McKesson 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Fiscal Year Ended March 31, 2010

Table of contents

-

Page 1

Annual Report Fiscal Year Ended March 31, 2010 -

Page 2

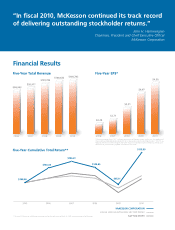

...cer McKesson Corporation Financial Results *Diluted earnings per share ("EPS") excludes adjustments for litigation charges (credits), net. For supplemental ï¬nancial data and corresponding reconciliation to U.S. generally accepted accounting principles ("GAAP"), see Appendix A to this 2010 Annual... -

Page 3

... Recovery and Reinvestment Act offers incentives totaling approximately $19 billion to care providers who adopt healthcare information technology (HIT). McKesson can help providers qualify for these funds with our marketleading clinical systems, analytics, and connectivity solutions. The need... -

Page 4

... clients at the CDC. Never before have so many McKesson employees from across the Company come together as one team for a customer, putting on full display our operational excellence and industry-leading capabilities. In total, all businesses in Distribution Solutions met or exceeded their strategic... -

Page 5

...innovation, people management, use of corporate assets, social responsibility, quality of management, ï¬nancial soundness, long-term investment, quality of products and services, and global competitiveness. McKesson ranked number one in all nine categories This distinction recognizes companies for... -

Page 6

(This page intentionally left blank) -

Page 7

... OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission File Number 1-13252 McKESSON CORPORATION A Delaware Corporation I.R.S. Employer Identification Number 94-3207296 McKesson Plaza One Post Street, San Francisco, CA 94104 Telephone (415) 983-8300... -

Page 8

... with Accountants on Accounting and Financial Disclosure...Controls and Procedures...Other Information...PART III 10. 11. 12. Directors, Executive Officers and Corporate Governance ...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 9

... General Business McKesson Corporation ("McKesson," the "Company," the "Registrant" or "we" and other similar pronouns), is a Fortune 14 corporation that delivers medicines, pharmaceutical supplies, information and care management products and services designed to reduce costs and improve quality... -

Page 10

... distribution network that supports best-in-class direct store delivery. EnterpriseRxSM - A fully integrated and centrally hosted pharmacy management solution (application service provider model). Built utilizing the latest technology, EnterpriseRxSM centralizes data, reporting, pricing and drug... -

Page 11

... brands. FrontEdgeâ„¢ - Strategic planning, merchandising and price maintenance program that helps independent pharmacies maximize store profitability. McKesson Home Health Care - Comprehensive line of more than 1,800 home health care products, including durable medical equipment, diabetes supplies... -

Page 12

... centralizes data, reporting, pricing and drug updates, providing the operational control, visibility and support needed to reduce costs and streamline administrative tasks. We also own a 39% interest in Parata which sells automated pharmacy and supply management systems and services to... -

Page 13

... a clinical data repository, health care planning, physician order entry, point-of-care documentation with bar-coded medication administration, enterprise laboratory, radiology, pharmacy, surgical management, an emergency department solution and an ambulatory EHR system. Horizon Clinicals® also... -

Page 14

... pharmacies and payors. Revenue cycle outsourcing enables physician groups to avoid the infrastructure investment and administrative costs of an in-house billing office. Services include clinical data collection, data input, medical coding, billing, contract management, cash collections, accounts... -

Page 15

McKESSON CORPORATION Competition In every area of healthcare distribution operations, our Distribution Solutions segment faces strong competition, both in price and service, from national, regional and local full-line, short-line and specialty wholesalers, service merchandisers, self-warehousing ... -

Page 16

McKESSON CORPORATION Other Information about the Business Customers: During 2010, sales to our ten largest customers accounted for approximately 53% of our total consolidated revenues. Sales to our two largest customers, CVS Caremark Corporation ("CVS") and Rite Aid Corporation ("Rite Aid"), ... -

Page 17

...1 and 21, "Significant Accounting Policies" and "Segments of Business," to the consolidated financial statements appearing in this Annual Report on Form 10-K. Forward-Looking Statements This Annual Report to Stockholders, including the Chairman's 2010 letter, "Management's Discussion and Analysis of... -

Page 18

... suppliers' pricing, selling, inventory, distribution or supply policies or practices, or changes in our customer mix could also significantly reduce our revenues and net income. Due to the diverse range of healthcare supply management and healthcare information technology products and services... -

Page 19

...government-sponsored healthcare programs, (2) impose a number of restrictions upon referring physicians and providers of designated health services under Medicare and Medicaid programs and (3) prohibit the knowing submission of a false or fraudulent claim for payment to a federal health care program... -

Page 20

... use of "certified" healthcare information technology products by healthcare providers in order to receive stimulus funds from the federal government. We may incur increased development costs and delays in delivering solutions if we need to upgrade our software and systems to be in compliance... -

Page 21

... Transparent Drug System for Patients Act and has recently announced a review of that legislation in an attempt to further reduce costs. Some of the changes being considered would adversely affect the distribution of drugs, pricing for prescription drugs and reduced funding for healthcare services... -

Page 22

...purchase and distribution of thousands of inventory items from numerous distribution centers, (2) receive, process and ship orders and handle other product and services on a timely basis, (3) manage the accurate billing and collections for thousands of customers and (4) process payments to suppliers... -

Page 23

... Solutions segment, deliver enterprise-wide clinical, patient care, financial, supply chain, strategic management software solutions and pharmacy automation to hospitals, physicians, homecare providers, retail and mail order pharmacies and payors. Challenges in integrating software products... -

Page 24

... claims, particularly if the access interruption is associated with problems in the timely delivery of medical care. We must maintain disaster recovery and business continuity plans that rely upon third-party providers of related services and if those vendors fail us at a time that our center... -

Page 25

...of 1996 ("HIPAA") and the HITECH Act, evolving laws and regulations in this area could restrict the ability of our customers to obtain, use or disseminate patient information or could require us to incur significant additional costs to re-design our products in a timely manner, either of which could... -

Page 26

... system, or modify or add business processes, are major decisions for healthcare organizations. Many of the solutions we provide typically require significant capital expenditures and time commitments by the customer. Recent legislation that provides incentives to purchase health information systems... -

Page 27

... capital and credit markets will not impair our liquidity or increase our costs of borrowing. Our $1.1 billion accounts receivable sales facility is generally renewed annually and will expire in mid-May 2010. Although we did not use this facility in 2010, we have historically used it to fund working... -

Page 28

... next several years without making capital expenditures materially higher than historical levels. Information as to material lease commitments is included in Financial Note 16, "Lease Obligations," to the consolidated financial statements appearing in this Annual Report on Form 10-K. Item 3. Legal... -

Page 29

...; Senior Vice President, Corporate Strategy and Business Development from September 2001 to April 2004. Service with the Company - 9 years. Executive Vice President, General Counsel and Chief Compliance Officer since April 2010 (functionally has served as chief compliance officer since March 2006... -

Page 30

...12, to this Annual Report on Form 10-K. (e) Share Repurchase Plans: The following table provides information on the Company's share repurchases during the fourth quarter of 2010: Share Repurchases (1) Total Number of Shares Purchased As Part of Publicly Announced Average Price Paid Program Per Share... -

Page 31

...stockholder return on the Company's common stock for the periods indicated with the Standard & Poor's 500 Index and the Value Line Healthcare Sector Index (composed of 154 companies in the health care industry, including the Company). $200.00 McKesson Corporation S&P 500 Index Value Line Healthcare... -

Page 32

... Position Working capital Days sales outstanding for: (1) Customer receivables Inventories Drafts and accounts payable Total assets Total debt, including capital lease obligations Stockholders' equity Property acquisitions Acquisitions of businesses, net Common Share Information Common shares... -

Page 33

...operating segments: Distribution Solutions and Technology Solutions. See Financial Note 21, "Segments of Business," to the accompanying consolidated financial statements for a description of these segments. RESULTS OF OPERATIONS Overview: (In millions, except per share data) Management's Discussion... -

Page 34

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Gross profit increased 6% to $5.7 billion and 7% to $5.4 billion in 2010 and 2009. As a percentage of revenues, gross profit increased 18 basis points ("bp") to 5.22% and 11 bp to 5.04% in 2010 and 2009. Gross profit margin increased in 2010 ... -

Page 35

...Distribution Solutions Direct distribution & services Sales to customers' warehouses Total U.S. pharmaceutical distribution & services Canada pharmaceutical distribution & services Medical-Surgical distribution & services Total Distribution Solutions Technology Solutions Services Software & software... -

Page 36

... this product line are now recorded by our U.S. pharmaceutical distribution and services business. Technology Solutions revenues increased in 2010 compared to prior year due to higher services revenues primarily caused by increases in outsourcing revenues for claims processing and other services and... -

Page 37

... our distribution businesses. Gross profit margin was also favorably affected by a higher buy side margin, which primarily reflects compensation from branded pharmaceutical manufacturers, and increased sales of higher margin generic drugs. These benefits were partially offset by a decline in sell... -

Page 38

... associated with our business acquisitions and higher employee compensation. The McKesson Corporation PSIP is a member of the settlement class in the Consolidated Securities Litigation Action. On April 27, 2009, the court issued an order approving the distribution of the settlement funds. On October... -

Page 39

... millions) 2010 $ 9 11 20 2008 - 8 8 Other workforce reduction charges, net (1) Distribution Solutions Technology Solutions Total Restructuring charges (credits), net Distribution Solutions (2) Technology Solutions (3) Corporate Total Total reduction in workforce and restructuring charges Cost of... -

Page 40

... AWP-related claims by public payors resulted in a pre-tax, non-cash charge of $493 million in the third quarter of 2009. Technology Solutions segment's operating expenses decreased over the past two years. Operating expenses and operating expenses as a percentage of revenues for 2010 benefited... -

Page 41

...the fourth quarter of 2009, we also recorded a pre-tax impairment of $5 million ($5 million after-tax) on another equity-held investment within our Distribution Solutions segment. Segment Operating Profit and Corporate Expenses: (Dollars in millions) 2010 $ 1,988 385 2,373 (342) 20 (187) 1,864 1.88... -

Page 42

... of limitations. In 2008, the U.S. Internal Revenue Service ("IRS") began its examination of our fiscal years 2003 through 2006. In 2009 and 2010, we received assessments from the Canada Revenue Agency ("CRA") for a total of $62 million related to transfer pricing for 2003, 2004 and 2005. We paid... -

Page 43

... pharmaceutical, health and beauty products to independent and regional chain pharmacies in the Midwestern U.S. This acquisition expanded our existing U.S. pharmaceutical distribution business. The acquisition was funded with cash on hand. During the first quarter of 2010, the acquisition accounting... -

Page 44

... Company reviews accounts receivable aging, industry trends, customer financial strength, credit standing, historical write-off trends and payment history to assess the probability of collection. If the frequency and severity of customer defaults due to our customers' financial condition or general... -

Page 45

.... Additional information concerning our allowance for doubtful accounts may be found in Schedule II included in this Annual Report on Form 10-K. Inventories: We report inventories at the lower of cost or market ("LCM"). Inventories for our Distribution Solutions segment consist of merchandise held... -

Page 46

... decline in the Company's stock price and/or market capitalization for a sustained period of time. Impairment testing is conducted at the reporting unit level, which is generally defined as a component - one level below our Distribution Solutions and Technology Solutions operating segments, for... -

Page 47

... carrying value. Supplier Incentives: Fees for service and other incentives received from suppliers, relating to the purchase or distribution of inventory, are generally reported as a reduction to cost of goods sold. We consider these fees and other incentives to represent product discounts and as... -

Page 48

... and in evaluating income tax uncertainties. We review our tax positions at the end of each quarter and adjust the balances as new information becomes available. Deferred income taxes arise from temporary differences between the tax and financial statement recognition of revenue and expense. In... -

Page 49

... related tax impact. These variables include the volatility of our stock price, employee stock option exercise behavior, timing, number and types of annual share-based awards and the attainment of performance goals. As a result, the future share-based compensation expense may differ from the Company... -

Page 50

... more detail in Financial Note 19, "Stockholders' Equity," to the consolidated financial statements appearing in this Annual Report on Form 10-K. During 2010, 2009 and 2008, the Company repurchased $299 million, $484 million and $1,686 million of its common stock at average prices of $41.47, $50.52... -

Page 51

... March 31, 2011. Working capital primarily includes cash and cash equivalents, receivables and inventories, net of drafts and accounts payable, deferred revenue and other current liabilities. Our Distribution Solutions segment requires a substantial investment in working capital that is susceptible... -

Page 52

... of the Company's long-term obligations including an immaterial amount of capital lease obligations. See Financial Note 12, "Long-Term Debt and Other Financing," for further information. (2) Represents our estimated benefit payments for the unfunded benefit plans and minimum funding requirements for... -

Page 53

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Credit Resources: We fund our working capital requirements primarily with cash and cash equivalents, our accounts receivable sales facility, short-term borrowings under the revolving credit facility and commercial paper. Long-Term Debt In March 2010,... -

Page 54

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Commercial Paper We issued and repaid commercial paper of nil and approximately $3.3 billion and $260 million in 2010, 2009 and 2008. There were no commercial paper issuances outstanding at March 31, 2010 and 2009. Debt Covenant Our various borrowing... -

Page 55

... debt securities with similar terms. Foreign exchange risk: We derive revenues and earnings from Canada, the United Kingdom, Ireland, other European countries, Israel, Asia Pacific and Mexico, which exposes us to changes in foreign exchange rates. We seek to manage our foreign exchange risk in part... -

Page 56

McKESSON CORPORATION Item 8. Financial Statements and Supplementary Data INDEX TO CONSOLIDATED FINANCIAL INFORMATION Page 51 52 53 54 55 56 57 Management's Annual Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Financial ... -

Page 57

...REPORTING The management of McKesson Corporation is responsible for establishing and maintaining an adequate system of internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). With the participation of the Chief Executive Officer and the Chief... -

Page 58

McKESSON CORPORATION REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of McKesson Corporation: We have audited the accompanying consolidated balance sheets of McKesson Corporation and subsidiaries (the "Company") as of March 31, 2010 and 2009, and ... -

Page 59

... $ 2010 Revenues Cost of Sales Gross Profit Operating Expenses Selling Distribution Research and development Administrative Litigation charge (credit), net Total Operating Expenses Operating Income Other Income, Net Interest Expense Income from Continuing Operations Before Income Taxes Income Tax... -

Page 60

McKESSON CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share amounts) March 31, 2010 ASSETS Current Assets Cash and cash equivalents Receivables, net Inventories, net Prepaid expenses and other Total Property, Plant and Equipment, Net Capitalized Software Held for Sale, Net ... -

Page 61

...tax benefit of $33 Net income Repurchase and retirement of common stock Cash dividends declared, $0.48 per common share Other Balances, March 31, 2009 Issuance of shares under employee plans Share-based compensation Tax benefit related to issuance of shares under employee plans ESOP note collections... -

Page 62

... taxes Share-based compensation expense Other non-cash items Changes in operating assets and liabilities, net of business acquisitions: Receivables Inventories Drafts and accounts payable Deferred revenue Taxes Litigation charge (credit), net Litigation settlement payments Deferred tax (benefit... -

Page 63

... medicines, pharmaceutical supplies, information and care management products and services designed to reduce costs and improve quality across the healthcare industry. We conduct our business through two operating segments, McKesson Distribution Solutions and McKesson Technology Solutions, as... -

Page 64

McKESSON CORPORATION FINANCIAL NOTES (Continued) Concentrations of Credit Risk and Receivables: Our trade receivables are subject to a concentration of credit risk with customers primarily in our Distribution Solutions segment. At March 31, 2010, revenues and accounts receivable from our ten largest... -

Page 65

...level below our Distribution Solutions and Technology Solutions operating segments, for which discrete financial information is available and segment management regularly reviews the operating results of that unit. Components that have essentially similar operations, products, services and customers... -

Page 66

... from revenues. The revenues for our Distribution Solutions segment include large volume sales of pharmaceuticals to a limited number of large customers who warehouse their own product. We order bulk product from the manufacturer, receive and process the product through our central distribution... -

Page 67

McKESSON CORPORATION FINANCIAL NOTES (Continued) We also offer certain products on an application service provider basis, making our software functionality available on a remote hosting basis from our data centers. The data centers provide system and administrative support, as well as hosting ... -

Page 68

...which is a wholly-owned, bankruptcy-remote subsidiary of McKesson Corporation that is consolidated in our financial statements. This SPE then sells undivided interests in the receivables to third-party purchaser groups, each of which includes commercial paper conduits ("Conduits"), which are special... -

Page 69

McKESSON CORPORATION FINANCIAL NOTES (Continued) Loss Contingencies: We are subject to various claims, other pending and potential legal actions for damages, investigations relating to governmental laws and regulations and other matters arising out of the normal conduct of our business. We record a ... -

Page 70

...earnings per share pursuant to the two-class method. This adoption did not have a material effect on our consolidated financial statements. Investments - Equity Method and Joint Ventures: On April 1, 2009, we adopted new standards on the initial measurement of an equity method investment, testing of... -

Page 71

... per share prospectively and is not a stock dividend. This adoption did not have a material affect on our consolidated financial statements; however, they may affect any future stock distributions. Compensation: On March 31, 2010, we adopted new standards on an employer's disclosures about plan... -

Page 72

... year and a not-to-compete agreement of $4 million with a useful life of 4 years. In 2008, we made the following acquisition: On October 29, 2007, we acquired all of the outstanding shares of Oncology Therapeutics Network ("OTN") of San Francisco, California for approximately $519 million, including... -

Page 73

... for our employees, officers and non-employee directors, including stock options, an employee stock purchase plan, restricted stock ("RS"), restricted stock units ("RSUs") and performancebased restricted stock units ("PeRSUs") (collectively, "share-based awards.") Most of our share-based awards are... -

Page 74

...options Employee stock purchase plan Share-based compensation expense Tax benefit for share-based compensation expense (3) Share-based compensation expense, net of tax $ $ 2010 47 39 19 9 114 (41) 73 2008 50 22 11 8 91 (31) 60 (1) This expense was primarily the result of PeRSUs awarded in prior... -

Page 75

McKESSON CORPORATION FINANCIAL NOTES (Continued) Weighted-average assumptions used to estimate the fair value of employee stock options were as follows: Years Ended March 31, 2010 2009 33% 27% 0.7% 0.6% 2% 3% 5 5 Expected stock price volatility Expected dividend yield Risk-free interest rate ... -

Page 76

... RS and RSUs under our stock plans is determined by the product of the number of shares that are expected to vest and the grant date market price of the Company's common stock. The Compensation Committee determines the vesting terms at the time of grant. These awards generally vest in four years. We... -

Page 77

...$146 million, pre-tax (based on the period-end market price of the Company's common stock) and the weighted-average period over which the cost is expected to be recognized is 3 years. Employee Stock Purchase Plan ("ESPP") The Company has an ESPP under which 16 million shares have been authorized for... -

Page 78

McKESSON CORPORATION FINANCIAL NOTES (Continued) 4. Restructuring Activities and Other Workforce Reduction Charges The following table summarizes the activity related to our restructuring liabilities for the last three years: Distribution Solutions Severance Exit-Related 6 3 $ Balance, March 31, ... -

Page 79

McKESSON CORPORATION FINANCIAL NOTES (Continued) Restructuring Activities - Liabilities Related to Business Combinations In connection with our OTN acquisition within our Distribution Solutions segment, to date we recorded a total of $8 million of employee severance costs and $5 million of facility ... -

Page 80

... million related to the Average Wholesale Price ("AWP") litigation charge described in more detail in Financial Note 18, "Other Commitments and Contingent Liabilities." The tax benefit could change in the future depending on the resolution of the pending and expected claims. In 2009, current income... -

Page 81

McKESSON CORPORATION FINANCIAL NOTES (Continued) In 2008, the U.S. Internal Revenue Service ("IRS") began its examination of our fiscal years 2003 through 2006. In 2009 and 2010, we received assessments from the Canada Revenue Agency ("CRA") for a total of $62 million related to transfer pricing for... -

Page 82

... Deferred revenue Compensation and benefit related accruals AWP litigation accrual Loss and credit carryforwards Other Subtotal Less: valuation allowance Total assets Liabilities Basis difference for inventory valuation and other assets Basis difference for fixed assets and systems development costs... -

Page 83

... from the Company's Acute Care business, which was sold in 2007. 8. Earnings Per Common Share Basic earnings per common share are computed by dividing net income by the weighted average number of common shares outstanding during the reporting period. Diluted earnings per common share are computed... -

Page 84

... of diluted net earnings per common share in 2010, 2009 and 2008 as their exercise and grant-date price was higher than the Company's average stock price. 9. Receivables, Net March 31, (In millions) Customer accounts Other Total Allowances Net $ $ 2010 7,256 968 8,224 (149) 8,075 $ $ 2009... -

Page 85

..., net of purchase price adjustments Acquisition accounting and other adjustments Foreign currency translation adjustments Balance, March 31, 2010 Information regarding intangible assets is as follows: $ $ $ Total 3,345 266 (24) (59) 3,528 11 (26) 55 3,568 March 31, (In millions) Customer lists... -

Page 86

...obligation of the Company and ranks equally with all of the Company's existing and future unsecured and unsubordinated indebtedness outstanding from time-to-time. Each Series is governed by an indenture common to all Notes and an officers' certificate specifying certain terms of each Series. Upon 30... -

Page 87

McKESSON CORPORATION FINANCIAL NOTES (Continued) In March 2010, we repaid our $215 million 9.13% Series C Senior Notes which had matured. Accounts Receivable Sales Facility In May 2009, we renewed our accounts receivable sales facility for an additional one year period under terms similar to those ... -

Page 88

...employed by the Company prior to December 31, 1996 are covered under the Company-sponsored defined benefit retirement plan. In 1997, we amended this plan to freeze all plan benefits based on each employee's plan compensation and creditable service accrued to that date. The Company has made no annual... -

Page 89

... of period Measurement date adjustment - adoption of new standards Service cost Interest cost Actuarial loss (gain) Benefit payments Foreign exchange impact and other Benefit obligation at end of period (1) Change in plan assets Fair value of plan assets at beginning of period Measurement date... -

Page 90

... a discount rate based on a yield curve developed from a portfolio of high quality corporate bonds rated AA or better whose maturities are aligned with the expected benefit payments of our plans. For March 31, 2010, we used a weighted average discount rate of 5.29%, which represents a decrease of... -

Page 91

...: Government securities Corporate bonds Mortgage-backed securities Asset-backed securities and other Fixed income commingled funds Other: Real estate and venture capital funds Hedge funds Total Receivables (1) Payables (1) Total (1) Represents pending trades at March 31, 2010. $ Level 1 10... -

Page 92

...The plans also have an interest in venture capital funds structured as limited partnerships that invest in privately-held companies. Due to the private nature of the partnership investments, pricing inputs are not readily observable. Asset valuations are developed by the general partners that manage... -

Page 93

... March 31, 2010, 2009 and 2008. Defined Contribution Plans We have a contributory profit sharing investment plan ("PSIP") for U.S. employees not covered by collective bargaining arrangements. Eligible employees may contribute to the PSIP up to 20% of their monthly eligible compensation for pre-tax... -

Page 94

McKESSON CORPORATION FINANCIAL NOTES (Continued) The McKesson Corporation PSIP is a member of the settlement class in the Consolidated Securities Litigation Action. On April 27, 2009, the court issued an order approving the distribution of the settlement funds. On October 9, 2009, the PSIP received ... -

Page 95

... drugs, 7.5% and 7% for medical and 6% for dental in 2010 and 2009. The healthcare cost trend rate assumption has a significant effect on the amounts reported. For 2010, 2009 and 2008, a one-percentage-point increase or decrease in the assumed healthcare cost trend rate would impact total service... -

Page 96

...at March 31, 2010 and 2009, are money market fund investments of $2.3 billion and $1.7 billion, which are reported at fair value. The fair value of these investments was determined by using quoted prices for identical investments in active markets, which are considered to be Level 1 inputs under the... -

Page 97

... for our products and services. For example, we provide warranties that the pharmaceutical and medical-surgical products we distribute are in compliance with the Food, Drug and Cosmetic Act and other applicable laws and regulations. We have received the same warranties from our suppliers, which... -

Page 98

... customers who purchase our software and automation products also purchase annual maintenance agreements. Revenues from these maintenance agreements are recognized on a straight-line basis over the contract period and the cost of servicing product warranties is charged to expense when claims become... -

Page 99

... the Company in the United States District Court, District of Massachusetts, New England Carpenters Health Benefits Fund, et al. v. First DataBank, Inc. and McKesson Corporation (Civil Action No. 1:05-CV-11148-PBS) (the "Private Payor RICO Action"). Plaintiffs are four health benefit plans. The... -

Page 100

... met. B. The Public Payor AWP Cases Commencing in May of 2008, a series of complaints alleging claims nearly identical to the Private Payor RICO Action were filed by various public payors - governmental entities that paid any portion of the price of certain prescription drugs. These actions were all... -

Page 101

...claims act, California Business and Professions Code §§ 17200 and 17500 and seeking damages, treble damages, civil penalties, restitution, interest and attorneys' fees, all in unspecified amounts, San Francisco Health Plan, et al. v. McKesson Corporation, (Civil Action No. 1:08-CV-10843-PBS) ("San... -

Page 102

... 19, 2010. No trial date is set in the San Francisco and Douglas County, Kansas Actions. The New Jersey United States' Attorney's Office AWP Investigation In June of 2007, the Company was informed that a qui tam action by an unknown relator was previously filed in the United States District Court in... -

Page 103

... v. McKesson Corporation, et al., (Civil Action No. 2:08-CV-00214-SA). The United States asserts in its complaint claims based on violations of the federal False Claims Act, 31 U.S.C Sections 3729-33, in connection with billing and supply services rendered by MediNet to the long-term care facility... -

Page 104

... to the Company's site between 1976 and 2000. In late 2001, Angeles filed an action against McKesson, Angeles Chemical Company v. McKesson Corporation, et al. (United States District Court for the Central District of California Case No. 01-10532-TJH) claiming that McKesson's contamination migrated... -

Page 105

... for pharmaceutical products; (4) the Company has received and have responded to subpoenas and requests for information from a number of Offices of state Attorney Generals or other state agencies, relating to the pricing, including FDB's AWPs, for branded and generic drugs; and (5) the Company has... -

Page 106

... price in connection with cashless exercises of employee stock options or shares tendered to satisfy tax withholding obligations in connection with employee equity awards. (2) All of the shares purchased were part of the publicly announced programs. (3) The number of shares purchased reflects... -

Page 107

McKESSON CORPORATION FINANCIAL NOTES (Continued) In July 2008, the Board authorized the retirement of shares of the Company's common stock that may be repurchased from time-to-time pursuant to its stock repurchase program. During the second quarter of 2009, all of the 4 million repurchased shares, ... -

Page 108

... solutions, medical management software businesses and our care management programs. The segment's customers include hospitals, physicians, homecare providers, retail pharmacies and payors from North America, the United Kingdom, Ireland, other European countries, Asia Pacific and Israel. Revenues... -

Page 109

...) 2010 2009 Revenues Distribution Solutions (1) Direct distribution & services $ 72,210 $ 66,876 $ Sales to customers' warehouses 21,435 25,809 Total U.S. pharmaceutical distribution & services 93,645 92,685 Canada pharmaceutical distribution & services 9,072 8,225 Medical-Surgical distribution... -

Page 110

... operations primarily consist of our operations in Canada, the United Kingdom, Ireland, other European countries, Asia Pacific and Israel. We also have an equity-held investment (Nadro) in Mexico. Net revenues were attributed to geographic areas based on the customers' shipment locations. 104 -

Page 111

...-held investments. 23. Subsequent Events In April 2010, our Technology Solutions segment entered into a definitive agreement to sell its wholly-owned subsidiary, McKesson Asia Pacific Pty Limited, a provider of phone and web-based healthcare services in Australia and New Zealand. This agreement is... -

Page 112

... Reporting Management's report on the Company's internal control over financial reporting (as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) and the related report of our independent registered public accounting firm are included on page 51 and page 52 of this Annual Report... -

Page 113

... Code of Ethics governing our Chief Executive Officer, Chief Financial Officer, Controller and Financial Managers can be found on our Web site, www.mckesson.com, under the Investors - Corporate Governance tab. The Company's Corporate Governance Guidelines and Charters for the Audit and Compensation... -

Page 114

... funds withheld by each participant will be used to purchase shares of the Company's common stock. The purchase price of each share of the Company's common stock is based on 85% of the fair market value of each share on the last day of the applicable Purchase Period. In general, the maximum number... -

Page 115

...Review section of this Annual Report on Form 10-K and Financial Note 20, "Related Party Balances and Transactions," to the consolidated financial statements. Item 14. Principal Accounting Fees and Services Information regarding principal accounting fees and services is set forth under the heading... -

Page 116

McKESSON CORPORATION PART IV Item 15. Exhibits and Financial Statement Schedule Page (a)(1) Consolidated Financial Statements...Report of Deloitte & Touche, LLP, Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended March 31, 2010, 2009 and 2008 ... -

Page 117

... duly authorized. MCKESSON CORPORATION Dated: May 4, 2010 /s/ Jeffrey C. Campbell Jeffrey C. Campbell Executive Vice President and Chief Financial Officer On behalf of the Registrant and pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 118

... 12 164 139 11 150 $ $ 41 - 41 $ $ 2010 17 - 17 $ $ 2009 $ (34) (2) (36) $ $ 163 9 172 2008 (1) Deductions: Written off ...$ Operation sold...Credited to other accounts...Total...$ Amounts shown as deductions from current and noncurrent receivables ...$ 49 - - 49 $ 27 6 12 45 $ $ 32... -

Page 119

... 2001. McKesson Corporation 1999 Stock Option and Restricted Stock Plan, as amended through May 26, 2004. McKesson Corporation 1997 Non-Employee Directors' Equity Compensation and Deferral Plan, as amended through January 29, 2003. McKesson Corporation Supplemental Profit Sharing Investment Plan, as... -

Page 120

... on December 29, 2008. McKesson Corporation Change in Control Policy for Selected Executive Employees, as amended and restated on April 21, 2009. McKesson Corporation 2005 Management Incentive Plan, as amended and restated on April 20, 2010. Form of Statement of Terms and Conditions Applicable to... -

Page 121

McKESSON CORPORATION Incorporated by Reference Exhibit Description Form Number 10.20 Second Amended and Restated Receivables 10-Q Purchase Agreement, dated as of May 20, 2009, among the Company, as servicer, CGSF Funding Corporation, as seller, the several conduit purchasers from time to time party ... -

Page 122

McKESSON CORPORATION Incorporated by Reference Exhibit Description Number 21†List of Subsidiaries of the Registrant. 23†24†31.1†Consent of Independent Registered Public Accounting Firm, Deloitte & Touche LLP. Power of Attorney. Certification of Chief Executive Officer Pursuant to Rule ... -

Page 123

...302 OF THE SARBANES-OXLEY ACT OF 2002 I, John H. Hammergren, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the... -

Page 124

... OF THE SARBANES-OXLEY ACT OF 2002 I, Jeffrey C. Campbell, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the... -

Page 125

... 32 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the annual report of McKesson Corporation (the "Company") on Form 10-K for the year ended March 31, 2010 as filed with the Securities and Exchange Commission... -

Page 126

... (87) (In millions except per share data) 2010 2009 Net income, as reported $ Exclude: Litigation charge (credit), net Income tax expense (benefit), net Income tax reserve reversal Litigation charge (credit), net of tax Net income, excluding litigation charge (credit), net $ Diluted earnings per... -

Page 127

... Services also has a website - http://www.melloninvestor.com/isd - that stockholders may use 24 hours a day to request account information. DIVIDENDS AND DIVIDEND REINVESTMENT PLAN Dividends are generally paid on the ï¬rst business day of January, April, July, and October. McKesson Corporation... -

Page 128

McKesson Corporation One Post Street San Francisco, CA 94104 www.mckesson.com © 2010 McKesson Corporation. All rights reserved. CORP-02161-06-10