Sally Beauty Supply 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Sally Beauty Supply annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Sally Beauty Holdings, Inc. - SBH

Filed: November 29, 2007 (period: September 30, 2007)

Annual report which provides a comprehensive overview of the company for the

past year

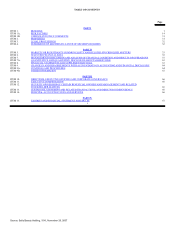

Table of contents

-

Page 1

FORM 10-K Sally Beauty Holdings, Inc. - SBH Filed: November 29, 2007 (period: September 30, 2007) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

Table of Contents PART I ITEM 1. ITEM 1. ITEM 1A. ITEM 1B. ITEM 2. ITEM 3. ITEM 4. BUSINESS 1 BUSINESS RISK FACTORS UNRESOLVED STAFF COMMENTS PROPERTIES LEGAL PROCEEDINGS SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS PART II ITEM 5. ITEM 6. ITEM 7. ITEM 7A. ITEM 8. ITEM 9. ITEM 9A. ITEM 9B. ... -

Page 3

INDEX TO FINANCIAL STATEMENTS EX-21.1 (EXHIBIT 21.1) EX-23.1 (EXHIBIT 23.1) EX-31.1 (EXHIBIT 31.1) EX-31.2 (EXHIBIT 31.2) EX-32.1 (EXHIBIT 32.1) EX-32.2 (EXHIBIT 32.2) -

Page 4

...20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED: SEPTEMBER 30, 2007 -ORo TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File No. 1-33145 ý SALLY BEAUTY HOLDINGS, INC... -

Page 5

... EXHIBITS AND FINANCIAL STATEMENT SCHEDULES i 1 14 31 31 32 32 33 35 37 63 63 64 64 65 66 66 66 66 66 67 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 6

...report, references to "the Company," "our company," "we," "our," "ours" and "us" refer to Sally Beauty Holdings, Inc., or Sally Beauty, and its consolidated subsidiaries for periods after the separation from Alberto-Culver Company, or Alberto Culver, and to Sally... to continue to supply products to us... -

Page 7

... materially from the results contemplated by these forward-looking statements. We assume no obligation to publicly update or revise any forward-looking statements. iii Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 8

...our net sales were in the U.S. and Canada for each of the last three fiscal years. For the year ended September 30, 2007 our net sales were $2,513.8 million. Sally Beauty Supply began as a single store in New Orleans in 1964 and was purchased in 1969 by our former parent company, Alberto-Culver. BSG... -

Page 9

... distributors and among professional beauty supply manufacturers. We believe that suppliers are increasingly likely to focus on larger distributors and retailers with broader scale and a retail footprint. We also believe that we are well 2 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 10

... Statements and Supplementary Data" of this report. Neither the sales nor the product assortment for Sally Beauty Supply or BSG are generally seasonal in nature. Sally Beauty Supply Sally Beauty Supply is the largest open-line distributor of professional beauty supplies in the U.S. based on store... -

Page 11

... approximately 10% of net sales in Sally Beauty Supply's U.S. stores for fiscal year 2007. We believe the breadth of selection of ethnic products available in Sally Beauty Supply Stores is unique and differentiates its stores from its competition. Sally Beauty Supply also aims to position itself to... -

Page 12

... recognition to leading third-party branded products. The following table sets forth the approximate percentage of Sally Beauty Supply's sales by merchandise category: Year Ended September 30, 2007 Hair color Skin and nail care Hair care Brushes, cutlery and accessories Electrical appliances Ethnic... -

Page 13

... table provides a history of Sally Beauty Supply store openings since the beginning of fiscal year 2003: Year Ended September 30, 2007 Stores open at beginning of period Net store openings during period Stores acquired during period Stores open at end of period Beauty Systems Group We believe that... -

Page 14

...2007 Company-owned retail stores Professional distributor sales consultants Franchise stores Total Merchandise BSG stores carry a broad selection of branded beauty supplies, ranging between 2,700 and 9,800 SKUs of beauty...attend, are educated on 7 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 15

...data and increase our understanding of customers' needs. Open New Stores and Exploring New Markets In fiscal year 2007, we opened 83 and 46 net new stores for Sally Beauty Supply and BSG, respectively. Because of the limited initial capital outlay, rapid payback, and attractive return on capital, we... -

Page 16

... of operations, especially in our BSG business. During fiscal year 2007 we made certain changes which included right-sizing the business (including... a focus on expanding our exclusive BSG territories and allowing Sally Beauty Supply to enter new markets outside the U.S. Competition Although there ... -

Page 17

... Sally Beauty Supply stores during fiscal year 2007, and we believe that the breadth of its selection of these products further differentiates Sally Beauty Supply from its competitors. In addition, as discussed above, Sally Beauty Supply also offers a customer loyalty program for Sally Beauty Supply... -

Page 18

...: Sally Beauty Supply Beauty Systems Group Consolidated Experienced Management Team with a Proven Track Record 2007 2.7%...reports to a territory manager. Suppliers We purchase our merchandise directly from manufacturers and fillers through supply contracts and by purchase order. For fiscal year 2007... -

Page 19

...continue to supply products to us." Distribution As of September 30, 2007, we operated 21 distribution centers, 6 of which serviced Sally Beauty Supply and 15 ... optimization program. We expect to achieve annual cost savings of approximately $10.0 million annually from this project within the next two... -

Page 20

... of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains our reports, proxy and information statements, and other information that we file electronically with the SEC atwww.sec.gov. 13 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 21

... us to include in our Annual Report on Form 10-K our management's report on, and assessment of, the effectiveness of our internal controls over financial reporting. In addition, our independent registered... the market price of our securities. 14 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 22

...financial information for the periods prior to the Separation Transactions included in this report is not representative of our future financial position, results of operations or ...administrative services and human resources. Our loss of these 15 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 23

...Sally Beauty Supply competes with other domestic and international beauty product wholesale and retail outlets, including local and regional open line beauty supply stores, professional-only beauty supply... west coast of the U.S. As a result, 16 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 24

...may be unable to provide products of adequate quality or who may be unwilling to continue to supply products to us. We do not manufacture the brand name or exclusive label products we sell, ... quantities or on acceptable terms in the future. 17 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 25

... business segments. For example, net sales and operating profits of Sally Beauty Supply and BSG were negatively affected in fiscal year 2005 by the... customers previously served by the distribution sales consultants to stores during fiscal year 2007, and we no longer expect to do so in the future. As ... -

Page 26

... facilities and capacity. If a material interruption of supply occurs, or a significant supplier ceases to supply us or materially decreases its supply to us, we may not be able to... the FDA and similar authorities in other jurisdictions, 19 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 27

... franchise agreements, or if Armstrong McCall fails to meet its obligations under its franchise agreements or vendor distribution agreements or is required to 20 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 28

...'s attention from our core business, including loss of management focus on marketplace developments; complying with foreign regulatory requirements, including multi-jurisdictional competition rules; 21 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 29

... additional geographic markets. The capital requirements to open a U.S. based Sally Beauty Supply or BSG store, excluding inventory, average approximately $60,000 and... $19.0 million capital spending program in fiscal years 2007 and 2008 to consolidate BSG warehouses and reduce administrative expenses... -

Page 30

...Sally," "Sally Beauty," "Sally Beauty Supply," "Sally ProCard," "BSG," "CosmoProf," "Armstrong McCall," "ion," "Salon Services" and "Beauty...fiscal year 2008 we will be upgrading our financial reporting system, our distribution systems (in connection with ... Sally Beauty Holding, 10-K, November 29, 2007 -

Page 31

...of an adequate work force in a market, the temporary or long term disruption in the supply of products (or a substantial increase in the cost of those products) from some local ... such refinancing to increase; and 24 • • • • • Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 32

...do not fully prohibit us or our subsidiaries from doing so. As of September 30, 2007, our senior credit facilities provided us commitments for additional borrowings of up to approximately $334...the Notes or make amendments to the terms thereof; 25 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 33

...consolidated EBITDA (as those terms are defined in the relevant credit agreement). In addition, if Sally Holdings fails to maintain a specified minimum level of borrowing capacity under the ABL facility, it... us to become bankrupt or insolvent. 26 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 34

..." in "Item 8-Financial Statements and Supplementary Data" of this report and "Item 7A-Quantitative & Qualitative Disclosure About Market Risk-Interest...interest expense was an increase of approximately $3.0 million for fiscal year 2007. Future changes in the fair value of the interest rate swap... -

Page 35

... minor additional change in the ownership of our common stock could trigger a significant tax liability for us under Section 355 of the Code. 28 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 36

... those transactions, and the instruments governing our indebtedness contain limits on our ability to incur additional debt, our inability to raise even a small 29 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 37

... any premium above market price for their shares that may otherwise be offered in connection with any attempt to acquire control of us. 30 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 38

... with customary renewal options. The following table provides the number of stores in the U.S. and globally, as of September 30, 2007: Sally Beauty Supply Location United States International: Puerto Rico Spain United Kingdom Canada Japan Germany Mexico Ireland Total International Total Store Count... -

Page 39

... no material legal proceedings pending against us or our subsidiaries, as of September 30, 2007. We are involved in various claims and lawsuits incidental to the conduct of our business...SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS None. 32 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 40

...prices of our common stock, as reported by the NYSE. Quarter Ended High Low September 30, 2007 $ 9.34 $ 7.52 June 30, 2007 $ 9.90 $ 8.78 March 31, 2007 $ 9.68 $ 7.57 November ...The following illustrates the comparative total return among Sally Beauty, the Dow Jones Wilshire Specialty Retailers Index... -

Page 41

... for the fiscal year ending September 30, 2007: COMPARISON OF CUMULATIVE TOTAL RETURN • The Dow Jones Wilshire Specialty Retailers Index (NYSE: DWCSRT) is a comprehensive view of entities which are primarily in the retail sector in the U.S. Sally Beauty is one of the entities included in this... -

Page 42

... thousands, except per share data): Year Ended September 30, 2007 2006 2005 2004 2003 Results of operations information: Net sales ... average shares, diluted Operating data: Number of retail stores (end of period): Sally Beauty Supply Beauty Systems Group 0.25 0.24 180,392 182,375 - - - - - ... -

Page 43

... 1,244 1,167 Comparable store sales growth(f): Sally Beauty Supply 2.7% 2.4% 2.4% 3.8% Beauty Systems Group 10.1% 4.1% (0.6%) 8.5% Consolidated ...2005. Fiscal years 2007 and 2006 include share-based compensation of $13.1 million and $5.2 million, respectively. 35 Source: Sally Beauty Holding, 10-K,... -

Page 44

...related to this conversion. Fiscal year 2007 includes one-time charges associated with the...Interest expense in fiscal year 2007 is primarily attributable to ...2007 was calculated from November 16, 2006 through September 30, 2007...time prior to the date of this report. We do not anticipate paying regular ... -

Page 45

... year 2006. Consolidated comparable stores sales growth increased 4.5%. Sally Beauty Supply and BSG opened 83 and 46 net stores, respectively, in fiscal year 2007. On February 15, 2007, we completed an acquisition in our Sally Beauty Supply business segment that expanded our presence in Europe. 37... -

Page 46

... Clairol, Revlon and Conair, as well as an extensive selection of exclusive label merchandise. For the year ended September 30, 2007, Sally Beauty Supply's net sales and segment operating profit were $1,567.4 million and $273.4 million, respectively, representing 62.4% and 80.9% of consolidated net... -

Page 47

... on our business. Favorable demographic and consumer trends. The aging baby-boomer population is expected to drive future growth in professional beauty supply sales through an increase in the usage of hair color and 39 • • • • • Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 48

... to rationalize our infrastructure. During fiscal year 2007, we began implementing a two-year, $19...believe that this plan could produce significant annual expense savings within the next two years... Sally Beauty Supply and BSG are generated through retail stores with respect to the Sally Beauty Supply ... -

Page 49

...by acquisitions of existing distributors. Recent Acquisitions On February 15, 2007, we entered into and completed an Agreement for the Sale ...the registered shareholders of Salon Services. This acquisition provided the Sally Beauty Supply segment a strong European presence. Pursuant to the Agreement, ... -

Page 50

Agreement. As a result: (i) we own and operate the Sally Beauty Supply and BSG distribution businesses that were owned and operated by Alberto-Culver prior to the ... equity and incentive compensation plans, and as a change in control for our 42 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 51

...in the business or applied to repay borrowings under the ABL facility. The Notes are unsecured obligations of Sally Holdings and its co-issuer and are guaranteed on a senior basis (in the case of the senior... on the NYSE under the symbol "SBH." 43 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 52

...benefits from employee exercises of stock options as operating cash inflow. As of September 30, 2007, we had $10.6 million of unrecognized compensation cost related to stock options issued to employees... had been granted stock options and 44 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 53

...November 16, 2006. For fiscal year 2007, we recorded a charge equal to ... 2007, 2006 and 2005 (amounts in millions): Year Ended September 30, 2007 Net... 834.4 192.6 3.0 189.6 73.1 116.5 (a) For the fiscal year 2007, net interest expense is primarily associated with debt incurred in connection with the... -

Page 54

...of net sales for the respective periods: Year Ended September 30, 2007 Net sales Cost of products sold and distribution expenses Gross profit ....0% 54.2% 45.8% 38.2% 7.6% 0.0% 7.6% 3.0% 4.6% 2005 100.0% 54.4% 45.6% 37.1% 8.5% 0.1% 8.4% 3.2% 5.2% Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 55

...concerning key measures we rely on to gauge our operating performance (dollars in thousands): Year Ended September 30, 2007 Net sales: Sally Beauty Supply BSG $ $ Gross Profit Gross profit margin Selling, general and administrative expenses Depreciation and amortization Earnings before provision for... -

Page 56

...Sally Beauty Supply. Sally Beauty Supply generates net sales primarily by selling products through its stores to both professional and retail customers. Sally Beauty Supply...a comparable expense. Transaction Expenses. For fiscal year 2007, transaction expenses are costs associated with the Separation ... -

Page 57

... of 2006, contributed approximately $21.4 million of incremental revenue during fiscal year 2007. Sally Beauty Supply. Net sales for Sally Beauty Supply increased $148.1 million, or 10.4%, to $1,567.4 million for fiscal year 2007 compared to $1,419.3 million for the same period in 2006. Net sales... -

Page 58

... are not reflected in the segment operating earnings of Sally Beauty Supply and BSG discussed below. Sally Beauty Supply. Sally Beauty Supply's segment operating earnings increased $38.0 million, or 16.1%, to $273.4 million for fiscal year 2007 compared to $235.4 million for the same period in... -

Page 59

...was acquired during the third quarter of fiscal year 2006. Sally Beauty Supply. Net sales for Sally Beauty Supply increased $60.4 million, or 4.4%, to $1,419.3 million... a full reporting period for CosmoProf for fiscal year 2006, which provided 51 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 60

...the addition of assets associated with acquisitions and the unit growth of the Sally Beauty Supply and BSG businesses. Sales-based Service Fee Charged by Alberto-Culver The...and Alberto-Culver was subsequently cancelled in fiscal year 2007 in connection with the Separation Transactions. Other Expenses... -

Page 61

... profit of Sally Beauty Supply and BSG discussed below. Sally Beauty Supply. As a result of the foregoing, Sally Beauty Supply's segment operating...00 at September 30, 2007 compared to 2.65 to 1.00 at September 30, 2006. The decrease in current assets at September 30, 2007 was primarily impacted by ... -

Page 62

... term of the debt. Accrued expenses increased $39.7 million to $153.8 million at September 30, 2007, compared to $114.1 million at September 30, 2006. This increase was primarily a result of $... considered separately from capital resources that 54 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 63

...depend on our subsidiaries, including Sally Holdings, to distribute funds ... covenants restricting Sally Holdings' ability... of each of Sally Holdings and its ...its liabilities, in the case of Sally Holdings or such subsidiary that is...activities and, for fiscal year 2007, from borrowings. The primary ... -

Page 64

...2007, 2006 and 2005 (in thousands): Year Ended September 30, 2007...during fiscal year 2007 increased by $... during fiscal year 2007 increased by $69...fiscal year 2007 is ...during fiscal year 2007 increased by $... overdraft balance. For fiscal year 2005, Sally Holdings borrowed $52.3 million from affiliated... -

Page 65

... Term Loans and the ABL facility are secured by substantially all of our assets, those of Sally Investment Holdings LLC, those of our domestic subsidiaries and, in the case of the ABL facility... Credit Agreement EBITDA), less unfinanced capital 57 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 66

... Agreement EBITDA likely will not be comparable to EBITDA or similarly titled measures reported by other companies. We believe that we are currently in compliance with the...867 $ Total 2,815,803 429,628 163,445 16,568 3,425,444 $ $ $ $ $ Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 67

...and interest rates as of September 30, 2007. In accordance with GAAP, these obligations ...report and "Item 7A-Quantitative & Qualitative Disclosure about Market Risk-Interest rate risk" for a discussion of interest rate swap agreements. The majority of our operating leases are for Sally Beauty Supply... -

Page 68

...conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets ... if actual results differ from management's expectations. 60 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 69

... liability on trends in claim payment history, historical trends in claims incurred but not yet reported, and other components such as expected increases in medical costs, projected premium costs and the... our effective tax rate at that time. 61 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 70

...related to these financial instruments reported in earnings at each subsequent reporting date. SFAS 159 is effective in fiscal years beginning after November 15, 2007. We are currently assessing... position, statements of earnings or cash flows. 62 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 71

...increase or decrease earnings before provision for income taxes by approximately $1.3 million on an annual basis, without considering the effect of any interest rate swap agreements we may have from... which is located on page 74 of this report. 63 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 72

...the effectiveness of our disclosure controls and procedures can be reported in our Quarterly Reports on Form 10-Q and our Annual Reports on Form 10-K. Many of the components of our disclosure... dynamic systems that change as conditions warrant. 64 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 73

... financial reporting identified in connection with the evaluation described above that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. ITEM 9B. OTHER INFORMATION None. 65 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 74

...information required by Item 14 of this Annual Report on Form 10-K is incorporated by reference from our Proxy Statement related to the 2008 Annual Meeting of Shareholders under the headings "Proposal 2-Ratification of Selection of Auditors." 66 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 75

... Company, Sally Holdings, Inc., New Sally Holdings, Inc. and New Aristotle Holdings, Inc., which is incorporated by reference from Exhibit 2.01 to the Company's Current Report on Form 8-K filed on October 30, 2006 2.2 2.3 2.4 2.5 2.6 67 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 76

...the Company's Quarterly Report on Form 10-Q filed May 10, 2007 Amended and Restated Certificate of Incorporation of Sally Beauty Holdings, Inc., ...Company's Annual Report on Form 10-K filed on December 22, 2006 Indenture, dated as of November 16, 2006, by and among Sally Holdings LLC and Sally Capital... -

Page 77

...reference from Exhibit 4.5.2 to the Company's Current Report on Form 8-K filed on November 22, 2006 Credit Agreement, dated November 16, 2006, with respect to an Asset-Based Loan Facility, among Sally Holdings LLC, Beauty Systems Group LLC, Sally Beauty Supply LLC, any Canadian Borrower from time to... -

Page 78

... Company, New Sally Holdings, Inc. and Howard B. Bernick, which is incorporated by reference from Exhibit 10.11 to the Current Report on Form 8-K filed by Alberto-Culver Company on June 22, 2006 70 10.1 10.2 10.3 10.4 10.5 10.6 10.7 10.8 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 79

..., which is incorporated by reference from Exhibit 10.10 to the Company's Annual Report on Form 10-K filed on December 22, 2006 Director and Officer Indemnification Agreement, dated as of January 15, 2007, between Sally Beauty Holdings, Inc. and David L. Rea, which is incorporated by reference from... -

Page 80

...(File No. 333-144427) of Sally Holdings LLC and Sally Capital, Inc. filed on July 9, 2007 Sally Beauty Holdings, Inc. Annual Incentive Plan, which is incorporated by...in agreements or other documents filed as exhibits to this Annual Report on Form 10-K. In certain instances the disclosure schedules to... -

Page 81

... Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on the 29th day of November, 2007. SALLY BEAUTY HOLDINGS, INC. By: /s/ GARY G. WINTERHALTER Gary G. Winterhalter President, Chief Executive Officer... -

Page 82

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Financial Statements Years ended September 30, 2007, 2006, and 2005 INDEX TO FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Introduction Consolidated Financial Statements: Consolidated Balance Sheets as of September 30,... -

Page 83

... Registered Public Accounting Firm The Board of Directors and Stockholders Sally Beauty Holdings, Inc.: We have audited Sally Beauty Holdings, Inc.'s internal control over financial reporting as of September 30, 2007, based on criteria established inInternal Control-Integrated Framework issued by... -

Page 84

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), Sally Beauty Holdings, Inc.'s internal control over financial reporting as of September 30, 2007, based on criteria established inInternal Control-Integrated Framework issued by the Committee of... -

Page 85

Introduction The following financial statements as of and for the fiscal year ended September 30, 2007 are those of Sally Beauty Holdings, Inc. and its consolidated subsidiaries. The financial condition as of September 30, 2006 and the financial statements for the fiscal years ended September 30, ... -

Page 86

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Consolidated Balance Sheets September 30, 2007 and 2006 (In thousands, except per share data) 2007 Assets Current assets: Cash and cash equivalents Trade accounts receivable, less allowance for doubtful accounts of $2,564 and $2,246 at September 30, 2007 ... -

Page 87

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Earnings Years ended September 30, 2007, 2006, and 2005 (In thousands, except per share data) 2007 Net sales Cost of products sold and distribution expenses Gross profit Selling, general and administrative expenses Depreciation ... -

Page 88

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Cash Flows Years ended September 30, 2007, 2006, and 2005 (In thousands) 2007 Cash Flows from Operating Activities: Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation ... -

Page 89

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Stockholder's (Deficit) Equity Years ended September 30, 2007, 2006, and 2005 (In thousands) Number of Shares Dollars Accumulated Other Comprehensive Income 9,224 $ - 4,208 4,208 - - - 13,432 - 2,851 2,851 - - - - 16,283 - 18,... -

Page 90

...of Business Sally Beauty Holdings, Inc. and its consolidated subsidiaries ("Sally Beauty", or "the Company") sell professional beauty supplies, primarily through its Sally Beauty Supply retail ...to conform to the current year's presentation. F-8 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 91

...conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent ... based on historical collection data and current customer F-9 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 92

... a straight-line basis over the lease term as a reduction of rent expense, which is consistent with the amortization period for the constructed assets. F-10 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 93

... Goodwill is reviewed for impairment annually, and whenever events or changes in circumstances indicate it is more likely than not that the fair value of a reporting unit is less than its ... losses may differ from the amounts provided. F-11 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 94

... million, $49.1 million and $45.3 million in the fiscal years ended September 30, 2007, 2006 and 2005, respectively, and are included in selling, general and administrative expenses in ... net basis, and are excluded from revenue. The Company F-12 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 95

...and $41.1 million for the fiscal years 2007, 2006 and 2005, respectively. All other ...thousands): Reported net earnings: Add: Stock-based compensation expense included in reported net earnings...289) $ 116,157 The $3.0 million addition to reported net earnings in fiscal year 2005 for share-based ... -

Page 96

...of September 30, 2007. This amount will ...In February 2007, the ...reported in earnings at each subsequent reporting date. SFAS 159 is effective in fiscal years beginning after November 15, 2007...15, 2007. The ... quarter of fiscal year 2007 and it did not ... ("Regis") to merge Sally Holdings with a subsidiary ... -

Page 97

... Agreement. As a result, the Company owns and operates the Sally Beauty Supply and BSG distribution businesses that were previously owned and operated by ... professional services, legal and investment banking fees. For fiscal year 2007, the total amount of transaction expenses was $21.5 million.... -

Page 98

... formula intended to reflect the limitations placed on the number of shares of Sally Beauty that CDRS may acquire in order not to jeopardize the intended tax-free...and approximately 180.9 million shares outstanding as of September 30, 2007. The change in common stock resulted from the issuance of ... -

Page 99

...30, 2007 Net earnings...16, 2006 through September 30, 2007, which represents the actual number of...At September 30, 2007, options to ...years 2007 and... 2007,...2007 Omnibus Incentive Plan (the "2007 Plan"). For fiscal years 2007... fiscal year 2007, the Company adopted the 2007 Plan, ...fiscal year 2007, the Company... -

Page 100

... continue vesting awards upon retirement under the terms of the 2007 Plan. Additionally, during fiscal year 2007, the Company granted approximately 0.1 million restricted stock units ("... from Alberto-Culver were adjusted accordingly. F-18 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 101

...per option, respectively. The total intrinsic value of options exercised during fiscal years 2007, 2006 and 2005 was $5.9 million, $7.5 million and $11.8 million, ... was $1.7 million during fiscal year 2007. Prior to the Separation Transactions the F-19 Source: Sally Beauty Holding, 10-K, November 29... -

Page 102

...2007, 2006 and 2005 was $7.3 million, $4.4 million and $4.3 million, respectively. At September 30, 2007...(a) Granted Vested Forfeited Non-vested at September 30, 2007 Number of Shares (In Thousands) 31 (31) ...For fiscal year 2007, approximately 31,... awards at September 30, 2007 was $2.4 million and the... -

Page 103

...on the closing price of the Company's common stock on the grant date. Under the 2007 Plan, the Company will issue to non-employee directors the shares of common stock underlying ...403 (2,252) 22 2,246 $ 2005 2,500 1,754 (2,292) 111 2,073 $ $ $ Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 104

... and Other Intangibles The change in the carrying amounts of goodwill by operating segment for the fiscal years 2007 and 2006 is as follows (in thousands): Sally Beauty Supply Balance at September 30, 2005 Additions, net of purchase price adjustments Foreign currency translation Balance at September... -

Page 105

...,992 52,525 $ 35,193 6,053 41,246 20,187 (8,195) 11,992 53,238 The increase in Sally Beauty Supply's trade names and intangible assets subject to amortization in fiscal year 2007 was primarily due to the acquisition of Salon Services. The increase in BSG's trade names and intangible assets subject... -

Page 106

...2007. Accrued expenses consist of the following (in thousands): September 30, 2007... properties. At September 30, 2007, future minimum payments under non...third quarter of fiscal year 2007, the Company exercised an option... and $123.1 million in fiscal years 2007, 2006 and 2005, respectively, and is... -

Page 107

...proceedings pending against the Company or its subsidiaries, as of September 30, 2007. The Company is involved in various claims and lawsuits incidental to the conduct...LIBOR plus (2.25% to 2.50%) (a) London Interbank Offered Rate ("LIBOR") F-25 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 108

... by substantially all of our assets, those of Sally Investment Holdings LLC, a wholly-owned subsidiary of Sally Beauty and the direct parent of Sally Holdings, those of our domestic subsidiaries and, in... 15, 2011, respectively, at par F-26 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 109

...interest. Interest on the senior notes and senior subordinated notes is payable semi-annually. On November 24, 2006, the Company entered into two interest rate swap..., at September 30, 2007 and 2006. Sally Beauty Holdings, Inc. Stand-Alone Financial Information Sally Beauty Holdings, Inc. is ... -

Page 110

...Net cash used by operating activities Net cash provided by financing activities Distribution from Sally Holdings LLC Proceeds from exercise of stock options Proceeds from equity, net of ... rate payments based on the three-month LIBOR rate. F-28 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 111

... employees may contribute a percentage of their annual compensation to the 401k Plan up to certain...Sally Beauty 401(k) Savings Plan. The Company recognized expense of $3.3 million, $2.1 million and $2.2 million in fiscal years 2007... a separate entity for tax reporting purposes. Prior to the Separation... -

Page 112

...and the effective income tax rate is summarized below: Year Ended September 30, 2007 Statutory tax rate State income taxes, net of federal tax benefit Effect of...2.1 (0.4) 6.9 2.5 46.1% 2006 35.0% 3.2 (0.1) - 0.7 38.8% 2005 35.0% 2.1 1.5 - - 38.6% Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 113

..., no U.S. income taxes have been provided on those earnings at September 30, 2007. The transactions separating us from Alberto-Culver were intended to qualify as a reorganization... in the Separation Transactions, we received: (i) a private F-31 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 114

... the date of acquisition. Salon Services is included in the Sally Beauty Supply segment. Pro-forma information for Salon Services is not provided ...be completed during fiscal year 2008. In addition, during fiscal year 2007 the Company made five other acquisitions, which were accounted for using the... -

Page 115

... are included in the Sally Beauty Supply segment. Such acquisition included...beauty products, in order to expand the geographic area served by BSG, for a total purchase price as of September 30, 2007, of $23.2 million. Approximately $1.8 million of the purchase price was to be paid in equal annual... -

Page 116

... $13.3 million in fiscal years 2007, 2006 and 2005, respectively. These amounts are classified as part of unallocated expenses for the Company's segment reporting purposes in Note 18. The costs... companies were subsequently repaid in F-34 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 117

... that benefit both the Sally Beauty Supply and BSG segments. Accordingly, management has defined its reportable segments as Sally Beauty Supply and BSG, to report these segments separately from ...The Company does not sell between segments. F-35 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 118

... 2006 and 2005 is as follows (in thousands): Year Ended September 30, 2007 Net sales: Sally Beauty Supply BSG Total Earnings before provision for income taxes: Segment operating profit: Sally Beauty Supply BSG Segment operating profit Unallocated expenses(a) Share-based compensation expense Non-cash... -

Page 119

...earnings information for the fiscal years ended September 30, 2007 and 2006 is summarized below (in thousands): Fiscal Year 2007: Net sales Gross profit Net earnings Earnings per ... common stock were publicly traded during the quarter. F-37 (b) Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 120

Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 121

...) Salon Success International, LLC (Florida) (3) Sally Beauty Supply LLC (Delaware) Diorama Services Company, LLC (Delaware) Sally Capital Inc. (Delaware) Sally Beauty Distribution LLC (Delaware) Sally Beauty International Finance LLC (Delaware) Sally Beauty Holding LLC (Delaware) Beyond the Zone... -

Page 122

... Avec Corporation Ltd (England) (a) Davines (UK) Ltd (Scotland) (b) Leader International Ltd (England) (c) Sally Beauty Supply, B.V. (Netherlands) Sally Hair and Beauty GmbH (Germany) (5) Sally Beauty Supply Japan, Inc. (Japan) SBCBSG Company de Mexico, s. de R.I. de C.V. (Mexico) SBIFCO Company de... -

Page 123

QuickLinks Exhibit 21.1 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 124

... in the three-year period ended September 30, 2007, and the effectiveness of internal control over financial reporting as of September 30, 2007, which reports appear in the September 30, 2007 Annual Report on Form 10-K of Sally Beauty Holdings, Inc. Our report refers to the adoption of the Financial... -

Page 125

QuickLinks Exhibit 23.1 Consent of Independent Registered Public Accounting Firm Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 126

...that: (1) I have reviewed this annual report on Form 10-K of Sally Beauty Holdings, Inc.; (2) Based on my knowledge, this report does not contain any untrue statement... reporting. Date: November 29, 2007 By: /s/ GARY G. WINTERHALTER Gary G. Winterhalter Chief Executive Officer Source: Sally Beauty ... -

Page 127

QuickLinks Exhibit 31.1 CERTIFICATION PURSUANT TO EXCHANGE ACT RULES 13a-14(a) AND 15d-14(a), AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 128

... (1) I have reviewed this annual report on Form 10-K of Sally Beauty Holdings, Inc.; (2) Based on my knowledge, this report does not contain any untrue ...reporting. Date: November 29, 2007 By: /s/ DAVID L. REA David L. Rea Senior Vice President and Chief Financial Officer Source: Sally Beauty... -

Page 129

QuickLinks Exhibit 31.2 CERTIFICATION PURSUANT TO EXCHANGE ACT RULES 13a-14(a) AND 15d-14(a), AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 130

... 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Sally Beauty Holdings, Inc. (the "Company") on Form 10-K for the fiscal year ended September 30, 2007 as filed with the Securities and Exchange Commission on the date hereof (the... -

Page 131

QuickLinks Exhibit 32.1 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 Source: Sally Beauty Holding, 10-K, November 29, 2007 -

Page 132

... 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the Annual Report of Sally Beauty Holdings, Inc. (the "Company") on Form 10-K for the fiscal year ended September 30, 2007 as filed with the Securities and Exchange Commission on the date hereof (the... -

Page 133

QuickLinks Exhibit 32.2 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 _____ Created by 10KWizard www.10KWizard.com Source: Sally Beauty Holding, 10-K, November 29, 2007