Honeywell 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

HONEYWELL INTERNATIONAL INC (HON) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/06/2003 Filed Period 12/31/2002 -

Page 2

-

Page 3

... file number 1-8974 HONEYWELL INTERNATIONAL INC. (Exact name of registrant as specified in its charter) DELAWARE State or other jurisdiction of incorporation or organization) 101 Columbia Road P.O. Box 4000 Morristown, New Jersey Address of principal executive offices) 22-2640650 I.R.S. Employer... -

Page 4

... and Executive Officers of the Registrant...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...Certain Relationships and Related Transactions...Controls and Procedures...[Reserved]...Principal Accountant Fees and Services... -

Page 5

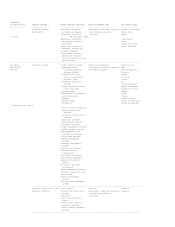

...Hannifin Electronic engine Goodrich (Lucas controls Aerospace) Sensors United Technologies Electric and pneumatic (Hamilton power generation systems Sundstrand) Thrust reverser actuation, pneumatic and electric PRODUCT CLASSES MAJOR PRODUCTS/SERVICES MAJOR CUSTOMERS/USES KEY COMPETITORS (APUs... -

Page 6

1 -

Page 7

..., cleaners Dixie and paints Fairchild Direct Electrical connectors, Wesco Aircraft switches, relays and circuit breakers Value-added services, repair and overhaul kitting and point-of-use replenishment Aerospace Avionics systems Flight safety systems: Commercial, business Airshow, Inc. Electronic... -

Page 8

2 -

Page 9

... Washington Group PRODUCT CLASSES Inertial sensor MAJOR PRODUCTS/SERVICES Inertial sensor systems for guidance, stabilization, navigation and control Gyroscopes, accelerometers, inertial measurement units and thermal switches MAJOR CUSTOMERS/USES Military and commercial vehicles Commercial... -

Page 10

... & Hauser zoning, air cleaners, Commercial customers and Holmes humidification, heat and homeowners served by the Invensys energy recovery distributor, wholesaler, Johnson Controls ventilators contractor, retail and Kavlico Controls plus integrated utility channels Motorola electronic systems for... -

Page 11

-

Page 12

STRATEGIC BUSINESS UNITS SPECIALTY MATERIALS Specialty Materials PRODUCT CLASSES MAJOR PRODUCTS/SERVICES MAJOR CUSTOMERS/USES KEY COMPETITORS Nylon filament and Commercial, residential and BASF staple yarns specialty carpet markets Bayer Bulk continuous Nylon for fibers, DSM filament ... -

Page 13

-

Page 14

STRATEGIC BUSINESS UNITS MAJOR PRODUCTS/SERVICES MAJOR CUSTOMERS/USES KEY COMPETITORS Ultra high purity HF Semiconductors Ashland Solvents Arch Inorganic acids E. Merck High purity solvents Sigma Aldrich Performance chemicals HF derivatives Diverse by product type Atotech Imaging chemicals ... -

Page 15

-

Page 16

... be negatively impacted. In addition, our sales to commercial aftermarket customers of aerospace products and services were 14, 15 and 17 percent of our total sales in 2002, 2001 and 2000, respectively. If there were a large decline in the number of flight hours for aircraft that use our components... -

Page 17

-

Page 18

... and development efforts and technical and managerial capability. While our competitive position varies among our products and services, we believe we are a significant competitor in each of our major product and service classes. However, a number of our products and services are sold in competition... -

Page 19

...specific process or product to be of material importance in relation to our total business. We have registered trademarks for a number of our products, including such consumer brands as Honeywell, Prestone, FRAM, Anso and Autolite. RESEARCH AND DEVELOPMENT Our research activities are directed toward... -

Page 20

..., IL SPECIALTY MATERIALS Pottsville, PA Columbia, SC Chesterfield, VA TRANSPORTATION AND POWER SYSTEMS Thaon-Les-Vosges, France Glinde, Germany Golden Valley, MN Syosset, NY Baton Rouge, LA Geismar, LA Moncure, NC Hopewell, VA Seelze, Germany Longlaville, France Mexicali, Mexico Atessa, Italy... -

Page 21

... of claimants. Rather, we made several products that contained small amounts of asbestos. Honeywell's Bendix Friction Materials business manufactured automotive brake pads that included asbestos in an encapsulated form. There is a group of potential claimants consisting largely of professional... -

Page 22

... toward the settlement or resolution of Bendix related asbestos claims. In the fourth quarter of 2002, we recorded a charge of $167 million consisting of a $131 million reserve for the sale of Bendix to Federal-Mogul, our estimate of asbestos related liabilities net of insurance recoveries and costs... -

Page 23

...fourth quarter of 2002, Honeywell has developed an estimated liability for settlement of pending and future asbestos claims. During the fourth quarter 2002, Honeywell recorded a charge of $1.4 billion for NARCO related asbestos litigation charges, net of insurance recoveries. This charge consists of... -

Page 24

... Senior Vice President of General Electric Company and President and Chief Executive Officer of GE Appliances from June 1996 to November 1999. President and Chief Executive Officer Specialty Materials since November 2001. Senior Vice President and Business Group Executive of Chemical Specialties and... -

Page 25

... 1999. President -- Aerospace Marketing, Sales and Services from January 1999 to March 1999. President -- Aerospace Electronic & Avionics Systems from October 1997 to December 1998. Larry E. Kittelberger, 54 2001 Senior Vice President Administration and Chief Information Officer since August 2001... -

Page 26

... the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after December 31, 2002, and such information is incorporated herein by reference. Certain other information relating to the Executive Officers of Honeywell appears in Part I. of this Form 10-K Annual Report... -

Page 27

... Executive Officers of the Registrant,' and such information is incorporated herein by reference. ITEM 14. CONTROLS AND PROCEDURES Within the 90 days prior to the filing of this report, Honeywell management, including the Chief Executive Officer and Chief Financial Officer, conducted an evaluation... -

Page 28

..., AND REPORTS ON FORM 8-K PAGE NUMBER IN ANNUAL REPORT TO SHAREOWNERS a)(1.) Consolidated Financial Statements: Incorporated by reference to the 2002 Annual Report to Shareowners: Consolidated Statement of Operations for the years ended December 31, 2002, 2001 and 2000 Consolidated Balance Sheet at... -

Page 29

... undersigned, thereunto duly authorized. HONEYWELL INTERNATIONAL INC. March 6, 2003 By: /s/ JOHN J. TUS John J. Tus Vice President and Controller Pursuant to the requirements of the Securities Exchange Act of 1934, this annual report has been signed below by the following persons on behalf of the... -

Page 30

Russell E. Palmer Director Ivan G. Seidenberg Director John R. Stafford Director Michael W. Wright Director /s/ JOHN J. TUS John J. Tus Vice President and Controller (Principal Accounting Officer) March 6, 2003 19 -

Page 31

... affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role... -

Page 32

... affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and (b) any fraud, whether or not material, that involves management or other employees who have a significant role... -

Page 33

... ended September 30, 1991) AlliedSignal Inc. Incentive Compensation Plan for Executive Employees, as amended (incorporated by reference to Exhibit B to Honeywell's Proxy Statement, dated March 10, 1994, filed pursuant to Rule 14a-6 of the Securities Exchange Act of 1934, and to Exhibit 10.5 to... -

Page 34

...to the securing of certain supplemental retirement benefits (incorporated by reference to Exhibit 10.19 to Honeywell's Form 10-K for the year ended December 31, 2000) Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control), as... -

Page 35

...DESCRIPTION ----------Early Retirement Agreement dated as of July 3, 2001 between Honeywell and Michael R. Bonsignore (incorporated by reference to Exhibit 10.22 to Honeywell's Form 10-Q for the quarter ended June 30, 2001) Settlement Agreement between Honeywell International Inc., Honeywell Europe... -

Page 36

... incorporated by reference in this Annual Report on Form 10-K) also included an audit of the Financial Statement Schedule listed in Item 17(a)(2) of this Form 10-K. In our opinion, the Financial Statement Schedule presents fairly, in all material respects, the information set forth therein when read... -

Page 37

HONEYWELL INTERNATIONAL INC SCHEDULE II -- VALUATION AND QUALIFYING ACCOUNTS THREE YEARS ENDED DECEMBER 31, 2002 (IN MILLIONS) ALLOWANCE FOR DOUBTFUL ACCOUNTS: Balance December 31, 1999...Provision charged to income...Deductions from reserves(1)...Balance December 31, 2000...Provision charged to ... -

Page 38

-

Page 39

... to participate in the Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and its Subsidiaries (Career Band 6 and above) (the "Plan"). 2. Definitions Capitalized terms not otherwise defined in the Plan have the respective meanings set forth in... -

Page 40

...the Qualified Savings Plans during the period of such suspension. Notwithstanding the preceding sentence, there shall be credited to the Participant's Account an amount equal to the product of (i) the number of whole shares of common stock of Honeywell International Inc. ("Common Stock") credited to... -

Page 41

...unfunded book entries stated as shares of Common Stock (including fractional shares). The number of shares of Common Stock credited to a Participant's Account shall be determined by dividing the equivalent cash amount (as determined under Section 4(b)) by the closing price of Common Stock on the day... -

Page 42

.... Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. (b) Adjustment of Method of Distribution. Prior to the beginning of any calendar year, a Participant may... -

Page 43

... within the 90-day period following a Change in Control, as defined in Section 9(c). Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. (d) Changing Prior... -

Page 44

... designation in writing with the Plan Administrator. Any fractional shares of Common Stock shall be paid in an equivalent cash amount, as determined using the closing price of Common Stock on the trading date next preceding the distribution date. 8. Payment in the Event of Hardship Upon receipt of... -

Page 45

... the Change in Control. (c) Definition of Change in Control. For purposes of the Plan, a Change in Control is deemed to occur at the time (i) when any entity, person or group (other than the Corporation, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of the... -

Page 46

... Control for purposes of the Plan. 10. Administration (a) Plan Administrator. The Plan Administrator and "named fiduciary" for purposes of ERISA shall be the Senior Vice President-Human Resources and Communications of the Corporation (or the person acting in such capacity in the event such position... -

Page 47

... periods set forth above, the claim shall be deemed denied and the claimant shall be permitted to proceed to the review procedures set forth below. If the Participant fails to appeal the Plan Administrator's denial of benefits in writing and within 60 days after receipt by the claimant of written... -

Page 48

...claims of its general creditors. Such funds, if any, shall not be deemed to be assets of the Plan. The Plan is intended to be unfunded for tax purposes and for purposes of Title I of the Employee Retirement Income Security Act of 1974, as amended. (c) Withholding. The Corporation shall withhold from... -

Page 49

...with the right of the Corporation or its subsidiaries to discharge any employee at any time without regard to the effect which such discharge might have upon the employee's participation in the Plan or benefits under it. (h) Fiduciary Capacities. Any person or group of persons may serve in more than... -

Page 50

-

Page 51

EXHIBIT 10.8 Salary and Incentive Award Deferral Plan for Selected Employees of Honeywell International Inc. and its Affiliates Amended and Restated as of January 1, 2002 -

Page 52

...payable with respect to pay periods in the calendar year next following the date such direction is received by the Corporation. 3. Contributions to Participant Accounts (a) Base Annual Salary. A Participant in Career Band 6 and above (or a Participant who occupies a position equivalent thereto) may... -

Page 53

...earlier of: three years following the last day of the calendar year in which the Deferral Amounts were earned; the date the Participant reaches normal retirement age and is eligible to receive a benefit under a pension plan of the Corporation or one of its affiliates; the date of Participant's death... -

Page 54

... each succeeding calendar year until the entire amount in the Account shall have been paid. Notwithstanding the foregoing, in the event a Participant's employment with the Company is terminated either voluntarily (other than on account of retirement as defined in the qualified pension plan in which... -

Page 55

... Vice President - Human Resources and Communications, or his designee, may cause the Corporation to accelerate (or require the subsidiary of the Corporation which employs or employed the Participant to accelerate) payment of all or any part of the Deferral Amount and Interest Equivalents credited... -

Page 56

... entity, person or group directly or indirectly owning beneficially 30% or more of the outstanding Common Stock, (ii) of the purchase of Common Stock pursuant to a tender offer or exchange offer (other than an offer by the Corporation) for all, or any part of, the Common Stock (iii) of a merger in... -

Page 57

... Employee Retirement Income Security Act of 1974, as amended. Nothing contained herein, and no action taken pursuant to the provisions of this Plan shall create or be construed to create a trust of any kind, or a fiduciary relationship between the Corporation and any Participant or any other person... -

Page 58

... in Control; (iii) any person or group (other than the Corporation, any subsidiary or any savings, pension or other benefit plan for the benefit of employees of the Corporation or its subsidiaries) becomes the beneficial owner, directly or indirectly, of securities of the Corporation representing... -

Page 59

... Treasury bills + 3%* 6% Contingent Rate N/A 3% Total Rate Treasury bills + 3%* 9% */Three-month Treasury bill average rate for the immediately preceding calendar quarter as reported by the Federal Reserve Bank; rate changes each calendar quarter. Deferred Salary (Band 6 and Above) Year Salary... -

Page 60

-

Page 61

EXHIBIT 10.10 364-DAY CREDIT AGREEMENT Dated as of November 27, 2002 HONEYWELL INTERNATIONAL INC., a Delaware corporation (the "Company"), the banks, financial institutions and other institutional lenders (the "Initial Lenders") listed on the signature pages hereof, and CITIBANK, N.A. ("Citibank"), ... -

Page 62

... Applicable Lending Office with respect to such Competitive Bid Advance. "Applicable Margin" means (a) for Base Rate Advances, 0% per annum and (b) for Eurocurrency Rate Advances, as of any date, a percentage per annum determined by reference to the Public Debt Rating in effect on such date as set... -

Page 63

...of any date prior to the Term Loan Conversion Date that the aggregate Advances exceed 50% of the aggregate Commitments, a percentage per annum determined by reference to the Public Debt Rating in effect on such date as set forth below Public Debt Rating Applicable S&P/Moody's Utilization Fee Level... -

Page 64

... Bid Borrowing. "Business Day" means a day of the year on which banks are not required or authorized by law to close in New York City and, if the applicable Business Day relates to any Eurocurrency Rate Advance or LIBO Rate Advance, on which dealings are carried on in the London interbank market... -

Page 65

... of Control" means that (i) any Person or group of Persons (within the meaning of Section 13 or 14 of the Securities Exchange Act of 1934, as amended (the "Act")) (other than the Company, any Subsidiary of the Company or any savings, pension or other benefit plan for the benefit of employees of... -

Page 66

... of such Person), acceptance facilities, or drafts or similar instruments issued or accepted by banks and other financial institutions for the account of such Person; and (v) obligations of such Person under leases which are required to be capitalized on a balance sheet of such Person in accordance... -

Page 67

... of Dollars determined by using the quoted spot rate at which the Sub-Agent's principal office in London offers to exchange such Foreign Currency for Dollars in London prior to 4:00 P.M. (London time) (unless otherwise indicated by the terms of this Agreement) on such date as is required pursuant to... -

Page 68

...'s controlled group, or under common control with such Person, within the meaning of Section 414 of the Internal Revenue Code. "ERISA Event" with respect to any Person means (a) (i) the occurrence of a reportable event, within the meaning of Section 4043 of ERISA, with respect to any Plan of such... -

Page 69

... to prime banks in the London interbank market at 11:00 A.M. (London time) two Business Days before the first day of such Interest Period in an amount substantially equal to such Reference Bank's Eurocurrency Rate Advance comprising part of such Revolving Credit Borrowing to be outstanding during... -

Page 70

... for any Interest Period for each Eurocurrency Rate Advance comprising part of the same Revolving Credit Borrowing shall be determined by the Agent on the basis of applicable rates furnished to and received by the Agent from the Reference Banks two Business Days before the first day of such Interest... -

Page 71

... benefit liabilities, as defined in Section 4001(a)(18) of ERISA. "Interest Period" means, for each Eurocurrency Rate Advance comprising part of the same Revolving Credit Borrowing and each LIBO Rate Advance comprising part of the same Competitive Bid Borrowing, the period commencing on the date... -

Page 72

...) of the rate per annum at which deposits in Dollars or in the relevant Foreign Currency are offered by the principal office of each of the Reference Banks in London, England to prime banks in the London interbank market at 11:00 A.M. (London time) two Business Days before the first day of such... -

Page 73

... in the most recent balance sheet of the Company and its Consolidated Subsidiaries and computed in accordance with GAAP. "Non-Consenting Lender" has the meaning specified in Section 2.16(b). "Note" means a Revolving Credit Note or a Competitive Bid Note. "Notice of Competitive Bid Borrowing" has the... -

Page 74

..." means the Pension Benefit Guaranty Corporation (or any successor). "Person" means an individual, partnership, corporation (including a business trust), joint stock company, trust, unincorporated association, joint venture, limited liability company or other entity, or a government or any political... -

Page 75

... event such plan has been or were to be terminated. "S&P" means Standard & Poor's Ratings Group, a division of The McGraw Hill Companies, Inc. "Sub-Agent" means Citibank International plc. "Subsidiary" of any Person means any corporation, partnership, joint venture, limited liability company, trust... -

Page 76

...or more of such Person's other Subsidiaries. "Telerate Page" means, as applicable, page 3740 or 3750 (or any successor pages, respectively) of Telerate Service of Bridge Information Services. "Term Loan Conversion Date" means the Termination Date on which all Revolving Credit Advances outstanding on... -

Page 77

... of the Commitments being a "Competitive Bid Reduction"). Each Revolving Credit Borrowing shall be in an aggregate amount...York City time) on the third Business Day prior to the date of the proposed Revolving Credit Borrowing in the case of a Revolving Credit Borrowing consisting of Eurocurrency Rate... -

Page 78

... in Dollars, and before 11:00 A.M. (London time) on the date of such Revolving Credit Borrowing, in the case of a Revolving Credit Borrowing consisting of Eurocurrency Rate Advances denominated in any Major Currency, make available for the account of its Applicable Lending Office to the Agent at the... -

Page 79

... Bid Borrowing, (C) interest rate basis and day count convention to be offered by the Lenders, (D) currency of such proposed Competitive Bid Borrowing, (E) in the case of a Competitive Bid Borrowing consisting of LIBO Rate Advances, Interest Period of each Competitive Bid Advance to be made as part... -

Page 80

... (w) 10:00 A.M. (New York City time) at least one Business Day prior to the date of the proposed Competitive Bid Borrowing, if such Borrower shall specify in its Notice of Competitive Bid Borrowing that the rates of interest to be offered by the Lenders shall be fixed rates per annum (each Advance... -

Page 81

...11:00 A.M. (New York City time) three Business Days before the date of such proposed Competitive Bid Borrowing, in the case of a Competitive Bid Borrowing consisting of LIBO Rate Advances denominated in Dollars, (C) before 10:00 A.M. (New York City time) on the Business Day prior to the date of such... -

Page 82

... of such Competitive Bid Borrowing, the consequent Competitive Bid Reduction and the dates upon which such Competitive Bid Reduction commenced and will terminate. (vi) If the Borrower proposing the Competitive Bid Borrowing notifies the Agent that it accepts one or more of the offers made by any... -

Page 83

... this Section 2.03, provided that a Competitive Bid Borrowing shall not be made within three Business Days of the date of any other Competitive Bid Borrowing. (d) Any Borrower that has borrowed through a Competitive Bid Borrowing shall repay to the Agent for the account of each Lender that has made... -

Page 84

...part of a Competitive Bid Borrowing shall be evidenced by a separate Competitive Bid Note of the Borrower payable to the order of the Lender making such Competitive Bid Advance. SECTION 2.04. Fees. (a) Facility Fee. The Company agrees to pay to the Agent for the account of each Lender a facility fee... -

Page 85

... 2.10 and any indemnification for Taxes under Section 2.13) as of the effective date of such assignment; and (iv) if the assignee selected by the Company is not an existing Lender, such assignee or the Company shall have paid the processing and recordation fee required under Section 9.07(a) for... -

Page 86

.... (e) Mandatory Reduction. On the Termination Date, if the Company has made the Term Loan Election in accordance with Section 2.06 prior to such date, and from time to time thereafter upon each prepayment of the Revolving Credit Advances, the Commitments of the Lenders shall be automatically and... -

Page 87

... Utilization Fee in effect from time to time, payable in arrears quarterly on the last day of each March, June, September and December during such periods and on the date such Base Rate Advance shall be paid in full. (ii) Eurocurrency Rate Advances. During such periods as such Revolving Credit... -

Page 88

...deposits in the London interbank market at or about 11:00 A.M. (London time) on the second Business Day before the making of a Borrowing in sufficient amounts to fund their respective Revolving Credit Advances as part of such Borrowing during its Interest Period or (ii) the Eurocurrency Rate for any... -

Page 89

...the Equivalent thereof in a Major Currency (determined on the date notice of prepayment is given) in excess thereof and (y) in the event of any such prepayment of a Eurocurrency Rate Advance other than on the last day of the Interest Period therefor, such Borrower shall be obligated to reimburse the... -

Page 90

...of this type, then, upon demand by such Lender (with a copy of such demand to the Agent), the Company shall pay to the Agent for the account of such Lender, from time to time as specified by such Lender, additional amounts sufficient to compensate such Lender or such corporation in the light of such... -

Page 91

... 2.10, and any indemnification for Taxes under Section 2.13) as of the effective date of such assignment and (iv) if the assignee selected by the Company is not an existing Lender, such assignee or the Company shall have paid the processing and recordation fee required under Section 9.07(a) for... -

Page 92

..., in accordance with market practice), in each case for the actual number of days (including the first day but excluding the last day) occurring in the period for which such interest or facility fees are payable. Each determination by the Agent of an interest rate hereunder shall be conclusive... -

Page 93

... shall be made within 30 days from the date such Lender or the Agent (as the case may be) makes written demand therefor. Each Lender agrees to provide reasonably prompt notice to the Agent, the Company and any Borrower of any imposition of Taxes or Other Taxes against such Lender; provided that... -

Page 94

..., at such address, an opinion of counsel acceptable to the Agent stating that such payment is exempt from Taxes. For purposes of this subsection (d) and subsection (e), the terms "United States" and "United States person" shall have the meanings specified in Section 7701 of the Internal Revenue Code... -

Page 95

...2.10, and any indemnification for Taxes under this Section 2.13) as of the effective date of such assignment; and (iv) if the assignee selected by the Company is not an existing Lender, such assignee or the Company shall have paid the processing and recordation fee required under Section 9.07(a) for... -

Page 96

... 2.10, and any indemnification for Taxes under this Section 2.13) as of the effective date of such assignment; and (iii) with respect to any such Assuming Lender, such Assuming Lender or the Company shall have paid the applicable processing and recordation fee required under Section 9.07(a) for... -

Page 97

... Lender. (d) In the event that (x) as to a Non-Consenting Lender, neither procedure contemplated by subsection (b)(i) or (b)(ii) above is implemented in a timely basis or (y) the Company shall, by written notice to the Agent at least four days prior to the Extension Date, withdraw its request for... -

Page 98

... following conditions precedent have been satisfied: (a) There shall have occurred no Material Adverse Change since December 31, 2001, except as otherwise publicly disclosed prior to the date hereof. (b) There shall exist no action, suit, investigation, litigation or proceeding affecting the Company... -

Page 99

... have paid all accrued fees and expenses of the Agent and the Lenders in respect of this Agreement. (d) On the Effective Date, the following statements shall be true and the Agent shall have received a certificate signed by a duly authorized officer of the Company, dated the Effective Date, stating... -

Page 100

(c) The Company shall have paid all accrued fees and expenses of the Agent (including the billed fees and expenses of counsel to the Agent). SECTION 3.03. Initial Loan to Each Designated Subsidiary. The obligation of each Lender to make an initial Advance to each Designated Subsidiary following any ... -

Page 101

... by a Designated Subsidiary, the representations and warranties of such Designated Subsidiary contained in its Designation Letter are correct on and as of the date of such Revolving Credit Borrowing, before and after giving effect to such Revolving Credit Borrowing and to the application of the... -

Page 102

.... The Agent shall promptly notify the Lenders of the occurrence of the Effective Date. ARTICLE IV REPRESENTATIONS AND WARRANTIES SECTION 4.01. Representations and Warranties of the Company. The Company represents and warrants as follows: (a) The Company is a corporation duly organized, validly... -

Page 103

... case of said balance sheet as at September 30, 2002, and said statements of income and cash flows for the nine months then ended, to year-end audit adjustments, the Consolidated financial condition of the Company and its Consolidated Subsidiaries as at such dates and the Consolidated results of the... -

Page 104

... material liability of the Company or any of its ERISA Affiliates. (j) The Schedules B (Actuarial Information) to the 2001 annual reports (Form 5500 Series) with respect to each Plan of the Company or any of its ERISA Affiliates, copies of which have been filed with the Internal Revenue Service (and... -

Page 105

...their officers or directors and with their independent certified public accountants. (f) Keeping of Books. Keep, and cause each Designated Subsidiary to keep, proper books of record and account, in which full and correct entries shall be made of all financial transactions and the assets and business... -

Page 106

... three quarters of each fiscal year of the Company, a Consolidated balance sheet of the Company and its Consolidated Subsidiaries as of the end of such quarter and a Consolidated statement of income and cash flows of the Company and its Consolidated Subsidiaries for the period commencing at the end... -

Page 107

... after the filing thereof with the Internal Revenue Service, copies of Schedule B (Actuarial Information) to each annual report (Form 5500 series) filed by the Company or any of its ERISA Affiliates with respect to each Plan; (viii) promptly after receipt thereof by the Company or any of its ERISA... -

Page 108

... (including exchange control approvals) ...consolidated with the Company or a Subsidiary of the Company; (ii) Liens on property of the Company or its Subsidiaries existing at the time of acquisition thereof or incurred to secure the payment of all or part of the purchase price thereof or to secure... -

Page 109

... be secured under clause (i) through (vi) above) and the aggregate value of the Sale and Leaseback Transactions in existence at such time, does not at any one time exceed 10% of the Net Tangible Assets of the Company and its Consolidated Subsidiaries; and provided further that the following type of... -

Page 110

...its part to be performed or observed and such failure shall remain unremedied for a period of 30 days after any Lender shall have given notice thereof to the relevant Borrower or, in the case of the Company, any of the principal financial officer, the principal accounting officer, the Vice-President... -

Page 111

... of the Company located outside the Exempt Countries, (C) such event or occurrence is due to the direct or indirect action of any government entity or agency in any Exempt Country and (D) as of the last day of the calendar quarter immediately preceding such event or occurrence, the book value of the... -

Page 112

... of the Company located outside the Exempt Countries, (C) such event or occurrence is due to the direct or indirect action of any government entity or agency in any Exempt Country and (D) as of the last day of the calendar quarter immediately preceding such event or occurrence, the book value of the... -

Page 113

... or any of its ERISA Affiliates has incurred exceeds 6% of Net Tangible Assets of the Company and its Consolidated Subsidiaries; or (iii) any Borrower or any of its ERISA Affiliates shall have been notified by the sponsor of a Multiemployer Plan of such Borrower or any of its ERISA Affiliates that... -

Page 114

... case of any extension of time of payment, in whole or in part, of such Advance, that all such sums shall be promptly paid when due (whether at stated maturity, by acceleration or otherwise) in accordance with the terms of such extension; and (b) all other amounts payable hereunder by any Designated... -

Page 115

... shall be held in trust for the benefit of the Lenders and the Agent and shall forthwith be paid to the Agent for its own account and the accounts of the respective Lenders to be credited and applied to the Obligations, whether matured or unmatured, in accordance with the terms of this Agreement, or... -

Page 116

... on the part of any Borrower or to inspect the property (including the books and records) of any Borrower; (e) shall not be responsible to any Lender for the due execution, legality, validity, enforceability, genuineness, sufficiency or value of this Agreement or any other instrument or document... -

Page 117

...reimburse the Agent promptly upon demand for its ratable share of any out-of-pocket expenses (including counsel fees) incurred by the Agent in connection with the preparation, execution, delivery, administration, modification, amendment or enforcement (whether through negotiations, legal proceedings... -

Page 118

... or to any Designated Subsidiary, at the Company's address at 101 Columbia Road, Morristown, New Jersey 07962-1219, Attention: Assistant Treasurer; if to any Initial Lender, at its Domestic Lending Office specified opposite its name on Schedule I hereto; if to any other Lender, at its Domestic... -

Page 119

... (including printing, distribution and bank meetings), transportation, computer, duplication, appraisal, consultant, and audit expenses and (ii) the reasonable fees and expenses of counsel for the Agent with respect thereto. The Company further agrees to pay on demand all costs and expenses of the... -

Page 120

... Advances. (c) If any payment of principal of, or Conversion of, any Eurocurrency Rate Advance or LIBO Rate Advance is made by the Borrower to or for the account of a Lender other than on the last day of the Interest Period for such Advance, as a result of a payment or Conversion pursuant to Section... -

Page 121

..., together with a processing and recordation fee of $3,500 and, if the assigning Lender is not retaining a Commitment hereunder, any Revolving Credit Note subject to such assignment. Upon such execution, delivery, acceptance and recording, from and after the effective date specified in each... -

Page 122

...Exhibit C hereto, (i) accept such Assignment and Acceptance, (ii) record the information contained therein in the Register and (iii) give prompt notice thereof to the Company and to each other Borrower. (d) The Agent shall maintain at its address referred to in Section 9.02 a copy of each Assumption... -

Page 123

... the Board of Governors of the Federal Reserve System. SECTION 9.08. Designated Subsidiaries (a) Designation. The Company may at any time, and from time to time, by delivery to the Agent of a Designation Letter duly executed by the Company and the respective Subsidiary and substantially in the form... -

Page 124

...information (i) by the Agent to any Lender, (ii) to the extent required by law (including statute, rule, regulation or judicial process), (iii) to counsel for any Lender or the Agent or to their respective independent public accountants, (iv) to bank examiners and auditors and appropriate government... -

Page 125

...any period prior to the date of any change or specification of a new Applicable Lending Office or any rebooking of any Advance. SECTION 9.11. Governing Law. This Agreement and the Notes shall be governed by, and construed in accordance with, the laws of the State of New York. SECTION 9.12. Execution... -

Page 126

... matters addressed herein and supercedes all prior communications, written or ...rate of exchange used shall be that at which in accordance with normal banking procedures the Agent could purchase the Original Currency with the Other Currency at 9:00 A.M. (New York City time) on the first Business Day... -

Page 127

... parties hereto have caused this Agreement to be executed by their respective officers thereunto duly authorized, as of the date first above written. HONEYWELL INTERNATIONAL INC. By:/s/ James V. Gelly Name: James V. Gelly Title: Vice President and Treasurer CITIBANK, N.A., as Agent By /s/ Carolyn... -

Page 128

... By:/s/ Christopher Criswell Name: Christopher Criswell Title: Managing Director By:/s/ Bruno Lavole Name: Bruno Lavole Title: Managing Director $55,000,000 BANK OF TOKYO-MITSUBISHI TRUST COMPANY By:/s/ Spencer Hughes Name: Spencer Hughes Title: Vice President $55,000,000 HSBC BANK USA By... -

Page 129

...: Assistant Vice President $50,000,000 BANK ONE, NA By:/s/ Mahua Thakurta Name: Mahua Thakurta Title: Associate Director $50,000,000 THE NORTHERN TRUST COMPANY By:/s/ Ashish S. Bhagwat Name: Ashish S. Bhagwat Title: Vice President CO-AGENTS $21,666,667 SUMITOMO MITSUI BANKING CORPORATION By... -

Page 130

...000,000 WESTPAC BANKING CORPORATION By:/s/ Lisa Porter -----------------------------------Name: Lisa Porter Title: Vice President $15,000,000 THE BANK OF NOVA SCOTIA By:/s/ KCC Clarke -----------------------------------Name: KCC Clarke Title: Managing Director $15,000,000 CREDIT AGRICOLE INDOSUEZ By... -

Page 131

... Sr. Relationship Manager $15,000,000 INTESA BCI By:/s/ F. Maffei Name: F. Maffei Title: Vice President By:/s/ C. Dougherty Name: C. Dougherty Title: Vice President $15,000,000 SOCIETE GENERALE By:/s/ Ambrish D. Thanawala Name: Ambrish D. Thanawala Title: Director Corporate Banking $1,000... -

Page 132

..., IL 60604 Chicago, IL 60604 Attn: Credit Administration Attn: Credit Administration Phone: (312) 992-51521 Phone: (312) 992-51521 Fax: (312) 992-5157 Fax: (312) 992-5157 Allied Irish Banks, plc AIB Business Support Unit, AIB Business Support Unit, BankCentre BankCentre 8 Ballsbridge 8 Ballsbridge... -

Page 133

...NY 10081 New York, NY 10081 Attn: Lenora Kiernan Attn: Lenora Kiernan Phone: (212) 552-7309 Phone: (212) 552-7309 Fax: (212) 552-5650 Fax: (212) 552-5650 ---------------------------------------------------------------------------------------------------The Northern Trust Company 50 S. LaSalle Street... -

Page 134

...Sumitomo Mitsui Banking 277 Park Avenue 277 Park Avenue Corporation New York, NY 10172 New York, NY 10172 Attn: Edward McColly Attn: Edward McColly Phone: (212) 224-4139 Phone: (212) 224-4139 Fax: (212) 224-4384 Fax: (212... -

Page 135

... Law Complaints principally allege that the defendants violated federal securities laws by purportedly making false and misleading statements and by failing to disclose material information concerning Honeywell's financial performance, thereby allegedly causing the value of Honeywell's stock to... -

Page 136

... majority of claimants. Rather, we made several products that contained small amounts of asbestos. Honeywell's Bendix Friction Materials business manufactured automotive brake pads that included asbestos in an encapsulated form. There is a limited group of potential claimants consisting largely of... -

Page 137

... plus the existing NARCO assets. While any such settlement could have a material adverse impact on our consolidated operating results or operating cash flows in the periods recognized or paid, we do not believe that it would have a material adverse impact on our consolidated financial position... -

Page 138

... Lending Office on the Termination Date (each as defined in the Credit Agreement referred to below) the aggregate principal amount of the Revolving Credit Advances made by the Lender to the Borrower pursuant to the 364-Day Credit Agreement dated as of November 27, 2002 among Honeywell International... -

Page 139

.... No failure to exercise, and no delay in exercising, any rights hereunder on the part of the holder hereof shall operate as a waiver of such rights. This promissory note shall be governed by, and construed in accordance with the laws of the State of New York. [NAME OF BORROWER] By Name: Title: 2 -

Page 140

ADVANCES AND PAYMENTS OF PRINCIPAL Amount of Amount of Advance in Principal Unpaid Type of Relevant Interest Paid Principal Notation Date Advance Currency Rate or Prepaid Balance Made By 3 -

Page 141

... [NAME OF BORROWER], a _____ corporation (the "Borrower"), HEREBY PROMISES TO PAY to the order of _____ (the "Lender") for the account of its Applicable Lending Office (as defined in the 364-Day Credit Agreement dated as of November 27, 2002 among Honeywell International Inc., the Lender and certain... -

Page 142

This Promissory Note shall be governed by, and construed in accordance with, the laws of the State of New York. [NAME OF BORROWER] By Name: Title: 2 -

Page 143

...") as required by Section 2.02(a) of the Credit Agreement: (i) The Business Day of the Proposed Revolving Credit Borrowing is _____. (ii) The Type of Advances comprising the Proposed Revolving Credit Borrowing is [Base Rate Advances] [Eurocurrency Rate Advances]. (iii) The aggregate amount of the... -

Page 144

Very truly yours, [NAME OF BORROWER] By Name: Title: 2 -

Page 145

... Date] [Interest Period] (D) Interest Rate Basis (E) Day Count Convention (F) Interest Payment Date(s) (G) [Currency] (H) Borrower's Account Location (I [Date] The undersigned hereby certifies that the conditions precedent to this Competitive Bid Borrowing set forth in Section 3.05 of the Credit... -

Page 146

The undersigned hereby confirms that the Proposed Competitive Bid Borrowing is to be made available to it in accordance with Section 2.03(a)(v) of the Credit Agreement. Very truly yours, [NAME OF BORROWER] By Name: Title: 2 -

Page 147

... is made to the 364-Day Credit Agreement dated as of November 27, 2002 (as amended or modified from time to time, the "Credit Agreement") among Honeywell International Inc., a Delaware corporation (the "Borrower"), the Lenders (as defined in the Credit Agreement), and Citibank, N.A., as agent... -

Page 148

...any Revolving Credit Notes for periods prior to the Effective Date directly between themselves. 7. This Assignment and Acceptance shall be governed by, and construed in accordance with, the laws of the State of New York. 8. This Assignment and Acceptance may be executed in any number of counterparts... -

Page 149

Schedule 1 to Assignment and Acceptance Dated: Section 1. Percentage interest assigned: Assignee's Commitment: Section 2. (a) Assigned Advances Aggregate outstanding principal amount of Revolving Credit Advances in Dollars assigned: Aggregate outstanding principal amount of Revolving Credit Advances... -

Page 150

... Lending Office: [Address] Consented to this _____ day of _____ [NAME OF BORROWER] By Name: Title: ] 'E'_____ EXHIBIT D - FORM OF ASSUMPTION AGREEMENT Dated:_____ Honeywell International Inc. P.O. Box 12l9 101 Columbia Road ---------(1) This date should be no earlier than five Business Days after... -

Page 151

... is made to the 364-Day Credit Agreement dated as of November 27, 2002 among Honeywell International Inc. (the "Company"), the Lenders parties thereto, and Citibank, N.A. as Agent (the "Credit Agreement"; terms defined therein being used herein as therein defined), for such Lenders. The undersigned... -

Page 152

... the terms of the Credit Agreement are required to be performed by it as a Lender; (v) specifies as its Lending Office (and address for notices) the offices set forth beneath its name on the signature pages hereof; and (vi) attaches the forms prescribed by the Internal Revenue Service of the United... -

Page 153

... the State of New York. Very truly yours, [NAME OF ASSUMING LENDER] By Name: Title: Domestic Lending Office (and address for notices): [Address] Eurodollar Lending Office [NAME OF ASSIGNOR](2) By Name: Title: [Address] Above Acknowledged and Agreed to: HONEYWELL INTERNATIONAL INC. By Name: Title... -

Page 154

... DESIGNATION LETTER [DATE] To each of the Lenders parties to the Credit Agreement (as defined below) and to Citibank, N.A., as Agent for such Lenders Ladies and Gentlemen: Reference is made to the 364-Day Credit Agreement dated as of November 27, 2002 among Honeywell International Inc. (the "Company... -

Page 155

..., filings or registrations by or with any governmental authority or administrative body are required in connection with the execution, delivery or performance by the Designated Subsidiary of this Designation Letter, the Credit Agreement or the Notes of the Designated Subsidiary except for such... -

Page 156

... Advance will not be, (a) an "investment company" within the meaning of the Investment Company Act of 1940, as amended, or (b) a "holding company" within the meaning of the Public Utility Holding Company Act of 1935, as amended. Very truly yours, HONEYWELL INTERNATIONAL INC. By Name: Title: [THE... -

Page 157

... of the Credit Agreement to which _____ has become subject pursuant to its Designation Letter, _____ has appointed the undersigned (with an office on the date hereof at 1633 Broadway, New York, New York 10019, United States) as Process Agent to receive on behalf of _____ and its property service of... -

Page 158

This acceptance and agreement shall be binding upon the undersigned and all successors of the undersigned. Very truly yours, [PROCESS AGENT] By 2 -

Page 159

EXHIBIT G - FORM OF OPINION OF GAIL E. LEHMAN, ASSISTANT GENERAL COUNSEL FOR THE COMPANY _____ __, 2002 To each of the Lenders parties to the Credit Agreement (as defined below), and to Citibank, N.A., as Agent for said Lenders Honeywell International Inc. Ladies and Gentlemen: This opinion is ... -

Page 160

...relied upon certificates of the Company or its officers or of public officials. I have assumed the due execution and delivery, pursuant to due authorization, of the Credit Agreement by the Initial Lenders and the Agent. I am qualified to practice law in the State of New York, and I do not purport to... -

Page 161

... of the law of any jurisdiction (other than the State of New York) wherein any Lender or Applicable Lending Office may be located or wherein enforcement of the Credit Agreement or the Notes of the Company may be sought which limits rates of interest which may be charged or collected by such Lender... -

Page 162

... 364-Day Credit Agreement dated as of November 27, 2002 among Honeywell International Inc., the Lenders named therein, and Citibank, N.A., as Agent for such Lenders (the "Credit Agreement"). In connection therewith, I have also examined the following documents: (i) The Designation Letter (as defined... -

Page 163

... than the State of New York) wherein any Lender or Applicable Lending Office may be located or wherein enforcement of the Credit Agreement, the Designation Letter of the Designated Subsidiary or the Notes of the Designated Subsidiary may be sought which limits rates of interest which may be charged... -

Page 164

... The Designated Subsidiary is not a "holding company" within the meaning of the Public Utility Holding Company Act of 1935, as amended. In connection with the opinions expressed by me above in paragraph 3, I wish to point out that (i) provisions of the Credit Agreement which permit the Agent or any... -

Page 165

... acted as special New York counsel to Citibank, N.A., as Agent, in connection with the preparation, execution and delivery of the 364-Day Credit Agreement dated as of November 27, 2002 (the "Credit Agreement"), among Honeywell International Inc., a Delaware corporation (the "Company"), and each of... -

Page 166

... State of New York wherein any Lender may be located or wherein enforcement of the Credit Agreement or any of the Notes may be sought that limits the rates of interest legally chargeable or collectible. A copy of Person that becomes Agreement. Any such opinion letter were this opinion letter may be... -

Page 167

...date of this opinion letter even though such development, circumstance or change may affect the legal analysis, a legal conclusion or any other matter set forth in or relating to this opinion letter. Accordingly, any Lender relying on this opinion letter at any time should seek advice of its counsel... -

Page 168

EXECUTION COPY U.S. $1,000,000,000 364-DAY CREDIT AGREEMENT Dated as of November 27, 2002 Among HONEYWELL INTERNATIONAL INC., as Borrower, and THE INITIAL LENDERS NAMED HEREIN, as Initial Lenders, and CITIBANK, N.A., as Administrative Agent and JPMORGAN CHASE BANK DEUTSCHE BANK AG, NEW YORK BRANCH ... -

Page 169

... Credit Advances ...29 Increased Costs ...30 Illegality ...31 Payments and Computations ...31 Taxes ...33 Sharing of Payments, Etc...35 Use of Proceeds ...36 Extension of Termination Date ...36 Evidence of Debt ...37 i Certain Defined Terms ...1 Computation of Time Periods ...16 Accounting Terms... -

Page 170

... ...54 Guarantee Absolute ...54 Waivers ...55 Remedies ...55 No Stay ...55 Survival ...55 Events of Default ...50 Affirmative Covenants ...45 Negative Covenants ...48 Representations and Warranties of the Company ...42 Conditions Precedent to Effectiveness of Sections 2.01 and 2.03 ...38 Conditions... -

Page 171

...SECTION 9.13. SECTION 9.14. SECTION 9.15. SECTION 9.16. SECTION 9.17. Lender Credit Decision ...57 Indemnification ...57 Successor Agent ...57 Sub-Agent ...58 Amendments, Etc...58... ...64 Mitigation of Yield Protection ...64 Governing Law ...65 Execution in Counterparts ...65 Jurisdiction, Etc...65 ... -

Page 172

... Notice of Revolving Credit Borrowing Form of Notice of Competitive Bid Borrowing Form of Assignment and Acceptance Form of Assumption Agreement Form of Designation Letter Form of Acceptance by Process Agent Form of Opinion of Gail E. Lehman, Assistant General Counsel of the Company Form of Opinion... -

Page 173

-

Page 174

... NO. 1 TO THE CREDIT AGREEMENT Dated as of November 27, 2002 AMENDMENT NO. 1 TO THE FIVE YEAR CREDIT AGREEMENT among HONEYWELL INTERNATIONAL INC., a Delaware corporation (the "Company"), the banks, financial institutions and other institutional lenders parties to the Credit Agreement referred to... -

Page 175

... 30 days; (e) The following new definitions are added to Section 1.01 immediately after the defined term "Escrow": "EURIBO Rate" means, for any Interest Period for each Eurocurrency Rate Advance comprising part of the same Borrowing, the rate per annum appearing on Page 248 of the Telerate Service... -

Page 176

... The definition of "Merger Agreement" in Section 1.01 is deleted in full. (j) The definition of "Reference Banks" in Section 1.01 is amended in full to read as follows: "Reference Banks" means Citibank, Bank of America, N.A., JPMorgan Chase Bank and Deutsche Bank AG New York Branch. (k) Section 2.13... -

Page 177

...execution, delivery and administration, modification and amendment of this Amendment and the other instruments and documents to be delivered hereunder (including, without limitation, the reasonable fees and expenses of counsel for the Agent) in accordance with the terms of Section 8.04 of the Credit... -

Page 178

... shall be governed by, and construed in accordance with, the laws of the State of New York. IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written. HONEYWELL INTERNATIONAL INC. By... -

Page 179

... Name: Douglas Bernegger Title: Director BANCA NAZIONALE DE LAVORO S.p.A.-NEW YORK BRANCH By Name: Title: THE BANK OF NEW YORK By Name: Title: BANK OF TOKYO-MITSUBISHI TRUST COMPANY By: /s/ Spencer Hughes Name: Spencer Hughes Title: Vice President BANK ONE, NA By: /s/ Mahua Thakurta Name: Mahua... -

Page 180

... J. Miller Title: Assistant Vice President BANCA DI ROMA By: ----------------------------------Name: Title: By: ----------------------------------Name: Title: BNP PARIBAS By: /s/ Christopher Criswell ----------------------------------Name: Christopher Criswell Title: Managing Director By: /s/ Bruno... -

Page 181

...: Peter M. Angelica Title: Vice President BANCO BILBAO VIZCAYA By: /s/ Miguel Lara ----------------------------------Name: Miguel Lara Title: VP, Global Corporate Banking By: /s/ Phillip Paddack ----------------------------------Name: Phillip Paddack Title: Senior VP, Branch Manager BANK OF MONTREAL... -

Page 182

...Name: Christopher Eldin Title: FVP & Deputy Manager By: /s/ Charles Michael ----------------------------------Name: Charles Michael Title: Vice President MIZUHO CORPORATE BANK, LTD By: /s/ Naoki Yamamori ----------------------------------Name: Naoki Yamamori Title: Deputy General Manager -

Page 183

-

Page 184

EXHIBIT 10.19 HONEYWELL INTERNATIONAL INC. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control) Effective February 6, 1988 Amended and Restated as of December 20, 2001 -

Page 185

HONEYWELL INTERNATIONAL INC. SEVERANCE PLAN FOR CORPORATE STAFF EMPLOYEES (Involuntary Termination Following a Change in Control) ARTICLE I PURPOSE 1.1 The purpose of this Plan is to provide severance benefits to Plan Participants in the event of the Involuntary Termination of their employment ... -

Page 186

... Corporate Staff Employee - means a salaried or non-union hourly employee of Honeywell International Inc. employed in Career Bands 1 through 7 who, during a Potential Change In Control Period and/or at the time of a Change in Control, (a) is not associated with (i) an operating business of Honeywell... -

Page 187

...'s Pay or employee benefits other than a reduction which is generally applicable to all salaried and non-union hourly employees of Honeywell International Inc., (ii) permanent elimination of the Participant's position, not including transfer pursuant to the sale of a facility or line of business in... -

Page 188

... Base Salary and, as to a Participant employed in Band 5 or above, Annual Incentive Compensation. 2.17 Plan - means the Honeywell International Inc. Severance Plan for Corporate Staff Employees (Involuntary Termination Following a Change in Control). 2.18 Plan Administrator - means the person or... -

Page 189

... to Honeywell International Inc.) in accordance with this Article IV. 4.2 Pay, Benefit and Pension Service Continuation A) Pay Continuation - A Participant shall receive Base Salary, paid in accordance with his or her normal payroll period, and, as to Participants employed in Career Band 5 or... -

Page 190

... to the terms of this Plan (including payments from any benefit or compensation plan or program sponsored or funded by Honeywell International Inc. but excluding payments and benefits provided upon a change in control under the AlliedSignal Severance Plan for Senior Executives, Honeywell Inc. Tier... -

Page 191

...any successor or substitute provision of the Code (hereafter the "Section 4999 tax") or Honeywell International Inc. has withheld the amount of the Section 4999 tax, an additional benefit shall be paid pursuant to this Plan to such affected Participant, in an amount, which when added to all payments... -

Page 192

... Period In the event a Potential Participant is involuntarily terminated by Honeywell International Inc. (i) during a Potential Change in Control Period, and (ii) under circumstances described in clause (a) of Section 2.13 that are related to the Potential Change in Control, the Plan Administrator... -

Page 193

... person or group (other than Honeywell International Inc., any Affiliated Company or any savings, pension or other benefit plan for the benefit of employees of Honeywell International Inc. or its Affiliated Companies) becomes the beneficial owner, directly or indirectly, of securities of Honeywell... -

Page 194

... be entitled to rely on the records of the Corporation in determining any Participant's entitlement to and the amount of benefits payable under the Plan. 5.3 Benefit Claims and Appeals Any request or claim for Plan benefits shall be deemed to be filed when a written request is made by the claimant... -

Page 195

... time periods set forth above, the claim shall be deemed denied and the claimant shall be permitted to proceed to the review procedures set forth below. If the claimant fails to appeal the Plan Administrator's denial of benefits in writing and within 60 days after receipt by the claimant of written... -

Page 196

...entitled to benefits under the Plan if the Plan Administrator ultimately determines that the facts and circumstances presented to the Plan Administrator would have constituted an Involuntary Termination under Section 2.13(b), provided such Participant resigns from Honeywell International Inc. within... -

Page 197

... of the amendment is to increase benefits hereunder. Notwithstanding anything in this Plan to the contrary, the Senior Vice President-Human Resources and Communications shall be permitted to amend the Plan to reflect changes in Honeywell International Inc.'s organization; provided, however, that no... -

Page 198

... XIV MISCELLANEOUS 14.1 Legal Fees After the Plan Administrator has determined that (i) an employee satisfies the definition of Participant, and (ii) such Participant is entitled to benefits under the Plan, Honeywell International Inc. shall reimburse such Plan Participant for all reasonable legal... -

Page 199

..., to waive such right. 14.3 Coordination of Benefits In the event that (i) a Participant in the Plan is covered by another severance plan of Honeywell International Inc. or an affiliate which provides benefits similar to those provided under the Plan, and (ii) such Participant becomes entitled to... -

Page 200

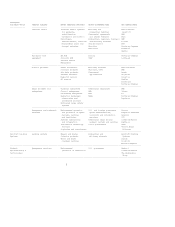

SCHEDULE A Bands ----5 and 6 4I Severance Pay Period 18 months Base Salary and Annual Incentive Compensation One month notice, plus Years of Service 0-4 5-9 10-19 20+ 4 Base Salary 6 9 12 15 months months months months One month notice, plus Years of Service 0-4 5-9 10-19 20+ Base Salary 6 9 12 15... -

Page 201

-

Page 202

...12 HONEYWELL INTERNATIONAL INC. STATEMENT RE: COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES 2002 ---DETERMINATION OF EARNINGS: Income (loss) before taxes...Add (Deduct): Amortization of capitalized interest...Fixed charges...Equity income, net of distributions...Total earnings, as defined...2001... -

Page 203

-

Page 204

... product line of Honeywell Inc. resulting in a net after-tax charge of $634 million, or $0.78 per share. In 1999, includes merger, repositioning and other charges and gains on the sales of our Laminate Systems business and our investment in AMP Incorporated common stock resulting in a net after-tax... -

Page 205

... $269 million decrease in cost of goods sold due principally to lower sales in our Specialty Materials and Aerospace segments and lower costs due to the benefits of repositioning actions, mainly workforce reductions. Selling, general and administrative expenses were $2,757, $3,064 and $3,134 million... -

Page 206

26 -

Page 207

..., PFC and Consumer Products businesses, tax benefits on export sales and favorable tax audit settlements. The effective tax (benefit) rate in 2001 was substantially higher than the statutory rate of 35 percent principally due to tax benefits on export sales, U.S. tax credits and favorable tax audit... -

Page 208

repositioning, litigation, business impairment and other charges recognized in 2002 and 2001. Those charges are described in 27 -

Page 209

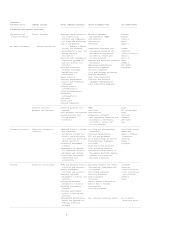

... of this MD&A. Review of Business Segments (Dollars in millions) 2002 2001 2000 Net Sales Aerospace...$ 8,855 $ 9,653 $ 9,988 Automation and Control Solutions...6,978 7,185 7,384 Specialty Materials...3,205 3,313 4,055 Transportation and Power Systems...3,184 3,457 3,527 Corporate...52 44 69 22... -

Page 210

... to lower sales of higher-margin aftermarket products, higher retirement benefit costs, engineering and development costs related to new products and the impact of prior year divestitures. This decrease was partially offset by the impact of cost-reduction actions, primarily workforce reductions. 28 -

Page 211

... impact of lower sales volumes and pricing pressures, mainly in our Automation and Control Products and Service businesses. This decrease was partially offset by lower costs due to the benefits of repositioning actions, mainly workforce reductions. Automation and Control Solutions segment profit in... -

Page 212

in North 29 -

Page 213

... to costs for the planned shutdown and consolidation of manufacturing plants in our Specialty Materials and Automation and Control Solutions reportable segments. Severance costs were related to announced workforce reductions of approximately 8,100 manufacturing and administrative positions of which... -

Page 214

...reasonable estimation related mainly to closed facilities in our Automation and Control Solutions and Specialty Materials reportable segments. Also, $76 million of previously established severance accruals were returned to income in 2002, due to fewer employee separations than originally anticipated... -

Page 215

... Automation and Control Solutions and Aerospace reportable segments. These repositioning actions are expected to generate incremental pretax savings of approximately $400 million in 2003 compared with 2002 principally from planned workforce reductions and facility consolidations. Cash expenditures... -

Page 216

acquirers of these businesses and assets. As part of this process, we evaluated the businesses and assets for possible impairment. As a result of our analysis, we recognized impairment charges in 2000 of $245 and $165 million principally related to the write-down of property, plant and equipment, ... -

Page 217

... claims and settlements of contract liabilities ...-56 -Write-offs of receivables, inventories and other assets ...10 31 13 295 $367 $263 Corporate (Dollars in millions) 2002 2001 2000 Net repositioning charge ...$ 38 $105 $ 8 Asbestos related litigation charges, net of insurance ...1,381 159... -

Page 218

...to our U.S. defined benefit pension plans of $830 million in 2002 and an increase in cash of $628 million. This increase was also due to an increase in deferred tax assets of $712 million due to the repositioning, litigation, business impairment and other charges and net operating tax losses in 2002... -

Page 219

...2002 increased by $384 million compared with 2001 mainly due to an improvement in working capital (receivables and inventories) turnover and lower tax payments. This increase was partially offset by a cash contribution to our U.S. defined benefit pension plans of $130 million and higher spending for... -

Page 220

33 -

Page 221

... cash flows will be sufficient to meet our future cash needs. Our available cash, committed credit lines, access to the public debt markets using debt securities and commercial paper, as well as our ability to sell trade accounts receivables, provide additional sources of short-term and long-term... -

Page 222

... represent probable insurance recoveries through 2018. See Asbestos Matters in Note 21 of Notes to Financial Statements. (4) Off-Balance Sheet Arrangements Following is a summary of our off-balance sheet arrangements: Guarantees We have issued or are a party to the following direct and indirect... -

Page 223

... are reflected in the table of contractual obligations and residual value guarantees are reflected in the table of guarantees. We do not expect any of our off-balance sheet arrangements to have a material adverse effect on our consolidated results of operations, financial position or liquidity. 35 -

Page 224

... accruals is generally no later than the completion of feasibility studies. We expect to fund expenditures for these matters from operating cash flow. The timing of cash expenditures depends on a number of factors, including the timing of litigation and settlements of personal injury and property... -

Page 225

...we issue both fixed and variable rate debt and use interest rate swaps to manage our exposure to interest rate movements and reduce overall borrowing costs. Financial instruments, including derivatives, expose us to counterparty credit risk for nonperformance and to market risk related to changes in... -

Page 226

...the impact of market risk on the fair value and cash flows of our derivative and other financial instruments considering reasonably possible changes in interest and currency exchange rates and restrict the use of derivative financial instruments to hedging activities. The following table illustrates... -

Page 227

... are subject to a number of lawsuits, investigations and claims (some of which involve substantial dollar amounts) that arise out of the conduct of our global business operations. These contingencies relate to product liabilities, including asbestos, commercial transactions, government contracts and... -

Page 228

... rate of return on plan assets is a long-term assumption and generally does not change annually. The discount rate reflects the market rate for high-quality fixed income debt instruments on our annual measurement date (December 31) and is subject to change each year. Changes in net periodic pension... -

Page 229

not be required to make any contributions in 2003. SFAS No. 87 requires recognition of an additional minimum pension liability if the fair value of plan assets is less than the accumulated benefit obligation at the end of the plan year. 38 -

Page 230

...information on recognized impairment charges see the repositioning, litigation, business impairment and other charges section of this MD&A. Sales Recognition on Long-Term Contracts Sales under long-term contracts (primarily in our Aerospace and Automation and Control Solutions segments) are recorded... -

Page 231

enhancement programs, including repositioning actions and Six Sigma initiatives, have largely offset any impact. Recent Accounting Pronouncements See Note 1 of Notes to Financial Statements for a discussion of recent accounting pronouncements. 39 -

Page 232

CONSOLIDATED STATEMENT OF OPERATIONS Honeywell International Inc. Years Ended December 31 Dollars in Millions, Except Per Share Amounts) 2002 2001 2000 Net sales ...$22,274 $23,652 $25,023 Costs, expenses and other Cost of goods sold ...17,615 20,125 18,673 Selling, general and administrative ... -

Page 233

... income taxes ...419 875 Postretirement benefit obligations other than pensions ...1,684 1,845 Asbestos related liabilities ...2,700 -Other liabilities ...2,538 1,385 CONTINGENCIES SHAREOWNERS' EQUITY Capital -- common stock -- Authorized 2,000,000,000 shares (par value $1 per share): -- issued... -

Page 234

...) to net cash provided by operating activities: (Gain) loss on sale of non-strategic businesses ...124 -(112) Repositioning and other charges ...634 2,491 549 Litton settlement payment, net of tax refund of $58 in 2002 ...(162) (220) -Asbestos related litigation charges, net of insurance ...1,548... -

Page 235

... pension liability adjustment...(47) (47) Unrealized holding loss on marketable securities...(3) (3) Change in fair value of effective cash flow hedges ...(5) (5) -----Nonowner changes in shareowners' equity ...(205) Common stock issued for employee savings and option plans (including related tax... -

Page 236

... aerospace products and services, control, sensing and security technologies for buildings, homes and industry, automotive products, specialty chemicals, fibers, and electronic and advanced materials. The following is a description of the significant accounting policies of Honeywell International... -

Page 237

..., and intangible assets with determinable lives) whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable. We evaluate events or changes in circumstances based on a number of factors including operating results, business plans and 44 -

Page 238

...is sold separately or competitor prices for similar products or services. Aerospace Customer Incentives We offer sales incentives to commercial aircraft manufacturers and airlines in connection with their selection of our products. These incentives may consist of free products, credits, discounts or... -

Page 239

Pro forma net income (loss)...$ (284) $ (184) $1,584 Earnings (loss) per share of common stock: Basic-- as reported...$(0.27) $(0.12) $ 2.07 Basic-- pro forma...$(0.35) $(0.23) $ 1.98 Earnings (loss) per share of common stock: Assuming dilution -- as reported...$(0.27) $(0.12) $ 2.05 Assuming ... -

Page 240

... number of common shares outstanding and all dilutive potential common shares outstanding. Use of Estimates The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported... -

Page 241

143, "Accounting for Asset Retirement Obligations" (SFAS No. 143), the provisions of which are effective for us on January 1, 2003. SFAS No. 143 requires entities to recognize the fair value of a liability for tangible long-lived asset retirement obligations in the period incurred, if a reasonable ... -

Page 242

... for homes and buildings. Its systems and products are marketed globally under the Ademco, Notifier, System Sensor, ADI, Northern Computers and other brand names. Pittway is part of our Security and Fire Solutions business in our Automation and Control Solutions reportable segment and gives us... -

Page 243

...other charges by income statement classification. 2002 2001 2000 Cost of goods sold ...$ 561 $2,134 $413 Selling, general and administrative expenses ...45 151 -Asbestos related litigation charges, net of insurance ...1,548 159 7 Business impairment charges ...877 145 410 Equity in (income) loss of... -

Page 244

... to costs for the planned shutdown and consolidation of manufacturing plants in our Specialty Materials and Automation and Control Solutions reportable segments. Severance costs were related to announced workforce reductions of approximately 8,100 manufacturing and administrative positions of which... -

Page 245

... to businesses in our Specialty Materials and Automation and Control Solutions segments, as well as our Friction Materials business. Based on current operating losses and deteriorating economic conditions in certain chemical and telecommunications end markets, we performed impairment tests and... -

Page 246

...) ON SALE OF NON-STRATEGIC BUSINESSES In 2002, we sold the following businesses: Pretax After-tax gain (loss) gain (loss Automation and Control Solutions -Consumer Products ...$(131) $(10) Specialty Materials -- Advanced Circuits ...(83) 18 Specialty Materials -- Pharmaceutical Fine Chemicals (PFC... -

Page 247

Years Ended December 31 2002 2001 2000 Interest income and other ...$(68) $(50) $(79) Minority interests ...8 24 34 Foreign exchange (gain) loss ...56 9 (12 4) $(17) $(57 49 -

Page 248

.... The weighted average interest rate on short-term borrowings and commercial paper outstanding at December 31, 2002 and 2001 was 1.23 and 7.46 percent, respectively. NOTE 7. INCOME TAXES Income (loss) before taxes Years Ended December 31 2002 2001 2000 United States ...$(1,262) $(751) $1,842... -

Page 249

... (572) $(878) Postretirement benefits other than pensions and postemployment benefits ...781 828 Investment and other asset basis differences ...(192) (219) Other accrued items ...796 376 Net operating losses ...863 597 U.S. net capital loss ...196 -Tax credits ...253 167 Undistributed earnings of... -

Page 250

.... Cash payments (refunds) of income taxes during the years 2002, 2001 and 2000 were $(14), $79 and $442 million, respectively. NOTE 8. EARNINGS (LOSS) PER SHARE The following table sets forth the computations of basic and diluted earnings (loss) per share: Net Average Per Share Income (Loss) Shares... -

Page 251

... when the options' exercise prices exceed the average market price of the common shares during the period. In 2000, the number of stock options not included in the computation was 14,563,673. These stock options were outstanding at the end of 2000. NOTE 9. ACCOUNTS, NOTES AND OTHER RECEIVABLES... -

Page 252

... and 2000, respectively. No credit losses were incurred during those years. NOTE 10. INVENTORIES December 31 2002 2001 Raw materials ...$ 936 $1,024 Work in process ...804 869 Finished products ...1,361 1,603 3,101 3,496 Less -Progress payments ...(28) (25) Reduction to LIFO cost basis ...(120... -

Page 253

... for the year ended December 31, 2002 by reportable segment is as follows: Currency December 31, Translation December 31, 2001 Acquisitions Divestitures Adjustment 2002 Aerospace ...$1,595 $ 46 $ -$ 3 $1,644 Automation and Control Solutions ...2,461 211 (13) 19 2,678 Specialty Materials ...861 -(24... -

Page 254

...December 31 2002 2001 Compensation and benefit costs ...$ 440 $ 638 Customer advances ...458 489 Income taxes ...56 31 Environmental costs ...75 81 Asbestos related liabilities ...741 182 Litton litigation settlement ...-220 Severance ...325 484 Product warranties and performance guarantees ...179... -

Page 255

... due 2011 ...500 500 Industrial development bond obligations, 4.40% - 6.75%, maturing at various dates through 2036 ...86 80 6 ...capitalized leases), 1.54% - 12.50%, maturing at various dates through 2033 ...384 437 4,719 $4,731 The schedule of principal payments on long-term debt is as follows... -

Page 256

... credit facilities with a group of banks which are comprised of: (a) a $1 billion Five-Year Credit Agreement and (b) a $1 billion 364-Day Credit Agreement. The credit agreements are maintained for general corporate purposes including support for the issuance of commercial paper. We had no balance... -

Page 257

.... NOTE 17. FINANCIAL INSTRUMENTS As a result of our global operating and financing activities, we are exposed to market risks from changes in interest and foreign currency exchange rates and commodity prices, which may adversely affect our operating results and financial position. We minimize our... -

Page 258

...we modified terms and conditions of our credit sales to mitigate or eliminate concentrations of credit risk with any single customer. Our sales are not materially dependent on a single customer or a small group of customers. Foreign Currency Risk Management We conduct our business on a multinational... -

Page 259

when the hedged transaction is recognized. Interest Rate Risk Management We use a combination of financial instruments, including medium-term and short-term financing, variable-rate commercial paper, and interest rate swaps to manage the interest rate mix of our total debt portfolio and related ... -

Page 260

... in the Consolidated Balance Sheet approximates fair value. Summarized below are the carrying values and fair values of our other financial instruments at December 31, 2002 and 2001. The fair values are based on the quoted market prices for the issues (if traded), current rates offered to us... -

Page 261

...adjustment for losses on securities available-for-sale included in net income Net unrealized losses arising during the year...(4) 1 (3) Foreign exchange translation adjustments...(51) -(51) Change in fair value of effective cash flow hedges...(8) 3 (5) Minimum pension liability adjustment...(78) 31... -

Page 262

...the Management Development and Compensation Committee of the Board. The options are granted at a price equal to our stock's fair market value on the date of grant. The options generally become exercisable over a three-year period and expire after ten years. The following table summarizes information... -

Page 263

...on date of grant using Black-Scholes option-pricing model. Restricted Stock Units Restricted stock unit (RSU) awards entitle the holder to receive one share of common stock for each unit when the units vest. RSU's are issued to certain key employees as compensation and as incentives tied directly to... -

Page 264

... of common stock at the fair market value on the date of grant. We have set aside 450,000 shares for issuance under the Directors' Plan. Options generally become exercisable over a three-year period and expire after ten years. Employee Stock Match Plans We sponsor employee savings plans under which... -

Page 265