Hibbett Sports 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Hibbett Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A N N U A L R E P O R T TO S TO C K H O L D E R S 2 0 1 1

H I B B E T T

S PO RTS

WHO’S KEEPING SCORE?

2 0 1 2 A N N U A L R E P O R T T O S T O C K H O L D E R S

Table of contents

-

Page 1

HIBBETT S P O RTS WHO'S KEEPING SCORE? A N N U A L R E P O R T TO S TO C K H O L D E R S 2 0 1 1 2 0 1 2 A N N U A L R E P O R T T O S T O C K H O L D E R S -

Page 2

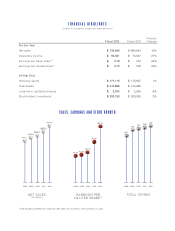

... per share amounts) Fiscal 2012 For the Year Net sales Operating income Earnings per basic share (1) Fiscal 2011 Percent Change $ 732,645 $ 093,531 $ 0002.19 $ 0002.15 $ 664,954 $ 073,547 $ 0001.63 $ 0001.60 10% 27% 34% 34% Earnings per diluted share(1) At Year End Working capital Total... -

Page 3

...We hope our stockholders are as well. Fiscal 2012 was Hibbett's best year ever on top of Fiscal 2011, which is now officially our second best year. This performance would not be possible without the daily commitment from more than 6,700 associates in our stores, store support center and distribution... -

Page 4

... program has grown to over 2.2 million members, and we are utilizing social media, email, and direct mail to reach our target customers. As we look ahead to Fiscal 2013, we are very confident we will continue to improve in all areas of our business and capitalize on the opportunities for new store... -

Page 5

...451 Industrial Lane, Birmingham, Alabama 35211 (Address of principal executive offices, including zip code) 205-942-4292 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.01 Par Value Per Share Title of Class Securities... -

Page 6

... closing sale price of $39.24 at July 29, 2011 for the common stock on such date on the NASDAQ Global Select Market. The number of shares outstanding of the Registrant's common stock, as of March 16, 2012 was 26,297,500. DOCUMENTS INCORPORATED BY REFERENCE Portions of the Registrant's Annual Report... -

Page 7

... 14. Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services. 52... -

Page 8

... revolving credit facilities; our seasonal sales patterns and assumptions concerning customer buying behavior; our expectations regarding competition; our ability to renew or replace store leases satisfactorily; our estimates and assumptions as they relate to preferable tax and financial accounting... -

Page 9

...and hired Mickey Newsome, our current Executive Chairman of the Board. The following year, we opened another sporting goods store in Birmingham and by the end of 1980, we had 12 stores in central and northwest Alabama with a distribution center located in Birmingham and our central accounting office... -

Page 10

... football teams, the Texas Rangers, St. Louis Cardinals and New York Yankees professional baseball teams, and the Chicago Bulls, Oklahoma City Thunder and Dallas Mavericks professional basketball teams. Sports Additions Our 19 Sports Additions stores are small, primarily enclosed mall-based stores... -

Page 11

... or special events, such as college or professional championships. Our merchandising staff, operations staff and management analyze current sporting goods trends primarily through the gathering and analyzing of daily sales activity available through point-of-sale terminals located in the stores... -

Page 12

... support larger format stores. Our stores compete with local sporting goods stores, department and discount stores, traditional shoe stores and mass merchandisers. On a limited basis, we have competition from national sporting goods chains in some of our larger markets. Although we face competition... -

Page 13

... retail clerk, outside salesman to schools, store manager, district manager, regional manager and President. Prior to joining us, Mr. Newsome worked in the sporting goods retail business for six years. Cathy E. Pryor, age 49, is currently our Senior Vice President of Operations and has been with us... -

Page 14

... suitable sites with acceptable terms, build-out and equip the stores with furnishings and appropriate merchandise, hire and train personnel and integrate the stores into our operations. In addition, our expansion strategy may be subject to rising real estate and construction costs, available credit... -

Page 15

...occur in the future, if they should impact areas in which we have our distribution center or a concentration of retail stores, such events could have a material adverse effect on our business, financial condition and results of operations, particularly if they occur during peak shopping seasons. Our... -

Page 16

... mass merchandisers and, on a limited basis, national sporting goods stores. Many of our competitors have greater financial resources than we do. In addition, many of our competitors employ price discounting policies that, if intensified, may make it difficult for us to reach our sales goals without... -

Page 17

...; calendar shifts or cancellations of sales tax-free holidays in certain states; the success or failure of college and professional sports teams within our core regions; changes in the other tenants in the shopping centers in which we are located; pricing, promotions or other actions taken by us... -

Page 18

... he is actively involved in the daily operations of our Company and his retirement is not currently planned. The Compensation Committee of our Board of Directors reviews a succession plan prepared by senior management in consideration of the loss of other key personnel positions on a bi-annual basis... -

Page 19

...other factors, we face many external risks and internal factors in meeting our labor needs, including competition for qualified personnel, overall unemployment levels, prevailing wage rates, as well as rising employee benefit costs, including insurance costs and compensation programs. We also engage... -

Page 20

... the Team facility located in Birmingham, Alabama that warehouses inventory for educational institutions and youth associations. We believe our current distribution center is suitable and adequate to support our needs in the next few years. The lease for our corporate offices and distribution center... -

Page 21

... centers include free-standing stores. The following shows the number of locations by state as of January 28, 2012: Alabama Arizona Arkansas Colorado Florida Georgia Iowa Illinois Indiana 83 6 41 5 39 89 8 19 20 Kansas Kentucky Louisiana Missouri Mississippi Nebraska New Mexico North Carolina Ohio... -

Page 22

...and Issuer Purchases of Equity Securities. Our common stock is traded on the NASDAQ Global Select Market (NASDAQ/GS) under the symbol HIBB. The following table sets forth, for the periods indicated, the high and low sales prices of shares of our Common Stock as reported by NASDAQ. Fiscal 2012: First... -

Page 23

... our equity compensation plans, see "Part III, Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters." Issuer Repurchases of Equity Securities The following table presents our shares repurchase activity for the thirteen weeks ended January 28, 2012... -

Page 24

... per share amounts and Selected Operating Data) Fiscal Year Ended January 28, January 29, January 30, January 31, February 2, 2012 2011 2010 2009 2008 Income Statement Data: Net sales Cost of goods sold, including distribution center and store occupancy costs Gross profit Store operating, selling... -

Page 25

... of customer service. As of January 28, 2012, we operated a total of 832 retail stores in 26 states composed of 812 Hibbett Sports stores, 19 Sports Additions athletic shoe stores and 1 Sports & Co. superstore. Our primary retail format and growth vehicle is Hibbett Sports, a 5,000-square-foot store... -

Page 26

...this Annual Report on Form 10-K for the fiscal year ended January 28, 2012, for information regarding recent accounting pronouncements. Results of Operations The following table sets forth the percentage relationship to net sales of certain items included in our consolidated statements of operations... -

Page 27

... our total store base and include free-standing store locations. Gross profit. Cost of goods sold includes the cost of inventory, occupancy costs for stores and occupancy and operating costs for the distribution center. Gross profit was $262.4 million, or 35.8% of net sales, in Fiscal 2012, compared... -

Page 28

... profit percent was due primarily to a higher percentage of merchandise sold at regular price and fewer promotions. Distribution expense as a percentage of net sales decreased 19 basis points primarily due to basis point decreases in salary and benefit costs compared to a year ago. Store occupancy... -

Page 29

... tax rate as a percentage of pre-tax income was 36.8% for Fiscal 2011 and 37.8% for Fiscal 2010. This decrease was primarily due to increased stock option exercise activity. Liquidity and Capital Resources Our capital requirements relate primarily to new store openings, stock repurchases and working... -

Page 30

... automobiles and security equipment for our stores. In addition, the lease for our existing distribution center expires in December 2014. We plan to build and own versus lease our new distribution facility at a cost of approximately $25.0 million over the next 3 years. As of January 28, 2012, we had... -

Page 31

... financial statements are detailed below. Revenue Recognition. We recognize revenue, including gift card and layaway sales, in accordance with ASC Topic 605, Revenue Recognition. Retail merchandise sales occur on-site in our retail stores. Customers have the option of paying the full purchase price... -

Page 32

... store purchases, website surveys and other activities on our website. Based on the number of points accumulated, customers receive reward certificates on a quarterly basis that can be redeemed in our stores. An estimate of the obligation related to the program, based on historical redemption rates... -

Page 33

... plans and stock purchase rights associated with the Employee Stock Purchase Plan. Volatility is estimated as of the date of grant or purchase date based on management's estimate of the time period that captures the relative volatility of our stock. We base the risk-free interest rate on the annual... -

Page 34

... shopping combined with tax-free holidays in many of our markets. In addition, our quarterly results of operations may fluctuate significantly as a result of a variety of factors, including the timing of new store openings, the amount and timing of net sales contributed by new stores, merchandise... -

Page 35

... financial statements and supplementary data of our Company are included in response to this item: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of January 28, 2012 and January 29, 2011 Consolidated Statements of Operations for the fiscal years... -

Page 36

... consolidated financial statements and an opinion on Hibbett Sports, Inc.'s internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 37

... Accrued payroll expenses Deferred rent Other accrued expenses Total current liabilities Capital lease obligations Deferred rent Unrecognized tax benefits Other liabilities, net Total liabilities Stockholders' Investment: Preferred stock, $.01 par value, 1,000,000 shares authorized, no shares issued... -

Page 38

HIBBETT SPORTS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share information) Net sales Cost of goods sold, including distribution center and store occupancy costs Gross profit Store operating, selling and administrative expenses Depreciation and ... -

Page 39

... from sale of property and equipment Net cash used in investing activities Cash Flows From Financing Activities: Cash used for stock repurchases Net payments on revolving credit facility and capital lease obligations Excess tax benefit from stock option exercises Cash used to settle net share equity... -

Page 40

... options, including tax benefit of $1,834 Tax shortfall on release of restricted stock and option exercises Adjustment to income tax benefit from exercises of employee stock options Purchase of shares under the stock repurchase program Stock-based compensation Balance-January 28, 2012 Amount $ 363... -

Page 41

...consolidated statements of operations for Fiscal 2012, Fiscal 2011 and Fiscal 2010 include 52 weeks of operations. Our merchandise assortment features a core selection of brand name merchandise emphasizing athletic footwear, team sports equipment, athletic and fashion apparel and related accessories... -

Page 42

..., merchandise purchases, store occupancy costs and a portion of our distribution costs related to our retail business in cost of goods sold. Costs associated with moving merchandise to and between stores are included in store operating, selling and administrative expenses. Stock Repurchase Program... -

Page 43

... store closing plans. Construction in progress has historically been comprised primarily of property and equipment related to unopened stores and costs associated with technology upgrades at period-end. At fiscal year ended January 28, 2012, approximately 95% of the construction in progress balance... -

Page 44

... of returns and discounts and exclude sales taxes. We offer a customer loyalty program, the MVP Rewards program, whereby customers, upon registration, can earn points in a variety of ways, including store purchases, website surveys and other activities on our website. Based on the number of points... -

Page 45

... the consolidated financial statements at this time. NOTE 3. STOCK-BASED COMPENSATION At January 28, 2012, we had four stock-based compensation plans: (a) The Amended 2005 Equity Incentive Plan (EIP) provides that the Board of Directors may grant equity awards to certain employees of the Company at... -

Page 46

... financial statements, as disclosed above, is based on the amount of compensation expense recorded for book purposes. The actual income tax benefit realized in our income tax return is based on the intrinsic value, or the excess of the market value over the exercise or purchase price, of stock... -

Page 47

... goals and cliff vest in one to five years from the date of grant after achievement of stated performance criterion and upon meeting stated service conditions. The following table summarizes the restricted stock unit awards activity under all of our plans during Fiscal 2012: RSUs Weighted Average... -

Page 48

... total unamortized unrecognized compensation cost related to RSU awards. This cost is expected to be recognized over a weighted average period of 2.4 years. Employee Stock Purchase Plan The Company's ESPP allows eligible employees the right to purchase shares of our common stock, subject to certain... -

Page 49

...800 nonvested stock awards granted to certain employees from the computation of diluted weighted average common shares and common share equivalents outstanding, because they are subject to performance-based annual vesting conditions which had not been achieved by the end of Fiscal 2012. Assuming the... -

Page 50

...a sale-leaseback transaction to finance our distribution center and office facilities. In December 1999, the related operating lease was amended to include the Fiscal 2000 expansion of these facilities. The amended lease rate is $0.9 million per year and can increase annually with the Consumer Price... -

Page 51

We also maintain the Hibbett Sports, Inc. Supplemental 401(k) Plan (Supplemental Plan) for the purpose of supplementing the employer matching contribution and salary deferral opportunity available to highly compensated employees whose ability to receive Company matching contributions and defer ... -

Page 52

... as a tax deduction or credit in future tax returns or are items of income that have not been recognized for financial statement purposes but were included in the current or prior tax returns for which we have already properly recorded the tax benefit in the consolidated statements of operations. At... -

Page 53

... In addition, the Compensation Committee (Committee) of the Board of Directors places performance criteria on awards of PSUs made in the form of RSUs to our NEOs under the EIP. The performance criteria are tied to performance targets with respect to future sales and operating income over a specified... -

Page 54

... following tables set forth certain unaudited consolidated financial data for the thirteen-week quarters indicated (dollar amounts in thousands, except per share amounts): Net sales Gross profit Operating income Net income Basic earnings per share Diluted earnings per share $ $ $ $ $ $ First 203... -

Page 55

..., including the Chief Executive Officer and President (principal executive officer) and Chief Financial Officer and Senior Vice President (principal financial officer), as appropriate, to allow timely decisions regarding the required disclosures. As of January 28, 2012, our management, under the... -

Page 56

... adopted a Code of Business Conduct and Ethics (Code) for all Company employees, including our Named Executive Officers as determined for our Proxy Statement for the 2012 Annual Meeting of Stockholders (Proxy Statement) to be held on May 24, 2012. We have also adopted a set of Corporate Governance... -

Page 57

...the Board of Directors of KPMG LLP as the Company's Independent Registered Public Accounting Firm" in the Proxy Statement. PART IV Item 15. Exhibits and Consolidated Financial Statement Schedules. (a) Documents filed as part of this report: 1. Financial Statements. The following Financial Statements... -

Page 58

... to the Registrant's Current Report on Form 8-K filed November 18, 2011. Annual Report to Security Holders Fiscal 2012 Annual Report to Stockholders. Subsidiaries of the Registrant List of Company's Subsidiaries: 1) Hibbett Sporting Goods, Inc., a Delaware Corporation 2) Hibbett Team Sales, Inc., an... -

Page 59

... information in Exhibit 101 to this Annual Report on Form 10-K shall not be deemed to be "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be part of any registration statement or other document filed under the Securities... -

Page 60

... duly authorized. HIBBETT SPORTS, INC. Date: March 26, 2012 By: /s/ Gary A. Smith Gary A. Smith Chief Financial Officer and Senior Vice President (Principal Financial Officer and Chief Accounting Officer) Pursuant to the requirements of the Exchange Act, this report has been signed below by... -

Page 61

... in the three-year period ended January 28, 2012 and (ii) the effectiveness of internal control over financial reporting as of January 28, 2012, which report appears in the January 28, 2012, Annual Report on Form 10-K of Hibbett Sports, Inc. /s/ KPMG LLP Birmingham, Alabama March 26, 2012 57 End... -

Page 62

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 26, 2012 /s/ Jeffry O. Rosenthal Jeffry O. Rosenthal Chief Executive Officer and President... -

Page 63

...Rule 13a-14(a)/15d-14(a) Certification of Principal Financial Officer I, Gary A. Smith, certify that: 1. I have reviewed this annual report on Form 10-K of Hibbett Sports, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 64

...information contained in the Report fairly presents in all material respects, the financial condition and results of operations of the Company. Date: March 26, 2012 /s/ Jeffry O. Rosenthal Jeffry O. Rosenthal Chief Executive Officer and President (Principal Executive Officer) Date: March 26, 2012... -

Page 65

... Registered Public Accounting Firm KPMG LLP Birmingham, Alabama BOARD OF DIRECTORS Michael J. Newsome - Executive Chairman of the Board, Hibbett Sports, Inc. Alton E. Yother - Lead Director, Senior Executive Vice President and Chief Financial Officer (Retired), Regions Financial Corporation... -

Page 66

H I B B E T T S P O RTS , I N C . 451 Industrial Lane Birmingham, Alabama 35211 205.942.4292 w w w. h i b b e t t . c o m