EMC 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

EMC CORP (EMC)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 02/26/2010

Filed Period 12/31/2009

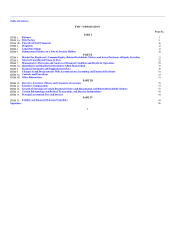

Table of contents

-

Page 1

EMC CORP

(EMC)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 02/26/2010 Filed Period 12/31/2009

-

Page 2

... The aggregate market value of voting stock held by non-affiliates of the registrant was $26,397,075,378 based upon the closing price on the New York Stock Exchange on the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2009). The number of shares of the...

-

Page 3

... About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership...

-

Page 4

...well as networking and storage infrastructures. EMC was incorporated in Massachusetts in 1979. Our corporate headquarters are located at 176 South Street, Hopkinton, Massachusetts. Products and Offerings EMC operates in two businesses, EMC's Information Infrastructure business and the VMware Virtual...

-

Page 5

... Avamar, EMC NetWorker and EMC Disk Library products, provide a combination of data protection solutions to help customers contend with massive information growth, cost constraints, virtual infrastructure backup challenges and increasingly stringent service requirements for recovery of data. In 2009...

-

Page 6

.... Iomega's NAS devices utilize EMC LifeLine software, a fully-developed Linux operating environment and suite of applications designed for cross-platform support with Windows, Mac and Linux computers. EMC Global Services EMC Global Services provides the strategic guidance and technology expertise...

-

Page 7

... enable EMC's customers to discover, classify and place appropriate controls around their data, secure access to the data, both inside and outside the network, and monitor and enforce these measures to prove compliance with security policies and regulations. In 2009, RSA introduced new versions of...

-

Page 8

..., resellers and original equipment manufacturers ("OEMs"). These agreements, subject to certain terms and conditions, enable these companies to market and resell certain EMC systems, software and related services. Additionally, VMware has developed a multi-channel distribution model to expand its...

-

Page 9

..., interoperability, connectivity, time-tomarket enhancements and total value of ownership. We believe our advantages in distribution include the world's largest information infrastructure-focused direct sales force and a broad network of channel partners. We believe our advantages in service include...

-

Page 10

... equity markets. Possible consequences from the financial crisis on our business, including insolvency of key suppliers resulting in product delays, inability of customers to obtain credit to finance purchases of our products, customer insolvencies, increased risk that customers may delay payments...

-

Page 11

...fluctuations in demand, adoption rates, sales cycles and pricing levels for VMware's products and services; fluctuations in foreign currency exchange rates; changes in customers' budgets for information technology purchases and in the timing of their purchasing decisions; VMware's ability to compete...

-

Page 12

...toward increased revenues and profits. Risks associated with the development and introduction of new products include delays in development and changes in data storage, networking virtualization, infrastructure management, information security and operating system technologies which could require us...

-

Page 13

...forecasting revenues; training our sales force to sell more software and services; successfully integrating new acquisitions; managing inventory levels, including minimizing excess and obsolete inventory, while maintaining sufficient inventory to meet customer demands; controlling expenses; managing...

-

Page 14

...sales force, we have agreements in place with many distributors, systems integrators, resellers and original equipment manufacturers to market and sell our products and services. We may, from time to time, derive a significant percentage of our revenues from such distribution channels. Our financial...

-

Page 15

... prohibiting us from marketing or selling certain of our products or a successful claim of infringement against us requiring us to pay royalties to a third party, and we fail to develop or license a substitute technology, our business, results of operations or financial condition could be materially...

-

Page 16

... and procedures for financial reporting. Should we or our independent auditors determine that we have material weaknesses in our internal controls, our results of operations or financial condition may be materially adversely affected or our stock price may decline. Changes in generally accepted...

-

Page 17

.... Our pension plan assets are subject to market volatility. We have a noncontributory defined benefit pension plan assumed as part of our Data General acquisition. The plan's assets are invested in common stocks, bonds and cash. The expected long-term rate of return on the plans' assets is 8.25...

-

Page 18

... Alto, CA owned: 1,304,000 Other North American Locations leased: 4,363,000 Asia Pacific leased: 1,457,000 owned: 578,000 leased: 123,000 Cork, Ireland owned: 35,000 Europe, Middle East and Africa leased: 1,669,000 (excluding Cork, Ireland) Latin America leased: 95,000

Hopkinton, MA

executive and...

-

Page 19

... and Cloud Services President and Chief Operating Officer, EMC Information Infrastructure Products Executive Vice President and Chief Financial Officer Executive Vice President President, EMC Content Management and Archiving Division Executive Vice President, Human Resources Executive Vice President...

-

Page 20

..., EMC Global Services and EMC Ionix from September 2007 to September 2009. Mr. Elias served as our Executive Vice President, Global Services and Resource Management Software Group from May 2006 to September 2007 and served as our Executive Vice President, Global Marketing and Corporate Development...

-

Page 21

... and Virtual Matrix Architecture are either registered trademarks or trademarks of EMC Corporation. RSA and enVision are registered trademarks of RSA Security LLC. VMware is a registered trademark of VMware, Inc. Data Domain is a registered trademark of Data Domain LLC. Acadia is a trademark of...

-

Page 22

..., RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock, par value $.01 per share, trades on the New York Stock Exchange under the symbol EMC. The following table sets forth the range of high and low sales prices of our common stock on the New York Stock Exchange...

-

Page 23

... Financial Statements). In 2007, EMC recognized a $148.6 million gain on the sale of VMware stock to Cisco. In 2006, EMC acquired all of the outstanding shares of 8 companies. In 2006, EMC adopted authoritative guidance on accounting for share-based payments which requires the expensing of stock...

-

Page 24

... into 2010 and perhaps longer. VMware Virtual Infrastructure VMware's current financial focus is on long-term revenue growth to generate cash flows to fund its expansion of industry segment share and development of virtualization-based products for data centers, desktop computers and cloud computing...

-

Page 25

... cash flows generated from the sale of existing products and services. VMware believes this is the appropriate priority for the long-term health of its business. RESULTS OF OPERATIONS Revenues The following table presents revenue by our segments:

Percentage Change 2009 2008 2007 2009 vs 2008 2008 vs...

-

Page 26

... services are generally purchased with licenses, the benefit from multi-year software maintenance contracts sold in previous periods and renewals of existing customer software maintenance contracts. Consolidated revenues by geography were as follows:

Percentage Change 2009 2008 2007 2009 vs...

-

Page 27

... overall gross margins by 11 basis points, and the Content Management and Archiving segment which improved overall gross margins by 7 basis points. The increase in corporate reconciling items, consisting of stock-based compensation, acquisition-related intangible asset amortization, restructuring...

-

Page 28

... expense associated with options exchanged in the acquisition of Data Domain and expense associated with VMware's equity grants. The decrease in intangible asset amortization expense in 2009 was attributable to acquisition-related intangible assets acquired in acquisitions becoming fully amortized...

-

Page 29

... in 2009 was primarily attributable to incremental expense associated with VMware's equity grants and expense associated with options exchanged in the acquisition of Data Domain. In 2008, stock-based compensation increased $56.8 and acquisition-related intangible asset amortization increased $34...

-

Page 30

... discount rates ranging from 20% to 60% to value the IPR&D projects acquired. The increase in IPR&D in 2008 when compared to 2007 was primarily attributable to higher levels of in-process R&D of acquisitions consummated during the respective period. Restructuring and Acquisition-Related Charges...

-

Page 31

...by an additional 4.5 percentage points. In 2009, we effected a plan to reorganize our international operations by transferring certain assets of our RSA and Data Domain entities and legacy foreign corporations owned directly by EMC into a single EMC international holding company. As a result of this...

-

Page 32

..., the number of shares purchased and timing of our purchases will be dependent upon a number of factors, including the price of our stock, market conditions, our cash position and alternative demands for our cash resources. We generated $594.0, $431.2 and $785.2 in 2009, 2008 and 2007, respectively...

-

Page 33

... an unrealized loss position, the financial condition and near-term prospects of the issuers, the issuers' credit rating, the underlying value and performance of the collateral, third party guarantees and the time to maturity. Our auction rate securities are predominantly rated AAA and are primarily...

-

Page 34

... a third-party trademark. Certain of these agreements require us to indemnify the other party against certain claims relating to property damage, personal injury or the acts or omissions of EMC, its employees, agents or representatives. In addition, from time to time, we have made certain guarantees...

-

Page 35

... partners in federal government transactions, and (ii) EMC's compliance with the terms and conditions of certain agreements pursuant to which we sold products and services to the federal government, primarily a schedule agreement we entered into with the United States General Services Administration...

-

Page 36

...guidance within the Accounting Standards Codification to our revenue is dependent upon the specific transaction and whether the sale or lease includes systems, software and services or a combination of these items. As our business evolves, the mix of products and services sold will impact the timing...

-

Page 37

... should the valuation of these companies change, this could impact our assessment of the fair value of the reporting units. Our discounted cash flow analyses factor in assumptions on revenue and expense growth rates. These estimates are based upon our historical experience and projections of future...

-

Page 38

...from changes in market conditions, using a 95% confidence level and assuming a one-day holding period. The value-at-risk on the combined foreign exchange position was $0.6 as of December 31, 2009 and $1.4 as of December 31, 2008. The average, high and low value-at-risk amounts for 2009 and 2008 were...

-

Page 39

... financial institutions. In addition to limiting the amount of contracts we enter into with any one party, we monitor the credit quality of the counterparties on an ongoing basis. We purchase or license many sophisticated components and products from one or a limited number of qualified suppliers...

-

Page 40

... STATEMENTS AND SUPPLEMENTARY DATA EMC CORPORATION AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SCHEDULE

Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets at December 31, 2009...

-

Page 41

... control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company's principal executive and principal financial officers and effected by the company's board of directors, management...

-

Page 42

... of their operations and their cash flows for each of the three years in the period ended December 31, 2009 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the accompanying index...

-

Page 43

... entity was acquired by the Company in a purchase business combination during 2009. We have also excluded Data Domain LLC from our audit of internal control over financial reporting. Data Domain LLC is a wholly-owned subsidiary of the Company whose total assets and total revenues represent 6.7% and...

-

Page 44

...; none outstanding Common stock, par value $0.01; authorized 6,000,000 shares; issued and outstanding 2,052,441 and 2,012,938 shares Additional paid-in capital Retained earnings Accumulated other comprehensive loss, net Total EMC Corporation's shareholders' equity Non-controlling interest in VMware...

-

Page 45

...

EMC CORPORATION CONSOLIDATED INCOME STATEMENTS (in thousands, except per share amounts)

For the Year Ended December 31, 2009 2008 (As Adjusted) 2007 (As Adjusted)

Revenues: Product sales Services Costs and expenses: Cost of product sales Cost of services Research and development Selling, general...

-

Page 46

... employees Dividends and interest received Interest paid Income taxes paid Net cash provided by operating activities Cash flows from investing activities: Additions to property, plant and equipment Capitalized software development costs Purchases of short and long-term available-for-sale securities...

-

Page 47

Non-cash investing and financing activity: Issuance of common stock and stock options exchanged in business acquisitions

$

83,780 $

4,057 $

4,607

The accompanying notes are an integral part of the consolidated financial statements. 45

-

Page 48

... purchase plans Tax benefit from stock options exercised Restricted stock grants, cancellations and withholdings, net Repurchase of common stock Stock options issued in business acquisitions Stock-based compensation Impact of adopting new standard on uncertainty in income taxes Impact from equity...

-

Page 49

Table of Contents

EMC CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in thousands)

For the Year Ended December 31, 2009 2008 2007 (As Adjusted) (As Adjusted)

Net income Other comprehensive income (loss), net of taxes (benefit): Recognition of actuarial net gain (loss) from pension ...

-

Page 50

... of revenues and expenses during the reporting period and the disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates. Revenue Recognition We derive revenue from sales of information systems, software and services. We...

-

Page 51

..., at which point all revenue for the arrangement is recognized over the remaining period of the undelivered element. • Shipping terms Our sales contracts generally provide for the customer to accept title and risk of loss when the product leaves our facilities. When shipping terms or local laws...

-

Page 52

... Statement. Cash and Cash Equivalents Cash and cash equivalents include highly liquid investments with a maturity of ninety days or less at the time of purchase. Cash equivalents consist primarily of money market securities, U.S. treasury bills, U.S. agency discount notes and short-term commercial...

-

Page 53

... a detailed program design or working model, if no program design is completed. Generally accepted accounting principles require that annual amortization expense of the capitalized software development costs be the greater of the amounts computed using the ratio of gross revenue to a products' total...

-

Page 54

... developed technology, trademarks and tradenames, customer relationships and customer lists, software licenses, patents, in-process research and development ("IPR&D") and other intangible assets, which include backlog, non-competition agreements and non-solicitation agreements. The intangible assets...

-

Page 55

... of shares of VMware held by EMC. Retirement Benefits Pension cost for our domestic defined benefit pension plan is funded to the extent that current pension cost is deductible for U.S. Federal tax purposes and to comply with the Employee Retirement Income Security Act and the General Agreement on...

-

Page 56

... customer orders. We attempt to minimize this risk by finding alternative suppliers or maintaining adequate inventory levels to meet our forecasted needs. Accounting for Stock-Based Compensation We have selected the Black-Scholes option-pricing model to determine the fair value of our stock option...

-

Page 57

... to additional paid-in capital which reflects the amount of EMC's share of VMware's net assets (after non-controlling interest) in excess of EMC's carrying value prior to the IPO. In October 2008, we purchased 500,000 shares of VMware's Class A common stock from Intel Capital Corporation for $13...

-

Page 58

...The fair value of our stock options issued to employees of Data Domain was estimated using a Black-Scholes option pricing model. The consolidated financial statements include the results of Data Domain from the date of acquisition. The purchase price has been allocated to the assets acquired and the...

-

Page 59

... aggregate purchase price, net of cash acquired for all 2009 acquisitions, excluding Data Domain, was $730.6 million, which consisted of $730.2 million of cash and $0.4 million in fair value of our stock options issued in exchange for the acquirees' stock options. The fair value of our stock options...

-

Page 60

... IPR&D projects was determined utilizing the income approach by determining cash flow projections relating to the projects. We applied discount rates ranging from 17% to 21% to determine the value of the IPR&D projects. Under new business combination guidance effective in 2009, each IPR&D project is...

-

Page 61

... to standardize and automate their IT management processes on VMware's infrastructure. The aggregate purchase price, net of cash acquired for all 2007 acquisitions was $696.6 million, which consisted of $689.9 million of cash, $4.6 million in fair value of our stock options issued in exchange for...

-

Page 62

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The pro forma impact on reported net income per weighted average share was primarily attributable to amortization of acquired intangible assets, foregone interest income on cash paid for the acquisitions and ...

-

Page 63

... factors could materially impact the value of the reporting unit. There was no impairment in 2009, 2008 or 2007. Other intangible assets are evaluated based upon the expected period the asset will be utilized, forecasted cash flows, changes in technology and customer demand. Changes in judgments on...

-

Page 64

...In connection with the sale of the Notes, we entered into separate convertible note hedge transactions with respect to our common stock (the "Purchased Options"). The Purchased Options allow us to receive shares of our common stock and/or cash related to the excess conversion value that we would pay...

-

Page 65

... auction rate securities, were recognized at fair value, which was determined based upon observable inputs from our pricing vendors for identical or similar assets. At December 31, 2009 and 2008, auction rate securities were valued using a discounted cash flow model. The following tables summarize...

-

Page 66

... tables represent our fair value hierarchy for our financial assets and liabilities measured at fair value as of December 31, 2009 and 2008 (in thousands):

December 31, 2009 Level 1 Level 2 Level 3 Total

Cash Cash equivalents U.S. government and agency obligations U.S. corporate debt securities...

-

Page 67

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) To determine the estimated fair value of our investment in auction rate securities, we used a discounted cash flow model. The assumptions used in preparing the discounted cash flow model include an ...

-

Page 68

... to third parties without recourse. In June 2009, we entered into a term loan agreement with Quantum Corporation ("Quantum"), pursuant to which Quantum borrowed $75.4 million from us. The agreement requires quarterly interest payments at a rate of 12% per annum. The scheduled maturity date of this...

-

Page 69

...we may sell additional maintenance contracts to our customers. Revenue from these additional maintenance contracts is included in deferred revenue and recognized ratably over the service period. The following represents the activity in our warranty accrual for our standard product warranty (table in...

-

Page 70

... (15.2) (2.1) (1.5) - 2.1 (0.5) 17.7%

In 2009, we effected a plan to reorganize our international operations by transferring certain assets of our RSA and Data Domain entities and legacy foreign corporations owned directly by EMC into a single EMC international holding company. As a result of this...

-

Page 71

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The components of the current and noncurrent deferred tax assets and liabilities are as follows (table in thousands):

December 31, 2008 December 31, 2009 Deferred Tax Asset Deferred Tax Liability Deferred Tax...

-

Page 72

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) policy was to classify accruals for uncertain positions as a current liability unless it was highly probable that there would not be a payment or settlement for such identified risks for a period of at least ...

-

Page 73

... policy provides that no security, except issues of the U.S. Government, shall comprise more than 5% of total plan assets, measured at market. At December 31, 2009, the Data General U.S. pension plan held $0.5 million of our common stock. The Data General U.S. pension plan and Canada pension plan...

-

Page 74

..., 2009 December 31, 2008 December 31, 2007

Discount rate Expected long-term rate of return on plan assets Rate of compensation increase The benefit payments are expected to be paid in the following years (table in thousands): 2010 2011 2012 2013 2014 2015 - 2019 Fair Value of Plan Assets

6.6% 8.25...

-

Page 75

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) U.S. Treasury Securities - valued daily at the closing price reported in active U.S. financial markets and are classified within Level 1 of the valuation hierarchy. Corporate Debt Securities - valued daily at...

-

Page 76

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The expected long-term rate of return on plan assets considers the current level of expected returns on risk free investments (primarily government bonds), the historical level of the risk premium associated with...

-

Page 77

... agreements, we have agreed to indemnify the supplier for certain claims that may be brought against such party with respect to our acts or omissions relating to the supplied products or technologies. We have agreed to indemnify the directors, executive officers and certain other officers of EMC...

-

Page 78

Table of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) In connection with certain acquisitions, we have agreed to indemnify the current and former directors, officers and employees of the acquired company in accordance with the acquired company's by-laws and ...

-

Page 79

... in thousands):

2008 2009 (As Adjusted) 2007 (As Adjusted)

Numerator: Net income attributable to EMC Corporation Incremental dilution from VMware Net income - diluted attributable to EMC Corporation Denominator: Weighted average shares, basic Weighted common stock equivalents Assumed conversion of...

-

Page 80

... to time in one or more series, with such terms as our Board of Directors may determine, without further action by our shareholders. P. Stock-Based Compensation EMC Information Infrastructure Equity Plans The EMC Corporation 2003 Stock Plan (the "2003 Plan") provides for the grant of stock options...

-

Page 81

... under all equity plans in 2009, 2008 and 2007 (shares in thousands):

Number of Shares Weighted Average Exercise Price (per share)

Outstanding, January 1, 2007 Options granted relating to business acquisitions Granted Forfeited Expired Exercised Exchanged to VMware awards Outstanding, December 31...

-

Page 82

... our restricted stock and restricted stock unit activity in 2009, 2008 and 2007 (shares in thousands):

Number of Shares Weighted Average Grant Date Fair Value

Restricted stock and restricted stock units at January 1, 2007 Granted Vested Forfeited Exchanged to VMware awards Outstanding, December 31...

-

Page 83

... date on which VMware's S-1 Registration Statement was declared effective by the SEC, and became exercisable on December 31, 2007. Options to purchase shares are generally granted twice yearly. In 2009, 0.9 million shares of Class A common stock were purchased under the ESPP at a purchase price per...

-

Page 84

...shares of VMware's Class A common stock in exchange for a stock option he held for the purchase of shares of common stock of EMC Corporation. The exercise price of his new VMware grant was $31.59 per share, the closing trading price of VMware Class A common stock on the grant date of August 12, 2009...

-

Page 85

...total stock-based compensation expense included in our consolidated income statement in 2009, 2008 and 2007 (in thousands):

Year Ended December 31, 2009 Stock Options Restricted Stock Total Stock-Based Compensation

Cost of product sales Cost of services Research and development Selling, general and...

-

Page 86

... date of grant using the Black-Scholes option-pricing model with the following weighted-average assumptions:

For the Year Ended December 31, EMC Stock Options 2009 2008 2007

Dividend yield Expected volatility Risk-free interest rate Expected term (in years) Weighted-average fair value at grant date...

-

Page 87

... of Contents

EMC CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

For the Year Ended December 31, VMware Employee Stock Purchase Plan 2009 2008 2007

Dividend yield Expected volatility Risk-free interest rate Expected term (in years) Weighted-average fair value at grant date...

-

Page 88

... strategic investments was based upon Level 2 inputs and the fair market value relating to $2.1 million of the $6.9 million charge was based upon Level 3 inputs. See Note G. The third quarter 2008 charge consisted of $5.5 million for employee termination benefits associated with a reduction in force...

-

Page 89

... 2003 for a ten-year term. In 2007, VMware entered into an agreement to license software from a third party. A member of our Board of Directors is a managing partner and general partner in a limited partnership which, until November 2009, had an equity interest in such third party of greater than 10...

-

Page 90

...121,801 (33,724) 1,088,077

2009: Revenues: Product revenues Services revenues Total consolidated revenues Cost of sales Gross profit Gross profit percentage Research and development Selling, general and administrative Restructuring and acquisition-related charges Total costs and expenses Operating...

-

Page 91

... to EMC Corporation

Information Storage $ 8,263,529 3,368,775 11,632,304 5,670,103 $ 5,962,201 51.3%

2007 (As Adjusted): Revenues: Product revenues Services revenues Total consolidated revenues Cost of sales Gross profit Gross profit percentage Research and development Selling, general and...

-

Page 92

... the geographic areas according to the location of the customers. Revenues by geographic area are included in the following table (table in thousands):

2009 2008 2007

United States Europe, Middle East and Africa Asia Pacific Latin America, Mexico and Canada Total

$

$

7,384,308 $ 4,290,274 1,603...

-

Page 93

... the changes in internal control over financial reporting as of December 31, 2009, our management excluded the evaluation of the disclosure controls and procedures of Data Domain LLC, which was acquired by EMC on July 23, 2009. See Note D to the Consolidated Financial Statements for a discussion of...

-

Page 94

... of Contents

PART III STOCK PRICE PERFORMANCE GRAPH

2004

2005

2006

2007

2008

2009

EMC S&P 500 Index S&P 500 Information Technology Sector Index

Source: Returns were generated from Thomson ONE Banker

$ $ $

100.00 $ 100.00 $ 100.00 $

91.59 $ 103.00 $ 100.38 $

88.77 $ 117.03 $ 108.11 $

124...

-

Page 95

...connection with various acquisitions. The option plans relating to such outstanding options were approved by the respective security holders of the acquired companies. Includes 28,674,988 shares of Common Stock available for future issuance under our Amended and Restated 1989 Employee Stock Purchase...

-

Page 96

... and Committees," "Review and Approval of Transactions with Related Persons" and "Certain Transactions" and included in Note R to the Consolidated Financial Statements. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information required by this item is incorporated herein by reference to...

-

Page 97

Table of Contents

PART IV ITEM 15. (a) 1. Financial Statements EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

The financial statements listed in the Index to Consolidated Financial Statements are filed as part of this report. 2. Schedule

The Schedule on page S-1 is filed as part of this report. 3. ...

-

Page 98

... By: JOSEPH M. TUCCI Joseph M. Tucci Chairman, President and Chief Executive Officer /S/

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of EMC Corporation and in the capacities indicated as of February 26...

-

Page 99

... and Restated Indemnification Agreement. (3) EMC Corporation Amended and Restated 1989 Employee Stock Purchase Plan, as amended and restated as of August 5, 2009. (filed herewith) Employment Arrangement with Joseph M. Tucci dated November 28, 2007. (8) Amendment to Employment Arrangement with Joseph...

-

Page 100

... by reference to EMC Corporation's Current Report on Form 8-K filed November 30, 2007 (No. 1-9853). Incorporated by reference to EMC Corporation's Quarterly Report on Form 10-Q filed May 8, 2009 (No. 1-9853).

(10) Incorporated by reference to EMC Corporation's Quarterly Report on Form 10...

-

Page 101

...

EMC CORPORATION AND SUBSIDIARIES SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS (in thousands) Allowance for Bad Debts Charged to Selling, General and Administrative Expenses 14,351 $ 34,667 8,885

Balance at Beginning Allowance for Bad Debts Description Year ended December 31, 2009 allowance...

-

Page 102

... are not employees of the Company or its Subsidiaries and (ii) who are not holders of more than 5% of the outstanding shares of Common Stock or persons in control of such holder(s) ("Eligible Directors"). 1.10 "Fair Market Value" in the case of a share of Common Stock on a particular date, means the...

-

Page 103

... levels, leverage ratios or credit rating; market share; capital expenditures; cash flow; stock price; shareholder return; sales of products or services; customer acquisition or retentions; acquisitions or divestitures (in whole or in part); joint ventures and strategic alliances; spin-offs, split...

-

Page 104

...or "Subsidiaries" means a corporation or corporations in which the Company owns, directly or indirectly, stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock. 1.26 "Ten Percent Shareholder" means any person who, at the time an Award is granted, owns...

-

Page 105

... are required of "incentive stock options" under the Code. Award agreements may be evidenced by an electronic transmission (including an e-mail or reference to a website or other URL) sent to the Participant through the Company's normal process for communicating electronically with its employees. As...

-

Page 106

... signed by the proper person and delivered or mailed to the office of Stock Option Administration of the Company, accompanied by an appropriate exercise notice and payment in full for the number of shares in respect to which the Award is exercised, or in such other manner as may be from time to time...

-

Page 107

... a shorter period) and that have a fair market value equal to the exercise price, (ii) by delivery to the Company of a promissory note of the person exercising the Award, payable on such terms as are specified by the Committee, (iii) through a broker-assisted exercise program acceptable to the...

-

Page 108

... years of age and at least ten years of continuous service as an employee, consultant or advisor of the Company or any of its Subsidiaries. In any event, the Retirement provisions of any Award shall be governed by the terms and conditions of the Plan in effect on the date of grant of each such Award...

-

Page 109

...term set forth in the Company's Key Employee Agreement (irrespective of whether the Senior Participant is a party to the Key Employee Agreement); (iii) any activity that results in termination of the Senior Participant's Service Relationship for Cause; (iv) a violation of any rule, policy, procedure...

-

Page 110

... stock option plans of the Company and any related corporation, such Incentive Stock Options do not become exercisable for the first time by such employee during any calendar year in a manner which would entitle the employee to purchase more than $100,000 in Fair Market Value (determined at the time...

-

Page 111

... nor, in the event the outstanding Common Stock is at the time listed upon any stock exchange, until the stock to be delivered has been listed or authorized to be added to the list upon official notice of issuance to such exchange. In addition, if the shares of Common Stock subject to any Award have...

-

Page 112

... of the shareholders of the Company (a) materially amend the Plan, (b) increase the Authorized Shares available under the Plan, (c) change the group of persons eligible to receive Awards under the Plan, (d) reprice any outstanding Options or Stock Appreciation Rights or reduce the price at which...

-

Page 113

...until such Participant shall have complied with all of the terms, conditions and provisions of the Plan and any Award agreement related thereto. Neither the Company nor any of its Subsidiaries, nor any of their respective directors, officers, employees or agents shall be liable to any Participant or...

-

Page 114

... with the terms of the Plan as then in effect, unless the Plan could have been amended to eliminate such inconsistency without further approval by the shareholders. The Committee shall also have the authority and discretion to delegate the foregoing powers to appropriate officers of the Company.

-

Page 115

... 10.8 FORM OF CHANGE IN CONTROL SEVERANCE AGREEMENT THIS AGREEMENT, dated [ residing at [Address]. ], is made by and between EMC Corporation (the "Company"), and [ ] (the "Executive")

WHEREAS, the Company considers the establishment and maintenance of a sound and vital management to be essential to...

-

Page 116

... a Change in Control, the Company shall pay the Base Salary to the Executive through the Date of Termination, together with all compensation and benefits payable to the Executive through the Date of Termination under the terms of the Company's compensation and benefit plans, programs or arrangements...

-

Page 117

... (other than stock options and stock appreciation rights). Except as described above or in Section 9.1, the Executive shall not be entitled to benefits pursuant to this Section 6.1 unless a Change in Control shall have occurred during the Term. (A) The Company shall pay to the Executive a lump sum...

-

Page 118

... of the thirty-six (36) month period following the Date of Termination, the Executive has not previously become eligible to receive comparable benefits from a new employer or pursuant to a government-sponsored health insurance or health care program, then the Company shall arrange, at its sole cost...

-

Page 119

... to the Executive, payable on the fifth (5th) business day after demand by the Company (together with interest at 120% of the rate provided in Section 1274(b)(2)(B) of the Code). At the time that payments are made under this Agreement, the Company shall provide the Executive with a written statement...

-

Page 120

... relating to the termination of the Executive's employment, in seeking in good faith to obtain or enforce any benefit or right provided by this Agreement or in connection with any tax audit or proceeding to the extent attributable to the application of Section 4999 of the Code to any payment...

-

Page 121

... the amount of any payment or benefit provided for in this Agreement shall not be reduced by any compensation earned by the Executive as the result of employment by another employer, by retirement benefits, by offset against any amount claimed to be owed by the Executive to the Company, or otherwise...

-

Page 122

... and conditions of the Executive's employment with the Company or any subsidiary of the Company. The validity, interpretation, construction and performance of this Agreement shall be governed by the laws of the Commonwealth of Massachusetts. All references to sections of the Exchange Act or the Code...

-

Page 123

...otherwise payable to or in respect of him under this Agreement pursuant to the Executive's termination of employment with the Company shall be delayed, to the extent required so that taxes are not imposed on the Executive pursuant to Section 409A of the Code, and shall be paid upon the earliest date...

-

Page 124

...Control, as such salary may be increased from time to time during the Term (in which case such increased amount shall be the Base Salary for purposes hereof), but without giving effect to any reduction thereto. 16.5 "Beneficial Owner" shall have the meaning set forth in Rule 13d-3 under the Exchange...

-

Page 125

... voting power of the Company's then outstanding securities; or (D) the stockholders of the Company approve a plan of complete liquidation or dissolution of the Company or there is consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company's assets...

-

Page 126

... the Executive, acquiring, directly or indirectly, 25% or more of either the then outstanding shares of common stock of the Company or the combined voting power of the Company's then outstanding securities. 16.9 "Code" shall mean the Internal Revenue Code of 1986, as amended from time to time. 16...

-

Page 127

... benefit enjoyed by the Executive at the time of the Change in Control; (D) the Company requiring the Executive to be based at an office that is greater than 50 miles from where the Executive's office is located immediately prior to the Change in Control except for required travel on the Company...

-

Page 128

... program or policy of the Company or its subsidiaries intended to benefit employees, but excluding following a Change in Control (but not during a Potential Change in Control Period) any stock option, restricted stock or other stock-based plan or benefit except with respect to any awards outstanding...

-

Page 129

... the reason for the termination by the Executive of the Executive's employment if such employment is terminated in accordance with the Company's retirement policy, including early retirement, generally applicable to its salaried employees. 16.24 "Severance Payments" shall have the meaning set forth...

-

Page 130

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written. EMC CORPORATION By: Name: Title: EXECUTIVE 16

-

Page 131

... combined voting power of all classes of stock unless the Board of Directors of the Company (the "Board of Directors") determines that employees of a particular subsidiary shall not be eligible. Section 2. Options to Purchase Stock Under the Plan as now amended, no more than 153,000,000 shares are...

-

Page 132

...as travel expenses, financial planning, tuition assistance, adoption assistance and similar reimbursements and advances), imputed income, cost-of-living allowances, tax gross-ups, nonqualified deferred compensation plan payments, severance or termination pay, third party sick pay, income relating to...

-

Page 133

...nor, if the outstanding stock is at the time listed on any securities exchange, unless and until the shares to be delivered have been listed (or authorized to be added to the list upon official notice of issuance) upon such exchange, nor unless or until all other legal matters in connection with the...

-

Page 134

...Section 8, and have the balance, if any, in such account in excess of the total purchase price of the whole shares so issued returned in cash. In the event such legal representative does not file a written election as provided above, any outstanding option shall be treated as if an election had been...

-

Page 135

... securities of the Company to be subject to the Plan and to options then outstanding or to be granted hereunder, the maximum number of shares or securities which may be delivered under the Plan, the option price and other relevant provisions shall be appropriately adjusted by the Board of Directors...

-

Page 136

... the time be permitted by law, provided that (except to the extent explicitly required or permitted herein) no such amendment will, without the approval of the shareholders of the Company, (a) increase the maximum number of shares available under the Plan, (b) reduce the option price of outstanding...

-

Page 137

... voting power or value of all classes of stock of the employer corporation or of its parent or subsidiary corporation, as defined in Section 424 of the Code. (b) No employee shall be granted an option under this Plan that would permit his or her rights to purchase shares of stock under all employee...

-

Page 138

...12.1 EMC CORPORATION STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

Year Ended December 31, 2009 2008 2007 2006 2005 (As Adjusted) (As Adjusted) (As Adjusted)

Computation of Earnings: Income before provision for taxes and cumulative effect of a change in accounting principle...

-

Page 139

Exhibit 21.1 Significant Subsidiaries

Name

State of Jurisdiction of Organization

EMC (Benelux) B.V. EMC Global Holdings Company EMC Information Systems International RSA Security LLC VMware, Inc.

Netherlands Massachusetts Ireland Delaware Delaware

-

Page 140

...-162946) of EMC Corporation of our report dated February 26, 2010 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. /s/ PricewaterhouseCoopers LLP Boston, Massachusetts February 26...

-

Page 141

... the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this report; The Registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules...

-

Page 142

... the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this report; The Registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules...

-

Page 143

... on the date hereof (the "Report"), fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of EMC Corporation...

-

Page 144

... on the date hereof (the "Report"), fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of EMC Corporation...