Lockheed Martin 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOCKHEED MARTIN CORPORATION

2002 ANNUAL REPORT

Table of contents

-

Page 1

2002 ANNUAL REPORT L OCKHEED M ARTIN C ORPORATION -

Page 2

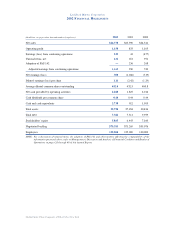

... Average diluted common shares outstanding Net cash provided by operating activities Cash dividends per common share Cash and cash equivalents Total assets Total debt Stockholders' equity Negotiated backlog Employees NOTE: For a discussion of unusual items, the adoption of FAS 142 and other matters... -

Page 3

... PASSION FOR INVENTION, AND AN APTITUDE FOR WHOLE-SYSTEMS THINKING. DEDICATION OF ITS THE TALENT AND 125,000 EMPLOYEES, LOCKHEED MARTIN CREATES AND DELIVERS ORIGINAL SOLUTIONS THAT SERVE THE VITAL INTERESTS OF OUR CUSTOMERS AT THEIR DEFINING MOMENTS. Contents: 2. Letter to Shareholders... -

Page 4

... to address our core markets in defense, homeland security, and government information technology and services. In 2002, we focused our attention on several key areas that were fundamental to positive financial results for our shareholders and superior performance for our customers. We directed our... -

Page 5

... to work at Lockheed Martin facilities every day. They are the intellectual capital of this enterprise, and we want to retain our talent pool in a competitive marketplace. We also want to recruit the best in their fields-people with diverse talents and backgrounds, offering the most creative ideas... -

Page 6

... marketplace. A talented, diverse, and innovative workforce is key to sustained success and is a company imperative. This management team recognizes Lockheed Martin's role in the defense of America and its allies, in homeland security, and in service to government agencies in the United States and... -

Page 7

CRITICAL RESPONSIBILITIES: P ROTEC TING and DEF ENDING L IBERT Y SIX SEVEN -

Page 8

... TO DEVELOP AN INTEROPERABLE, JOINT NETWORK-CENTRIC ARCHITECTURE AND CAPABILITY ASSURING ACCESS TO NECESSARY INFORMATION IN THE FACE OF ATTACK AND CONDUCTING EFFECTIVE INFORMATION OPERATIONS PROVIDING RELIABLE AND ASSURED ACCESS TO SPACE The enduring values shared by all people who cherish... -

Page 9

... the Theater Battle Management Core Systems, cockpit electronics and radars. The Integrated Space Command and Control program integrates 40 separate systems into one architecture to weld a potent joint force. Reliable and assured access to space is vital to national security, and the Atlas family of... -

Page 10

L I BE RT Y SHALL NOT BE DIMMED THE FLAME of TWELVE THIRTEEN -

Page 11

... defense and civil markets worldwide, Lockheed Martin offers solutions in the key areas of homeland security: Coast Guard; border and transportation security; emergency preparedness and response; science and technology; information analysis and infrastructure protection; and Secret Service. Lockheed... -

Page 12

SERVING P UBLIC G OOD the SIXTEEN SEVENTEEN -

Page 13

...in air traffic. As a systems integrator serving a broad range of federal agencies, Lockheed Martin technologies are instrumental in delivering 35 million Social Security checks every month; helping a million families a year become homeowners through Fannie Mae; assisting the U.S. Postal Service sort... -

Page 14

VA L U E S of A C O R P O R AT E C I T I Z E N TWENTY TWENTY-ONE -

Page 15

...for our customers, shareholders, employees and communities. The men and women of Lockheed Martin are committed to the highest standards of ethical business conduct. We conduct regular ethics training for every one of our employees, rooting these standards deep into our corporate culture. TWENTY-TWO -

Page 16

... of Lockheed Martin's corporate citizenship, recognizing the aesthetic and cultural value that the arts play in a free society. Ours is a company that deals in the currency of ideas, and the arts build the strength of that currency. And wherever possible we link our support for the arts directly to... -

Page 17

... of Financial Condition and Results of Operations 26 Management's Responsibility for Financial Reporting 49 Report of Ernst & Young LLP, Independent Auditors 50 Consolidated Statement of Operations 51 Consolidated Statement of Cash Flows 52 Consolidated Balance Sheet 53 Consolidated Statement of... -

Page 18

... systems, products and services. We have customers in both domestic and international defense and commercial markets. Our principal customers are agencies of the U.S. Government. Our main areas of focus are in the defense, space, homeland security, and government/civil information technology markets... -

Page 19

... air traffic management, biohazard detection systems for postal equipment, information systems security and other technical systems solutions. Recent trends have indicated an increase in demand by federal and civil government agencies for upgrading and investing in new information technology systems... -

Page 20

...Technology Services business segments. In 2002, work for NASA accounted for approximately 6% of our consolidated net sales, of which approximately one-half was related to the Space Shuttle program. We also have a 50% equity interest in United Space Alliance, LLC, which provides ground processing and... -

Page 21

... joint venture was formed, International Launch Services (ILS), with Lockheed Martin and LKEI each holding a 50% ownership. ILS was formed to market commercial Atlas and Proton launch services around the world. We consolidate the results of operations of LKEI and ILS into our financial statements... -

Page 22

... accounting policies related to contract accounting. Business segment personnel perform reviews of the status of contracts through periodic contract status and performance reviews. When adjustments in estimated contract revenues or costs are required, any changes from prior estimates are generally... -

Page 23

... by our personnel, and are subject to audit by the Defense Contract Audit Agency. Post-Retirement Benefit Plans Most employees are covered by defined benefit pension plans, and we provide health care and life insurance benefits to eligible retirees. Our earnings may be positively or negatively... -

Page 24

Lockheed Martin Corporation of the investment has declined below our carrying value, and that decline is viewed to be other than temporary. For publicly traded companies, the fair value of the equity securities is determined by multiplying the number of shares we own by the stock price, as well as ... -

Page 25

... of state income tax benefits, of approximately $2.0 billion in the fourth quarter of 2001 related to these actions. The charges reduced net earnings by about $1.7 billion ($3.98 per diluted share). The global telecommunications services businesses included the operations of COMSAT Corporation. We... -

Page 26

...the sale of Lockheed Martin IMS Corporation (IMS), a wholly-owned subsidiary, for $825 million in cash in August 2001. This transaction resulted in a gain, net of state income taxes, of $476 million and increased net earnings by $309 million ($0.71 per diluted share). The results of IMS's operations... -

Page 27

... 2000 related to the AES businesses totaled approximately $655 million, excluding intercompany sales. In September 2000, we sold Lockheed Martin Control Systems (Control Systems) for $510 million in cash. This transaction resulted in the recognition of an unusual gain, net of state income taxes, of... -

Page 28

Lockheed Martin Corporation in Inmarsat did not impact our results of operations. The transaction generated net cash proceeds of about $115 million after transaction costs and federal and state income tax payments. On an ongoing basis, we will continue to explore the sale of various non-core ... -

Page 29

... Space Other charges related to global telecommunications Impairment charge related to Americom Asia-Pacific Loss on early repayment of debt Other portfolio shaping activities Gain on sale of surplus real estate Discontinued operations- Charges related to discontinued businesses, net of IMS gain... -

Page 30

... diluted share) related to our decision to exit the global telecommunications services business. The 2001 results also include an unusual after-tax gain of $309 million ($0.71 per diluted share) from the third quarter 2001 sale of Lockheed Martin IMS Corporation. Net Earnings (Loss) We reported net... -

Page 31

... the segment's operating results (e.g., sales of surplus real estate, impairment charges, divestitures and other portfolio shaping activities) are excluded from the business segment results; • The difference between pension costs calculated and funded in accordance with Cost Accounting Standards... -

Page 32

... Technology Services Total business segments Unallocated Corporate expense, net Impact of FAS 142 adoption $ 952 443 448 177 2,020 (862) - $ 1,158 The Space Systems and Aeronautics segments generally include fewer programs that have much larger sales and operating results than programs included... -

Page 33

... of favorable adjustments recorded on the Titan IV program in 2000. Operating profit for the segment increased 23% in 2002 as compared to 2001, mainly driven by the commercial space business. Reduced losses in commercial space during 2002 resulted in increased operating profit of $90 million when... -

Page 34

...information technology and military aircraft lines of business. This growth was partially offset by lower sales volume associated with the segment's energy-related contracts due to program completions. Operating profit for the segment increased by 55% in 2002 compared to 2001. The increase is mainly... -

Page 35

...between pension costs calculated and funded in accordance with CAS and pension expense or income determined in accordance with FAS 87 is not included in segment operating results and therefore is a reconciling item between operating profit from the business segments and consolidated operating profit... -

Page 36

... sufficient to operate our businesses, finance capital expenditures and to pay dividends on our common stock each year. Investing Activities Investing activities used $539 million of cash in 2002, compared to providing $139 million in 2001 and $1.8 billion in 2000. Cash used for property, plant and... -

Page 37

... of Space Imaging, LLC's existing credit facility (see the related discussions below). Our long-term debt is mainly in the form of publicly issued, fixed-rate notes and debentures. At December 31, 2002, we held cash and cash equivalents of $2.7 billion, some of which will be used to meet scheduled... -

Page 38

... to the fair value of long-term debt relating to the Corporation's interest rate swap agreements which will not be settled in cash. (b) Includes future payments related to a leasing arrangement with a state government authority for Atlas V launch facilities. Total payments under the arrangement are... -

Page 39

... equal number of shares of Loral Space common stock. Due to the market price of Loral Space stock and the potential impact of underlying market and industry conditions on Loral Space's ability to execute its current business plans, we recorded an unusual charge, net of state income tax benefits, of... -

Page 40

... costs through insurance policy coverage or from other PRPs, which we are pursuing as required by agreement and U.S. Government regulation. These matters include the following items: We are responding to three administrative orders issued by the California Regional Water Quality Control Board... -

Page 41

.... Within 90 days prior to the date of this report, we performed an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures. The evaluation was performed with the participation of senior management of each business segment and key Corporate functions, and... -

Page 42

... of conduct and practices in dealings with customers, including the U.S. Government. The Code provides for a help line that employees can use to confidentially or anonymously transmit to the Corporation's ethics office complaints or concerns about accounting, internal control or auditing matters... -

Page 43

... position of Lockheed Martin Corporation at December 31, 2002 and 2001, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2002, in conformity with accounting principles generally accepted in the United States. As discussed... -

Page 44

... NET SALES Cost of sales Earnings from operations Other income and expenses, net Interest expense Earnings from continuing operations before income taxes Income tax expense Earnings (loss) from continuing operations Discontinued operations NET EARNINGS (LOSS) EARNINGS (LOSS) PER COMMON SHARE: Basic... -

Page 45

...to divestiture of AES and Control Systems Changes in operating assets and liabilities: Receivables Inventories Accounts payable Customer advances and amounts in excess of costs incurred Income taxes Other Net cash provided by operating activities INVESTING ACTIVITIES Expenditures for property, plant... -

Page 46

... cash equivalents Receivables Inventories Deferred income taxes Assets of businesses held for sale Other current assets Total current assets Property, plant and equipment, net Investments in equity securities Intangible assets related to contracts and programs acquired Goodwill Prepaid pension cost... -

Page 47

Lockheed Martin Corporation C ONSOLIDATED S TATEMENT OF S TOCKHOLDERS ' E QUITY (In millions, except per share data) Common Stock Additional Paid-In Capital Retained Earnings Unearned ESOP Shares Accumulated Other Comprehensive Loss Total Stockholders' Equity Comprehensive Income (Loss) ... -

Page 48

... lead systems integrator, its products and services range from aircraft, spacecraft and launch vehicles to missiles, electronics and information systems. The Corporation serves customers in both domestic and international defense and commercial markets, with its principal customers being agencies of... -

Page 49

...generally accounted for under the cost method of accounting. Goodwill and other intangible assets-Intangible assets related to contracts and programs acquired are amortized over the estimated periods of benefit (15 years or less) and are displayed in the consolidated balance sheet net of accumulated... -

Page 50

...instruments for trading purposes. Stock-based compensation-The Corporation measures compensation cost for stock-based compensation plans using the intrinsic value method of accounting as prescribed in Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," and related... -

Page 51

... consolidated balance sheet is recorded in the Systems Integration, Space Systems and Technology Services segments. There is no goodwill recorded in the Aeronautics segment. Using the guidance in FAS 142, the Corporation evaluated the operating units within the Systems Integration and Space Systems... -

Page 52

..., LLC and Astrolink. Discontinued Operations The $2.0 billion in charges recorded in the fourth quarter of 2001 included charges, net of state income tax benefits, of approximately $1.4 billion related to certain global telecommunications services businesses held for sale and exit costs associated... -

Page 53

...sale of Lockheed Martin IMS Corporation (IMS), a wholly-owned subsidiary, for $825 million in cash on August 24, 2001. The transaction resulted in a gain, net of state income taxes, of $476 million and increased net earnings by $309 million ($0.71 per diluted share). The results of IMS's operations... -

Page 54

.... The loss reduced net earnings for 2000 by $878 million ($2.18 per diluted share). In September 2000, the Corporation sold Lockheed Martin Control Systems (Control Systems) for $510 million in cash. This transaction resulted in the recognition of an unusual gain, net of state income taxes, of $302... -

Page 55

...of unamortized deferred costs related to commercial launch vehicles were reclassified to property, plant and equipment. The deferred costs related to the Atlas Space Operations Center, the vehicle integration facility and certain related ground equipment for the Atlas V program. The reclassification... -

Page 56

..., of unamortized deferred costs for aircraft not under contract related to the Corporation's C-130J program. Work in process inventories at December 31, 2002 and 2001 included general and administrative costs, including independent research and development costs and bid and proposal costs, of $502... -

Page 57

... income tax benefits, in cost of sales for certain other costs related to Astrolink. On a combined basis, these charges reduced net earnings for 2001 by approximately $267 million ($0.62 per diluted share). After several months of negotiation, in January 2003, the Corporation finalized an agreement... -

Page 58

Lockheed Martin Corporation In the first quarter of 2001, the Corporation recorded an unusual charge, net of state income tax benefits, of $100 million in other income and expenses related to impairment of its investment in Americom Asia-Pacific, LLC. The charge reduced net earnings for the year ... -

Page 59

...-term senior unsecured debt are below investment grade, holders of the notes may require the Corporation to purchase the notes and pay accrued interest. These notes are obligations of the ESOP but are guaranteed by the Corporation and included as debt in the Corporation's consolidated balance sheet... -

Page 60

...income taxes: Current Deferred Total federal income taxes Foreign income taxes Total income taxes provided Deferred tax assets related to: Accumulated post-retirement benefit obligations Contract accounting methods Basis differences of impaired investments Accrued compensation and benefits Pensions... -

Page 61

... approved the Lockheed Martin 1995 Omnibus Performance Award Plan (the Omnibus Plan). Under the Omnibus Plan, employees of the Corporation may be granted stock-based incentive awards, including options to purchase common stock, stock appreciation rights, restricted stock or other stockbased... -

Page 62

... number of shares of Lockheed Martin common stock reserved for issuance under the Corporation's stock option and award plans totaled 43 million. The following table summarizes stock option and restricted stock activity related to the Corporation's plans during 2000, 2001 and 2002: Number of Shares... -

Page 63

... terms and generally vest over a two-year service period. Exercise prices of options awarded in those years were equal to the market price of the stock on the date of grant. Pro forma information regarding net earnings and earnings per share as if the Corporation had accounted for its employee stock... -

Page 64

... open market for allocation to participant accounts. These ESOP trusts held approximately 3.5 million issued and outstanding shares of common stock at December 31, 2002. Defined benefit pension plans, and retiree medical and life insurance plans-Most employees are covered by defined benefit pension... -

Page 65

... or cash flows. These matters include the following items: Environmental matters-The Corporation is responding to three administrative orders issued by the California Regional (a) The expected long-term rate of return on plan assets for determining the 2003 net pension and post-retirement costs was... -

Page 66

Lockheed Martin Corporation Water Quality Control Board (the Regional Board) in connection with the Corporation's former Lockheed Propulsion Company facilities in Redlands, California. Under the orders, the Corporation is investigating the impact and potential remediation of regional groundwater ... -

Page 67

...AND MAJOR CUSTOMERS In the fourth quarter of 2002, the Corporation changed the manner in which it reports the results of its business segments. This change in presentation was made to align the measurement criteria used by the Corporation's senior management in their evaluation of the performance of... -

Page 68

...The results of operations of the Corporation's segments will now only include pension expense as determined and funded in accordance with CAS rules. Transactions between segments are generally negotiated and accounted for under terms and conditions that are similar to other government and commercial... -

Page 69

... services to federal agencies and other customers. Major product lines include complete life-cycle software support; information systems development; information assurance and enterprise integration for the U.S. Department of Defense, civil government agencies and commercial customers; aircraft... -

Page 70

... businesses totaling $10 million, $74 million and $58 million in 2002, 2001 and 2000, respectively. (c) The Corporation has no significant long-lived assets located in foreign countries. (d) Assets primarily include cash, investments, deferred income taxes and, for 2001 and 2000, the prepaid pension... -

Page 71

... continuing operations Diluted earnings (loss) per share(c) (87) (146) 213 (1,508) 0.30 0.25 0.34 0.33 (0.20) 0.50 (0.34) (3.49) COMMERCIAL(b) Systems Integration Space Systems Aeronautics Technology Services Total business segments Other $ 279 1,048 17 293 1,637 16 $ 1,653 (a) Sales made... -

Page 72

...$ Cash dividends CONDENSED BALANCE SHEET DATA Current assets Property, plant and equipment, net Intangible assets related to contracts and programs acquired Goodwill Other assets Total Short-term borrowings Current maturities of long-term debt Other current liabilities Long-term debt Post-retirement... -

Page 73

... from continuing operations before income taxes by $249 million, $162 million after tax ($0.42 per diluted share). Also includes a cumulative effect adjustment relating to the adoption of SOP No. 98-5 regarding costs for start-up activities which resulted in an unusual charge that reduced net... -

Page 74

.... Bennett, Coffman, Murphy and Savage Marcus C. Bennett Retired Executive Vice President and Chief Financial Officer Lockheed Martin Corporation Anne Stevens Vice President North America Vehicle Operations Ford Motor Company Finance Committee Mr. Savage, Chairman Messrs. Archibald, Augustine... -

Page 75

Lockheed Martin Corporation C ORPORATE D IRECTORY As of March 1, 2003 OFFICERS James F. Berry Vice President Theofanis G. Gavrilis Vice President Frank H. Menaker, Jr. Senior Vice President and General Counsel Rajeev Bhalla Vice President and Controller Linda R. Gooden Vice President Frank C.... -

Page 76

... and dividend news as well as other Lockheed Martin announcements are available by calling the above toll-free number. The information will be read to the caller and can also be received by mail, fax or email. You may also reach Shareholder Services for account information or Investor Relations for... -

Page 77

... improve homeland security); the level of returns on pension and retirement plan assets; the termination of programs or contracts for convenience by customers; difficulties in developing and producing operationally advanced technology systems; launch failures and potential problems that might result... -

Page 78

... BEST ADVANCED TECHNOLOGY SYSTEMS INTEGRATOR . OUR PURPOSE: TO ACHIEVE M ISSION S UCCESS BY ATTAINING TOTAL CUSTOMER SATISFACTION AND MEETING ALL OUR COMMITMENTS . OUR VALUES: E THICS E XCELLENCE "C AN -D O '' I NTEGRITY P EOPLE T EAMWORK ACHIEVING RESULTS THROUGH... L EADERSHIP C OMMITMENT... -

Page 79

Lockheed Martin Corporation 6801 Rockledge Drive • Bethesda, MD 20817 www.lockheedmartin.com