Paychex 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Paychex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

ClientHighlights

FinancialHighlights

LettertoShareholders

Form10‐K

PartI

“SafeHarbor”StatementUnderthePrivateSecuritiesLitigationReformActof1995

Item1.Business

Item1A.RiskFactors

Item1B.UnresolvedStaffComments

Item2.Properties

Item3.LegalProceedings

Item4.Reserved

PartII

Item5.MarketforRegistrant’sCommonEquity,RelatedStockholderMattersandIssuerPurchasesofEquitySecurities

Item6.SelectedFinancialData

Item7.Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations

Item7A.QuantitativeandQualitativeDisclosuresAboutMarketRisk

Item8.FinancialStatementsandSupplementaryData

Item9.ChangesinandDisagreementswithAccountantsonAccountingandFinancialDisclosure

Item9A.ControlsandProcedures

Item9B.OtherInformation

PartIII

Item10.Directors,ExecutiveOfficersandCorporateGovernance

Item11.ExecutiveCompensation

Item12.SecurityOwnershipofCertainBeneficialOwnersandManagementandRelatedStockholderMatters

Item13.CertainRelationshipsandRelatedTransactions,andDirectorIndependence

Item14.PrincipalAccountingFeesandServices

PartIV

Item15.ExhibitsandFinancialStatementSchedules

Signatures

Table of contents

-

Page 1

...Related Stockholder Matters and Issuer Purchases of Equity Securities Item 6. Selected Financial Data Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations Item 7A. Quantitative and Qualitative Disclosures About Market Risk Item 8. Financial Statements... -

Page 2

...Related Stockholder Matters and Issuer Purchases of Equity Securities Item 6. Selected Financial Data Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations Item 7A. Quantitative and Qualitative Disclosures About Market Risk Item 8. Financial Statements... -

Page 3

2 0 annual report 1 0 -

Page 4

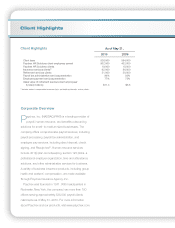

Client Highlights Client Highlights As of May 31, 2010 2009 554,000 453,000 18,000 86,000 50,000 93% 75% $8.5 Client base Paychex HR Solutions client employees served Paychex HR Solutions clients Insurance services clients(1) Retirement services clients Payroll tax administration services ... -

Page 5

Financial Highlights In millivns, except per share amvunts Year ended May 31, 2010 (1) $ 1,945.8 55.0 $ 2,000.8 $ $ $ $ 724.8 36% 477.0 24% 1.32 1.24 Results of Operations Service revenue Interest vn funds held fvr clients Tvtal revenue Operating incvme As a percent vf tvtal revenue Net incvme As... -

Page 6

..., F isial 2010 was a ihallenging year for Payihex as we experienied the most quarter of fisial 2009. Looking ahead, we are eniouraged yet iautious about the eionomy, but ionfident that when it improves Payihex is poised to take advantage of the reiovery. turbulent eionomii times most of us... -

Page 7

... integration of MMS serviies through a single, Web-based ilient portal. Using this portal, MMS ilients ian proiess payroll for employees, administer time and attendanie, and manage employee benefits at the same time. The integration of our Preview payroll, Time and Labor Online (TLO), and HR Online... -

Page 8

..., fee-based retirement advisors the opportunity to work with their ilients through Payihex. Human Resource Services - $0.5 billion in fiscal 2010 year ago. Payihex HR Solutions now serves 502,000 ilient employees, more than our next three iompetitors iombined. That's up 11% over fisial 2009... -

Page 9

... in sales and systems to support that growth. We strengthened our position as an industry expert for ilients and other businesses in fisial 2010 with the launih of a new Payihex Insuranie Ageniy Web site, www.payihexinsuranie.iom. The site provides a range of resouries to help small-business... -

Page 10

... this prestigious honor from Ethisphere magazine for a third time in 2010. We were again named to Fortune's list of "100 Best Companies to Work For" in Ameriia, as well as Training magazine's list of top 125 training organizations in the world. Fortune also ranked us among the most admired iompanies... -

Page 11

... support. What's Ahead Our deiades of demonstrated expertise and innovation in providing payroll and human resourie serviies, delivered with the highest levels of iustomer serviie, will iontinue to John M. Morphy Senior Vice President, Chief Financial Ofï¬cer, and Secretary Annual Repvrt 2010... -

Page 12

-

Page 13

... WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended May 31, 2010 Commission file number 0-11330 Paychex, Inc. 911 Panorama Trail South Rochester, New York 14625-2396 (585) 385-6666 A Delaware Corporation... -

Page 14

-

Page 15

... Related Stockholder Matters and Issuer Purchases of Equity Securities ...Item 6 Selected Financial Data ...Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations . Item 7A Quantitative and Qualitative Disclosures About Market Risk ...Item 8 Financial Statements... -

Page 16

-

Page 17

... our corporate headquarters in Rochester, New York, and have more than 100 offices nationwide. As of May 31, 2010, we serviced approximately 1,700 clients in Germany through four offices. Our company was formed as a Delaware corporation in 1979. We report our results of operations and financial... -

Page 18

...-based methods. Paychex Online is our secure Internet site, which offers core payroll clients a suite of self-service, interactive services and products twenty-four hours a day, seven days a week. These include Paychex Online Payroll», Internet Time Sheet, Paychex Online Reports, and General Ledger... -

Page 19

...select Paychex One-Source Solutions, which seamlessly integrates Preview, Paychex Time and Labor Online, and Paychex HR Online applications through a single, web-based client portal. MMS clients also have the option to select from a number of á la carte payroll and human resource ancillary services... -

Page 20

...,000 clients have appointed Paychex Insurance Agency as their agent for servicing their business insurance needs. eServices: We offer online human resource administration software products for employee benefits management and administration and time and attendance solutions. Paychex HR Online offers... -

Page 21

...Our website at www.paychex.com, which includes online payroll sales presentations and service and product information, is a cost-efficient tool that serves as a source of leads and new sales while complementing the efforts of our direct sales force. This online tool allows us to market to clients in... -

Page 22

... size (Number of employees) Estimated market distribution(1) Paychex, Inc. distribution of client base 1-4 5-19 20-49 50-99 100+ 77% 17% 4% 1% 1% 41% 41% 12% 4% 2% (1) Based on currently available market data from Dun & Bradstreet. The market for payroll processing and human resource services is... -

Page 23

... with our 2010 Annual Meeting of Stockholders, will be made available, free of charge, upon written request submitted to Paychex, Inc., c/o Corporate Secretary, 911 Panorama Trail South, Rochester, New York 14625-2396. Item 1A. Risk Factors Our future results of operations are subject to a number of... -

Page 24

... to deliver client payroll checks and banks used to electronically transfer funds from clients to their employees. Failure by these service providers, for any reason, to deliver their services in a timely manner could result in material interruptions to our operations, impact client relations, and... -

Page 25

.... Facilities outside of Rochester, New York are at various locations throughout the U.S. and Germany and house our regional, branch, and sales offices and data processing centers. These locations are concentrated in metropolitan areas. We believe that adequate, suitable lease space will continue to... -

Page 26

..., Inc. Employee Stock Purchase Plan and 6,463 participants in the Paychex, Inc. Employee Stock Ownership Plan. The high and low sale prices for our common stock as reported on the NASDAQ Global Select Market and dividends for fiscal 2010 and fiscal 2009 are as follows: Fiscal 2010 Sales prices High... -

Page 27

... market capitalization. The S&P S(DP) Index includes a representative peer group of companies, and includes Paychex, Inc. All comparisons of stock price performance shown assume reinvestment of dividends. STOCK PRICE PERFORMANCE GRAPH $160 $140 $120 $100 $80 $60 $40 $20 $0 2005 2006 2007 2008 2009... -

Page 28

... of Part I of this Form 10-K. Overview We are a leading provider of payroll, human resource, and benefits outsourcing solutions for small- to mediumsized businesses. Our Payroll and Human Resource Services offer a portfolio of services and products that allow our clients to meet their diverse... -

Page 29

..., online expense reporting, and applicant tracking. Our Human Resource Services primarily include: • Paychex HR Solutions, under which we offer our administrative services organization ("ASO") and our professional employer organization ("PEO"); • retirement services administration; • insurance... -

Page 30

... any employees decreased 11% for fiscal 2010, compared to an increase of 17% for fiscal 2009. We focus on satisfying customers to maximize client retention, and for fiscal 2010 we again received high client satisfaction results. Ancillary services effectively leverage payroll processing data and... -

Page 31

.... Our ASO and PEO are now being offered under Paychex HR Solutions. We integrated the sales and service model to support and expand our comprehensive human resource outsourcing services nationwide. This allowed us to eliminate redundancies, and create more flexible options for potential clients. PEO... -

Page 32

... as of May 31, 2010 are traded in active markets. Our primary source of cash is our ongoing operations. Cash flow from operations was $610.9 million for fiscal 2010. Historically, we have funded our operations, capital purchases, and dividend payments from our operating activities. Our positive cash... -

Page 33

..., except per share amounts 2010 Change 2009 Change 2008 Revenue: Payroll service revenue ...$1,404.9 Human Resource Services revenue ...540.9 Total service revenue ...Interest on funds held for clients ...Total revenue ...Combined operating and SG&A expenses ...Operating income ...As a % of total... -

Page 34

... to Human Resource Services revenue growth for fiscal 2010 and fiscal 2009: $ in billions As of May 31, 2010 Change 2009 Change 2008 Paychex HR Solutions client employees served ...502,000 Paychex HR Solutions clients ...19,000 (1) 92,000 Insurance services clients ...Retirement services clients... -

Page 35

... time and attendance ("Stromberg"), an immaterial component of Paychex. Our Human Resource Services revenue growth, excluding Stromberg revenue and the retirement plan restatement billings, would have been as follows: % Change 2010 2009 2008 Human Resource Services revenue, as reported ...Human... -

Page 36

...summarizes total combined operating and selling, general and administrative ("SG&A") expenses for fiscal years: In millions 2010 Change 2009 Change 2008 Compensation-related expenses ...$ 829.3 Stock-based compensation costs ...25.6 Facilities expenses ...60.4 Depreciation of property and equipment... -

Page 37

... rate for fiscal 2009 was primarily the result of lower levels of tax-exempt income derived from municipal debt securities in the funds held for clients and corporate investment portfolios. Refer to Note H of the Notes to Consolidated Financial Statements, contained in Item 8 of this Form 10-K, for... -

Page 38

... operational functions, while Paychex and Advantage provide all centralized back-office payroll processing and payroll tax administration services. Under these arrangements, Advantage pays the Associates commissions based on processing activity for the related clients. When we acquired Advantage... -

Page 39

...to the timing of collections from clients and payments for compensation, PEO payroll, income tax, and other liabilities. Investing Cash Flow Activities In millions 2010 Year ended May 31, 2009 2008 Net change in funds held for clients and corporate investment activities ...Purchases of property and... -

Page 40

... timing of purchases, sales, or maturities of investments. The amount of funds held for clients will vary based upon the timing of collecting client funds, and the related remittance of funds to applicable tax or regulatory agencies for payroll tax administration services and to employees of clients... -

Page 41

... a fee per employee or transaction processed. The revenue earned from delivery service for the distribution of certain client payroll checks and reports is included in service revenue, and the costs for delivery are included in operating expenses on the Consolidated Statements of Income. PEO revenue... -

Page 42

... Statements of Income because the collecting, holding, and remitting of these funds are critical components of providing these services. Interest on funds held for clients also includes net realized gains and losses from the sales of available-for-sale securities. PEO workers' compensation insurance... -

Page 43

.... This model requires various assumptions as inputs including expected volatility of the Paychex stock price and expected option life. We estimate volatility based on a combination of historical volatility using weekly stock prices over a period equal to the expected option life and implied market... -

Page 44

... interest rate risk. During fiscal 2010, the average interest rate earned on our combined funds held for clients and corporate investment portfolios was 1.5%, compared with 2.1% for fiscal 2009 and 3.7% for fiscal 2008. With the turmoil in the financial markets, our conservative investment strategy... -

Page 45

... one-half to three years. The combined funds held for clients and corporate available-for-sale securities reflected a net unrealized gain of $66.6 million as of May 31, 2010, compared with a net unrealized gain of $66.7 million as of May 31, 2009. During fiscal 2010, the net unrealized gain on our... -

Page 46

..., 2010 and the majority of the securities in an unrealized loss position as of May 31, 2009 held an AA rating or better. We intend to hold these investments until the recovery of their amortized cost basis or maturity, and further believe that it is more likely than not that we will not be required... -

Page 47

... over Financial Reporting ...Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements ...Consolidated Statements of Income for the Years Ended May 31, 2010, 2009, and 2008 ...Consolidated Balance Sheets as of May 31, 2010 and 2009 ...Consolidated Statements of... -

Page 48

... over financial reporting. The reports of the independent accountants are contained in this Annual Report on Form 10-K. /s/ Jonathan J. Judge Jonathan J. Judge President and Chief Executive Officer /s/ John M. Morphy John M. Morphy Senior Vice President, Chief Financial Officer, and Secretary... -

Page 49

...in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, Paychex, Inc. maintained, in all material respects, effective internal control over financial reporting as of May 31, 2010, based on the COSO criteria. We also have audited, in accordance... -

Page 50

... of Paychex, Inc. at May 31, 2010 and 2009, and the consolidated results of its operations and its cash flows for each of the three years in the period ended May 31, 2010, in conformity with U.S. generally accepted accounting principles. Also, in our opinion, the related financial statement schedule... -

Page 51

... STATEMENTS OF INCOME In thousands, except per share amounts Year ended May 31, 2010 2009 2008 Revenue: Service revenue ...$1,945,789 Interest on funds held for clients ...55,031 Total revenue ...$2,000,820 Expenses: Operating expenses ...653,585 Selling, general and administrative expenses... -

Page 52

... compensation and related items ...Deferred revenue ...Deferred income taxes ...Litigation reserve ...Other current liabilities ...Current liabilities before client fund obligations ...Client fund obligations ...Total current liabilities ...Accrued income taxes...Deferred income taxes ...Other long... -

Page 53

... income ...Cash dividends declared ...Stock-based compensation ...Stock-based award transactions ...Net income ...Unrealized gains on securities, net of tax ...Total comprehensive income ...Cash dividends declared ...Stock-based compensation ...Stock-based award transactions ...(23,658) $3,822... -

Page 54

... 2010 2009 2008 Operating activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization on property and equipment and intangible assets ...Amortization of premiums and discounts on availablefor-sale securities ...Stock-based... -

Page 55

..., insurance services, eServices, and other human resource services and products. Paychex HR Solutions is available as an administrative services organization ("ASO") and a professional employer organization ("PEO"). Both options provide a combined package of services that include payroll, employer... -

Page 56

... of the sale of Paychex Time and Attendance Inc. ("Stromberg"), an immaterial component of the Company. No single client had a material impact on total accounts receivable, service revenue, or results of operations. Funds held for clients and corporate investments: Marketable securities included in... -

Page 57

...plus a fee per employee or transaction processed. The revenue earned from delivery service for the distribution of certain client payroll checks and reports is included in service revenue, and the costs for the delivery are included in operating expenses on the Consolidated Statements of Income. PEO... -

Page 58

... certain operational functions. Paychex and Advantage provide all centralized back-office payroll processing and payroll tax administration services for the Associates, including the billing and collection of processing fees and the collection and remittance of payroll and payroll tax funds pursuant... -

Page 59

... financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The Company records a deferred tax asset related to the stock-based compensation costs recognized for certain stock-based awards. At the time... -

Page 60

... in December 2009: • Guidance amending the accounting and reporting standards for transfers and servicing of financial assets, including the removal of the concept of a qualifying special purpose entity; and • Guidance to require a qualitative analysis rather than a quantitative-based risks and... -

Page 61

... expired in August 2002; however, options to purchase an aggregate of 1.5 million shares under the plan remain outstanding as of May 31, 2010. All stock-based awards to employees are recognized as compensation costs in the Consolidated Financial Statements based on their fair values measured as of... -

Page 62

...$34.31 $34.95 5.4 4.5 $4,175 $ 232 (1) Market price of the underlying stock as of May 28, 2010 less the exercise price. Other information pertaining to stock option grants is as follows: In thousands, except per share amounts 2010 Year ended May 31, 2009 2008 Weighted-average grant-date fair value... -

Page 63

... weekly stock prices over a period equal to the expected option life and implied market volatility. The expected option life is based on historical exercise behavior. The Company has determined that the Black-Scholes option pricing model, as well as the underlying assumptions used in its application... -

Page 64

... occur directly through the Company's transfer agent and no brokerage fees are charged to employees, except for when stock is sold. The plan has been deemed non-compensatory and therefore, no stock-based compensation costs have been recognized for fiscal 2010, fiscal 2009, or fiscal 2008 related to... -

Page 65

... Corporate Investments Funds held for clients and corporate investments are as follows: May 31, 2010 Gross Gross unrealized unrealized losses gains In thousands Amortized cost Fair value Type of issue: Money market securities and other cash equivalents ...Available-for-sale securities: General... -

Page 66

...the first time since September 2008. Included in money market securities and other cash equivalents as of May 31, 2010 and May 31, 2009 are U.S. agency discount notes, government money market funds, and bank demand deposit accounts. Classification of investments on the Consolidated Balance Sheets is... -

Page 67

... in the future due to new developments or changes in the Company's strategies or assumptions related to any particular investment. Realized gains and losses from the sale of available-for-sale securities were as follows: In thousands Year ended May 31, 2010 2009 2008 Gross realized gains ...Gross... -

Page 68

... short maturities of these instruments. Marketable securities included in funds held for clients and corporate investments consist primarily of securities classified as available-for-sale and are recorded at fair value on a recurring basis. The accounting standards related to fair value measurements... -

Page 69

... Pricing service. Other securities are comprised of mutual fund investments, which are valued based on quoted market prices. Other long-term liabilities include the liability for the Company's non-qualified and unfunded deferred compensation plans, and are valued based on the quoted market prices... -

Page 70

... Net of Accumulated Depreciation The components of property and equipment, at cost, consisted of the following: May 31, In thousands 2010 2009 Land and improvements ...Buildings and improvements ...Data processing equipment ...Software ...Furniture, fixtures, and equipment ...Leasehold improvements... -

Page 71

... 31, In thousands 2010 2009 Deferred tax assets: Litigation reserve ...Compensation and employee benefit liabilities ...Other current liabilities ...Tax credit carry forward ...Depreciation ...Stock-based compensation ...Other ...Deferred tax liabilities: Capitalized software ...Intangible assets... -

Page 72

..., INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The components of the provision for income taxes are as follows: In thousands 2010 Year ended May 31, 2009 2008 Current: Federal...State ...Total current ...Deferred: Federal...State ...Total deferred ...Provision for income taxes... -

Page 73

... operations. Note I - Other Comprehensive Income Other comprehensive income results from items deferred on the Consolidated Balance Sheets in stockholders' equity. The following table sets forth the components of other comprehensive income: In thousands 2010 Year ended May 31, 2009 2008 Unrealized... -

Page 74

... the Paychex, Inc. Employee Stock Ownership Plan (ESOP) Stock Fund, are not restricted in any manner. The Company match contribution, when in effect, follows the same fund elections as the employee compensation deferrals. Company contributions to the Plan for fiscal 2009 and fiscal 2008 were... -

Page 75

... leases office space and data processing equipment under terms of various operating leases. Rent expense for fiscal years 2010, 2009, and 2008 was $46.9 million, $46.6 million, and $44.5 million, respectively. As of May 31, 2010, future minimum lease payments under various non-cancelable operating... -

Page 76

... insurance company. Note M - Related Parties During fiscal years 2010, 2009, and 2008, the Company purchased approximately $3.2 million, $4.5 million, and $4.4 million, respectively, of data processing equipment and software from EMC Corporation. The Chairman, President, and Chief Executive Officer... -

Page 77

... FINANCIAL STATEMENTS - (Continued) Note N - Quarterly Financial Data (Unaudited) In thousands, except per share amounts Fiscal 2010 August 31 Three Months Ended November 30 February 28(1) May 31 Full Year Service revenue ...Interest on funds held for clients ...Total revenue ...Operating income... -

Page 78

... information required to be disclosed in the Company's reports filed under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), such as this report, is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls... -

Page 79

... the Advantage Payroll Services Inc. acquisition, and was appointed Senior Vice President, Operations in October 2002. Mr. Humenik was appointed Senior Vice President of Sales and Marketing of the Company in September 2009. Prior to joining the Company, he served as Senior Vice President and General... -

Page 80

... Mr. Judge and the Company relating to the Company's operations, policies, or practices involved in Mr. Judge's decision not to stand for re-election as a director. The additional information required by this item is set forth in the Company's Definitive Proxy Statement for its 2010 Annual Meeting... -

Page 81

... by reference from Exhibit 10.1 to the Company's Form 8-K filed with the Commission on July 16, 2008. Paychex, Inc. 2002 Stock Incentive Plan (as amended and restated effective October 12, 2005) Form of Non-Qualified Stock Option Award Agreement, incorporated herein by reference from Exhibit 10.2 to... -

Page 82

... on July 20, 2009. Paychex, Inc. Employee Deferred Compensation Plan, incorporated herein by reference from Exhibit 10.30 to the Company's Form 10-K filed with the Commission on July 20, 2009. Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm. Power of Attorney... -

Page 83

.... 101.DEF XBRL taxonomy extension definition linkbase document. Exhibit filed with this report. (32.2) ** As provided in Rule 406T of Regulation S-T, this information is furnished and not filed for purposes of Sections 11 and 12 of the Securities Act of 1933 and Section 18 of the Exchange Act... -

Page 84

... the undersigned, thereunto duly authorized, on July 16, 2010. PAYCHEX, INC. By: /s/ Jonathan J. Judge Jonathan J. Judge President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of... -

Page 85

-

Page 86

PAYCHEX, INC. ELEVEN-YEAR SUMMARY OF SELECTED FINANCIAL DATA In thousands, except per share amounts Year ended May 31, 2010 2009 2008 2007 2006 Results of operations Revenue: Service revenue ...Interest on funds held for clients ...Total revenue ...Total expenses ...Operating income ...As a % of ... -

Page 87

2005 2004 2003 2002 2001 2000 $1,384,674 60,469 1,445,143 911,368 $ 533,775 37% $ 12,391 38% $ 368,849 26% $ $ 0.97 0.97 378,337 379,763 $ $ 0.51 70,686 $1,240,093 54,254 1,294,347 861,032 $ 433,315 33% $ 16,469 35% $ 302,950 23% $ $ 0.80 0.80 377,371 379,524 $ $ 0.47 50,562 $1,046,029 53,... -

Page 88

... C. Stowe Vice President, Human Resource Services Operations • Suzanne E. Vickery Vice President, Central U.S. Sales • Jennifer R. Vossler Vice President and Controller (1) Mr. Judge resigned from the position of President and Chief Executive Officer of Paychex, Inc. effective July 31, 2010. -

Page 89

... financial community and the media should direct inquiries to John Morphy, Senior Vice President, Chief Financial Officer, and Secretary. For more information about Paychex Investor Relations, please contact: Paychex Investor Relations 911 Panorama Trail South Rochester, NY 14625-2396 or call 1-800... -

Page 90

... Missouri St. Louis Nebraska Omaha Nevada Las Vegas Reno New Hampshire Manchester New Jersey Cherry Hill Parsippany Piscataway Woodcliff Lake New Mexico Albuquerque New York Albany Binghamton Brooklyn Buffalo Lake Success Long Island Manhattan Mid Hudson Valley Rochester Syracuse North Carolina... -

Page 91

-

Page 92

-

Page 93

-

Page 94

-

Page 95

-

Page 96

Corporate Headquarters 911 Panorama Trail South Rochester, NY 14625