Peachtree 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Peachtree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Results for the year ended

30 September 2009

30

September

2009

Table of contents

-

Page 1

Results for the year ended 30 September 2009 -

Page 2

... restructuring costs Operating cash flow/EBITA†Dividend per share £1,439.3m Statutory +11% Underlying -4%* £307.5m^ £307 5 ^ £333.9m^ 16.63p^ 112% 7.43p +11% +14% 2%^ -2%^ +6%^ 0%^ +3% *At constant t t exchange h rates t ^Stated prior to amortisation of intangible fixed assets and after... -

Page 3

...'s Sage s business model demonstrated in the year • Subscription revenues continued to grow, limiting the impact of contraction in software and software-related services revenues • Operating O ti cash h flow fl remains i strong t at t 112% of f EBITA • Final Fi l f full ll year di dividend id... -

Page 4

Trusted partner to SMEs 4 -

Page 5

2009 focus • Provision of high quality support • Range g of p products launched in y year recognising g g evolving market • Operational improvements in North America and positioned Sage Healthcare Division for future growth • Quiet year for acquisitions but remains part of our growth th ... -

Page 6

Fi Financial i l review i -

Page 7

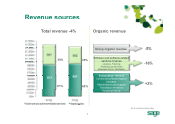

...and software-related services revenue Licence, Training Professional services Business forms, Hardware -5% 5% 39% 35% 16% -16% 61% 65% Subscription revenue Combined software/support contracts Maintenance and support Transaction revenues H t d products Hosted d t +2% £m at constant exchange... -

Page 8

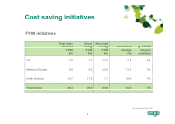

... costs incurred FY09 £m UK Mainland Europe North America Total Group 6.9 8.8 10.7 26.4 Gross g saving FY09 £m 2.2 5.6 17.8 25.6 Net (cost) /saving g FY09 £m (4.7) (3.2) 7.1 (0.8) Annualised savings £m 5.8 13.5 34.6 53.9 % of FY08 full year cost base 4% 3% 7% 5% At constant exchange rates 8 -

Page 9

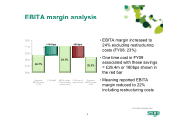

...Reported EBITA margin FY09 -180 bps • EBITA margin increased to 24% excluding restructuring costs (FY08: 23%) • One time cost in FY09 associated with these savings... = £26.4m or 180bps shown in the red bar • Meaning reported EBITA margin reduced to... -

Page 10

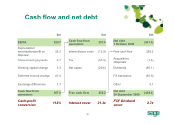

... Depreciation/ amortisation/profit on disposal payments y Share-based p Working capital change Deferred income change Exchange differences Cash C h flow fl from f operations 320.7 25.3 6.7 3.3 (0 1) (0.1) 1.7 357.6 Free cash flow 259.2 Cash flow from operations Interest/issue costs Tax Net capex... -

Page 11

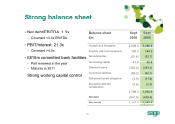

... tax liabilities Retirement benefit obligations Acquisition deferred consideration Sept 2008 2,049.2 140.5 (21.6) 47 8 47.8 (352.2) (69.2) (3.9) (2.6) 1,788.0 Sept 2009 2,246.8 144.5 (33.7) 46 6 46.6 (391.1) (62.1) (11.8) (2.3) 1,936.9 (439.4) 1,497.5 , • PBIT/Interest: 21.3x - Covenant >4.0x... -

Page 12

R i Regional l review i -

Page 13

...decline of 3% - S Subscription b i i +5% 5% - Software and software-related services -19% - Sage Pay grew strongly, and has significant potential - Accountants' Practice Solutions performed well with enhanced service levels - Accounting and ERP ERP, including Sage 50, declined 5% in difficult market... -

Page 14

...£521m £275m • Organic O i revenue d decline li of f 3% - - - - Subscription +5% Software and software-related services -13% France resilient at 2% organic contraction Spain contracted 7% on an organic basis after exceptional growth last year - Germany G robust b t with ith fl flat t revenue 22... -

Page 15

... - EBITA margin increased to 17% (FY08: 8%) 18% 37% margin margin FY08 Sage Healthcare Division 18% margin FY09 • EBITA margin 18% (FY08: 18%) - Margin pre-restructuring costs was 20% Sage Payment Solutions Division g Business Solutions Division ( (SBS) ) Sage At constant exchange rates 15 -

Page 16

... +14% - Software and software software-related related services -8% 8% £100m £100m • South Africa still grew strongly at 9% • Australia contracted 3% organically after strong growth last year • Smaller Asian businesses declined 15% pp in the absence of established support models • EBITA... -

Page 17

Business B i review i and d outlook tl k -

Page 18

Overview of Sage g 18 -

Page 19

... and delivery models • Today a number of services delivered over web by Sage • Launched SaaS accounting offers aimed at small/micro businesses • For mid-market accounting/ERP we see demand for a hybrid model with web/cloud services ( (such as hosting g and remote access) ) complementing... -

Page 20

... My Business Online Billing Boss Edonea "SaaS" "Cloud" Computing Sage 50 Online Sage SalesLogix Sage Project Lifecycle M Management t Web services Sage Abra HR Employee Self Service ACT! E-marketing Sage Pay schnellcheck Globalisation Sage Accpac ERP Sage ERP X3 Sage ACT!/SalesLogix Mobile... -

Page 21

Products for a mobile workforce ACT! Mobile Live ACT! E-marketing E k ti 21 -

Page 22

...,000 000 new customers • Upgrades organic revenue declined by 18% - Releases well received but customers remain cautious • Software revenue from migrations declined organically by 15% • Professional services, training and other revenue declined organically by 8% At constant exchange rates 22 -

Page 23

Subscription p revenues • Support renewal rates stable at 81% • Premium now two thirds of total support • Payments services attractive market • Healthcare transaction services offers opportunity 23 -

Page 24

Customer support pp • 2,700 support staff with 1.7m support contracts • Examples of issues - Legislation changes - Payroll issues - Invoicing - Credit control functionality • Increased use of web forums and communities 24 -

Page 25

North American progress p g Phase 2: Operational i improvements t Activ vities Phase 1: New team, organisation structure and cost focus FY09 FY10 25 -

Page 26

Sage g Healthcare Division • Market leading US practice management and Electronic Health Records (EHR) solutions • Target the 1 to 25 physician practice segment - customer base of 15,000 , practices p • Profitability of the business has increased to 17% in the year (FY08: 8%) • EHR stimulus ... -

Page 27

Outlook and g growth drivers Outlook • Customers remain cautious - for FY10 continue to pr dentl manage costs and position b prudently business siness for upturn L Longer term t drivers di • 6m SME customers - resilience and platform for growth in evolving market • North America/Healthcare ... -

Page 28

Supplementary S l t information -

Page 29

Regional g profile p Revenue FY09 £m UK Mainland Europe North America Rest of World Total 242.2 520.5 576 4 576.4 100.2 1,439.3 FY09 revenue % of Group 17% 36% 40% 7% 100% EBITA FY09 £m 84.3 107.3 105 3 105.3 23.8 320.7 EBITA margin FY09 % 35% 21% 18% 24% 22% 29 -

Page 30

UK Revenue Subscription Software and software-related services Total £171.1m £71.1m £242.2m EBITA margin EBITA EBITA £84.3m 35% Customers New in the year At 30 September 2009 31,000 803,000 Support contracts (3,000) 360,000 30 -

Page 31

Mainland Europe p Revenue Subscription Software and software-related services Total £292.7m £227.8m £520.5m EBITA margin EBITA EBITA £107.3m 21% Customers New in the year At 30 September 2009 47,000 1,676,000 Support contracts 24,000 652,000 31 -

Page 32

North America Revenue Subscription Software and software-related services Total £428.3m £148.1m £576.4m EBITA margin EBITA EBITA £105.3m 18% Customers* Customers New in the year At 30 September 2009 123,000 3,118,000 Support contracts 601,000 * Excluding ACT! 32 -

Page 33

Rest of World Revenue Subscription Software and software-related services Total £44.7m £55.5m £100.2m EBITA margin EBITA EBITA £23.8m 24% Customers New in the year At 30 September 2009 44,000 545,000 Support contracts 12,000 166,000 33