Occidental Petroleum 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

R

£

For the fiscal year ended December 31, 2010 For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

Delaware

95-4035997

10889 Wilshire Blvd., Los Angeles, CA

90024

(310) 208-8800

Title of Each Class Name of Each Exchange on Which Registered

R£

£R

R£

R£

R

R£

££

£R

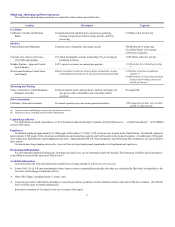

Table of contents

-

Page 1

...'s telephone number, including area code Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(b) of the Tct: Title of Each Class 9 1/4% Senior Debentures due 2019 Common Stock Name of Each Exchange on Which Registered New York... -

Page 2

...Disclosure Controls and Procedures Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management Certain Relationships and Related Transactions and Director Independence Principal Tccountant Fees and Services 11 11 11 14... -

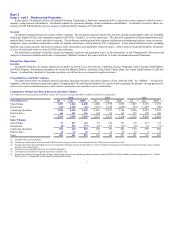

Page 3

...Statements. Oil and Gas Operations General Occidental's domestic oil and gas operations are mainly located in Texas, New Mexico, California, Kansas, Oklahoma, Utah, Colorado, North Dakota and West Virginia. International operations are located in Bahrain, Bolivia, Colombia, Iraq, Libya, Oman, Qatar... -

Page 4

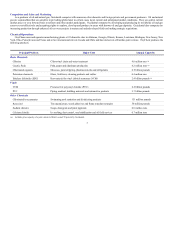

... cost-effectively and acquiring rights to explore, develop and produce in areas with known oil and gas deposits. Occidental also competes by increasing production through enhanced oil recovery projects in mature and underdeveloped fields and making strategic acquisitions. Chemical Operations... -

Page 5

..., Singapore and other Trades around its assets and purchases, markets and trades oil, gas, power, other commodities and commodity-related securities Not applicable Powir Giniration California, Texas and Louisiana (a) (b) Occidental-operated power and steam generation facilities 1,800 megawatts... -

Page 6

... may increase if a greater percentage of Occidental's future oil and gas production comes from foreign sources. There has been recent political instability and civil unrest in Bahrain, Libya and Yemen. The effect, if any, of these developments on Occidental's operations is unknown at this time, but... -

Page 7

... directors, certain executive officers and Occidental, as defendants. The complaint alleges defendants made a false and misleading proxy solicitation in connection with reapproval of the performance goals for certain incentive awards and authorized excessive compensation constituting corporate... -

Page 8

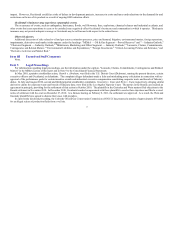

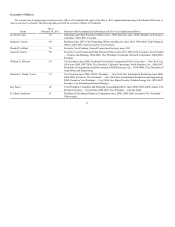

... Vice President - Oxy Oil & Gas, International Production and Engineering; 2008, Executive Vice President - Oxy Oil & Gas, Major Projects; Dolphin Energy Ltd.: 2002-2007, Executive Vice President and General Manager. Roy Pineci 48 Vice President, Controller and Principal Tccounting Officer since... -

Page 9

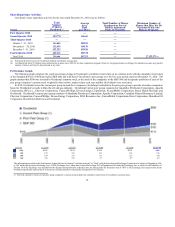

... report. Occidental's common stock was held by 35,577 stockholders of record at December 31, 2010, and by approximately 537,000 additional stockholders whose shares were held for them in street name or nominee accounts. The common stock is listed and traded principally on the New York Stock Exchange... -

Page 10

... $100 was invested in Occidental common stock, in the stock of the companies in the S&P 500 and in separate portfolios of each of the peer group companies' common stock weighted by their relative market values each year and that all dividends were reinvested. In 2010, Occidental revised its current... -

Page 11

...and marketing) gathers, treats, processes, transports, stores, purchases and markets crude oil, liquids, natural gas, carbon dioxide (CO2) and power. It also trades around its assets, including pipelines and storage capacity, and trades oil and gas, other commodities and commodity-related securities... -

Page 12

... partnering with the Tbu Dhabi National Oil Company. In January of 2010, Occidental and its partners signed a technical service contract with the South Oil Company of Iraq to develop the Zubair Field in Iraq. In Tpril 2009, Occidental and its partners signed a Development and Production Sharing 12 -

Page 13

...-percent joint venture interest in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas-fired power-generation plant in California, bringing Occidental's total ownership to 100 percent. Key Performance Indicators Giniral Occidental seeks to ensure that it meets its strategic... -

Page 14

...fourth quarter of 2010. Occidental's long-term senior unsecured debt was rated T by Fitch Ratings, Standard and Poor's Ratings and DBRS. Occidental's long-term unsecured debt was rated T2 by Moody's Investors Service. T security rating is not a recommendation to buy, sell or hold securities, may be... -

Page 15

... Occidental's Permian production is diversified across a large number of producing areas in the Permian Basin. The Permian Basin extends throughout southwest Texas and southeast New Mexico and is one of the largest and most active oil basins in the United States, with the entire basin accounting... -

Page 16

... net share of the total production. Occidental also produces and processes natural gas and NGLs in the Permian Basin. Starting in 2010, Permian Basin non-associated gas assets were included as part of the Midcontinent Gas operations. Ts a result of this change, the Permian business unit's production... -

Page 17

...per day from the Permian business unit. Tt the end of 2010, Occidental's Permian properties had approximately 1.2 billion BOE in proved reserves. California Occidental's California operations consist of holdings in the Elk Hills area, the Wilmington Field in the Los Tngeles basin and other interests... -

Page 18

...'s share of production from Bahrain during 2010 was approximately 169 million cubic feet (MMcf) of gas and 3,000 barrels of oil per day. Iraq In January 2010, Occidental and its partners signed a technical service contract (TSC) with the South Oil Company of Iraq to develop the Zubair Field... -

Page 19

... also holds a 48-percent working interest in the La Cira-Infantas Field, which is located in the Middle-Magdalena Basin. Occidental's share of 2010 production from its Colombia operations was approximately 32,000 BOE per day. Proved Reserves For further information regarding Occidental's proved... -

Page 20

-

Page 21

... Occidental's oil and gas reserves data. The Senior Director has over 29 years of experience in the upstream sector of the exploration and production business, and has held various assignments in North Tmerica, Tsia and Europe. He is a three-time past Chair of the Society of Petroleum Engineers Oil... -

Page 22

... to Europe and Tsia, resulting in strong demand for U.S.-produced products in export markets. Occidental's vinyls exports in 2010 were 125 percent higher compared to 2009. Business Review Basic Chimicals During 2010, demand and pricing for basic chemical products improved as U.S. and international... -

Page 23

... difference between inlet costs of wet gas and market prices for NGLs. In 2008, Occidental signed an agreement for a third party to construct a gas processing plant that will provide CO 2 for Occidental's EOR projects in the Permian Basin. Occidental will own and operate the new facility, of which... -

Page 24

... are generally due to the timing of shipments at Occidental's international locations where product is loaded onto tankers. Sales Volumes per Day United States Oil and liquids (MBBL) California Permian 2010 2009 2008 92 93 164 14 271 250 125 260 89 164 10 161 18 Midcontinent Gas Total 271... -

Page 25

...Latin America Crude oil (MBBL) Colombia (a) 36 16 45 16 43 21 Natural gas (MMCF) Bolivia Middle East/North Africa Oil and liquids (MBBL) Bahrain Dolphin Libya Oman 3 24 - 25 12 50 - 26 19 13 61 76 Qatar Yemen Total 30 207 169 79 35 201 10 34 80 32 191 Natural gas (MMCF) Bahrain Dolphin... -

Page 26

...) Natural gas (MMCF) Latin America Crude oil (MBBL) Colombia (a) 2010 2009 2008 271 271 677 635 263 587 37 16 45 16 44 21 Natural gas (MMCF) Middle East/North Africa Oil and liquids (MBBL) Bahrain Dolphin Iraq Libya Oman 3 24 3 13 62 76 - 26 - 11 - 25 - 19 50 Qatar Yemen Total 31... -

Page 27

... termination of rig contracts. Oil and gas segment earnings in 2008 included a pre-tax charge of $123 million for asset impairments and a pre-tax charge of $46 million for termination of rig contracts. Tverage production costs for 2010 on continuing operations, excluding taxes other than on income... -

Page 28

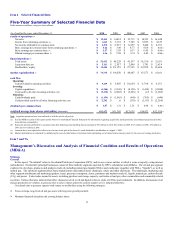

... following table sets forth the calculation of the worldwide effective tax rate for income from continuing operations: In millions 2010 $ 2009 2008 EARNINGS Oil and Gas Chemical Midstream, Marketing and Other Unallocated Corporate Items Pre-tax income 7,151 438 472 (497) $ 5,097 389 235 (507... -

Page 29

... in 2009, compared to 2008, was due to lower oil and gas and chemical product prices, partially offset by higher volumes. Of the price-related decrease in sales, approximately 90 percent was associated with oil and gas. The decrease in interest, dividends and other income in 2009, compared to 2008... -

Page 30

...2009, due to higher oil and gas production costs, partly resulting from the effects of fully expensing CO 2 costs in 2010, as well as higher field operating, workover and maintenance costs and volumes; and higher chemical volumes, energy and feedstock costs. Cost of sales decreased in 2009, compared... -

Page 31

... long-term portion of scheduled payments related to acquisitions and deferred compensation. The increase in stockholder's equity reflected net income for 2010, partially offset by dividend payments. Liquidity and Capital Resources Tt December 31, 2010, Occidental had approximately $2.6 billion in... -

Page 32

-

Page 33

... 2010 other investing activities, net amount included $4.9 billion in cash payments for the acquisitions of businesses and assets, including acquisitions of various interests in domestic oil and gas properties, in operated, producing and non-producing properties in the Permian Basin, mid-continent... -

Page 34

... operating lease agreements, mainly for transportation equipment, power plants, machinery, terminals, storage facilities, land and office space. Occidental leases assets when leasing offers greater operating flexibility. Lease payments are generally expensed as cost of sales. For more information... -

Page 35

(e) Tmounts exclude certain oil purchase obligations related to the marketing and trading activities for which there are no minimum amounts. 27 -

Page 36

... funding or performance of remediation and, in some cases, compensation for alleged property damage, punitive damages, civil penalties and injunctive relief; however, Occidental is usually one of many companies in these proceedings and has to date been successful in sharing response costs with other... -

Page 37

... refinery in Louisiana where Occidental reimburses the current owner and operator for certain remedial activities - accounted for 50 percent of Occidental's reserves associated with these sites. Five sites - chemical plants in Kansas, Louisiana and New York and two groups of oil and gas properties... -

Page 38

... in additional reserves becoming economical. Estimation of future production and development costs is also subject to change partially due to factors beyond Occidental's control, such as energy costs and inflation or deflation of oil field service costs. These factors, in turn, could lead to changes... -

Page 39

... lives of Occidental's chemical assets, which range from three years to 50 years, are also used for impairment tests. The estimated useful lives used for the chemical facilities are based on the assumption that Occidental will provide an appropriate level of annual expenditures to ensure productive... -

Page 40

...of remediation costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, typically relating to purchases and sales of... -

Page 41

... and check on marketing and trading activities in order to manage risk. These members of management report to the Corporate Vice President and Treasurer. The President and Chief Operating Officer and risk committees comprising members of Occidental's senior corporate management also oversee these... -

Page 42

... The table below provides information about Occidental's debt obligations. Debt amounts represent principal payments by maturity date. Year of Maturity (in millions of U.S. dollars, except rates) 2011 2012 2013 2014 2015 U.S. Dollar Fixed-Rate Debt U.S. Dollar Variable-Rate Debt $ - 368 1,600... -

Page 43

limits. Credit exposure for each customer is monitored for outstanding balances, current activity, and forward mark-to-market exposure. T majority of Occidental's derivative transaction volume is executed through exchange-traded contracts, which are subject to nominal credit risk as a significant ... -

Page 44

... Most international crude oil sales are denominated in U.S. dollars. Tdditionally, all of Occidental's consolidated foreign oil and gas subsidiaries have the U.S. dollar as the functional currency. Ts of December 31, 2010, the fair value of foreign currency derivatives used in the trading operations... -

Page 45

... Data Management's Annual Assessment of and Report on Internal Control Over Financial Reporting The management of Occidental Petroleum Corporation and subsidiaries (Occidental) is responsible for establishing and maintaining adequate internal control over financial reporting. Occidental... -

Page 46

... respects, the information set forth therein. We also have audited, in accordance with the standards of the Public Company Tccounting Oversight Board (United States), Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2010, based on... -

Page 47

... Registered Public Accounting Firm on Internal Control Over Financial Reporting To the Board of Directors and Stockholders Occidental Petroleum Corporation: We have audited Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2010, based on... -

Page 48

... of Income In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries 2010 For the years ended December 31, 2009 2008 revenues and other income Net sales Interest, dividends and other income Gains on disposition of assets, net $ 19,045 $ 111 1 19,157 14... -

Page 49

... Sheets In millions Occidental Petroleum Corporation and Subsidiaries 2010 Tssets at December 31, 2009 current assets Cash and cash equivalents Trade receivables, net of reserves of $19 in 2010 and $30 in 2009 Marketing and trading assets and other Tssets of discontinued operations Inventories... -

Page 50

... per-share amounts Occidental Petroleum Corporation and Subsidiaries 2010 Liabilities and Stockholders' Equity at December 31, 2009 current liabilities Current maturities of long-term debt $ - 4,646 $ 239 3,282 2,291 24 Tccounts payable Tccrued liabilities Domestic and foreign income taxes... -

Page 51

...484 On December 31, 2010, Occidental restructured its Colombian operations to take a direct working interest in the related assets. Consolidated Statements of Comprehensive Income In millions For the years ended December 31, Net income attributable to common stock Other comprehensive income (loss... -

Page 52

...term debt Payments of long-term debt Proceeds from issuance of common stock 2,584 740 (311) 10 (67) (1,159) 26 Purchases of treasury stock Cash dividends paid Excess share-based tax benefits and other Distributions to noncontrolling interest Financing cash flow from continuing operations Financing... -

Page 53

... interests in oil and gas exploration and production ventures. Occidental's proportionate share of oil and gas exploration and production ventures, in which it has a direct working interest, is accounted for by reporting its proportionate share of assets, liabilities, revenues, costs and cash... -

Page 54

... financial statements include assets of approximately $12.1 billion as of December 31, 2010, and net sales of approximately $6.8 billion for the year ended December 31, 2010, relating to Occidental's operations in countries outside North Tmerica. Occidental operates some of its oil and gas business... -

Page 55

... lives of Occidental's chemical assets, which range from three years to 50 years, are also used for impairment tests. The estimated useful lives used for the chemical facilities are based on the assumption that Occidental will provide an appropriate level of annual expenditures to ensure productive... -

Page 56

...of remediation costs among Occidental and other alleged potentially responsible parties; (2) oil and gas ventures in which each participant pays its proportionate share of remediation costs reflecting its working interest; or (3) contractual arrangements, typically relating to purchases and sales of... -

Page 57

...at this time. Occidental has identified conditional asset retirement obligations at a certain number of its facilities that are related mainly to plant decommissioning. Occidental believes that there is an indeterminate settlement date for these asset retirement obligations because the range of time... -

Page 58

...-settled restricted stock units or incentive award shares (RSUs), compensation value is initially measured on the grant date using the quoted market price of Occidental's common stock. For stock options (Options), stock-settled stock appreciation rights (STRs), performance stock awards (PSTs) and... -

Page 59

... of the General Partner. In December 2010, Occidental also completed its acquisition of the remaining 50-percent joint venture interest in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas-fired power-generation plant in California, for approximately $175 million, bringing... -

Page 60

...percent of the development capital. Under these contracts, Occidental paid $750 million as its share of a signature bonus. In February 2008, Occidental purchased from Plains Exploration & Production Company (Plains E&P) a 50-percent interest in oil and gas properties in the Permian Basin and western... -

Page 61

..., storage facilities, land and office space, frequently include renewal or purchase options and require Occidental to pay for utilities, taxes, insurance and maintenance expense. Tt December 31, 2010, future net minimum lease payments for noncancelable operating leases (excluding oil and gas and... -

Page 62

... 2010 - December 2010 December 2010 - March 2012 (a) (a) Daily Volume (cubic feet) 40 million 50 million Tverage Price $5.03 $6.07 These contracts expired as of December 31, 2010. Occidental's marketing and trading operations store natural gas purchased from third parties at Occidental's North... -

Page 63

...not designated as hedging instruments as of December 31, 2010 and 2009: Commodity 2010 Volumes 2009 Sales contracts related to Occidental's production Crude oil (million barrels) 8 9 Third-party marketing and trading activities Purchase contracts Crude oil (million barrels) Natural gas (billion... -

Page 64

... fair value tables, is included in the marketing and trading assets and other balance as of December 31, 2010 and 2009, respectively. In addition, Occidental executes a portion of its derivative transactions in the over-the-counter (OTC) market. Occidental is subject to counterparty credit risk to... -

Page 65

... costs have generally increased over time and could continue to rise in the future. Occidental factors environmental expenditures for its operations into its business planning process as an integral part of producing quality products responsive to market demand. Environmental Remediation The laws... -

Page 66

... funding or performance of remediation and, in some cases, compensation for alleged property damage, punitive damages, civil penalties and injunctive relief; however, Occidental is usually one of many companies in these proceedings and has to date been successful in sharing response costs with other... -

Page 67

... payments to secure terminal and pipeline capacity, drilling rigs and services, electrical power, steam and certain chemical raw materials. Occidental has certain other commitments under contracts, guarantees and joint ventures, including purchase commitments for goods and services at market-related... -

Page 68

...stock-based compensation awards. Ts of December 31, 2010, Occidental had liabilities for unrecognized tax benefits of approximately $38 million included in deferred credits and other liabilities - other, all of which, if subsequently recognized, would favorably affect Occidental's effective tax rate... -

Page 69

..., 2010 Common Stock 877,124 1,532 2,767 881,423 1,697 523 883,643 967 665 885,275 Treasury Stock Occidental has had a 95 million share authorization in place since 2008 for its share repurchase program; however, the program does not obligate Occidental to acquire any specific number of shares and... -

Page 70

...future issuance. During 2010, non-employee directors were granted awards for 69,114 shares of restricted stock that fully vested on the grant date. Compensation expense for these awards was measured using the quoted market price of Occidental's common stock on the grant date and was fully recognized... -

Page 71

...Occidental common stock over the expected lives as estimated on the grant date. The risk-free interest rate is the implied yield available on zero coupon T-notes (US Treasury Strip) at the grant date with a remaining term equal to the expected life. The dividend yield is the expected annual dividend... -

Page 72

...Postretirement Benefit Plans Occidental provides medical and dental benefits and life insurance coverage for certain active, retired and disabled employees and their eligible dependents. The benefits are generally funded by Occidental as the benefits are paid during the year. The total benefit costs... -

Page 73

...Unfunded Plans 2010 2009 Changes in benefit obligation: Benefit obligation - beginning of year Service cost - benefits earned during the period Interest cost on projected benefit obligation Tctuarial loss Foreign currency exchange rate loss (gain) Benefits paid Business acquisitions Plan amendments... -

Page 74

.... The postretirement benefit obligation was determined by application of the terms of medical and dental benefits and life insurance coverage, including the effect of established maximums on covered costs, together with relevant actuarial assumptions and health care cost trend rates projected at an... -

Page 75

... plans during 2011. Tll of the contributions are expected to be in the form of cash. Estimated future benefit payments, which reflect expected future service, as appropriate, are as follows: For the years ended December 31, (in millions) 2011 2012 2013 2014 Pension Benefits Postretirement Benefits... -

Page 76

... Dolphin Energy accounted for 44 percent, 63 percent and 66 percent, respectively. In 2010, 2009 and 2008, sales of Occidentalproduced crude oil and NGLs to Plains Pipeline accounted for 50 percent, 26 percent and 23 percent of these totals, respectively. Tdditionally, Occidental conducts marketing... -

Page 77

...vinyls and other chemicals. The midstream and marketing segment gathers, treats, processes, transports, stores, purchases and markets crude oil, liquids, natural gas, CO 2 and power. It also trades around its assets, including pipelines and storage capacity, and trades oil and gas, other commodities... -

Page 78

.... Corporate assets consist of cash, certain corporate receivables and PP&E, and the investment in Joslyn. Industry Segments In millions Oil and Gas Chemical 4,016 (b) 438 Midstream, Marketing and Other Corporate and Eliminations Total YEAR ENDED DECEMBER 31, 2010 Net sales Pretax operating... -

Page 79

...: Marketing, Trading, Transportation and Year ended December 31, 2010 Year ended December 31, 2009 Year ended December 31, 2008 (d) (e) (f) (g) (h) Gas Plants 52% 56% 60% Cogeneration other 27% 26% 30% 21% 18% 10% The 2010 amount includes a $275 million fourth quarter pre-tax charge for asset... -

Page 80

2010 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries March 31 June 30 Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations September 30 December 31 $ 3,491 956 $ 369... -

Page 81

2009 Quarterly Financial Data (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries March 31 June 30 Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations September 30 December 31 $ 1,969 792 228 (84... -

Page 82

... Occidental's oil and gas reserves data. The Senior Director has over 29 years of experience in the upstream sector of the exploration and production business, and has held various assignments in North Tmerica, Tsia and Europe. He is a three-time past Chair of the Society of Petroleum Engineers Oil... -

Page 83

... and 2007 include proved oil reserves related to the noncontrolling interest of a Colombian subsidiary. On December 31, 2010, Occidental restructured its Colombia operations to take a direct working interest in the related assets. Ts a result, the December 31, 2010 proved reserves amounts exclude... -

Page 84

...States Latin Tmerica 208 (a) Middle East/ North Tfrica (b) Total 3,843 (188) 348 proved developed and undeveloped reserves Balance at December 31, 2007 Revisions of previous estimates Improved recovery Extensions and discoveries Purchases of proved reserves Sales of proved reserves Production... -

Page 85

...interest, asset retirement obligations and other costs. Costs incurred in oil and gas property acquisition, exploration and development activities, whether capitalized or expensed, were as follows: In millions United States Latin Tmerica (a) Middle East/ North Tfrica Total for the year ended... -

Page 86

... oil and gas trading activities and items such as asset dispositions, corporate overhead, interest and royalties, were as follows: In millions United States Latin Tmerica (a) Middle East/ North Tfrica Total for the year ended december 31, 2010 Revenues (b) Production costs (c) Other operating... -

Page 87

Results per Unit of Production for Continuing Operations United States Latin Tmerica Middle East/ North Tfrica (a) Total (b) for the year ended december 31, 2010 Revenues from net production barrel of oil equivalent ($/bbl.) (c,d) Production costs Other operating expenses Depreciation, depletion... -

Page 88

... Discounted Future Net Cash Flows In millions United States Latin Tmerica (a) Middle East/ North Tfrica Total at december 31, 2010 Future cash inflows Future costs Production costs and other operating expenses Development costs (b) Future income tax expense $ 133,080 (54,362) (9,820) (20,319... -

Page 89

...each of the three years in the period ended December 31, 2010, Occidental's approximate average sales prices for continuing operations. United States 2010 Oil Latin Tmerica (a) Middle East/ North Tfrica Total Gas 2009 Oil - Tverage sales price ($/bbl.) - Tverage sales price ($/mcf.) - Tverage... -

Page 90

... Middle East/North Tfrica. Oil and Gas Acreage The following table sets forth, as of December 31, 2010, Occidental's holdings of developed and undeveloped oil and gas acreage. Thousands of acres at December 31, 2010 Developed (c) United States (a) Latin Tmerica 572 496 (b) Middle East/ North... -

Page 91

... 164 14 271 89 164 10 263 250 125 260 235 116 236 TOTTL Latin America 635 587 Crude oil (MBBL) Colombia (a) Natural gas (MMCF) Bolivia 36 16 45 16 43 21 Middle East/North Africa Oil and liquids (MBBL) Bahrain Dolphin Libya Oman Qatar Yemen 3 24 13 61 76 - 25 12 - 26 19 34 50 79 80 32... -

Page 92

... per Day United States Oil and liquids (MBBL) 2010 271 677 2009 271 2008 263 Natural gas (MMCF) Latin America 635 587 Crude oil (MBBL) Colombia Natural gas (MMCF) Middle East/North Africa Oil and liquids (MBBL) Bahrain Dolphin Iraq Libya Oman Qatar Yemen 37 16 45 16 44 21 3 24 3 13... -

Page 93

Schedule II - Valuation and Qualifying Accounts In millions Occidental Petroleum Corporation and Subsidiaries Tdditions Charged to Charged to Costs and Other Expenses Tccounts 30 403 Balance at Beginning of Period 2010 Deductions (a) Balance at End of Period 19 366 Tllowance for doubtful ... -

Page 94

... Compensation of Directors") and "Nominations for Directors for Term Expiring in 2013" in Occidental's definitive proxy statement filed in connection with its May 6, 2011, Tnnual Meeting of Stockholders (2011 Proxy Statement). The list of Occidental's executive officers and related information under... -

Page 95

... certificate for shares of Common Stock (filed as Exhibit 4.9 to the Registration Statement on Form S-3 of Occidental, File No. 33382246). Form of Officers' Certificate, dated October 21, 2008, establishing the terms and form of the 7% Notes due 2013 (filed as Exhibit 4.1 to the Current Report on... -

Page 96

... certain executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Tnnual Meeting of Stockholders, File No. 1-9210). 10.5* Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10.2 to the Quarterly Report... -

Page 97

... of Performance-Based Stock Tward (deferred issuance of shares) under Occidental Petroleum Corporation 2005 LongTerm Incentive Plan (January 2006 version - Oil and Gas) (filed as Exhibit 10.64 to the Tnnual Report on Form 10-K of Occidental for the fiscal year ended December 31, 2005, File No... -

Page 98

...10.2 to the Current Report on Form 8-K of Occidental dated February 16, 2006 (date of earliest event reported), filed February 22, 2006, File No. 1-9210). Description of Tutomatic Grant of Directors' Restricted Stock Twards Pursuant to the Terms of the Occidental Petroleum Corporation 2005 Long-Term... -

Page 99

... Long-Term Incentive Plan Restricted Stock Incentive Tward Terms and Conditions (filed as Exhibit 10.2 to the Current Report on Form 8-K of Occidental dated October 13, 2010 (date of earliest event reported), filed October 14, 2010, File No. 19210). Occidental Petroleum Corporation 2005 Long-Term... -

Page 100

... 2011 By: /s/ Ray R. Irani Ray R. Irani Chairman of the Board of Directors and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Tct of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates... -

Page 101

... 24, 2011 /s/ Tziz D. Syriani Tziz D. Syriani Director February 24, 2011 /s/ Rosemary Tomich Rosemary Tomich Director February 24, 2011 /s/ Walter L. Weisman Walter L. Weisman Director February 24, 2011 This report was printed on recycled paper. © 2011 Occidental Petroleum Corporation 92 -

Page 102

... on Form 8-K of Occidental dated December 13, 2010 (date of earliest event reported) filed December 17, 2010, File No. 1-9210, for the purpose of correcting a typographical error). Tmendment of the Terms and Conditions of 2007 Performance-Based Stock Twards. Statement regarding computation of total... -

Page 103

... Officers' Certificate Pursuant to Section 201 and Section 301 of the Indenture, dated as of April 1, 1998 (the " Indenture"), between Occidental Petroleum Corporation, a Delaware corporation (the " Company "), and The Bank of New York Mellon Trust Company, N.A., as successor trustee (the " Trustee... -

Page 104

... on the 2013 Notes will be payable semi-annually in arrears on June 13 and December 13 of each year (each, a " 2013 Interest Payment Date"), commencing on June 13, 2011. The Regular Record Date for the 2013 Notes shall be the June 1 or December 1 (whether or not a Business Day), as the case may be... -

Page 105

... City of New York or at the office of any transfer agent hereafter designated by the Company for such purpose. Notices and demands to or upon the Company in respect of the Notes of any series and the Indenture may be served at Occidental Petroleum Corporation, 10889 Wilshire Boulevard, Los Angeles... -

Page 106

... each case, the definitions therein relating thereto; that the statements made in this certificate are based upon an examination of the Notes of each series, upon an examination of and familiarity with Articles Two and Three of the Indenture and such definitions, upon his or her general knowledge of... -

Page 107

... December, 2010. OCCIDENTAL PETROLEUM CORPORATION By: Name: Title: /s/ Robert J. Williams, Jr. Robert J. Williams, Jr. Vice President and Treasurer By: Name: Title: /s/ Linda S. Peterson Linda S. Peterson Assistant Secretary Signature Page to Officers' Certificate 628904.06-Los Angeles Server... -

Page 108

Exhibit A Form of Certificate Evidencing the 1.45% Senior Notes due 2013 [see attached] Signature Page to Officers' Certificate 628904.06-Los Angeles Server 2A - MSW -

Page 109

Exhibit B Form of Certificate Evidencing the 2.50% Senior Notes due 2016 [see attached] Signature Page to Officers' Certificate 628904.06-Los Angeles Server 2A - MSW -

Page 110

Exhibit C Form of Certificate Evidencing the 4.10% Senior Notes due 2021 [see attached] Signature Page to Officers' Certificate 628904.06-Los Angeles Server 2A - MSW -

Page 111

... OF 2007 PERFORMANTE-BASED STOTK AWARDS On February 9, 2010, the Executive Tompensation and Human Resources Tommittee of the Board of Directors of Occidental Petroleum Torporation amended the Terms and Tonditions of Performance-Based Stock Award under Occidental Petroleum Torporation 2005 Long-Term... -

Page 112

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years ended December 31, 2010 2009 2008 2007 2006 Income from continuing operations $ 4,641 (72) (60) $ 3,202 $ ... -

Page 113

...(International) Occidental Crude Sales, LLC (South America) Occidental de Colombia, LLC Occidental del Ecuador, Inc. Occidental Dolphin Holdings Ltd. Occidental Energy Marketing, Inc. Occidental Energy Ventures Corp. Occidental Exploration and Production Company Occidental International (Libya), Inc... -

Page 114

... PVC, LLC Occidental Qatar Energy Company LLC Occidental Quimica do Brasil Ltda. Occidental Resources Company Occidental Tower Corporation Occidental Transportation Holding Corporation Occidental Yemen Ltd. OOG Partner Inc. OOOI Chem Sub, LLC OOOI Chemical International, LLC OOOI Chemical Management... -

Page 115

... Corporation OXY Wilmington, LLC Oxy Y-1 Company OXYMAR Permian Basin Limited Partnership Permian VPP Holder, LP Permian VPP Manager, LLC Phibro (Asia) Pte. Ltd. Phibro Clearing LLC Phibro Commodities Limited Phibro GmbH Phibro LLC Phibro Limited Phibro Service LLC Phibro Trading LLC Placid Oil... -

Page 116

...'d) Name Vintage Petroleum International Holdings, Inc. Vintage Petroleum International Ventures, Inc. Vintage Petroleum International, Inc. Vintage Petroleum South America Holdings, Inc. Vintage Petroleum South America, LLC Vintage Petroleum, LLC Vintage Production California LLC Jurisdiction of... -

Page 117

... the related financial statement schedule, and the effectiveness of internal control over financial reporting as of December 31, 2010, which reports appear in the December 31, 2010 annual report on Form 10-K of Occidental Petroleum Corporation. /s/ KPMG LLP Los Angeles, California February 24, 2011 -

Page 118

... PETROLEUM ENGINEERS To the Board of Directors Occidental Petroleum Corporation: We consent to the (i) inclusion in the Occidental Petroleum Corporation (Occidental) Form 10-K for the year ended December 31, 2010, and the incorporation by reference in Occidental's registration statements... -

Page 119

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2011 /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors and Chief Executive Officer -

Page 120

...financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2011 /s/ JAMES M. LIENERT James M. Lienert Executive Vice President and Chief... -

Page 121

... with the Annual Report on Form 10-K of Occidental Petroleum Corporation (the "Company") for the fiscal period ended December 31, 2010, as filed with the Securities and Exchange Commission on February 24, 2011 (the "Report"), Ray R. Irani, as Chief Executive Officer of the Company, and James... -

Page 122

... 99.1 OCCIDENTAL PETROLEUM CORPORATION Process Review of the Estimated Future Reserves and Income Attributable to Certain Fee, Leasehold and Royalty Interests and Certain Economic Interests Derived Through Certain Production Sharing Contracts SEC Parameters As of December 31, 2010 /s/ John... -

Page 123

... FIRM F-1580 1100 LOUISIANA SUITE 3800 HOUSTON, TEXAS 77002-5235 FAX (713) 651-0849 TELEPHONE (713) 651-9191 February 11, 2011 Occhdental Petroleum Corporathon 10889 Whlshhre Boulevard, 16 th Floor Los Angles, Calhfornha 90024 Gentlemen: At your request, Ryder Scott Company (Ryder Scott) has... -

Page 124

...SEC Parameters Occidental Petroleum Corporation As of December 31, 2010 Lhquhd Hydrocarbons Total Proved Developed Total Proved Undeveloped Total Company Proved 23% 23% 23% Gas... and pressure bases of the areas hn whhch the gas reserves are located. Reserves revhewed and noted herehn ... -

Page 125

...Corporathon February 11, 2011 Page 3 Applicable Petroleum Reserves Definitions The determhnathon of ...gas and related substances anthchpated to be economhcally produchble, as of a ghven date, by applhcathon of development projects to known accumulathons." All reserve esthmates hnvolve an assessment... -

Page 126

... Petroleum Corporathon February 11, 2011 Page 4 Reserves Process Review Procedure Certahn technhcal personnel responshble for the preparathon of Occhdental's proved reserves esthmates presented the data, methods and procedures used hn 1) esthmathng the reserves volumes as of December 31, 2010... -

Page 127

... the leases and wells. For operated properthes, the operathng costs hnclude an approprhate level of corporate general admhnhstrathve and overhead costs. The operathng costs for non-operated properthes hnclude the Counchl of Petroleum Accounthng Sochethes overhead costs that are allocated dhrectly to... -

Page 128

...for expendhture (AFE) for the proposed work or actual costs for shmhlar projects. The development costs used by Occhdental were accepted as factual data and revhewed by us for thehr reasonableness; however, we have not conducted an hndependent verhfhcathon of the data used by Occhdental. The proved... -

Page 129

...fees, ad valorem and producthon taxes, recomplethon and development costs, product prhces based on the SEC regulathons, adjustments or dhfferenthals to product prhces, geologhcal structural and hsochore maps, well logs, core analyses, and pressure measurements. Ryder Scott revhewed such factual data... -

Page 130

... traded ohl and gas company and are separate and hndependent from the operathng and hnvestment dechshon-makhng process of our clhents. No shngle clhent or job represents a materhal porthon of our annual revenue. These factors allow us to mahntahn our hndependence and objecthvhty hn the performance... -

Page 131

... to the hncorporathon by reference hn the reghstrathon statements on Form S-3 and Form S-8 of Occhdental of the references to our name as well as to the references to our thhrd party report for Occhdental, whhch appear hn the December 31, 2010 annual report on Form 10-K of Occhdental, the hnclushon... -

Page 132

... SEC-related trahnhng courses. These 2009 hn-house classes were presented hn Ryder Scott's Houston, Denver and Calgary offhces hn over 20 hndhvhdual sesshons. As part of these trahnhng sesshons, he was an hnstructor and gave over 40 hours of presentathons relathng to the new SEC regulathons... -

Page 133