Office Depot 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(Mark One)

x

Or

¨

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $0.01 per share NASDAQ Stock Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of

Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer” “accelerated filer,”

and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 28, 2014 (based on the closing market price on the Composite Tape on June 27, 2014) was approximately

$3,009,760,984 (determined by subtracting from the number of shares outstanding on that date the number of shares held by affiliates of Office Depot, Inc.).

The number of shares outstanding of the registrant’s common stock, as of the latest practicable date: At January 24, 2015, there were 545,374,602 outstanding shares of Office Depot, Inc. Common Stock, $0.01

par value.

Documents Incorporated by Reference:

Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the Office Depot, Inc. definitive Proxy Statement for its 2015 Annual Meeting of Shareholders, which

shall be filed with the Securities and Exchange Commission pursuant to Regulation 14A of the Securities Act of 1934, as amended, within 120 days of Office Depot, Inc.’s fiscal year end.

Table of contents

-

Page 1

.... Common Stock, $0.01 par value. Documents Incorporated by Reference: Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the Office Depot, Inc. definitive Proxy Statement for its 2015 Annual Meeting of Shareholders, which shall be filed with... -

Page 2

... Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 3

... of Staples (the "Staples Acquisition"). Under the terms of the Staples Merger Agreement, Office Depot shareholders will receive, for each Office Depot share held by such shareholders, $7.25 in cash and 0.2188 of a share in Staples common stock at closing. Each employee share-based award outstanding... -

Page 4

... contract sales force, Internet sites, an outbound telephone account management sales force, direct marketing catalogs and call centers, all supported by a network of supply chain facilities and delivery operations. Office Depot currently operates under the Office Depot® and OfficeMax ® brands and... -

Page 5

... Division The North American Business Solutions Division sells nationally branded and our own brands' office supplies, technology products, cleaning and breakroom supplies, office furniture, certain services, and other solutions to customers in Canada and the United States, including Puerto Rico... -

Page 6

...-sized customers. During 2014, the Company launched its co-branded and expanded website to serve legacy customers of both Office Depot and OfficeMax. Similar to the approach used in reaching the customers identified in the North America Retail Division, the co-branded site operates under the banner... -

Page 7

... business and certain retail locations. Refer to the "Merchandising" section below for additional product information. As of December 27, 2014, the International Division sold to customers in 54 countries throughout Europe, Asia/Pacific, and Latin America. Outside of North America, the Company... -

Page 8

... advertising campaigns, and direct marketing efforts, such as the Internet and social networking. Our North American marketing programs are now prepared on a combined banner basis. In early 2015, we combined the previously existing separate Office Depot and OfficeMax loyalty programs. Our customer... -

Page 9

... retail locations, online sales activities are reported in the North American Business Solutions or International Divisions, as appropriate. Intellectual Property We currently operate under the Office Depot ® and OfficeMax ® brand names. We hold trademark registrations domestically and worldwide... -

Page 10

... and technology recycling services in our retail stores. Office Depot continues to implement environmental programs in line with our stated environmental vision to "increasingly buy green, be green and sell green" - including environmental sensitivity in our packaging, operations and sales offerings... -

Page 11

... Age: 46 Ms. Moehler was appointed as our Senior Vice President and Controller in March 2012, and Senior Vice President, Finance and Chief Accounting Officer in December 2013. Ms. Moehler previously served as Senior Vice President, Finance - North American Retail and North America Financial Planning... -

Page 12

... Executive Officer of Delhaize America, LLC, the U.S. division of Delhaize Group, and Executive Vice President of Delhaize Group, an international food retailer, from October 2012 to September 2013. Mr. Smith was a Special Advisor to The Wendy's Company, a restaurant owner, operator and franchisor... -

Page 13

... those set forth below. For additional information related to the Staples Merger Agreement, please refer to the Current Report on Form 8-K filed with the SEC on February 4, 2015 (the "Staples Merger Form 8-K"). The foregoing description of the Staples Merger Agreement is qualified in its entirety by... -

Page 14

... disclosed, this plan is expected to provide $90 million of annual cost savings by the end of 2016. We may not be able to achieve the expected Merger synergies or restructuring benefits due to certain risks, among other things, risks that the businesses of Office Depot and OfficeMax may not be... -

Page 15

... be unanticipated downturns in business relationships with customers; there may be competitive pressures on the combined Company's sales and pricing; we may be unable to close all of the stores targeted for closure or such store closures may not result in the benefits or cost savings at levels that... -

Page 16

..., addresses, phone numbers, driver license numbers, e-mail addresses, contact preferences, personally identifiable information stored on electronic devices, and payment account information, including credit and debit card information. We also gather and retain information about our employees in the... -

Page 17

...will win a contract. Our ability to compete successfully for and retain business with the federal and various state and local governments is highly dependent on cost-effective performance. Our business with governmental entities and agencies is also sensitive to changes in national and international... -

Page 18

... securities. While Merger-related costs have been significant in 2014 and 2013, historically, we have generated positive cash flow from operating activities and have had access to broad financial markets that provide the liquidity we need to operate our business. Together, these sources have been... -

Page 19

Table of Contents well as invest in business expansion through new store openings, capital improvements and acquisitions. A deterioration in our financial results or the impact of significant Merger and integration costs could negatively impact our credit ratings, our liquidity and our access to ... -

Page 20

... results. Additional future contributions to the Pension Plans, financial market performance and Internal Revenue Service ("IRS") funding requirements could materially change these expected payments. In connection with OfficeMax's sale of its paper, forest products and timberland assets in 2004... -

Page 21

... of December 27, 2014, we sold to customers in 56 countries throughout North America, Europe, Asia/Pacific, and Latin America. We operate whollyowned entities and participate in joint ventures and alliances globally. Sales from our operations outside the U.S. are denominated in local currency, which... -

Page 22

... to increase our annual employee health care costs, with the most significant increases commencing in 2015. We cannot predict the extent of the effect of this statute, or any future state or federal healthcare legislation or regulation, will have on us. However, an expansion in government's role in... -

Page 23

...following retail stores, which are presented in the tables below by Division and location. STORES North Tmerican Retail Division State # State # UNITED STTTES: Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana... -

Page 24

... Arizona California Colorado Connecticut Florida Georgia Hawaii Illinois Indiana Kansas Kentucky Maine Massachusetts Minnesota Mississippi 1 1 6 2 1 4 2 4 4 1 1 2 1 1 2 1 Missouri Nevada New Hampshire New Jersey New York North Carolina Ohio Oregon Pennsylvania Puerto-Rico Tennessee Texas Utah... -

Page 25

... results of operations or cash flows. On February 4, 2015, Staples and Office Depot entered into the Staples Merger Agreement under which the companies would combine in a stock and cash transaction. On February 9, 2015, a putative class action lawsuit was filed by purported Office Depot shareholders... -

Page 26

..., the Company is unable to estimate a reasonably possible range of loss in these matters. Office Depot intends to vigorously defend itself in these lawsuits. OfficeMax is named a defendant in a number of lawsuits, claims, and proceedings arising out of the operation of certain paper and forest... -

Page 27

... on NASDAQ at market open on September 26, 2014. The Company's common stock continues to trade under the ticker symbol "ODP". As of the close of business on January 23, 2015, there were 9,634 holders of record of our common stock. The last reported sale price of the common stock on the NASDAQ on... -

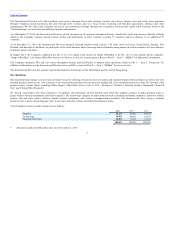

Page 28

Table of Contents The following graph compares the five-year cumulative total shareholder return on our common stock with the cumulative total returns of the S&P 500 index and the S&P Specialty Stores index. The foregoing graph shall not be deemed to be filed as part of this Annual Report and does... -

Page 29

... supply stores Distribution centers and crossdock facilities Call centers Total square footage - North American Retail Division Percentage of sales by segment: North American Retail Division North American Business Solutions Division International Division Balance Sheet Data: Total assets Long-term... -

Page 30

...$41 million were recognized from settlements. Includes Canadian locations. Fiscal year 2013 includes 144 stores operated by our International Division and 19 stores in Canada operated by our North American Business Solutions Division. These Canadian stores were closed in 2014. 28 (4) (5) (6) (7) -

Page 31

... and print center offering printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply products and services in Canada and the United States, including Puerto Rico and the U.S. Virgin Islands. North American Business Solutions Division customers... -

Page 32

... to service both Office Depot and OfficeMax banner customers, create or repurpose five locations, expand capacity in 12 existing facilities, and close another 12 locations. Additionally, in 2014, we converted over 50 stores to common point of sale systems, launched a combined company website (www... -

Page 33

...the sale of our interest in Office Depot de Mexico. Both 2014 and 2013 include charges related to underperforming stores in North America. • We incurred $403 million and $201 million of Merger, restructuring, and other operating expenses, net in 2014 and 2013, respectively. In 2014, this line item... -

Page 34

...North American Business Solutions Division. While store closures result in lower sales in the North American Retail Division, they are typically lower performing stores and future Division operating results may benefit. Comparable sales in 2014 from the 973 Office Depot branded stores that were open... -

Page 35

... the Internet shopping offering and experience, as well as a result of the Office Depot banner benefit from the launch of a combined website for Office Depot and OfficeMax customers in September 2014 (www.officedepot.com). The increased online sales were partially offset by reduced call center sales... -

Page 36

... of Division operating income. These locations primarily serviced contract and other small business customers and, accordingly, were included in results of the North America Business Solutions Division. INTERNTTIONTL DIVISION (In millions) 2014 2013 2012 Sales % change Division operating income... -

Page 37

... license agreement. Includes 249 stores operated by Office Depot de Mexico, which the Company sold its interest in during 2013. 22 Company-owned stores and 93 stores operated by Grupo OfficeMax. Stores operated by Grupo OfficeMax, which the Company sold its interest in the third quarter of 2014. 35 -

Page 38

... paid GBP 5.5 million ($9 million, measured at then-current exchange rates) to the Company to allow for future monthly payments to the pension plan. In January 2012, the Company and the seller entered into a settlement agreement that settled all claims by either party for this and any other matter... -

Page 39

... in a net increase in operating profit for 2012 of $63 million. Refer to Note 14, "Employee Benefit Plans - Pension Plans-Europe" of the Consolidated Financial Statements for additional information about this pension plan. Tsset Impairments, Merger, Restructuring, Other Charges and Credits In recent... -

Page 40

... charge. The 2013 goodwill impairment of $44 million was triggered by the sale of our interest in Office Depot de Mexico. The related reporting unit of the International Division included operating subsidiaries in Europe and ownership of the investment in Office Depot de Mexico. A substantial... -

Page 41

... direct costs to combine the companies. Expenses in 2013 include expenses incurred by Office Depot prior to the Merger and are primarily investment banking and professional fees associated with the transaction, including preparation for regulatory filings and shareholder approvals, as well employee... -

Page 42

.... Following the Merger, unallocated costs also include certain pension expense or credit related to the frozen OfficeMax pension and other benefit plans. Unallocated costs were $122 million, $89 million, and $74 million in 2014, 2013, and 2012, respectively. The 2014 and 2013 increases are primarily... -

Page 43

... tax expense resulting from the sale of our investment in Office Depot de Mexico. The sale of our interest in Grupo OfficeMax during 2014 did not generate a similar gain or income tax expense. The 2013 effective tax rate also includes certain Merger related expenses and the International Division... -

Page 44

...term borrowings represent outstanding balances on uncommitted lines of credit, which do not contain financial covenants. The Company was in compliance with all applicable financial covenants at December 27, 2014. In 2014, we have incurred $332 million in expenses associated primarily with the Merger... -

Page 45

...reflect outflows related to Merger and integration activities in 2014 and 2013. Cash used in operating activities in 2013 was negatively impacted by the payment of $147 million of income taxes related to the Company's gain on the disposition of the investment in Office Depot de Mexico. The source of... -

Page 46

... sale of Office Depot de Mexico provided additional liquidity for the preferred stock retirement, debt maturity and for the needs of the combined Company for Merger-related expenses. A $35 million return of investment in Boise Cascade Holdings also contributed to the source of cash in 2013. Capital... -

Page 47

... million in 2012. Off-Balance Sheet Trrangements As of December 27, 2014, we lease retail stores and other facilities and equipment under operating lease agreements, which are included in the table below. In addition, Note 17, "Commitments and Contingencies," of the Consolidated Financial Statements... -

Page 48

...in the table above represent the estimated, minimum contributions required per Internal Revenue Service funding rules and the Company's estimated future payments under nonqualified pension and postretirement plans. Actuarially-determined liabilities related to pension and postretirement benefits are... -

Page 49

... and adjust these balances accordingly. The second broad category of arrangements with our vendors is event-based programs. These arrangements can take many forms, including advertising support, special pricing offered by certain of our vendors for a limited time, payments for special placement... -

Page 50

.... The analysis uses input from retail store operations and the Company's accounting and finance personnel that organizationally report to the chief financial officer. These projections are based on management's estimates of store-level sales, gross margins, direct expenses, and resulting cash flows... -

Page 51

... result. Closed store accruals - During 2014, the Company developed the Real Estate Strategy that included closing of approximately 400 retail stores in the United States through 2016. The locations identified for possible closure considered market position, sales trends, remaining lease term, the... -

Page 52

... in the discount rate would increase the 2015 pension expense credit by $2 million. A 50 basis point reduction in the assumed long-term rate of return on plan assets would reduce the 2015 net pension credit by $6 million. Income taxes - Income tax accounting requires management to make estimates and... -

Page 53

...our overall business strategy and operating plans. Economic Factors - Our customers in the North American Retail Division, the International Division, and many of our customers in the North American Business Solutions Division are predominantly small and home office businesses. Accordingly, spending... -

Page 54

... to pay benefits, contribution levels and expense are also impacted by the return on the pension plan assets. The pension plan assets include U.S. equities, international equities, global equities and fixed-income securities, the cash flows of which change as equity prices and interest rates vary... -

Page 55

... Statements. Additionally, during 2014, the Financial Accounting Standards Board ("FASB") issued a new accounting standard relating to revenue recognition. That standard will be effective in 2017, with retrospective application possible. The Company has not finalized assessing the impact this... -

Page 56

... our assessment, management has concluded that the Company's internal control over financial reporting was effective as of December 27, 2014. Our internal control over financial reporting as of December 27, 2014, has been audited by Deloitte & Touche LLP, an independent registered public accounting... -

Page 57

Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors and Stockholders of Office Depot, Inc. Boca Raton, Florida We have audited the internal control over financial reporting of Office Depot, Inc. and subsidiaries (the "Company") as of December 27, 2014... -

Page 58

... Annual Report. Our Code of Ethical Behavior is in compliance with applicable rules of the SEC that apply to our principal executive officer, our principal financial officer, and our principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Ethical... -

Page 59

... the headings "Related Person Transactions Policy" and "Director Independence," respectively, and is incorporated by reference in this Annual Report. Item 14. Principal Tccountant Fees and Services. Information with respect to principal accounting fees and services and pre-approval policies will be... -

Page 60

... Statements." The financial statement schedules listed in "Index to Financial Statement Schedules." The exhibits listed in the "Index to Exhibits." Exhibit 99 1. Financial statements of Office Depot de Mexico, S.A. de C.V. and Subsidiaries as of July 9, 2013 (Unaudited) and December 31, 2012 58 -

Page 61

Table of Contents SIGNTTURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on this 24th day of February 2015. OFFICE DEPOT, INC. By: /s/ ... -

Page 62

Table of Contents INDEX TO FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Consolidated Statements of Operations Consolidated Statements of Comprehensive Income (Loss) Consolidated Balance Sheets Consolidated Statements of Cash Flows Consolidated Statements of ... -

Page 63

Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors and Stockholders of Office Depot, Inc. Boca Raton, Florida We have audited the accompanying consolidated balance sheets of Office Depot, Inc. and subsidiaries (the "Company") as of December 27, 2014 ... -

Page 64

Table of Contents OFFICE DEPOT, INC. CONSOLIDTTED STTTEMENTS OF OPERTTIONS (In millions, except per share amounts) 2014 2013 2012 Sales Cost of goods sold and occupancy costs Gross profit Selling, general and administrative expenses Recovery of purchase price Asset impairments Merger, ... -

Page 65

Table of Contents OFFICE DEPOT, INC. CONSOLIDTTED STTTEMENTS OF COMPREHENSIVE INCOME (LOSS) (In millions) 2014 2013 2012 Net loss Other comprehensive income (loss), net of tax, where applicable: Foreign currency translation adjustments Amortization of gain on cash flow hedge Change in deferred ... -

Page 66

Table of Contents OFFICE DEPOT, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares and par value) December 27, 2014 December 28, 2013 TSSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other current assets Total current assets Property and ... -

Page 67

... debt Debt retirement Debt issuance Debt related fees Redemption of redeemable preferred stock Redeemable preferred stock dividends Proceeds from issuance of borrowings Payments on long- and short-term borrowings Net cash provided by ( used in) financing activities Effect of exchange rate changes on... -

Page 68

...stock issuance related to OfficeMax merger Preferred stock dividends Grant of long-term incentive stock Forfeiture of restricted stock Exercise and release of incentive stock (including income tax benefits and withholding) Amortization of long-term incentive stock grants Balance at December 28, 2013... -

Page 69

...the International Division and reported as Other to align with how this information is presented for management reporting. Office Depot currently operates through wholly-owned entities and participates in other ventures and alliances. The Company's corporate headquarters is located in Boca Raton, FL... -

Page 70

... customer credit card and debit card transactions are classified as cash. The banks process the majority of these amounts within two business days. Amounts not yet presented for payment to zero balance disbursement accounts of $91 million and $118 million at December 27, 2014 and December 28, 2013... -

Page 71

..., respectively, relating to short-term advance payments on rent, marketing, services and other matters. Also, refer to Note 9 for information on deferred taxes included in this financial statement caption. Income Taxes : Income taxes are accounted for under the asset and liability method. This... -

Page 72

... closure costs are based on the future commitments under contracts, adjusted for assumed sublease benefits and discounted at the Company's credit-adjusted risk-free rate at the time of closing. Accretion expense is recognized over the life of the contractual payments. Additionally, the Company... -

Page 73

... sales return rates. The Company also records reductions to revenue for customer programs and incentive offerings including special pricing agreements, certain promotions and other volume-based incentives. A liability for future performance is recognized when gift cards are sold and the related... -

Page 74

... amounts incurred related to expenses of operating and support functions, including: employee payroll and benefits, including variable pay arrangements; advertising; store and field support; executive management and various staff functions, such as information technology, human resources functions... -

Page 75

... periods. Self-insurance: Office Depot is primarily self-insured for workers' compensation, auto and general liability and employee medical insurance programs. The Company has stop-loss coverage to limit the exposure arising from these claims. Self-insurance liabilities are based on claims filed and... -

Page 76

... lease payments in the Company's capital lease tests and in determining straight-line rent expense for operating leases. Straight-line rent expense is also adjusted to reflect any allowances or reimbursements provided by the lessor. When required under lease agreements, estimated costs to return... -

Page 77

... of the Company being the accounting acquirer. Like Office Depot, OfficeMax is a leader in both business-to-business and retail office products distribution. OfficeMax had operations in the U.S., Canada, Mexico, Australia, New Zealand, the U.S. Virgin Islands and Puerto Rico. The Merger was intended... -

Page 78

... property and equipment, favorable and unfavorable lease values, the Timber Notes and Nonrecourse debt, and share-based compensation awards; valuation allowances on U.S. deferred tax assets limited deferred tax benefit recognition; elimination of the OfficeMax recognition of deferred gain in 2013 of... -

Page 79

.... Transaction-related expenses are included in the Merger, restructuring, and other operating expenses, net line in the Consolidated Statements of Operations. Refer to Note 3 for additional information about the costs incurred and Note 9 for discussion of the income tax impacts of the Merger. 77 -

Page 80

... in the 2014 Consolidated Statements of Operations for this business through the date of sale are as follows: (In millions) Sales Income before income taxes Income attributable to Office Depot, before income taxes Office Depot de Mexico $155 6 4 In the third quarter of 2013, the Company sold its... -

Page 81

..., salary and benefits for employees dedicated to Merger activity, travel costs, non-capitalizable software integration costs, and other direct costs to combine the companies. Expenses in 2013 primarily relate to legal, accounting, and pre-merger integration activities incurred by Office Depot. Such... -

Page 82

... Incurred OfficeMax Merger Additions Cash Payments Ending Balance 2014 Termination benefits Merger-related accruals European restructuring plan Other restructuring accruals Acquired entity accruals Lease and contract obligations, accruals for facilities closures and other costs Merger-related... -

Page 83

... balance sheet accounts. The $137 million incurred in 2014 is comprised of $124 million merger transaction and integration expenses, $9 million European restructuring transaction and integration expenses, $5 million employee noncash equity compensation expenses, and $1 million net credit associated... -

Page 84

...Foreign currency rate impact Balance as of December 29, 2012 Impairment loss Additions Foreign currency rate impact Balance as of December 28, 2013 Measurement period fair value adjustments Sale of Grupo OfficeMax Tllocation to reporting units Balance as of December 27, 2014 $ $ $ $ 2 (2 78 78... -

Page 85

... (Continued) account adjustments were $1 million. Goodwill of $24 million was allocated to the Grupo OfficeMax business and was removed following the August 2014 sale of that business. As a result of the disposition of its investment in Office Depot de Mexico and the associated return of cash... -

Page 86

Table of Contents OFFICE DEPOT, INC. NOTES TO CONSOLIDTTED FINTNCITL STTTEMENTS (Continued) Definite-lived intangible assets generally are amortized using the straight-line method. The pattern of benefit associated with one customer relationship asset recognized as part of the Merger warranted a ... -

Page 87

... in Boise Cascade Holdings was accounted for under the cost method because the Company did not have the ability to significantly influence the entity's operating and financial policies. The investment was recorded at fair value on the date of the Merger. At December 28, 2013, the investment of $46... -

Page 88

... 27, 2014. Tmended Credit Tgreement On May 25, 2011, the Company entered into an Amended and Restated Credit Agreement with a group of lenders. Additional amendments to the Amended and Restated Credit Agreement have been entered into and were effective February 2012 and November 2013 (the Amended... -

Page 89

...the Company which is effective November 5, 2013 (the "Amendment") increased the Facility from $1.0 billion to $1.25 billion, allowed for the Merger, recognized OfficeMax debt and assets, expanded amounts permitted for indebtedness, liens, investments and asset sales and increased restricted payments... -

Page 90

... that, among other things, limit or restrict the Company's ability to: incur additional debt or issue stock, pay dividends, make certain investments or make other restricted payments; engage in sales of assets; and engage in consolidations, mergers and acquisitions. However, many of these currently... -

Page 91

... Lease Obligations Capital lease obligations primarily relate to buildings and equipment. Short-Term Borrowings The Company had short-term borrowings of $1 million at December 27, 2014 under various local currency credit facilities for international subsidiaries that had an effective interest rate... -

Page 92

... tax benefits Tax expense from intercompany transactions Subpart F and dividend income, net of foreign tax credits Change in tax rate Non-taxable return of purchase price Deferred taxes on undistributed foreign earnings Tax accounting method change ruling Other items, net Income tax expense... -

Page 93

... Office Depot de Mexico. Due to valuation allowances against the Company's deferred tax assets, no income tax benefit was recognized in the 2014 Consolidated Statement of Operations related to stock-based compensation. In addition, no income tax benefit was initially recognized in the 2012 and 2013... -

Page 94

...) December 27, 2014 December 28, 2013 U.S. and foreign net operating loss carryforwards Deferred rent credit Pension and other accrued compensation Accruals for facility closings Inventory Self-insurance accruals Deferred revenue U.S. and foreign income tax credit carryforwards Allowance for... -

Page 95

... Merger in 2013, the Company triggered an "ownership change" as defined in Internal Revenue Code Section 382 and related provisions. Sections 382 and 383 place a limitation on the amount of taxable income which can be offset by carryforward tax attributes, such as net operating losses or tax credits... -

Page 96

... of 2015. The Company will continue to assess the realizability of its deferred tax assets in the U.S. and remaining foreign jurisdictions. The following table summarizes the activity related to unrecognized tax benefits: (In millions) 2014 2013 2012 Beginning balance Increase related to current... -

Page 97

... 43 $2,610 These minimum lease payments do not include contingent rental payments that may be due based on a percentage of sales in excess of stipulated amounts. As of December 27, 2014 and December 28, 2013, unfavorable lease deferred credit for store leases with terms above market value amounted... -

Page 98

...fair value measurement information. Reported dividends calculated on a per share basis were $221.50 and $94.10 for 2013 and 2012, respectively. In accordance with certain Merger-related agreements, which the Company entered into with the holders of the Company's preferred stock concurrently with the... -

Page 99

... pension amounts generally have little or no tax impact. The component balances are net of immaterial tax impacts, where applicable. NOTE 13. STOCK-BTSED COMPENSTTION Long-Term Incentive Plans During 2007, the Company's Board of Directors adopted, and the shareholders approved, the Office Depot... -

Page 100

...purchase Office Depot common stock, on the same terms and conditions adjusted by the 2.69 exchange ratio provided for in the Merger Agreement. The fair value of those options was measured using an option pricing model with the following assumptions: risk-free rate 0.42%; expected life 2.34; dividend... -

Page 101

... stock grants to Company employees typically vest annually over a three-year service period. A summary of the status of the Company's nonvested shares and changes during 2014, 2013, and 2012 is presented below. 2014 2013 2012 Outstanding at beginning of year Granted Assumed - Merger Vested... -

Page 102

...grant date fair value of shares vested during 2014 was approximately $6.3 million. NOTE 14. EMPLOYEE BENEFIT PLTNS Pension and Other Postretirement Benefit Plans Pension and Other Postretirement Benefit Plans - North America The Company has retirement obligations under OfficeMax's U.S. pension plans... -

Page 103

...17) The following table shows the amounts recognized in the Consolidated Balance Sheets related to the Company's North America defined benefit pension and other postretirement benefit plans as of year-ends: (In millions) Pension Benefits 2014 2013 Other Benefits 2014 2013 Noncurrent assets Current... -

Page 104

... and timing of future benefit payments. The following table presents the key weighted average assumptions used in the measurement of the Company's benefit obligations as of yearends: Other Benefits Pension Benefits 2014 2013 United States 2014 2013 2014 Canada 2013 Discount rate 102 3.91% 4.84... -

Page 105

... STTTEMENTS (Continued) The following table presents the weighted average assumptions used in the measurement of net periodic benefit: Pension Benefits 2014 2013 Other Benefits United States Canada 2014 2013 2014 2013 Discount rate Expected long-term rate of return on plan assets 4.84% 6.50% 4.76... -

Page 106

... exposure to various asset classes in a lower-cost manner than trading securities in the underlying portfolios. Generally, quoted market prices are used to value pension plan assets. Equities, some fixed-income securities, publicly traded investment funds, and U.S. government obligations are valued... -

Page 107

... of Contents OFFICE DEPOT, INC. NOTES TO CONSOLIDTTED FINTNCITL STTTEMENTS (Continued) The following table presents the pension plan assets by level within the fair value hierarchy at year-ends. (In millions) Quoted Prices in Tctive Markets for Identical Tssets (Level 1) Fair Value Measurements... -

Page 108

... Pension Benefits Other Benefits 2015 2016 2017 2018 2019 Next five years Pension Plan - Europe $ 94 91 89 87 85 393 $ 1 1 1 1 1 4 The Company has a defined benefit pension plan which is associated with a 2003 European acquisition and covers a limited number of employees in Europe. During 2008... -

Page 109

... impairment in 2008, this recovery and related charge is reported at the corporate level, not part of International Division operating income. The cash payment from the seller was received by a subsidiary of the Company with the Euro as its functional currency and the pension plan funding was... -

Page 110

... the funded status included: 2014 2013 2012 Expected long-term rate of return on plan assets Discount rate Inflation 5.55% 3.80% 3.10% 6.33% 4.60% 3.40% 6.00% 4.40% 3.00% The long-term rate of return on assets assumption has been derived based on long-term UK government fixed income yields... -

Page 111

...Contents OFFICE DEPOT, INC. NOTES TO CONSOLIDTTED FINTNCITL STTTEMENTS (Continued) The following table presents the pension plan assets by level within the fair value hierarchy. (In millions) Quoted Prices in Tctive Markets for Identical Tssets (Level 1) Fair Value Measurements at December 27, 2014... -

Page 112

...2012 Purchases, sales, and settlements Balance at December 28, 2013 Cash Flows Anticipated benefit payments for the European pension plan, at December 27, 2014 exchange rates, are as follows: (In millions) $- 7 $ 7 Benefit Payments 2015 2016 2017 2018 2019 Next five years Retirement Savings Plans... -

Page 113

... OFFICE DEPOT, INC. NOTES TO CONSOLIDTTED FINTNCITL STTTEMENTS (Continued) NOTE 15. ETRNINGS PER SHTRE The following table presents the calculation of net loss per common share - basic and diluted: (In millions, except per share amounts) 2014 2013 2012 Basic Earnings Per Share Numerator: Net... -

Page 114

...2014, the foreign exchange contracts extend through March 2015 and fuel contracts extended through January 2016. The fair values of the Company's foreign currency contracts and fuel contracts are the amounts receivable or payable to terminate the agreements at the reporting date, taking into account... -

Page 115

... from retail store operations and the Company's accounting and finance personnel that organizationally report to the Chief Financial Officer. These Level 3 projections are based on management's estimates of store-level sales, gross margins, direct expenses, exercise of future lease renewal options... -

Page 116

... existing Office Depot businesses, were substantially in excess of their carrying values. As of December 29, 2012, goodwill of $45 million (at then-current exchange rates) was included in the International Division in a reporting unit comprised of wholly-owned operating subsidiaries in Europe and... -

Page 117

... multiple distribution centers and the adoption of new warehousing systems which impacted customer service and delayed or undermined planned marketing activities, the Company re-evaluated remaining balances of acquisition-related intangible assets of customer relationships and short-lived trade name... -

Page 118

... results of operations or cash flows. On February 4, 2015, Staples and Office Depot entered into the Staples Merger Agreement under which the companies would combine in a stock and cash transaction. On February 9, 2015, a putative class action lawsuit was filed by purported Office Depot shareholders... -

Page 119

... and print center offering printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply products and services in Canada and the United States, including Puerto Rico and the U.S. Virgin Islands. North American Business Solutions Division customers... -

Page 120

...and services through direct mail catalogs, contract sales forces, Internet sites, and retail stores in Europe and Asia/Pacific. Following the date of the Merger, the former OfficeMax U.S. Retail business is included in the North American Retail Division. The former OfficeMax United States and Canada... -

Page 121

...(ii) accounts and balances associated with Grupo OfficeMax, and (ii) $377 million of goodwill in December 28, 2013, which was allocated to reporting units in 2014. A reconciliation of the measure of Division operating income to Income (loss) before income taxes follows. (In millions) 2014 2013 2012... -

Page 122

... United States or single customer that accounts for 10% or more of the Company's total sales. Geographic financial information relating to the Company's business is as follows (in millions). 2014 Sales 2013 2012 Property and Equipment, Net 2014 2013 2012 United States International Total $12,132... -

Page 123

... an after-tax gain of approximately $235 million resulting from the sale of Office Depot de Mexico and preferred stock dividends of $22 million associated to redemption in July 2013. Net income available to common stockholders includes (i) impact of the Merger of $939 million in Sales and $(39... -

Page 124

Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors and Stockholders of Office Depot, Inc. Boca Raton, Florida We have audited the consolidated financial statements of Office Depot, Inc. and subsidiaries (the "Company") as of December 27, 2014 and ... -

Page 125

Table of Contents INDEX TO FINTNCITL STTTEMENT SCHEDULES Page Schedule II - Valuation and Qualifying Accounts and Reserves All other schedules have been omitted because they are not applicable, not required or the information is included elsewhere herein. 123 124 -

Page 126

... millions) Column A Column B Column C Column D Deductions - Write-offs, Payments and Other Adjustments Column E Description Balance at Beginning of Period Additions - Charged to Expense Balance at End of Period Allowance for doubtful accounts: 2014 2013 2012 124 $ $ $ 26 23 20 8 14 15 16 11 12... -

Page 127

... Annual Report on Form 10-K, filed with the SEC on February 25, 2014). Second Supplemental Indenture, dated as of November 22, 2013, between Office Depot Inc., Mapleby Holdings Merger Corporation, OfficeMax Incorporated, OfficeMax Southern Company, OfficeMax Nevada Company, OfficeMax North America... -

Page 128

...reference from OfficeMax Incorporated's Quarterly Report on Form 10-Q, filed with the SEC on November 9, 2004). Lease Agreement dated November 10, 2006, by and between Office Depot, Inc. and Boca 54 North LLC (Incorporated by reference from Office Depot, Inc.'s Annual Report on Form 10-K, filed with... -

Page 129

...Depot Inc.'s Annual Report on Form 10-K, filed with the SEC on February 20, 2013). Letter Agreement between the Company and Stephen E. Hare (Incorporated by reference from Office Depot, Inc.'s Current Report on Form 8-K, filed with the SEC on December 5, 2013).* 2013 Non-Qualified Stock Option Award... -

Page 130

... 18, 2013).* 2013 Performance Share Award Agreement between the Company and Roland C. Smith (Incorporated by reference from Office Depot, Inc.'s Current Report on Form 8-K, filed with the SEC on November 18, 2013).* 2003 OfficeMax Incentive and Performance Plan (amended and restated effective as of... -

Page 131

... on May 6, 2014). Second Amendment to 2013 Performance Share Award Agreement between Office Depot, Inc. and Stephen E. Hare (Incorporated by reference from Office Depot's Quarterly Report on Form 10-Q, filed with the SEC on May 6, 2014). Form of 2014 Restricted Stock Award Agreement (Incorporated by... -

Page 132

... Report on Form 10-Q, filed with the SEC on November 9, 2004). Director Stock Compensation Plan, as amended through September 26, 2003 (Incorporated by reference from OfficeMax Incorporated's Annual Report on Form 10-K, filed with the SEC on March 2, 2004).* 2003 Director Stock Compensation Plan... -

Page 133

... to OfficeMax Incorporated 2005 Directors Deferred Compensation Plan (Incorporated by reference from OfficeMax Incorporated's Quarterly Report on Form 10-Q, filed with the SEC on November 6, 2008).* List of Office Depot, Inc.'s Subsidiaries Consent of Independent Registered Public Accounting Firm... -

Page 134

...Indenture dated September 16, 2004, among Boise Cascade Corporation, U.S. Bank Trust National Association and BNY Western Trust Company was filed as exhibit 4.1 to OfficeMax Incorporated's Current Report on Form 8-K filed on September 22, 2004. The Sixth Supplemental Indenture dated October 29, 2004... -

Page 135

... Trading Limited, Inc. 2300 South Congress LLC Neighborhood Retail Development Fund, LLC HC Land Company LLC Notus Aviation, Inc. OD Medical Solutions LLC OD Brazil Holdings, LLC Office Depot N.A. Shared Services LLC Office Depot (Netherlands) LLC Office Depot Foreign Holdings GP, LLC Office Depot... -

Page 136

...Holdings BV. Guilbert International B.V. Office Depot (Operations) Holdings B.V. Office Depot Coöperatief W.A. Office Depot Europe B.V. Xtreme Office B.V. OfficeMax New Zealand Limited Office Depot Puerto Rico, LLC 134 Australia Austria Belgium Bermuda Bermuda Brazil Brazil Canada (Ontario) Cayman... -

Page 137

... Office Depot Service Center SRL Office Depot s.r.o. Office Depot S.L. Office Depot Sweden (Holding) AB Office Depot Svenska AB (f.k.a. Frans Svanström & Cu AB) Office Depot GmbH Office Depot Holding GmbH Office Depot International (UK) Limited Viking Direct (Holdings) Limited Office Depot... -

Page 138

... Office Depot, Inc. and subsidiaries (the "Company"), and the effectiveness of the Company's internal control over financial reporting, appearing in this Annual Report on Form 10-K of the Company for the fiscal year ended December 27, 2014. /s/ DELOITTE & TOUCHE LLP Certified Public Accountants Boca... -

Page 139

... vary from accounting principles generally accepted in the United htates of America, the nature and effects of which are presented in Note 19 in such consolidated financial statements), appearing in the Annual Report on Form 10-K of mffice Depot, Inc. for the year ended December 27, 2014. /s/ Ma... -

Page 140

... internal control over financial reporting; and 5. The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons... -

Page 141

... information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ STEPHEN E. HARE Name: Stephen E. Hare Title: Executive Vice President and Chief Financial Officer... -

Page 142

...the Annual Report on Form 10-K of Office Depot, Inc. (the "Company") for the fiscal year ended December 27, 2014 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Roland C. Smith, as Chief Executive Officer of the Company, and Stephen E. Hare, as Chief Financial... -

Page 143

Exhibit 99 Office Depot de México, S. A. de C. V. and Subsidiaries Consolidated Financial Statements as of July 9, 2013(Unaudited) and December 31, 2012 and for the Period from January 1, 2013 to July 9, 2013 (Unaudited) and for the Years Ended December 31, 2012 and 2011 -

Page 144

Office Depot de México, S. A. de C. V. and Subsidiaries Consolidated Financial Statements for the Period from January 1, 2013 to July 9, 2013 (Unaudited) and for the Years Ended 2012 and 2011 Table of contents Page Independent Auditors' Report Consolidated Balance Sheets Consolidated Statements of... -

Page 145

... Auditors' Report to the Board of Directors and Stockholders of Office Depot de México, S. A. de C. V. We have audited the accompanying consolidated financial statements of Office Depot de México, S. A. de C. V. and its subsidiaries (the "Company"), which comprise the consolidated balance sheet as... -

Page 146

... in certain significant respects from accounting principles generally accepted in the United States of America ("U.S. GAAP"). Information relating to the nature and effect of such differences is presented in Note 19 to the accompanying consolidated financial statements. The accompanying consolidated... -

Page 147

... profit sharing Intangible assets - Net Goodwill Total Liabilities and stockholders' equity Current liabilities: Trade accounts payable Office Depot Asia Holding Limited - Related party Accrued expenses Taxes payable Total current liabilities Employee benefits Total liabilities Stockholders' equity... -

Page 148

... 09/07/2013 (Unaudited) 31/12/2012 31/12/2011 Revenues: Net sales Other Costs and expenses: Cost of sales Selling, administrative and general expenses Other expenses Net comprehensive financing cost: Bank commissions Interest expense Interest income Exchange gain (loss) Other financial income - Net... -

Page 149

Office Depot de México, S. A. de C. V. and Subsidiaries Consolidated Statements of Changes in Stockholders' Equity For the period from January 1, 2013 to July 9, 2013 (unaudited) and for the years ended December 31, 2012 and 2011 (In thousands of Mexican pesos) Common stock Retained earnings ... -

Page 150

... related parties - Net Inventories Prepaid expenses Trade accounts payable Accrued expenses Income taxes paid Other liabilities Net cash provided by operating activities Investing activities: Purchases of equipment and investments in leasehold improvements Proceeds from sale of equipment Interest... -

Page 151

..., twelve in Colombia, eight distribution centers, a cross dock in Mexico that sells office supplies and electronic goods, and a printing service specializing in the retail and catalogue business for office supplies. 2. Significant events On July 9, 2013, Grupo Gigante, S. A. B. de C. V. ("Grupo... -

Page 152

... holding company of subsidiaries specialized in the retail, 99.999999% catalogue business for office supplies, located in Colombia. Provides administrative services to Mexican related parties, located 99.840000% in Mexico. Operates stores specializing in the sale of services and office supplies... -

Page 153

... distribution and handling of office supplies inventories as well as fabrication of printed forms, located in Colombia, (subsidiary of 100.000000% OD Colombia, S. A. S.). This company has not initiated operations as of the date of these 99.000000% consolidated financial statements and it is located... -

Page 154

... in comprehensive financing (cost) income of the period Concentration of credit risk IThe Company sells products to customers primarily in the retail trade in Mexico. The Company conducts periodic evaluations of its customers' financial condition and generally does not require collateral. The... -

Page 155

.... Direct employee benefits-Direct employee benefits are calculated based on the services rendered by employees, considering their most recent salaries. The liability is recognized as it accrues. These benefits include mainly statutory employee profit sharing ("PTU") payable, compensated absences... -

Page 156

... is recognized at the point of sale for retail transactions and at the time of successful delivery for contract, catalog and internet sales. Sales taxes collected are not included in reported sales. The Company does not charge shipping and handling costs to its customers; such costs are included... -

Page 157

... receivable and recoverable taxes 09/07/2013 (Unaudited) 31/12/2012 Trade accounts receivable Allowance for doubtful accounts Sundry debtors Recoverable taxes, mainly value-added tax and income tax $647,146 (6,053) 641,093 29,720 263,014 $933,827 $ 663,894 (5,728) 658,166 33,263 342,188 $1,033... -

Page 158

8. Property, equipment and leasehold improvements 09/07/2013 (Unaudited) 31/12/2012 31/12/2011 a. Investment Land Buildings Leasehold improvements Furniture ... 09/07/2013 (Unaudited) 31/12/2012 Intangible assets with finite useful lives: Non-compete agreement Customer list Accumulated amortization ... -

Page 159

... of 2013 2014 2015 10. Employee benefits a. The Company pays seniority premium benefits to its employees, which consist of a lump sum payment of 12 days' wage for each year worked, calculated using the most recent salary, not to exceed twice the minimum wage established by law. The related liability... -

Page 160

... legislation, the Company must make payments equivalent to 2% of its workers' daily integrated salary to a defined contribution plan that is part of the retirement savings system. The expense for the period from January 1, 2013 to July 9, 2013 and for the years ended December 31, 2012 and 2011 was... -

Page 161

... Company at the rate in effect upon distribution. Any tax paid on such distribution may be credited against annual and estimated income taxes of the year in which the tax on dividends is paid and the following two fiscal years. The balances of the stockholders' equity tax accounts as of July 9, 2013... -

Page 162

... 822 183,755 18,657 606 Mexican peso exchange rates in effect at the dates of the consolidated balance sheets and the date of issuance of the accompanying consolidated financial statements were as follows: 07/02/2014 (Unaudited) 09/07/2013 31/12/2012 31/12/2011 Mexican pesos per one U. S. dollar... -

Page 163

... inventories: Office Depot Asia Holding Limited b. Balances due from related parties are as follows: 23,125 3,867 1,364 3,682 I 40,142 1,161 2,680 15,558 1,957 4,832 38,891 3,088 170 9,687 I 18,899 2,433 I 269,706 954 897 196,739 1,929 I 426,262 09/07/2013 (Unaudited) 31/12/2012 Restaurantes... -

Page 164

15. Tax environment Income taxes in Mexico The Company is subject to ISR and IETU and pays the greater of the two. ISR -The rate was 30% in 2013 and 2012 and as a result of the new 2014 ISR law (2014 Law), it will continue at 30% in 2014 and subsequent years. IETU - IETU was eliminated as of 2014; ... -

Page 165

...The main items originating the deferred ISR asset as of July 9, 2013 and December 31, 2012 are: 09/07/2013 (Unaudited) 31/12/2012 Deferred ISR asset: Effect of tax loss carryforwards Property, equipment and leasehold improvements Accrued expenses Allowance for doubtful accounts Other, net Deferred... -

Page 166

... rentals, there are certain executory costs such as real estate taxes, insurance and common area maintenance on most of the Company's facility leases. The table below shows future minimum lease payments due under the non-cancelable portions of our leases as of July 9, 2013. 2013 2014 2015 2016... -

Page 167

...2012 and $352,185 in 2011. Legal Matters On August 31, 2005, in an effort to expand operations within Mexico, a sublease agreement with respect to a plot of land was signed between the Company and a third party, under which the Company would sublease the land and build one of its Office Depot stores... -

Page 168

18. New accounting principles During 2013, the Mexican Board for the Research and Development of Financial Reporting Standards enacted the following NIFs, which go into effect January 1, 2014, although early application is permitted as follows: NIF B-12 Offsetting of Financial Assets and Financial ... -

Page 169

... 31, 2007. The elimination of the effects of inflation on individual line items in the consolidated balance sheets under MFRS are as follows: 09/07/2013 (Unaudited) 31/12/2012 Property, equipment and leasehold improvements Intangible assets Goodwill Total adjustment $394,446 377 13,897 $408... -

Page 170

...benefits 09/07/2013 (Unaudited) Employee benefits 31/12/2012 Components of net periodic cost: Service cost Interest cost Amortization of transition obligation Amortization of prior service cost Effect of personnel reduction or early termination (other than a restructuring or discontinued operation... -

Page 171

... 31, 2012: 09/07/2013 % 31/12/2012 % Discount of the projected benefit obligation at present value Salary increase Minimum wage increase rate (iii) 8.19 5.73 4.27 8.19 5.73 4.27 Renn holidaysIUnder MFRS, rental expense is recorded beginning when the related store initiates operations. Under... -

Page 172

... 14,412 (93,068) 320,170 $318,558 14,669 260,195 96,368 11,636 (93,068) 289,800 $284,231 The effective rate differs from the statutory rate mainly due to the effects of non-deductible expenses as well as different tax rates applicable in different tax jurisdiction in which the Company operates. 28 -

Page 173

... or a portion of the benefit related to such tax position may not be recognized. The Company has not taken any tax position for which it does not believe that it is more likely than not that the full amount of the benefit taken will be sustained upon review, based on technical merits of the position... -

Page 174

... for doubtful accounts (Gain) loss on sale of fixed assets Deferred income tax Net periodic cost Unrealized foreign exchange loss (gain) Changes in operating assets and liabilities: Accounts receivable and recoverable taxes Due to/from related parties Inventories Trade accounts payable Accrued... -

Page 175

... from the sale of equipment Net cash used in investing activities Cash flows from financing activities: Borrowings from related party Banks borrowings Repayments to related party Repayments of banks borrowings Dividends paid Net cash used in financing activities Effect of exchange rate changes on... -

Page 176

...following are new pronouncements issued under U.S. GAAP which will be effective in future reporting periods: In February 2013, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2013-02, Comprehensive Income (Topic 220): Reporning of Amounns Reclassified Oun... -

Page 177