Progress Energy 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Progress Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 Annual Report and Form 10-K

Lighting the way

l

Table of contents

-

Page 1

Lighting the way 2013 Annual Report and Form 10-K -

Page 2

... 2013, 2012 and 2011 asset impairments (see Note 4 to the Consolidated Financial Statements, "Regulatory Matters"). On July 2, 2012, immediately prior to the merger with Progress Energy, Duke Energy executed a one-for-three reverse stock split. All share and earnings per share amounts are presented... -

Page 3

.... Duke Energy has been learning and adapting throughout its 110-year history, including disruptive periods in the utility industry. We have adjusted to changes in technologies, fuel prices, regulations, economic conditions and consumer behavior. Today, our industry faces a 2013 ANNUAL REPORT 1 l -

Page 4

... After our July 2012 merger with Progress Energy, we knew we needed to concentrate on the immediate priorities in our regulated utility business. Our utilities serve 7.2 million 7.2 MILLION retail electric customers retail electric customers in North Carolina, South Carolina, Florida, Indiana, Ohio... -

Page 5

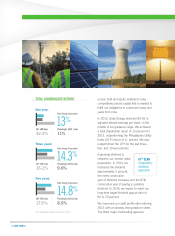

MET OUR 2013 GOALS: Completed a $9 billion plant modernization program Put Edwardsport clean coal plant into service Achieved constructive rate case settlements and approvals Met merger-integration and cost-savings milestones Resolved Crystal River Nuclear Plant future Achieved our financial ... -

Page 6

... year of dividend increases and the 87th consecutive year of paying a quarterly dividend. In 2014, we expect to reach our long-term target dividend payout ratio of 65 to 70 percent. We improved our credit profile after entering 2013 with an already strong balance sheet. The three major credit-rating... -

Page 7

... injury rate in our history. Generation: Achieved a combined nuclear fleet capacity factor above 90 percent for the 15th year in a row. Reliability: Met the operational challenges of record-breaking winter weather in 2014. improved their outlooks for Duke Energy or our various utility subsidiaries... -

Page 8

... expense savings in 2014, which helps hold down future rate increases for all our customers. Our nuclear fleet of 11 units achieved a combined capacity factor of 92.8 percent in 2013, our 15th consecutive year above 90 percent. During the critical months of June through August, when low-cost power... -

Page 9

...; utility-sponsored efficiency programs; and the continued focus on cutting energy expenses in homes and businesses. At the same time, utilities face additional costs from upgrading aging infrastructure and complying with new regulations for plant emissions, nuclear safety and grid security. Duke... -

Page 10

... technology helps customers make more efficient use of energy and paves the way for new products and services. Meanwhile, across the nation, new technologies and nontraditional providers are tapping into the growing consumer interest in energy management and on-site power generation. North Carolina... -

Page 11

... successful in signing new contracts to supply more of their power needs. In February 2014, we announced exclusive discussions with the North Carolina Eastern Municipal Power Agency (NCEMPA) to purchase its minority interest in some of our generating plants. If we reach an agreement and secure the... -

Page 12

... was a bridging year for our company - a time of accomplishment, integration and transition. We are achieving greater efficiencies, producing electricity more cleanly and delivering it more reliably. Lynn J. Good Vice Chairman, President and Chief Executive Officer March 7, 2014 10 DUKE ENERGY l -

Page 13

... projects 41% Coal 33% Nuclear 24% Natural Gas/Fuel Oil 2% Hydro and Solar Customer Diversity (in billed GWh sales) 2 33% Residential 31% General Services 21% Industrial 15% Wholesale/Other Regulated Utilities consists of Duke Energy's regulated generation, electric and natural gas transmission... -

Page 14

... Operations Committee Director of Duke Energy or its predecessor companies since 2001 John H. Forsgren Retired Vice Chairman, Executive Vice President and Chief Financial Officer - Northeast Utilities Member, Finance and Risk Management Committee, Nuclear Oversight Committee Director of Duke Energy... -

Page 15

DUKE ENERGY CORPORATION Cautionary Statement Regarding Forward-Looking Information Non-GAAP Financial Measures 2013 Form 10-K A DUKE ENERGY l -

Page 16

... deï¬ned beneï¬t pension plans, other post-retirement beneï¬t plans, and nuclear decommissioning trust funds; changes in rules for regional transmission organizations, including changes in rate designs and new and evolving capacity markets, and risks related to obligations created by the default... -

Page 17

...per share amounts) Adjusted segment income Crystal River Unit 3 charges Costs to achieve Progress Energy merger Nuclear development charges Litigation reserve Economic hedges (Mark-to-market) Asset sales Segment income (loss) Income from Discontinued Operations Net Income Attributable to Duke Energy... -

Page 18

... operations for accounting purposes, management expects to continue including any Midwest generation ï¬,eet earnings in adjusted earnings, adjusted diluted EPS, and adjusted segment income. Management believes it is unlikely a sale transaction will close in 2014. hedges in the Commercial Power... -

Page 19

... a shell company (as deï¬ned in Rule 12b-2 of the Exchange Act). Yes ï,¨ No ï¸ Estimated aggregate market value of the common equity held by nonafï¬liates of Duke Energy at June 30, 2013. 47,550,155,353 Number of shares of Common Stock, $0.001 par value, outstanding at February 25, 2014. 706,455... -

Page 20

... for deï¬ned beneï¬t pension plans, other postretirement beneï¬t plans, and nuclear decommissioning trust funds; • Changes in rules for regional transmission organizations, including changes in rate designs and new and evolving capacity markets, and risks related to obligations created by the... -

Page 21

... Per Share ERISA ...Employee Retirement Income Security Act ESOP ...Employee Stock Ownership Plan ESP ...Electric Security Plan ETR ...Effective tax rate FASB ...Financial Accounting Standards Board FERC ...Federal Energy Regulatory Commission Fitch ...Fitch Ratings, Inc. Florida Progress...Florida... -

Page 22

...Parent ...Duke Energy Corporation Holding Company PJM ...PJM Interconnection, LLC Progress Energy...Progress Energy, Inc. PSCSC...Public Service Commission of South Carolina PSD ...Prevention of Signiï¬cant Deterioration Public Staff ...North Carolina Utilities Commission Public Staff PUCO...Public... -

Page 23

...Energy Florida, Duke Energy Indiana, and the regulated transmission and distribution operations of Duke Energy Ohio. These electric and gas operations are subject to the rules and regulations of the FERC, the North Carolina Utilities Commission (NCUC), the Public Service Commission of South Carolina... -

Page 24

...Fuel Coal Natural Gas Natural Gas Natural Gas Natural Gas Natural Gas Coal Commercial Operation 2012 2011 2012 2012 2011 2013 2013 $ Cost (in millions) $ 2,100 675 675 725 575 575 3,550 8,875 Regulated Utilities' largest stranded cost exposure is primarily related to Duke Energy Florida's purchased... -

Page 25

... of nuclear fuel materials and services. Oil and Gas Oil and natural gas supply for Regulated Utilities' generation ï¬,eet is purchased under term and spot contracts from various suppliers. Duke Energy Carolinas, Duke Energy Progress, Duke Energy Florida and Duke Energy Indiana use derivative... -

Page 26

... 2013, 2012, and 2011, respectively, under purchase obligations and leases and had 3,800 and 4,500 MW of ï¬rm purchased capacity under contract during 2013 and 2012, respectively. These amounts include MWh for Duke Energy Progress and Duke Energy Florida for all periods presented. These agreements... -

Page 27

... rates. Fuel, fuel-related costs and certain purchased power costs are eligible for recovery by Regulated Utilities. Regulated Utilities uses coal, oil, hydroelectric, natural gas and nuclear fuel to generate electricity, thereby maintaining a diverse fuel mix that helps mitigate the impact of cost... -

Page 28

... - Rate Related Information." Federal The FERC approves Regulated Utilities' cost-based rates for electric sales to certain wholesale customers, as well as sales of transmission service. Regulations of FERC and the state utility commissions govern access to regulated electric and gas customers and... -

Page 29

... of electric power, fuel and emission allowances related to these plants as well as other contractual positions. Commercial Power's generation operations consist primarily of Duke Energy Ohio's coal-ï¬red and gas-ï¬red nonregulated generation assets located in the Midwest region of the United... -

Page 30

...Vice President, Regulated Utilities. Mr. Yates assumed his current position in November 2012. Prior to that, he was named Executive Vice President, Customer Operations in July 2012, upon the merger of Duke Energy and Progress Energy. Mr. Yates served as Chief Executive Ofï¬cer, Duke Energy Progress... -

Page 31

..., Inc. is a public utility holding company primarily engaged in the regulated electric utility business. Headquartered in Raleigh, North Carolina, and subject to regulation by the FERC, it owns Duke Energy Progress and Duke Energy Florida. When discussing Progress Energy's ï¬nancial information, it... -

Page 32

... customers and provides regulated transmission and distribution services for natural gas to 500,000 customers. See Item 2, "Properties" for further discussion of Duke Energy Ohio's Regulated Utilities generating facilities. COMMERCIAL POWER Commercial Power owns, operates and manages power plants... -

Page 33

...from the Dan River ash basis release, may require the Duke Energy Registrants to make additional capital expenditures and increase operating and maintenance costs. Duke Energy's investments and projects located outside of the U.S. expose it to risks related to the laws, taxes, economic and political... -

Page 34

... and distribution facilities owned and operated by utilities and other energy companies to deliver electricity sold to the wholesale market. FERC's power transmission regulations, as well as those of Duke Energy's international markets, require wholesale electric transmission services to be... -

Page 35

...'s and Duke Energy Indiana's membership in an RTO presents risks that could have a material adverse effect on their results of operations, ï¬nancial condition and cash ï¬,ows. The price at which Duke Energy Ohio can sell its generation capacity and energy is dependent on a number of factors, which... -

Page 36

... agreements. Market performance and other changes may decrease the value of the NDTF investments of Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida, which then could require signiï¬cant additional funding. Ownership and operation of nuclear generation facilities also requires... -

Page 37

... below projected rates of return. Although a number of factors impact funding requirements, a decline in the market value of the assets may increase the funding requirements of the obligations for decommissioning nuclear plants. If Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida... -

Page 38

PART I ITEM 2. PROPERTIES REGULATED UTILITIES The following table provides information related to Regulated Utilities' electric generation stations as of December 31, 2013. The MW displayed in the table below are based on summer capacity. Facility Duke Energy Carolinas Oconee Catawba(a) McGuire ... -

Page 39

... North Carolina Municipal Power Agency Number 1, North Carolina Electric Membership Corporation and Piedmont Municipal Power Agency. (b) Jointly owned with North Carolina Eastern Municipal Power Agency. (c) Duke Energy Florida owns and operates Intercession City Station Units 1-10 and 12-14. Unit... -

Page 40

...400 19,500 500 - - 300 7,200 6,100 Substantially all of Regulated Utilities' electric plant in service are mortgaged under indentures relating to Duke Energy Carolinas', Duke Energy Progress', Duke Energy Florida's, Duke Energy Ohio's and Duke Energy Indiana's various series of First Mortgage Bonds... -

Page 41

... Jointly owned with Ohio Power Company and/or The Dayton Power & Light Company. (b) Station is not operated by Duke Energy Ohio. (c) Beckjord Unit 4 with a total capacity of 150 MW was retired on February 17, 2014. In addition to the above facilities, Commercial Power owns an equity interest in the... -

Page 42

...court to postpone consideration of the consent order while DENR reviews Duke Energy Carolinas' and Duke Energy Progress's coal ash ponds in light of the release that occurred at Dan River on February 2, 2014. On February 20, 2014, DENR informed the court it will make a recommendation on the proposed... -

Page 43

... August 1, 2008 through March 31, 2013, Duke Energy Indiana's Gibson steam station violated opacity limits contained in its Title V permit. Duke Energy Indiana expects to enter into a settlement agreement with the EPA in the ï¬rst quarter of 2014, which would require payment of a civil penalty of... -

Page 44

... ISSUER PURCHASES OF EQUITY SECURITIES Duke Energy's common stock is listed for trading on the New York Stock Exchange (NYSE) (ticker symbol DUK). As of February 25, 2014, there were approximately 181,065 common stockholders of record. Common Stock Data by Quarter 2013 Stock Price Range(a) Dividends... -

Page 45

... Index 2012 Philadelphia Utility Index 2013 Duke Energy Corporation NYSE CEO Certiï¬cation Duke Energy has ï¬led the certiï¬cation of its Chief Executive Ofï¬cer and Chief Financial Ofï¬cer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 as exhibits to this Annual Report on Form... -

Page 46

...(a) Signiï¬cant transactions reï¬,ected in the results above include: (i) 2013 charges related to Crystal River Unit 3 and nuclear development costs (see Note 4 to the Consolidated Financial Statements, "Regulatory Matters"); (ii) the 2012 merger with Progress Energy (see Note 2 to the Consolidated... -

Page 47

... addressed cost recovery of the nuclear unit, Crystal River 1 and 2 coal units, and the proposed Levy Nuclear Station (Levy). The settlement agreement also provides for new generation in the latter half of this decade to meet customer demand. Improving Nuclear Fleet Performance In 2013, Duke Energy... -

Page 48

... coal, electricity, natural gas). Economic hedging involves both purchases and sales of those input and output commodities related to generation assets. Operations of the generation assets are accounted for under the accrual method. Management believes excluding impacts of mark-to-market changes... -

Page 49

... Midwest coal generation results; and • Incremental shares issued to complete the Progress Energy merger (impacts per diluted share amounts only). SEGMENT RESULTS The remaining information presented in this discussion of results of operations is on a GAAP basis. Regulated Utilities Years Ended... -

Page 50

...pricing and rate riders, the inclusion of Progress Energy results for the ï¬rst six months of 2013, a net increase in wholesale power revenues, and higher weather normal sales volumes. These impacts were partially offset by higher income tax expense, Crystal River Unit 3 charges, lower AFUDC equity... -

Page 51

... additional information; • A $277 million increase in fuel expense (including purchased power and natural gas purchases for resale) primarily related to higher purchases of power in Ohio as a result of the new Ohio ESP, higher volumes of natural gas used in electric generation, higher coal prices... -

Page 52

... prices, net of lower volumes, and • A $65 million increase in Chile as a result of asset acquisitions in 2012. Operating Expenses. The variance was driven primarily by: • A $65 million decrease in Central America due to lower fuel costs, partially offset by higher purchased power and coal... -

Page 53

... primarily to the sale of non-core businesses in 2012. Operating Expenses. The variance was driven primarily by: • A $109 million increase in fuel expenses from the gas-ï¬red generation assets driven by higher average natural gas prices per million British Thermal Units (MMBtu), partially offset... -

Page 54

... quarter of 2011 and a reduction of coal sales volumes as a result of lower natural gas prices; • An $18 million decrease in PJM capacity revenues related to lower average cleared capacity auction pricing in 2012 compared to 2011 for the gas-ï¬red generation assets, net of an increase associated... -

Page 55

... charges related to the Progress Energy merger, the sale of DukeNet, and increased current year activity from mitigation sales related to the Progress Energy merger. These impacts were partially offset by increased interest expense, lower income tax beneï¬t and the Crescent Resources LLC (Crescent... -

Page 56

... costs associated with mitigation sales pursuant to merger settlement agreements with the FERC. Partially offset by: • A $118 million increase in fuel expense (including purchased power) primarily related to higher sales volumes and increased prices of natural gas used in electric generation... -

Page 57

...Energy Progress due to revised rates in North Carolina; • A $57 million increase in nuclear cost-recovery clause revenues at Duke Energy Florida primarily due to an increase in recovery rates related to the Crystal River Unit 3 uprate project, prior period true-ups, and Levy as allowed by the 2012... -

Page 58

...tax rates for the years ended December 31, 2013 and 2012 were 36.2 percent and 32.7 percent, respectively. The increase in the effective tax rate is primarily due to the impact of lower AFUDC equity and the Employee Stock Ownership Plan (ESOP) dividend deduction being recorded at Duke Energy in 2012... -

Page 59

... year impairment charge resulting from the decision to suspend the application for two proposed nuclear units at Harris. 41 Partially offset by: • A $29 million increase in fuel expense (including purchased power) primarily due to higher non-recoverable purchased power costs and increased sales... -

Page 60

... related to Crystal River Unit 3 and Levy. In 2012, Duke Energy Florida recorded impairment and other charges related to the decision to retire Crystal River Unit 3. See Note 4 to the Consolidated Financial Statements, "Regulatory Matters," for additional information; and • A $138 million increase... -

Page 61

... Income Tax Expense Net Income 2013 $3,245 2,999 5 251 4 78 177 75 $ 102 2012 $3,152 2,810 7 349 13 89 273 98 $ 175 Variance $ 93 189 (2) (98) (9) (11) (96) (23) $ (73) The following table shows the percent changes in Regulated Utilities' GWh sales and average number of customers for Duke Energy... -

Page 62

... additional information. DUKE ENERGY INDIANA Introduction Management's Discussion and Analysis should be read in conjunction with the accompanying Consolidated Financial Statements and Notes for the years ended December 31, 2013, 2012, and 2011. Basis of Presentation The results of operations and... -

Page 63

... IGCC plant. In 2013, Duke Energy Florida recorded a charge of $295 million related to the retired Crystal River Unit 3 Nuclear Station. Also as discussed in Note 2 to the Consolidated Financial Statements, "Acquisitions and Sales of Other Assets", Duke Energy Carolinas and Duke Energy Progress... -

Page 64

.... In the 2013 impairment tests, Duke Energy considered implied WACCs for certain peer companies in determining the appropriate WACC rates to use in its analysis. As each reporting unit has a different risk proï¬le based on the nature of its operations, including factors such as regulation, the WACC... -

Page 65

... the present value of the plan's projected beneï¬t payments discounted at this rate with the market value of the bonds selected. Future changes in plan asset returns, assumed discount rates and various other factors related to the participants in Duke Energy's pension and post-retirement plans will... -

Page 66

... Outstanding letters of credit Tax-exempt bonds Available capacity Duke Energy $ 6,000 (450) (62) (240) $ 5,248 Duke Energy (Parent) $ 2,250 - (55) - $ 2,195 Duke Energy Carolinas $ 1,000 (300) (4) (75) $ 621 Duke Energy Progress $ 750 - (2) - $ 748 Duke Energy Florida $ 650 - (1) - $ 649 Duke... -

Page 67

...Parent) Tax-exempt Bonds Duke Energy Progress Other Current maturities of long-term debt $ January 2014 0.105% 167 387 2,104 February 2014 March 2014 September 2014 6.300% 6.050% 3.950% $ 750 300 500 Maturity Date Interest Rate December 31, 2013 DIVIDEND PAYMENTS Duke Energy has paid quarterly cash... -

Page 68

... debt. Duke Energy's capitalization is balanced between debt and equity as shown in the table below. The 2014 projected capitalization percentages exclude purchase accounting adjustments related to the merger with Progress Energy. Projected 2014 Equity Debt 52% 48% Actual 2013 50% 50% Actual 2012 50... -

Page 69

... expense and other Progress Energy merger related costs), resulting from the inclusion of Progress Energy's results beginning July 2, 2012 and the impact of the 2011 North Carolina and South Carolina rate cases, net of unfavorable weather. • A $560 million increase in operating cash ï¬,ows from... -

Page 70

... million increase in quarterly dividends primarily due to an increase in common shares outstanding, resulting from the merger with Progress Energy and an increase in dividends per share from $0.765 to $0.78 in the third quarter of 2013. The total annual dividend per share was $3.09 in 2013 compared... -

Page 71

..., 2012 Interest Rate 3.15% 1.63% 3.05% 2.64% 2.77% 4.74% 1.01% 1.56% 4.20% 2.80% 4.10% 4.00% 0.65% 3.85% Duke Energy (Parent) $ - 700 500 330 203 220 190 200 2,343 Duke Energy Carolinas 650 - - $ 650 Progress Energy (Parent) $ 450 450 Duke Energy Progress 500 500 - - - $1,000 Duke Energy Florida... -

Page 72

... ï¬rm capacity payments that provide Duke Energy with uninterrupted ï¬rm access to electricity transmission capacity and natural gas transportation contracts, as well as undesignated contracts and contracts that qualify as normal purchase/normal sale (NPNS). For contracts where the price paid is... -

Page 73

... Financial Statements is required until settlement of the contract as long as the transaction remains probable of occurring. GENERATION PORTFOLIO RISKS Duke Energy is primarily exposed to market price ï¬,uctuations of wholesale power, natural gas, and coal prices in the Regulated Utilities... -

Page 74

... Energy maintains investments to help fund the costs of providing non-contributory deï¬ned beneï¬t retirement and other post-retirement beneï¬t plans. These investments are exposed to price ï¬,uctuations in equity markets and changes in interest rates. The equity securities held in these pension... -

Page 75

... incur increased fuel, purchased power, operation and maintenance, and other expenses in conjunction with the non-GHG regulations. The Duke Energy Registrants are planning to retire coal-ï¬red generating capacity that is not economic to bring into compliance with the EPA's regulations. Beyond 2013... -

Page 76

... NRC and a collaborative industry review, Duke Energy will be able to determine an implementation plan and associated costs. See Item 1A, "Risk Factors," for further discussion of applicable risk factors. New Accounting Standards See Note 1 to the Consolidated Financial Statements, "Summary of Signi... -

Page 77

... Income ...Consolidated Balance Sheets...Consolidated Statements of Cash Flows ...Consolidated Statements of Changes in Equity ...Duke Energy Carolinas, LLC (Duke Energy Carolinas) Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Operations and Comprehensive... -

Page 78

...REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Duke Energy Corporation Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Duke Energy Corporation and subsidiaries (the "Company") as of December 31, 2013 and 2012, and the related... -

Page 79

...generation and purchased power - regulated Fuel used in electric generation and purchased power - nonregulated Cost of natural gas and coal sold Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses (Losses) Gains on Sales... -

Page 80

...-sale securities Other Comprehensive Loss, net of tax Comprehensive Income Less: Comprehensive Income Attributable to Noncontrolling Interests Comprehensive Income Attributable to Duke Energy Corporation (a) Net of $17 million tax expense in 2013, $9 million tax expense in 2012 and $23 million tax... -

Page 81

PART II DUKE ENERGY CORPORATION CONSOLIDATED BALANCE SHEETS December 31, (in millions) ASSETS Current Assets Cash and cash equivalents Short-term investments Receivables (net of allowance for doubtful accounts of $30 at December 31, 2013 and $34 at December 31, 2012) Restricted receivables of ... -

Page 82

...Investment tax credits Accrued pension and other post-retirement beneï¬t costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Preferred Stock of Subsidiaries Equity Common stock, $0.001 par value, 2 billion shares... -

Page 83

... Investment expenditures Acquisitions Cash acquired from the merger with Progress Energy Purchases of available-for-sale securities Proceeds from sales and maturities of available-for-sale securities Net proceeds from the sales of equity investments and other assets, and sales of and collections... -

Page 84

... from) paid for income taxes Merger with Progress Energy Fair value of assets acquired Fair value of liabilities assumed Issuance of common stock Signiï¬cant non-cash transactions: Accrued capital expenditures See Notes to Consolidated Financial Statements 2013 2012 2011 $ 3,601 9 (2,761) (96... -

Page 85

...the Progress Energy Merger Common stock issuances, including dividend reinvestment and employee beneï¬ts Common stock dividends Contribution from noncontrolling interest in DS Cornerstone, LLC(c) Deconsolidation of DS Cornerstone, LLC(c) Changes in noncontrolling interest in subsidiaries(a) Balance... -

Page 86

... II REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Duke Energy Carolinas, LLC Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Duke Energy Carolinas, LLC and subsidiaries (the "Company") as of December 31, 2013 and 2012... -

Page 87

...COMPREHENSIVE INCOME Years Ended December 31, (in millions) Operating Revenues Operating Expenses Fuel used in electric generation and purchased power Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses Gains on Sales of... -

Page 88

PART II DUKE ENERGY CAROLINAS, LLC CONSOLIDATED BALANCE SHEETS December 31, (in millions) ASSETS Current Assets Cash and cash equivalents Receivables (net of allowance for doubtful accounts of $3 at December 31, 2013 and December 31, 2012) Restricted receivables of variable interest entities (net ... -

Page 89

... of nuclear fuel) Equity component of AFUDC FERC mitigation costs Community support and charitable contributions expense Gains on sales of other assets and other, net Impairment charges Deferred income taxes Voluntary opportunity cost deferral Accrued pension and other post-retirement beneï¬t costs... -

Page 90

PART II DUKE ENERGY CAROLINAS, LLC CONSOLIDATED STATEMENTS OF CHANGES IN MEMBER'S EQUITY Accumulated Other Comprehensive Income (Loss) Unrealized Losses on Availablefor-Sale Securities $ (2) - - - $ (2) - 1 - $ (1) - - - $ (1) (in millions) Balance at December 31, 2010 Net income Other ... -

Page 91

PART II REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Progress Energy, Inc. Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Progress Energy, Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012, and ... -

Page 92

... INCOME Years Ended December 31, (in millions) Operating Revenues Operating Expenses Fuel used in electric generation and purchased power Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses Gains (Losses) on Sales of... -

Page 93

PART II PROGRESS ENERGY, INC. CONSOLIDATED BALANCE SHEETS December 31, (in millions) ASSETS Current Assets Cash and cash equivalents Receivables (net of allowance for doubtful accounts of $14 at December 31, 2013 and $16 at December 31, 2012) Restricted receivables of variable interest entities ... -

Page 94

... costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Preferred Stock of Subsidiaries Common Stockholder's Equity Common stock, $0.01 par value, 100 shares authorized and outstanding at December 31, 2013 and 2012... -

Page 95

... charitable contributions expense Losses (gains) on sales of other assets Impairment charges Deferred income taxes Amount to be refunded to customers Accrued pension and other post-retirement beneï¬t costs Contributions to qualiï¬ed pension plans (Increase) decrease in Net realized and unrealized... -

Page 96

...net of amount capitalized Cash received from income taxes Signiï¬cant non-cash transactions: Accrued capital expenditures Asset retirement obligation additions Capital expenditures ï¬nanced through capital leases See Notes to Consolidated Financial Statements 2013 2012 2011 $ 845 - (1,196) (96... -

Page 97

...(a) Other comprehensive income (loss) Common stock issuances, including dividend reinvestment and employee beneï¬ts Common stock dividends Distributions to noncontrolling interests Recapitalization for merger with Duke Energy Other Balance at December 31, 2012 Net income Other comprehensive (loss... -

Page 98

... II REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Duke Energy Progress, Inc. Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Duke Energy Progress, Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012... -

Page 99

...COMPREHENSIVE INCOME Years Ended December 31, (in millions) Operating Revenues Operating Expenses Fuel used in electric generation and purchased power Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses Gains on Sales of... -

Page 100

...ï¬t costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Preferred Stock Common Stockholder's Equity Common stock, no par value, 200 million shares authorized; 160 million shares outstanding at December 31, 2013... -

Page 101

... of nuclear fuel) Equity component of AFUDC Severance expense FERC mitigation costs Community support and charitable contributions expense Gains on sales of other assets and other, net Impairment charges Deferred income taxes Accrued pension and other post-retirement beneï¬t costs Contributions... -

Page 102

..., 2011 Net income Other comprehensive Income Stock-based compensation expense Dividend to parent Preferred stock dividends at stated rate Tax dividend Balance at December 31, 2012 Net income Premium on the redemption of preferred stock Balance at December 31, 2013 See Notes to Consolidated Financial... -

Page 103

... INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Duke Energy Florida, Inc. Charlotte, North Carolina We have audited the accompanying balance sheets of Duke Energy Florida, Inc. (the "Company") as of December 31, 2013 and 2012, and the related statements of operations and... -

Page 104

... II DUKE ENERGY FLORIDA, INC. STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME Years Ended December 31, (in millions) Operating Revenues Operating Expenses Fuel used in electric generation and purchased power Operation, maintenance and other Depreciation and amortization Property and other taxes... -

Page 105

...-retirement beneï¬t costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Preferred Stock Common Stockholder's Equity Common Stock, no par; 60 million shares authorized; 100 shares outstanding at December 31, 2013... -

Page 106

... and accretion Equity component of AFUDC Severance expense Gains on sales of other assets and other, net Impairment charges Deferred income taxes Amount to be refunded to customers Accrued pension and other post-retirement beneï¬t costs Contributions to qualiï¬ed pension plans (Increase) decrease... -

Page 107

... Stock-based compensation expense Dividend to parent Preferred stock dividends at stated rate Tax dividend Balance at December 31, 2012 Net income Other comprehensive loss Dividend to parent Premium on the redemption of preferred stock Balance at December 31, 2013 See Notes to Consolidated Financial... -

Page 108

PART II REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Duke Energy Ohio, Inc. Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Duke Energy Ohio, Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012, and... -

Page 109

... Fuel used in electric generation and purchased power - regulated Fuel used in electric generation and purchased power - nonregulated Cost of natural gas Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses Gains on Sales... -

Page 110

...-retirement beneï¬t costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Common Stockholder's Equity Common stock, $8.50 par value, 120,000,000 shares authorized; 89,663,086 shares outstanding at December 31, 2013... -

Page 111

... to net cash provided by operating activities: Depreciation and amortization Equity component of AFUDC Gains on sales of other assets and other, net Impairment charges Deferred income taxes Accrued pension and other post-retirement beneï¬t costs Contributions to qualiï¬ed pension plans (Increase... -

Page 112

... (6) Pension and OPEB Related Adjustments Total Equity (in millions) Balance at December 31, 2010 Net income Other comprehensive loss Dividends to parent Balance at December 31, 2011 Net income Other comprehensive income Transfer of Vermillion Generating Station to Duke Energy Indiana Dividends to... -

Page 113

... II REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of Duke Energy Indiana, Inc. Charlotte, North Carolina We have audited the accompanying consolidated balance sheets of Duke Energy Indiana, Inc. and subsidiary (the "Company") as of December 31, 2013 and 2012, and... -

Page 114

...OF OPERATIONS AND COMPREHENSIVE INCOME Years Ended December 31, (in millions) Operating Revenues Operating Expenses Fuel used in electric generation and purchased power Operation, maintenance and other Depreciation and amortization Property and other taxes Impairment charges Total operating expenses... -

Page 115

...ï¬t costs Asset retirement obligations Regulatory liabilities Other Total deferred credits and other liabilities Commitments and Contingencies Common Stockholder's Equity Common Stock, no par; $0.01 stated value, 60,000,000 shares authorized; 53,913,701 shares outstanding at December 31, 2013 and... -

Page 116

... net income (loss) to net cash provided by operating activities: Depreciation and amortization Equity component of AFUDC Impairment charges Deferred income taxes Accrued pension and other post-retirement beneï¬t costs Contributions to qualiï¬ed pension plans (Increase) decrease in Net realized and... -

Page 117

... loss Balance at December 31, 2011 Net loss Other comprehensive loss Transfer of Vermillion Generating Station from Duke Energy Ohio Balance at December 31, 2012 Net income Other comprehensive loss Dividend to parent Balance at December 31, 2013 See Notes to Consolidated Financial Statements... -

Page 118

... Duke Energy Florida. Substantially all of Progress Energy's operations qualify for regulatory accounting. Duke Energy Progress is a regulated public utility primarily engaged in the generation, transmission, distribution and sale of electricity in portions of North Carolina and South Carolina. Duke... -

Page 119

... those estimates. Regulatory Accounting The majority of the Duke Energy Registrants' operations are subject to price regulation for the sale of electricity and gas by state utility commissions or FERC. When prices are set on the basis of specific costs of the regulated operations and an effective... -

Page 120

...supplies Coal held for electric generation Oil, gas and other fuel held for electric generation Total inventory Investments in Debt and Equity Securities The Duke Energy Registrants classify investments into two categories - trading and available-for-sale. Both categories are recorded at fair value... -

Page 121

... utility commissions and/or the FERC when required. The composite weighted-average depreciation rates, excluding nuclear fuel, are included in the table that follows. Years Ended December 31, 2013 Duke Energy Duke Energy Carolinas Progress Energy Duke Energy Progress Duke Energy Florida Duke Energy... -

Page 122

...River Nuclear Station - Unit 3 (Crystal River Unit 3) will be placed into a safe storage configuration until eventual dismantlement begins in approximately 60 years. Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida also assume that spent fuel will be stored on site until such time... -

Page 123

... severance plan benefits, the fair value of the obligation is expensed at the communication date if there are no future service requirements, or over the required future service period. From time to time, Duke Energy offers special termination benefits under voluntary severance programs. Special... -

Page 124

...purchase date. Merger with Progress Energy On July 2, 2012, Duke Energy completed its merger with Progress Energy, a North Carolina corporation engaged in the regulated utility business of generation, transmission and distribution and sale of electricity in portions of North Carolina, South Carolina... -

Page 125

...for Progress Energy common shares outstanding Closing price of Duke Energy common shares on July 2, 2012 Purchase price for common stock Fair value of outstanding earned stock compensation awards Total purchase price 296,116 0.87083 257,867 $ 69.84 the merger was allocated entirely to the Regulated... -

Page 126

... closing of the merger. Charges related to transmission projects and impairment of the carrying value of generation assets were recorded within Impairment charges in the Consolidated Statements of Operations. Mark-to-market losses on interim power sale agreements was recorded in Regulated electric... -

Page 127

... generation located throughout the U.S. The asset portfolio has a diversified fuel mix with baseload and mid-merit coal-fired units as well as combined cycle and peaking natural gas-fired units. In addition, Commercial Power operates and develops transmission projects. The remainder of Duke Energy... -

Page 128

... revised customer rates. Regulated Utilities recorded charges related to Duke Energy Florida's Crystal River Unit 3. See Note 4 for additional information about the Crystal River Unit 3 charges. Regulated Utilities recorded an impairment charge related to Duke Energy Progress' Shearon Harris Nuclear... -

Page 129

... • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2011 Regulated Utilities $ 10... -

Page 130

... operating revenues from PJM Interconnection, LLC (PJM) in 2013, all of which is included in the Commercial Power segment. These revenues relate to the sale of capacity and electricity from Commercial Power's nonregulated generation assets. Year Ended December 31, 2012 Regulated Utilities... -

Page 131

... taxes Hedge costs and other deferrals Demand side management (DSM)/Energy efficiency (EE) Vacation accrual Deferred fuel Nuclear deferral Post-in-service carrying costs and deferred operating expenses Gasification services agreement buyout Transmission expansion obligation Manufactured gas plant... -

Page 132

... Accrued pension and OPEB Retired generation facilities Debt fair value adjustment Asset retirement obligations Net regulatory asset related to income taxes Hedge costs and other deferrals DSM/EE Vacation accrual Deferred fuel Nuclear deferral Post-in-service carrying costs and deferred operating... -

Page 133

... obligations to net periodic benefit costs for pension and OPEB plans. See Note 21 for additional detail. Retired generation facilities. Duke Energy Florida earns a reduced return on a substantial portion of the amount of regulatory asset associated with the retirement of Crystal River Unit... -

Page 134

... as well as sales of transmission service. Duke Energy Carolinas 2013 North Carolina Rate Case On September 24, 2013, the NCUC approved a settlement agreement related to Duke Energy Carolinas' request for a rate increase with minor modifications. The North Carolina Utilities Commission Public Staff... -

Page 135

...information addressing seismic hazard evaluation resulting from recommendations of the Fukushima Near-Term Task Force. Duke Energy Progress 2012 North Carolina Rate Case On May 30, 2013, the NCUC approved a settlement agreement related to Duke Energy Progress' request for a rate increase. The Public... -

Page 136

... (retirement decision refund). Duke Energy Florida recorded a Regulatory liability in the third quarter of 2012 related to these replacement power obligations. Duke Energy Florida has reclassified all Crystal River Unit 3 investments, including property, plant and equipment, nuclear fuel, inventory... -

Page 137

... Customer Rate Matters section below. Duke Energy Florida is a party to a master participation agreement and other related agreements with the joint owners of Crystal River Unit 3, which convey certain rights and obligations on Duke Energy Florida and the joint owners. In December 2012, Duke Energy... -

Page 138

... Environmental Cost Recovery Clause. New Generation Duke Energy Florida currently projects a significant need for additional generation to offset the impact of retirement of Crystal River Unit 3 as well as the possible retirement of Crystal River 1 and 2 coal units. The 2013 Settlement establishes... -

Page 139

...to request a retail electric base rate increase prior to March 2013, with rates in effect no earlier than April 1, 2014. The IURC modified the 2012 Edwardsport settlement as previously agreed to by the parties to (i) require Duke Energy Indiana to credit customers for cost control incentive payments... -

Page 140

... FERC Mitigation is expected to increase power imported into the Duke Energy Carolinas and Duke Energy Progress service areas and enhance competitive power supply options in the service areas. These projects are expected to be completed in 2014. On August 8, 2012, FERC granted certain intervenors... -

Page 141

... Energy Progress for certain expenses associated with nuclear insurance per the Brunswick and Harris joint owner agreements. Duke Energy Florida manages and has a partial ownership interest in Crystal River Unit 3, which has been retired. The other joint owners of Crystal River Unit 3 reimburse Duke... -

Page 142

...In the event of NEIL losses, NEIL's board of directors may assess member companies retroactive premiums of amounts up to 10 times their annual premiums for up to six years after a loss. The current potential maximum assessments for Duke Energy Carolinas are $42 million for primary property insurance... -

Page 143

... retirement of some coal-fired electric-generating units. For additional information, refer to Note 4 regarding potential plant retirements. Several petitions for review of the final rule were filed with the D.C. Circuit Court. A decision is expected in the first half of 2014. The Duke Energy... -

Page 144

... 485 The Duke Energy Registrants also expect to incur increased fuel, purchased power, operation and maintenance, and other expenses, and costs for replacement generation for potential coal-fired power plant retirements as a result of these EPA regulations. The actual compliance costs incurred may... -

Page 145

..., the government sued Duke Energy Carolinas in the U.S. District Court in Greensboro, North Carolina. The EPA claims 29 projects performed at 25 of Duke Energy Carolinas' coal-fired units violate the NSR provisions. Duke Energy Carolinas asserts the projects were routine or not projected to increase... -

Page 146

... the North Carolina Global Case. Progress Energy does not expect the resolution of these matters to have a material effect on it results of operations, cash flows or financial position. Duke Energy Progress and Duke Energy Florida Spent Nuclear Fuel Matters On December 12, 2011, Duke Energy Progress... -

Page 147

..., cash flows or financial position. Purchase Obligations Purchased Power Duke Energy Progress, Duke Energy Florida, and Duke Energy Ohio have ongoing purchased power contracts, including renewable energy contracts, with other utilities, wholesale marketers, co-generators, and qualified facilities... -

Page 148

...Energy Progress and Duke Energy Florida, respectively, related to power purchase agreements that are not accounted for as leases in their financial statements because of grandfathering provisions in GAAP. (c) Substantially all tax-exempt bonds are secured by first mortgage bonds or letters of credit... -

Page 149

... for Duke Energy Progress and Duke Energy Florida, respectively, related to power purchase agreements that are not accounted for as leases on their financial statements because of grandfathering provisions in GAAP. (c) Substantially all tax-exempt bonds are secured by first mortgage bonds or letters... -

Page 150

...purchase accounting adjustments related to the merger with Progress Energy. See Note 2 for additional information. The Duke Energy Registrants have the ability under certain debt facilities to call and repay the obligation prior to its scheduled maturity. Therefore, the actual timing of future cash... -

Page 151

... rate swap for 75 percent of the loan. (i) Relates to the securitization of accounts receivable at a subsidiary of Duke Energy Progress; the proceeds were used to repay short-term debt. See Note 17 for further details. (j) Proceeds were used to repay notes payable to affiliated companies as well... -

Page 152

... CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Interest Rate... -

Page 153

...or some of its subsidiaries. None of the significant debt or credit agreements contain material adverse change clauses. Other Loans During 2013 and 2012, Duke Energy and Duke Energy Progress had loans outstanding against the cash surrender value of life insurance policies it owns on the lives of its... -

Page 154

... facilities. The Duke Energy Registrants are entitled to shares of the generating capacity and output of each unit equal to their respective ownership interests. The Duke Energy Registrants pay their ownership share of additional construction costs, fuel inventory purchases and operating... -

Page 155

... with North Carolina Eastern Municipal Power Agency. All costs associated with Crystal River Unit 3 are included within Regulatory assets on the Consolidated Balance Sheets of Duke Energy, Progress Energy and Duke Energy Florida. See Note 4 for additional information. Co-owned with Seminole Electric... -

Page 156

... Crystal River Unit 3. For Progress Energy, Duke Energy Progress and Duke Energy Florida, amounts primarily relate to spent nuclear fuel disposal recorded in the third quarter of 2012 to conform to Duke Energy's assumptions for nuclear asset retirement obligations. (e) Balances at December 31, 2013... -

Page 157

... Duke Energy Florida has requested the NRC terminate the Crystal River Unit 3 operating license as a result of the retirement of the unit. 10. PROPERTY, PLANT AND EQUIPMENT The following tables summarize the property, plant and equipment. December 31, 2013 Estimated Useful Life (Years) Duke Energy... -

Page 158

... DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) December 31, 2012 Estimated Useful Life (Years) Duke Energy... -

Page 159

... fourth quarter 2013 impairment analysis, the fair value of the Renewables reporting unit exceeded its carrying value and no impairment was recorded. The fair value of the Renewables reporting unit is impacted by a multitude of factors, including legislative actions related to tax credit extensions... -

Page 160

...program as of September 30, 2011. Amortization Expense The following table presents amortization expense for gas, coal and power contracts, wind development rights and other intangible assets. December 31, (in millions) Duke Energy Duke Energy Ohio Duke Energy Indiana 2013 $13 8 1 2012 $14 12 1 2011... -

Page 161

... wind power projects in the United States. Duke Energy also owns a 50 percent interest in Duke American Transmission Co., LLC which builds, owns and operates electric transmission facilities in North America. Other As of December 31, 2012, investments accounted for under the equity method primarily... -

Page 162

... forward sales and purchases of electricity, coal, and natural gas. Duke Energy Indiana's undesignated contracts are primarily associated with forward purchases and sales of electricity and ï¬nancial transmission rights. Volumes The tables show information relating to the volume of the outstanding... -

Page 163

... CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) December 31, 2012 Duke Energy Electricity (Gigawatt-hours)(a) Natural gas... -

Page 164

...Earnings Commodity contracts Revenue: Regulated electric Revenue: Nonregulated electric, natural gas and other Other income and expenses Fuel used in electric generation and purchased power-regulated Fuel used in electric generation and purchased power - nonregulated Interest rate contracts Interest... -

Page 165

... DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) December 31, 2013 (in millions) 2012 (in millions) Location... -

Page 166

... interest rate derivatives for regulated operations as cash ï¬,ow hedges. As a result, the pretax losses on derivatives as of the date of the merger were reclassiï¬ed from AOCI to Regulatory assets. There was no hedge ineffectiveness during the years ended December 31, 2013, 2012, and 2011, and... -

Page 167

...Balance Sheets where the pretax gains and losses were reported. Years Ended December 31, (in millions) Location of Pretax Gains and (Losses) Recognized in Earnings Commodity contracts Operating revenues Fuel used in electric generation and purchased power Other income and expenses, net Interest rate... -

Page 168

... Balance Sheets where the pretax gains and losses were reported. Years Ended December 31, (in millions) Location of Pretax Gains and (Losses) Recognized in Earnings Commodity contracts Operating revenues Fuel used in electric generation and purchased power Interest rate contracts Interest... -

Page 169

...ed from AOCI to Regulatory Assets 2013 $ 1 - $ 1 2012 $ 1 (2) $ (1) 2011 $ (3) (35) $(38) (in millions) Location of Pretax Gains and (Losses) Recognized in Earnings Commodity contracts Fuel used in electric generation and purchased power Interest rate contracts Interest expense Total Pretax (Losses... -

Page 170

...Pretax Gains and (Losses) Recognized in Earnings Commodity contracts Revenue: Nonregulated electric, natural gas and other $ 44 $ 76 $ (26) Fuel used in electric generation and purchased power - nonregulated (100) 2 (1) Interest rate contracts Interest expense (1) (1) (1) Total Pretax (Losses) Gains... -

Page 171

... derivatives and the line items on the Consolidated Balance Sheets where the pretax gains and losses were reported. Years Ended December 31, 2013 2012 2011 $ - $ 10 The tables below show the balance sheet location of derivative contracts subject to enforceable master netting agreements and include... -

Page 172

... value of collateral already posted Additional cash collateral or letters of credit in the event credit-risk-related contingent features were triggered December 31, 2012 Duke Energy $466 163 230 Progress Energy $286 59 227 Duke Energy Progress $ 108 9 99 Duke Energy Florida $ 178 50 128 Duke Energy... -

Page 173

...Consolidated Balance Sheets and are available for current operations of Duke Energy's foreign business. The fair value of these investments was $44 million as of December 31, 2013 and $333 million as of December 31, 2012. Duke Energy classiï¬es all other investments in debt and equity securities as... -

Page 174

... ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) DUKE ENERGY The following table presents the estimated fair value... -

Page 175

..., LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) DUKE ENERGY CAROLINAS The following table presents the estimated fair value of... -

Page 176

... CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) PROGRESS ENERGY The following table presents the estimated fair value... -

Page 177

...CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) DUKE ENERGY PROGRESS The following table presents the estimated fair value... -

Page 178

... CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) DUKE ENERGY FLORIDA The following table presents the estimated fair value... -

Page 179

... CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) DUKE ENERGY INDIANA The following table presents the estimated fair value... -

Page 180

..., increases (decreases) in natural gas forward prices result in favorable (unfavorable) fair value adjustments for gas purchase contracts; and increases (decreases) in electricity forward prices result in unfavorable (favorable) fair value adjustments for electricity sales contracts. Duke Energy... -

Page 181

... value on a recurring basis on the Consolidated Balance Sheets. Derivative amounts in the table below exclude cash collateral which is disclosed in Note 14. See Note 15 for additional information related to investments by major security type. December 31, 2013 (in millions) Nuclear decommissioning... -

Page 182

... 31, 2012 (in millions) Balance at December 31, 2011 Amounts acquired in Progress Energy Merger Total pretax realized or unrealized gains (losses) included in earnings Total pretax gains included in other comprehensive income Purchases, sales, issuances and settlements: Purchases Sales Issuances... -

Page 183

... value on a recurring basis on the Consolidated Balance Sheets. Derivative amounts in the table below exclude cash collateral, which is disclosed in Note 14. See Note 15 for additional information related to investments by major security type. December 31, 2013 (in millions) Nuclear decommissioning... -

Page 184

... ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) December 31, 2012 Investments Balance... -

Page 185

... contracts becoming observable due to the passage of time. 2013 $(38) - 10 - (6) 34 $- $ 11 2012 $(24) 1 (16) 4 (3) - $(38) 2011 $(36) - - - (21) 33 $(24) DUKE ENERGY PROGRESS The following tables provide recorded balances for assets and liabilities measured at fair value on a recurring basis... -

Page 186

... of Operations and Comprehensive Income related to Level 3 measurements outstanding (a) Transfers reï¬,ect derivative contracts becoming observable due to the passage of time. 2013 $(38) - 10 - (6) 34 $- $ 11 2012 $(24) 1 (16) 4 (3) - $(38) 2011 $(36) - - - (20) 32 $(24) DUKE ENERGY FLORIDA The... -

Page 187

...value on a recurring basis on the Consolidated Balance Sheets. Derivative amounts in the table below exclude cash collateral, which is disclosed in Note 14. See Note 15 for additional information related to investments by major security type. December 31, 2013 (in millions) Available-for-sale equity... -

Page 188

... quantitative information about the Duke Energy Registrants' derivatives classiï¬ed as Level 3. December 31, 2013 Investment Type Duke Energy Natural gas contracts FERC mitigation power sale agreements Financial transmission rights (FTRs) Electricity contracts Commodity capacity option contracts... -

Page 189

..., 2012 Investment Type Duke Energy Natural gas contracts FERC mitigation power sale agreements FTRs Electricity contracts Capacity contracts Capacity option contracts Reserves Total Level 3 derivatives Duke Energy Carolinas FERC mitigation power sale agreements Progress Energy Natural gas contracts... -

Page 190

... below related to CRC, no ï¬nancial support was provided to any of the VIEs during the years ended December 31, 2013, 2012 and 2011, or is expected to be provided in the future, that was not previously contractually required. A VIE is an entity that is evaluated for consolidation using more... -

Page 191

...special purpose subsidiary of Duke Energy Progress formed in 2013, buys certain accounts receivable arising from the sale of electricity and/or related services from Duke Energy Progress. DEPR is a wholly owned limited liability company with a separate legal existence from its parent, and its assets... -

Page 192

... CRC On a revolving basis, CRC buys certain accounts receivable arising from the sale of electricity and/or related services from Duke Energy Ohio and Duke Energy Indiana. Receivables sold are securitized by CRC through a facility managed by two unrelated third parties and are used as collateral for... -

Page 193

... interest expense, as well as earn a return on equity. Accordingly, the value of this contract is subject to variability due to ï¬,uctuations in power prices and changes in OVEC's costs of business, including costs associated with its 2,256 MW of coal-ï¬red generation capacity. As discussed in Note... -

Page 194

... settled. Duke Energy's participating securities are restricted stock units that are entitled to dividends declared on Duke Energy common shares during the restricted stock units' vesting period. On July 2, 2012, just prior to the close of the merger with Progress Energy, Duke Energy executed a one... -

Page 195

... do not ï¬nd job opportunities at other locations. Approximately 600 employees worked at Crystal River Unit 3. For the year ended December 31, 2013, Duke Energy Florida deferred $26 million of severance costs as a regulatory asset. Severance costs expected to be accrued over the remaining retention... -

Page 196

...includes information related to Duke Energy's stock options. Years Ended December 31, (in millions) Intrinsic value of options exercised Tax beneï¬t related to options exercised Cash received from options exercised Stock options granted (in thousands) 2013 $ 26 10 9 310 2012 $ 17 7 21 340 2011 $ 26... -

Page 197

...return (TSR) of Duke Energy stock relative to a pre-deï¬ned peer group (relative TSR). These awards are valued using a path-dependent model that incorporates expected relative TSR into the fair value determination of Duke Energy's performance-based share awards. The model uses three-year historical... -

Page 198

... of pay credits based upon a percentage of current eligible earnings based on age and/ or years of service and interest credits. Certain employees are covered under plans that use a ï¬nal average earnings formula. As of January 1, 2014, these deï¬ned beneï¬t plans are closed to new participants... -

Page 199

...) Service cost Interest cost on projected beneï¬t obligation Expected return on plan assets Amortization of actuarial loss Amortization of prior service cost (credit) Other Net periodic pension costs(a)(b) Year Ended December 31, 2011 Duke Energy $ 96 232 (384) 77 6 18 $ 45 Duke Energy Carolinas... -

Page 200

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 201

...DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 202

...ï¬t accounting. For Progress Energy plans, the assumptions used in 2012 to determine net periodic pension cost reï¬,ect remeasurement as of July 1, 2012, due to the merger between Duke Energy and Progress Energy. Duke Energy December 31, 2013 Beneï¬t Obligations Discount rate Salary increase Net... -

Page 203

... Service cost Interest cost on projected beneï¬t obligation Amortization of actuarial loss Amortization of prior service credit Net periodic pension costs Year Ended December 31, 2012 Duke Energy $ 2 12 4 1 $19 Duke Energy Carolinas $- 1 - - $ 1 Progress Energy $ 2 8 5 (1) $14 Duke Energy Progress... -

Page 204

... year Prior year service credit arising during the year Net amount recognized in accumulated other comprehensive loss (income) Year Ended December 31, 2012 Duke Energy $ 34 $ (8) $- (2) $ (2) Duke Energy Carolinas Progress Energy $ (6) $- $ (1) 3 $ 2 Duke Energy Progress $ (2 Duke Energy Florida... -

Page 205

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 206

... Energy, nine years for Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana, 12 years for Duke Energy Progress and 17 years for Duke Energy Florida. The following tables present the assumptions used for pension beneï¬t accounting. For Progress Energy plans, the assumptions used in 2012... -

Page 207

..., LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Duke Energy December 31, 2013 Beneï¬t Obligations Discount rate Salary increase... -

Page 208

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 209

...DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 210

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 211

...ts accounting. For Progress Energy plans, the assumptions used in 2012 to determine net periodic other post-retirement beneï¬t cost reï¬,ect remeasurement as of July 1, 2012, due to the merger between Duke Energy and Progress Energy. Duke Energy December 31, 2013 Beneï¬t Obligations Discount rate... -

Page 212

...ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Sensitivity to Changes in Assumed Health Care Cost Trend Rates Year... -

Page 213

...trading currency using the currency exchange rate in effect at the close of the principal active market. Prices have not been adjusted to reï¬,ect after-hours market activity. The majority of investments in equity securities are valued using Level 1 measurements. When (i) the Duke Energy Registrants... -

Page 214

... pension and other post-retirement assets. (in millions) Equity securities Corporate debt securities Short-term investment funds Partnership interests Hedge funds Real estate trusts U.S. government securities Guaranteed investment contracts Governments bonds - foreign Cash Government and commercial... -

Page 215

... 2013 $ 352 288 25 (152) 33 $ 546 2012 $ 322 - 21 (4) 13 $ 352 Progress Energy Master Retirement Trust The following table provides the fair value measurement amounts for the Progress Energy Master Retirement Trust qualiï¬ed pension assets. (in millions) Equity securities Corporate debt securities... -

Page 216

... generally equal to 100 percent of employee before-tax and Roth 401(k) contributions, and, as applicable, after-tax contributions, of up to 6 percent of eligible pay per pay period. Dividends on Duke Energy shares held by the savings plans are charged to retained earnings when declared and... -

Page 217

...CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) 22. INCOME TAXES INCOME TAX EXPENSE Components of Income Tax Expense Year... -

Page 218

...600 $ 3,920 2012 $ 1,827 624 $ 2,451 2011 $1,780 685 $2,465 Statutory Rate Reconciliation The following tables present a reconciliation of income tax expense at the U.S. federal statutory tax rate to the actual tax expense from continuing operations. Year Ended December 31, 2013 Duke Energy $ 1,372... -

Page 219

...(1,927) Duke Energy Indiana $ 9 (2) 54 - 521 14 - 596 (7) (1,591) (117) (1,715) $ (1,119) (in millions) Deferred credits and other liabilities Capital lease obligations Pension, postretirement and other employee beneï¬ts Progress Energy merger purchase accounting adjustments(a) Tax credits and NOL... -

Page 220

... CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) On July 23, 2013, HB 998 was signed into law. HB 998 reduces the North... -

Page 221

... II DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) December 31, 2012 Duke Energy... -

Page 222

... Consolidated Balance Sheets. Year Ended December 31, 2013 Duke Energy $ 2 27 Duke Energy Carolinas $ 2 8 Progress Energy $ 6 10 Duke Energy Progress $ 7 2 Duke Energy Florida $ - 7 Duke Energy Ohio $ 4 - Duke Energy Indiana $ 1 - (in millions) Net interest income recognized related to income taxes... -

Page 223

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 224

... DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC. Combined Notes to Consolidated Financial Statements - (Continued) Year Ended December 31, 2012 Duke... -

Page 225

... Third Fourth Quarter Quarter Quarter Quarter Total 2013 Costs to achieve Progress Energy merger (see Note 2) $ (55) $ (82) $ (88) $ (72) $ (297) Crystal River Unit 3 charges (see Note 4) - (295) - (57) (352) Harris and Levy nuclear development charges (see Note 4) - (87) - - (87) Gain on sale of... -

Page 226

...) 2013(a) Costs to achieve the merger with Duke Energy (see Note 2) Crystal River Unit 3 charges (see Note 4) Harris and Levy nuclear development charges (see Note 4) Total 2012 Costs to achieve the merger with Duke Energy (see Note 2) Florida replacement power refund (see Note 4) Crystal River Unit... -

Page 227

...) (19) Fourth Quarter Total (in millions) 2013(a) Costs to achieve the merger with Duke Energy (see Note 2) Crystal River Unit 3 charges (see Note 4) Levy nuclear development charges (see Note 4) Total 2012 Costs to achieve the merger with Duke Energy (see Note 2) Replacement power refund (see Note... -

Page 228

... ï¬scal quarter ended December 31, 2013 and have concluded no change has materially affected, or is reasonably likely to materially affect, internal control over ï¬nancial reporting. Management's Annual Report On Internal Control Over Financial Reporting The Duke Energy Registrants' management is... -

Page 229

... Exchange Commission's or other applicable regulatory bodies' rules of regulations must be speciï¬cally pre-approved by the Duke Energy Audit Committee. All services performed in 2013 and 2012 by the independent public accountant were approved by the Duke Energy Audit Committee and Legacy Progress... -

Page 230

...required information is included in the Consolidated Financial Statements or Notes. Duke Energy Florida, Inc. Financial Statements Statements of Operations and Comprehensive Income for the Years Ended December 31, 2013, 2012 and 2011 Balance Sheets as of December 31, 2013 and 2012 Statements of Cash... -

Page 231

... of Changes in Common Stockholder's Equity for the Years Ended December 31, 2013, 2012 and 2011 Notes to the Consolidated Financial Statements Quarterly Financial Data, (unaudited, included in Note 25 to the Consolidated Financial Statements) Report of Independent Registered Public Accounting Firm... -

Page 232

... duly authorized. Date: February 28, 2014 DUKE ENERGY CORPORATION (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Vice Chairman, President and Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on... -

Page 233

... 28, 2014 DUKE ENERGY CAROLINAS, LLC (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 234

...: February 28, 2014 PROGRESS ENERGY, INC. (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 235

... 28, 2014 DUKE ENERGY PROGRESS, INC. (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 236

... 28, 2014 DUKE ENERGY FLORIDA, INC. (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 237

...: February 28, 2014 DUKE ENERGY OHIO, INC (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 238

...February 28, 2014 DUKE ENERGY INDIANA, INC (Registrant) By: /s/ LYNN J. GOOD Lynn J. Good Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on... -

Page 239

..., management contract or compensation plan or arrangement required to be ï¬led as an exhibit to this report pursuant to Item 15 (b) of Form 10-K (+). Duke Energy Carolinas Duke Energy Progress Duke Energy Florida Duke Energy Ohio Duke Energy Indiana Exhibit Number 2.1 Agreement and Plan of Merger... -

Page 240

... of Duke Energy Progress, Inc. (formerly Carolina Power & Light Company), effective May 13, 2009, (incorporated by reference to Exhibit 3(b) to registrant's Quarterly Report on Form 10-Q for the quarter ended June 30, 2009 ï¬led on August 7, 2009, File No. 1-15929). By-Laws of Duke Energy Florida... -

Page 241

PART IV Duke Energy Carolinas Duke Energy Progress Duke Energy Florida Duke Energy Ohio Duke Energy Indiana Exhibit Number 4.1.5 Fifth Supplemental Indenture, dated as of August 25, 2011, (incorporated by reference to Exhibit 4.1 to Duke Energy Corporation's Current Report on Form 8-K ï¬led on ... -

Page 242

... by reference to Exhibit 4.1 to Duke Energy Carolinas, LLC's Current Report on Form 8-K ï¬led on September 21, 2012, File No.1-04928). Mortgage and Deed of Trust between Duke Energy Progress, Inc. (formerly Carolina Power & Light Company) and The Bank of New York Mellon (formerly Irving Trust... -

Page 243

... Progress, Inc.'s (formerly Carolina Power & Light Company (d/b/a Progress Energy Carolinas, Inc.)) Current Report on Form 8-K ï¬led on March 12, 2013, File No. 1-03382). Indenture (for Debt Securities) between Duke Energy Progress, Inc. (formerly Carolina Power & Light Company) and The Bank of New... -

Page 244

... Indenture, dated as of August 1, 2004, (incorporated by reference to Exhibit 4(m) to Duke Energy Florida, Inc.'s (formerly Florida Power Corporation (d/b/a Progress Energy Florida, Inc.)) Annual Report on Form 10-K for the year ended December 31, 2004 ï¬led on March 16, 2005, File No. 1-03274... -

Page 245

... Carolinas Duke Energy Progress Duke Energy Florida X Duke Energy Ohio Duke Energy Indiana Exhibit Number 4.8 Indenture (for Debt Securities) between Duke Energy Florida, Inc. (formerly Florida Power Corporation (d/b/a Progress Energy Florida, Inc.)) and The Bank of New York Mellon Trust Company... -

Page 246