Paychex 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Paychex annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

Table of contents

-

Page 1

-

Page 2

... services, including payroll processing, payroll tax administration, and employee pay services, including direct deposit, check signing, and Readychex®. Human resource services include 401(k) plan recordkeeping, section 125 plans, a professional employer organization, time and attendance solutions...

-

Page 3

... section of Item 7 of our Annual Report on Form 10-K for the year ended May 31, 2012, for further information.

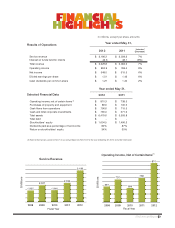

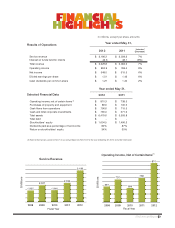

Operating Income, Net of Certain Items(1) Service Revenue

2,186 738 810

$ Millions

2,007 1,935 1,946

2,036

$ Millions

730 697

689

2008

2009

2010 Fiscal Year

2011

2012

2008...

-

Page 4

...of the way our 12,400 employees work together every day to ensure that we remain the leading provider of payroll, human resource, and benefits outsourcing solutions for our clients and their employees. We are united in our purpose: to provide our clients the freedom to succeed.

2 2012 Annual Report

-

Page 5

... saw this in 2012, with near-record client retention and best-ever client satisfaction levels. Client satisfaction is a particularly important measurement for us, because as payroll and human resource rules and regulations get more complicated, businesses turn to Paychex to help them navigate those...

-

Page 6

TAKING ECONOMICS TO THE BANK

4

-

Page 7

... 2012, we continued our introduction of technology enhancements to our software-as-a-service (SaaS) offerings with the launch of Paychex Mobile products, just one area of focus for us in product development. Our mobility innovation gives clients and their employees the same access to Paychex online...

-

Page 8

SOUTH WEDGE HAUTE CUISINE

6

6 2012 Annual Report

-

Page 9

..., and retirement information in the palm of a user's hand. The app's customizable dashboard lets employers and employees connect to their most frequently used tasks quickly and in a way that works for them. Our mobile app also offers accountants another tool to instantly access their clients' data...

-

Page 10

...a 23% increase in the number of applicants.

HUMAN RESOURCE SERVICES Insurance services and Paychex HR Solutions were major factors in the 13% increase in Human Resource Services revenue we had this year, totaling $676.2 million. Paychex HR Solutions - our human resources outsourcing business, which...

-

Page 11

9

-

Page 12

... SurePayroll a year and a half ago, we expanded our product set by adding their Web-based platform for small businesses. Earlier this year, we acquired Icon Time Systems, Inc. and incorporated the business into our company. We already had a successful Continued on page 13

10 2012 Annual Report

-

Page 13

Brown & Brown

SUPERIOR INSTALLATIONS, INC.

11

-

Page 14

12

14 2012 Annual Report

-

Page 15

... sales force did this year communicating our message, we put extra emphasis on search engine marketing and our CPA referral channel, both of which proved successful. Since 2003, Paychex has been the preferred payroll and retirement plan services provider of the AICPA Trusted Business Advisor Program...

-

Page 16

... Childs, Vice President, Marketing; Kevin Hill, Vice sure to read about the President, Insurance and HR Solutions Services; Mark Bottini, Sr. Vice President, executive role on our payroll Sales; Michael Gioja, Sr. Vice President, IT, Product Management valued Paychex clients and Development; Efrain...

-

Page 17

..., D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended May 31, 2012

Commission file number 0-11330

Paychex, Inc.

911 Panorama Trail South Rochester, New York 14625-2396 (585) 385-6666 A Delaware Corporation IRS Employer...

-

Page 18

PAYCHEX, INC. INDEX TO FORM 10-K For the fiscal year ended May 31, 2012

Description Page

PART I Cautionary Note Regarding Forward-Looking Statements Pursuant to the United States Private Securities Litigation Reform Act of 1995 ...Item 1 Business ...Item 1A Risk Factors ...Item 1B Unresolved Staff ...

-

Page 19

... collection and payment of payroll taxes, professional employer organizations, and employee benefits, including retirement plans, workers' compensation, health insurance, state unemployment, and section 125 plans; • changes in health insurance and workers' compensation rates and underlying...

-

Page 20

... clients to meet their diverse payroll and human resource needs. These include: • payroll processing; • payroll tax administration services; • employee payment services; • regulatory compliance services (new-hire reporting and garnishment processing); • Paychex HR Solutions; • retirement...

-

Page 21

...select Paychex One-Source Solutions, which seamlessly integrates Preview, Paychex Time and Labor Online, and Paychex HR Online applications through a single, web-based client portal. MMS clients also have the option to select from a number of á la carte payroll and human resource ancillary services...

-

Page 22

... agencies for late filings and late or under payment of taxes. Employee payment services: As of May 31, 2012, 82% of our clients utilized our employee payment services, which provide the employer the option of paying their employees by direct deposit, payroll debit card, a check drawn on a Paychex...

-

Page 23

... 107,000 clients have appointed PIA as their agent for servicing their business insurance needs. eServices: We offer online human resource administration software products for employee benefits management and administration and time and attendance solutions. Paychex HR Online offers powerful tools...

-

Page 24

...(1) Paychex, Inc. distribution of client base

1-4 5-19 20-49 50-99 100+

83% 13% 2% 1% 1%

42% 40% 12% 4% 2%

(1) Based on currently available market data from Dun & Bradstreet. The market for payroll processing and human resource services is highly competitive and fragmented. Our primary national...

-

Page 25

..., and logo are of material importance to us. Seasonality There is no significant seasonality to our business. However, during our third fiscal quarter, which ends in February, the number of new payroll clients, new retirement services clients, and new Paychex HR Solutions worksite employees tends to...

-

Page 26

... and type of taxes employers and employees are required to pay. Such changes could reduce or eliminate the need for some of our services and substantially decrease our revenue. Added requirements could also increase our cost of doing business. Failure to educate and assist our clients regarding new...

-

Page 27

... to deliver client payroll checks and banks used to electronically transfer funds from clients to their employees. Failure by these service providers, for any reason, to deliver their services in a timely manner could result in material interruptions to our operations, impact client relations, and...

-

Page 28

... of Rochester, New York are at various locations throughout the U.S. and Germany and house our regional, branch, and sales offices and data processing centers. These locations are concentrated in metropolitan areas. We believe that adequate, suitable lease space will continue to be available to meet...

-

Page 29

..., Inc. Employee Stock Purchase Plan and 5,674 participants in the Paychex, Inc. Employee Stock Ownership Plan. The high and low sale prices for our common stock as reported on the NASDAQ Global Select Market and dividends for fiscal 2012 and fiscal 2011 are as follows:

Fiscal 2012 Sales prices High...

-

Page 30

... Data Processing, Inc. (direct competitor) Fiserv, Inc. The Western Union Company Total Systems Services, Inc. Global Payments Inc. The Brink's Company DST System, Inc. The Dun & Bradstreet Corporation Equifax Inc. Broadridge Financial Solutions, Inc. Robert Half International Inc. Intuit Inc...

-

Page 31

... (new-hire reporting and garnishment processing). In addition to the above, our software-as-a-service ("SaaS") solution through our MMS platform provides human resource management, employee benefits management, time and attendance systems, online expense reporting, and applicant tracking.

13

-

Page 32

... employer organization ("PEO"). We also offer Paychex HR Essentials, an ASO product that provides support to our clients over the phone or online to help manage employee-related topics; • retirement services administration; • insurance services; • eServices; and • other human resource...

-

Page 33

... our Human Resource Services ancillary service offerings:

As of May 31, 2012 Organic growth for fiscal year(1) 2012 2011 2010

Paychex HR Solutions client employees served(2) ...Paychex HR Solutions clients(2) ...Insurance services clients(3) ...Health and benefits services applicants ...Retirement...

-

Page 34

... to support our existing SaaS products. Recent launches include a single sign-on and landing page; Paychex Online Mobile iPad® and Android™ tablet applications; and, most recently, a smartphone application. These mobile applications allow our clients instant access and increased productivity...

-

Page 35

... is based upon anticipated client base growth, offset by an expected lower rate of growth in checks per payroll, and modest increases in revenue per check. Human Resource Services revenue growth is expected to remain in line with our historical organic experience. Prior acquisitions are expected to...

-

Page 36

... 2012 Change 2011 Change 2010

Revenue: Payroll service revenue ...Human Resource Services revenue ...Total service revenue ...Interest on funds held for clients ...Total revenue ...Combined operating and SG&A expenses ...Operating income ...Investment income, net ...Income before income taxes...

-

Page 37

... number of applicants. • Products that primarily support our MMS clients through our SaaS solution continue to experience growth in clients and revenue. • Retirement services revenue benefited from an increase in the average asset value of retirement services client employees' funds (excluding...

-

Page 38

...of May 31,

2012

Change

2011

Change

2010

Paychex HR Solutions client employees served(1) ...Paychex HR Solutions clients(1) ...Insurance services clients(2) ...Health and benefits services applicants ...Retirement services clients(3) ...Asset value of retirement services client employees' funds...

-

Page 39

... of salary increases and 401(k) employer match during fiscal 2011, along with one-time costs related to the separation agreement entered into with Jonathan J. Judge, our former President and Chief Executive Officer. As of May 31, 2012 and 2011, we had approximately 12,400 employees compared...

-

Page 40

...income on available-for-sale securities during fiscal 2011 compared to fiscal 2010. Refer to Note I of the Notes to Consolidated Financial Statements, contained in Item 8 of this Form 10-K, for additional disclosures on income taxes. Net income and earnings per share: Net income increased 6% to $548...

-

Page 41

... operational functions, while Paychex and Advantage provide all centralized back-office payroll processing and payroll tax administration services. Under these arrangements, Advantage pays the Associates commissions based on processing activity for the related clients. When we acquired Advantage...

-

Page 42

...fiscal 2012 and fiscal 2011 were primarily related to the timing of collections from clients and payments for compensation, PEO payroll, income tax, and other liabilities. Investing Cash Flow Activities

In millions 2012 Year ended May 31, 2011 2010

Net change in funds held for clients and corporate...

-

Page 43

... the Company. The purchases of other assets were for customer lists. Financing Cash Flow Activities

In millions, except per share amounts 2012 Year ended May 31, 2011 2010

Net change in client fund obligations ...Dividends paid ...Proceeds from exercise and excess tax benefit related to stock-based...

-

Page 44

... a fee per employee or transaction processed. The revenue earned from delivery service for the distribution of certain client payroll checks and reports is included in service revenue, and the costs for delivery are included in operating expenses on the Consolidated Statements of Income. PEO revenue...

-

Page 45

... employees, including grants of stock options, are recognized as compensation costs in our consolidated financial statements based on their fair values measured as of the date of grant. We estimate the fair value of stock option grants using a Black-Scholes option pricing model. This model requires...

-

Page 46

... for uncertain tax positions. Item 7A. Quantitative and Qualitative Disclosures About Market Risk Market Risk Factors Changes in interest rates and interest rate risk: Funds held for clients are primarily comprised of shortterm funds and available-for-sale securities. Corporate investments are...

-

Page 47

...funds held for clients and corporate available-for-sale securities reflected a net unrealized gain of $59.5 million as of May 31, 2012, compared with an unrealized gain of $59.3 million as of May 31, 2011. In determining fair value, we utilize the Interactive Data Pricing Service. During fiscal 2012...

-

Page 48

...loss of $0.3 million was due to changes in interest rates and was not due to increased credit risk or other valuation concerns. Substantially all of the securities in an unrealized loss position as of May 31, 2012 and 2011 held an AA rating or better. We do not intend to sell these investments until...

-

Page 49

... Balance Sheets as of May 31, 2012 and 2011 ...Consolidated Statements of Stockholders' Equity for the Years Ended May 31, 2012, 2011, and 2010 ...Consolidated Statements of Cash Flows for the Years Ended May 31, 2012, 2011, and 2010 ...Notes to Consolidated Financial Statements ...Schedule II...

-

Page 50

... this Annual Report on Form 10-K, and as a part of their audit, has issued their report, included herein, on the effectiveness of the Company's internal control over financial reporting.

/s/ Martin Mucci Martin Mucci President and Chief Executive Officer

/s/ Efrain Rivera Efrain Rivera Senior Vice...

-

Page 51

... reporting as of May 31, 2012, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Paychex, Inc. as of May 31, 2012 and 2011, and the related consolidated statements...

-

Page 52

... balance sheets of Paychex, Inc. as of May 31, 2012 and 2011, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended May 31, 2012. Our audits also included the financial statement schedule listed in the Index at...

-

Page 53

PAYCHEX, INC. CONSOLIDATED STATEMENTS OF INCOME In millions, except per share amounts

Year ended May 31, 2012 2011 2010

Revenue: Service revenue ...Interest on funds held for clients ...Total revenue ...Expenses: Operating expenses ...Selling, general and administrative expenses ...Total expenses ...

-

Page 54

PAYCHEX, INC. CONSOLIDATED BALANCE SHEETS In millions, except per share amount

As of May 31, 2012 2011

Assets

Cash and cash equivalents ...Corporate investments ...Interest receivable ...Accounts receivable, net of allowance for doubtful accounts ...Deferred income taxes ...Prepaid income taxes ......

-

Page 55

...Stock-based compensation ...Stock-based award transactions ...Balance as of May 31, 2010 ...Net income ...Unrealized losses on securities, net of tax ...Total comprehensive income ...Cash dividends declared ...Stock-based compensation ...Stock-based award transactions ...Balance as of May 31, 2011...

-

Page 56

......Acquisition of businesses, net of cash acquired ...Proceeds from sale of business ...Purchases of other assets ...Net cash used in investing activities ...Financing activities Net change in client fund obligations ...Dividends paid ...Proceeds from exercise and excess tax benefit related to stock...

-

Page 57

...insurance, and offers health care coverage to PEO client employees. PEO services are sold through the Company's registered and licensed subsidiary, Paychex Business Solutions, Inc. Paychex HR Essentials is an ASO product that provides support to the Company's clients over the phone or online to help...

-

Page 58

... of operations. Funds held for clients and corporate investments: Marketable securities included in funds held for clients and corporate investments consist primarily of securities classified as available-for-sale and are recorded at fair value obtained from an independent pricing service. The funds...

-

Page 59

...plus a fee per employee or transaction processed. The revenue earned from delivery service for the distribution of certain client payroll checks and reports is included in service revenue, and the costs for the delivery are included in operating expenses on the Consolidated Statements of Income. PEO...

-

Page 60

...: All stock-based awards to employees are recognized as compensation costs in the consolidated financial statements based on their fair values measured as of the date of grant. The Company estimates the fair value of stock option grants using a Black-Scholes option pricing model. This model requires...

-

Page 61

... May 31, 2012 and $34.4 million as of May 31, 2011. Refer to Note I for further discussion of the Company's reserve for uncertain tax positions. Use of estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires management to...

-

Page 62

...of SurePayroll and ePlan are included in the Company's consolidated financial statements from their respective dates of acquisition. These acquisitions are not material to the Company's results of operations, financial position, or cash flows. Note D - Stock-Based Compensation Plans The Paychex, Inc...

-

Page 63

... Consolidated Statements of Income on a straight-line basis over the requisite service period and increase additional paid-in capital. Stock-based compensation expense was $22.9 million, $24.8 million, and $25.6 million for fiscal years 2012, 2011, and 2010, respectively. Related income tax benefits...

-

Page 64

... 2010

Total intrinsic value of stock options exercised ...Total grant-date fair value of stock options vested ...

$ 0.8 $10.4

$ 1.9 $20.0

$ 1.4 $19.0

Performance stock options: In July 2011, the Board approved a special award of performance-based stock options under a Long-Term Incentive Plan...

-

Page 65

PAYCHEX, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes performance stock option activity for the year ended May 31, 2012:

Shares subject to options Weighted-average exercise price per share Weighted-average remaining contractual term (years) Aggregate ...

-

Page 66

...the dividends accrued on those shares will be forfeited and returned to Paychex. For restricted stock awards granted to officers prior to July 2010, the shares vest upon the fifth anniversary of the grant date provided the recipient is still an employee of the Company on that date. These awards have...

-

Page 67

... the Company's transfer agent and no brokerage fees are charged to employees, except for when stock is sold. The plan has been deemed non-compensatory and therefore, no stock-based compensation costs have been recognized for fiscal years 2012, 2011, or 2010 related to this plan. Note E - Funds Held...

-

Page 68

...of May 31, 2011 included money market funds, U.S. agency discount notes, a short-term municipal bond, FDIC-insured deposit accounts, and other bank demand deposit accounts. Within bank demand deposit accounts for funds held for clients, the Company maintained $13.7 million as of May 31, 2012 and $16...

-

Page 69

... due to new developments or changes in the Company's strategies or assumptions related to any particular investment. Realized gains and losses from the sale of available-for-sale securities were as follows:

In millions Year ended May 31, 2012 2011 2010

Gross realized gains ...Gross realized losses...

-

Page 70

.... Marketable securities included in funds held for clients and corporate investments consist primarily of securities classified as available-for-sale and are recorded at fair value on a recurring basis. Money market securities are classified as level 1 in the fair value hierarchy. The Company...

-

Page 71

... securities are mutual fund investments, consisting of participants' eligible deferral contributions under the Company's non-qualified and unfunded deferred compensation plans. The related liability is reported as other long-term liabilities. The mutual funds are valued based on quoted market prices...

-

Page 72

... Sheets of $517.4 million as of May 31, 2012, and $513.7 million as of May 31, 2011. The increase in goodwill since May 31, 2011 was the result of an immaterial business acquisition. The increase in goodwill from May 31, 2010 to May 31, 2011 was the result of the acquisition of two SaaS companies...

-

Page 73

... millions May 31, 2012 2011

Deferred tax assets: Compensation and employee benefit liabilities ...Other current liabilities ...Tax credit carry forward ...Depreciation ...Stock-based compensation ...Other ...Gross deferred tax assets ...Deferred tax liabilities: Capitalized software ...Depreciation...

-

Page 74

PAYCHEX, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The components of the provision for income taxes are as follows:

In millions 2012 Year ended May 31, 2011 2010

Current: Federal ...State ...Total current ...Deferred: Federal ...State ...Total deferred ...Provision for income ...

-

Page 75

...Statements of Income. The amount of accrued interest and penalties associated with the Company's tax positions is immaterial to the Consolidated Balance Sheets. The amount of interest and penalties recognized for fiscal years 2012, 2011, and 2010 was immaterial to the Company's results of operations...

-

Page 76

... at that time. Deferred compensation plans: The Company offers non-qualified and unfunded deferred compensation plans to a select group of key employees, executive officers, and outside directors. Eligible employees are provided with the opportunity to defer up to 50% of their annual base salary and...

-

Page 77

... The Company leases office space and data processing equipment under terms of various operating leases. Rent expense for fiscal years 2012, 2011, and 2010 was $43.0 million, $45.4 million, and $46.9 million, respectively. As of May 31, 2012, future minimum lease payments under various non-cancelable...

-

Page 78

... insurance company. Note N - Related Parties During fiscal years 2012, 2011, and 2010, the Company purchased approximately $2.6 million, $5.7 million, and $3.2 million, respectively, of data processing equipment and software from EMC Corporation. The Chairman, President, and Chief Executive Officer...

-

Page 79

PAYCHEX, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Fiscal 2011 August 31 Three Months Ended November 30 February 28 May 31 Full Year

Service revenue ...Interest on funds held for clients ...Total revenue ...Operating income ...Investment income, net ...Income before income taxes...

-

Page 80

... and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures are also designed with the objective of ensuring that such information is accumulated and communicated to the Company's management, including the Company's principal executive officer and...

-

Page 81

... the Company, Mr. Bottini served as Vice President of Sales for Ricoh, North America, a provider of advanced office technology and innovative document imaging products, services, and software since 2008. He assumed his most recent position with Ricoh when Ricoh acquired IKON Office Solutions, Inc...

-

Page 82

Name

Age

Position and business experience

Kevin N. Hill ...

53

Jennifer Vossler ...

49

Laurie L. Zaucha ...

47

Mr. Hill was named Vice President of Insurance and Human Resource Solutions Services in October 2011. He joined Paychex in April 2008 as Vice President of Insurance Operations, and ...

-

Page 83

..."Policy on Transactions with Related Persons" within the section "CORPORATE GOVERNANCE," and is incorporated herein by reference. Item 14. Principal Accounting Fees and Services The information required by this item is set forth in the Company's Definitive Proxy Statement for its 2012 Annual Meeting...

-

Page 84

.... Paychex, Inc. Non-Qualified Stock Option Agreement, incorporated herein by reference from Exhibit 4.1 to the Company's Registration Statement on Form S-8, No. 333-129571. Paychex, Inc. 2002 Stock Incentive Plan (as amended and restated effective October 12, 2005) 2008 Master Restricted Stock Award...

-

Page 85

... Option Award Agreement (Board), incorporated herein by reference from Exhibit 10.20 to the Company's Form 10-K filed with the Commission on July 15, 2011. Paychex, Inc. 2002 Stock Incentive Plan (as amended and restated effective October 13, 2010) Form of Restricted Stock Award Agreement (Board...

-

Page 86

... Mucci Martin Mucci, President and Chief Executive Officer, and Director (Principal Executive Officer) /s/ Efrain Rivera Efrain Rivera, Senior Vice President, Chief Financial Officer, and Treasurer (Principal Financial Officer) B. Thomas Golisano*, Chairman of the Board Joseph G. Doody*, Director...

-

Page 87

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 88

PAYCHEX, INC. ELEVEN-YEAR SUMMARY OF SELECTED FINANCIAL DATA

In millions, except per share amounts Year ended May 31, 2012 2011 2010 2009 2008

Results of operations Revenue: Service revenue ...Interest on funds held for clients ...Total revenue ...Total expenses ...Operating income ...As a % of ...

-

Page 89

....9 134.1 1,887.0 1,185.5 $ 701.5 37% $ 41.7 $ 743.2 39% $ 515.4 27% $ 1.35 $ 1.35 381.1 382.8 $ 0.79 $ 79.0 $1,224.2 $6,246.5 $ - $1,952.2 28%

$1,573.8 100.8 1,674.6 1,025.0 $ 649.6 39% $ 25.2 $ 674.8 40% $ 464.9 28% $ 1.23 $ 1.22 379.5 381.4 $ 0.61 $ 81.1 $ 962.0 $5,549.3 $ - $1,654.8 30%

$1,384...

-

Page 90

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 91

... Efrain Rivera, Senior Vice President, Chief Financial Officer, and Treasurer. For more information about Paychex Investor Relations, please contact: Paychex Investor Relations 911 Panorama Trail South Rochester, NY 14625-2396 or call 1-800-828-4411 Paychex, Inc. financial materials can be accessed...

-

Page 92

... Hill Vice President, Insurance and Human Resource Solutions Services • Sanjay Hiranandani Vice President, Information Technology Operations • Bryan R. Hodge Vice President, Eastern Operations • Laurie A. Maffett Vice President, Centralized Product Operations and Support • Lonny C. Ostrander...

-

Page 93

... Business Insurance magazine's list of

Top 100 Brokers of U.S. Business,

based on revenue generated by U.S.-based clients. Cited as a

World's Most Ethical Companies.

Training Top 125

11th consecutive appearance on Training magazine's list of organizations that excel at employee development.

2011...

-

Page 94

SM

paychex.com buildmybiz.com 911 Panorama Trail South, Rochester, New York 14625

twitter.com/paychex facebook.com/paychex linkedin.com/company/paychex