionally, negative publicity over the safety, efficacy or... -

Page 24

... pay a judgment, in which case our creditors could levy against our assets. As a fresh, natural and organic retailer, we believe that many customers choose to shop our stores because of their interest in health, nutrition and food safety. As a result, we believe that our customers hold us to a high... -

Page 25

...such organization attempts may distract management and team members and may have a negative financial impact on individual stores, or on our business as a whole. Our lease obligations could adversely affect our financial performance and may require us to continue paying rent for store locations that... -

Page 26

... at all. The fact that a substantial portion of our cash flow from operations could be needed to make payments on this indebtedness could have important consequences, including the following reducing our ability to execute our growth strategy, including new store development; impacting our ability... -

Page 27

... prices, our ability to maintain profit margins and sales levels may be negatively impacted. In addition, some competitors are aggressively expanding their number of stores or their product offerings or increasing the space allocated to perishable and specialty foods, including natural and organic... -

Page 28

..., 2014, we operated 79 stores in California, making California our largest market representing 41% of our total stores and 44% of our net sales in the fiscal year ended December 28, 2014. We also have store concentration in Texas, Arizona and Colorado, operating 33, 27 and 25 stores in those states... -

Page 29

... epidemic may cause customers to avoid public gathering places such as our stores or otherwise change their shopping behaviors. Additionally, a widespread health epidemic could also adversely impact our business by disrupting production and delivery of products to our stores and by impacting our... -

Page 30

... may increase our costs, limit or eliminate our ability to sell certain products, raise regulatory enforcement risks not present in the past, or otherwise adversely affect our business, reputation, results of operations and financial condition. As a retailer of food, vitamins and supplements and... -

Page 31

...foods and dietary supplements, including powers to issue a public warning letter to a company, publicize information about illegal products, institute an administrative detention of food, request or order a recall of illegal products from the market, and request the Department of Justice to initiate... -

Page 32

...provide nutrition-oriented education to our customers, and these activities may be subject to state and federal regulation, and oversight by professional organizations. In the past, the FDA has expressed concerns regarding summarized health and nutrition-related information that (i) does not, in the... -

Page 33

...could result, the perception of our brand and products could be negatively affected, and our sales and profitability could suffer as a result. We also license the SPROUTS FARMERS MARKETS trademark to a third party for use in operating two grocery stores. If the licensee fails to maintain the quality... -

Page 34

..., and the listing requirements of NASDAQ Global Select Market. We incur significant legal, accounting, and other expenses as a public company, including costs resulting from our public company reporting obligations and maintenance of corporate governance practices. Our management and other personnel... -

Page 35

... in our financial statements, in which case investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may decline. As a public company, we are required to maintain internal control over financial reporting. Pursuant to... -

Page 36

...; fluctuations in stock market prices and trading volumes of securities of similar companies; sales, or anticipated sales, of large blocks of our stock; short selling of our common stock by investors; additions or departures of key personnel; new store openings or entry into new markets by us or by... -

Page 37

...affect the price that some investors are willing to pay for our common stock. If securities or industry analysts cease publishing research or reports about us, our business, or our market, or if they adversely change their recommendations regarding our stock, our stock price and trading volume could... -

Page 38

... located in ten states, as shown in the chart below: State Number of Stores State Number of Stores Arizona ...California ...Colorado ...Georgia ...Kansas ... 27 79 25 4 2 Nevada ...New Mexico ...Oklahoma ...Texas ...Utah ... 5 6 6 33 4 In fiscal 2013, we opened 19 new stores, and in fiscal 2014... -

Page 39

the ordinary course of business, which have not resulted in any material losses to date. Although management does not expect that the outcome in these proceedings will have a material adverse effect on our financial condition or results of operations, litigation is inherently unpredictable. ... -

Page 40

... Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information Our common stock began trading on the NASDAQ Global Select Market under the symbol "SFM" on August 1, 2013. Prior to that date, there was no public market for our common stock. The price range per... -

Page 41

... sale price on that day of $40.11 per share and not the initial offering price to the public of $18.00 per share. The performance shown on the graph below is based on historical results and is not intended to suggest future performance. COMPARISON OF 17 MONTH CUMULATIVE TOTAL RETURN* Among Sprouts... -

Page 42

... per share data) Fiscal 2010(1) Statements of Operations Data: Net sales ...$2,967,424 $2,437,911 $1,794,823 $1,105,879 $516,816 Cost of sales, buying and occupancy ...2,082,221 1,712,644 1,264,514 794,905 366,947 Gross profit ...Direct store expenses ...Selling, general and administrative expenses... -

Page 43

... (ii) the first day of the 61st week following the store's opening. We use pro forma comparable store sales to calculate pro forma comparable store sales growth. (6) During Fiscal 2014, we also relocated one store. Supplemental Pro Forma Data-Net Sales Fiscal 2014 Fiscal 2013 Fiscal Fiscal 2012 2011... -

Page 44

... Sprouts Farmers Market operates as a healthy grocery store that offers fresh, natural and organic food that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing... -

Page 45

... ability to identify market trends, and to source and provide product offerings that promote customer traffic and growth in average ticket; the number of customer transactions and average ticket; the prices of our products, including the effects of inflation and deflation; opening new stores in the... -

Page 46

... increase, gross margin is affected by the relative mix of products sold, pricing strategies, inventory shrinkage and improved leverage of fixed costs of sales, buying and occupancy. Direct store expenses Direct store expenses consist of store-level expenses such as salaries and benefits, related... -

Page 47

...Markets, LLC, a Delaware limited liability company, converted into Sprouts Farmers Market, Inc., a Delaware corporation. See "-Factors Affecting Comparability of Result of Operations-Corporate Conversion." The corporate conversion has not had a material impact on our results of operations, financial... -

Page 48

... consummated on the first day of fiscal 2012 as set out under "Pro Forma for the Sunflower Transaction" in "Unaudited Supplemental Fiscal 2012 Pro Forma Information." This fiscal 2012 pro forma information presented in this "Management's Discussion and Analysis of Financial Condition and Results of... -

Page 49

... 51,326 $ 19,500 Fiscal 2012 (in thousands) Unaudited Supplemental Pro Forma Information(1): Net sales ...Cost of sales, buying and occupancy ...Gross profit ...Direct store expenses ...Selling, general and administrative expenses ...Store pre-opening costs ...Store closure and exit costs ...Income... -

Page 50

...growth at stores operated prior to December 29, 2013 contributed $343.0 million, or 65% of the increase in net sales for 2014. New store openings during 2014 contributed $186.5 million, or 35%, of the increase in net sales during 2014. Cost of sales, buying and occupancy and gross profit Fiscal 2014... -

Page 51

... to increased store count and expansion into new regions, $1.3 million increase in IT maintenance due to growth. $0.9 million increase in depreciation primarily due to accelerated depreciation for corporate office move, $0.5 million increase in secondary offering expenses including related payroll... -

Page 52

... offset by $2.0 million of net sales related to a store closed in 2012. Comparing 2013 to pro forma 2012, net sales increased primarily as a result of pro forma comparable store sales growth and new store openings. Pro forma comparable store sales growth of 10.7% during 2013 contributed $206... -

Page 53

... in the vitamin, supplement and body care departments as a result of mark downs from merchandise alignment. Comparing 2013 to pro forma 2012, cost of sales, buying and occupancy and gross margin increased primarily due to the factors noted above. Direct store expenses Fiscal 2013 Fiscal 2012 Change... -

Page 54

... number of stores opened, increases related to opening stores in new markets which require additional pre-opening advertising, travel and team member training expenses, and certain pre-opening costs for stores opened in 2012 that were incurred in the Sunflower pre-acquisition financial statements... -

Page 55

... offset by a reduction in the interest rates related to the April 2013 Refinancing, the August 2013 pay down on the Term Loan, and the May 2013 payoff of the Senior Subordinated Notes. See Note 13 "Long-Term Debt" to our audited consolidated financial statements. Comparing 2013 to pro forma for 2012... -

Page 56

... 163% 109% Net income growth was attributable to strong business performance driven by comparable store sales and resulting operating leverage, strong performance of new stores opened, and reduced interest expense. Unaudited Supplemental Fiscal 2012 Pro Forma Information The comparability of our... -

Page 57

... Historical Sprouts Farmers Market, Inc.(1) Sunflower Fiscal Period Alignment(2) Historical Sunflower(1) Sunflower Transaction(2) Notes Pro Forma for Sunflower Transaction(2) Net sales ...$1,794,823 Cost of sales, buying and occupancy ...1,264,514 Gross profit ...Direct store expenses ...Selling... -

Page 58

...to our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K. The historical Sprouts Farmers Market, Inc. results of operations for fiscal 2012 are derived from our audited consolidated financial statements included elsewhere in this Annual Report on Form 10... -

Page 59

... first day of fiscal 2012. (f) Quarterly Financial Data The following table sets forth certain of our unaudited consolidated statements of operations data for each of the fiscal quarters in fiscal 2014 and fiscal 2013. Thirteen weeks ended December 28, September 28, 2014 2014(1) June 29, 2014 March... -

Page 60

... including new store openings, remodel and maintenance capital expenditures at existing stores, store initiatives and other corporate capital expenditures and activities. Our cash and cash equivalents position benefits from the fact that we generally collect cash from sales to customers the same day... -

Page 61

... in new stores, including leasehold improvements and store equipment, annual maintenance capital expenditures to maintain the appearance of our stores, sales enhancing initiatives and other corporate investments. We expect capital expenditures of approximately $100 to 110 million in fiscal 2015, net... -

Page 62

... Closing Date. Covenants. The Credit Facility contains financial, affirmative and negative covenants that we believe are usual and customary for a senior secured credit agreement. In addition, if we have any amounts outstanding under the Revolving Credit Facility as of the last day of any fiscal... -

Page 63

... facility and classified as current at December 28, 2014. This financing lease obligation and the related asset are expected to be removed from the balance sheet in the first quarter of fiscal 2015 as there will be no continuing involvement provisions at the end of the construction period... -

Page 64

... are passed through to our customers, which is subject to competitive market conditions. In the first half of fiscal 2012, we experienced produce price deflation, which contributed to higher gross margins in our business during that period and the full fiscal year. Food inflation and deflation is... -

Page 65

... cost relating to outstanding awards was $3.7 million at December 28, 2014, with a weighted average remaining recognition period of 1.3 years. Valuation. We have used the Black-Scholes option pricing model to calculate the fair value of our equity-based compensation awards at grant date. For... -

Page 66

... and 2013 Incentive Plan. We routinely evaluate the appropriateness of the forfeiture rate based on actual forfeiture experience, analysis of team member turnover and expectations of future option exercise behavior. We will continue to use judgment in evaluating the assumptions related to our equity... -

Page 67

...and integration of Henry's, Sprouts Arizona and Sunflower operations achieved by the end of fiscal 2012; Our operating and financial performance and forecasts as a combined company; New store openings and planned openings; Market valuations of comparable publicly traded grocers; The applicability of... -

Page 68

... the cost of acquired businesses in excess of the fair value of assets and liabilities acquired. Our indefinite-lived intangible assets consist of trade names related to "Sprouts Farmers Market" and liquor licenses. We also hold intangible assets with finite useful lives, consisting of favorable and... -

Page 69

...group. The fair value is estimated based on discounted future cash flows or comparable market values, if available. When assessing the recoverability of our long-lived assets, we make assumptions regarding estimated future cash flows from the use and eventual disposition of the asset groups. We base... -

Page 70

... federal and certain state income tax groups for income tax reporting purposes. For the period through such closing date, the consolidated financial statements have been prepared on the basis as if Henry's prepared its tax returns and accounted for income taxes on a separate-company basis. As... -

Page 71

... in which the change becomes known, considering timing of new information regarding market, subleases or other lease updates. Adjustments in the closed store reserves are recorded in store closure and exit costs in the consolidated statements of operations. Recently Issued Accounting Pronouncements... -

Page 72

Item 7A. Quantitative and Qualitative Disclosures about Market Risk Interest Rate Sensitivity As described above under "Management...of December 28, 2014, each hundred ...annually. This sensitivity analysis assumes our mix of financial instruments and all other variables will remain constant in future... -

Page 73

... STATEMENTS Consolidated Financial Statements for Sprouts Farmers Market, Inc. and Subsidiaries: Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of December 28, 2014 and December 29, 2013 ...Consolidated Statements of Operations for the fiscal years ended... -

Page 74

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 75

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS) December 28, 2014 December 29, 2013 ASSETS Current assets: Cash and cash equivalents ...Accounts receivable, net ...Inventories ...Prepaid expenses and other current assets ...Deferred ... -

Page 76

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) December 28, 2014 Year Ended December 29, 2013 December 30, 2012 Net sales ...Cost of sales, buying and occupancy ...Gross profit ...Direct store expenses ...Selling, general... -

Page 77

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (IN THOUSANDS, EXCEPT SHARE AMOUNTS) Additional Common Paid-in Stock Capital (Accumulated Deficit) / Retained Earnings Total Stockholders' Equity Shares Balances at January 1, 2012 ...110,000,000 Net ... -

Page 78

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS) Year Ended December 28, 2014 December 29, 2013 December 30, 2012 Cash flows from operating activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: ... -

Page 79

...of natural and organic food, offering a complete shopping experience that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing interest in eating and living healthier... -

Page 80

..., meat, seafood, deli and bakery. Non-perishable product categories include grocery, vitamins and supplements, bulk items, dairy and dairy alternatives, frozen foods, beer and wine, and natural health and body care. The following is a breakdown of the Company's perishable and nonperishable sales mix... -

Page 81

... be identified with a specific store location, are charged to direct store expenses in the accompanying consolidated statements of operations. Asset Retirement Obligations The Company's asset retirement obligations ("ARO") are related to the Company's commitment to return leased facilities to the... -

Page 82

... of trade names related to "Sprouts Farmers Market" and liquor licenses. The Company also holds intangible assets with finite useful lives, consisting of favorable and unfavorable leasehold interests and the "Sunflower Farmers Market" trade name. Goodwill is evaluated for impairment on an annual... -

Page 83

..." for further discussion. The trade name related to "Sunflower Farmers Market" meets the definition of a defensive intangible asset and is amortized on a straight line basis over an estimated useful life of 10 years from the date of its acquisition by the Company. Favorable and unfavorable leasehold... -

Page 84

... over their remaining useful lives. The present value of the lease payments associated with these buildings is recorded as financing lease obligations. At December 28, 2014 the Company has also recorded a current financing lease obligation and related construction in progress totaling $25.0 million... -

Page 85

... and other charges using a weighted average cost of capital, reduced by estimated sublease rentals. The weighted average cost of capital is estimated using information from comparable companies and management's judgment related to the risk associated with the operations of the stores. Cash and cash... -

Page 86

... redeemed by the customer. The Company has not applied a gift card breakage rate. Licensing fees are generated from license agreements related to two former Henry's stores and are recorded as net sales. Cost of Sales, Buying and Occupancy Cost of sales includes the cost of inventory sold during the... -

Page 87

... during construction of new stores and costs related to new store openings, including costs associated with hiring and training personnel and other miscellaneous costs. Store pre-opening costs are expensed as incurred. Loss on Extinguishment of Debt In 2014, the Company made a voluntary principal... -

Page 88

... the total amount of the obligation is fixed at the reporting date. The amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2013 and should be applied retrospectively. The provisions were effective from the Company's first quarter of 2014... -

Page 89

... reason for this transaction was to build a larger portfolio of stores under the Sprouts Farmers Market banner and to derive synergies from the combined operations of the companies. In a business combination, the purchase price is allocated to assets acquired and liabilities assumed based on their... -

Page 90

... to be achieved from the combined operations of the Company and Sunflower, primarily related to buying and distribution costs, economies of scale for certain direct store expenses and savings on marketing-related selling costs and corporate overhead. Goodwill recorded in the Sunflower Transaction is... -

Page 91

... amounts receivable from the Company's health insurance carrier for claims in excess of stop-loss limits. See Note 15, "Self-Insurance Programs" for more information. Landlord receivable relates to amounts receivable from landlords for lease incentives. As of December 28, 2014 and December 29, 2013... -

Page 92

... the fourth quarter of 2014, the Company determined that certain store level equipment was not being depreciated over the proper useful lives. The Company made an entry resulting in an additional $4.4 million of depreciation expense which was recorded as Direct store expense in the Consolidated... -

Page 93

... is as follows: 2015 ...2016 ...2017 ...2018 ...2019 ...Thereafter ...Total amortization ...$1,292 1,044 967 967 950 3,996 $9,216 The remaining weighted-average amortization period of leasehold interests acquired total 10.7 years. The remaining amortization period of the finite-lived trade name is... -

Page 94

... 29, 2014 2013 Gift cards ...Workers' compensation / general liability reserves ...Sales and use tax liabilities ...Medical insurance claim reserves ...Unamortized lease incentives ...Accrued occupancy related (CAM, property taxes, etc.) ...Interest ...Closed store reserves ...Other ...Total... -

Page 95

... each of the years are as follows: 2015 ...2016 ...2017 ...2018 ...2019 ...Thereafter ...Gross principal ...Less: discount ...Total debt at December 28, 2014 ...Senior Secured Credit Facilities April 2013 Refinancing On April 23, 2013, the Company's subsidiary, Sprouts Farmers Markets Holdings, LLC... -

Page 96

...initial Term Loan, the total leverage ratio does not exceed 5.25 to 1.00. Guarantees Obligations under the Credit Facility are guaranteed by the Company and all of its current and future...the Company's statements of operations for the year ended December 28, 2014. On December 27, 2013, the Company ... -

Page 97

...the Company's ability to incur additional indebtedness; grant additional liens; enter into sale-leaseback transactions; make loans or investments; merge, consolidate or enter into acquisitions; pay dividends or distributions; enter into transactions with affiliates; enter into new lines of business... -

Page 98

... 2012. In connection with the April 2013 Refinancing, the Company repaid the Former Term Loan in its entirety and recorded a related $8.2 million loss on extinguishment of debt as reflected in the consolidated statement of operations for the year ended December 29, 2013. Between 2011 and 2012, the... -

Page 99

... the Sprouts Farmers Market, Inc. Employee 401(k) Savings Plan (the "Plan"), which is a defined contribution plan covering all eligible team members. Under the provisions of the Plan, participants may direct the Company to defer a portion of their compensation to the Plan, subject to the Internal... -

Page 100

... Company had elected to be taxed as a corporation for income tax purposes. Income Tax Provision The income tax provision consists of the following: December 28, 2014 Year Ended December 29, 2013 December 30, 2012 U.S. Federal-current ...U.S. Federal-deferred ...U.S. Federal-total ...State-current... -

Page 101

... the year ended December 28, 2014 included $1.4 million of income tax benefits related to stock award activity in 2013. The excess tax benefits are not credited to stockholders' equity until the deduction reduces income taxes payable. Deferred Taxes Significant components of the Company's deferred... -

Page 102

... for Sunflower's pre-merger federal tax returns for 2010 through 2012 and state tax returns for 2008 through 2012. 19. Related-Party Transactions The Company incurred costs related to its use of a private aircraft owned by a member of senior management. During 2012, fees paid in connection with the... -

Page 103

..., respectively. Future minimum lease obligations for operating leases with initial terms in excess of one year at December 28, 2014 are as follows: 2015 ...2016 ...2017 ...2018 ...2019 ...Thereafter ...Total payments ...$ 87,137 99,926 104,585 102,986 98,930 655,780 $1,149,344 The Company has... -

Page 104

... at various dates from 2015 to 2032. As of December 28, 2014, future minimum lease payments required by all capital and financing leases during the initial lease term are as follows: Fiscal Year Capital Leases Financing Leases 2015 ...2016 ...2017 ...2018 ...2019 ...Thereafter ...Total ...Plus... -

Page 105

... fiscal years 2015, 2016 and 2017, respectively. Purchase commitments under this agreement are based on volumes and commodities prices in effect at the time of purchase. The amounts above were calculated based on current commodities prices. From October 1, 2014 through December 28, 2014, the Company... -

Page 106

... the market price of the Company's common stock and the voting and other rights of the holders of the Company's common stock. The Company has no current plan to issue any shares of preferred stock. 22. Net Income per Share The computation of net income per share is based on the number of weighted... -

Page 107

...options vest over a period of three years based on financial performance targets set for each year. The options expire seven years from grant date. On March 4, 2014, under the 2013 Incentive Plan, the Company granted to certain officers and team members time-based options to purchase an aggregate of... -

Page 108

... estimated at zero as the Company does not anticipate making regular future distributions to stockholders. The following table summarizes option activity: Weighted Average Exercise Price Weighted Average Remaining Contractual Life (In Years) Number of Options Aggregate Intrinsic Value Outstanding... -

Page 109

...$172,957 RSUs The fair value of RSUs is based on the closing price of the Company's common stock on the grant date. RSUs generally vest annually over a period of two or three years. The estimated fair values of RSUs granted during 2014 range from $28.50 to $39.01. The following table summarizes RSU... -

Page 110

... 28, 2014 Year Ended December 29, 2013 December 30, 2012 Cost of sales, buying and occupancy ...Direct store expenses ...Selling, general and administrative expenses ...Total equity-based compensation expense ... $ 695 788 3,872 $5,355 $ 672 104 5,004 $5,780 $ 502 127 4,024 $4,653 The Company... -

Page 111

... financial statements in Item 8 of this Annual Report on Form 10-K. Remediation of Prior Material Weakness in Internal Control Over Financial Reporting As previously disclosed in our Annual Report on Form 10-K for the year ended December 29, 2013 and each of the interim periods ending March 30, 2014... -

Page 112

... there were no changes in our internal control over financial reporting that occurred during the quarterly period ended December 28, 2014 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. Item 9B. Other Information None. 109 -

Page 113

... disclosure of future updates, amendments or waivers from the Code by posting them to our investor relations website located at http://investors.sprouts.com. The information contained on or accessible through our website is not incorporated by reference into this Annual Report on Form 10-K. Item 11... -

Page 114

...Inc., Centennial Post-Closing Merger Sub, LLC, Sunflower Farmers Markets, Inc. and KMCP Grocery Investors, LLC, as Representative (2) Credit Agreement, dated as of April 23, 2013, among Sprouts Farmers Markets, LLC, Sprouts Farmers Markets Holdings, LLC, the several lenders from time to time parties... -

Page 115

... Agreement dated as of July 29, 2013 (1) Form of Indemnification Agreement by and between Sprouts Farmers Market, Inc. and its directors and officers (2) List of subsidiaries Consent of PricewaterhouseCoopers LLP, independent registered accounting firm Consent of Buxton Company Certification... -

Page 116

...authorized. SPROUTS FARMERS MARKET, INC. Date: February 26, 2015 /s/ J. Douglas Sanders By: Name: J. Douglas Sanders Title: President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 117

...Inc., Centennial Post-Closing Merger Sub, LLC, Sunflower Farmers Markets, Inc. and KMCP Grocery Investors, LLC, as Representative (2) Credit Agreement, dated as of April 23, 2013, among Sprouts Farmers Markets, LLC, Sprouts Farmers Markets Holdings, LLC, the several lenders from time to time parties... -

Page 118

... Agreement dated as of July 29, 2013 (1) Form of Indemnification Agreement by and between Sprouts Farmers Market, Inc. and its directors and officers (2) List of subsidiaries Consent of PricewaterhouseCoopers LLP, independent registered accounting firm Consent of Buxton Company Certification... -

Page 119

... of Sprouts Farmers Market, Inc. Subsidiary Jurisdiction of Organization Control by Registrant Subsidiary Sprouts Farmers Markets Holdings, LLC ...Sunflower Farmers Markets, LLC ...SFM, LLC ...SFM Logistics, LLC ...SFM Manager, LLC ...SF Market Texas, LLC ...Henry's Holdings LLC ...Sprouts Farmers... -

Page 120

... Form S-8 (No. 333-190920) of Sprouts Farmers Market, Inc. of our report dated February 26, 2015 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in this Form 10K. /s/ PricewaterhouseCoopers LLP Phoenix, Arizona February 26, 2015 -

Page 121

...hereby consent to the use of our name and other references to us and our reports by Sprouts Farmers Market, Inc. in its filings with the Securities and Exchange Commission during or relating to 2015. BUXTON COMPANY By Name: Title: Date: /s/ David Glover David Glover Chief Financial Officer 2/17/2015 -

Page 122

...J. Douglas Sanders, certify that: 1. I have reviewed this Annual Report on Form 10-K of Sprouts Farmers Market, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 123

...I, Amin N. Maredia, certify that: 1. I have reviewed this Annual Report on Form 10-K of Sprouts Farmers Market, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 124

... the annual report of Sprouts Farmers Market, Inc., (the "Company") on Form 10-K for the fiscal year ended December 28, 2014 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, J. Douglas Sanders, President and Chief Executive Officer of the Company, certify... -

Page 125

... with the annual report of Sprouts Farmers Market, Inc., (the "Company") on Form 10-K for the fiscal year ended December 28, 2014 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Amin N. Maredia, Chief Financial Officer of the Company, certify, based...