Fifth Third Bank 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

strength

stability

performance

Over the past 143

years, Fifth Third

has become one of

the strongest, most

financially sound

banks in the nation.

Fifth Third Bancorp

is one of a handful of

U.S. bank holding

companies with

Moody’s Aa3 credit

rating.

2001 marks

Fifth Third’s 28th

year of consecutive

increased earnings

and the 23rd year of

double-digit earnings

growth.

2001 Annual Report

Table of contents

-

Page 1

... sound banks in the nation. stability performance 2001 marks Fifth T hird's 28 th year of consecutive increased earnings and the 23 rd year of double-digit earnings growth. Fifth T hird Bancorp is one of a handful of U.S. bank holding companies with Moody's Aa3 credit rating. 2001 Annual Report -

Page 2

... SUBSIDIARIES Corporate Profile Fifth T hird Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. It operates 16 affiliates in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida and West â- Traverse City Virginia, and provides a broad MICHIGAN â- Grand Rapids... -

Page 3

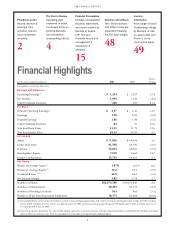

...Dividends Operating Earnings (a) Net Income Cash Dividends Declared Per Share Diluted Operating Earnings (a) Earnings Diluted Earnings Cash Dividends Declared Year-End Book Value Year-End Market Price At Year-End Assets Loans and Leases Deposits Shareholders' Equity Market Capitalization Key Ratios... -

Page 4

... of an uncertain environment and ᮣ Our capital ratio improved to 10.28%, representing the successful integration of Old Kent. Compared to the an additional billion dollars in shareholder equity and year 2000, one of the best capitalized balance sheets in the ᮣ Operating earnings increased 15% to... -

Page 5

...and two bank holding companies. By far, the largest acquisition was Old Kent Financial, which was about half our size. Apart from acquiring many new customers and deposits, we obtained a formidable presence throughout Michigan, a stronger base in Chicago, greater market share across northern Indiana... -

Page 6

... past 28 consecutive years illustrates our consistency, regardless of economic or credit cycles. When other banks were losing deposits to money market centers and mutual funds, we increased our transaction deposits. When other banks were struggling with their acquisitions and posting huge losses, we... -

Page 7

2001 ANNUAL REPORT Last year's acquisition of Old Kent materially enhanced our presence in Chicago. We now have 102 full-service Banking Centers in Chicagoland to serve its approximate eight million residents. Our convenient locations clearly demonstrate that at Fifth Third, we're "working hard to ... -

Page 8

... core funding base, fuel service income growth and represent an important ᮣ A Fifth Third Bank Mart® in Cincinnati. These full-service Banking Centers, located in more than 140 grocery stores, offer evening and weekend hours, seven days a week. The Bank Mart brings convenience to customers and... -

Page 9

...checking account paying a money market rate, as well as a Totally Free account with no minimum balance. T his strategy gives our sales force the perfect platform for adding new customers and selling additional products. Fifth T hird's business, investment and payment processing sales personnel share... -

Page 10

... the world's first allplastic automobile body. Fifth Third Bank, Western Michigan, encompassing Grand Rapids, Muskegon and Holland, has deposits of $5.7 billion and a marketleading 40 percent share. full-range of services for small, middle-market and large corporate clients. Whether a company needs... -

Page 11

...-based banks that can support companies with operations in Europe and Asia. As a result, our cash management and international service revenues increased 36 percent over last year. ᮤ Officer Call Program- Commercial James R. Gaunt (left), President & CEO of Fifth Third Bank in Louisville, enjoys... -

Page 12

...Quality Growth, Disciplined Value, Broadly Diversified and Fixed Income and features 31 nationally recognized stock, bond and money market mutual funds.* Barnes & Noble, the nation's largest book retailer with more than 1,000 stores throughout the Midwest, chose MPS to process its customers' credit... -

Page 13

... REPORT Electronic Funds Transfer (EFT ) Services. Our Merchant Services group provides more than 160,000 retail locations nationwide with debit, credit and stored value payment processing, which represents an increase of 88 Acquisitions-2001 T he four acquisitions we completed last year- Old Kent... -

Page 14

... Ohio, and Bob Sullivan, the former Capital Bank President, became the President of Fifth T hird Bank in Northwestern Ohio. Universal Companies, an electronic payment processor serving over 61,000 merchant locations with over $4 billion in annual transaction volume, was acquired on October 31, 2001... -

Page 15

... Vice President David J. Rhodes, processed 96 million customer payments, settled 1.5 million securities trades and fielded 41 million customer calls in 2001 at five sites throughout Fifth Third's footprint, including the newly constructed Madisonville Operations Center pictured here in Cincinnati... -

Page 16

...to Grand Valley State University to construct a new Health Education Professions Center; $50,000 to Northwestern Michigan College for its West Bay Campus Project; and $20,000 to Pontiac Neighborhood Housing Services to support housing projects. ILLINOIS $50,000 to Habitat for Humanity. Fifth T hird... -

Page 17

...Expense Interest on Deposits Interest Checking...Savings ...Money Market ...Other T ime ...Certificates-$100,000 and Over . Foreign Office ... T otal Interest on Deposits ...Interest on Federal Funds Borrowed...Interest on Short-T erm Bank Notes ...Interest on Other Short-T erm Borrowings . Interest... -

Page 18

... 835 558 3,168 69,658 Total Assets ...Liabilities Deposits Demand ...Interest Checking ...Savings ...Money Market ...Other T ime ...Certificates-$100,000 Foreign Office...and Over... T otal Deposits ...Federal Funds Borrowed...Short-T erm Bank Notes ...Other Short-T erm Borrowings ...Accrued T axes... -

Page 19

... Losses on Securities Available-for-Sale, Net ...Net Income and Nonowner Changes in Equity Cash Dividends Declared Fifth T hird Bancorp: Common Stock at $.59 per share...Pooled Companies Prior to Acquisition: Common Stock...Preferred Stock ...Shares Acquired for T reasury or Retired...Stock... -

Page 20

FIFTH THIRD BANCORP AND SUBSIDIARIES Consolidated Statements of Cash Flows For the Years Ended December 31 ($ in millions) 2001 2000 1999 Operating Activities Net Income ...Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Provision for Credit Losses ...Minority ... -

Page 21

... from 933 offices located throughout Ohio, Indiana, Kentucky, Michigan, Illinois, Florida and West Virginia. Principal activities include commercial and retail banking, investment advisory services and electronic payment processing. Interest income on direct financing leases is recognized... -

Page 22

...Bancorp calculates fair value based on the present value of future expected cash flows using management's best estimates of the key assumptions - credit losses, prepayment speeds, forward yield curves and discount rates commensurate with the risks involved. Servicing rights resulting from loan sales... -

Page 23

...executing offsetting swap agreements with primary dealers. Upon adoption of this statement on January 1, 2001, the Bancorp recorded a cumulative effect of change in accounting principle of approximately $7 million, net of tax. Fair Value Hedges The Bancorp enters into interest rate swaps to convert... -

Page 24

...a fee charged on the market value of ending account balances associated with individual contracts. The Bancorp recognizes revenue from its electronic payment processing services as such services are performed, recording revenues net of certain costs (primarily interchange fees charged by credit card... -

Page 25

... January 1 ...Losses charged off...Recoveries of losses previously charged off ...Net charge-offs...Provision charged to operations. Merger-related provision charged to operations...Reserve of acquired institutions and other ...Balance at December 31 ... ... 2001 $609.3 (308.6) 81.5 (227.1) 200.6 35... -

Page 26

... impairment losses on the mortgage servicing rights portfolio. T his strategy included the purchase of various securities classified as available-for-sale on the Consolidated Balance Sheet as of December 31, 2001. T hroughout the year certain of these securities were sold resulting in net realized... -

Page 27

... Consolidated Balance Sheets and are comprised of the following temporary differences at December 31: ($ in millions) Lease financing ...Reserve for credit losses ...Bank premises and equipment ...Net unrealized gains on securities available-for-sale and hedging instruments . Mortgage servicing and... -

Page 28

... risk-free interest rates of 5.1%, 5.2% and 5.9%, respectively. On May 3, 1999, the Bancorp issued 129,563 shares of common stock under the 1998 Long-Term Incentive Plan. These shares were awarded to non-officer employees with three or more years of service. The market value of these shares on the... -

Page 29

... the mortgage servicing rights portfolio and to meet the financing needs of its customers in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida and West Virginia. T hese financial instruments primarily include commitments to extend credit, standby and commercial letters of credit, foreign exchange... -

Page 30

...) Other Service Charges and Fees: Cardholder fees ...Consumer loan and lease fees ...Commercial banking ...Bank owned life insurance income ...Insurance income...Gain on sale of branches...Other ...T otal other service charges and fees ...Other Operating Expenses: Marketing and communications... -

Page 31

... 10.12 9.21 7.06 Total Capital (to Risk-Weighted Assets): Fifth T hird Bancorp (Consolidated) . . Fifth T hird Bank (Ohio) ...Fifth T hird Bank, Michigan ...Fifth T hird Bank, Indiana...Fifth T hird Bank, Kentucky, Inc...Fifth T hird Bank, Northern Kentucky. Tier 1 Capital (to Risk-Weighted Assets... -

Page 32

..., 2001 and 2000, the outstanding balance of loans transferred was $2.0 billion and $1.9 billion, respectively. The commercial loans transferred to the QSPE are primarily fixed-rate and short-term investment grade in nature. The commercial loans are transferred at par with no gain or loss recognized... -

Page 33

... Cash Shares Method of Completed (in millions) Issued Accounting Universal Companies (USB), 10/ 31/ 01 Milwaukee, Wisconsin Old Kent Financial 4/ 2/ 01 Corporation, Grand Rapids, Michigan Capital Holdings, Inc. (Capital), 3/ 9/ 01 Sylvania, Ohio Resource Management, Inc., 1/ 2/ 01 Cleveland, Ohio... -

Page 34

... Bancorp's credit rating and review systems, as documented in the Bancorp's credit policies. T he merger-related charges consist of: ($ in millions) 2001 Employee severance and benefit obligations...$ 77.4 Duplicate facilities and equipment ...95.1 Conversion expenses ...50.9 Professional fees ...45... -

Page 35

... market rates and limited credit risk, carrying amounts approximate fair value. T hose financial instruments include cash and due from banks, other short-term investments, accrued income receivable, certain deposits (demand, interest checking, savings and money market), Federal funds borrowed, short... -

Page 36

... Midwest Payment Systems (MPS), provides electronic funds transfer (EFT) services, merchant transaction processing, operates the Jeanie ATM network and provides other data processing services to affiliated and unaffiliated customers. General Corporate and Other includes the investment portfolio... -

Page 37

... Services Processing (a) General Corporate and Other Eliminations (a) Total 2001 Results of Operations Net Interest Income (Expense) ...$ Provision for Credit Losses ...Net Interest Income (Expense) After Provision for Credit Losses ...Other Operating Income ...Merger-Related Charges...Operating... -

Page 38

...and their cash flows for each of the three years in the period ended December 31, 2001 in conformity with accounting principles generally accepted in the United States of America. Cincinnati, Ohio January 15, 2002 Fifth Third Funds® Performance Disclosure *Investments in the Fifth Third Funds are... -

Page 39

... and policies affecting financial services companies, credit quality and credit risk management, changes in the banking industry including the effects of consolidation resulting from possible mergers of financial institutions, acquisitions and integration of acquired businesses. Fifth Third Bancorp... -

Page 40

... Interest Checking ...Savings...Money Market ...Other T ime Deposits ...CDs > $100,000 ...Foreign Deposits...Federal Funds Borrowed ...Short-T erm Bank Notes ...Other Short-T erm Borrowings ...Long-T erm Debt ...Total Interest Expense Change ... Volume ... 2001 Compared to 2000 Yield/Rate Mix Total... -

Page 41

... EMPLOYEE ($ in thousands) Five Year Growth Rate: 14% 97 EFFICIENCY RATIO* Fifth Third 98 99 00 0 1 ** Peer * For comparability, certain financial ratios and statistics exclude the impact of the 2001 merger-related charges and nonrecurring accounting principle change of $394.5 million pretax... -

Page 42

... insurance (BOLI) represent the majority of other service charges and fees. T he commercial banking revenue component of other service charges and fees grew 46% to $125.1 million in 2001, led by international department revenue which included foreign currency exchange, letters of credit and trade... -

Page 43

...promotion of the Bancorp's diversified loan, investment and deposit products. Total operating expenses for 2001 and 2000 include pretax merger-related charges of $348.6 million and $87.0 million, respectively. For 2001, the merger charge relates directly to the acquisition of Old Kent. These charges... -

Page 44

...million of credit quality charges in 2001 and 2000, respectively, to conform acquired entities commercial and consumer loans to the Bancorp's credit policies. 2000, due to the sale, with servicing retained, of $1 billion of leases during the year, and represent 4% and 6% of total loans and leases at... -

Page 45

... Deposit Sources ($ in millions) 2001 2000 Demand ...$1,137.2 178.5 978.1 Interest checking . . 1,957.8 Savings ...( 870.4) ( 407.9) Money market...1,612.4 ( 388.5) Other time ...( 243.3) ( 141.7) Certificates- $100,000 and over ...( 462.0) 86.2 Foreign office ...(1,903.3) 2,943.2 Total change... -

Page 46

...'s A-1+/ Prime-1 ratings on its commercial paper and AA-/ Aa3 ratings for its senior debt, along with the AA-/ Aa2 long-term deposit ratings of Fifth Third Bank (Ohio); Fifth Third Bank, Michigan; Fifth Third Bank, Indiana; Fifth Third Bank, Kentucky, Inc.; and Fifth Third Bank, Northern Kentucky... -

Page 47

... ALCO capital planning directives, to hedge changes in fair value of its fixed rate mortgage servicing rights portfolio or to provide qualifying customers access to the derivative products market. These policies are reviewed and approved annually by the Audit Committee and the Board of Directors. As... -

Page 48

...694.9 Summarized Quarterly Financial Information 2001 (Unaudited) Fourth ($ in millions, except per share data) Quarter Interest Income ...$1,065.7 Net Interest Income...629.0 Provision for Credit Losses...61.6 Merger-Related Loan Loss Provision ...- Merger-Related Charges...- Income Before Income... -

Page 49

... 483.6 474.0 427.4 382.2 326.2 (a) Federal funds loaned and interest-bearing deposits in banks are combined in other short-term investments in the Consolidated Financial Statements. (b) Number of shares outstanding and per share data have been adjusted for stock splits in 2000, 1998, 1997, 1996 and... -

Page 50

... Southern Indiana Patrick J. Fehring, Jr. Eastern Michigan James R. Gaunt Louisville, Kentucky Stewart M. Greenlee Ohio Valley Kevin T. Kabat Western Michigan Robert J. King, Jr. Northeastern Ohio Colleen M. Kvetko Florida Timothy T. O'Dell Central Ohio John E. Pelizzari Northern Michigan Timothy... -

Page 51

2001 ANNUAL REPORT Investor Information Corporate Office Fifth T hird Center Cincinnati, Ohio 45263 (513) 579-5300 Transfer Agent/Shareholder Relations Fifth T hird Bank Corporate Trust Services Mail Drop 10AT 66-3212 Fifth T hird Center Cincinnati, Ohio 45263 (800) 837-2755 (513) 579-5320 (... -

Page 52