Family Dollar 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10−K

FAMILY DOLLAR STORES INC − FDO

Filed: March 28, 2007 (period: August 26, 2006)

Annual report which provides a comprehensive overview of the company for the past year

Table of contents

-

Page 1

FORM 10âˆ'K FAMILY DOLLAR STORES INC âˆ' FDO Filed: March 28, 2007 (period: August 26, 2006) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

...MARKET RISK FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ITEM 9A CONTROLS AND PROCEDURES ITEM 9B. OTHER INFORMATION PART III ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE ITEM... -

Page 3

EXâˆ'31.1 (Certifications required under Section 302 of the Sarbanesâˆ'Oxley Act of 2002) EXâˆ'31.2 (Certifications required under Section 302 of the Sarbanesâˆ'Oxley Act of 2002) EXâˆ'32.1 (Certifications required under Section 906 of the Sarbanesâˆ'Oxley Act of 2002) EXâˆ'32.2 (Certifications ... -

Page 4

... 20549 FORM 10âˆ'K x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended August 26, 2006 or o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File No. 1âˆ'6807 FAMILY DOLLAR STORES, INC... -

Page 5

...12bâˆ'2 of the Exchange Act). Yes o No x The aggregate market value of voting and nonâˆ'voting common equity held by nonâˆ'affiliates of the registrant based on the closing price on March 3, 2007, was approximately $4.0 billion. The number of shares of the registrant's Common Stock outstanding as of... -

Page 6

... Financial Statements included in this Report. Explanatory Note The Company was named as a nominal defendant in certain litigation filed in September 2006, alleging that the Company "backdated" certain stock option grants. In connection with that lawsuit, the Board of Directors appointed a Special... -

Page 7

...apparel, food, cleaning and paper products, home décor, beauty and health aids, toys, pet products, automotive products, domestics, seasonal goods and electronics. The original predecessor of the Company was organized in 1959 to operate a selfâˆ'service retail store in Charlotte, North Carolina. In... -

Page 8

... in fiscal 2006. The Company maintains a substantial variety and depth of merchandise inventory in stock in its stores (and in its distribution centers for weekly store replenishment) to attract customers and meet their shopping needs. Vendors' trade payment terms are negotiated to help finance the... -

Page 9

... of total annual sales. Trademarks The Company has registered with the U.S. Patent and Trademark Office the name "Family Dollar Stores" as a service mark and also has registered a number of other names as trademarks for certain merchandise sold in stores. Employees As of August 26, 2006, the Company... -

Page 10

... on a quarterly or annual basis. In addition, changes in the types of products made available for sale and the selection of the products by customers affect sales, product mix and margins. Future economic conditions affecting disposable consumer income, such as employment levels, business conditions... -

Page 11

... in staffing and operating new store locations and lack of customer acceptance of stores in expanded market areas all may negatively impact the Company's new store growth, the costs associated with new stores and/or the profitability of new stores. 7 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28... -

Page 12

...and retain employees, and changes in health care and other insurance costs could affect the Company's business. The growth of the Company could be adversely impacted by its inability to attract and retain employees at the store operations level, in distribution facilities, and at the corporate level... -

Page 13

.... ITEM 1B. None. ITEM 2. PROPERTIES UNRESOLVED STAFF COMMENTS The Company operates a chain of selfâˆ'service retail discount stores. As of September 30, 2006, there were 6,208 stores in 44 states and the District of Columbia as follows: Texas Ohio Florida North Carolina Michigan Georgia New York... -

Page 14

... total square feet of space. The Company also owns its corporate headquarters and distribution center located on a 108âˆ'acre tract of land in Matthews, North Carolina, just outside of Charlotte, in two buildings containing approximately 1.13 million square feet. Approximately 890,000 square feet... -

Page 15

The Company also owns eight additional fullâˆ'service distribution centers described in the table below: Facility Size Building Distribution Center Land Date Operational West Memphis, AR Front Royal, VA Duncan, OK Morehead, KY Maquoketa, IA Odessa, TX Marianna, FL Rome, NY 75 acres 108 acres 85... -

Page 16

... 15, 2006, a shareholder derivative complaint was filed in the United States District Court for the Western District of North Carolina, Case No. 3:06CV510âˆ'W, by Dorothy M. Lee against the Company as a nominal defendant and certain of its current and former officers and directors, Howard R. Levine... -

Page 17

... AND ISSUER PURCHASES OF EQUITY SECURITIES The Company's common stock is traded on the New York Stock Exchange under the ticker symbol FDO. At March 3, 2007, there were approximately 2,680 holders of record of the Company's common stock. The accompanying tables give the high and low sales prices of... -

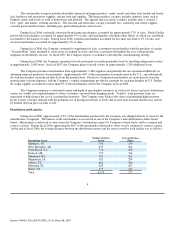

Page 18

... General Merchandise Stores Index. The comparison assumes that $100 was invested in the Company's common stock on August 25, 2001, and, in each of the foregoing indices on August 31, 2001, and that dividends were reinvested. COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN Among Family Dollar Stores... -

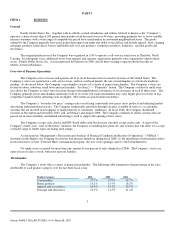

Page 19

...Net sales Cost of sales and operating expenses Income before income taxes Income taxes Net income Diluted net income per common share Dividends declared Dividends declared per common share Total assets Working capital Longâˆ'term debt Shareholders' equity Stores opened Stores closed Number of stores... -

Page 20

... 13 weeks in the second quarter of fiscal 2006. During fiscal 2007, the Company plans to focus its efforts on the following initiatives designed to support sustainable and profitable growth and to make Family Dollar a more compelling place to shop, work, and invest. • To support an enhanced food... -

Page 21

Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 22

... develop an eventâˆ'driven strategy that creates excitement for customers and employees; continue to focus on improving inventory flow and turns, resulting in better presentation of new products; and enhance the apparel assortment. During fiscal 2007, the Company plans to open approximately 300... -

Page 23

... costs. The Company expects that the opening of the ninth distribution center in Rome, New York, during the third quarter of fiscal 2006, will continue to lower the average distance to the stores from the distribution centers and will positively impact freight costs. The increase in cost of sales... -

Page 24

... Financial Statements included in this Report for information on the Company's current and longâˆ'term debt. Also during fiscal 2006, the Company recorded $1.4 million of interest expense relating to income tax adjustments as a result of changes to the measurement dates of certain stock option... -

Page 25

... Board of Directors to investigate the Company's stock option granting practices. As a result, the Company was unable to file its Annual Report on Form 10âˆ'K for fiscal 2006 and its Quarterly Report on Form 10âˆ'Q for the first quarter of fiscal 2007 by the required deadlines. As of the date of the... -

Page 26

..., which requires all companies to measure compensation cost for all shareâˆ'based payments (including employee stock options) at fair value, effective for public companies for interim or annual periods beginning after June 15, 2005. The FASB concluded that companies can adopt the new standard in one... -

Page 27

... are based on the total estimated costs of claims filed and estimates of claims incurred but not reported, less amounts paid against such claims, and are not discounted. Management reviews current and historical claims data in developing its estimates. The Company also uses information provided... -

Page 28

... The Company is subject to market risk from exposure to changes in interest rates based on its financing, investing and cash management activities. The Company maintains an unsecured revolving credit facility at a variable rate of interest to meet the shortâˆ'term needs of its expansion program and... -

Page 29

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INDEX TO CONSOLIDATED FINANCIAL STATEMENTS FAMILY DOLLAR STORES, INC. Report of Independent Registered Public Accounting Firm Consolidated Statements of Income for fiscal 2006, fiscal 2005 and fiscal 2004 Consolidated Balance Sheets as of August ... -

Page 30

... financial statements listed in the accompanying index present fairly, in all material respects, the financial position of Family Dollar Stores, Inc., and its subsidiaries at August 26, 2006 and August 27, 2005, and the results of their operations and their cash flows for each of the three years... -

Page 31

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Years Ended August 27, 2005 (in thousands, except per share amounts) August 26, 2006 August 28, 2004 Net sales Cost and expenses: Cost of sales Selling, general and administrative Litigation charge (Note 8) Cost of ... -

Page 32

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS August 26, 2006 August 27, 2005 (in thousands, except per share and share amounts) Assets Current assets: Cash and cash equivalents Investment securities (Note 2) Merchandise inventories Deferred income taxes (Note 6) Income ... -

Page 33

... shares treasury stock) Net income for the year Issuance of 297,595 common shares under employee stock option plan, including tax benefits (Note 9) Purchase of 4,745,293 common shares for treasury Issuance of 5,591 shares of treasury stock under the Family Dollar 2000 Outside Directors Plan Purchase... -

Page 34

... from investing activities: Purchases of investment securities Sales of investment securities Capital expenditures Proceeds from dispositions of property and equipment Cash flows from financing activities: Issuance of longâˆ'term debt Payment of debt issuance costs Repurchases of common stock Change... -

Page 35

... Accounting Policies: Description of business: The Company operates a chain of neighborhood retail discount stores in 44 contiguous states. The Company manages its business on the basis of one reportable segment. The Company's products include apparel, food, cleaning and paper products, home décor... -

Page 36

The Company capitalizes certain costs incurred in connection with developing, obtaining and implementing software for internal use. Capitalized costs are amortized over the expected economic life of the assets, generally ranging from five to eight years. 30 Source: FAMILY DOLLAR STORES, 10âˆ'K, ... -

Page 37

... recognizes compensation expense related to its stockâˆ'based awards based on the grantâˆ'date fair value estimated in accordance with SFAS No. 123 (revised 2004) "Shareâˆ'Based Payment" ("SFAS 123R"). The Company utilizes the Blackâˆ'Scholes Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 38

... date. Compensation expense for the Company's stockâˆ'based awards is recognized ratably, net of estimated forfeitures, over the service period of each award. See Note 9 for more information on the Company's stockâˆ'based compensation plans. 31 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 39

... which requires all companies to measure compensation cost for all shareâˆ'based payments (including employee stock options) at fair value, effective for public companies for interim or annual periods beginning after June 15, 2005. The FASB concluded that companies can adopt the new standard in one... -

Page 40

... interest rate based on shortâˆ'term market interest rates. Outstanding standby letters of credit reduce the borrowing capacity of the credit facility. The Company had no borrowings against its credit facilities during fiscal 2006. The credit facility contains certain restrictive financial covenants... -

Page 41

Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 42

... Board of Directors to investigate the Company's stock option granting practices. As a result, the Company was unable to file its Annual Report on Form 10âˆ'K for fiscal 2006 and its Quarterly Report on Form 10âˆ'Q for the first quarter of fiscal 2007 by the required deadlines. As of the date of the... -

Page 43

Total $ 116,033 $ 125,286 148,758 34 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 44

... to make future payments under contractual obligations, including future minimum rental payments required under operating leases that have initial or remaining nonâˆ'cancelable lease terms in excess of one year at the end of fiscal 2006: Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 45

35 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 46

(in thousands) Contractual Obligations Total August 2007 Payments Due During One Year Fiscal Period Ending August August August 2008 2009 2010 August 2011 Thereafter Longâˆ'term debt Interest Merchandise letters of credit Operating leases Construction obligations Total $ 250,000 $ 118,691 ... -

Page 47

Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 48

... 15, 2006, a shareholder derivative complaint was filed in the United States District Court for the Western District of North Carolina, Case No. 3:06CV510âˆ'W, by Dorothy M. Lee against the Company as a nominal defendant and certain of its current and former officers and directors, Howard R. Levine... -

Page 49

...$9.1 million ($5.7 million after taxes) cumulative charge to record nonâˆ'cash stockâˆ'based compensation expense as a result of new measurement date determinations for certain historical stock option grants. See Note 10 for more information. 38 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 50

... 2006 is not material. Stock Options The Company's stock option plans provide for grants of stock options to key employees at prices not less than the fair market value of the Company's common stock on the grant date. The Company's practice for a number of years has been to make a single annual... -

Page 51

... in the 2006 Plan. Performance share rights give employees the right to receive shares of the Company's common stock at a future date based on the Company's performance relative to a peer group. Performance is measured based on two preâˆ'tax metrics: Return on Equity and Income Growth. The... -

Page 52

...to the current year. Therefore, the Company has not restated its previously issued financial statements, but rather recorded the Stock Option Charge and tax related adjustments in the fourth quarter of fiscal 2006. Company's Historical Process for Granting Options Several key findings of the Special... -

Page 53

... the common stock expected to result from the release of favorable sales results. The Special Committee made no finding that the Option Committee or management acted in a fraudulent manner in connection with the Company's stock option grants. 42 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 54

... date of the stock options issued pursuant to the annual grants made in fiscal years 1995 to 2004 to all stock option participants. Grants to Newly Hired Employees The Special Committee found that the Company's policy of using the lowest price within a tenâˆ'day window following an employee's hire... -

Page 55

... fiscal 2006. The total cost of the overnight share repurchase transaction was $234.2 million. Upon completion of the overnight share repurchase transaction and related forward contract, the Company continued to purchase shares of its common stock pursuant to Rule 10b5âˆ'1 of the Securities Exchange... -

Page 56

...âˆ'employee family members of the Company's Chairman of the Board and Chief Executive Officer. These transactions totaled approximately $1.3 million, $1.2 million and $1.2 million, in fiscal 2006, in fiscal 2005 and fiscal 2004, respectively. 45 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 57

... Company files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms and that such information is accumulated and communicated to the Company's management, including the Chief Executive Officer and Chief Financial... -

Page 58

... control over financial reporting during the Company's fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting. ITEM 9B. None 47 OTHER INFORMATION Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 59

...Prior to his retirement in December 2001, Mr. Dolby was employed by Bank of America Corporation for 32 years, where his positions included President of the North Carolina and South Carolina Consumer and Commercial Bank. Glenn A. Eisenberg has served as a director since 2002. He is the Executive Vice... -

Page 60

... is also a director of Palomar Medical Technologies, Inc. and the North Carolina Capital Management Trust. Dale C. Pond was appointed to the Board in April 2006. He retired in June 2005 as Senior Executive Vice Presidentâˆ'Merchandising/Marketing after serving twelve years with Lowe's Companies, Inc... -

Page 61

... Board and Chief Executive Officer President and Chief Operating Officer, Interim Chief Financial Officer Executive Vice Presidentâˆ' Merchandising Executive Vice Presidentâˆ' Supply Chain Senior Vice Presidentâˆ' Human Resources Senior Vice Presidentâˆ' Strategy and Business Development Senior Vice... -

Page 62

... employee stock options granted on September 28, 2005. Additionally, Mr. Levine filed a Form 5 on October 10, 2006, reporting the gift of 50,000 shares on December 27, 2004. Code of Ethics The Company has adopted: (i) a Code of Ethics that applies to the Chief Executive Officer and senior financial... -

Page 63

...principal financial officer and three additional most highly compensated executive officers (the "Named Executive Officers" or "NEOs Base salary; Annual cash bonus; Performanceâˆ'based share awards; Stock options; Certain perquisites; Severance and change in control benefits; and 401(k) savings and... -

Page 64

..., advice of management and other information such as the performance, experience and longevity of the individual officer, existing pay levels and external market demands. Steven Hall & Partners does not provide compensation advice to the Company's management. 52 Source: FAMILY DOLLAR STORES, 10... -

Page 65

.... The total direct compensation of the CEO for the current fiscal year is between the 25th and 50th percentiles for comparable positions at retail companies. The Committee has weighted the compensation packages of the NEOs toward performance based compensation, with shortâˆ'term bonus opportunities... -

Page 66

Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 67

...Officer to Chief Operating Officer, at its August 17, 2006 meeting, the Committee approved a base salary of $600,000 for Mr. R. James Kelly in recognition of his expanded role and competitive market data for such new role. Shortâˆ'Term Incentive Awards The Company provides shortâˆ'term (annual) cash... -

Page 68

... total dollar value of longâˆ'term incentive compensation to award each NEO. This dollar value is reviewed each year, and can change based on the executive officer's performance and market conditions. Once the dollar value is established, it is divided equally between stock options and PSRs. Option... -

Page 69

... at a meeting held the same day. The exercise price for all stock options is determined by the closing price of Family Dollar stock on the date the option grant is approved. Performance Share Rights Awards PSRs were awarded under the 2006 Plan, and according to the terms of the 2006 Incentive Plan... -

Page 70

... 1,333 4,000 Based on the Company's achieving at the 56th percentile in relation to its peer group for earnings growth and ROE in fiscal 2006, the NEOs earned the following number of shares of common stock pursuant to the 1âˆ'year PSR awards: Name PSRs Earned Howard R. Levine R. James Kelly Robert... -

Page 71

Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 72

... than 40% of the number of shares subject to the option after two years, 70% after three years and 100% after four years. This vesting schedule encourages executives to remain employed by the Company and helps to ensure an appropriate link to stockholder total return. Grants do not include reload... -

Page 73

58 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 74

... all applicable executive officer compensation paid in fiscal 2006 met the deductibility requirements of Section 162(m). FAS 123(R) The Company began accounting for shareâˆ'based payments including stock options and PSRs pursuant to FAS 123(R) on August 27, 2006. 59 Source: FAMILY DOLLAR STORES, 10... -

Page 75

... Name and Principal Position Year Salary ($)(1) Bonus ($) Stock Awards ($)(2) Option Awards ($)(3) All Other Compâˆ' ensation ($)(5) Total ($) Howard R. Levine Chairman of the Board and Chief Executive Officer R. James Kelly President, Chief Operating Officer and Chief Financial Officer... -

Page 76

... tripâˆ'related hangar and parking costs, and then dividing that figure by the Company's total annual flight hours for all Company aircraft. Represents a signing bonus paid in connection with Mr. George's employment. (7) 2006 Grants Of Planâˆ'Based Awards The following table sets forth information... -

Page 77

...subject to annual review by the Board, and for participation in the Company's annual cash bonus plan, now currently pursuant to the 2006 Plan. Subject to certain terms and conditions contained therein, the employment agreements provide that the Company will pay severance of one year's base salary if... -

Page 78

.... See "Option Exercises and Stock Vested" table, set forth below. Indicates market value of unearned PSRs by reference to the closing price of the Company's common stock on the last trading day in 2006, August 25, 2006, of $23.58 per share. 63 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 79

... options. Represents shares issued under the oneâˆ'year PSR program for fiscal 2006 performance. Determined by reference to the closing price of the Company's common stock on October 3, 2006, the date such shares vested. The closing price on such date was $29.41. 64 Source: FAMILY DOLLAR STORES... -

Page 80

... termination of an NEO other than for Cause or Medical Disability, the NEO would become entitled to receive: • • one year of base salary payable in twelve monthly installments; and a pro rata payout under the Company's annual cash bonus plan. Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 81

...Based Awards table. In addition, upon the NEO's obtaining new employment during the severance period the monthly severance payment would be reduced by the amount of monthly compensation payable to the NEO under the new employment arrangement. 65 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 82

... company does not assume the obligation to perform under the 2006 Plan with respect to outstanding awards, or if within two years following the change in control, a participating employee is terminated from employment without "Cause" (as defined in the 2006 Plan) or the participant resigns for "Good... -

Page 83

... or any Change in Control. All stock options granted prior to August 26, 2006, were made pursuant to the 1989 Plan. Represents severance pay equal to 12 months of the executive's base salary in effect on the date of termination. Represents the 2006 award granted under the Profit Sharing Plan, as set... -

Page 84

...the Company's common stock with a value of $30,000 pursuant to the Family Dollar Stores, Inc. 2006 Incentive Plan (the "2006 Plan") and in accordance with the terms of the Directors' Share Awards Guidelines, which were adopted pursuant to the 2006 Plan, beginning with the Annual Meeting. The Company... -

Page 85

... Directors Stock Plan and 11,939,749 shares available for awards of options and other stockâˆ'based awards under the 2006 Plan. Ownership Of The Company's Securities Ownership by Directors and Officers The following table sets forth, for each of the Company's directors, each of the Named Executive... -

Page 86

...150,807,820 shares of the Company's common stock outstanding as of March 3, 2007. Based solely on the Schedule 13G/A filed by FMR Corp., Edward C. Johnson 3d and Fidelity Management Research Company ("Fidelity"), as of December 31, 2006. All of such shares are held by FMR Corp. with sole dispositive... -

Page 87

... was amended by the Board in 2005 and is also posted on the Company's website. The Code sets forth the Company's policy of prohibiting participation by an employee (or his/her family members) in any transaction that could create an actual or 71 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 88

... and annual review of these preâˆ'approved transactions. Related Party Transactions The Company purchased apparel for use by the Company's store employees and other merchandise, at a cost of approximately $1.3 million during fiscal 2006 from a company owned by Eric Lerner, Howard R. Levine's brother... -

Page 89

72 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 90

... work in connection with employee benefit plans of the Company, review of an SEC comment letter received by the Company in the ordinary course of business and consultation related to the Company's restatement to reflect adjustments made in the Company's lease accounting methods, as reported on Forms... -

Page 91

... the applicable accounting regulations of the SEC are not required under the related instructions, are inapplicable or the information is included in the Consolidated Financial Statements, and therefore, have been omitted. The Financial Statements of Family Dollar Stores, Inc., (Parent Company) are... -

Page 92

..., thereunto duly authorized. FAMILY DOLLAR STORES, INC. (Registrant) Date March 28, 2007 By /s/ Howard R. Levine Howard R. Levine Chairman of the Board (Chief Executive Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons... -

Page 93

... Inc., as Borrowers, and Wachovia Bank, Nation Association, as Administrative Agent, Swingline Lender and Fronting Bank, and various other Lenders named therein (filed as Exhibit 10 to the Company's Report on Form 8âˆ'K filed August 28, 2006) 76 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 94

... for the year ended August 28, 2004) 10.21 Family Dollar Stores, Inc., 1989 Nonâˆ'Qualified Stock Option Plan, amended as of August 17, 2004 (filed as Exhibit 10(i) to the Company's Report on Form 8âˆ'K filed January 21, 2005) 10.22 Resolution of the Board of Directors of Family Dollar Stores, Inc... -

Page 95

...Income Plan (filed as Exhibit 10.25 to the Company's Form 10âˆ'K for the year ended August 27, 2005) 10.29 Family Dollar Stores, Inc., Executive Life Plan (filed as Exhibit 10.26 to the Company's Form 10âˆ'K for the year ended August 27, 2005) 10.30 Relocation Policy applicable to executive officers... -

Page 96

... on Form 8âˆ'K filed December 22, 2006) * 10.49 The Family Dollar Stores, Inc. 2006 Incentive Plan Guidelines for Annual Cash Bonus Awards (filed as Exhibit 10 to the Company's Report on Form 8âˆ'K filed October 6, 2006) 14 Code of Ethics for Chief Executive and Senior Financial Officers (filed as... -

Page 97

... to Section 906 of the Sarbanesâˆ'Oxley Act of 2002 of Chief Executive Officer Certification pursuant to Section 906 of the Sarbanesâˆ'Oxley Act of 2002 of Chief Financial Officer Exhibit represents a management contract or compensatory plan 80 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28... -

Page 98

... to as the "Corporation") is FAMILY DOLLAR STORES, INC. SECOND: The registered office of the Corporation is to be located at 229 South State Street, in the City of Dover, County of Kent, Zip Code 19901, in the State of Delaware. The name of the registered agent at such address is The Prenticeâˆ'Hall... -

Page 99

..., be entitled as of right to purchase or to subscribe for any shares of stock of the Corporation of any class or any series now or hereafter authorized, or any securities convertible into or exchangeable for any such shares, or any warrants, options, rights or other instruments evidencing rights... -

Page 100

... or other amounts and whether or not the presence of such director or directors at any meeting at which such resolution is so passed is or was necessary to constitute a quorum thereat. (b) The Board of Directors shall have the power and authority: Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28... -

Page 101

... of the stockholders of the Corporation; (3) from time to time to fix the compensation or additional compensation or other remuneration to be paid to any of the officers, agents or employees of the Corporation for services rendered, or to be rendered, and to adopt any plan or other arrangement that... -

Page 102

... of the fact that any director, or any firm of which any director is a member or has a financial interest, or any corporation of which any director is an officer, director or stockholder or has a financial interest, is in any way interested in such Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28... -

Page 103

... existence of a quorum at a meeting to consider any contract or transaction between the Corporation and any subsidiary, parent or other affiliated corporation of which he is also a director or officer and may vote upon any such contract or transaction, Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28... -

Page 104

... for breach of fiduciary duty as a director, except for liability (i) for any breach of the director's duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 105

... repeal or modification of this Article by the stockholders of the Corporation shall be prospective only and shall not adversely affect any right or protection of a director of the Corporation existing at the time or such repeal or modification. Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 106

... has been executed on behalf of the Corporation by its duly elected Senior Vice President, General Counsel and Secretary this 8th day of November, 2006. /s/ Janet G. Kelly Janet G. Kelly WITNESS: /s/ Michele Hartsell Michele Hartsell Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 107

...(ii) Family Dollar Stores, Inc. 2006 Incentive Plan Guidelines for Longâˆ'Term Incentive Performance Share Rights Awards , (iii) Family Dollar Stores, Inc. 2006 Incentive Plan 2006 Nonâˆ'Qualified Stock Option Grant Program (filed as Exhibits 10.1, 10.2, and 10.3, respectively, to the Company's Form... -

Page 108

... Kentucky Louisiana Maryland Massachusetts Michigan Mississippi Missouri New Jersey New Mexico New York North Carolina Ohio Oklahoma Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Vermont Virginia West Virginia Wisconsin 1 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 109

... EXECUTIVE OFFICER PURSUANT TO RULES 13aâˆ'14(a) AND 15dâˆ'14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANESâˆ'OXLEY ACT OF 2002 I, Howard R. Levine, certify that: 1. 2. I have reviewed this Annual Report on Form 10âˆ'K of Family Dollar Stores... -

Page 110

1 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 111

...THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANESâˆ'OXLEY ACT OF 2002 I, R. James Kelly, certify that: 1. 2. I have reviewed this Annual Report on Form 10âˆ'K of Family Dollar Stores, Inc.; Based on my knowledge, this report does not contain any untrue statement... -

Page 112

1 Source: FAMILY DOLLAR STORES, 10âˆ'K, March 28, 2007 -

Page 113

...of the Securities Exchange Act of 1934; and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. • Date: March 28, 2007 /s/ Howard R. Levine Howard R. Levine Chairman of the Board and Chief Executive... -

Page 114

... Operating Officer - Interim Chief Financial Officer (Principal Financial Officer) A signed original of this written statement required by Section 906 has been provided to Family Dollar Stores, Inc., and will be retained by Family Dollar Stores, Inc., and furnished to the Securities and Exchange...