Honeywell 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

HONEYWELL INTERNATIONAL INC (HON) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/15/2008 Filed Period 12/31/2007 -

Page 2

...S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR £ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-8974 Honeywell... -

Page 3

... to Section 13 or Section 15(d) of No X the Exchange Act. Yes Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was... -

Page 4

... Controls and Procedures Other Information Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services... -

Page 5

...'s corporate governance listing standards as of that date. Major Businesses We globally manage our business operations through four businesses that are reported as operating segments: Aerospace, Automation and Control Solutions, Specialty Materials and Transportation Systems. Financial information... -

Page 6

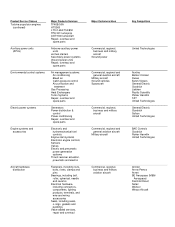

...Ground power units Repair, overhaul and spare parts Air management systems: Air conditioning Bleed air Cabin pressure control Air purification and treatment Gas Processing Heat Exchangers Turbo Systems Repair, overhaul and spare parts Generators Power distribution & control Power conditioning Repair... -

Page 7

< /font>kitting and use replenishment Avionics systems point-of- Flight safety systems: Enhanced Ground Proximity Warning Systems (EGPWS) Traffic Alert and Collision Avoidance Systems (TCAS) Windshear detection systems Flight data and cockpit voice recorders Weather radar Commercial, business and... -

Page 8

... Products/Services Major Customers/Uses Key Competitors Avionics systems (continued) Communication, navigation and surveillance systems: Navigation & guidance systems Global positioning systems Satellite systems Integrated systems Flight management systems Cockpit display systems Data management... -

Page 9

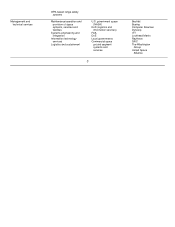

...range safety systems Management and technical services Maintenance/operation and provision of space systems, services and facilities Systems engineering and integration Information technology services Logistics and sustainment U.S. government space (NASA) DoD (logistics and information services) FAA... -

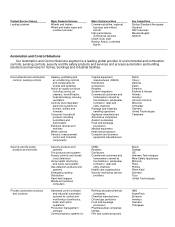

Page 10

... combustion controls, sensing controls, security and life safety products and services and process automation and building solutions and services for homes, buildings and industrial facilities. Environmental and combustion controls; sensing controls Heating, ventilating and air conditioning controls... -

Page 11

... Control equipment and systems Consulting, networking engineering and installation Terminal automation solutions Process control instrumentation Field instrumentation Analyti cal instrumentation Recorders Controllers Critical environment control solutions and services Aftermarket maintenance, repair... -

Page 12

... Plant managers Utilities Large global corporations Public school systems Universities Local governments Public housing agencies Airports Ameresco GroupMac Ingersoll Rand Invensys Johnson Controls Local contractors and utilities Safegate Schneider Siemens Trane Thorn United Technologies Specialty... -

Page 13

...-silanes High modulus polyethylene fiber and shield composites Aramid shield composites Diverse by product type Atotech BASF DSM Bullet resistant vests, helmets and other armor applications Cut-resistant gloves Rope & cordage Food and pharmaceutical packaging DuPont DSM Teijin Specialty films... -

Page 14

...MHI Thermal systems Exhaust gas coolers Charge-air coolers Aluminum radiators Aluminum cooling modules Behr Modine Valeo Aftermarket filters, spark plugs, electronic components and car care products Oil, air, fuel, transmission and coolant filters PCV valves Spark plugs Wire and cable AC Delco... -

Page 15

...Friction Brake hard parts and other friction materials Disc brake pads and shoes Drum brake linings Brake blocks Disc and drum brake components Brake hydraulic components Brake fluid Aircraft brake linings Railway linings Automotive and heavy vehicle OEMs, OES, brake manufacturers and aftermarket... -

Page 16

... technological capabilities. In addition, some of our products compete with the captive component divisions of original equipment manufacturers. International Operations We are engaged in manufacturing, sales, service and research and development mainly in the United States, Europe, Canada... -

Page 17

... accounted for 58 percent of total 2007 Automation and Control Solutions sales. The principal manufacturing facilities outside the U.S. are in Europe with less significant operations in Asia, Canada and Latin America. Approximately 18 percent of total 2007 sales of Specialty Materials products... -

Page 18

... due to the impact of additional R&D expense for UOP in Specialty Materials as well as product, design and development costs in Aerospace and Automation and Control Solutions. Customer-sponsored (principally the U.S. Government) R&D activities amounted to an additional $881, $777 and $694 million... -

Page 19

..., terrorism and safety concerns as well as changes in regulations. Future terrorist actions or pandemic health issues could dramatically reduce both the demand for air travel and our Aerospace aftermarket sales and margins. The operating results of our Automation and Control Solutions (ACS) segment... -

Page 20

...our products and services and impact our ability to meet commitments to customers. The cost of raw materials is a key element in the cost of our products, particularly in our Specialty Materials (benzene (the key component in phenol), natural gas, ethylene and sulfur), Transportation Systems (nickel... -

Page 21

... impact our access to the public debt and equity markets. A change in the level of U.S. Government defense and space funding or the mix of programs to which such funding is allocated could adversely impact sales of Aerospace's defense and space-related product and services. Sales of our defense and... -

Page 22

... providing Automation and Control Solutions products, services and solutions can be impacted by fire, security, safety, health care, enviornmental and energy efficiency standards and regulations. Specialty Materials' results of operations can be affected by environmental (e.g. government regulation... -

Page 23

... our business, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employment, employee benefits plans, intellectual property, import and export matters and environmental, health and safety matters... -

Page 24

..., IL Aerospace South Bend, IN Olathe, KS Minneapolis, MN Plymouth, MN Rocky Mount, NC Albuquerque, NM Automation and Control Solutions Golden Valley, MN Skaneateles Falls, NY (leased) Mosbach, Germany Neuss, Germany Schonaich, Germany Specialty Materials Geismar, LA Shreveport, LA Pottsville, PA... -

Page 25

... Korea (leased) Mexicali, Mexico (partially leas Barcelona, Spain Item 3. Legal Proceedings We are subject to a number of lawsuits, investigations and claims (some of which involve substantial amounts) arising out of the conduct of our business. See a discussion of environmental, asbestos and other... -

Page 26

... Transportation Systems since January 2005. Vice President and General Manager of Engine Systems & Accessories from September 2001 to December 2004. President and Chief Executive Officer Specialty Materials since November 2001. President and Chief Executive Officer Automation and Control Solutions... -

Page 27

... ending December 31, 2007, under its previously reported $3 billion authorized share repurchase program. Honeywell purchased a total of 74,235,000 shares of common stock in 2007: Issuer Purchases of Equity Securities (a) (b) (c) Total Number of Shares Purchased as Part of Publicly Announced Plans... -

Page 28

... non-aerospace businesses conducted by Honeywell and their contribution to our overall segment profits. The annual changes for the five-year period shown in the graph are based on the assumption that $100 had been invested in Honeywell stock and each index on December 31, 2002 and that all dividends... -

Page 29

...Results of Operations Net sales Income (loss) from continuing operations Per Common Share Earnings (loss) from continuing operations: Basic Assuming dilution Dividends Financial Position at Year-End Property, plant and equipment-net Total assets Short-term debt Long-term debt Total debt Shareowners... -

Page 30

Price Volume Foreign Exchange Acquisitions/Divestitures 1% 6 2 1 10 % 1% 6 - 6 13 % A discussion of net sales by segment can be found in the Review of Business Segments section of this MD&A. 20 -

Page 31

... expenses in Automation and Control Solutions (ACS) and Specialty Materials as a result of acquisitions. A reduction of repositioning and pension costs of 0.2 of a percentage point offset the 0.2 of a percentage point increase for expenses of $77 million relating to stock-based compensation expense... -

Page 32

... in segment profit (most significantly in Aerospace and Automation and Control Solutions), a reduction in the number of shares outstanding due to the previously announced stock repurchase program, and lower pension and other post retirement expense, partially offset by increased repositioning... -

Page 33

... economic growth rates (US, Europe and emerging regions); • Overall sales mix, in particular the mix of Aerospace original equipment and aftermarket sales and the mix of Automation and Control Solutions products and services sales; • The extent to which cost savings from productivity actions are... -

Page 34

... post-retirement expenses and our tax expense; and • Achieving productivity savings and price increases to offset inflation. Review of Business Segments 2007 2006 (Dollars in millions) 2005 Net Sales Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate... -

Page 35

...environmental control systems, engine controls, flight safety, communications, navigation, radar and surveillance systems, aircraft lighting, management and technical services, advanced systems and instruments, aircraft wheels and brakes and repair and overhaul services. Aerospace sells its products... -

Page 36

...676 Aerospace sales by major customer end-markets were as follows: % of Aerospace Sales % Change in Sales 2006 2007 Versus Versus 2005 2006 Customer End-Markets 2007 2006 2005 Commercial: Air transport and regional original equipment Air transport and regional aftermarket Business and general... -

Page 37

-

Page 38

...software applications for home/building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow, temperature and electrical current; security, fire and gas detection; access control; video surveillance; remote patient monitoring systems; products... -

Page 39

-

Page 40

... and European economic conditions; • Economic growth rates in emerging markets; • The strength of capital spending on process (including petrochemical and refining) and building automation; and • Changes to energy, fire, security, health care, safety and environmental concerns and regulations... -

Page 41

-

Page 42

... sales of electronic chemicals and specialty additives and higher sales to customers in the health care industry. Partially offsetting these increases was a 6 percent decrease in Fluorine Products sales primarily due to lower refrigerant pricing and lower sales volume of foam blowing agents used... -

Page 43

-

Page 44

... through state-of-the-art technologies, world class brands and global solutions to customers' needs. Transportation Systems' products include turbochargers and charge-air and thermal systems; car care products including anti-freeze (Prestone(R)), filters (Fram(R)), spark plugs (Autolite(R)), and... -

Page 45

... with 2005 due primarily to increased Turbo Technologies volume and productivity savings including the benefits of prior year restructuring actions, which offset higher material and labor inflation and increased warranty expense. 2008 Areas of Focus Transportation Systems primary areas of focus in... -

Page 46

30 -

Page 47

... Further global expansion and extension of established strong product brands in CPG; and • Addressing CPG operational planning and production issues. Repositioning and Other Charges A summary of repositioning and other charges follows: Years Ended December 31, 2007 2006 2005 (Dollars in millions... -

Page 48

Other - $ 127 31 - $ 39 1 $ 85 -

Page 49

... at our Aerospace, Transportation Systems and Specialty Materials segments, were returned to income in 2006 due mainly to changes in the scope of previously announced severance programs and due to fewer employee separations than originally planned associated with prior Aerospace severance actions... -

Page 50

-

Page 51

... matter in Brunswick, GA and our entrance into a plea agreement related to an environmental matter at our Baton Rouge, LA. facility. We recognized impairment charges of $12 million related to the write-down of property, plant and equipment held for sale in our Specialty Materials segment. We also... -

Page 52

... from the sale of an insurance receivable, an increase in customer advances and deferred income (net of acquisitions) of $115 million, and $93 million receipt of an arbitration award relating to Specialty Materials, partially offset by increased working capital usage (accounts and other receivables... -

Page 53

...filed with the Securities and Exchange Commission under which we may issue additional debt securities, common stock and preferred stock that may be offered in one or more offerings on terms to be determined at the time of the offering. Net proceeds of any offering would be used for general corporate... -

Page 54

...800 million in dividends on our common stock in 2008, reflecting the 10 percent increase in the dividend rate announced by Honeywell's Board of Directors in December 2007. • Asbestos claims-we expect our cash spending for asbestos claims and our cash receipts for related insurance recoveries to be... -

Page 55

...2008 (Dollars in millions) Total Thereafter Long-term debt, including capitalized leases(1) Minimum operating lease payments Purchase obligations(2) Estimated environmental liability payments(3) Asbestos related liability payments(4) Asbestos insurance recoveries(5) $ 5,837 1,185 2,357 799 1,655... -

Page 56

populations, and are principally dependent upon the future cost of retiree medical benefits under our plans. We expect our OPEB payments to approximate $206 million in 2008 net of the benefit of approximately $15 million 37 -

Page 57

... predecessor companies, we, like other companies engaged in similar businesses, have incurred remedial response and voluntary cleanup costs for site contamination and are a party to lawsuits and claims associated with environmental and safety matters, including past production of products containing... -

Page 58

-

Page 59

... accounting policies for derivative financial instruments is included in Note 1 to the financial statements. We conduct our business on a multinational basis in a wide variety of foreign currencies. Our exposure to market risk from changes in foreign currency exchange rates arises from international... -

Page 60

... discussion of our procedures to monitor market risk and the estimated changes in fair value resulting from our sensitivity analyses are forward-looking statements of market risk assuming certain adverse market conditions occur. Actual results in the future may differ materially from these estimated... -

Page 61

We have discussed the selection, application and disclosure of these critical accounting policies with the Audit Committee of our Board of Directors and our Independent Registered Public Accountants. New accounting standards effective in 2007 which had a material impact on our 40 -

Page 62

...claims (some of which involve substantial dollar amounts) that arise out of the conduct of our global business operations or those of previously owned entities. These contingencies primarily relate to product liabilities (including asbestos), contractual matters, and environmental, health and safety... -

Page 63

... defined benefit pension plans covering a majority of our employees and retirees. For financial reporting purposes, net periodic pension expense is calculated based upon a number of significant actuarial assumptions, including a discount rate for plan obligations and an expected long-term rate of... -

Page 64

... of 6.50 percent there would not be a significant change to annual pension expense. Only if the discount rate were to decrease to 6.25% would the sensitivities described in the table be applicable. Net periodic pension expense for our pension plans is expected to be approximately $30 million in 2008... -

Page 65

... our reporting units is estimated utilizing a discounted cash flow approach incorporating historic and projected future operating performance. This impairment test involves the use of accounting estimates and assumptions, changes in which could materially impact our financial condition or operating... -

Page 66

... sales using the percentage-of-completion method for long-term contracts in our Automation and Control Solutions, Aerospace and Specialty Materials segments. These long-term contracts are measured on the cost-tocost basis for engineering-type contracts and the units-of-delivery basis for production... -

Page 67

...the financial statements for a discussion of recent accounting pronouncements. Item 7A. Quantitative and Qualitative Disclosures About Market Risk Information relating to market risk is included in Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations under the... -

Page 68

... and Supplementary Data HONEYWELL INTERNATIONAL INC. CONSOLIDATED STATEMENT OF OPERATIONS 2007 Years Ended December 31, 2006 2005 (Dollars in millions, except per share amounts) Product sales Service sales Net sales Costs, expenses and other Cost of products sold Cost of services sold Selling... -

Page 69

... current assets Total current assets Investments and long-term receivables Property, plant and equipment-net Goodwill Other intangible assets-net Insurance recoveries for asbestos related liabilities Deferred income taxes Prepaid pension benefit cost Other assets Total assets LIABILITIES $ 1,829... -

Page 70

48 -

Page 71

... Proceeds from issuance of long-term debt Payments of long-term debt Excess tax benefits from share based payment arrangements Repurchases of common stock Cash dividends paid on common stock Net cash (used for) financing activities Effect of foreign exchange rate changes on cash and cash equivalents... -

Page 72

The Notes to Financial Statements are an integral part of this statement. 49 -

Page 73

... exchange translation adjustments Minimum pension liability adjustment Other Comprehensive Income (Loss) Common stock issued for employee savings and option plans (including related tax benefits of $17) Repurchases of common stock Cash dividends on common stock ($0.825 per share) Other owner changes... -

Page 74

... of common stock Uncertain tax positions Cash dividends on common stock ($1.00 per share) Other owner changes Balance at December 31, 2007 957.6 $ 958 $ 65 (74.2 ) (3,987 ) ( 3 4,014 .2 (211.0 ) 10 $ (9,479 ) $ (544 ) $ 14, The Notes to Financial Statements are an integral part of this... -

Page 75

...million ($21 million after tax) that was reported as a cumulative effect of an accounting change. Upon initial recognition of a liability the cost is capitalized as part of the related long-lived asset and depreciated over the corresponding asset's useful life. See Note 11 and Note 17 for additional... -

Page 76

... as services are rendered. Sales under long-term contracts in the Aerospace and Automation and Control Solutions segments are recorded on a percentage-of-completion method measured on the cost-to-cost basis for engineering-type contracts and the units-of-delivery basis for production-type contracts... -

Page 77

... insurance programs and our consideration of the impacts of any settlements with our insurers. Aerospace Sales Incentives-We provide sales incentives to commercial aircraft manufacturers and airlines in connection with their selection of our aircraft equipment, predominately wheel and braking system... -

Page 78

... the majority of our employees and retirees. We also sponsor postretirement benefit plans that provide health care benefits and life insurance coverage to eligible retirees. For our U.S. defined benefit pension plans we use the market-related value of plan assets reflecting changes in the fair value... -

Page 79

... number of common shares outstanding and all dilutive potential common shares outstanding. Use of Estimates-The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported... -

Page 80

... position and results of operations. In March 2007, the FASB ratified Emerging Issues Task Force ("EITF") Issue No. 06-10 "Accounting for Collateral Assignment Split-Dollar Life Insurance Agreements" (EITF 06-10). EITF 06-10 provides guidance for determining a liability for postretirement benefit... -

Page 81

... the Aerospace segment and were not material to the consolidated financial statements. In July 2007, the Company completed the acquisition of Enraf Holding B.V., a provider of comprehensive solutions for the control and management of transportation, storage and blending operations in the oil and gas... -

Page 82

... 31, 2006 are included in the Automation and Control Solutions segment and were not material to the consolidated financial statements. In March 2006, the Company purchased First Technology plc, a U.K. publicly listed company. The aggregate value of the purchase price was $723 million, including the... -

Page 83

...in the Automation and Control Solutions segment and were not material to the consolidated financial statements. During the year, the Company completed the sales of the First Technology Safety & Analysis business for $93 million and First Technology Automotive for $90 million which were accounted for... -

Page 84

...2005 Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 37 127 14 119 246 $ 543 $ 10 39 5 293 136 $ 483 $ 96 85 (34 ) 82 183 $ 412 In 2007, we recognized repositioning charges totaling $209 million primarily for severance costs related to workforce... -

Page 85

60 -

Page 86

... matter in Brunswick, GA and our entrance into a plea agreement related to an environmental matter at our Baton Rouge, LA facility. We recognized impairment charges of $12 million related to the write- down of property, plant and equipment held for sale in our Specialty Materials segment. We also... -

Page 87

-

Page 88

... of property, plant and equipment held and used in our Specialty Materials segment. We also recognized other charges of $18 million principally related to the modification of a lease agreement for the Corporate headquarters facility ($10 million) and for various legal settlements ($7 million). Note... -

Page 89

-

Page 90

...U.S. tax rate (1) Asset basis differences Nondeductible amortization State income taxes (1) Tax benefits on export sales Domestic Manufacturing Deduction ESOP Dividend Tax Benefit Tax credits Equity income Repatriation expense related to American Jobs Creation Act of 2004 Audit Settlements All other... -

Page 91

... Net of changes in valuation allowance. The Company's effective tax rate increased by 0.7 of a percentage point in 2007 compared with 2006 due principally to the expiration of the tax benefit on export sales, partially offset by a decrease in the overall state and foreign effective tax rate and an... -

Page 92

... reporting purposes. The tax effects of temporary differences and tax carryforwards which give rise to future income tax benefits and payables are as follows: December 31, 2007 2006 Property, plant and equipment basis differences Postretirement benefits other than pensions and post employment... -

Page 93

... as applicable Based on the outcome of these examinations, or as a result of the expiration of statute of limitations for specific jurisdictions, it is reasonably possible that the related unrecognized tax benefits for tax positions taken regarding previously filed tax returns will materially change... -

Page 94

65 -

Page 95

... average market price of the common shares during the period. In 2007, 2006 and 2005, the number of stock options not included in the computation were 8,599,620, 22,749,056 and 17,793,385, respectively. These stock options were outstanding at the end of each of the respective years. Note 8-Accounts... -

Page 96

$ 6,387 66 $ 5,740 -

Page 97

...$ 750 Losses on sales of receivables were $29, $27 and $18 million in 2007, 2006 and 2005, respectively. No credit losses were incurred during those years. Note 9-Inventories December 31, 2007 2006 Raw materials Work in process Finished products Less- Progress payments Reduction to LIFO cost basis... -

Page 98

67 -

Page 99

... as follows: December 31, 2006 Currency Translation Adjustment December 31, 2007 Acquisitions Divestitures Aerospace Automation and Control Solutions Specialty Materials Transportation Systems $ 1,745 4,959 1,151 548 8,403 $ 180 547 2 - 729 $ - - (6 ) - (6 ) $ 14 23 9 3 49 $ 1,939 5,529... -

Page 100

2,297 Trademarks with indefinite lives 107 $ 2,404 $ 68 (906 ) - (906 ) 1,391 107 $ 1,498 1,876 107 $ 1,983 $ (736 ) - (736 ) 1,140 107 $ 1,247 -

Page 101

... 31, 2007 2006 Compensation, benefit and other employee related Customer advances and deferred income Income taxes Environmental costs Asbestos related liabilities Product warranties and performance guarantees Restructuring Other taxes (payroll, sales, VAT etc.) Insurance Accrued interest Other... -

Page 102

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Note 14-Long-term Debt and Credit Agreements December 31, 2007 2006 7.0% notes due 2007 1 7 /8% notes due 2008 6.20% notes due 2008 Floating rate notes due 2009 Floating rate ... -

Page 103

... does not restrict our ability to pay dividends and contains no financial covenants. The failure to comply with customary conditions or the occurrence of customary events of default contained in the credit agreement would prevent any further borrowings and would generally require the repayment... -

Page 104

... under Employee Retirement Income Security Act. Additionally, each of the banks has the right to terminate its commitment to lend additional funds or issue letters of credit under the agreement if any person or group acquires beneficial ownership of 30 percent or more of our voting stock, or... -

Page 105

... customer. Our sales are not materially dependent on a single customer or a small group of customers. Foreign Currency Risk Management-We conduct our business on a multinational basis in a wide variety of foreign currencies. Our exposure to market risk for changes in foreign currency exchange rates... -

Page 106

... Management-Our exposure to market risk for commodity prices can result in changes in our cost of production. We primarily mitigate our exposure to commodity price risk through the use of long-term, fixed-price contracts with our suppliers and formula price agreements with suppliers and customers... -

Page 107

... of nuclear fuel conversion facilities in our Specialty Materials segment and the future retirement of facilities in our Automation and Control Solutions segment. A reconciliation of our liability for asset retirement obligations for the year ended December 31, 2007, is as follows: Balance... -

Page 108

74 -

Page 109

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share ... Tax AfterTax Year Ended December 31, 2007 Foreign exchange translation adjustments Change in fair value of effective cash flow hedges Pension and postretirement benefit adjustment $ 248... -

Page 110

... price, term and other conditions applicable to each option granted under our stock plans are generally determined by the Management Development and Compensation Committee of the Board. The exercise price of stock options is set on the grant date and may not be less than the fair market value... -

Page 111

...Basic-as reported Basic-pro forma Earnings per share of common stock: Assuming dilution-as reported Assuming dilution-pro forma $ 1,638 (53 ) $ 1,585 $ 1.93 $ 1.87 $ 1.92 $ 1.86 The following table sets forth fair value per share information, including related weighted-average assumptions, used to... -

Page 112

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) The following table summarizes information about stock option activity for the three years ended December 31, 2007: Number of Options Weighted Average Exercise Price Outstanding... -

Page 113

... remaining contractual life in years. There were 37,902,956 and 42,416,585 options exercisable at weighted average exercise prices of $40.16 and $40.01 at December 31, 2006 and 2005, respectively. There were 38,279,009 shares available for future grants under the terms of our stock option plans at... -

Page 114

... receive one share of common stock for each unit when the units vest. RSU's are issued to certain key employees at fair market value at the date of grant as compensation. RSUs typically become fully vested over periods ranging from three to seven years and are payable in Honeywell common stock upon... -

Page 115

-

Page 116

..., we do not expect that these environmental matters will have a material adverse effect on our consolidated financial position. New Jersey Chrome Sites-Provisions have been made in our financial statements for the estimated costs of the court-ordered excavation and transport for offsite disposal of... -

Page 117

...predecessor Honeywell site located in Jersey City, New Jersey, known as Study Area 7 ("SA 7"). These expenditures have been and are expected to continue to be incurred evenly over a five-year period that started in April 2006. We do not expect implementation of this remedy to have a material adverse... -

Page 118

... ACO; thus, we do not believe the lawsuit will significantly change our obligations with respect to the Honeywell ACO Sites. Lawsuits have also been filed against Honeywell in the District Court under the Resource Conservation and Recovery Act (RCRA) by Jersey City and two of its municipal utilities... -

Page 119

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) investigate and mitigate related environmental issues, and have entered into a cost sharing agreement under which Honeywell will bear a 77 percent share of the costs of developing ... -

Page 120

... a material impact on Honeywell's operating cash flows. In November 2007, the Bankruptcy Court entered an amended order confirming the NARCO Plan without modification and approving the 524(g) trust and channeling injunction in favor of NARCO and Honeywell. In December 2007, certain insurers filed an... -

Page 121

...2006, Travelers Casualty and Insurance Company ("Travelers") filed a lawsuit against Honeywell and other insurance carriers in the Supreme Court of New York, County of New York, disputing obligations for NARCO-related asbestos claims under high excess insurance coverage issued by Travelers and other... -

Page 122

...in light of any changes to the projected liability or other developments that may impact insurance recoveries. Friction Products-Honeywell's Bendix friction materials (Bendix) business manufactured automotive brake parts that contained chrysotile asbestos in an encapsulated form. There is a group of... -

Page 123

...asbestos claims, of which $197 and $302 million are reflected as receivables in our consolidated balance sheet at December 31, 2007 and 2006, respectively. This coverage is provided by a large number of insurance policies written by dozens of insurance companies in both the domestic insurance market... -

Page 124

... have a material adverse effect on our consolidated financial position in light of our insurance coverage and our prior experience in resolving such claims. If the rate and types of claims filed, the average resolution value of such claims and the period of time over which claim settlements are paid... -

Page 125

... Bendix NARCO Year Ended December Beginning of year Probable insurance recoveries related to claims filed Probable insurance recoveries related to annual update of expected resolution values for pending claims Insurance receipts for asbestos related liabilities Insurance receivables settlements... -

Page 126

..., will be paid from the Company's pension plan. The definitive settlement agreement received final approval from the U.S. District Court for the District of Arizona in February 2008. We continue to expect to prevail on the remaining claims in light of applicable law and our substantial affirmative... -

Page 127

...which involve substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures, employee benefit plans, intellectual property, and health and safety matters. We... -

Page 128

... sponsor postretirement benefit plans that provide health care benefits and life insurance coverage to eligible retirees. Our retiree medical plans mainly cover U.S. employees who retire with pension eligibility for hospital, professional and other medical services. All non-union hourly and salaried... -

Page 129

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Decrease in prepaid pension benefit cost Decrease in intangible asset Decrease in accrued and minimum pension liability Increase in postretirement benefit obligations other than ... -

Page 130

... Benefits 2007 2006 Pension Benefits 2007 2006 Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost Plan amendments Actuarial (gains) losses Acquisitions Benefits paid Settlements and curtailments Other Benefit obligation at end of year Change in plan... -

Page 131

-

Page 132

...Pension Benefits Years Ended December 31, 2007 2006 2005 Other Postretirement Benefits Years Ended December 31, 2007 2006 2005 Net Periodic Benefit Cost Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Recognition of actuarial losses Settlements... -

Page 133

respectively. The estimated net loss and prior service credit for other postretirement benefits that will be amortized from accumulated other comprehensive income (loss) into net periodic benefit cost in 2008 are expected to be $35 and $(40) million, respectively. 93 -

Page 134

... Pension Benefits 2006 2005 Other Postretiremen Benefits 2007 2006 Actuarial assumptions used to determine benefit obligations as of December 31: Discount rate Expected annual rate of compensation increase Actuarial assumptions used to determine net periodic benefit cost for years ended December... -

Page 135

... of various types. There is no stated limit on investments in publicly-held U.S. and international equity securities. Our non-U.S. investment policies are different for each country, but the long-term investment objectives remain the same. Our general funding policy for qualified pension plans is to... -

Page 136

...effect on the amounts reported. A one-percentagepoint change in the assumed health care cost trend rate would have the following effects: 1 percentage point Increase Decrease Effect on total of service and interest cost components Effect on postretirement benefit obligation $ $ 6 79 $ (5 ) $ (70... -

Page 137

... reportable segments are as follows: • Aerospace is organized by customer end-market (Air Transport and Regional, Business and General Aviation and Defense and Space) and provides products and services which include auxiliary power units; propulsion engines; environmental control systems; engine... -

Page 138

HONEYWELL INTERNATIONAL INC. NOTES TO FINANCIAL STATEMENTS-(Continued) (Dollars in millions, except per share amounts) Years Ended December 31, 2006 2005 2007 Net sales Aerospace Automation and Control Solutions Specialty Materials Transportation Systems Corporate $ 12,236 12,478 4,866 5,009 - $ ... -

Page 139

-

Page 140

... in cost of products and services sold and selling, general and administrative expenses. Note 24-Geographic Areas-Financial Data Net Sales(1) Years Ended December 31, 2007 2006 2005 Long-lived Assets(2) Years Ended December 31, 2007 2006 2005 United States Europe Other International $ 21,101... -

Page 141

...Environmental payments Proceeds from sale of insurance receivable Insurance receipts for asbestos related liabilities Asbestos...paid, net of amounts capitalized Income taxes paid, net of refunds Non-cash investing and financing activities: Common stock contributed to U.S. savings plans 99 $ 444 474 ... -

Page 142

... Net income Earnings per share- assuming dilution: Income from continuing operations Income from discontinued operations Net income Dividends paid Market price(1) High Low $ 8,041 1,... .66 . 226875 41.37 36.21 (1) From composite tape-stock is primarily traded on the New York Stock Exchange. 100 -

Page 143

..., the manner in which it accounts for stock- based compensation and defined benefit pension and other postretirement plans in 2006 and the manner in which it accounts for conditional asset retirement obligations in 2005. A company's internal control over financial reporting is a process designed to... -

Page 144

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management assessed the effectiveness of Honeywell's internal control over financial reporting as of December 31, 2007. In making this assessment, management used the criteria set forth... -

Page 145

... are "independent" as that term is defined in applicable SEC Rules and NYSE listing standards. Honeywell's Code of Business Conduct is available, free of charge, on our website under the heading "Investor Relations" (see "Corporate Governance"), or by writing to Honeywell, 101 Columbia Road, Morris... -

Page 146

... stock), and the 1994 Stock Plan for Non-Employee Directors of Honeywell International Inc. (181,500 shares of Common Stock to be issued for options and 33,000 shares of restricted stock). 822,060 growth plan units were issued in the first quarter of 2005 pursuant to a long-term compensation program... -

Page 147

...' accounts under the UK Sharebuilder Plan. The remaining three sub-plans, Honeywell International Technologies Employees Share Ownership Plan (Ireland), the Honeywell Measurex (Ireland) Limited Group Employee Profit Sharing Scheme and the Honeywell Ireland Software Employees Share Ownership Plan... -

Page 148

...under the Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and its Subsidiaries is not determinable because the number of securities that may be issued under this plan depends upon the amount deferred to the plan by participants in future years... -

Page 149

...' Equity for the years ended December 31, 2007, 2006 and 2005 Notes to Financial Statements Report of Independent Registered Public Accounting Firm (a)(2.) Consolidated Financial Statement Schedules: Schedule II-Valuation and Qualifying Accounts 47 48 49 50 51 101 Page Number in Form 10-K 113... -

Page 150

... Vice President and Controller Pursuant to the requirements of the Securities Exchange Act of 1934, this annual report has been signed ...Director /s/ Talia M. Griep Talia M. Griep Vice President and Controller (Principal Accounting Officer) /s/ David J. Anderson (David J. Anderson Attorney-in-fact... -

Page 151

..., dated March 10, 1994, filed pursuant to Rule 14a-6 of the Securities and Exchange Act of 1934, and amended by Exhibit 10.5 to Honeywell's Form 10-Q for the quarter ended June 30, 1999) Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and its... -

Page 152

... Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control), as amended and restated (incorporated by reference to Exhibit 10.19 to Honeywell's Form 10-K for the year ended December 31, 2002 and amended by the attached amendment (filed herewith)) Employment Agreement... -

Page 153

... June 30, 2006) 2007 Honeywell Global Employee Stock Plan (incorporated by reference to Honeywell's Proxy Statement, dated March 12, 2007, filed pursuant to Rule 14a-6 of the Securities and Exchange Act of 1934) Letter Agreement dated July 20, 2007 between Honeywell and Roger Fradin (incorporated by... -

Page 154

... 8-K filed May 18, 2007) Purchase and Sale Agreement between Catalysts, Adsorbents and Process Systems, Inc., and Honeywell Specialty Materials, LLC, dated September 30, 2005 (incorporated by reference to Exhibit 10.23 to Honeywell's Form 10-Q for the quarter ended September 30, 2005) Stock Purchase... -

Page 155

... ) 4 217 79 (115 ) $ 181 (1) Represents uncollectible accounts written off, less recoveries, translation adjustments and reserves acquired. Deferred Tax Assets-Valuation Allowance Balance December 31, 2004 Additions charged to income tax expense Reductions credited to income tax expense Additions... -

Page 156

Balance December 31, 2007 113 $ 490 -

Page 157

... TO THE HONEYWELL INTERNATIONAL INC. SEVERANCE PLAN FOR CORPORATE STAFF EMPLOYEES (INVOLUNTARY TERMINATION FOLLOWING A CHANGE IN CONTROL) EFFECTIVE FEBRUARY 6, 1988 AMENDED AND RESTATED AS OF OCTOBER 24, 2000 The Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary... -

Page 158

...]day of [MONTH, YEAR] (the "Date of Grant"), between Honeywell International Inc. (the "Company") and [EMPLOYEE NAME] (the "Employee"). 1. Grant of Award. The Company has granted you [NUMBER] Restricted Units, subject to the provisions of this Agreement and the 2006 Stock Incentive Plan of Honeywell... -

Page 159

... by reason of your Full Retirement, death or Disability, or a Change in Control, will immediately be forfeited, and your rights with respect to these Restricted Units [and Additional Restricted Units] will end. For purposes of this Agreement, if your employment is terminated under circumstances that... -

Page 160

...] as of the date of the Change in Control (including any Restricted Units [and Additional Restricted Units] that vest pursuant to this Section 9) and a multiplication factor, as set forth in the Plan. Withholdings. The Company or your local employer shall have the power and the right to deduct or... -

Page 161

... Units] will be duly listed, upon official notice of redemption, upon the New York Stock Exchange, and (b) a Registration Statement under the Securities Act of 1933 with respect to the Shares will be effective. The Company will not be required to deliver any Common Stock until all applicable... -

Page 162

... applicable law. (b) You understand that your local employer holds, by means of an automated data file, certain personal information about you, including, but not limited to, name, home address and telephone number, date of birth, social insurance number, salary, nationality, job title, any shares... -

Page 163

... be considered part of your salary or compensation under your employment with your local employer for purposes of calculating any severance, resignation, redundancy or other end of service payments, vacation, bonuses, long-term service awards, indemnification, pension or retirement benefits, or any... -

Page 164

... this Award by signing the Agreement below and, by signing this Agreement, you will be deemed to consent to the application of the terms and conditions set forth in this Agreement and the Plan. If you do not wish to accept this Award, you must contact Honeywell International Inc., Executive 7/8 -

Page 165

Compensation/AB-1D, 101 Columbia Road, Morristown, NJ 07962 in writing within thirty (30) days of the date of this Agreement. Honeywell International Inc. /s/ David M. Cote By: David M. Cote Chairman of the Board and Chief Executive Officer I Accept Signature Date 8/8 -

Page 166

EXHIBIT 12 HONEYWELL INTERNATIONAL INC. STATEMENT RE: COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES 2007 2006 2005 (In millions) 2004 200 Determination of Earnings: Income from continuing operations before taxes Add (Deduct): Amortization of capitalized interest Fixed charges Equity income, ... -

Page 167

... & Chemicals L.L.C. Honeywell Specialty Chemicals Seelze GmbH Honeywell spol s.r.l. (Czech Republic) Honeywell Technical Services S.r.l. Honeywell Technologies Sarl Honeywell Technology Solutions Inc. Honeywell Turbocharging Systems Japan Inc. Honeywell UK Limited Novar Controls Corporation Novar ED... -

Page 168

The names of Honeywell's other consolidated subsidiaries, which are primarily totally-held by Honeywell, are not listed because all such subsidiaries, considered in the aggregate as a single subsidiary, would not constitute a significant subsidiary. -

Page 169

EXHIBIT 23 CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM We hereby consent to the ...Honeywell International Inc. of our report dated February 14, 2008 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting... -

Page 170

... and all capacities, (i) (ii) (iii) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2007, to sign any amendment to the Annual Report referred to in (i) above, and to file the documents described in (i) and (ii) above and all... -

Page 171

... authorized plan pursuant to which securities of the Company are issued to employees, and (b) on Form S-3 (or other appropriate form) for the registration of shares of the Company's Common Stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any plan which... -

Page 172

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. /s/ ... -

Page 173

... filed by the Company on Form S-3 (or other appropriate form) for the registration of: (i) debt securities of the Company, with such terms as may be from time to time specified in such registration statement or any amendment or posteffective amendment; (ii) (iii) shares of the Company's common stock... -

Page 174

This Power of Attorney may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. /s/ ... -

Page 175

... filed by the Company on Form S-3 (or other appropriate form) for the registration of: (i) debt securities of the Company, with such terms as may be from time to time specified in such registration statement or any amendment or posteffective amendment; (ii) (iii) shares of the Company's common stock... -

Page 176

... and all capacities, (i) (ii) (iii) to sign the Company's Annual Report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2007, to sign any amendment to the Annual Report referred to in (i) above, and to file the documents described in (i) and (ii) above and all... -

Page 177

... authorized plan pursuant to which securities of the Company are issued to employees, and (b) on Form S-3 (or other appropriate form) for the registration of shares of the Company's Common Stock to be offered under the Dividend Reinvestment and Share Purchase Plan of the Company and any plan which... -

Page 178

... cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control... -

Page 179

...report financial information; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 15, 2008 By: /s/ David J. Anderson David J. Anderson Chief Financial Officer -

Page 180

... In connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the year ending December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David M. Cote, Chief Executive Officer of the Company, certify, pursuant to... -

Page 181

... connection with the Annual Report of Honeywell International Inc. (the Company) on Form 10-K for the year ending December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the Report), I, David J. Anderson, Chief Financial Officer of the Company, certify, pursuant to...