Peachtree 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Peachtree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Preliminary Results

Year ended 30 September 2011

Table of contents

-

Page 1

Preliminary Results Year ended 30 September 2011 -

Page 2

Guy Berruyer Chief Executive -

Page 3

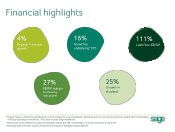

...†margin (continuing operations) 25% Growth in dividend figures exclude the contributions of current and prior year acquisitions, disposals and non-core products and are stated after neutralisation of foreign exchange movements. They also exclude Sage Healthcare * Stated prior to amortisation... -

Page 4

Key developments in the year • Good commercial performance • Renewal rates maintained at 81% • 261,000 new paying customers added • New organisation structure driving greater collaboration • Continued progress with the web • Disposal of Sage Healthcare 4 -

Page 5

Paul Harrison Chief Financial Officer -

Page 6

Financial overview Return to organic revenue growth in all regions EBITA margins increased, investments progressing Renewal rates maintained at 81% Continued strong cash generation at 111% of EBITA Proposal to rebase dividend and leverage balance sheet 6 -

Page 7

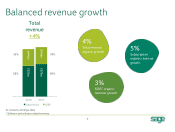

... revenue growth Total revenue +4% £458m £446m 35% 34% 4% Total revenue organic growth 5% Subscription organic revenue growth £832m £876m 65% 66% 3% SSRS* organic revenue growth 2010 2011 SSRS* Subscription At constant exchange rates * Software and software-related services 7 -

Page 8

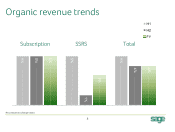

Organic revenue trends H1 H2 FY Subscription 5% 5% 5% SSRS 5% 3% 1% 5% Total 4% 4% At constant exchange rates 8 -

Page 9

... which are premium 2009 2010 2011 UK and North America driving progress • 5% growth in subscription revenue • Renewal rates stable at 81% • Premium contracts organic revenue growth of 6%: • • Increase in volumes driven by UK and North America New higher levels of premium support 40... -

Page 10

... 4% Subscription +5% Software and software-related services +3% UK & Ireland grew 5% with good performance in all market segments 5% growth in France with good performance in the mid-market and added stimulus from SEPA changes Germany grew 5% with new releases of core products generating demand... -

Page 11

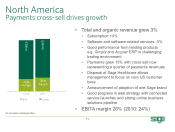

... 15% with cross-sell now representing a quarter of payments revenues Disposal of Sage Healthcare allows management to focus on core US customer base Announcement of adoption of one Sage brand Good progress in web strategy with connected service launches and strong online business solutions pipeline... -

Page 12

... software-related services +6% 14% growth in South Africa with good performance by core Pastel and VIP products Progress made in selling into Africa with good future opportunity Australia grew by 2% led by our HandiSoft product for tax practitioners and consultants Middle East and Asian businesses... -

Page 13

... ERP X3 Web-based products Customer service, particularly in the UK 25 24 23 22 21 20 EBITA margin 2011 Healthcare 2010 (continuing margin decline and discontinued operations) 2011 margin uplift in continuing operations 2011 margin (continuing and discontinued operations) Removal of Healthcare... -

Page 14

... Agreement in September to sell Sage Healthcare to Vista Equity Partners for £203.8m ($320.0m) • Sale completed post year end • Share buyback programme commenced with proceeds • Sage Healthcare reported as discontinued operations in accordance with IFRS 5 2011 Sale proceeds less costs to sell... -

Page 15

... movement/other Cash flow from continuing operations Cash: profit conversion (19.7) 29.9 (2.7) 405.1 111% Tax Net capex (92.5) (29.9) Dividends Exchange movement Other (104.0) (1.9) 13.2 (24.9) 2.8x Free cash flow Interest cover 287.0 27.5x Net debt 30 September 2011 FCF Dividend cover 15 -

Page 16

M&A as an enabler of strategy Technology Payments Web hosting and e-commerce Business intelligence Online Existing geographies • Fill in gaps in portfolio • Likely to be smaller transactions New geographies • Achieve market leader position • Includes emerging markets 16 -

Page 17

Strong cash flow driving increased shareholder returns • Group remains highly cash generative and well funded to 2015 • Target a minimum of 1x EBITDA within 18 months • Achieved by a combination of returns to shareholders and targeted M&A • Current year dividend increased by 25%, with ... -

Page 18

... term Increasing EPS Selected disposals Investment and R&D + Leveraging the web Targeted M&A Rigorous capital allocation + Through cycle gearing Strong cash flow Share buybacks Sustainable & progressive dividends Increasing dividend + Returns of surplus capital + Re-engaging in M&A 18 -

Page 19

Guy Berruyer Chief Executive -

Page 20

Delivering our priorities 1 2 3 4 Improving organic revenue growth Driving margins in the medium term Leveraging the web Re-engaging in M&A 20 -

Page 21

... more to existing customers • 6m customer base represents two-fold opportunity • Increase revenue from customers with contracts • Up-sell to higher tier contracts • Cross-sell new products or services • Actively targeting customers without a contract • Re-engineering offerings to include... -

Page 22

Attracting new customers Progress in micro market 1 261,000 paying customers added in the year Core solutions continue to resonate Good demand for Sage ERP X3 • Total growth of 13% • Licence growth of 30% Strong growth in newer markets • South Africa and Africa • Poland • Singapore and... -

Page 23

Building exposure to higher growth segments Segment Payments Current position US, UK, South Africa Potential Significant, with close link to accounting European roll-out 1 Online accounting and payroll Business Intelligence Mid-market businesses with more sophisticated needs E-commerce/web hosting... -

Page 24

... the medium term • Increase in EBITA margin in FY11 of 100bp • Continue to invest in business in FY12 • The web • Sage ERP X3 • Internal systems • European payments • Medium term growth • Scalable business model • Selling more to existing customers inherently more profitable 24 2 -

Page 25

... Cloud versions of key midmarket products Previous releases performing well e.g. Sage Continued roll out across key countries e.g. Sage Priority Sage One launch in North America ERP Accpac Online Office Line, Sage ERP MAS 90, Sage Logic Class Connected services Over 20 launches in the year... -

Page 26

... • New common development platform for small business online solutions across Sage • Platform includes user interface, authentication and billing, but leaves flexibility for meeting local needs • Joint development with staff from 6 separate Sage businesses • Will apply to accounting, payroll... -

Page 27

Re-engaging in M&A 4 • Acquired in October 2011 • Business Intelligence for SMEs, with flexible reporting and Existing analytics capabilities including dashboards and real-time Online geographies data • Embedded into products in AAMEA • Integrating into key North America products 27 -

Page 28

Driving a collaborative organisation Country led leadership Collaborative leadership Varied incentives, focus on profit Common incentives, focus on revenue growth and profit Each country addressing issues Single approach to issues, e.g. Sage One platform Product brands Sage brand -

Page 29

Summary Good results demonstrating strength of business model Uncertain economies; managing our business prudently Remain confident about long term prospects Re-positioning Sage for the next stage of its evolution Aim to increase organic revenue growth, with additional shareholder returns 29 -

Page 30

-

Page 31

Segmental analysis Year ended 30 September 2011 Subscription revenue Europe £500.9m ...£457.6m £1,334.1m +4% £229.1m £99.7m £36.3m £365.1m EBITA margin New support contracts Total support contracts * Excludes ACT! contracts 29% 58,000 1,102,000 26% 11,000* 568,000* 31 25% 12,000 197... -

Page 32

... North America AAMEA Group 247.8 149.7 5% 4% 157.6 46.9 5% 2% 405.4 196.6 5% 4% 36.6 434.1 15% 5% 33.5 238.0 5% 5% 70.1 672.1 10% 5% H1 excludes Sage Healthcare which is treated as a discontinued operation in the full year results Figures restated to year end 2011 exchange rates 32