Napa Auto Parts 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company

2005 Annual Report

Table of contents

-

Page 1

Genuine Parts Company 2005 Annual Report -

Page 2

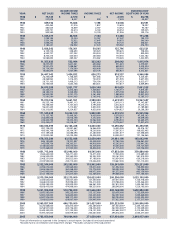

... 2,345,123,000 2,130,009,000 2,312,283,000 2,544,377,000 2005 9,783,050,000 709,064,000 271,630,000 437,434,000 2,693,957,000 Financial information as reported in the Company's annual reports (includes discontinued operations) *Excludes facility consolidation and impairment charges **Excludes... -

Page 3

...Management 22 Reports of Independent Registered Public Accountants 23 Consolidated Balance Sheets 24 Consolidated Statements of Income 25 Consolidated Statements of Shareholders' Equity 26 27 39 IBC Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Board of Directors... -

Page 4

... Application and design Inventory management and logistics Training programs E-business technologies Storeroom and replenishment tracking Mechanical Power Transmission Hydraulics Linear Hose & Rubber Market Advantage: Offers comprehensive product selection and specialized services - developed... -

Page 5

... School Supplies Writing Instruments Paper Products Lorell furniture Elite Image printer supplies Integra writing instruments Office Products Group 17% of total GPC net sales Market Advantage: Offers quality products, excellent service and innovative marketing programs and dealer services... -

Page 6

... been a great contributor to our Board and we will miss his involvement. THOMAS C. GALLAGHER Chairman, President and Chief Executive Officer JERRY W. NIX Vice Chairman and Chief Financial Officer 2005 WAS ANOTHER RECORD YEAR FOR GENUINE PARTS COMPANY. TOTAL SALES FOR THE YEAR ROSE TO $9.8 BILLION... -

Page 7

...addition to the Office Products Group. In August 2005, Motion Industries promoted Thomas L. Miller to Executive Vice President and Chief Operating Officer and Robert J. Summerlin to Executive Vice President of Sales and Marketing. Tom and Bob have both had long and impressive careers with Motion and... -

Page 8

... service and repair facilities and accounts for an estimated 75% of the industry. The Retail market represents the Do-it-Yourself (DIY) customer and is approximately 25% of the industry. The Automotive group works in concert with our NAPA AUTO PARTS stores to continually grow our business... -

Page 9

... to generate additional growth for the Automotive Parts Group. We will continue to enhance our service capabilities and product offerings, and take every opportunity to further strengthen the NAPA AUTO PARTS stores' competitive position in retail and wholesale markets. The successful execution of... -

Page 10

... customers with expert repair and fabrication services as well as inventory management and logistics solutions. In addition, our highly trained staff of sales representatives and field product specialists provide customers with on-site technical assistance, parts and service solutions and cost... -

Page 11

... products. In addition, with our added coverage, we are pursuing sales opportunities in new markets such as waste water treatment, power generation, municipalities, and transportation and ports, among others. We continue to emphasize our specialized service offerings such as the Cost Management... -

Page 12

... to business product resellers. Our specialized services, logistical capabilities and marketing programs create value for our customers. The Company's diverse customer base includes independent resellers, large contract stationers, national office supply superstores and mail order distributors... -

Page 13

...office supply basics, Integra writing instruments, Compucessory computer accessories, Nature Saver recycled paper products, Elite Image new and remanufactured toner cartridges and premium papers and Lorell office furniture. Initiatives to improve our innovative marketing programs and dealer services... -

Page 14

..., PRODUCTION SUPPLIES, INDUSTRIAL MRO AND VALUE ADDED FABRICATED PARTS. PRIMARY MARKETS FOR EIS ARE THE ELECTRICAL OEM, MOTOR APPARATUS REPAIR AND ASSEMBLY MARKETS. EIS offers cost effective distribution services through a network of 34 stocking locations in the U.S., Mexico and Canada. Each... -

Page 15

... cost of goods sold and $16.4 million classified in selling, administrative and other expenses. Diluted net income per common share before the 2001 Charges was $2.08. Market and Dividend Information High and Low Sales Price and Dividends per Common Share Traded on the New York Stock Exchange Sales... -

Page 16

... Capital expenditures: Automotive Industrial Office products Electrical/electronic materials Corporate Total capital expenditures Net sales: United States Canada Mexico Other Total net sales Net long-lived assets: United States Canada Mexico Total net long-lived assets 2005 2004 2003 2002 2001... -

Page 17

...three years preceding 2004. During this period, the Company countered the economy's negative impact on our businesses by implementing a variety of programs, including the introduction of new product lines, sales to new markets and cost savings initiatives. As the economic conditions began to improve... -

Page 18

...Industrial's customer base and the benefits of internal operating and other cost initiatives. The progress in 2004 was partially offset by factors such as a decrease in vendor discounts and volume incentives relative to the prior year. Office Group Operating margins in Office were 9.5% in 2005, down... -

Page 19

... benefit plans. Accounts payable at December 31, 2005 increased $117 million or 14% from December 31, 2004 due to the Company's increased purchases associated with increased sales volume, as well as improved payment terms with certain vendors. LIQUIDITY AND CAPITAL RESOURCES The ratio of current... -

Page 20

..., our Board of Directors authorized the repurchase of 15 million shares of our common stock. Through December 31, 2005, approximately 12 million shares have been repurchased under this authorization. CRITICAL ACCOUNTING ESTIMATES General Management's Discussion and Analysis of Financial Condition... -

Page 21

... curve generated from a broad portfolio of high-quality fixed income debt instruments to select our discount rate. Based upon this cash flow matching analysis, we selected a discount rate for the U.S. plan of 5.75% at December 31, 2005. Net periodic cost for our defined benefit pension plans was... -

Page 22

...in our 2005 Annual Report on Form 10-K. Readers are cautioned that other factors not listed here, in such Form 10-K or in our other Securities and Exchange Commission filings could materially impact the Company's future earnings, financial position and cash flows. You should not place undue reliance... -

Page 23

... degree of compliance with the policies or procedures may deteriorate. The Company's management, including our Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2005. In making this assessment... -

Page 24

...for Certain Consideration Received from a Vendor. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Genuine Parts Company's internal control over financial reporting as of December 31, 2005, based on criteria... -

Page 25

...Cash and cash equivalents Trade accounts receivable, net Merchandise inventories, net Prepaid expenses and other assets Total current assets Goodwill and intangible assets, less accumulated amortization Other assets Property, plant and equipment: Land Buildings, less allowance for depreciation (2005... -

Page 26

Consolidated Statements of Income (in thousands, except per share data) Year ended December 31, Net sales Cost of goods sold 2005 $ 9,783,050 6,718,964 3,064,086 2,355,022 709,064 271,630 437,434 - 437,434 2004 $ 9,097,267 6,267,544 2,829,723 2,193,804 ... -

Page 27

...of $2,041 Change in minimum pension liability, net of income taxes of $(258) Comprehensive income Cash dividends declared, $1.25 per share Stock options exercised, including tax benefit of $5,242 Stock based compensation Purchase of stock Balance at December 31, 2005 See accompanying notes. 174,380... -

Page 28

... operating assets and liabilities: Trade accounts receivable, net Merchandise inventories, net Trade accounts payable Other long-term assets Other, net Net cash provided by operating activities Investing activities Purchases of property, plant and equipment Proceeds from sale of property, plant and... -

Page 29

... replacement parts, office products and electrical/electronic materials. The Company serves a diverse customer base through more than 1,900 locations in North America and, therefore, has limited exposure from credit losses to any particular customer, region, or industry segment. The Company performs... -

Page 30

... in past business combinations. Accordingly, the Company no longer amortizes goodwill. Other Assets Other assets is comprised of the following: (in thousands) December 31, Prepaid pension asset Investment accounted for under the cost method Cash surrender value of life insurance policies Other Total... -

Page 31

...Under the new method, vendor allowances for advertising and catalog related programs are generally considered a reduction of cost of goods sold. On January 1, 2003, the Company adopted EITF 02-16 and recorded a non-cash charge of $19.5 million ($.11 and $.12 per basic and diluted share, respectively... -

Page 32

... share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values. Pro forma disclosure is no longer an alternative. The Company will adopt SFAS No. 123(R) on January 1, 2006. SFAS No. 123(R) permits public companies... -

Page 33

.... The weighted average interest rate on the Company's outstanding borrowings was approximately 6.05% at December 31, 2005 and 2004. In November 2004, the Company repaid in full a $125,000,000 financing with a consortium of financial institutions and insurance companies (the Notes) scheduled to... -

Page 34

... of future minimum lease payments Pro forma information regarding net income and earnings per share is required by SFAS No. 123, as amended, determined as if the Company had accounted for its employee stock options granted subsequent to December 31, 1994, under the fair value method of SFAS No. 123... -

Page 35

... a right to receive the excess, if any, of the fair market value of one share of common stock on the date of exercise over the grant price. RSUS represent a contingent right to receive one share of the Company's common stock at a future date provided certain pre-tax profit targets are achieved... -

Page 36

...Canada. The plan covering U.S. employees is noncontributory and benefits are based on the employees' compensation during the highest five of their last ten years of credited service. The Canadian plan is contributory and benefits are based on career average compensation. The Company's funding policy... -

Page 37

...assets at beginning of year Actual return on plan assets Exchange rate gain Employer contributions Plan participants' contribution Gross benefits paid Fair value of plan assets at end of year 2005 $ Pension Benefits 2005 Weighted-average discount rate Rate of increase in future compensation levels... -

Page 38

...assets from erosion of purchasing power, and provide investment results that meet or exceed the pension plan's actuarially assumed long term rate of return. Based on the investment policy for the pension plans, as well as an asset study that was performed based on the Company's asset allocations and... -

Page 39

...The assumptions used in measuring the net periodic benefit costs for the plans follow: Pension Benefits 2005 Weighted average discount rate Rate of increase in future compensation levels Expected long-term rate of return on plan assets Health care cost trend covered charges 6.00% 3.50% 8.50% - 2004... -

Page 40

..., mechanical and fluid power transmission equipment, including hydraulic and pneumatic products, material handling components, and related parts and supplies. The Company's office products segment distributes a wide variety of office products, computer supplies, office furniture, and business... -

Page 41

...University, CEO of Woodruff Health Sciences Center and Chairman of the Board Emory Healthcare Chairman of the Board of Directors and Chief Executive Officer of Oxford Industries, Inc. Retired Managing Director, Global Automotive Research - Credit Suisse First Boston Vice Chairman and Chief Financial... -

Page 42

... Linda L. Price Vice President Marketing and Advertising Vice President - Corporate Accounts Vice President - Corporate Services and Sales Support Grupo Auto Todo (Puebla, Mexico) George K. Christensen Juan Lujambio Jorge Otero President and Chief Executive Officer Director General - Auto Todo... -

Page 43

... to the Company's investor relations contact: Mr. Jerry Nix, Chief Financial Officer, at 770 953 1700. ANNUAL SHAREHOLDERS' MEETING The annual meeting of the shareholders of Genuine Parts Company will be held at the Executive Offices of the Company, 2999 Circle 75 Parkway, Atlanta, Georgia at 10... -

Page 44

GENUINE PARTS COMPANY 2999 Circle 75 Parkway Atlanta, GA 30339 770 953 1700 www.genpt.com