Petsmart 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Petsmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MORE REASONS

TO SHOP

2010 ANNUAL REPORT

Table of contents

-

Page 1

MORE REASONS TO SHOP 2 010 A N N U A L R E P O R T -

Page 2

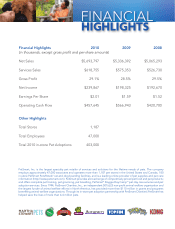

...Total Stores Total Employees Total 2010 in-store Pet Adoptions 1,187 47,000 403,000 employs approximately 47,000 associates and operates more than 1,187 pet stores in the United States and Canada, 180 in-store PetSmart PetsHotels® ® Doggie Day CampSM pet day care services and pet ® , PetSmart... -

Page 3

... sales, with grooming representing the largest share. The PetsHotels business is benefiting from an uptick in human travel in addition to our focus on improved operational efficiencies and cost controls. As the leading specialty provider of pet services in North America... -

Page 4

... growth opportunities. Although we are in an attractive competitive position, we remain humble, knowing that continued success will require hard work, solid execution and consistency of our brand in all that we do. We remain committed to delivering superior shareholder returns in 2011... -

Page 5

... common stock on August 1, 2010, the last business day of the registrant's most recently completed second fiscal quarter, as reported on the NASDAQ Global Select Market was approximately $3,644,575,000. This calculation excludes approximately 1,180,000 shares held by directors and executive officers... -

Page 6

-

Page 7

... About Market Risk...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation... -

Page 8

(This page intentionally left blank) -

Page 9

... brands, including both exclusive and private label products, across a range of product categories. We complement our strong product assortment with a differentiated selection of pet services, including grooming, training, boarding and day camp. All our stores offer complete pet training services... -

Page 10

..., shampoos, flea and tick control and aquatic supplies. Veterinary care, pet services, and live animal purchases represent 26.8%, 7.2% and 4.6%, respectively, of the market. Competition Based on total net sales, we are North America's leading specialty retailer of products, services and solutions... -

Page 11

... to our customers. Grow our pet services business. Based on net services sales, we are North America's leading specialty provider of pet services, which includes professional grooming, training, boarding and day camp. Full-service veterinary hospitals are available in 768 of our stores, through our... -

Page 12

... controlled rooms and suites, daily specialty treats and play time, as well as day camp for dogs. As of January 30, 2011, we operated 180 PetsHotels, and we plan to open 8 to 10 new PetsHotels in 2011. Veterinary Services The availability of comprehensive veterinary care in our stores further... -

Page 13

... in our business. Employees As of January 30, 2011, we employed approximately 47,000 associates, approximately 22,000 of whom were employed full-time. We continue to invest in education for our full and part-time associates as part of our emphasis on customer service and providing pet care solutions... -

Page 14

... an internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Management Our executive officers and their ages and positions on March 1, 2011, are as follows: Name Age Position Philip... -

Page 15

... Business Development. Prior to joining PetSmart, he worked in Brand Management for Procter & Gamble Europe and in Financial Planning and Analysis for IBM. Donald E. Beaver joined PetSmart as Senior Vice President and Chief Information Officer in May 2005. Prior to joining PetSmart, he was employed... -

Page 16

... until December 2009, he completed an executive rotational assignment in the field in Store Operations. Prior to PetSmart, he worked with Bain & Company, where he developed business and customer loyalty strategies and programs for major retail, automotive and financial services companies. He began... -

Page 17

... increasingly competitive due to the expansion of pet-related product offerings by certain supermarkets, warehouse clubs and other mass and retail merchandisers and the entrance of other specialty retailers into the pet food and pet supply market, some of which have developed store formats similar... -

Page 18

... in fewer customers shopping at our stores, or fail to drive additional sales and thereby negatively impact our business and financial performance. A disruption, malfunction or increased costs in the operation, expansion or replenishment of our distribution centers or our supply chain would impact... -

Page 19

... to gain market share at the expense of the premium brands sold only through specialty pet food and pet supply outlets, our business could be harmed. We purchase a substantial amount of pet supplies from a number of vendors with limited supply capabilities, and two of our largest vendors account for... -

Page 20

... been high among entry-level or part-time associates at our stores and distribution centers, increases the risk associates will not have the training and experience needed to provide competitive, high-quality customer service. Our ability to meet our labor needs while controlling our labor costs is... -

Page 21

... tax laws and financial accounting standards; and • Political and economic instability and developments. Our business may be harmed if the operation of veterinary hospitals at our stores is limited or fails to continue. We and Banfield, the third-party operator of Banfield, The Pet Hospital... -

Page 22

... be subject to costs, including fines, penalties or sanctions and third-party claims as a result of violations of, or liabilities under, the above referenced contracts, laws and regulations. Failure of our internal controls over financial reporting could harm our business and financial results. We... -

Page 23

... in our internal controls over financial reporting, our results of operations or financial condition may be adversely affected and the price of our common stock may decline. Changes in laws, accounting standards and subjective assumptions, estimates and judgments by management related to complex... -

Page 24

... common stock. Further, a change in an analyst's published opinion or rating of our business could impact the market price of our common stock. Continued volatility and disruption to the global capital and credit markets may adversely affect our ability to access credit and the financial soundness... -

Page 25

...in management or control that our shareholders may not believe is in their best interests. These provisions include: • Until 2012, a classified board of directors consisting of two classes; • The ability of our board of directors to issue, without stockholder approval, up to 10,000,000 shares of... -

Page 26

... 30, 2011: United States: Number of Stores Alabama ...Alaska ...Arizona ...Arkansas...California ...Colorado...Connecticut ...Delaware ...Florida ...Georgia ...Idaho ...Illinois ...Indiana ...Iowa...Kansas ...Kentucky ...Louisiana ...Maine...Maryland ...Massachusetts . . Michigan ...Minnesota... -

Page 27

... centers and respective lease expirations as of January 30, 2011, were as follows: Location Square Footage (In thousands) Date Opened Distribution Type Lease Expiration Ennis, Texas ...Phoenix, Arizona ...Columbus, Ohio ...Gahanna, Ohio ...Hagerstown, Maryland ...Ottawa, Illinois ...Newnan... -

Page 28

...are material to our consolidated financial statements. PART II Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Price Range of Common Stock. Our common stock is traded on the NASDAQ Global Select Market under the symbol PETM... -

Page 29

... common stock under this program for each period in the thirteen weeks ended January 30, 2011: Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Period Total Number of Shares Purchased Average Price Paid per Share Value That May Yet be Purchased Under the Plans or... -

Page 30

... or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing. The following graph shows a five-year comparison of the cumulative total return for our common stock, the S&P 500 Index, and the S&P Specialty Stores Index... -

Page 31

... ...Net sales per square foot(2) ...Net sales growth ...Increase in comparable store sales(3) ...Selected Balance Sheet Data: Merchandise inventories ...Average inventory per store(4) ...Working capital ...Total assets ...Total debt(5) ...Total stockholders' equity ...Current ratio ...Long-term debt... -

Page 32

... 24-hour supervision, an on-call veterinarian, temperature controlled rooms and suites, daily specialty treats and play time, as well as day camp for dogs. As of January 30, 2011, we operated 180 PetsHotels, and we anticipate opening 8 to 10 PetsHotels in 2011. We make full-service veterinary care... -

Page 33

... shares of our common stock for $263.3 million and $165.0 million during 2010 and 2009, respectively. • We added 38 net new stores during 2010 and operated 1,187 stores as of the end of the year. Critical Accounting Policies and Estimates The discussion and analysis of our financial condition... -

Page 34

...closed stores would not be material to our consolidated financial statements. Insurance Liabilities and Reserves We maintain workers' compensation, general liability, product liability and property insurance, on all our operations, properties and leasehold interests. We utilize high deductible plans... -

Page 35

... growth in 2010, compared to a 30 basis point decline in 2009. An increase in the average sales per transaction represented 270 basis points of the comparable store sales growth in 2010, compared to 190 basis points in 2009. Services sales, which include grooming, training, boarding and day camp... -

Page 36

... compensation associated with better than expected financial results, increased advertising costs, higher bank fees associated with increases in debit card rates and higher claims expense for health insurance. Interest Expense, net Interest expense, which is primarily related to capital lease... -

Page 37

... advertising rates and lower store preopening expenses due to slower store growth. Store labor expense, travel and supplies costs were also lower due to vendor renegotiations and various cost control initiatives. Interest Expense, net Interest expense, which is primarily related to capital lease... -

Page 38

... increased purchases of merchandise inventories and income tax payments. Income tax payments were greater in 2010 as a result of increased earnings and due to the benefit provided in 2009 by the prepaid tax position at the end of 2008. The primary differences between 2009 and 2008 were lower levels... -

Page 39

... for 2010, 2009, and 2008, respectively. For the year ended January 30, 2011, our free cash flow decreased primarily due to increases in merchandise inventory balances, income tax payments, capital spending and capital lease payments during 2010. For the year ended January 31, 2010, our free cash... -

Page 40

... our control. The following table presents our capital expenditures for each of the past three years (in thousands): January 30, 2011 Year Ended January 31, 2010 February 1, 2009 Capital Expenditures: New stores ...Store-related projects(1) ...PetsHotel(2) ...Information technology ...Supply chain... -

Page 41

... subsidiary, Medical Management International, Inc., operates full-service veterinary hospitals in 757 of our stores. We use the equity method of accounting for our investment in Banfield, which consists of common and convertible preferred stock. As of January 30, 2011 and January 31, 2010, we owned... -

Page 42

...large trade area, sales also may be impacted by adverse weather or travel conditions, which are more prevalent during certain seasons of the year. As a result of our expansion plans, the timing of new store and PetsHotel openings and related preopening costs, the amount of revenue contributed by new... -

Page 43

... internal control over financial reporting is supported by a program of internal audits and appropriate reviews by management, written policies and guidelines, careful selection and training of qualified personnel and a written Code of Business Conduct adopted by our Board of Directors, applicable... -

Page 44

Directors, officers, employees and subsidiaries. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements and even when determined to be effective, can only provide reasonable assurance with respect to financial statement preparation and ... -

Page 45

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of PetSmart, Inc. Phoenix, Arizona We have audited the internal control over financial reporting of PetSmart, Inc. and subsidiaries (the "Company") as of January 30, 2011, based on criteria established in Internal Control... -

Page 46

...Analysis," "Executive Compensation," "Stock Award Grants," "Exercises and Plans," "Employment and Severance Agreements," "Director Compensation," "Compensation Committee Interlocks and Insider Participation," and "Report of the Compensation Committee of the Board of Directors" in our proxy statement... -

Page 47

... Statement Schedule: The financial statement schedule required under the related instructions is included within Appendix F of this Annual Report. See Index to Consolidated Financial Statements and Financial Statement Schedule on page F-1. 3. Exhibits: The exhibits which are filed with this Annual... -

Page 48

... Robert F. Moran Executive Chairman March 24, 2011 /s/ President, Chief Executive Officer and Director (Principal Executive Officer) Senior Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Director March 24, 2011 /s/ LAWRENCE P. MOLLOY... -

Page 49

... Khalifa Director March 24, 2011 /s/ Director March 24, 2011 Director March 24, 2011 /s/ RICHARD K. LOCHRIDGE Richard K. Lochridge Director March 24, 2011 /s/ BARBARA A. MUNDER Barbara A. Munder /s/ THOMAS G. STEMBERG Thomas G. Stemberg Director March 24, 2011 Director March 24, 2011... -

Page 50

(This page intentionally left blank) -

Page 51

APPENDIX F PetSmart, Inc. and Subsidiaries Index to Consolidated Financial Statements and Financial Statement Schedule Page Report of Independent Registered Public Accounting Firm...Consolidated Balance Sheets as of January 30, 2011, and January 31, 2010 ...Consolidated Statements of Income and ... -

Page 52

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of PetSmart, Inc. Phoenix, Arizona We have audited the accompanying consolidated balance sheets of PetSmart, Inc. and subsidiaries (the "Company") as of January 30, 2011 and January 31, 2010, and the related consolidated statements... -

Page 53

... Balance Sheets (In thousands, except par value) January 30, 2011 January 31, 2010 ASSETS Cash and cash equivalents ...Short-term investments ...Restricted cash...Receivables, net ...Merchandise inventories ...Deferred income taxes ...Prepaid expenses and other current assets ...Total current... -

Page 54

..., except per share data) Year Ended January 31, 2010 January 30, 2011 February 1, 2009 Merchandise sales...Services sales ...Other revenue ...Net sales ...Cost of merchandise sales ...Cost of services sales ...Cost of other revenue ...Total cost of sales...Gross profit ...Operating, general... -

Page 55

... (Loss) Income Shares Common Treasury Common Stock Stock Stock Additional Paid-In Capital Retained Earnings Treasury Stock Total BALANCE AT FEBRUARY 3, 2008 ...158,104 (30,066) $16 $1,079,190 $ 758,674 Stock options and employee stock purchase plan compensation cost ...10,074 Net tax benefits... -

Page 56

... from short-term debt ...Payments on short-term debt ...(Decrease) increase in bank overdraft...Tax benefits from tax deductions in excess of the compensation cost recognized ...Cash dividends paid to stockholders ...Net cash used in financing activities ...EFFECT OF EXCHANGE RATE CHANGES ON CASH... -

Page 57

... Financial Statements Note 1 - The Company and its Significant Accounting Policies Business PetSmart, Inc., including its wholly owned subsidiaries (the "Company," "PetSmart" or "we"), is the leading specialty provider of products, services and solutions for the lifetime needs of pets in North... -

Page 58

...and accounts payable. These balances, as presented in the consolidated financial statements at January 30, 2011, and January 31, 2010, approximate fair value because of the short-term nature. We also have short-term investments in municipal bonds, which are recorded at fair value using quoted prices... -

Page 59

... software purchased for internal use. Costs associated with the preliminary stage of a project are expensed as incurred. Once the project is in the development phase, external consulting costs, as well as qualifying internal labor costs, are capitalized. Training costs, data conversion costs and... -

Page 60

... the cost for future occupancy payments, net of expected sublease income, associated with closed stores using the net present value method at a credit-adjusted risk-free interest rate over the remaining life of the lease. Judgment is used to estimate the underlying real estate market related to... -

Page 61

... greater than 5% of total current liabilities. Revenue Recognition We recognize revenue for store merchandise sales when the customer receives and pays for the merchandise at the register. Services sales are recognized at the time the service is provided. E-commerce sales are recognized at the... -

Page 62

... lease assets; and • Reductions for vendor rebates, promotions and discounts. Cost of Services Sales Cost of services sales includes payroll and benefit costs, as well as professional fees for the training of groomers, training instructors and PetsHotel associates. Cost of Other Revenue Cost... -

Page 63

... Executive Officer are members of the Banfield Board of Directors. Our ownership interest in the stock of Banfield was as follows (in thousands): January 30, 2011 Shares Amount January 31, 2010 Shares Amount Voting common stock and preferred stock ...Equity in income from Banfield ...Total equity... -

Page 64

... 30, 2011, and January 31, 2010, respectively, and were included in receivables, net in the Consolidated Balance Sheets. The master operating agreement also includes a provision for the sharing of profits on the sales of therapeutic pet foods sold in all stores with an operating Banfield hospital... -

Page 65

... related to the reserve for closed stores was as follows (in thousands): January 30, 2011 Year Ended January 31, 2010 February 1, 2009 Opening balance ...Reserve for new store closures ...Changes in sublease assumptions ...Lease terminations ...Other ...Charges, net ...Payments ...Ending balance... -

Page 66

... 30, 2011 Year Ended January 31, 2010 February 1, 2009 Provision at federal statutory tax rate. . State income taxes, net of federal income tax benefit ...Adjustments to tax reserves...Tax exempt interest income ...Adjustment to valuation allowance ...Tax on equity income from Banfield . . Other... -

Page 67

... in the Consolidated Balance Sheets are as follows (in thousands): January 30, 2011 January 31, 2010 Deferred income tax assets: Capital lease obligations ...Employee benefit expense ...Deferred rents ...Net operating loss carryforwards ...Reserve for closed stores ...Miscellaneous reserves and... -

Page 68

... Financial Statements - (Continued) A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in thousands): January 30, 2011 Year Ended January 31, 2010 February 1, 2009 Unrecognized tax benefits, beginning balance ...Gross increases - tax positions related... -

Page 69

..., 14, 13, 12, 2010 2010 2010 2011 2009 2009 2009 2010 May 1, July 31, October 30, January 29, We have several long-term incentive plans, including plans for stock options, restricted stock, performance share units, management equity units and employee stock purchases. Shares issued under our long... -

Page 70

... employees, including officers and our Directors, at the fair market value on the date of the grant. Activity in all of our stock option plans is as follows (in thousands, except per share data): Year Ended January 30, 2011 Weighted-Average Weighted-Average Remaining Exercise Price Contractual Term... -

Page 71

... share units, or "PSUs," under the 2006 Equity Incentive Plan to executive officers and certain other members of our management team based upon an established performance goal. For units granted in 2010, the performance goal was defined as a specified end-of-year pre-tax income. The actual number... -

Page 72

...allowed employees to purchase shares at 85% of the fair market value of the shares on the offering date or, if lower, at 85% of the fair market value of the shares on the purchase date. Effective February 2, 2009, the discount rate changed to 5%, allowing participants to purchase our common stock on... -

Page 73

...): January 30, 2011 Year Ended January 31, 2010 February 1, 2009 Stock options expense ...Restricted stock expense ...PSU expense ...Employee stock purchase plan expense ...Stock-based compensation cost - equity awards ...MEU expense...Total stock-based compensation cost ...Tax benefit ... $ 9,668... -

Page 74

...performance goal. Compensation expense, net of forfeitures, for MEUs is recognized over the requisite service period, or three years, and is evaluated quarterly based upon the current market value of our common stock. Note 10 - Employee Benefit Plans We have a defined contribution plan, or the "Plan... -

Page 75

... to control the use of the property and includes open stores, closed stores, stores to be opened in the future, distribution centers and corporate offices. We have recorded accrued rent of $0.9 million and $1.7 million in the Consolidated Balance Sheets as of January 30, 2011, and January 31, 2010... -

Page 76

...Powell v. Menu Foods, et al., Ontario Superior Court of Justice (filed 3/28/07) By order dated June 28, 2007, the Bruski, Rozman, Ford, Wahl, Demith and Thompkins cases were transferred to the U.S. District Court for the District of New Jersey and consolidated with other pet food class actions under... -

Page 77

... financial statements. There have been no appeals filed in Canada. In January 2011, we were named as a defendant in Pedroza v. PetSmart, Inc., et al., a lawsuit originally filed in California Superior Court for the County of San Bernardino. The case has been removed to the U.S. District Court... -

Page 78

... financial information for 2010 and 2009 is as follows: Year Ended January 30, 2011 First Quarter (13 weeks) Second Third Fourth Quarter Quarter Quarter (13 weeks) (13 weeks) (13 weeks) (In thousands, except per share data) Merchandise sales ...$1,233,595 Services sales ...153,287 Other revenue... -

Page 79

.... Phoenix, Arizona We have audited the consolidated financial statements of PetSmart, Inc. and subsidiaries (the "Company") as of January 30, 2011 and January 31, 2010, and for each of the three years in the period ended January 30, 2011, and the Company's internal control over financial reporting... -

Page 80

... at End of Period Valuation reserves deducted in the Consolidated Balance Sheets from the asset to which it applies: Merchandise inventories: Lower of cost or market 2008...2009...2010...Shrink 2008...2009...2010... $ 5,868 $ 7,777 $12,564 $ 7,424 $ 6,822 $ 3,867 $ 4,736 $ 9,652 $ 6,493 $26,430... -

Page 81

... 2002 Employee Stock Purchase Plan, as amended Non-Qualified 2005 Deferred Compensation Plan, as amended Executive Short-Term Incentive Plan, as amended Amended and Restated Employment Agreement, between PetSmart and Philip L. Francis, Chairman of the Board of Directors and Chief Executive Officer... -

Page 82

... Stock Agreement for 2006 Equity Incentive Plan Offer letter to Lawrence "Chip" Molloy dated August 23, 2007 Letter of Credit Agreement, dated June 30, 2006, between PetSmart, Inc. and Bank of America, N.A. Second Amendment to Letter of Credit Agreement, dated as of May 13, 2009 Credit Agreement... -

Page 83

...X X X X †Compensation plans or arrangements in which directors or executive officers are eligible to participate. * The certifications attached as Exhibit 32.1 and Exhibit 32.2 accompany this Annual Report on Form 10-K, are not deemed filed with the Securities and Exchange Commission and are not... -

Page 84

(This page intentionally left blank) -

Page 85

... Human Resources Bruce K. Thorn Senior Vice President, Supply Chain Kenneth T. Hall Senior Vice President, Strategic Planning and Business Development 19601 North 27th Avenue Phoenix, AZ 85027 (623) 580-6100 Transfer Agent and Registrar Wells Fargo Bank, N.A. Wells Fargo Shareowner Services P.O. Box... -

Page 86

PetSmart® 19601 North 27th Avenue Phoenix, AZ 85027 (623) 580-6100 petsmart.com ©2011 PetSmart Store Support Group, Inc. All rights reserved.