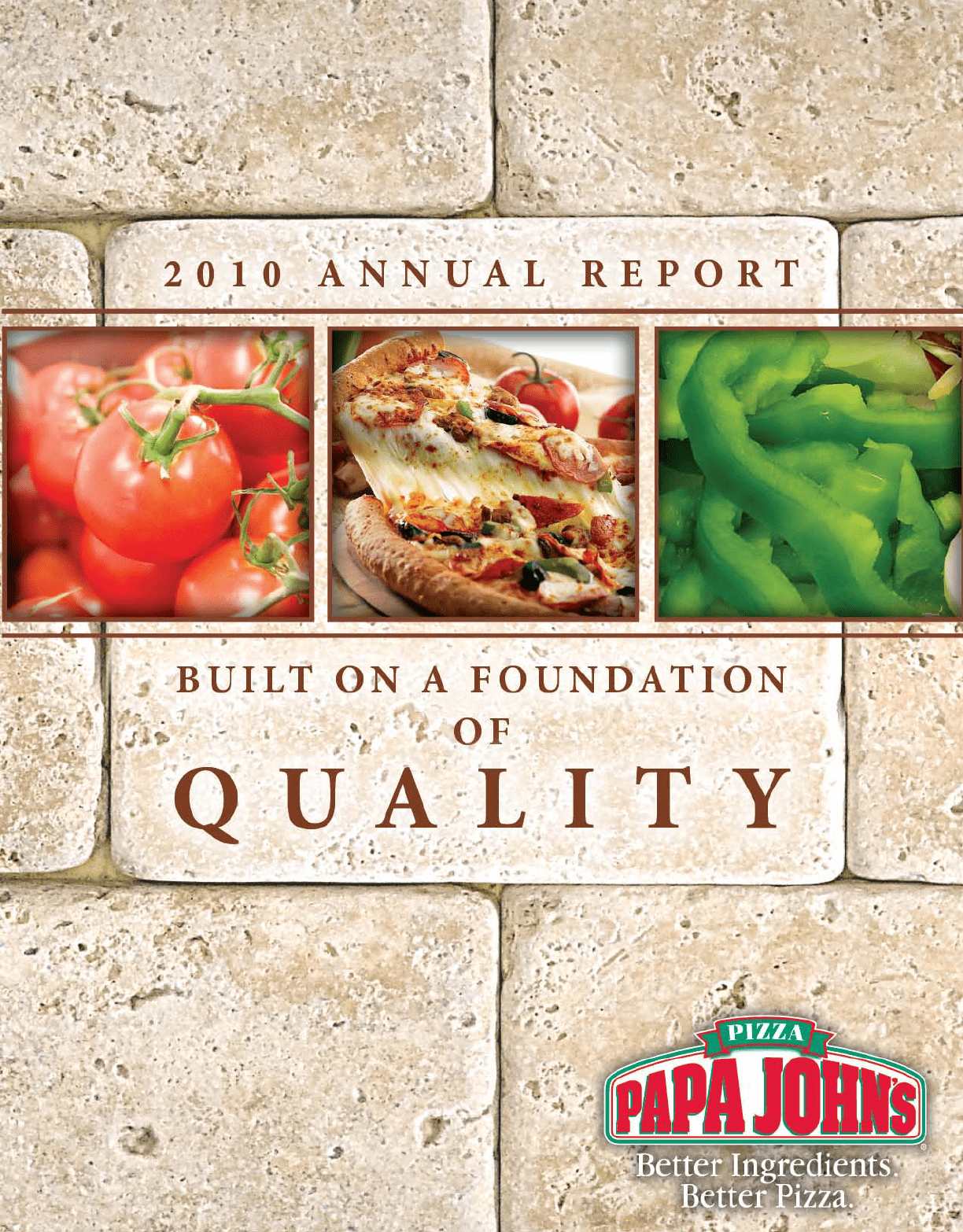

Papa Johns 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Papa Johns annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

Table of contents

-

Page 1

-

Page 2

-

Page 3

-

Page 4

-

Page 5

...Delaware

(State or other jurisdiction of incorporation or organization)

61-1203323

(I.R.S. Employer Identification No.)

2002 Papa Johns Boulevard Louisville, Kentucky

(Address of principal executive offices)

40299-2367

(Zip Code)

(502) 261-7272

(Registrant's telephone number, including area code...

-

Page 6

... closing sale price on The NASDAQ Stock Market as of the last business day of the Registrant's most recently completed second fiscal quarter, June 27, 2010, was approximately $500,242,651. As of February 15, 2011, there were 25,664,898 shares of the Registrant's Common Stock outstanding. DOCUMENTS...

-

Page 7

... of Operations Quantitative and Qualitative Disclosures About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information

24 27 28 56 58 92 93 93

Directors, Executive Officers...

-

Page 8

...Item 1. Business General Papa John's International, Inc. (referred to as the "Company", "Papa John's" or in the first person notations of "we", "us" and "our") operates and franchises pizza delivery and carryout restaurants and, in certain international markets, dine-in and restaurant-based delivery...

-

Page 9

... few years in response to increasing consumer use of online and mobile web technology. Our local restaurant-level marketing programs target consumers within the delivery area of each restaurant through the use of local TV, print materials, targeted direct mail, store-to-door flyers, email marketing...

-

Page 10

... average cash investment for the eight domestic Company-owned restaurants expected to open in 2011 to approximate $240,000 per unit. Substantially all domestic restaurants do not offer dine-in areas, which reduces our restaurant capital investment. Development A total of 325 Papa John's restaurants...

-

Page 11

..." domestic Papa John's restaurant as a delivery and carryout unit that services a defined trade area. We consider the location of a traditional restaurant to be important and therefore devote significant resources to the investigation and evaluation of potential sites. The site selection process...

-

Page 12

... systems to Papa John's franchisees. Our franchisees can purchase complete new store equipment packages through an approved third-party supplier. In addition, we sell replacement smallwares and related items to our franchisees. QC Center System; Strategic Supply Chain Management Our domestic...

-

Page 13

... to the Marketing Fund is currently set at 4.0% for 2011. Restaurant-level marketing programs target the delivery area of each restaurant, making extensive use of targeted print materials including direct mail and store-to-door coupons. The local marketing efforts also include a variety of community...

-

Page 14

... restaurants in specific geographic regions. Effective in late 2010, the operations vice presidents began reporting directly to the Senior Vice President, Operations and Global Operations Support and Training. These team members are eligible to earn performance-based financial incentives. Training...

-

Page 15

... in the development agreements will be achieved. During 2010, 312 (169 domestic and 143 international) franchised Papa John's restaurants were opened. Approval. Franchisees are approved on the basis of the applicant's business background, restaurant operating experience and financial resources. We...

-

Page 16

... credited against the standard $25,000 franchise fee payable to us upon signing the franchise agreement for a specific location. Generally, a franchise agreement is executed when a franchisee secures a location. Our current standard development agreement requires the franchisee to pay a royalty fee...

-

Page 17

...either a development agreement or a master franchise agreement with a franchisee for the opening of a specified number of restaurants within a defined period of time and specified geographic area (see "Strategy - International Operations" for 2011 reporting changes to the International business unit...

-

Page 18

... food service operator that operates a Papa John's as part of a food court at a college or university. Each franchised restaurant manager is also required to complete our Company-certified management training program. Domestically, we provide an on-site training team three days before and three days...

-

Page 19

...required payments, including the payment of royalties, Marketing Fund contributions, risk management services, online ordering fees and purchases from our print and promotions operations and QC Centers. This system significantly reduces the resources needed to process receivables, improves cash flow...

-

Page 20

...other proposed increases in minimum wage rates and nutritional guidelines or disclosure requirements, could adversely affect Papa John's as well as the restaurant industry. As we expand internationally, we will be subject to applicable laws in each jurisdiction where franchised units are established...

-

Page 21

... longer period than Papa John's and may be better established in the markets where restaurants operated by us or our franchisees are, or may be, located. Experience has shown that a change in pricing or other marketing or promotional strategies, including new product and concept developments, by...

-

Page 22

... such matters as wages, benefits, working conditions, citizenship requirements and overtime. A significant number of hourly personnel employed by our franchisees and us are paid at rates closely related to the federal and state minimum wage requirements. Accordingly, further increases in the federal...

-

Page 23

to provide health care coverage that was not previously offered to certain part-time team members. Additional compliance with government mandates, including nutritional content and menu labeling legislation, could increase costs and be harmful to system-wide restaurant sales. Current credit markets ...

-

Page 24

... increased risks and other factors that may make it more difficult to achieve or maintain profitability or meet planned growth rates. Our international operations could be negatively impacted by changes in international economic, political and health conditions in the countries in which the Company...

-

Page 25

...Unresolved Staff Comments None. Item 2. Properties As of December 26, 2010, there were 3,646 Papa John's restaurants system-wide. Company-owned Papa John's Restaurants Number of Restaurants Arizona...Florida...Georgia...Illinois ...Indiana ...Kansas...Kentucky...Maryland...Missouri ...North Carolina...

-

Page 26

Domestic Franchised Papa John's Restaurants Number of Restaurants 72 30 20 203 46 3 11 10 205 54 10 78 80 24 20 65 54 7... ...District of Columbia...Florida ...Georgia...Idaho...Illinois ...Indiana...Iowa...Kansas ...Kentucky ...Louisiana ...Maine ...Maryland ...Massachusetts...Michigan ...Minnesota...

-

Page 27

..." operations as units located outside the contiguous United States. Beginning in fiscal 2011, we realigned management responsibility for Hawaii, Alaska and Canada from international to domestic operations in order to better leverage existing infrastructure and systems. In our reported financial...

-

Page 28

... accommodates the Louisville QC Center operation and promotions division. The remainder of the larger building houses our corporate offices. We own a 49,000 square foot full-service QC Center in the United Kingdom. The Papa John's UK management team is located in a leased office near London with...

-

Page 29

... Human Resources Senior Vice President, Chief Financial Officer and Treasurer Senior Vice President, Development Senior Vice President, Corporate Communications and General Counsel Senior Vice President, International Executive Vice President, North American Operations and President, PJ Food Service...

-

Page 30

...has held the positions of Senior Vice President, PJ Food Service from 2009 to May 2010 and Vice President, QCC Operations from 2006 to 2009. Prior to joining Papa John's, Mr. Thompson worked for the Scotts Company for six years as Plant Manager, Director of Marysville Operations and Director of Lawn...

-

Page 31

... served as Chief Financial Officer of Evergreen Real Estate, a company owned by John Schnatter. Mr. Tucker is a licensed Certified Public Accountant. Andrew M. Varga was appointed Senior Vice President and Chief Marketing Officer in August 2009. Mr. Varga joined Papa John's after 21 years with Brown...

-

Page 32

... - 12/26/2010

Total Number of Shares Purchased 55 160 93 257 410 238 242 283 43 100 -

Average Price Paid per Share * $22.51 $25.14 $25.64 $25.50 $24.93 $24.22 $24.78 $24.83 $25.99 $25.78 *

*There were no share repurchases during this period.

The Company utilizes a written trading plan under Rule...

-

Page 33

... return of the Company's common stock to the NASDAQ Stock Market (U.S.) Index and a group of the Company's peers consisting of U.S. companies listed on NASDAQ with standard industry classification (SIC) codes 5800-5899 (eating and drinking places). Relative performance is compared for the five-year...

-

Page 34

... in Item 7 and Item 8, respectively, of this Form 10-K.

(In thousands, except per share data) Dec. 26, 2010 Income Statement Data Domestic revenues (2): Company-owned restaurant sales Franchise royalties (3) Franchise and development fees Commissary sales (2) Other sales International revenues...

-

Page 35

... the general public by Company-owned restaurants, franchise royalties, sales of franchise and development rights, sales to franchisees of food and paper products, printing and promotional items, risk management services, and information systems and related services used in their operations. New unit...

-

Page 36

... 2010, compared to 40% of our revenues for 2009 and 41% of our revenues for 2008, were derived from the sale to our domestic and international franchisees of food and paper products, printing and promotional items, risk management services and information systems equipment and software and related...

-

Page 37

...cost of claims significantly differ from historical trends used to estimate the insurance reserves recorded by the Company.

1

Deferred Income Tax Accounts and Tax Reserves Papa John's is subject to income taxes in the United States and several foreign jurisdictions. Significant judgment is required...

-

Page 38

... impact on our consolidated statements of income. Fair Value Measurements and Disclosures The Fair Value Measurements and Disclosures topic of the Accounting Standards Codification ("ASC") requires companies to determine fair value based on the price that would be received to sell the asset or paid...

-

Page 39

... prior period financial statements. The retrospective application resulted in the exclusion of $3.4 million of assets in our accompanying consolidated balance sheet at December 27, 2009 (there was no impact on our consolidated statements of stockholders' equity from this new accounting pronouncement...

-

Page 40

... the years indicated:

Year Ended (1) Dec. 26, Dec. 27, Dec. 28, 2010 2009 2008 Income Statement Data: Domestic revenues: Company-owned restaurant sales Franchise royalties Franchise and development fees Commissary sales Other sales International revenues: Royalties and franchise and development fees...

-

Page 41

... sales. Includes only Company-owned restaurants open throughout the periods being compared. Beginning in 2011, we realigned our Hawaii, Alaska and Canadian operations from International to Domestic franchising (North America Franchising). This realignment will result in an increase of units...

-

Page 42

... of cheese purchased by Company-owned restaurants during the period. This portion of BIBP operating income (loss) is reflected as a reduction (increase) in the "Domestic Company-owned restaurant expenses - cost of sales" line item. This approach effectively reports cost of sales for Company-owned...

-

Page 43

... of Operating Results

Franchise Support Initiatives The Company provided domestic franchise system support initiatives in response to the difficult economic environment in both 2009 and 2010. The initiatives included:

•

Providing cheese cost relief by modifying the cheese pricing formula used by...

-

Page 44

... in 2009 as summarized in the following table on an operating segment basis (in thousands):

Increase (Decrease)

2010 Domestic Company-owned restaurants Domestic commissaries* Domestic franchising International All others Unallocated corporate expenses Elimination of intersegment profits Income...

-

Page 45

.... Domestic Company-owned restaurants' operating income decreased $3.3 million from the prior comparable period. The decrease was primarily due to a decline in operating margin from lower average ticket prices due to increased levels of discounting, partially offset by increased customer traffic and...

-

Page 46

... by increased revenues due to growth in the number of international units. All Others Segment. Operating income for the "All others" reporting segment decreased approximately $850,000 in 2010 as compared to 2009. The decrease was primarily due to increased costs in our online ordering business due...

-

Page 47

... compensation cost related to non-vested awards to be recognized in 2011, 2012 and 2013. (2) The management incentive bonus plan is based on the Company's annual operating performance, domestic unit openings and certain sales measures as compared to preestablished targets. (b) Franchise support...

-

Page 48

... Average weekly sales for non-traditional units not subject to continuous operation are calculated based upon actual days open. The comparable sales base and average weekly sales for 2010 and 2009 for domestic Company-owned and domestic franchised restaurants consisted of the following:

Year Ended...

-

Page 49

...sales in 2010 compared to 2009, primarily due to labor efficiencies from implemented initiatives, and a change in pay practices for certain team members. Advertising and related costs as a percentage of sales were 0.3% higher in 2010 due to an increase in local marketing initiatives. Occupancy costs...

-

Page 50

... or loss related to the proportion of BIBP cheese sales to franchisees. The total impact of the consolidation of BIBP on Papa John's pre-tax income was pre-tax income of $21.0 million in 2010 (including a reduction in BIBP's cost of sales of $14.2 million associated with PJFS's agreement to pay to...

-

Page 51

... million primarily due to a decline in sales at Preferred, reflecting the deterioration of the U.S. economy. International revenues increased $2.8 million, reflecting increases in both the number and average unit volumes of our Company-owned and franchised restaurants over the comparable period.

44

-

Page 52

... table on an operating segment basis (in thousands):

Increase (Decrease)

2009 Domestic Company-owned restaurants Domestic commissaries Domestic franchising International All others Unallocated corporate expenses Elimination of intersegment profits Income before income taxes, excluding variable...

-

Page 53

...of the increased royalty rate for 2009 was also offset partially by additional development incentive programs offered by the Company in 2009. During 2009, incentive payments of $440,000 were made to certain franchisees under our 25th Anniversary development incentive program for opening new units in...

-

Page 54

... fee percentage as we began to operate the online business at a break-even level beginning in 2009. The decline in profitability in our print and promotions business was due to lower sales in 2009, as compared to 2008, reflecting the challenging U.S. economic environment.

•

Unallocated Corporate...

-

Page 55

... vesting period. At December 27, 2009, there was $5.7 million of unrecognized compensation cost related to non-vested options and restricted stock that will be recognized during 2010, 2011 and 2012. (ii) The annual management incentive bonus plan is based on the Company's annual operating income...

-

Page 56

... in the royalty rate from 4.25% to 4.50% for the last four months of 2009 and an increase in equivalent units. The comparable sales base and average weekly sales for 2009 and 2008 for domestic Company-owned and domestic franchised restaurants consisted of the following:

Year Ended December 27...

-

Page 57

...2008 to an average of $1.55 per pound in 2009, a 14.4% decrease. The cost of wheat, as measured on domestic commodity markets, decreased approximately 37% in 2009 as compared to 2008. Other sales, which include our online and print and promotions businesses as well as our insurance agency operations...

-

Page 58

...

2009 Restaurant impairment and disposition losses (a) Disposition and valuation-related costs Provisions for uncollectible accounts and notes receivable (b) Pre-opening restaurant costs Franchise support initiatives (c) 25th Anniversary incentives Commissary closing costs Other Total other general...

-

Page 59

...year 2010 as compared to $100.1 million in 2009. The consolidation of BIBP increased cash flow from operations by approximately $6.8 million in 2010 and $22.5 million in 2009 (as reflected in the net income and deferred income taxes captions in the accompanying "Consolidated Statements of Cash Flows...

-

Page 60

... Company's free cash flow for the last three years was as follows (in thousands):

Year Ended Dec. 27, 2009 $ 100,070 (22,543) (33,538) $ 43,989 $

Dec. 26, 2010 Net cash provided by operating activities Loss (gain) from BIBP cheese purchasing entity Purchase of property and equipment Free cash flow...

-

Page 61

...-balance sheet arrangements that are reasonably likely to have a current or future effect on the Company's financial condition are leases of Company-owned restaurant sites, QC Centers, office space and transportation equipment. In connection with the 2006 sale of our former Perfect Pizza operations...

-

Page 62

...an increase in or continuation of the aggressive pricing and promotional environment; new product and concept developments by food industry competitors; the ability of the Company and its franchisees to meet planned growth targets and operate new and existing restaurants profitably; general economic...

-

Page 63

... direction of our Franchise Advisory Council for the sole purpose of reducing cheese price volatility to domestic system-wide restaurants. Papa John's consolidates the operating results of BIBP. Consolidation accounting requires the portion of BIBP operating income (loss) related to domestic Company...

-

Page 64

... impact on our consolidated statements of income. The following table presents the actual average block price for cheese and the BIBP block price by quarter in 2010, 2009 and 2008 and the projected 2011 average block price for cheese by quarter (based on the actual average price for the month of...

-

Page 65

... external purposes in accordance with generally accepted accounting principles as of December 26, 2010. Ernst & Young LLP, an independent registered public accounting firm, has audited and reported on the consolidated financial statements of Papa John's International, Inc. and on the effectiveness...

-

Page 66

...balance sheets of Papa John's International, Inc. as of December 26, 2010 and December 27, 2009, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended December 26, 2010. Our audits also included the financial statement...

-

Page 67

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Papa John's International, Inc. as of December 26, 2010 and December 27, 2009, and the related consolidated statements of income, stockholders' equity, and cash flows for each...

-

Page 68

Papa John's International, Inc. and Subsidiaries Consolidated Statements of Income (In thousands, except per share amounts) December 26, 2010 Domestic revenues: Company-owned restaurant sales Franchise royalties Franchise and development fees Commissary sales Other sales International revenues: ...

-

Page 69

Papa John's International, Inc. and Subsidiaries Consolidated Balance Sheets December 26, 2010 December 27, 2009

(In thousands, except per share amounts) Assets Current assets: Cash and cash equivalents Accounts receivable (less allowance for doubtful accounts of $2,795 in 2010 and $2,791 in 2009) ...

-

Page 70

... Statements of Stockholders' Equity

Common Stock Shares Outstanding Papa John's International, Inc. Accumulated Additional Other Common Paid-In Comprehensive Stock Capital Income (Loss)

(In thousands) Balance at December 30, 2007 Comprehensive income: Net income Change in valuation of interest rate...

-

Page 71

... to reconcile net income to net cash provided by operating activities: Restaurant impairment and disposition losses Provision for uncollectible accounts and notes receivable Depreciation and amortization Deferred income taxes Stock-based compensation expense Excess tax benefit related to exercise of...

-

Page 72

... to the general public by Company-owned restaurants, franchise royalties, sales of franchise and development rights, and sales to franchisees of food and paper products, printing and promotional items, risk management services, and information systems and related services used in their operations...

-

Page 73

... of food, promotional items, and supplies sales to franchised restaurants located in the United States and are recognized as revenue upon shipment of the related products to the franchisees. Information services, including software maintenance fees, help desk fees and online ordering fees are...

-

Page 74

...the cash sales price that would be received at the time of the sale and the second component is an investment in the continuing franchise agreement, representing the discounted value of future royalties less any incremental direct operating costs, that would be collected under the ten-year franchise...

-

Page 75

...in 2010, $800,000 in 2009 and $750,000 in 2008. The unamortized systems development costs approximated $3.6 million and $2.8 million as of December 26, 2010 and December 27, 2009, respectively.

Deferred Income Tax Accounts and Tax Reserves

Papa John's is subject to income taxes in the United States...

-

Page 76

... Policies (continued)

Advertising and Related Costs

Advertising and related costs include the costs of domestic Company-owned restaurant activities such as mail coupons, door hangers and promotional items and contributions to Papa John's Marketing Fund, Inc. (the "Marketing Fund") and local market...

-

Page 77

...for the net change in fair value of our derivatives associated with our debt agreements. The ineffective portion of our hedge was $25,000 in 2010 and $40,000 in 2009 (none in 2008). Fair value is based on quoted market prices. See Note 7 for additional information on our debt and credit arrangements...

-

Page 78

... than the average market price for the year were not included in the computation of the dilutive effect of common stock options because the effect would have been antidilutive. The weighted average number of shares subject to antidilutive options was 1.5 million in 2010, 1.4 million in 2009 and...

-

Page 79

...Limited, LLC 75 52

Restaurant Locations Texas Maryland and Virginia

Papa John's Ownership * 51% 70%

*The number of restaurants was the same for the 2010 and 2009 years presented in the accompanying consolidated financial statements. There were 77 Star Papa, LP restaurants and 51 Colonel's Limited...

-

Page 80

... and related hedged items are accounted, and how derivative instruments and related hedged items affect an entity's financial position, results of operations and cash flows. See Note 7 for additional information.

Modification of our Non-qualified Deferred Compensation Plan

During 2010, we...

-

Page 81

... sells it to our distribution subsidiary, PJ Food Service, Inc. ("PJFS"), at a fixed price. PJFS in turn sells cheese to Papa John's restaurants (both Company-owned and franchised) at a set price. PJFS purchased $153.0 million, $142.4 million and $165.4 million of cheese from BIBP during 2010, 2009...

-

Page 82

... Assets Our consolidated balance sheets include $74.7 million and $75.1 million of goodwill at December 26, 2010 and December 27, 2009, respectively. The changes in the carrying amount of goodwill by reportable segment for the years ended December 26, 2010 and December 27, 2009 are as follows...

-

Page 83

.... The forecasted cash flows were based on our assessment of the individual restaurant's future profitability, which is based on the restaurant's historical financial performance, the maturing of the restaurant's market, as well as our future operating plans for the restaurant and its market. In...

-

Page 84

... rates, at our option. The commitment fee on the unused balance ranged from 12.5 to 20.0 basis points. The remaining availability under our line of credit, reduced for certain outstanding letters of credit, approximated $59.1 million and $58.0 million as of December 26, 2010 and December 27, 2009...

-

Page 85

... and Credit Arrangements (continued) The following tables provide information on the location and amounts of our swaps in the accompanying consolidated financial statements (in thousands):

Fair Values of Derivative Instruments Liability Derivatives Fair Value Balance Sheet Location 2010 Derivatives...

-

Page 86

.... 10. Insurance Reserves Our insurance programs for workers' compensation, general liability, owned and non-owned automobiles and health insurance coverage provided to our employees are self-insured up to certain individual and aggregate reinsurance levels. Losses are accrued based upon undiscounted...

-

Page 87

...

Deferred compensation plan Captive insurance claims loss reserves Interest rate swaps Other Total

$

$

2010 10,478 1,027 313 282 12,100

$

$

2009 10,724 1,754 4,044 364 16,886

13. Income Taxes A summary of the provision (benefit) for income taxes follows (in thousands):

2010 Current: Federal...

-

Page 88

... (25,088) 9,306 2009 $ 2,034 12,861 6,022 7,064 4,816 1,496 7,158 (7,158) 34,293 (2,461) (5,349) (6,254) (5,017) (19,081) 15,212

Unearned development fees Accrued liabilities Other assets and liabilities BIBP net operating loss Stock options Other Foreign net operating losses Valuation allowance on...

-

Page 89

... compensation plan (income) loss Tax credits and other Total

$

$

$

Income taxes paid were $21.7 million in 2010, $24.8 million in 2009 and $23.9 million in 2008. The Company files income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. The Company...

-

Page 90

..., during 2010 and 2009, the Company sold certain print and promotional materials to a company of which one member of our Board of Directors is the President and Chief Executive Officer (not significant in 2010 or 2009 and none in 2008). The above transactions were at market rates. We contributed...

-

Page 91

... sites to our Papa John's franchisees located in the United Kingdom in 2010, 2009 and 2008 and received payments of $3.1 million, $2.9 million and $3.0 million, respectively, which are netted with international operating expenses. In addition, as a condition of the sale of our former Perfect Pizza...

-

Page 92

... after 2005 generally expire five years from the date of grant and vest over a 24- or 36-month period. We recorded stock-based employee compensation expense of $6.1 million in 2010, $5.8 million in 2009 and $2.6 million in 2008. The total income tax benefit recognized in the income statement for...

-

Page 93

... a three-year cliff vesting schedule. The performance-based shares vest based upon the Company's achievement of compounded annual growth rate (CAGR) of consolidated corporate operating income, as defined. The fair value of the restricted stock is based on the market price of the Company's shares on...

-

Page 94

...Code. The 401(k) Plan is open to employees who meet certain eligibility requirements and allows participating employees to defer receipt of a portion of their compensation and contribute such amount to one or more investment funds. At our discretion, we contributed a matching payment of 2.1% in 2009...

-

Page 95

... printing and promotional items, risk management services, and information systems and related services used in restaurant operations and certain partnership development activities. Generally, we evaluate performance and allocate resources based on profit or loss from operations before income taxes...

-

Page 96

...reportable segments are business units that provide different products or services. Separate management of each segment is required because each business unit is subject to different operational issues and strategies. No single external customer accounted for 10% or more of our consolidated revenues...

-

Page 97

...' operating income decreased approximately $15.2 million in 2010 and $800,000 in 2009 compared to the prior comparable periods. The decrease in 2010 was primarily due to an increase in cost of sales of $14.2 million associated with PJFS's agreement to pay to BIBP for past cheese purchases...

-

Page 98

... due to an increase in infrastructure and support costs associated with our online ordering business unit. This decline was partially offset by an improvement in operating results at our wholly-owned print and promotions subsidiary, Preferred Marketing Solutions, Inc. The 2009 operating results were...

-

Page 99

... year Form 10-K, because we are no longer required to consolidate the financial results of certain franchise entities to which we have extended loans (see Note 2 for additional information). Total revenues and operating income for the first three quarters of 2009 were adjusted in the applicable 2010...

-

Page 100

... 26, 2010 that have materially affected, or are likely to materially affect, the Company's internal control over financial reporting. See "Management's Report on Internal Control over Financial Reporting" in Item 8. Item 9B. Other Information None. PART III Item 10. Directors, Executive Officers and...

-

Page 101

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters The following table provides information as of December 26, 2010 regarding the number of shares of the Company's common stock that may be issued under the Company's equity compensation plans.

(c) ...

-

Page 102

... related thereto and report of independent auditors are included in Item 8 of this Report:

Reports of Independent Registered Public Accounting Firm Consolidated Statements of Income for the years ended December 26, 2010, December 27, 2009 and December 28, 2008 Consolidated Balance Sheets as...

-

Page 103

(a)(2) Financial Statement Schedules: Schedule II - Valuation and Qualifying Accounts

Charged to (recovered from) Costs and Additions / Expenses (Deductions)

Classification (in thousands) Fiscal year ended December 26, 2010: Deducted from asset accounts: Reserve for uncollectible accounts ...

-

Page 104

... duly authorized. Date: February 22, 2011 By: PAPA JOHN'S INTERNATIONAL, INC. /s/ John H. Schnatter John H. Schnatter Founder, Chairman and Co-Chief Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 105

... Form of Performance Unit Award Agreement - 1999 Team Member Stock Ownership Plan. Exhibit 10.4 to our report on Form 10-K for the fiscal year ended December 31, 2006 is incorporated herein by reference. Papa John's International, Inc. Omnibus Plan. Exhibit 10.1 to our Registration Statement on Form...

-

Page 106

... and PJ Food Service, Inc. dated July 6, 2009. Exhibit 10.1 to our report on Form 8-K/A dated July 10, 2009 is incorporated herein by reference. 10.13* Agreement and Release between William Mitchell and Papa John's International, Inc. Exhibit 10.1 to our report on Form 8-K/A dated May 7, 2010 is...

-

Page 107

... Statements of Income, (ii) the Consolidated Balance Sheets, (iii) the Consolidated Statements of Stockholders' Equity, (iv) the Consolidated Statements of Cash Flows and (v) the Notes to Consolidated Financial Statements tagged as blocks of text.

101

_____

*Compensatory plan required to be filed...

-

Page 108

The Exhibits to this Annual Report on Form 10-K are not contained herein. The Company will furnish a copy of any of the Exhibits to a stockholder upon written request to Investor Relations, Papa John's International, Inc., P.O. Box 99900, Louisville, KY 40269-0900.

101

-

Page 109

-

Page 110