FairPoint Communications 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 FairPoint Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(Mark One)

oo

Common Stock, par value $0.01 per share New York Stock Exchange

Indicate by check mark if the Registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes o No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer o Accelerated filer Non-accelerated filer o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2007 (based on the closing price of

$17.75 per share as quoted on the New York Stock Exchange as of such date) was approximately $610,510,000.

As of February 25, 2008, there were 35,264,945 shares of the Registrant’s common stock, par value $0.01 per share, outstanding.

Certain information required by Part III of this Annual Report will be incorporated by reference from the Registrant’s Proxy Statement to be filed

pursuant to Regulation 14A with respect to the Registrant’s fiscal 2008 annual meeting of stockholders.

Table of contents

-

Page 1

... North Carolina (Address of Principal Executive Offices) 28202 (Zip code) Registrant's Telephone Number, Ingluding Trea Code: (704) 344-8150. Segurities registered pursuant to Segtion 12(b) of the Tgt: Title of Eagh Class N a m e o f E x g h a n g e o n W h i g h R e g i s t e r e d Common Stock... -

Page 2

...Business Risk Factors Unresolved Staff Comments Properties Legal Proceedings Submission of Matters to a Vote of Security Holders 2 21 40 40 40 40 PTRT II Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management... -

Page 3

... of the date on which this Annual Report was filed with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related... -

Page 4

... voice access lines and high speed data lines, which include digital subscriber lines, or DSL, wireless broadband and cable modem) in service as of December 31, 2007. We were incorporated in February 1991 for the purpose of acquiring and operating incumbent telephone companies in rural and small... -

Page 5

...Wireless), collectively referred to as the Verizon Group, will transfer certain specified assets and liabilities of the local exchange business of Verizon New England Inc., or Verizon New England, in Maine, New Hampshire and Vermont and the customers of the related long distance and Internet service... -

Page 6

... subject to certain conditions. The orders issued by the state regulatory authorities in Maine, New Hampshire and Vermont provide for, among other things: • a 35% reduction in the rate of dividends to be paid by us following the merger (as compared to the dividend rate paid by us since our... -

Page 7

...the availability of broadband service (such as DSL) to specified levels in each of Maine, New Hampshire and Vermont; and • a requirement that the Verizon Group pay $15 million to us for each of the first and second years after the closing of the merger if in either such year our line losses in New... -

Page 8

... local telephone companies, as well as other services such as long distance, Internet and broadband enabled services. Based on our understanding of our local customers' needs, we have attempted to be proactive by offering bundled services designed to simplify the customer's purchasing and management... -

Page 9

... calling features. In a rural local exchange carrier's territory, the amount that we can charge a customer for local service is determined by rate proceedings involving the appropriate state regulatory authorities. Network Access Charges Network access enables long distance companies to utilize... -

Page 10

... or Carrier Services, we offer wholesale long distance services to communications providers that are not affiliated with us. Data anb Internet Services We offer Internet access via DSL technology, dedicated T-1 connections, Internet dial-up, high speed cable modem and wireless broadband. Customers... -

Page 11

... acquiring such rural local exchange carriers, we typically change this practice to provide additional support for existing products and services as well as to support the introduction of new services. As of December 31, 2007, we had 244 employees engaged in sales, marketing and customer service... -

Page 12

... New England areas in which we will operate: • the offering of long distance services and prepaid calling card services and the resale of local exchange service; • the offering of products and services to business and government customers other than as the incumbent local exchange carrier... -

Page 13

.... Cable television companies are entering the communications market by upgrading their networks with fiber optics and installing facilities to provide fully interactive transmission of broadband, voice, video and data communications. Electric utilities have existing assets and access to low cost... -

Page 14

... other resources than those available to us. Long Distance Competition The long distance communications market is highly competitive. Competition in the long distance business is based primarily on price, although service bundling, branding, customer service, billing service and quality play a role... -

Page 15

..., following the transactions our non-rural operations will receive support under the nonrural model methodology in Maine and Vermont. The FCC's current rules for support to high-cost areas served by non-rural local telephone companies were remanded by the U.S. Court of Appeals for the Tenth Circuit... -

Page 16

...result, competition in our local exchange service areas will continue to increase from competitive local exchange carriers, wireless providers, cable companies, Internet service providers, electric companies and other providers of network services. Many of these competitors have a significant market... -

Page 17

... to telephone numbers, operator service, directory assistance and directory listing; (iv) ensure competitive access to telephone poles, ducts, conduits and rights of way; and (v) compensate competitors for the cost of completing calls to competitors' customers from the other carrier's customers. In... -

Page 18

... as providing special access performance metrics, offering low-volume calling plans, and making available certain monthly usage information on customers' bills. The FCC also has ruled that the Bell Operating Companies and their independent incumbent local exchange carrier affiliates are no longer... -

Page 19

... states, our intrastate long-distance rates are also subject to state regulation. States typically regulate local service quality, billing practices and other aspects of our business as well. Most state commissions have traditionally regulated local exchange carrier pricing through cost-based "rate... -

Page 20

...the availability of broadband service (such as DSL) to specified levels in each of Maine, New Hampshire and Vermont; and • a requirement that the Verizon Group pay $15 million to us for each of the first and second years after the closing of the merger if in either such year our line losses in New... -

Page 21

... of rates for basic local exchange services and allows pricing flexibility for other services, including intrastate long distance, optional services and bundled packages. Our existing telephone companies in Maine currently operate under traditional rate of return regulation and have limited forms... -

Page 22

... a complaint brought by a competitive local exchange carrier seeking a ruling that access charges, or at least the carrier common line rate element, do not apply to certain interexchange calls where neither the calling nor the called party is served by Verizon New England. Verizon New England... -

Page 23

... or electric utilities with which we will have contracts already possess the requisite authorizations to construct or expand our networks. Environmental Regulations Like all other local telephone companies, our 30 local exchange carrier subsidiaries are subject to federal, state and local laws and... -

Page 24

...1. Business - Recent Developments - Regulatory Conditions," "Item 1. Business - Regulatory Environment - State Regulation - Regulatory Conditions to the Merger" and "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Dividend Policy... -

Page 25

... of our common stock, including: • limiting our ability to pay dividends on our common stock or make payments in connection with our other obligations, including under our existing credit facility; • limiting our ability in the future to obtain additional financing for working capital, capital... -

Page 26

... common stock and to meet its debt service obligations generally. The ability of the Company's subsidiaries to pay dividends or make other payments or distributions to the Company will depend on their respective operating results and may be restricted by, among other things: • the laws of their... -

Page 27

...pay dividends to our stogkholders. Our initial public offering in February 2005 resulted in an "ownership change" within the meaning of the U.S. federal income tax laws addressing net operating loss carryforwards, alternative minimum tax credits and other similar tax attributes. Moreover, the merger... -

Page 28

... stock, certain specified options, restricted stock units, restricted units and certain restricted shares outstanding as of the date of the merger agreement). Consequently, our current stockholders, collectively, will be able to exercise less influence over the management and policies of the Company... -

Page 29

..., the local exchange business and related landline activities in Maine, New Hampshire and Vermont as historically operated by the Verizon Group have experienced net voice access line losses in the past few years. The Northern New England business's 2007 revenues from switched access lines comprised... -

Page 30

... New England areas in which we will operate: • the offering of long distance services and prepaid calling card services and the resale of local exchange service; • the offering of products and services to business and government customers other than as the incumbent local exchange carrier... -

Page 31

..., when we lose a customer for local service we also lose that customer for all related services); • reduced usage of our network by our existing customers who may use alternative providers for long distance and data services; • reductions in the prices for our services which may be necessary to... -

Page 32

... acquiring other businesses. Subject to restrictions in the tax sharing agreement that limit our ability to take certain actions during the two years following the spin-off that could jeopardize the tax-free status of the spin-off or merger and restrictions imposed by the orders of state regulatory... -

Page 33

... to maintain the negessary rights-of-way for our networks. We are dependent on rights-of-way and other permits from railroads, utilities, state highway authorities, local governments and transit authorities to install and maintain conduit and related communications equipment for any expansion of our... -

Page 34

...health and safety matters. Our operations and properties are subject to federal, state and local laws and regulations relating to protection of the environment, natural resources, and worker health and safety, including laws and regulations governing the management, storage and disposal of hazardous... -

Page 35

...our internal controls over financial reporting existed as of December 31, 2007: • Our management oversight and review procedures designed to monitor the effectiveness of control activities in our northern New England division, which was formed in 2007 to handle transactions relating to the merger... -

Page 36

...(i) specified assets and liabilities associated with the local exchange business of Verizon New England in Maine, New Hampshire and Vermont, and (ii) the customers of the Verizon Group's related long distance and Internet service provider businesses in those states. The contributed assets may not be... -

Page 37

... No single state accounted for more than 22% of our access line equivalents as of December 31, 2007, which limited our exposure to competition, local economic downturns and state regulatory changes. Following the merger, we expect that 88% of our access line equivalents will be located in Maine, New... -

Page 38

... ruling from the Internal Revenue Service to the effect that the spin-off, including (i) the contribution of specified assets and liabilities associated with the local exchange business of Verizon New England in Maine, New Hampshire and Vermont, and the customers of the Verizon Group's related long... -

Page 39

... calls in the regions served and for providing special access services which connect interexchange third-party private line carriers to their end users in our service areas. This also includes Universal Service Fund payments for local switching support, long term support and interstate common line... -

Page 40

...." We will also receive other Universal Service Fund support payments, including Interstate Access Support, in all three of our price cap study areas following the merger (Maine, New Hampshire and Vermont) and Interstate Common Line Support in our rate-of-return study areas. If we were unable to... -

Page 41

... customer privacy or addressing other issues that impact our business. For example, existing provisions of the Communications Assistance for Law Enforcement Act and FCC regulations implementing that legislation require communications carriers to ensure that their equipment, facilities, and services... -

Page 42

... rolling stock, central office and remote switching platforms and transport and distribution network facilities in each of the 18 states in which we operate our rural local exchange carrier business. Our administrative and maintenance facilities are generally located in or near the rural communities... -

Page 43

... companies listed on the New York Stock Exchange and (ii) the cumulative total return of the peer group set forth below which was selected by us. The period compared commences on February 4, 2005 and ends on December 31, 2007. This graph assumes that $100 was invested on February 4, 2005 (the date... -

Page 44

..., dividends on our future senior classes of capital stock, if any, capital expenditures, taxes and future reserves, if any, this policy could be modified or revoked by our board of directors at any time; • the orders issued by the state regulatory authorities in Maine, New Hampshire and Vermont... -

Page 45

... the merger, we expected to maintain our current dividend policy for the Company following the transactions, subject to the limitations and restrictions described below under "- Restrictions on Payments of Dividends." However, following the transactions we will pay dividends at a reduced annual rate... -

Page 46

... merger and related transactions and the repayment in full of all obligations owing under our existing credit agreement. New Crebit Facility Our new credit facility is expected to restrict our ability to declare and pay dividends on our common stock as follows: • We may declare and pay dividends... -

Page 47

..., subject to certain conditions. The orders issued by the state regulatory authorities in Maine, New Hampshire and Vermont provided for, among other things: • a 35% reduction in the rate of dividends to be paid by us following the merger (as compared to the dividend rate paid by us since our... -

Page 48

... above for the FairPoint Communications, Inc. 2005 Stock Incentive Plan include shares that have become available due to forfeitures or have been re-acquired by the Company for any reasons without delivery of the stock, as allowed under the terms of the plan. Purghases of Equity Segurities by the... -

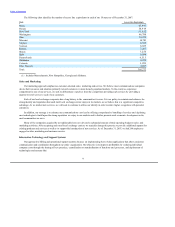

Page 49

... Diluted shares outstanding Basic and diluted earnings (loss) from continuing operations per share Cash dividends paid per share Operating Data: Capital expenditures Access line equivalents(5) Residential access lines Business access lines High Speed Data subscribers Summary Cash Flow Data: Net cash... -

Page 50

... in February 2005. (5) Total access line equivalents includes voice access lines and high speed data lines, which include DSL lines, wireless broadband and cable modem. (6) In connection with our initial public offering, we repurchased all of our series A preferred stock from the holders thereof... -

Page 51

..." in this Annual Report. Overview We are a leading provider of communications services in rural and small urban communities, offering an array of services, including local and long distance voice, data, Internet and broadband product offerings. We are one of the largest telephone companies in the... -

Page 52

...Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Dividend Policy and Restrictions." We are subject to regulation primarily by federal and state governmental agencies. At the federal level, the FCC has jurisdiction over interstate and international communications... -

Page 53

... video services (including cable television and video-over - DSL), billing and collection, directory services and sale and maintenance of customer premise equipment. Following the merger, we expect to be less dependent on certain regulated revenues, including USF payments and access charges. 51 -

Page 54

... Telephone Company, or GITC. The merger consideration was $10.7 million (or $9.2 million net of cash acquired). GITC is a single exchange rural incumbent local exchange carrier located in the Village of Germantown, Ohio, which served approximately 4,400 access line equivalents as of the date... -

Page 55

... Telephone Corporation, or Berkshire, for a purchase price of approximately $20.3 million (or $16.4 million net of cash acquired). Berkshire is an independent local exchange carrier that provides voice communication, cable and internet services to over 7,200 access line equivalents, as of the date... -

Page 56

...represented by selected items ... Interest and dividend income Interest expense Impairment of investments Equity in net ...earnings of investees Loss on derivative instruments Other nonoperating, net Total other expense Income (loss) from continuing operations before income taxes Income tax... -

Page 57

... and bundled product offerings with unlimited long distance designed to generate more revenue. Cata and Internet services. Data and Internet services revenues increased $5.4 million to $33.6 million in 2007 compared to 2006. Of this increase, $1.3 million was attributable to acquired companies and... -

Page 58

...and long distance services), an increase in operating taxes of $1.3 million, an increase in bad debt expense of $0.9 million, and an increase in various network expenses of $1.2 million. These increases were partially offset by decreases in employee related costs of $0.9 million and billing expenses... -

Page 59

... and bundled product offerings with unlimited long distance designed to generate more revenue. Cata and Internet services. Data and Internet services revenues increased $4.0 million to $28.2 million in 2006 compared to 2005. Of this increase, $1.1 million was attributable to acquired companies and... -

Page 60

...1. Business - Recent Developments - Regulatory Conditions," "Item 1. Business - Regulatory Environment - State Regulation - Regulatory Conditions to the Merger" and "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Dividend Policy... -

Page 61

... was primarily due to merger related costs incurred during 2007. Our ability to service our indebtedness depends on our ability to generate cash in the future. We are not required to make any scheduled principal payments under our existing credit facility's term loan facility prior to maturity in... -

Page 62

...and 2006 included in this Annual Report. As a result of these swap agreements, as of December 31, 2007, approximately 89% of our indebtedness bore interest at fixed rates rather than variable rates. After these interest rate swap agreements expire, our annual debt service obligations on such portion... -

Page 63

... were used to pay fees and penalties associated with the early retirement of long term debt of $61.0 million, to pay a deferred transaction fee of $8.4 million and to pay debt issuance costs of $9.0 million. Our annual capital expenditures for our rural telephone operations have historically been... -

Page 64

... to support the growth of our business; (iv) dividend payments on our common stock, to the extent permitted by the agreements governing our indebtedness, including the new credit facility, and restrictions imposed by state regulatory authorities as conditions to their approval of the merger; and... -

Page 65

...," "Item 1. Business - Regulatory Environment - State Regulation - Regulatory Conditions to the Merger" and "Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Dividend Policy and Restrictions." We expect that our annual maintenance... -

Page 66

... TSA, we expect to issue to Capgemini shares of FairPoint preferred stock having a liquidation preference equal to the aggregate amount of such fees paid by Capgemini. The preferred stock will have a stated liquidation value of $1,000 per share, a 6.75% cumulative annual dividend in year one and an... -

Page 67

...and • Accounting for software development costs. Revenue recognition. Certain of our interstate network access and data revenues are based on tariffed access charges filed directly with the FCC; the remainder of such revenues are derived from revenue sharing arrangements with other local exchange... -

Page 68

... federal and state NOL carryforwards as of December 31, 2007. In February 2005, we completed our initial public offering which resulted in an "ownership change" within the meaning of the U.S. federal income tax laws addressing NOL carryforwards, alternative minimum tax credits and other similar tax... -

Page 69

... in earnings at each subsequent reporting date. The fair value option may be elected on an instrument-by-instrument basis, with a few exceptions. SFAS No. 159 amends previous guidance to extend the use of the fair value option to available-for-sale and held-tomaturity securities. SFAS No. 159 also... -

Page 70

...24.3 million from a balance of $34.1 million as of December 31, 2007 to $58.4 million as of February 15, 2008. We use variable and fixed-rate debt to finance our operations, capital expenditures and acquisitions. The variable-rate debt obligations expose us to variability in interest payments due to... -

Page 71

... TO FINTNCITL STTTEMENTS Page FAIRPOINT COMMUNICATIONS, INC. AND SUBSIDIARIES: Report of Independent Registered Public Accounting Firm CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2007, 2006 AND 2005: Consolidated Balance Sheets as of December 31, 2007 and 2006 Consolidated... -

Page 72

... of Directors and Stockholders FairPoint Communications, Inc.: We have audited the accompanying consolidated balance sheets of FairPoint Communications, Inc. and subsidiaries (the Company) as of December 31, 2007 and 2006, and the related consolidated statements of operations, stockholders' equity... -

Page 73

...459 - 46,500 3,805 27,940 593 5,128 2,631 33,648 5,425 79,170 Total gurrent assets Property, plant, and equipment, net Goodwill Investments Intangible assets, net Debt issue costs, net Deferred income tax Interest rate swaps Other 268,890 498,725 6,654 12,257 6,663 56,042 - 736 $ 896,467 246,264... -

Page 74

...2007, 2006, and 2005 (in thousands, exgept per share data) 2007 2006 2005 Revenues Operating expenses: Operating expenses, excluding depreciation and amortization Depreciation and amortization Gain on sale...,090 380 $ 380 28,930 Basic weighted average shares outstanding Diluted weighted average... -

Page 75

...Tggumulated defigit equity (defigit) Balance at December 31, 2004 Net income Net proceeds from issuance of common stock Transfer of Class A and Class C to common stock Exercise of stock options Issuance of restricted shares, net of forfeitures Recognition of compensation expense Dividends declared... -

Page 76

... Other comprehensive (loss) income: Cash flow hedges: Change in net unrealized (loss) gain, net of tax (benefit) expense of ($9,618), ($61) and $3,308 for the years ended December 31, 2007, 2006 and 2005, respectively Other comprehensive (loss) income Comprehensive (loss) income $ 6,014 $ 31,090... -

Page 77

...Loss of preferred stock subject to mandatory redemption Amortization of debt issue costs Provision for uncollectible revenue Deferred income taxes Income from equity method investments Deferred patronage dividends Minority interest in income of subsidiaries Loss on early retirement of debt Net (gain... -

Page 78

... associated with early retirement of long term debt Payment of deferred transaction fee Payment of tax withholdings on vested restricted shares Repurchase of shares of common stock subject to put options Repurchase of redeemable preferred stock Loan origination and offering costs Dividends paid to... -

Page 79

... provide telephone local exchange services in various states. Operations also include resale of long distance services, internet services, cable services, equipment sales, and installation and repair services. MJD Capital Corp. leases equipment to other subsidiaries of FairPoint. Carrier Services... -

Page 80

... cash expenditures and cost obligations related to the Merger during the three months ending March 31, 2008; (ii) provides accommodations for certain restructuring charges that the Company would incur if the Merger is not consummated; (iii) amends the interest coverage ratio maintenance covenant... -

Page 81

...from: access, pooling, local calling services, Universal Service Fund receipts, long distance services, internet and data services, and other miscellaneous services. Local access charges are billed to local end users under tariffs approved by each state's public utilities commission. Access revenues... -

Page 82

... nonmarketable and stated at cost. For investments in partnerships, the equity method of accounting is used. Non-Qualified Deferred Compensation Plan assets are classified as trading. The Company uses fair value reporting for marketable investments in debt and equity securities classified as trading... -

Page 83

... property and equipment is determined using the straight-line method for financial reporting purposes. The Company capitalizes certain costs incurred in connection with developing or obtaining internal use software in accordance with American Institute of Certified Public Accountants Statement... -

Page 84

... for impairment at least annually. During this assessment, management relies on a number of factors, including operating results, business plans, and anticipated future cash flows. Other intangible assets recorded by the Company consist of acquired customer relationships. These intangible assets... -

Page 85

... by evaluating hedging opportunities. The Company maintains risk management control systems to monitor interest rate cash flow risk attributable to both the Company's outstanding and forecasted debt obligations. The risk management control systems involve the use of analytical techniques, including... -

Page 86

... 31, 2007 to $58.4 million as of February 15, 2008. (m) Stock Option Plans Effective January 1, 2006, the Company adopted the provisions of SFAS No. 123(R), Share-Based Payment (SFAS No. 123(R)). SFAS No. 123(R) establishes accounting for stock-based awards granted in exchange for employee services... -

Page 87

... in earnings at each subsequent reporting date. The fair value option may be elected on an instrument-by-instrument basis, with a few exceptions. SFAS No. 159 amends previous guidance to extend the use of the fair value option to available-for-sale and held-tomaturity securities. The Statement also... -

Page 88

... formed wholly-owned subsidiary of Verizon that will own or indirectly own Verizon's local exchange and related business activities in Maine, New Hampshire and Vermont. The Company will be the acquiree for accounting purposes. Consequently, certain Merger related costs that are normally capitalized... -

Page 89

...single exchange rural incumbent local exchange carrier located in the Village of Germantown, Ohio. In 2007, the Company recorded a $0.3 million purchase adjustment to reduce the goodwill related to GITC. The GITC acquisition has been accounted for using the purchase method of accounting for business... -

Page 90

... Telephone Corporation, or Berkshire, for a purchase price of approximately $20.3 million (or $16.4 million net of cash acquired). Berkshire is an independent local exchange carrier that provides voice communication, cable and internet services to over 7,200 access line equivalents, as of the date... -

Page 91

... Communications Corporation, or Bentleyville, for a purchase price of approximately $11.0 million (or $9.3 million net of cash acquired). Bentleyville, which had approximately 3,600 access line equivalents as of the date of acquisition, provides telecommunications, cable and internet services... -

Page 92

...: 2007 2006 (in thousands) Equity method investments in cellular companies and partnerships: Orange County - Poughkeepsie Limited Partnership Chouteau Cellular Telephone Company Syringa Networks, LLC Other equity method investments Investments in securities carried at cost: CoBank stock and... -

Page 93

... equity investments Total 124 634 210 $2,672 $10,654 $10,859 On January 15, 2007, Taconic Telephone Corp., or Taconic, a subsidiary of the Company, entered into a Partnership Interest Purchase Agreement, or the O-P Interest Purchase Agreement, with Cellco Partnership d/b/a Verizon Wireless... -

Page 94

... in Equity Securities Carrieb at Cost The aggregate cost of the Company's cost method investments totaled $3.7 million at December 31, 2007. These investments consist primarily of investments in stock of governmental agencies and minority interests in limited partnerships or corporations. Therefore... -

Page 95

... commitments equal to 0.5% per annum, payable quarterly in arrears, as well as other fees. On January 25, 2007, the Company entered into an amendment to its credit facility which is intended to facilitate certain transactions related to the Merger. Among other things, such amendment: (i) permits... -

Page 96

... of the Company's business, mergers, acquisitions, asset sales and transactions with the Company's affiliates. The existing credit facility restricts the Company's ability to declare and pay dividends on its common stock as follows: • The Company may use all of its available cash accumulated... -

Page 97

... Notes. The Company also has $0.3 million unsecured demand notes payable to various individuals and entities with interest payable at 5.25% at December 31, 2007 and 2006. (9) Redeemable preferred stogk Series A preferred stock was issued to the lenders in connection with the Carrier Services debt... -

Page 98

... date (May 2011). On March 6, 2003, in connection with the Company's issuance of the 2003 Notes, the Company used a portion of these proceeds to repurchase $13.3 million aggregate liquidation preference of its Series A preferred stock at a 35% discount (together with accrued and unpaid dividends... -

Page 99

... 2007 2006 2005 Computed "expected" Federal tax (expense) benefit from continuing operations State income tax (expense) benefit, net of Federal income tax expense Merger transaction costs Change in FIN 48 reserve Dividends and loss on redemption on preferred stock Dividends received deduction Rate... -

Page 100

... 31, 2007, the Company has alternative minimum tax credits of $3.8 million that may be carried forward indefinitely. The Company completed an initial public offering on February 8, 2005, which resulted in an "ownership change" within the meaning of the U.S. Federal income tax laws addressing net... -

Page 101

...and with various state and local governments. With few exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations by tax authorities for years prior to 2004. During the quarter ended June 30, 2007, the Internal Revenue Service ("IRS") completed... -

Page 102

..., the Company adopted the FairPoint Communications, Inc. (formerly MJD Communications, Inc.) 1995 Stock Incentive Plan (the 1995 Plan). The 1995 Plan covers officers, directors, and employees of the Company. The Company was allowed to issue qualified or nonqualified stock options to purchase up to... -

Page 103

... price. This cancellation was triggered by certain events noted in the 1998 Plan. These stock options were granted by the Company prior to becoming a public company and therefore the Company is accounting for these options under the prospective method under SFAS 123(R). As of December 31, 2007... -

Page 104

... exercise price for such option. The Company has not previously exercised this right and does not currently intend to exercise this right in the future. The 2000 Plan stock options and stock units were granted by the Company prior to becoming a public company and therefore the Company is accounting... -

Page 105

... the FairPoint Communications, Inc. 2005 Stock Incentive Plan (the 2005 Plan). The 2005 Plan provides for the grant of up to 947,441 shares of non-vested stock, stock units and stock options to members of the Company's board of directors and certain key members of the Company's management. Shares... -

Page 106

... that vested in 2007 was $18.36. (14) Disgontinued Operations and Restrugturing Charges (a) Competitive Communications Business Operations In November 2001, in connection with the sale of certain assets of its competitive communications operations, the Company announced its plan to discontinue the... -

Page 107

...in pre-tax gains of $16.4 million. In addition, in the fourth quarter of 2006, the Company incurred $2.4 million in expenses related to the merger agreement with Verizon Communications Inc. (16) Disglosures Tbout the Fair Value of Finangial Instruments (a) Cash, Accounts Receivable, Accounts Payable... -

Page 108

... and advisory services related, but not limited to, equity financings and strategic planning. In 2005, the Company paid approximately $0.1 million related to these agreements. These agreements were cancelled on February 8, 2005. In connection with our initial public offering, the Company terminated... -

Page 109

... to be included relating to the Company's broadband products and access line trends. The plaintiff, who has been a plaintiff in several prior securities cases, seeks rescission rights and unspecified damages on behalf of a purported class of purchasers of the common stock "issued pursuant and/or... -

Page 110

...formed in 2007 to handle transactions relating to the merger. This division is in the development stage at this time, with evolving processes and controls, relatively small staff sizes and entirely new personnel. (b) Management's Report on Internal Control Over Financial Reporting Our management is... -

Page 111

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of FairPoint Communications, Inc. and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements of operations, stockholders' equity (deficit), comprehensive (loss... -

Page 112

... of the objectives of the control criteria, FairPoint Communications, Inc. and subsidiaries has not maintained effective internal control over financial reporting as of December 31, 2007, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring... -

Page 113

... in Rule 13a-15(f) of the Exchange Act) that occurred during the quarter ended December 31, 2007 that have materially affected or are reasonably likely to materially affect our internal control over financial reporting. Subsequent to December 31, 2007, management has begun to address the material... -

Page 114

... Act is incorporated herein by reference to the Company's definitive proxy statement to be filed not later than April 29, 2008 with the SEC pursuant to Regulation 14A under the Exchange Act. ITEM 14. PRINCIPTL TCCOUNTING FEES TND SERVICES The information required by Item 9(e) of Schedule 14A... -

Page 115

... listed in the index to the financial statements under "Item 8. Financial Statements and Supplementary Data" in this Annual Report, which index to the financial statements is incorporated herein by reference. In addition, certain financial statements of equity method investments owned by the Company... -

Page 116

... duly authorized. Fairpoint Communications, Inc. Date: February 28, 2008 By: /s/ Eugene B. Johnson Name: Eugene B. Johnson Title: Chairman of the Board of Directors and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this Annual Report has been signed... -

Page 117

... Telephone Company.(1) Agreement and Plan of Merger, dated as of January 15, 2007, by and among Verizon Communications Inc., Northern New England Spinco Inc. and FairPoint.(2) Amendment No. 1 to the Agreement and Plan of Merger, dated as of April 20, 2007, by and among Verizon Communications... -

Page 118

...., Ravenswood Communications, Inc., Utilities, Inc., FairPoint Carrier Services, Inc. and St. Joe Communications, Inc.(9) Subsidiary Guaranty, dated as of February 8, 2005, by FairPoint Broadband, Inc., MJD Ventures, Inc., MJD Services Corp., ST Enterprises, Ltd. and FairPoint Carrier Services, Inc... -

Page 119

... Utilities Commission, dated January 23, 2008.(28) Order of the New Hampshire Public Utilities Commission, dated February 25, 2008.(29) * Filed herewith. †Pursuant to Securities and Exchange Commission Release No. 33-8238, this certification will be treated as "accompanying" this Annual Report... -

Page 120

... to the Annual Report on Form 10-K of FairPoint for the year ended December 31, 2005. (24) Incorporated by reference to the Current Report on Form 8-K of FairPoint filed on December 13, 2007. (25) Incorporated by reference to the Current Report on Form 8-K of FairPoint filed on February 6, 2008. (26... -

Page 121

...("Capgemini") and FairPoint Communications, Inc. ("FairPoint"). In connection with the Order Approving Settlement Agreement with Conditions (Order No. 24,823), dated Februarb 25, 2008, issued bb the State of New Hampshire Public Utilities Commission, the parties desire to make certain amendments to... -

Page 122

... Long Distance Corp. Sidney Telephone Company Utilities, Inc. Standish Telephone Company China Telephone Company Maine Telephone Company UI Long Distance, Inc. UI Communications, Inc. UI Telecom, Inc. Telephone Service Company Chouteau Telephone Company Chautauqua and Erie Telephone Corporation... -

Page 123

...El Paso Long Distance Company Unite Communications Systems, Inc. ExOp of Missouri, Inc. d/b/a Unite Yates City Telephone Company FairPoint Carrier Services, Inc. (f/k/a FairPoint Communications Solutions Corp., f/k/a FairPoint Communications Corp.) FairPoint Communications Solutions Corp. - New York... -

Page 124

... (the Company), of our reports dated February 28, 2008, with respect to the consolidated balance sheets of FairPoint Communications, Inc. and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements of operations, stockholders' equity (deficit), comprehensive... -

Page 125

... REGISTERED PUBLIC ACCOUNTING FIRM We consent to the incorporation by reference in Registration htatements No. 33-141825 on Form h-4, No. 333-122809 on Form h-8, and Nos. 333-127759 and 333-127760 on Form h-3 of FairPoint Communications, Inc. of our report dated February 22, 2008, relating to... -

Page 126

... report financial information; and (ii) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal controls over financial reporting. Date: February 28, 2008 /s/ Eugene B. Johnson Eugene B. Johnson Chief Executive Officer -

Page 127

... and report financial information; and (ii) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal controls over financial reporting. Date: February 28, 2008 /s/ John P. Crowley John P. Crowley Chief Financial Officer -

Page 128

... with the Annual Report on Form 10-K of FairPoint Communications, Inc. (the "Company") for the year ended December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Eugene B. Johnson, Chief ExecutiKe Officer of the Company, certify, pursuant... -

Page 129

... connection with the Annual Report on Form 10-K of FairPoint Communications, Inc. (the "Company") for the year ended December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, John P. Crowley, Chief Financial Officer of the Company, certify, pursuant... -

Page 130

... 31, 2007, 2006 and 2005, and Report of Independent Registered Public Accounting Firm The information contained herein is confidential and is not to be reproduced or published without the express authorization of Verizon Wireless. It is intended solely for use by authorized Verizon Wireless and... -

Page 131

ORANGE COUNTY - POUGHKEEPSIE LIMITED PARTNERSHIP TABLE OF CONTENTS Page REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Balance Sheets 1 2 December 31, 2007 and 2006 Statements of Operations 3 For the years ended December 31, 2007, 2006 and 2005 Statements of Changes in Partners' ... -

Page 132

... of the Partnership's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates... -

Page 133

... other current assets Total current assets PROPERTY, PLANT AND EQUIPMENT - Net $ 168 683 12,107 90 13,048 $ TOTAL ASSETS LIABILITIES AND PARTNERS' CAPITAL CURRENT LIABILITIES: Accounts payable and accrued liabilities Total current liabilities LONG TERM LIABILITIES Total liabilities COMMITMENTS... -

Page 134

... Note 4 for Transactions with Affiliates): Cost of service (excluding depreciation and amortization related to network assets included below) General and administrative Depreciation and amortization Net loss on sale of property, plant and equipment Total operating costs and expenses OPERATING INCOME... -

Page 135

... PARTNERS' CAPITAL YEARS ENDED DECEMBER 31, 2007, 2006 AND 2005 General Partner Verizon Wireless Limited Partners of the East LP Taconic Cellco Telephone Partnership Corporation (Dollars in thousands) Warwick Valley Telephone Company Total Partners' Capital BALANCE, JANUARY 1, 2005 Net income... -

Page 136

... Depreciation and amortization Net loss on sale of property, plant and equipment Changes in certain assets and liabilities: Accounts receivable Unbilled revenue Prepaid expenses and other current assets Accounts payable and accrued liabilities Advance billings Long term liabilities Net cash provided... -

Page 137

... Orange County and Poughkeepsie, New York metropolitan service areas. The partners and their respective ownership percentages as of December 31, 2007 are as follows: Managing and General Partner: Verizon Wireless of the East LP* Limited partners: Warwick Valley Telephone Company ("Warwick") Cellco... -

Page 138

..., customer gross additions, or minutes-of-use, are reasonable. Property, Plant and Equipment - Property, plant and equipment primarily represents costs incurred to construct and expand capacity and network coverage on Mobile Telephone Switching Offices ("MTSOs") and cell sites. The cost of property... -

Page 139

... is affiliate revenue. Cellco and the Partnership rely on local and long-distance telephone companies, some of whom are related parties, and other companies to provide certain communication services. Although management believes alternative telecommunications facilities could be found in a timely... -

Page 140

...are charged to the Partnership through this account. Interest expense/income is based on the average monthly outstanding balance in this account and is calculated by applying Cellco's average cost of borrowing from Verizon Global Funding, a wholly owned subsidiary of Verizon Communications. The cost... -

Page 141

...Direct telecommunication charges(a) Long distance charges Allocation of cost of service(a) Allocation of switch usage cost(a) General and Administrative: Allocation of certain general and administrative expenses(a) (a) Expenses were allocated based on the Partnership's percentage of total customers... -

Page 142

... wireless phone usage. Various consumer class action lawsuits allege that Cellco breached contracts with consumers, violated certain state consumer protection laws and other statutes and defrauded customers through concealed or misleading billing practices. Certain of these lawsuits and other claims...