Sonic 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

Table of contents

-

Page 1

-

Page 2

... Control Over Financial Reporting Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting Directors and Officers Corporate Information

Sonic began in 1953 in Shawnee, Oklahoma. Today, we franchise and operate the largest chain of drive-in restaurants...

-

Page 3

Financial Highlights

2006 2005 Change

($ in thousands, except per share data)

Operations (for the year) Total revenues Income from operations 1 Net income 1 Net income per diluted share 1, 2 Return on average stockholders' equity 1 Financial Position (at year's end) Total assets Stockholders' ...

-

Page 4

... Corp. 2006 Annual Report

2

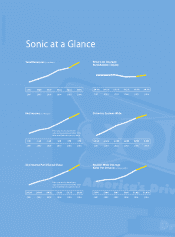

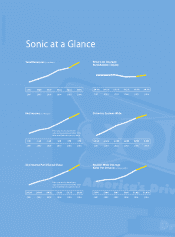

Sonic at a Glance

Total Revenues (in millions) Return on Average Stockholders' Equity

$331 2001

$400 2002

$447 2003

$536 2004

$623 2005

$693 2006

20.1% 2001

20.2% 2002

19.1% 2003

19.2% 2004

19.4% 2005

20.2% 2006

Net Income (in millions)

Drive-Ins System...

-

Page 5

...-Store Sales

System-Wide Marketing Expenditures (in millions)

Total National Cable and System Marketing Fund

$80 2.3% 2001 3.5% 2002 0.3% 2003 6.5% 2004 6.0% 2005 4.5% 2006 $15 2001

$90 $17 2002

$100 $20 2003

$110 $32 2004

$125 $60 2005

$145 $72 2006

System-wide Store Locations

Day Part...

-

Page 6

... - above our long-term target growth rate - as we notched our twentieth consecutive year of positive same-store sales. A successful development program is another catalyst pushing our revenues and earnings. During fiscal 2006, we opened 173 new drive-ins. This nearly matched the 175 new drive-ins we...

-

Page 7

... our common stock in open-market transactions. In fiscal 2006, we purchased 4.8 million shares at a total value of approximately $94 million. At the beginning of the year, we also acquired 15 franchise drive-ins operating in our core markets. Taking advantage of our strong balance sheet, our Board...

-

Page 8

..., have helped ensure our success in building our penetration in existing markets while forming a strong foundation for our expansion to new markets. Supported by strong media strategies, these fundamentals continue to produce tangible results for our operators, like average unit volume that climbed...

-

Page 9

7

Sonic Corp. 2006 Annual Report

-

Page 10

Sonic Corp. 2006 Annual Report

8

Increasingly, we have viewed our business in terms of day part performance and have placed greater emphasis on how we can improve sales and profits by day part for our partners and franchisees. These goals intersect critically with our marketing strategies as we ...

-

Page 11

... effect, we also have found that it typically has stimulated considerable interest for Sonic prior to our arrival in new markets, raising consumer awareness and excitement in advance of new drive-in openings. For example, consider that in fiscal 2006, our average annual system-wide drive-in volume...

-

Page 12

-

Page 13

... and partners to build on new technologies to help improve our operational performance. A great example of this is PartnerNet, a bi-directional communications platform linking company and franchisee information systems. It also supports system-wide programs to standardize and improve the way Sonic...

-

Page 14

... to improve their business, such as current system-wide sales information to develop an ideal food cost model, as well as e-learning modules to train staff. PartnerNet also unites franchisor and franchisees in a sophisticated process for supply chain management so we can work together with vendors...

-

Page 15

..., actual and expected profitability, advertising effectiveness, franchisor management ability, support programs, and the overall operational effectiveness of the franchisor. We're proud to note that Sonic scored highest overall in the quick-service restaurant industry and number one in many of...

-

Page 16

... one first in line at Sonic, keeping us at the forefront of the quick-service sector. Refreshing the appearance of our drive-ins periodically is much the same and also can help create momentum. Just look at the last retrofit program we implemented in the mid-1990s. Change is good. Any driver will...

-

Page 17

...-out proceeded during the year in each test market. In making these refinements, we were successful in maintaining the high-energy excitement and iconic Sonic look. At the same time, we've reduced the investment amount per drive-in and have worked to lower ongoing operating costs, particularly for...

-

Page 18

... in this report. Year ended August 31, 2005(1) 2004(1) 2003(1)

(In thousands, except per share data)

2006 Income Statement Data: Partner Drive-In sales $585,832 Franchise Drive-Ins: Franchise royalties 98,163 Franchise fees 4,747 Other 4,520 Total revenues 693,262 Cost of Partner Drive-In sales 468...

-

Page 19

... unit volume. System-wide information includes both Partner Drive-In and Franchise Drive-In information, which we believe is useful in analyzing the growth of the brand as well as the company's revenues since franchisees pay royalties based on a percentage of sales.

Sonic Corp. 2006 Annual Report

-

Page 20

Sonic Corp. 2006 Annual Report

18

Management's Discussion and Analysis of Financial Condition and Results of Operations

System-Wide Performance Year Ended August 31, 2006 2005 2004

($ in thousands)

Percentage increase in sales System-wide drive-ins in operation (1): Total at beginning of period ...

-

Page 21

... $160 million in fiscal 2007. The system-wide marketing fund portion will again represent approximately one-half of total media expenditures for fiscal 2007. Sonic opened 173 new drive-ins during fiscal year 2006, consisting of 35 Partner Drive-Ins and 138 Franchise Drive-Ins, down slightly from 175...

-

Page 22

.... The increase in revenues primarily relates to solid sales growth for Partner Drive-Ins and a rise in franchising income. Revenues Year Ended August 31, 2006 2005 Revenues: Partner Drive-In sales Franchise revenues: Franchise royalties Franchise fees Other Total revenues

(In thousands)

Increase...

-

Page 23

... in franchise income (franchise royalties and franchise fees) as well as franchise sales, average unit volumes and the number of Franchise Drive-Ins. While we do not record Franchise DriveIn sales as revenues, we believe this information is important in understanding our financial performance since...

-

Page 24

Sonic Corp. 2006 Annual Report

22

Management's Discussion and Analysis of Financial Condition and Results of Operations

Franchise Information Year Ended August 31, 2006 2005 2004

($ in thousands)

Franchise fees and royalties (1) Percentage increase Franchise Drive-Ins in operation (2): Total at ...

-

Page 25

... ownership. We anticipate 150 to 160 store openings by franchisees during fiscal year 2007. Substantially all of these new drive-ins will open under our current form of license agreement, which contains a higher average royalty rate and initial opening fee. As a result of these new Franchise Drive...

-

Page 26

Sonic Corp. 2006 Annual Report

24

Management's Discussion and Analysis of Financial Condition and Results of Operations

staffing increases at the assistant manager level, as well as higher labor costs related to opening newly constructed stores as higher staffing levels were required for pre-...

-

Page 27

...due to the timing of tax payments. The noncurrent portion of long-term debt increased $61.2 million or 109.5% as a result of advances on the company's line of credit to fund portions of the share repurchases, capital expenditures and the Tennessee and Kentucky acquisition. Overall, total liabilities...

-

Page 28

...the cost of newly opened drive-ins, new equipment for existing drive-ins, drive-ins under construction, the acquisition of Franchise Drive-Ins and real estate, and other capital expenditures, from cash generated by operating activities and borrowings under our line of credit. During fiscal year 2006...

-

Page 29

... the development of additional Partner Drive-Ins, retrofit of existing Partner Drive-Ins and other drive-in level expenditures. We expect to fund these capital expenditures through cash flow from operations and borrowings under our new senior secured credit facility.

Sonic Corp. 2006 Annual Report

-

Page 30

Sonic Corp. 2006 Annual Report

28

Management's Discussion and Analysis of Financial Condition and Results of Operations

As of August 31, 2006, our total cash balance of $9.6 million reflected the impact of the cash generated from operating activities, borrowing activity, and capital expenditures ...

-

Page 31

...Sheets, and their share of the drive-in earnings is reflected as Minority interest in earnings of Partner Drive-Ins in the Costs and expenses section of the Consolidated Statements of Income. The ownership agreements contain provisions, which give Sonic the right, but not the obligation, to purchase...

-

Page 32

Sonic Corp. 2006 Annual Report

30

Management's Discussion and Analysis of Financial Condition and Results of Operations

Revenue Recognition Related to Franchise Fees and Royalties. Initial franchise fees are nonrefundable and are recognized in income when we have substantially performed or ...

-

Page 33

...We do not use financial instruments to hedge commodity prices because these purchase agreements help control the ultimate cost and any commodity price aberrations are generally short term in nature. This market risk discussion contains forward-looking statements. Actual results may differ materially...

-

Page 34

Sonic Corp. 2006 Annual Report

32

Consolidated Balance Sheets

August 31, 2006 2005*

(In thousands)

Assets: Current assets: Cash and cash equivalents Accounts and notes receivable, net Net investment in direct financing leases Inventories Deferred income taxes Prepaid expenses and other Total ...

-

Page 35

Consolidated Statements of Income

33

2006 Revenues: Partner Drive-In sales Franchise Drive-Ins: Franchise royalties Franchise fees Other Costs and expenses: Partner Drive-Ins: Food and packaging Payroll and other employee benefits Minority interest in earnings of Partner Drive-Ins Other operating ...

-

Page 36

Sonic Corp. 2006 Annual Report

34

Consolidated Statements of Stockholders' Equity

Common Stock Shares Amount

Paid-in Capital*

Accumulated Other Retained Comprehensive Treasury Stock Earnings* Income Shares Amount

(In thousands)

Balance at August 31, 2003 Exercise of common stock options Stock-...

-

Page 37

... financing activities Proceeds from borrowings Payments on long-term debt Purchases of treasury stock Payments on capital lease obligations Exercises of stock options Excess tax benefit from exercise of employee stock options Net cash used in financing activities Net increase (decrease) in cash and...

-

Page 38

Sonic Corp. 2006 Annual Report

36

Notes to Consolidated Financial Statements

August 31, 2006, 2005 and 2004 (In thousands, except per share data)

1. Summary of Significant Accounting Policies Operations Sonic Corp. (the "company") operates and franchises a chain of quick-service drive-ins in the ...

-

Page 39

... 20 years. The company's trademarks and trade names were deemed to have indefinite useful lives and are not subject to amortization. See Note 5 for additional disclosures related to goodwill and other intangibles. Ownership Program The company's drive-in philosophy stresses an ownership relationship...

-

Page 40

Sonic Corp. 2006 Annual Report

38

Notes to Consolidated Financial Statements

August 31, 2006, 2005 and 2004 (In thousands, except per share data)

Revenue Recognition, Franchise Fees and Royalties Revenue from Partner Drive-In sales is recognized when food and beverage products are sold. Initial ...

-

Page 41

...will generally be less than the company's overall tax rate, and will vary depending on the timing of employees' exercises and sales of stock. As a result of adopting SFAS 123R retrospectively, financial statements for the prior periods presented have been adjusted to reflect the fair value method of...

-

Page 42

Sonic Corp. 2006 Annual Report

40

Notes to Consolidated Financial Statements

August 31, 2006, 2005 and 2004 (In thousands, except per share data)

Income Taxes Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial ...

-

Page 43

... earnings per share for the years ended August 31: 2006 Numerator: Net income Denominator: Weighted average shares outstanding - basic Effect of dilutive employee stock options Weighted average shares - diluted Net income per share - basic Net income per share - diluted Anti-dilutive employee stock...

-

Page 44

... leases contain one to four renewal options at the end of the initial term for periods of five years. The company classifies income from leasing operations as other revenue in the Consolidated Statements of Income. Certain Partner Drive-Ins lease land and buildings from third parties. These leases...

-

Page 45

Notes to Consolidated Financial Statements

August 31, 2006, 2005 and 2004 (In thousands, except per share data)

43

Initial direct costs incurred in the negotiations and consummations of direct financing lease transactions have not been material. Accordingly, no portion of unearned income has been ...

-

Page 46

Sonic Corp. 2006 Annual Report

44

Notes to Consolidated Financial Statements

August 31, 2006, 2005 and 2004 (In thousands, except per share data)

Total rent expense for all operating leases and capital leases consists of the following for the years ended August 31: 2006 Operating leases: Minimum ...

-

Page 47

...year-end, Sonic signed a credit agreement with a group of banks which provides for a $100,000 five-year revolving credit facility and a $486,000 seven-year term loan facility. The new facility was used to refinance the existing line of credit in September 2006. See Note 18 for additional information...

-

Page 48

... recorded as a charge or credit to earnings. As of August 31, 2006, there was no hedge ineffectiveness. The following table presents the components of comprehensive income for the year ended August 31, 2006: Net Income Unrealized gains on interest rate swap agreement, net of tax Total comprehensive...

-

Page 49

... related to direct financing leases and different year ends for financial and tax reporting purposes Capital loss carryover State net operating losses Property, equipment and capital leases Allowance for doubtful accounts and notes receivable Deferred income from affiliated franchise fees...

-

Page 50

... of the common stock issued of $382 was reclassified from paid-in capital to common stock. All references in the accompanying consolidated financial statements to weighted average numbers of shares outstanding, per share amounts and Stock Purchase Plan and Stock Options share data have been adjusted...

-

Page 51

...the issuance of one common stock purchase right for each outstanding share of the company's common stock. Each right initially entitles stockholders to buy one unit of a share of preferred stock for $85. The rights will be exercisable only if a person or group acquires beneficial ownership of 15% or...

-

Page 52

... cost of $93,682 during fiscal year 2006. As of August 31, 2006, the company had $89,413 available under the program. 13. Net Revenue Incentive Plan The company has a Net Revenue Incentive Plan (the "Incentive Plan"), as amended, which applies to certain members of management and is at all times...

-

Page 53

... note purchase agreement, and has not been required to make any payments under any of these guarantees. 16. Selected Quarterly Financial Data (Unaudited)

First Quarter 2006 2005* Income statement data: Partner Drive-In sales Other Total revenues Partner Drive-In operating expenses Selling, general...

-

Page 54

..., at a purchase price of $23.00 per share for a total purchase price of $366,117. We funded the repurchase of the shares of our common stock with the proceeds from new senior secured credit facilities with a syndicate of financial institutions led by Banc of America Securities LLC and Lehman...

-

Page 55

... balance sheets of Sonic Corp. as of August 31, 2006 and 2005, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended August 31, 2006. These financial statements are the responsibility of the company's management...

-

Page 56

Sonic Corp. 2006 Annual Report

54

Management's Report on Internal Control Over Financial Reporting

The management of the company is responsible for establishing and maintaining adequate internal control over financial reporting. The company's internal control system was designed to provide ...

-

Page 57

...Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Sonic Corp. as of August 31, 2006 and 2005, and the related consolidated statements of income, retained earnings, and cash flows for each of the three years in the period ended August 31, 2006 of Sonic Corp...

-

Page 58

...P. Reed Vice President of Supply Chain Management Claudia San Pedro Vice President of Investor Relations and Treasurer Richard A. Schwabauer Vice President of Operations Paul S. Sinowitz Vice President of Purchasing & Distribution David A. Vernon Vice President of Franchise Sales J. Alan Walker Vice...

-

Page 59

... 2007 Annual Meeting of Stockholders will be held at 1:30 p.m. Central Standard Time on January 31, 2007, at our Headquarters Building, 4th Floor, 300 Johnny Bench Drive, Oklahoma City, Oklahoma. Annual Report on Form 10-K A copy of our annual report on Form 10-K for the year ended August 31, 2006...

-

Page 60

300 Johnny B ench Dr ive Ok lahoma Cit y, Ok lahoma 73104 405/225-5000 www.sonicdr ivein.com