Fifth Third Bank 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

focused.

Fifth Third Bancorp

annual report 2005

Table of contents

-

Page 1

Fifth Third Bancorp annual report 2005 focused. -

Page 2

.... Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. The Company has $105.2 billion in assets and operates 19 affiliates with 1,119 full-service banking centers, including 119 Bank Mart® locations open seven days a week inside select grocery stores... -

Page 3

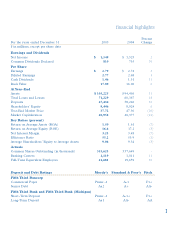

... per share data Earnings and Dividends Net Income Common Dividends Declared Per Share Earnings Diluted Earnings Cash Dividends Book Value At Year-End Assets Total Loans and Leases Deposits Shareholders' Equity Year-End Market Price Market Capitalization Key Ratios (percent) Return on Average Assets... -

Page 4

... company still earned more than $1.5 billion in net income and added significantly to our customer base. Throughout its history, the story of Fifth Third has been one of growth and value creation that was perhaps unrivaled in the banking industry. In fact, Fifth Third is more than five times larger... -

Page 5

.... In total, noninterest revenues increased by a healthy 10 percent over the prior year, excluding operating lease revenue, gains and losses on the sales of securities and a gain realized on the sales of certain third-party sourced merchant processing contracts in 2004. Despite good loan and deposit... -

Page 6

... any business is defined as consistently delivering above average returns that compound over time. History has shown that a company cannot shrink its way to meeting that standard. During 2005, Fifth Third: • Invested in customer service. The manner and efficiency in which we support and interact... -

Page 7

... is to invest shareholders' capital in a manner that enhances value while ensuring that our businesses are being properly compensated for the level of risk being assumed. " Maintaining Financial Discipline Financial discipline is the foundation of great companies, and great companies consistently... -

Page 8

... this company has long been known. In each of our affiliates, we have experienced leaders working as a team to serve all of the customers in their market. Whether, like me, these leaders have been with Fifth Third for a very long time or have brought to our company many years of banking experience... -

Page 9

... our business - deposits, fees and loans - remain intact, with annualized growth rates consistent with Fifth Third's standards and historical performance. Change can be seen, however, in improvements in our commitment to customer service, use of technology, corporate governance and capital and risk... -

Page 10

... a personalized level of service to our customers. FITB Affiliate Cincinnati Chicago Western Michigan Detroit Columbus Cleveland South Florida Dayton Indianapolis Toledo Southern Indiana Louisville Northern Michigan Northern Kentucky Nashville Lexington Ohio Valley Tampa Bay Orlando State OH IL... -

Page 11

...all of our affiliates, business lines and banking centers are managed to detailed financial statements. It fosters a culture of business ownership. It rewards talented individuals for making the right decisions for customers, communities and shareholders. It encourages our employees to work together... -

Page 12

...expertise. Fifth Third has been highly successful over the years in gaining new customers. High-performing employees, a performance-based sales culture, a strong balance sheet and nimble operating model have afforded Fifth Third numerous advantages in a highly competitive industry. Beginning in 2004... -

Page 13

... management solution that creates a single customer view across our key operating platforms. This solution crosses business lines and affiliates with a seamless integration of a common set of sales and management information. The simplified and faster information flow will increase reaction time... -

Page 14

... on service. Fifth Third's 1,119 banking centers, including 119 Bank Mart® locations open seven days a week inside select grocery stores, and 2,024 Jeanie® ATM's serve as the primary point of contact for our six million customers. Fifth Third's internet banking and bill payment system provides... -

Page 15

... customized solutions through integrated web-based platforms that offer big company functionality at small business prices. With increased database marketing and new bundled deposit and cash management products, small business deposits increased by 19 percent in 2005 and now total $5.1 billion... -

Page 16

... the communities in which they operate. Fifth Third's commercial team has the experience to advise our customers, the financial resources to support their growth and the willingness, infrastructure and ability to provide customized financial solutions. Period End Commercial Loans & Leases $ billions... -

Page 17

... matching products and services to their needs. Fifth Third offers a comprehensive product set from traditional commercial and industrial lending, to real estate and leasing, to corporate and international finance, trade facilitation and payment solutions. Our extensive cash management expertise... -

Page 18

...transactions as part of integrated cash management solutions for financial institutions, merchants and consumers all over the world. As a leading electronic payment processor, we help our customers eliminate paper and reduce cycle time and expense while providing instant online access to information... -

Page 19

... transactions, an increase of 33 percent over 2004 and double the number processed just three years ago. FTPS operates three primary businesses - Merchant Services, Financial Institution and Card Services. Our Merchant Services group provides over 127,000 merchant locations with debit, credit... -

Page 20

.... Our broad array of equity and fixed income products are offered through separately managed portfolios, daily-valued collective funds, lifestyle funds and our nationally recognized mutual funds* . 2005 Revenue Mix Asset Management 5% Private Client 66% Retail Brokerage 15% Institutional 14% 18... -

Page 21

... transfer to heirs or charitable institutions. • Private Banking Comprehensive services designed to meet traditional and specialized banking needs, including personal checking and cash management, mortgage loans, lines of credit and other customized solutions. • Wealth Protection Specialized... -

Page 22

... Third footprint. Our Community Affairs department identifies lending and real estate opportunities in traditionally underserved markets, such as ethnically diverse, urban and low- to moderate-income census tracts. This group also champions financial literacy by providing homebuyer training, credit... -

Page 23

... Operations Income Taxes Retirement and Benefit Plans Earnings Per Share Fair Value of Financial Instruments Business Combinations Certain Regulatory Requirements and Capital Ratios Parent Company Financial Statements Segments 69 69 70 71 72 73 74 75 76 76 77 78 79 79 81 89 90 91 Annual Report... -

Page 24

... real estate owned Average Balances Loans and leases, including held for sale Total securities and other short-term investments Total assets Transaction deposits Core deposits Interest-bearing deposits Short-term borrowings Long-term debt Shareholders' equity Regulatory Capital Ratios Tier I capital... -

Page 25

... is derived primarily from electronic funds transfer ("EFT") and merchant transaction processing fees, fiduciary and investment management fees, banking fees and service charges and mortgage banking revenue. Net interest income, net interest margin, net interest rate spread and the efficiency ratio... -

Page 26

... largest affiliate markets. The Bancorp opened 63 new banking centers during 2005, excluding relocations, with a net increase of 34, excluding acquisitions. The Bancorp plans to continue adding banking centers in key markets during 2006 with a planned addition of approximately 50 net new locations... -

Page 27

... of certain leasing transactions. For additional information, see Note 22 of the Notes to the Consolidated Financial Statements. Valuation of Servicing Rights When the Bancorp sells loans through either securitizations or individual loan sales in accordance with its investment policies, it often... -

Page 28

...include securities dealers, brokers, mortgage bankers, investment advisors, specialty finance and insurance companies who seek to offer one-stop financial services that may include services that banks have not been able or allowed to offer to their customers in the past. The increasingly competitive... -

Page 29

... related to its businesses • Operating and stock performance of other companies deemed to be peers • New technology used or services offered by traditional and nontraditional competitors • News reports of trends, concerns and other issues related to the financial services industry The Bancorp... -

Page 30

... in the average federal funds rate. The combined results of these actions have been a 45% increase in net new account additions compared to 2004 and a migration of interest checking balances into money market and savings accounts. In 2005, the cost of interest-bearing core deposits was 2.10%, up... -

Page 31

...millions) Volume Yield/Rate Total Volume Yield/Rate Increase (decrease) in interest income: Loans and leases $582 488 1,070 235 (99) Securities: Taxable (228) 43 (185) 76 (85) Exempt from income taxes (10) (10) (10) 1 Other short-term investments (2) 3 1 2 Total change in interest income 342 534 876... -

Page 32

... loan and TABLE 6: NONINTEREST INCOME For the years ended December 31 ($ in millions) Electronic payment processing revenue Service charges on deposits Mortgage banking net revenue Investment advisory revenue Other noninterest income Operating lease revenue Securities gains (losses), net Securities... -

Page 33

... residential mortgage loans serviced for others. Investment advisory revenues were slightly down in 2005 compared to 2004 with increases in mutual fund revenues offset by decreases in retail brokerage, private client and retirement planning services. The Bancorp continues to focus its sales efforts... -

Page 34

... management solution that creates a single customer view across the Bancorp's key operating systems, a new teller automation platform that provides employees with better access to information to improve customer service while eliminating certain manual processes and paper forms and customer service... -

Page 35

.... The Bancorp manages interest rate risk centrally at the corporate level by employing a funds transfer pricing ("FTP") methodology. This methodology insulates the lines of business from interest rate risk, enabling them to focus on servicing customers through loan originations and deposit taking... -

Page 36

... small businesses, and includes the branch network, consumer finance and mortgage banking. Through 1,119 banking centers, Retail Banking offers depository and loan products, such as checking and savings accounts, home equity lines of credit, credit cards and loans for automobile and other personal... -

Page 37

...mortgage banking fees and loan sales, less $13 million in amortization and valuation adjustments on mortgage servicing rights and less $10 million of losses and mark-to-market adjustments on both settled and outstanding free-standing derivative financial instruments. Other noninterest income totaled... -

Page 38

... finance companies offering promotional lease rates and an overall increased emphasis on growth in other elements of the consumer lending business. The acquisition of First National did not have a material impact on consumer lease balances. On an average basis, commercial loans and leases increased... -

Page 39

... of FHLB and Federal Reserve Bank restricted stock holdings that are carried at cost, Federal Home Loan Mortgage Corporation ("FHLMC") preferred stock holdings, certain mutual fund holdings and equity security holdings. TABLE 16: COMPONENTS OF INVESTMENT SECURITIES (AMORTIZED COST BASIS) As of... -

Page 40

...'s internal control structure and related systems and processes. The Enterprise Risk Management division includes the following key functions: (i) a Risk Policy function that ensures consistency in the approach to risk management as the Bancorp's clearinghouse for credit, market and operational risk... -

Page 41

... the accuracy of risk grades and the charge-off and allowance analysis process. The Bancorp's credit review process and overall assessment of required allowances is based on ongoing quarterly assessments of the probable estimated losses inherent in the loan and lease portfolio. The Bancorp uses this... -

Page 42

... other real estate owned 67 74 Total nonperforming assets 361 303 Commercial loans and leases 21 22 Commercial mortgages and construction 14 13 Credit card receivables 10 13 Residential mortgages and construction (a) 53 43 Consumer loans and leases 57 51 Total 90 days past due loans and leases 155... -

Page 43

... OF OPERATIONS TABLE 21: SUMMARY OF CREDIT LOSS EXPERIENCE For the years ended December 31 ($ in millions) 2005 Losses charged off: Commercial loans $(99) Commercial mortgage loans (13) Construction loans (5) Residential mortgage loans (18) Consumer loans (181) Lease financing (57) Total losses... -

Page 44

...Bancorp manages credit risk in the mortgage portfolio through conservative underwriting and documentation standards and geographic and product diversification. The Bancorp may also package and sell loans in the portfolio without recourse or may purchase mortgage insurance for the loans sold in order... -

Page 45

...to the Risk and Compliance Committee of the Board of Directors, monitors and manages interest rate risk within Board approved policy limits. In addition to the risk management activities of ALCO, the Bancorp created a Market Risk Management function as part of the Enterprise Risk Management division... -

Page 46

...of Income. The balance of the Bancorp's foreign denominated loans at December 31, 2005 is approximately $130 million. The Bancorp also enters into foreign exchange derivative contracts for the benefit of commercial customers involved in international trade to hedge their exposure to foreign currency... -

Page 47

... meeting the Bancorp's ALCO capital planning directives, to hedge changes in fair value of its largely fixed-rate mortgage servicing rights portfolio or to provide qualifying commercial customers access to the derivative products market. These policies are reviewed and approved annually by the Risk... -

Page 48

... mortgage loans, certain floating rate home equity lines of credit, certain auto loans and other consumer loans. The cash flows to and from the securitization trusts are principally limited to the initial proceeds from the securitization trust at the time of sale with subsequent cash flows relating... -

Page 49

... is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to the Bancorp's management, including its Chief Executive Officer and Chief Financial Officer, as... -

Page 50

...accounting firm, that audited the Bancorp's consolidated financial statements included in this annual report, has issued an attestation report on our internal control over financial reporting as of December 31, 2005 and Bancorp Management's assessment of the internal control over financial reporting... -

Page 51

...on management's assessment and an opinion on the effectiveness of the Bancorp's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 52

... for loan and lease losses Net Interest Income After Provision for Loan and Lease Losses Noninterest Income Electronic payment processing revenue Service charges on deposits Mortgage banking net revenue Investment advisory revenue Other noninterest income Operating lease revenue Securities gains... -

Page 53

...loans and leases, net Bank premises and equipment Operating lease equipment Accrued interest receivable Goodwill Intangible assets Servicing rights Other assets Total Assets Liabilities Deposits: Demand Interest checking Savings Money market Other time Certificates - $100,000 and over Foreign office... -

Page 54

... corporate tax benefit related to stock-based compensation Shares issued in business combinations 11 Retirement of shares (11) Other Balance at December 31, 2005 $1,295 9 See Notes to Consolidated Financial Statements Accumulated Other Capital Retained Comprehensive Treasury Surplus Earnings Income... -

Page 55

... Increase in Cash and Due from Banks Cash and Due from Banks at Beginning of Year Cash and Due from Banks at End of Year Cash Payments Interest Federal income taxes Supplemental Cash Flow Information Transfer from portfolio loans to loans held for sale, net Business Acquisitions: Fair value... -

Page 56

... TO CONSOLIDATED FINANCIAL STATEMENTS 1. SUMMARY OF SIGNIFICANT ACCOUNTING AND REPORTING POLICIES Nature of Operations Fifth Third Bancorp ("Bancorp"), an Ohio corporation, conducts its principal lending, deposit gathering, transaction processing and service advisory activities through its banking... -

Page 57

.... Adjustments to fair value for retained interests classified as trading securities are recorded within noninterest income in the Consolidated Statements of Income. Servicing rights resulting from residential mortgage, home equity line of credit and automotive loan sales are amortized in proportion... -

Page 58

... market value of ending account balances associated with individual contracts. The Bancorp recognizes revenue from its electronic payment processing services on an accrual basis as such services are performed, recording revenues net of certain costs (primarily interchange fees charged by credit card... -

Page 59

... cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award with the cost to be recognized over the service period. This Statement is effective for financial statements as of the beginning of the first interim or annual reporting... -

Page 60

... the Bancorp's Consolidated Financial Statements. In July 2005, the FASB released a proposed Staff Position ("FSP") FAS 13-a, "Accounting for a Change or Projected Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction," which addresses the accounting... -

Page 61

... TO CONSOLIDATED FINANCIAL STATEMENTS In August 2005, the FASB issued an Exposure Draft, "Accounting for Transfers of Financial Assets, an amendment of FASB Statement No. 140." This Exposure Draft would amend FASB Statement No. 140 by addressing the criteria necessary for obtaining sales accounting... -

Page 62

...secure borrowings, public deposits, trust funds and for other purposes as required or permitted by law. Unrealized gains (losses) on trading securities held at December 31, 2005 and 2004 were not material to the Consolidated Financial Statements. 3. LOANS AND LEASES AND ALLOWANCE FOR LOAN AND LEASE... -

Page 63

.... The Bancorp completed its most recent annual goodwill impairment test required by this Statement as of September 30, 2005 and determined that no impairment exists. In the table above, acquisition activity includes acquisitions in the respective year plus purchase accounting adjustments related to... -

Page 64

... of mortgage banking net revenue in the Consolidated Statements of Income. The estimated fair value of capitalized servicing rights was $466 million and $353 million at December 31, 2005 and 2004, respectively. The Bancorp serviced $25.7 billion and $23.0 billion of residential mortgage loans and... -

Page 65

...substantially matching terms and currencies. Credit risks arise from the possible inability of counterparties to meet the terms of their contracts and from any resultant exposure to movement in foreign currency exchange rates, limiting the Bancorp's exposure to the replacement value of the contracts... -

Page 66

... related to interest rate risk The following table reflects the market value of all free-standing derivatives included in the Consolidated Balance Sheets as of December 31: ($ in millions) Included in other assets: Foreign exchange contracts Interest rate contracts for customers Interest rate lock... -

Page 67

... assets included in the Consolidated Balance Sheets as of December 31, 2005: ($ in millions) Bank owned life insurance Accounts receivable and drafts-in-process Partnership investments Derivative instruments Prepaid pension and other expenses Other real estate owned Other Total 2005 $1,865 1,073 388... -

Page 68

...-rate notes FixFloat notes Junior subordinated: Floating-rate debentures (a) Floating-rate debentures (a) Mandatorily redeemable securities (a) Federal Home Loan Bank advances Securities sold under repurchase agreements Commercial paper-backed obligations Other Total (a) Qualify as Tier I capital... -

Page 69

... to manage its interest rate risks and prepayment risks and to meet the financing needs of its customers. These financial instruments primarily include commitments to extend credit, standby and commercial letters of credit, foreign exchange contracts, commitments to sell residential mortgage loans... -

Page 70

... provided including commercial real estate, physical plant and property, inventory, receivables, cash and marketable securities. Through December 31, 2005, the Bancorp had transferred, subject to credit recourse, certain primarily floating-rate, short-term investment grade commercial loans to an... -

Page 71

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 15. RELATED PARTY TRANSACTIONS At December 31, 2005 and 2004, certain directors, executive officers, principal holders of Bancorp common stock and associates of such persons were indebted, including undrawn commitments to lend, to the Bancorp's banking ... -

Page 72

... Plan to key employees and directors of the Bancorp and its subsidiaries. The Incentive Compensation Plan was approved by shareholders on March 23, 2004. The plan authorized the issuance of up to 20 million shares as equity compensation. Options and SARs are issued at fair market value at the date... -

Page 73

...) Other noninterest income: Cardholder fees Consumer loan and lease fees Commercial banking revenue Bank owned life insurance income Insurance income Gain on sale of third-party sourced merchant processing contracts Other Total Other noninterest expense: Marketing and communication Postal and... -

Page 74

... TO CONSOLIDATED FINANCIAL STATEMENTS 20. SALES AND TRANSFERS OF LOANS The Bancorp sold fixed and adjustable rate residential mortgage loans during 2005 and 2004. The Bancorp also securitized and sold certain automotive loans in 2004 and securitized and sold certain home equity lines of credit in... -

Page 75

... interest is subordinate to investor's interests and its value is subject to credit, prepayment and interest rate risks on the sold home equity lines of credit. During 2005, pursuant to the terms of the sales and servicing agreement, $18 million in fixed-rate home equity line of credit balances were... -

Page 76

... tax assets: Allowance for credit losses Deferred compensation Other comprehensive income State net operating losses Other Total deferred tax assets Deferred tax liabilities: Lease financing State deferred taxes Bank premises and equipment Other Total deferred tax liabilities Total net deferred tax... -

Page 77

... The expected rate of compensation increase and the expected return on plan assets were not changed. Plan assets consist primarily of common trust and mutual funds (equities and fixed income) managed by Fifth Third Bank, a subsidiary of the Bancorp, and Bancorp common stock securities. The following... -

Page 78

...Trading securities Other short-term investments Loans held for sale Portfolio loans and leases, net Derivative assets Bank owned life insurance assets Financial liabilities: Deposits Federal funds purchased Short-term bank notes Other short-term borrowings Long-term debt Derivative liabilities Short... -

Page 79

...deductible for income tax purposes. On June 11, 2004, the Bancorp completed the acquisition of Franklin Financial, a bank holding company located in the Nashville, Tennessee metropolitan market. Under the terms of the transaction, each share of Franklin Financial common stock was exchanged for .5933... -

Page 80

...actions by regulators that could have a direct material effect on the Consolidated Financial Statements of the Bancorp. Tier I capital consists principally of shareholders' equity including Tier I qualifying subordinated debt but excluding unrealized gains and losses on securities available-for-sale... -

Page 81

... Processing Solutions. Commercial Banking offers banking, cash management and financial services to large and middle-market businesses, government and professional customers. Retail Banking provides a full range of deposit products and loans and leases to individuals and small businesses. Investment... -

Page 82

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Results of operations and average assets by segment for each of the three years ended December 31: ($ in millions) 2005 Net interest income (b) Provision for loan and lease losses Net interest income after provision for loan and lease losses Noninterest ... -

Page 83

..., 79-80 Average Balance Sheets 29 Analysis of Net Interest Income and Net Interest Income Changes 28-30 Investment Securities Portfolio 37, 59-60 Loan and Lease Portfolio 36, 60-61 Risk Elements of Loan and Lease Portfolio 39-43 Deposits 38,44 Return on Equity and Assets 22 Short-term Borrowings 38... -

Page 84

...variety of checking, savings and money market accounts, and credit products such as credit cards, installment loans, mortgage loans and leasing. Each of the banking subsidiaries has deposit insurance provided by the Federal Deposit Insurance Corporation ("FDIC") through the Bank Insurance Fund ("BIF... -

Page 85

... adopted a customer information security program that has been approved by the Bancorp's Board of Directors (the "Board"). The GLBA requires financial institutions to implement policies and procedures regarding the disclosure of nonpublic personal information about consumers to non-affiliated third... -

Page 86

... United States financial system, has significant implications for depository institutions, brokers, dealers and other businesses involved in the transfer of money. The Patriot Act, as implemented by various federal regulatory agencies, requires financial institutions, including the Bancorp and its... -

Page 87

... The banking centers are located in the states of Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania and Missouri. The Bancorp's significant owned properties are owned free from mortgages and major encumbrances. EXECUTIVE OFFICERS OF THE BANCORP Officers are... -

Page 88

...'s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 26, 1997. Old Kent Capital Trust I Floating Rate Subordinated Capital Income Securities. Incorporated by reference to the Exhibits to Old Kent Financial Corporation's Form S-4 Registration Statement filed July... -

Page 89

... Meeting Proxy Statement dated March 1, 1997. * Old Kent Stock Incentive Plan of 1999. Incorporated by reference to Old Kent Financial Corporation's Annual Meeting Proxy Statement dated March 1, 1999. * Schedule of Director Compensation Arrangements. * Schedule of Executive Officer Compensation... -

Page 90

...Pursuant to requirements of the Securities Exchange Act of 1934, this report has been signed on February 16, 2006 by the following persons on behalf of the Registrant and in the capacities indicated. OFFICERS: George A. Schaefer, Jr. Director, President, and CEO Principal Executive Officer R. Mark... -

Page 91

... 9 755 2,663 17 4,695 (a) Federal funds sold and interest-bearing deposits in banks are combined in other short-term investments in the Consolidated Financial Statements. (b) Adjusted for stock splits in 2000, 1998, 1997 and 1996. Allowance Book Value for Loan Per and Lease Losses Share (b) $17.00... -

Page 92

...Koch Enterprises, Inc. Mitchel D. Livingston, Ph.D. Vice President for Student Affairs and Services University of Cincinnati Kenneth W. Lowe President & CEO The E.W. Scripps Company Hendrik G. Meijer Co-Chairman & CEO Meijer, Inc. Robert B. Morgan Executive Counselor Cincinnati Financial Corporation... -

Page 93

... Vice President & Investor Relations Officer (513) 534-0983 (513) 534-0629 (fax) Press Releases For copies of current press releases, please visit our website at www.53.com. Independent Registered Public Accounting Firm Deloitte & Touche LLP 250 East Fifth Street Cincinnati, OH 45202 Transfer Agent... -

Page 94

www.53.com