Express 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 ANNUAL REPORT

Table of contents

-

Page 1

2012 ANNUAL REPORT -

Page 2

-

Page 3

... BUSINESS PARTNER Dear Valued Business Partner: It is my pleasure, on behalf of the Board of Directors and the associates of Express, to present you with our 2012 annual report. We began the year optimistically, faced some challenges in our second and third quarters and ended the year on a far more... -

Page 4

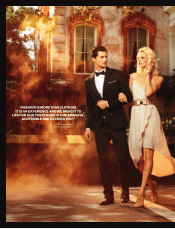

"FAShION IS mORE ThAN cLOThINg. IT IS AN ExPERIENcE AND wE BRINg IT TO LIFE FOR OUR cUSTOmERS IN A mEANINgFUL, AccESSIBLE AND ExcITINg wAy." Michael Weiss Chairman & CEO -

Page 5

...time show Fashion Star®, which prominently features the Express brand. It's gratifying to report that a large percentage of people clicking the ... want. A third growth pillar calls for expansion of our store base. In 2012, we added 16 net new stores in the United States and Canada collectively, ... -

Page 6

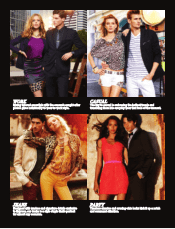

... the hottest trends and translating them into everyday wear that feels of-the-moment. JEANS Designed with washes and signature details exclusive to Express, our denim is a style staple that's perfect for almost any occasion. pARty Timeless classics and evening-chic looks kick it up a notch and... -

Page 7

...last October, we launched women's watches in 500 stores. EXPAND INTERNATIONALLY The Express brand resonates abroad. Last year, we expanded in the Middle East and entered...and social media presence is driving rapid e-commerce growth, with 2012 sales from that channel reaching 13% of net sales. Active ... -

Page 8

EXPRESS IN THE PRESS CELEBRITIES IN EXPRESS CARRIE UNDERWOOD BETHENNY FR ANK E L CAMILL A BELL E KRISTEN BELL S TERRELL OWEN EVA LONGORIA LOUISE ROE -

Page 9

... ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 2, 2013 OR ' TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-34742 EXPRESS... -

Page 10

Table Of Contents Part I ...ITEM 1. BUSINESS ...ITEM 1A. RISK FACTORS ...ITEM 1B. UNRESOLVED STAFF COMMENTS ...ITEM 2. PROPERTIES ...ITEM 3. LEGAL PROCEEDINGS ...ITEM 4. MINE SAFETY DISCLOSURE ...Part II ...ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER ... -

Page 11

... those expressed in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We do not undertake any obligation to make any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report on... -

Page 12

... L Brands. In May 2010, Express, Inc., the parent company of subsidiaries that operate our business, was converted into a Delaware corporation and completed an initial public offering ("IPO"), including listing its common stock on the New York Stock Exchange. In this Annual Report on Form 10-K, we... -

Page 13

...our e-commerce business becomes an increased percentage of our sales. In 2012, e-commerce represented 13% of our total sales. Expand Internationally. We believe Express has the potential to be a successful global brand. During 2012, we entered into new franchise agreements covering portions of Latin... -

Page 14

... primarily in Asia and South and Central America. Our top 10 manufacturers, based on cost, supplied approximately 30% of our merchandise in 2012. We purchase our merchandise using purchase orders and, therefore, are not subject to long-term production contracts with any of our vendors, manufacturers... -

Page 15

Quality Assurance and Compliance Monitoring Each factory, subcontractor, supplier, and agent that manufactures our merchandise is required to adhere to our Code of Vendor Conduct. This is designed to ensure that each of our suppliers' operations are conducted in a legal, ethical, and responsible ... -

Page 16

...philosophy. This new store design was utilized for new and remodeled stores beginning in 2012. As of February 2, 2013, we operate 44 stores in the new design ... maintain the strength of the Express brand in the United States, and increase awareness of the Express brand globally. Store Management and... -

Page 17

... management, design, planning and allocation, and financial reporting. During 2012, we made additional investments to upgrade our general ledger...many foreign countries. In addition, we own domain names, including express.com which include our primary trademarks. We believe our material trademarks... -

Page 18

...Fall selling patterns as well as the impact of the holiday season. In 2012, approximately 56% of our net sales were generated in the Fall season (....express.com, copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to these reports ... -

Page 19

that affect domestic and worldwide economic conditions, including employment, consumer debt, reductions in net worth, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence, value of the United States dollar versus foreign currencies, and ... -

Page 20

... part on our ability to anticipate and respond quickly to fashion trends, maintain the strength of the Express brand in the United States, and increase awareness for the Express brand globally. Some of our competitors have greater financial, marketing, and other resources available. In many cases... -

Page 21

in payment terms from manufacturers, which could adversely affect our financial condition or results of operations. Failure by our manufacturers to comply with our guidelines also exposes us to various risks, including with respect to use of acceptable labor practices and compliance with applicable ... -

Page 22

United States or foreign labor strikes and work stoppages or boycotts, could increase the cost or reduce the supply of apparel available to us and adversely affect our business, financial condition, or results of operations. If we encounter difficulties associated with distribution facilities or if ... -

Page 23

negotiating acceptable leases, completing projects on budget, supplying proper levels of merchandise and successfully hiring and training store managers and sales associates. In order to optimize profitability for new stores, we must secure desirable retail lease space when opening stores in new and... -

Page 24

... new stores, or a breach in security of these systems could adversely impact the promptness and accuracy of our merchandise distribution, transaction processing, financial accounting and reporting, the efficiency of our operations, and our ability to properly forecast earnings and cash 16 -

Page 25

...effect on us. We sell merchandise over the Internet through our website, express.com. Our Internet operations may be affected by our reliance on third-party... 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K. Any claims could result in litigation against us... -

Page 26

... pay amounts due in respect of our indebtedness. We also have, and will continue to have, significant lease obligations. As of February 2, 2013, our minimum annual rental obligations under long-term lease arrangements for 2013 and 2014 were $202.4 18 -

Page 27

million and $174.1 million, respectively. Our substantial indebtedness and lease obligations could have important consequences and significant effects on our business. For example, they could: • • increase our vulnerability to adverse changes in general economic, industry, and competitive ... -

Page 28

indebtedness, which could adversely affect our ability to respond to changes in our business and manage our operations. Additionally, a default by us under one agreement covering our indebtedness may trigger crossdefaults under another agreement covering our indebtedness. Upon the occurrence of an ... -

Page 29

• • prohibit stockholder action by written consent, which requires all stockholder actions to be taken at a meeting of our stockholders; and establish advance notice requirements for nominations for elections to our Board of Directors or for proposing matters that can be acted upon by ... -

Page 30

... proceedings is set forth in Note 15 to our Consolidated Financial Statements included in "Item 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K and is incorporated herein by reference. ITEM 4. MINE SAFETY DISCLOSURE Not applicable. 22 -

Page 31

... maintained by depositories. The table below sets forth the high and low sales prices per share of our common stock reported on the NYSE for 2012 and 2011. Market Price High Low 2012 Fourth quarter ...Third quarter ...Second quarter ...First quarter ... $18.81 $17.45 $24.39 $26.27 $10.47 $10.93... -

Page 32

... (2) Represents shares of restricted stock purchased in connection with employee tax withholding obligations under the Express, Inc. 2010 Incentive Compensation Plan (as amended, the "2010 Plan"). On May 24, 2012, the Board authorized the repurchase of up to $100 million of our common stock (the... -

Page 33

...Results of Operations," and our Consolidated Financial Statements and the related Notes and other financial data included elsewhere in this Annual Report on Form 10-K. Year Ended 2012* 2011 2010 2009 2008 (dollars in thousands, excluding net sales per gross square foot and per share data) Statement... -

Page 34

...limited liability company into a Delaware corporation and changed our name to Express, Inc. See Note 1 to our Consolidated Financial Statements. In ...at least thirteen full months as of the end of the reporting period. For 2012, comparable sales were calculated based upon the fifty-three week... -

Page 35

... and elsewhere in this Annual Report on Form 10-K, particularly in the section entitled "Risk Factors." All references herein to "2012", "2011", and "...compared to the fifty-three week period ended February 4, 2012. Overview Express is a specialty apparel and accessories retailer offering both women... -

Page 36

..., we plan to continue our investment in these initiatives, and, in addition, we brought our website hosting and administration in-house after Holiday 2012, providing us additional flexibility and control over the look, content, and feel of our website. We believe this affords us the opportunity to... -

Page 37

...open at least thirteen full months as of the end of the reporting period. In 2012, comparable sales were calculated based upon the fifty-three week period ... 2, 2013 compared to the fifty-three week period ended February 4, 2012. In the fourth quarter of 2010, we began including e-commerce sales... -

Page 38

...Income as a percentage of net sales for the last three years. 2012 2011 2010 Net sales ...Cost of goods sold, buying and occupancy costs...February 2, 2013 compared to the fifty-three week period ended February 4, 2012. The flat comparable sales resulted from decreases in both transactions and average... -

Page 39

...decrease in gross margin, or gross profit as a percentage of net sales, in 2012 compared to 2011 was comprised of a 140 basis point deterioration in merchandise margin ... a $21.9 million increase in payroll primarily from annual merit increases, increased share-based compensation expense, additional ... -

Page 40

...the full prepayment of the Term Loan in the fourth quarter of 2011. The remaining reduction in expense relates to a lower debt balance in 2012 compared to 2011 due to the previously-mentioned repurchases and prepayment. The $23.7 million decrease in interest expense in 2011 compared to 2010 resulted... -

Page 41

...Adjusted Net Income and Adjusted Earnings Per Diluted Share for the stated periods: 2012 Year Ended 2011 (in thousands) 2010 Adjusted Net Income ...Adjusted Earnings ...considered in isolation or as a substitute for reported net income and reported earnings per diluted share. These non-GAAP financial... -

Page 42

...Shares Outstanding (in thousands, except per share amounts) Net Income Reported GAAP Measure ...Transaction Costs (a)* ...Advisory/LLC Fees (b) * ..., investing and financing activities are shown in the following table: 2012 Year Ended 2011 (in thousands) 2010 Provided by operating activities ... -

Page 43

... cash outflows also include payments for income taxes and interest on long-term debt. Net cash provided by operating activities was $269.4 million in 2012 compared to $212.6 million in 2011, an increase of $56.8 million. Relative to the fifty-three weeks ended February 2, 2013, the increase in cash... -

Page 44

... $65.1 million of our common stock, including broker commissions, in 2012 as part of the Repurchase Program. The cash used in financing activities...exceeded 10% of the borrowing base. Senior Notes On March 5, 2010, Express, LLC and Express Finance Corp., as co-issuers, issued $250.0 million of 8 3/4% ... -

Page 45

...included in our operating lease agreements are not included above. Estimated annual expense incurred for such charges is approximately $98.7 million. (5)...higher degree of judgment or complexity and are most significant to reporting its results of operations and financial position and are, therefore, ... -

Page 46

Description of Policy Judgments and Uncertainties Effect if Actual Results Differ from Assumptions Gift Card Breakage We sell gift cards in our retail stores and through our e-commerce website and third parties, which do not expire or lose value over periods of inactivity. We account for gift ... -

Page 47

... if Actual Results Differ from Assumptions Intangible Assets Intangible assets with indefinite lives, primarily trade names, are reviewed for impairment annually in the fourth quarter and may be reviewed more frequently if indicators of impairment are present. The impairment review is performed... -

Page 48

Description of Policy Judgments and Uncertainties Effect if Actual Results Differ from Assumptions Claims and Contingencies We are subject to various claims and contingencies related to legal, regulatory, and other matters arising out of the normal course of business. Our determination of the ... -

Page 49

... and liabilities are recognized for the estimated future tax consequences of temporary differences that currently exist between the tax basis and the financial reporting basis of our assets and liabilities. Deferred tax assets and liabilities are measured using the enacted tax rates in effect in the... -

Page 50

...term, and, beginning with the second anniversary of the IPO in May 2012, we began using our own volatility as an additional input as well. ... rates. We did not borrow any amounts under the Revolving Credit Facility during 2012. Borrowings under our Senior Notes bear interest at a fixed rate. For fixed... -

Page 51

U.S. subsidiaries that eliminate upon consolidation, but the transactions resulting in such accounts do expose us to foreign currency exchange risk. We do not utilize hedging instruments to mitigate foreign currency exchange risks. As of February 2, 2013, a hypothetical 10% change in the Canadian ... -

Page 52

... material respects, the financial position of Express, Inc. and its subsidiaries at February 2, 2013 and January 28, 2012, and the results of their operations ... Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of... -

Page 53

PART I - FINANCIAL INFORMATION ITEM 1. FINANCIAL STATEMENTS. EXPRESS, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Per Share Amounts) February 2, 2013 January 28, 2012 ASSETS CURRENT ASSETS: Cash and cash equivalents ...Receivables, net ...Inventories ...Prepaid minimum rent ...... -

Page 54

EXPRESS, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in Thousands, Except Per Share Amounts) 2012 2011 2010 NET SALES ...COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS ...Gross profit ...OPERATING EXPENSES: Selling, general, and administrative expenses ...Other ... -

Page 55

EXPRESS, INC. CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (Amounts in Thousands) ...based compensation ...Repurchase of common stock ...Foreign currency translation ...BALANCE, January 28, 2012 ...Net income ...Issuance of common stock ...Share-based compensation ...Tax benefit from share... -

Page 56

EXPRESS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) 2012 2011 2010 CASH FLOWS FROM OPERATING ACTIVITIES: Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...Loss ... -

Page 57

... 2, 2013 and the 52-week periods ended January 28, 2012 and January 29, 2011. Basis of Presentation In connection with the initial public offering of the Company's common stock ("IPO") on May 12, 2010, Express Parent LLC ("Express Parent") converted into a Delaware corporation and changed its name... -

Page 58

...the Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting period, as well as the... deposits with financial institutions. As of February 2, 2013 and January 28, 2012, amounts due from banks for credit and debit card transactions totaled approximately $... -

Page 59

... adjustment to inventory as of February 2, 2013 and January 28, 2012 was $7.6 million and $9.0 million, respectively. The Company also records...the "Card Agreement"). Each private label credit card bears the logo of the Express brand and can only be used at the Company's retail store locations and... -

Page 60

...this program out to stores in the United States in the first quarter of 2012. Upon reaching specified point values, customers are issued a reward, which they...website. Intangible assets with indefinite lives are reviewed for impairment annually in the fourth quarter and may be reviewed more frequently... -

Page 61

... determined by the estimated discounted future cash flows of the asset. The Company did not incur any impairment charges on intangible assets in 2012, 2011, or 2010. Leases and Leasehold Improvements The Company has leases that contain pre-determined fixed escalations of minimum rentals and/or rent... -

Page 62

... and $28.8 million as of February 2, 2013 and January 28, 2012, respectively, and was included in accrued liabilities on the Consolidated Balance Sheets...accrued based on known claims and estimates of incurred but not reported ("IBNR") claims. IBNR claims are estimated using historical claim ... -

Page 63

... time a gift card is sold. The gift card liability balance was $24.0 million and $23.2 million, as of February 2, 2013 and January 28, 2012, respectively, and is included in deferred revenue on the Consolidated Balance Sheets. The Company recognizes income from gift cards when they are redeemed by... -

Page 64

... segment. Therefore, the Company reports results as a single segment, which includes the operation of its Express brickand-mortar retail stores and ... 2012 and January 29, 2011, and as of February 2, 2013 and January 28, 2012, respectively, were not material and, therefore, not reported separately... -

Page 65

4. Leased Facilities and Commitments Annual store rent consists of a fixed minimum amount and/or contingent rent based on a percentage of sales exceeding a stipulated amount. Rent expense is summarized as follows: 2012 2011 (in thousands) 2010 Store rent: Fixed minimum ...Contingent ...Total store ... -

Page 66

... construction begins. Once the store opens, the Company will not report rent expense for the portion of the rent payment determined to ... $196,144 1,575 1,939 $199,658 $17,811 Cost January 28, 2012 Accumulated Ending Net Amortization Balance (in thousands) Tradename ...Internet domain name/other ... -

Page 67

..., Golden Gate ceased to be a related party as of June 1, 2012. Transactions with L Brands The Company is party to a logistics services ... 58,098 Prior to the IPO, under the Limited Liability Company Agreement of Express Parent ("LLC Agreement"), L Brands was entitled to receive a cash payment at... -

Page 68

...Gate an annual management fee equal to the greater of (i) $2.0 million per fiscal year or (ii) 3% of adjusted EBITDA of Express Holding. ... The Company did not incur any interest expense under the Topco Credit Facility in 2012 or 2011 due to the prepayments of the Topco Credit Facility in the first... -

Page 69

...liquidation of Express Parent. The Reorganization resulted in a taxable gain to Express Parent. Except in those few jurisdictions where Express Parent was...payment during the second quarter of 2011. In the first quarter of 2012, the Company recorded an additional pre-IPO tax liability of $0.3 million ... -

Page 70

... for foreign tax credit carryovers totaled $0.3 million. The Company did not have a valuation allowance for foreign tax credit as of January 28, 2012. The foreign tax credit carryovers begin expiring in 2021. The amount of the deferred tax assets considered realizable could be adjusted if estimates... -

Page 71

... of net interest in tax expense related to interest and penalties for 2012, 2011, and 2010 was negligible. The Company does not expect material...,850 (2,311) $198,539 Revolving Credit Facility On July 29, 2011, Express Holding, LLC, a wholly-owned subsidiary, and its subsidiaries entered into an ... -

Page 72

... the $119.7 million outstanding balance under its $125.0 million variable rate term loan ("Term Loan"). Senior Notes On March 5, 2010, Express, LLC and Express Finance, wholly-owned subsidiaries of the Company, co-issued, in a private placement, $250.0 million of 8 3/4% Senior Notes due in 2018... -

Page 73

... Senior Notes should subsequently decline to below investment grade, the suspended covenants will be reinstated. Topco Credit Facility On June 26, 2008, Express Topco, as borrower, entered into a $300.0 million secured term loan facility. The Topco Credit Facility was scheduled to mature on June 26... -

Page 74

..., the Company repurchased certain shares of common stock or equity units at cost from employees who were separated from the Company. On May 24, 2012, the Company's Board authorized the repurchase of up to $100 million of the Company's common stock ("Repurchase Program"), which may be made from time... -

Page 75

...terminated. In 2010, the Board approved, and the Company implemented, the Express, Inc. 2010 Incentive Compensation Plan (as amended, the "2010 Plan")....in order to attract, retain, and reward such individuals. Effective April 3, 2012, the Board amended the 2010 Plan to, among other things, reduce the... -

Page 76

...17.43 $19.53 $18.99 $19.60 $17.64 8 8.2 7.6 $2,275 $1,246 $ 952 The following provides additional information regarding the Company's stock options: 2012 2011 2010 (in thousands, except per share amounts) Weighted average grant date fair value of options granted ...Total intrinsic value of options... -

Page 77

...17.95 $23.18 $21.49 The total fair value/intrinsic value of RSUs and restricted stock that vested was $3.2 million and $0.1 million during 2012 and 2011, respectively. No RSUs or restricted stock vested during 2010. As of February 2, 2013, there was approximately $15.6 million of total unrecognized... -

Page 78

... account balances, excluding actuarial considerations as permitted by the applicable authoritative guidance. The annual activity for the Company's Non-Qualified Plan, was as follows: January 28, 2012 February 2, 2013 (in thousands) Balance, beginning of period ...Contributions: Employee ...Company... -

Page 79

...any Guarantor Subsidiary, or designation of any restricted subsidiary that is a Guarantor Subsidiary as an unrestricted subsidiary. On August 26, 2012, Express, LLC contributed certain assets and liabilities to a newly created Guarantor Subsidiary. As a result, the current and prior period condensed... -

Page 80

..., INC. CONDENSED CONSOLIDATING BALANCE SHEET (Amounts in thousands) February 2, 2013 Subsidiary Guarantor Other Consolidated Express, Inc. Issuers Subsidiaries Subsidiaries Eliminations Total Assets Current assets Cash and cash equivalents ...$ Receivables, net ...Inventories ...Prepaid minimum... -

Page 81

...INC. CONDENSED CONSOLIDATING BALANCE SHEET (Amounts in thousands) January 28, 2012 Subsidiary Guarantor Other Consolidated Express, Inc. Issuers Subsidiaries Subsidiaries Eliminations Total Assets Current assets Cash and cash equivalents ...$ 1,575 $121,273 $ 27,964 $ 1,550 $ - $152,362 Receivables... -

Page 82

..., INC. CONDENSED CONSOLIDATING STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2012 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling... -

Page 83

... STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2011 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling, general, and administrative... -

Page 84

... STATEMENT OF INCOME AND COMPREHENSIVE INCOME (Amounts in thousands) Subsidiary Issuers 2010 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Net sales ...Cost of goods sold, buying and occupancy costs ...Gross profit ...Selling, general, and administrative... -

Page 85

..., INC. CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) 2012 Express, Inc. Subsidiary Issuers Guarantor Subsidiaries Other Subsidiaries Eliminations Consolidated Total Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital... -

Page 86

... CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) Subsidiary Issuers 2011 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital expenditures... -

Page 87

... CONSOLIDATING STATEMENT OF CASH FLOWS (Amounts in thousands) Subsidiary Issuers 2010 Guarantor Other Subsidiaries Subsidiaries Consolidated Total Express, Inc. Eliminations Operating Activities Net cash provided by (used in) operating activities ...Investing Activities Capital expenditures... -

Page 88

17. Quarterly Financial Data (Unaudited) Summarized unaudited quarterly financial results for 2012 and 2011 follows: 2012 Quarter First Second Third Fourth (in thousands, except per share amounts) Net sales ...Gross profit ...Net income ...Earnings per basic share ...Earnings per diluted share ...... -

Page 89

... of this Annual Report on Form 10-K. Changes in Internal Control Over Financial Reporting There were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d15(f) under the Exchange Act of 1934) that occurred during the fourth quarter of 2012 that materially... -

Page 90

...Compensation-Compensation and Governance Committee Report" in the Proxy Statement for our 2013 Annual Meeting of Stockholders. ITEM 12... Statement for its 2013 Annual Meeting of Stockholders. The following table summarizes share and exercise price information about Express' equity compensation plan as... -

Page 91

...Express, Inc. and its subsidiaries are filed as part of this report under Item 8. Financial Statements and Supplementary Data: Report... of Cash Flows for the years ended February 2, 2013, January 28, 2012, and January 29, 2011 Notes to Consolidated Financial Statements (2) Financial Statement ... -

Page 92

... Inc.'s definitive proxy statement on Schedule 14A, filed with the SEC on April 30, 2012). Amendment No. 1 to Express, Inc. 2010 Incentive Compensation Plan (incorporated by reference to Exhibit 10.1 to the Quarterly Report on Form 10-Q, filed with the SEC on June 3, 2011). Form of Incentive Stock... -

Page 93

...Form 8-K, filed with the SEC on September 23, 2011). Severance Agreement, dated September 20, 2011, between Express, LLC and Dominic Paul Dascoli (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K, filed with the SEC on September 23, 2011). Amended and Restated $200,000,000... -

Page 94

... 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: April 2, 2013 EXPRESS, INC. By: /s/ D. PAUL DASCOLI D. Paul Dascoli Senior Vice President, Chief Financial Officer and Treasurer... -

Page 95

-

Page 96